Is USDC safe? A Complete Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Yes, USDC (USD Coin) is considered one of the safer stablecoins in the crypto market due to its full backing by cash and short-term U.S. Treasury assets, along with regular audits. Managed by Circle and governed under the Centre Consortium, USDC maintains a 1:1 peg to the U.S. dollar and operates under strong compliance standards in the U.S. financial ecosystem.

In this article, we explore whether USDC is safe by examining its stability, how it’s backed, and the role of Circle in managing its reserves.We also break down key risks, real-world use cases, and how USDC compares to other stablecoins. By the end, you'll understand if USDC fits your goals for secure transactions, savings, or crypto trading.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

What is USDC?

USDC, or USD Coin, is a stablecoin pegged to the US dollar, designed to maintain a 1:1 value ratio. It is issued by Circle, a fintech company, and offers transparency and stability by being backed with cash and short-term U.S. government bonds.

USDC was launched in 2018 as a joint effort between Circle and Coinbase under the Centre Consortium. As a stablecoin, its value remains consistent with the U.S. dollar, making it an appealing option for trading, remittances, and hedging against market volatility.

Circle claims USDC’s reserves are audited monthly by Grant Thornton, a leading accounting firm. These reserves include a mix of cash and high-quality short-term government bonds, ensuring that each USDC token is fully collateralized. This transparency sets USDC apart from many other cryptocurrencies.

Unlike volatile cryptocurrencies like Bitcoin and Ethereum, USDC’s stability lies in its underlying reserves and adherence to regulatory frameworks. It’s widely accepted on various crypto exchanges and platforms, further solidifying its role in the digital economy.

Is USDC safe?

USDC is generally considered safe due to its full backing by cash and short-term U.S. government bonds, audited reserves, and adherence to regulatory standards. However, risks related to regulatory changes and the broader crypto market remain.

USDC stands out for its transparent operational model, where every token is backed 1:1 with tangible assets. Monthly reserve attestations provide additional assurance to users. Unlike some cryptocurrencies with unclear backing, USDC’s emphasis on transparency has boosted its credibility.

However, safety is not absolute. Regulatory scrutiny of stablecoins is increasing globally, which could impact UDC’s operations. Additionally, while Circle’s financial practices are robust, external factors like market disruptions or changes in U.S. monetary policy could indirectly affect USDC’s perceived stability.

For users prioritizing low-risk digital assets, USDC offers an excellent balance of safety and usability. Still, it’s essential to monitor ongoing developments in the regulatory and financial landscapes.

Pros and cons of USDC

Here are some pros and cons of USDC:

- Pros

- Cons

Fully backed by cash and U.S. government bonds.

Transparent reserves are audited monthly.

Wide acceptance across exchanges and platforms.

Minimal volatility compared to other cryptocurrencies.

Enables fast and low-cost transactions.

Subject to regulatory scrutiny.

Limited yield potential compared to riskier assets.

Reliance on Circle’s operational integrity.

Not immune to systemic crypto market risks.

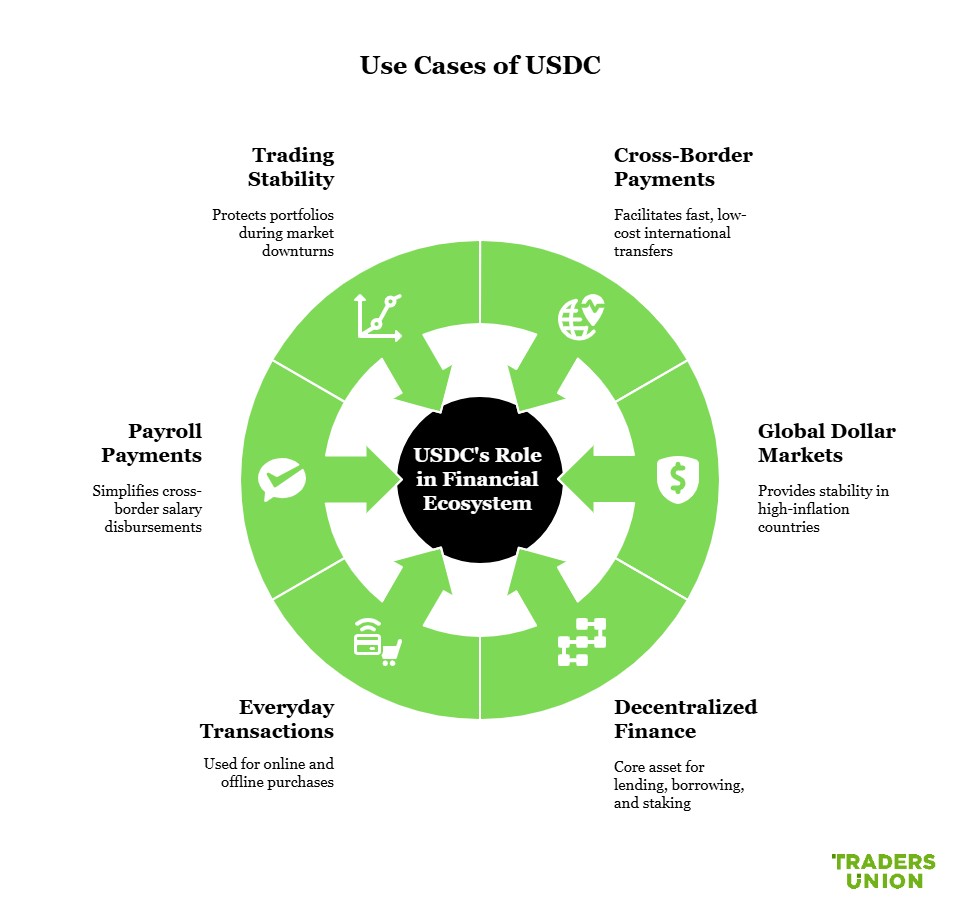

Use cases of USDC

USDC serves various purposes in the crypto ecosystem and beyond:

Cross-border payments and remittances

USDC enables fast, low-cost international money transfers, making it a powerful alternative to traditional remittance services. Since it’s digital and stable, recipients in other countries can receive funds without needing a bank account. This is particularly useful in regions with underdeveloped banking systems, where USDC can offer greater financial inclusion.

Access to global dollar markets

In countries facing high inflation or unstable local currencies, USDC acts as a digital dollar — allowing individuals and businesses to protect their wealth. By holding USDC, they can retain purchasing power and avoid rapid currency devaluation without needing access to U.S.-based financial institutions.

Participation in decentralized finance (DeFi)

USDC is a core asset in the DeFi ecosystem. It’s commonly used for lending, borrowing, staking, and yield farming. Because of its price stability and trustworthiness, many users prefer it when interacting with smart contracts, especially when they want to earn passive income without exposure to crypto market volatility.

Everyday transactions and e-commerce

With increasing acceptance from merchants and integration into payment apps, USDC can now be used for daily purchases — both online and offline. It offers the convenience of digital payments without the unpredictable price swings typical of cryptocurrencies like Bitcoin or Ethereum.

Payroll and contractor payments

Companies, especially those with international teams or remote freelancers, are beginning to use USDC for payroll. It simplifies cross-border salary disbursements, reduces transaction fees, and ensures near-instant settlement, which benefits both employers and employees.

Store of value and trading stability

Traders often convert volatile cryptocurrencies into USDC during market downturns to protect their portfolios. It acts as a safe harbor during uncertainty, helping users stay in the crypto ecosystem without completely cashing out to fiat.

Is USDC a good investment?

USDC is not typically an investment in the traditional sense but is a stable digital asset for preserving value and facilitating transactions. It’s suitable for those seeking stability rather than high returns.

Unlike cryptocurrencies like Bitcoin or Ethereum, USDC is designed to maintain a stable value rather than appreciate. This makes it an ideal choice for users who prioritize stability over speculative gains.

Investors often use USDC as a safe haven during market downturns or to transfer value between exchanges. Additionally, some DeFi platforms offer modest yields on USDC deposits, providing a low-risk way to earn interest.

For individuals seeking growth, other asset classes or cryptocurrencies may offer better returns. However, as a tool for managing volatility and enabling seamless transactions, USDC remains highly valuable.

Are there any risks of USDC?

USDC’s risks include regulatory uncertainty, reliance on Circle’s financial practices, and exposure to broader crypto market volatility. Despite these, it is widely regarded as one of the safest stablecoins.

Regulatory risks

Governments globally are intensifying their focus on stablecoins, potentially introducing stricter regulations or outright restrictions. This increased scrutiny could influence how USDC operates, limiting its adoption or creating compliance challenges for Circle.

However, Circle’s proactive approach to transparency and regulatory engagement positions USDC to navigate potential changes effectively, ensuring its resilience despite evolving legal landscapes.

Operational risks

USDC’s reliability hinges on Circle’s commitment to maintaining transparent financial practices and sound operations. Any misstep, such as lapses in reporting or financial mismanagement, could erode trust in the currency.

Fortunately, Circle’s strong track record and frequent audits reinforce its credibility, reducing the likelihood of such operational pitfalls.

Market risks

While USDC maintains price stability, broader market volatility can impact its utility and perception. Economic uncertainty or shifts in crypto sentiment could affect user confidence in stablecoins.

Even so, USDC’s clear backing by real-world assets and focus on transparency act as safeguards, helping it retain value and trust during turbulent times.

Legal and regulatory concerns

Stablecoins like USDC operate in a grey area of financial regulation. In the U.S., agencies like the SEC and CFTC have expressed interest in regulating stablecoins, arguing they could pose risks to financial stability if not adequately overseen.

Circle has proactively engaged with regulators to ensure compliance. However, regulatory developments could impose restrictions or affect the broader stablecoin market, impacting USDC’s adoption and operations.

| Aspect | USDC (USD Coin) | USDT (Tether) |

|---|---|---|

| Issuer | Circle & Coinbase (Centre Consortium) | Tether Limited |

| Launch Year | 2018 | 2014 |

| Reserve Backing | Fully backed by cash & U.S. Treasuries; transparent audits | Backed by mixed assets; reserve transparency questioned |

| Regulatory Compliance | Strong U.S. regulatory focus; regular audits | Faced fines; regulatory concerns persist |

| Transparency | Monthly third-party attestations | Periodic attestations; criticized for inconsistency |

| Market Adoption | Growing in DeFi & institutions | Most used stablecoin; dominant in trading |

| Blockchain Availability | Ethereum, Solana, Algorand & more | Ethereum, Tron, Omni & others |

| Use Cases | DeFi, institutional trades, stable value | Exchange trading, remittances, emerging markets |

| Liquidity & Volume | High, but below USDT | Highest liquidity & trading volume |

| Regulatory Scrutiny | Proactive compliance | Scrutinized for past reserve claims |

How to buy USDC

Here’s a step-by-step guide on how to buy USDC:

Choose a platform. Select a crypto exchange that supports USDC. Make sure it's reliable, secure, and aligns with your goals.

Create an account. Sign up on the chosen platform and complete the identity verification (KYC) as required.

Deposit funds. Add money to your account using bank transfer, debit card, or any other supported payment method.

Purchase USDC. Search for USDC, enter the amount you want to buy, and place your order. Confirm the transaction details to complete the purchase.

Transfer to wallet (optional). For added security, consider moving your USDC to a private wallet rather than keeping it on the exchange.

Best platforms to buy USDC. Compare exchanges based on fees, usability, security, and available funding options before deciding where to buy.

Here are some of the best crypto exchanges to buy USDC and other coins:

| USDC available | Min. Deposit, $ | Foundation year | Deposit fee | Withdrawal fee | Demo account | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | 10 | 2017 | No | 0,0004 BTC 2,6 USDT | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 10 | 2011 | No | 0,0005 BTC | No | No | 8.48 | Open an account Your capital is at risk. |

|

| Yes | 1 | 2016 | No | 0,0005 BTC | No | Malta Financial Services Authority | 8.36 | Open an account Your capital is at risk. |

|

| Yes | 1 | 2018 | No | 0-0,1% | Yes | No | 7.41 | Open an account Your capital is at risk. |

|

| Yes | No | 2004 | No | No | No | No | 7.3 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

If you hold large amounts of USDC, don’t keep it on a single platform

Most people will tell you USDC is safe because it's “backed 1:1 by dollars.” But here’s what they don’t mention — what those dollars actually are. A chunk of USDC’s reserves isn’t just paper cash — it’s in short-term U.S. Treasuries. Sounds stable, right? But during fast-moving market events (like the SVB collapse in 2023), even those “safe” instruments can become a bottleneck. If a bunch of users panic-withdraw at once, there's a delay in converting those Treasuries into liquid cash.

So here’s the pro move: if you hold large amounts of USDC, don’t keep it on a single platform. Use non-custodial wallets with instant withdrawal options — or break it across platforms that have a strong history of honoring redemptions without delays.

Here’s something nobody tells beginners: the safety of USDC depends more on where you hold it than the coin itself. USDC could be fully backed, but if your centralized exchange freezes withdrawals due to platform risk or regulatory pressure, you’re stuck. Don’t blindly trust the coin’s stability without asking yourself — “can I actually access it when I need it?”

Smart traders use cold wallets or multi-sig setups and rotate funds regularly. And if you’re using USDC for passive income through lending protocols, check if they offer “real-time reserve audits” or if they simply quote high APYs without showing how those returns are generated. Chasing yield blindly is how people end up learning lessons the hard way.

Conclusion

USDC is widely recognized as one of the most transparent and stable digital assets in the crypto ecosystem. Backed by cash and short-term U.S. Treasuries, and issued by Circle, USDC maintains a 1:1 peg to the U.S. dollar with monthly audits to ensure full collateralization. While it’s considered safe for everyday transactions, trading, and DeFi, users should remain aware of broader regulatory developments and market risks. As with any digital asset, safety also depends on where and how you store your funds. Diversifying stablecoin holdings and using secure wallets can further reduce exposure. USDC is not designed for high returns — but it excels at preserving value in a volatile market.

FAQs

Can I earn interest by holding USDC?

Yes, some crypto platforms and DeFi protocols offer interest on USDC holdings, but yields vary and depend on the platform’s lending model and associated risks.

Is it safe to keep USDC on exchanges?

While USDC itself is stable, storing it on centralized exchanges can expose users to platform risks. Transferring funds to private wallets with strong security features is often recommended.

Who controls USDC issuance and reserve management?

Circle, a U.S.-based fintech company, issues USDC and manages its reserves under the oversight of the Centre Consortium. They follow regulatory guidelines and conduct regular audits.

Does USDC work on multiple blockchains?

Yes, USDC operates on several blockchains including Ethereum, Solana, Avalanche, and Polygon — making it accessible for a wide range of applications and platforms.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.