How To Buy Gold In Brazil: A Full Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

You can buy gold in Brazil using any of the following methods:

Banks: secure but costly, requires an investment account, with limited buyback options.

Authorized dealers: better prices than banks but require due diligence to avoid fraud.

Gold exchange (BM&FBOVESPA): market-based pricing via brokerage, but complex withdrawals.

Pawnshops: discounted prices possible but require gold valuation knowledge.

Private sellers: cheapest but riskiest; verify authenticity and negotiate well.

Digital gold (brokers): low capital entry via stocks, CFDs, ETFs, or similar instruments.

Gold has always been a go-to asset for people looking to protect their money from inflation and economic swings. In Brazil, buying gold isn’t just about wealth — many see it as a way to diversify their investments and keep something tangible for the future. But before making a purchase, knowing where to buy, how to store it, and what legal factors to consider can help you avoid common mistakes.

There are different ways to buy gold in Brazil, whether you prefer physical gold like coins and bars or digital options that let you invest without holding the metal yourself. Understanding how taxes apply, where to store your gold safely, and how to verify authenticity can make a big difference in securing a smart investment.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

How to buy gold in Brazil

Buying gold in Brazil can be done through banks, authorized dealers, exchanges, and private sellers. Each method has its advantages and potential risks, making it crucial to choose wisely.

Buying from banks

Buying gold from banks in Brazil isn’t as straightforward as going to a teller and handing over cash. Unlike gold shops or online platforms, banks mainly deal in official gold bars or certified coins, and the process is usually handled through investment advisors rather than regular banking services. Major banks like Banco do Brasil and Itaú don’t advertise gold sales like other investment products, so you’ll need to ask about it directly. The price you pay is higher than market rates since banks add costs for storage, security, and taxes, making it a premium option rather than the cheapest way to buy gold.

If you’re looking to buy gold through a bank, you may need to open an investment account first, and some banks only offer gold to private banking clients. Unlike in many countries where you can take physical possession of your gold, Brazilian banks usually don’t let you walk out with it immediately. Instead, your gold is either kept in a bank vault or sent to a storage service. If you decide to sell, some banks have strict buyback policies, and the resale price may not always match global gold prices, making liquidity a concern.

Buying from authorized dealers

Buying gold from authorized dealers in Brazil gives you more options than buying from a bank, but it also requires extra caution. While banks usually have fixed pricing and strict policies, dealers can offer better rates and a wider range of gold, including bars, coins, and investment-grade jewelry. However, some dealers charge extra fees disguised as service or storage costs, making the total price higher than expected. The best way to avoid overpaying is to buy from well-known dealers, preferably those connected to official financial networks. Some dealers also accept direct cash payments, making the process easier for those who prefer not to go through heavy paperwork.

One thing most buyers don’t realize is that some dealers get their gold directly from mining companies before it’s sold on global markets. This sometimes allows buyers to get gold at better prices than those offered by banks or resellers. A few dealers also provide discounts on large purchases, something you won’t usually find at banks. Another advantage is that when you buy from a dealer, you can usually take your gold home the same day, whereas bank-bought gold is often kept in storage. That said, some dealers try to upsell certain types of gold that might not have strong resale value, so it’s important to know exactly what you’re buying.

Buying from the gold exchange

Buying gold from the gold exchange in Brazil is different from walking into a shop and picking out a gold bar. The BM&FBOVESPA exchange allows investors to trade gold through licensed brokers, meaning you’ll need an investment account with a firm that offers gold trading. Instead of buying from a bank or a dealer, you’re purchasing contracts that represent real gold stored in approved vaults.

One of the biggest advantages is that gold on the exchange is often priced closer to market value, so you avoid the high premiums charged by banks or jewelry stores. However, the process is more technical — you’ll need to understand brokerage fees, taxes, and how gold delivery works if you want to take physical possession.

A big plus of buying gold this way is that you don’t need to buy an entire bar upfront — some contracts let you invest in smaller portions, making it easier to get started. But if you decide to withdraw your gold, be prepared for a process. It’s not immediate; you’ll have to file a request, arrange for transport, and possibly handle some tax paperwork. Unlike gold held in private vaults, exchange-traded gold can also be used as loan collateral or for margin trading, giving investors more flexibility.

Buying gold from pawnshops and private sellers

Buying gold from pawnshops and private sellers in Brazil offers a unique opportunity to get gold at prices lower than banks or official dealers, but it comes with significant risks. Pawnshops often sell gold jewelry and bullion at discounted prices, especially when they need quick liquidity. However, the real deals come from understanding when and how pawnshops price their gold. They often base prices on weight rather than craftsmanship, meaning high-quality or antique gold pieces can sometimes be undervalued. Smart buyers track pawnshops in high-turnover areas, where owners are more likely to cut prices to keep inventory moving.

Private sellers can offer even lower prices, but this is where due diligence is critical. Unlike pawnshops, which are at least partially regulated, private transactions rely entirely on trust, negotiation, and verification. Scammers often mix gold with lesser metals, so a portable testing kit is a must. Sellers in financial distress may be willing to part with gold below market value, but buyers should always cross-check the origin and authenticity. Also, in high-demand regions, some sellers inflate prices beyond reasonable market rates, assuming buyers lack knowledge. Negotiating is not just recommended — it’s necessary to avoid overpaying.

Buying digital gold

Digital gold is an easy way to invest without worrying about storing physical bars or coins. You can do this through gold ETFs, mining stocks, or CFDs that let you buy small amounts of gold. It’s convenient, easy to sell, and avoids the hassle of security risks. But keep in mind, prices fluctuate just like stocks, and some platforms charge extra fees. Before jumping in, check how reliable the platform is and make sure you understand the costs involved.

How to buy digital gold in Brazil

Choose a reputable platform

Start by looking for a digital gold provider with a solid reputation. Check how secure their system is, what fees they charge, and if they’re backed by any financial regulators. Make sure the platform lets you buy and sell gold easily without hidden restrictions. Reading customer feedback and going through the terms of service can help you avoid problems later.

If you’re considering gold ETFs or stocks, you will require an account with a broker that is available in Brazil and offers gold ETFs, CFDs or stocks. Some of the top options based on our research are:

| Available in Brazil | Gold | ETFs | Demo | Min. deposit, $ | XAU/USD spread, pips | XAU/USD commission, $ | Deposit fee, % | Withdrawal fee, % | Max. Regulation Level | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | Yes | No | Yes | 100 | 25 | No | No | No | Tier-1 | 9.2 | ||

| Yes | Yes | No | Yes | 5 | 35 | 3,5 | No | No | Tier-1 | 9.1 | ||

| Yes | Yes | Yes | Yes | 10 | 18 | 2 | No | 0-4 | Tier-3 | 9 | ||

| Yes | Yes | No | Yes | 10 | 20 | 2,5 | No | No | Tier-1 | 8.9 | ||

| Yes | Yes | Yes | Yes | 100 | No | 3 | No | 1-3 | Tier-1 | 8.7 |

Create an account

Before you can start buying digital gold, you’ll need to create an account on the platform. Most providers ask for ID verification as part of their security process, so have your documents ready. Once approved, you’ll be able to track gold prices, manage your account, and make transactions without hassle.

Buy gold

After funding your account, decide how much gold you want to buy based on live market rates. Always double-check the transaction details before confirming your purchase. Some platforms store your gold for you, while others give you the option to convert it into physical gold when needed.

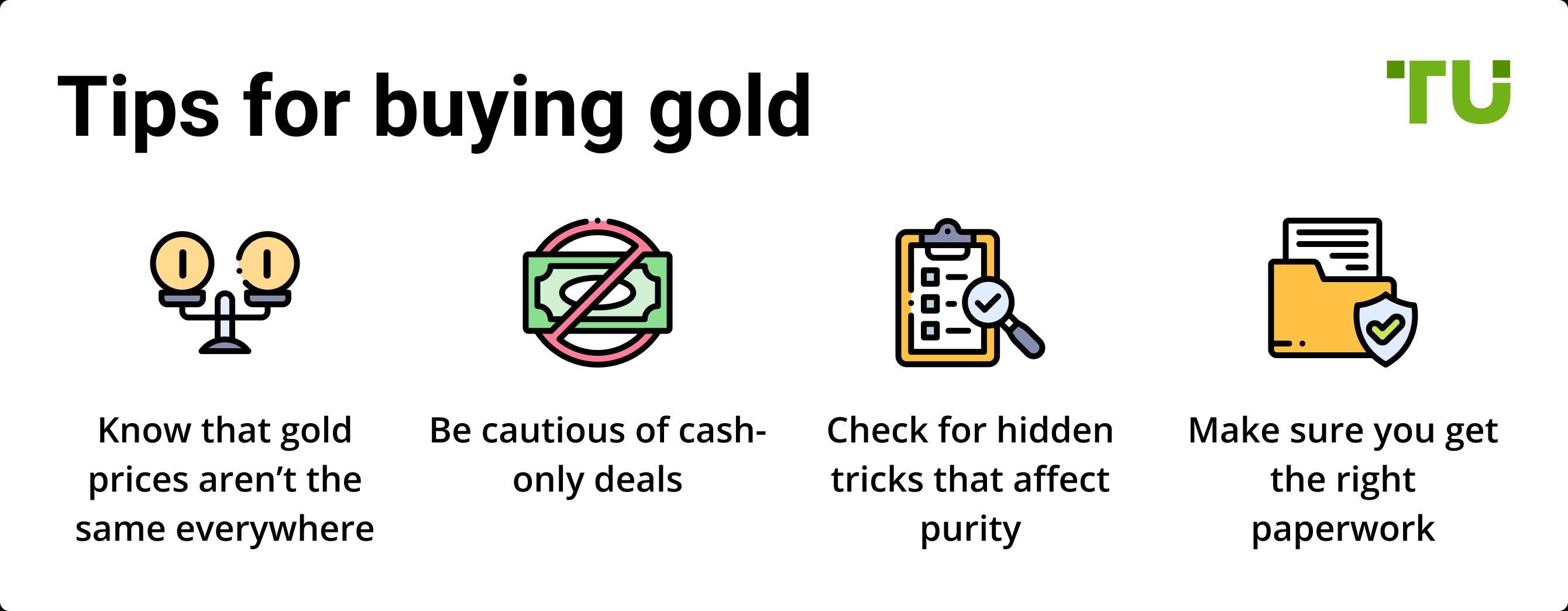

Tips for safely buying gold

Buying gold in Brazil can be a smart investment, but without the right precautions, you could end up paying too much, falling for scams, or running into legal trouble.

Know that gold prices aren’t the same everywhere. In some areas, gold costs less because it’s mined nearby, while in other places, import fees and extra costs drive up the price. Checking multiple sources before buying can save you from overpaying.

Be cautious of cash-only deals. Some sellers refuse digital payments to avoid leaving a paper trail. A trustworthy dealer should accept bank transfers, credit cards, or even escrow services to keep the transaction secure. If a seller is pushing for cash and offering a deal that sounds too good, it’s probably a red flag.

Check for hidden tricks that affect purity. Some gold sellers add coatings or mix in other metals to make gold look higher quality than it really is. To be sure of what you’re buying, bring a portable gold tester or visit a jeweler who uses an XRF machine. If a seller won’t let you verify the gold, it’s best to walk away.

Make sure you get the right paperwork. In Brazil, there are taxes on gold purchases, and if you don’t report them correctly, you could run into trouble later. Some sellers don’t give official invoices, which can make it harder to prove ownership.

Smart ways to buy gold in Brazil without overpaying or running into legal trouble

Many people assume buying gold in Brazil is as easy as walking into a bank, but banks often charge high fees and limit how you can sell the gold later. A smarter approach is using licensed gold brokers or trading desks, where prices are much closer to market rates. These sellers also offer more flexibility when it comes to storing or selling your gold later. Another overlooked option is gold-backed digital accounts at private banks. This lets you invest in gold while keeping access to cash, so you don’t have to physically store it or deal with security risks.

If you’re buying physical gold, where you buy it matters just as much as how you buy it. Some areas in Brazil, especially mining regions, offer lower taxes and direct access to refineries, which can save you a lot of money. The downside? Some sellers add impurities to increase the weight, so verifying purity with an XRF scanner or a trusted jeweler is a must. Another thing most buyers miss is that some states have rules that make it harder to resell or export gold. Knowing the resale laws in your region can save you from unexpected restrictions when it’s time to cash out.

Conclusion

Buying gold in Brazil is a viable investment option, provided buyers follow secure and legal methods. Whether purchasing physical gold, digital gold, or ETFs, understanding the market ensures informed decisions.

FAQs

Is it legal to buy gold in Brazil?

Yes, buying gold in Brazil is legal, but transactions must comply with local regulations. Always purchase from authorized dealers or institutions to ensure authenticity and avoid legal issues.

What is the safest way to buy gold in Brazil?

The safest options include purchasing from reputable banks, certified dealers, and gold exchanges. Always verify certifications and request authenticity documents to avoid counterfeit gold.

Do I have to pay taxes when buying gold in Brazil?

Yes, gold purchases may be subject to taxes and reporting requirements. It’s important to check the latest tax regulations or consult a financial expert to ensure compliance.

Can I buy gold online in Brazil?

Yes, digital gold and gold-backed ETFs are available through online platforms. Choose a reputable provider with secure transactions and transparent pricing to avoid fraud.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).