Best Halal Crypto in 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best halal cryptocurrencies are:

- Bitcoin: Real asset, widely accepted for transactions, and compliant with Shariah

- Ethereum: Smart contract functionality, transparency, decentralised applications

- Solana (SOL): High throughput, low fees, scalability for DApps

Investors will learn more about the best halal cryptocurrencies, including Polkadot, Ethereum, Tether, and Bitcoin. Each cryptocurrency was chosen for its compliance with Islamic law and relevance in the digital economy.

This article also clarifies frequent questions and concerns about halal cryptocurrency investing, including earning techniques, Shariah law compliance, and ethical factors in the cryptocurrency arena.

What are the best halal cryptos?

Bitcoin (BTC)

Bitcoin remains the foundational asset in the cryptocurrency market and a leading halal investment option in 2025. As the first decentralised digital currency, Bitcoin has cemented its role as a store of value, akin to "digital gold." Recent macroeconomic factors, such as the approval of multiple Bitcoin ETFs, have driven institutional adoption, enhancing liquidity and reducing barriers to entry for traditional investors.

Bitcoin’s blockchain technology ensures transparency and security, aligning with Shariah principles by preventing fraudulent practices. Its widespread acceptance in legitimate financial transactions, including remittances and retail payments, underscores its compliance with Islamic finance norms.

Ethereum (ETH)

Ethereum's ecosystem continues to expand, supported by its innovative smart contract capabilities. In 2025, Ethereum stands out not only for its technological advancements but also for its macroeconomic significance, highlighted by the approval of Ethereum ETFs. These developments have bolstered Ethereum's status as an investable asset, increasing demand and stabilising its market position.

The transition to a Proof-of-Stake (PoS) consensus mechanism through Ethereum 2.0 has reduced energy consumption by over 99%, addressing environmental concerns and aligning with Shariah principles of sustainability. Furthermore, its practical applications in decentralised finance (DeFi) and tokenised assets enhance its legitimacy as a halal investment.

Ripple (XRP)

Ripple remains a pivotal player in cross-border payments and financial interoperability. Its blockchain-based solutions enable instantaneous and cost-effective global transactions, which are increasingly adopted by financial institutions. The resolution of significant regulatory disputes in 2024 has restored confidence in Ripple and its native token, XRP, as a viable investment.

Ripple’s recent foray into stablecoins, including its XRP Ledger-based stablecoin initiatives, adds another layer of utility. These developments ensure compliance with Shariah principles by avoiding speculative practices and focusing on facilitating transparent, real-world financial operations.

USD Coin (USDC)

USD Coin continues to dominate the stablecoin market due to its transparent reserves and strict compliance with regulatory standards. Its one-to-one backing with US dollars ensures stability, making it a preferred option for investors seeking to mitigate volatility.

USDC’s integration into global payment systems, including partnerships with major financial institutions, underscores its role in enabling seamless cross-border settlements and its use in halal financial platforms make it an ideal option for Shariah-compliant investments. USDC's transparency and operational integrity ensure it avoids speculative risks, adhering to Islamic principles.

Cardano (ADA)

Cardano is a scientifically driven blockchain platform that has gained recognition for its innovative and sustainable approach. Its decentralised architecture, peer-reviewed protocol development, and focus on transparency make it a leading halal cryptocurrency.

In 2025, Cardano's expansion into emerging markets and its partnerships for blockchain-based education and financial inclusion projects highlight its macroeconomic relevance. These initiatives, particularly in underbanked regions, resonate with the ethical objectives of Islamic finance. Cardano’s use in real-world applications, such as supply chain transparency and non-interest-based microloans, solidifies its compliance with Shariah principles.

Solana (SOL)

Solana has established itself as one of the most efficient blockchain platforms, offering high-speed and low-cost transactions. Its scalable infrastructure supports decentralised applications (DApps) and smart contracts, making it a key player in the DeFi and NFT sectors.

The macroeconomic factors driving Solana’s growth include increased institutional investment and the migration of high-profile projects to its network. Solana’s eco-friendly Proof-of-History (PoH) consensus mechanism reduces energy usage, aligning with sustainability goals valued in Islamic finance. Additionally, its role in enabling halal financial applications, such as decentralised fundraising, enhances its Shariah-compliant credentials.

Avalanche (AVAX)

Avalanche stands out as a robust and scalable blockchain network that addresses key limitations of existing platforms, such as speed and interoperability. Its unique consensus mechanism and multi-chain structure enable it to support diverse applications, including DeFi, gaming, and tokenised assets.

In 2025, Avalanche's collaboration with traditional financial institutions to develop blockchain-based solutions further cements its macroeconomic importance. Its transparent and decentralised ecosystem ensures that transactions avoid elements prohibited in Islamic finance, such as excessive uncertainty and speculation, making it a suitable halal cryptocurrency.

Polygon (MATIC)

Polygon has gained prominence as a leading Layer 2 scaling solution for Ethereum, offering efficient and cost-effective transactions. Its network is increasingly adopted for DeFi, gaming, and NFT applications, providing practical use cases that comply with Islamic finance principles. Explore our full Islamic analysis, based on the latest data, on whether the NFT is halal?

The rise of institutional interest in blockchain technology has boosted Polygon’s adoption in 2025. Its partnerships with major brands and integration with enterprise solutions reflect its macroeconomic impact. Polygon’s governance model and emphasis on decentralisation ensure that it remains a transparent and Shariah-compliant platform.

Algorand (ALGO)

Algorand is a highly scalable and secure blockchain platform that has been designed with sustainability in mind. Its Pure Proof-of-Stake (PPoS) consensus mechanism ensures fairness and energy efficiency, meeting the environmental and ethical standards valued in Islamic finance.

Macroeconomic factors contributing to Algorand's growth include its adoption by governments and central banks for issuing Central Bank Digital Currencies (CBDCs). Its use in halal applications, such as green financing and tokenised sukuk (Islamic bonds), further strengthens its position as a compliant cryptocurrency for Muslim investors.

Tezos (XTZ)

Tezos is known for its self-amending blockchain, which allows it to evolve without hard forks. This feature ensures long-term stability and adaptability, making it a preferred choice for institutional and retail investors alike.

In 2025, Tezos has gained traction in the tokenisation of assets, including real estate and art, as well as in eco-friendly blockchain initiatives. Its decentralised governance and focus on transparency align with Shariah principles, while its energy-efficient Proof-of-Stake (PoS) mechanism addresses environmental concerns. These attributes make Tezos a reliable and ethical investment option for Muslim investors.

Where can I buy halal crypto?

We compared cryptocurrency exchanges suitable for Muslim investors by evaluating key factors, including:

Availability in Muslim-Majority Countries: Ensuring these exchanges accept clients from regions with significant Muslim populations.

Wide Selection of Cryptocurrencies: Offering diverse crypto portfolios, including many considered halal under Islamic principles.

Affordable Trading Fees: Exchanges with competitive maker and taker fees for cost-efficient transactions.

| Min. Deposit, $ | Coins Supported | Spot Taker fee, % | Spot Maker Fee, % | TU overall score | Open an account | |

|---|---|---|---|---|---|---|

| 10 | 329 | 0,1 | 0,08 | 8.9 | Open an account Your capital is at risk. |

|

| 10 | 278 | 0,4 | 0,25 | 8.48 | Open an account Your capital is at risk. |

|

| 1 | 250 | 0,5 | 0,25 | 8.36 | Open an account Your capital is at risk. |

What makes a crypto halal or haram?

A thorough framework for assessing if a cryptocurrency is halal is provided by the Sharlife Methodology. To guarantee that a cryptocurrency project complies with Islamic principles, it comprises five essential screening criteria that each cover a distinct component of the project:

Screening for Legitimacy

Screening for legitimacy means determining if a cryptocurrency project satisfies legal and regulatory standards. This covers confirming that the project is registered, adhering to KYC and anti-money laundering (AML) rules, and following pertinent financial legislation. Investors lower their chance of participating in illegal activity or endorsing non-compliant businesses by making sure the project runs within legal bounds.

Project Screening

Project screening assesses a cryptocurrency project's objectives, transparency, and conformity to Islamic principles. Examining the project's governance structure, roadmap, and whitepaper closely is necessary in order to evaluate its morality and validity.

Additionally, project screening scrutinises how well the project adheres to Islamic values, including social justice, fair trade, and moral corporate conduct.

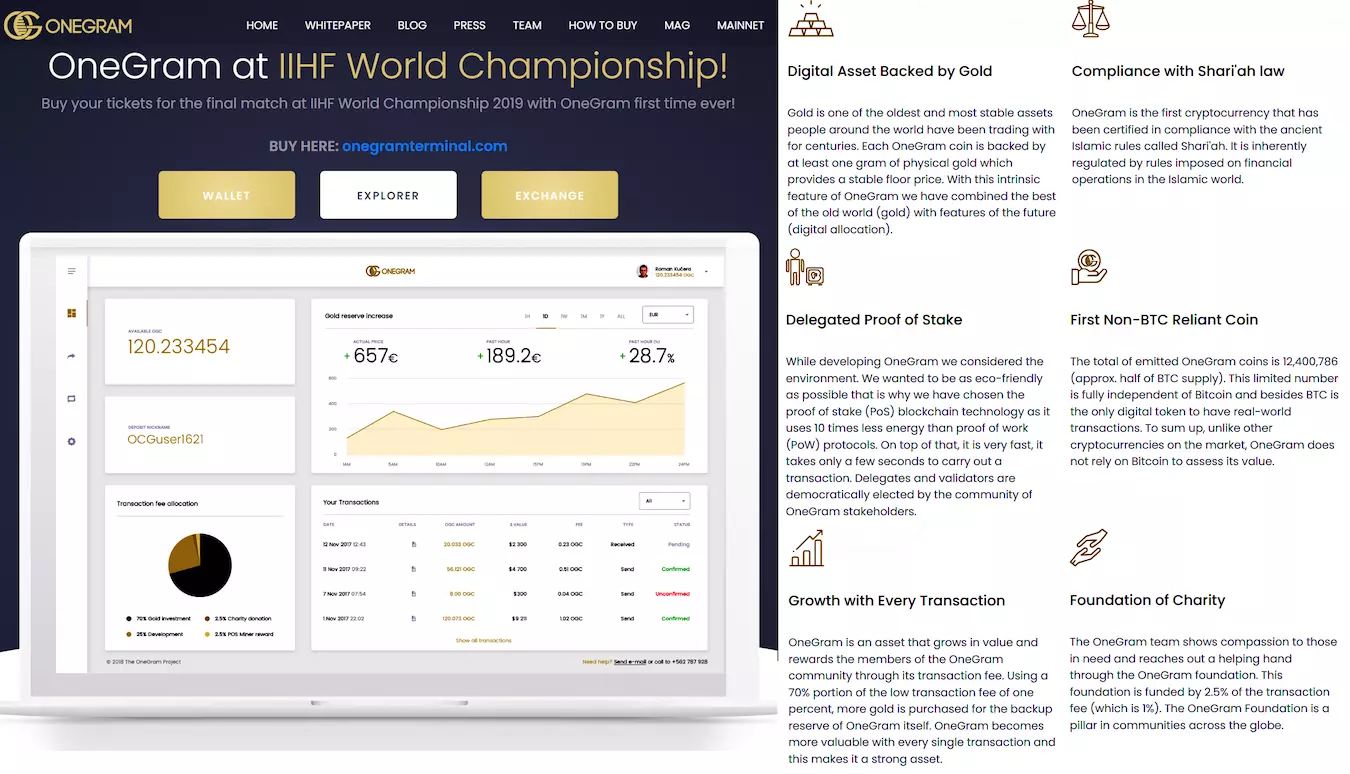

Example halal crypto project

Example halal crypto projectOneGram, a true cryptocurrency project that adheres to Islamic law, provides a digital currency that is backed by gold and compliant with Sharia law. Investors that prioritise Islamic values will find it compliant with ethical standards due to its adherence to Islamic financial rules, which include refraining from interest-based transactions and guaranteeing asset backing. By choosing projects that share Islamic principles, investors help to promote ethical growth and good societal effects in the cryptocurrency ecosystem.

Financial Screening:

Financial screening focuses on analysing the financial structure, revenue sources, and avoidance of interest-based transactions within a cryptocurrency project. It entails evaluating the financing strategy, sources of income, and adherence to Islamic finance norms like the ban on riba (interest) and gharar (uncertainty). Let’s take SukukChain, for example SukukChain is an excellent initiative that meets Islamic finance's financial screening standards.

SukukChain uses blockchain technology to issue sukuk, Islamic financial instruments similar to bonds that follow Sharia standards. By providing transparent revenue streams and avoiding interest-based transactions, SukukChain provides a halal investment option for Islamic finance devotees looking for ethical financial opportunities in the cryptocurrency industry.

Token Screening:

Token screening verifies the use cases, distribution models, and tokenomics of a cryptocurrency token to guarantee moral ramifications and adherence to Islamic values. Token screening also takes into account the moral ramifications of token use situations, staying out of sectors like gambling, alcohol, and weaponry manufacturing that are deemed haram (forbidden) in Islam.

Staking Screening:

Staking screening examines the staking mechanisms and rewards associated with a cryptocurrency project to avoid participation in prohibited activities. It involves assessing stake interest-based returns, speculative trading, and engagement in non-compliant activities. Staking screening also considers the environmental impact of staking activities, ensuring they align with principles of sustainability and ethical stewardship of resources.

Investors can choose halal cryptocurrency that conforms to Islamic values and moral norms by using the Sharlife Methodology. With the use of this all-encompassing screening system, investors can avoid engaging in illegal activities or non-compliant businesses while nevertheless supporting initiatives that advance social justice, moral corporate conduct, and beneficial societal effects.

Are all cryptocurrencies halal?

Not all cryptocurrencies are regarded as halal (permissible) in Islam, despite the fact that they provide creative solutions and economic opportunities. If you're wondering if all cryptocurrencies are halal, the quick answer is no, and here are two reasons why.

Riba (interest): Many cryptocurrencies involve elements of riba, which is considered haram (forbidden) in Islam. Riba refers to the charging or paying of interest, which is prohibited in Islamic finance.

Gharar (uncertainty): Cryptocurrencies with speculative or uncertain features may fall under the category of gharar, which is another concept prohibited in Islam. Gharar refers to uncertainty or ambiguity in transactions, which can lead to unfair outcomes or exploitation.

Haram Activities: Some cryptocurrencies are linked to haram sectors, including gambling, alcohol, tobacco, and weapons production. Islamic beliefs forbid investing in cryptocurrency linked to such activities since it supports immoral businesses.

Non-Compliant Practices: Cryptocurrency projects or platforms that engage in fraudulent schemes, money laundering, or Ponzi schemes are non-halal. Investment in such ventures violates Islamic honesty, openness, and ethics.

Note: Muslim investors should choose halal solutions that adhere to Islamic standards with prudence and diligence, even though cryptocurrencies offer prospects for innovation and investment. Investors can make sure their cryptocurrency holdings are in line with their moral and religious principles by steering clear of cryptocurrency linked to interest-based returns, speculative trading, haram activities, non-compliant procedures, and a lack of transparency.

Expert opinion

As a seasoned financial specialist, I support ethical and educated halal cryptocurrency investing. Through the utilisation of research, screening techniques, and cautious risk management, investors may ensure that their choices are in line with Islamic values and also have a beneficial social and financial impact.

Summary

Investing in halal cryptocurrencies means adhering to Shariah laws, carefully examining transparency, and placing a higher priority on the well-being of society. Investors can create a path of ethical riches by adhering to religious principles and tackling the fluid digital asset world with integrity and purpose, all with the help of professional counsel and rigorous screening processes.

FAQs

Can Muslims own crypto?

As long as they follow Shariah rules—which include staying away from riba (interest) and gharar (uncertainty) and investing in projects that are morally acceptable—Muslims are allowed to possess cryptocurrency.

Are all cryptocurrencies halal?

Not all cryptocurrencies are considered halal according to Islamic principles. There are certain elements that are not permissible according to Islamic law, such as interest-based transactions (riba), involvement in prohibited industries (haram), or speculative trading.

How to choose the best halal crypto?

A number of factors must be considered while choosing halal cryptocurrencies, including the project's legality, conformity to Islamic law, operational transparency, and the lack of haram components in its use cases and capabilities.

Is crypto earning haram?

Depending on the source of income and the actions involved, earning money using cryptocurrency can be either legal (halal) or illegal (haram). It is imperative to guarantee that profits are acquired in a way that complies with Islamic law.

Related Articles

Team that worked on the article

Victor has contributed insightful articles to reputable platforms like DecodeFX and FXScouts, showcasing his expertise in the field of finance, Forex and investing. Currently pursuing a masters program in business administration, Victor combines academic rigor with practical industry insights.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

A Ponzi scheme may be defined as a fraudulent scheme in which the perpetrators attract investors and pay them a relatively small profit from new investors just before the criminals abscond with the overwhelming bounty of the funds.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.