Jack Dorsey Crypto Portfolio: A Deep Dive Into His Holdings And Market Influence

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Jack Dorsey’s crypto portfolio is all-in on Bitcoin. He holds BTC personally and has steered his company, Block, to accumulate over 8,000 BTC, while building mining chips, funding developer grants, and integrating Bitcoin into Cash App. His long-term focus on Bitcoin has influenced both markets and regulation, making Block a leader in institutional Bitcoin adoption.

Jack Dorsey, the co-founder and former CEO of Twitter and the founder of Block (formerly Square), has shown ongoing support for Bitcoin (BTC). Unlike many investors who diversify across multiple cryptocurrencies, Dorsey firmly believes Bitcoin will shape the future of digital money. His portfolio, investments, and strategic decisions are aligned with this belief over the long run.

Breakdown of Jack Dorsey’s cryptocurrency holdings

Jack Dorsey, co-founder and CEO of Block, Inc., has a distinctive approach to cryptocurrency investments, focusing almost exclusively on Bitcoin.

Personal Bitcoin holdings. Dorsey has publicly confirmed that he holds Bitcoin personally.

Block's Bitcoin investments. Under Dorsey's leadership, Block, Inc. has made substantial investments in Bitcoin, purchasing 4,709 bitcoins in October 2020 and an additional 3,318 bitcoins in early 2021.

Support for Bitcoin development. Dorsey has financially backed Bitcoin development through various initiatives. In May 2023, his charity, Start Small, pledged $5 million over five years to Brink, a nonprofit supporting Bitcoin developers. Additionally, in May 2024, Dorsey donated $21 million to OpenSats, a nonprofit focused on Bitcoin-related open-source projects.

Investment in Bitcoin-focused companies. Dorsey has invested in companies advancing Bitcoin technologies. In March 2023, Block launched "c=", a service provider aimed at improving liquidity and routing on Bitcoin's Lightning Network. Furthermore, in November 2024, Dorsey led a $6.2 million investment in Mummolin to support Ocean, a decentralized Bitcoin mining pool.

Bitcoin-focused donations. Beyond supporting development, Dorsey has made significant donations to initiatives like OpenSats and Brink, emphasizing his commitment to fostering decentralized finance through Bitcoin.

Block (formerly Square): Jack Dorsey’s crypto venture

One of Dorsey’s biggest contributions to the cryptocurrency space is through Block. His company has made several strategic moves to integrate Bitcoin into mainstream financial services:

Bitcoin treasury holdings. Block had accumulated 8,027 BTC.

Cash App Bitcoin integration. In the last quarter of 2023, Cash App’s Bitcoin sales reached $2.52 billion, showing a 37% increase compared to the same period the year before.

TBD platform. Block launched the TBD platform to develop open financial services using Bitcoin, but the initiative was officially wound down by November 2024.

Bitcoin mining and decentralization. In July 2024, Block partnered with Core Scientific to unveil a new 3-nanometer Bitcoin mining chip, with the goal of making mining infrastructure more accessible and decentralized.

Financial performance and market reactions

Dorsey's deep involvement in Bitcoin has had a notable impact on the crypto market:

Square made billions on Bitcoin but barely kept any of it. In 2021, Block pulled in over $10 billion in Bitcoin sales — but here’s the kicker: they only held onto around 2% as profit. It was a massive number on paper, but the margins were almost nonexistent.

That $170M Bitcoin bet? It turned into a gut-check moment. Block scooped up over 8,000 BTC for $170 million in 2021. When prices tanked in 2022, it wasn’t about making a return anymore — it became a real-time test of how deep their belief ran.

Wall Street couldn’t agree on Dorsey’s Bitcoin obsession. When Dorsey went all-in on “Bitcoin is the future,” some big players like Cathie Wood piled in even harder. Others, like JP Morgan, backed off and cut their ratings, saying the crypto angle was just too much risk.

His plan to launch a Bitcoin-based DEX shook up old-school investors. Dorsey’s move to create TBD — a decentralized Bitcoin exchange — didn’t sit well with folks used to Ethereum-dominated DeFi. It was a curveball that made traditional fintech investors uneasy.

Dorsey’s Bitcoin loyalty came at a cost to Block’s stock price. While other payment giants like PayPal dipped into crypto to boost activity, Dorsey went full maximalist. That deep crypto focus led Block to trade at a noticeable discount compared to peers who played it safer.

Ethical considerations and regulatory scrutiny

Jack Dorsey’s deep dive into crypto via Block Inc. hasn’t just turned heads — it’s stirred intense legal and ethical scrutiny, far beyond the usual industry noise.

Block Inc. hit with multi-state scrutiny. In 2024, Block faced an $80M regulatory settlement after failing anti-money laundering checks — unusual even for major crypto firms.

Transactions linked to sanctioned nations. Reports revealed Square and Cash App may have processed payments tied to Cuba, Iran, and Russia, triggering federal investigations.

Whistleblower exposed systemic failures. A former insider leaked files showing over 50 critical gaps in compliance, with thousands of risky transactions slipping through.

Dorsey fought FinCEN’s crypto wallet rules. In 2021, Dorsey publicly opposed FinCEN proposals that could’ve driven U.S. users to off-grid crypto tools — raising long-term oversight risks.

Satoshi Nakamoto theories swirl around Dorsey. A February 2025 editorial suggested Dorsey might actually be Bitcoin’s creator, citing timeline coincidences — no proof, but intriguing.

Block sued for $1.2 trillion by fake Satoshi. Craig Wright tried suing Block over Bitcoin IP; courts ruled he forged evidence, then held him in contempt for ignoring a lawsuit ban.

Jack Dorsey’s cryptocurrency strategy

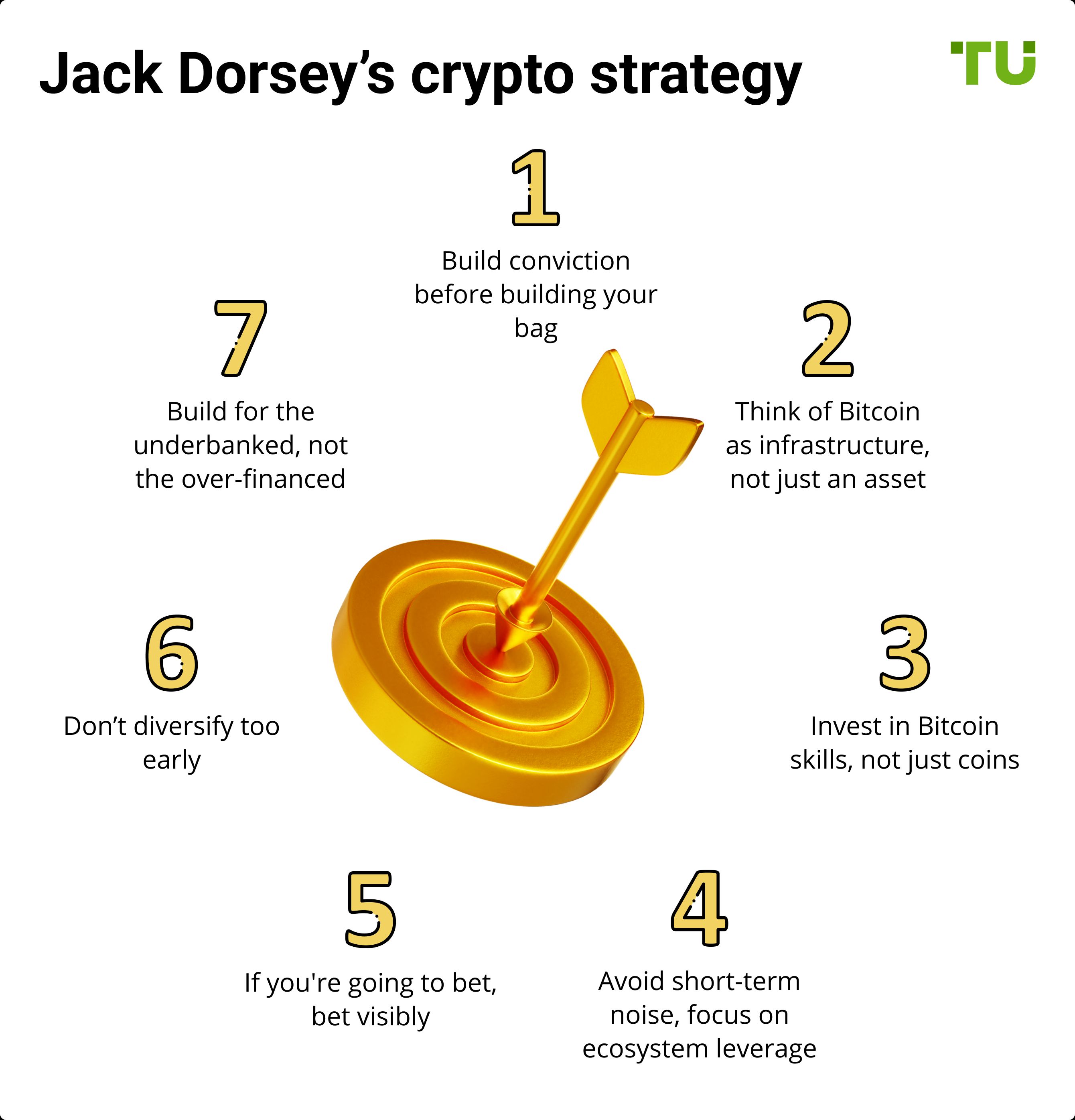

If you’re diving into crypto inspired by Dorsey’s playbook, here are powerful strategies that you can use:

Build conviction before building your bag. Dorsey didn’t just invest in Bitcoin — he studied its philosophy and committed publicly, which gave his moves long-term staying power.

Think of Bitcoin as infrastructure, not just an asset. Through initiatives like TBD and mining chip development, Dorsey treats Bitcoin as the base layer of a future financial system — not a quick trade.

Invest in Bitcoin skills, not just coins. Instead of chasing altcoins, Dorsey focused on engineering talent and product design around Bitcoin, which pays off when building scalable platforms.

Avoid short-term noise, focus on ecosystem leverage. Cash App wasn’t built to ride a trend — it became a gateway into Bitcoin for millions by integrating it into everyday financial tools.

If you're going to bet, bet visibly. Dorsey made Bitcoin part of Block’s public identity; if you're serious, make your commitment visible — share your journey, build in public.

Don’t diversify too early. Dorsey ignored the multi-coin hype and doubled down on Bitcoin; spreading out too early can dilute your learning and conviction.

Build for the underbanked, not the over-financed. Dorsey’s strategies reflect a belief that Bitcoin empowers those left behind by traditional finance — find use cases that solve real-world problems, not just trading gains.

Future outlook: What’s next for Jack Dorsey in crypto?

If you’re just stepping into crypto and watching what Jack Dorsey’s doing, here’s how you can get ahead of the curve with real, sharp moves.

Watch Block’s Bitcoin infrastructure moves. Don’t just follow the token price — watch how Dorsey is trying to control the base layer, like mining chips and nodes; it’s a peek into where power in crypto is shifting.

Think beyond trading — look at protocol-level plays. Dorsey’s focus is on Bitcoin as a network, not just an asset. Beginners can explore how to build or support tools around Bitcoin rather than trying to catch short-term gains.

Tinker with TBD’s open source remnants. Even though Block shut TBD down, their repos and ideas around decentralized identity (DID) and web5 still exist — great for learning what the next web could look like.

Follow the developer money trail. Watch where Block and its affiliates are funding developers — those grants often foreshadow major shifts in the ecosystem.

Build “Bitcoin-first” thinking. Instead of diving into Ethereum or trendy altcoins, try understanding Dorsey’s angle on why Bitcoin should be the internet’s native currency — it’ll help you develop a grounded, long-term thesis.

Expanding the vision: How Dorsey's investments shape the market

Jack Dorsey’s crypto portfolio reflects his broader vision to challenge and rethink the current financial landscape. His continued focus on Bitcoin and blockchain-based systems highlights a deep-rooted belief in decentralization and long-term transformation over short-term trends. Unlike many other tech entrepreneurs, Dorsey avoids speculative hype and prioritizes sustained adoption through meaningful innovation.

With Block, Dorsey has created a platform where Bitcoin is treated not just as a store of value but as a tool for real-world payments and everyday transactions. The company actively explores ways to integrate Bitcoin into financial services that people and businesses can use daily, pushing for practical applications over abstract potential.

If you wish to begin your crypto investing journey, the first step is to open an account with a reputed crypto exchange. We have researched the market and prepared a list of the top crypto exchanges for beginners. You can compare them through the table below and choose one for yourself:

| Crypto | Foundation year | Min. Deposit, $ | Coins Supported | Spot Taker fee, % | Spot Maker Fee, % | Alerts | Copy trading | Tier-1 regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2017 | 10 | 329 | 0,1 | 0,08 | Yes | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 2011 | 10 | 278 | 0,4 | 0,25 | Yes | Yes | Yes | 8.48 | Open an account Your capital is at risk. |

|

| Yes | 2016 | 1 | 250 | 0,5 | 0,25 | Yes | No | Yes | 8.36 | Open an account Your capital is at risk. |

|

| Yes | 2018 | 1 | 72 | 0,2 | 0,1 | Yes | Yes | Yes | 7.41 | Open an account Your capital is at risk. |

|

| Yes | 2004 | No | 1817 | 0 | 0 | No | No | No | 7.3 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Risks and warnings

While Dorsey's Bitcoin-focused strategy has many advantages, it also carries risks:

Market volatility. Bitcoin remains highly volatile, affecting the value of Dorsey's investments.

Regulatory challenges. Future regulations could impact Block’s Bitcoin-related services.

Technological risks. Competition from other blockchain technologies could challenge Bitcoin’s dominance.

Jack Dorsey’s one-asset crypto strategy is a masterclass in long-term conviction

Jack Dorsey’s crypto portfolio doesn’t follow the trend of diversification — and that’s exactly what makes it so powerful. While most traders scramble to balance dozens of coins, Dorsey’s all-in stance on Bitcoin shows a level of focused conviction that beginners can learn from. He treats Bitcoin not just as an investment but as infrastructure — something to build on, not flip.

If you’re new to crypto, the takeaway isn’t to copy his portfolio, but to understand the value of aligning your investments with your beliefs. Beginners often chase fast profits across meme coins and hype tokens, while Dorsey’s success reminds us that clarity and patience often outperform complexity and chaos.

What’s often missed in Dorsey’s approach is how much he invests in the ecosystem rather than just the asset. Through Block, he’s funding tools, hardware (like self-custody wallets), and even developer grants that strengthen Bitcoin’s usability. That’s a subtle but important shift in thinking — he isn’t just betting on price appreciation, he’s building long-term infrastructure to support it. For beginners, this is an underrated lesson: the real alpha isn’t always in the chart, it’s in understanding who is shaping the rails the crypto economy will run on in five or ten years.

Conclusion

Jack Dorsey’s crypto portfolio is unique in its unwavering commitment to Bitcoin. Unlike many investors who diversify across altcoins, Dorsey believes in Bitcoin’s long-term potential as a decentralized global currency. Through his company Block, investments in Bitcoin infrastructure, and advocacy for financial decentralization, Dorsey continues to shape the future of cryptocurrency. While his approach carries risks, his influence on the crypto space remains undeniable.

FAQs

Has Jack Dorsey ever commented on Ethereum or other altcoins?

Yes — he’s made it clear he’s not a fan. Dorsey has publicly dismissed Ethereum and other altcoins, arguing they distract from Bitcoin’s mission. He believes Bitcoin is the only truly decentralized and secure option worth building on.

Does Jack Dorsey use his Bitcoin for anything beyond holding?

He does! Dorsey uses Bitcoin to support developers, fund nonprofits, and promote infrastructure projects. It’s not just a store of value for him — it’s a way to push forward decentralization.

What’s Jack Dorsey’s take on Bitcoin’s environmental impact?

While critics point to Bitcoin’s energy use, Dorsey advocates for clean mining solutions. He’s pushed for renewable energy integration and has backed initiatives aiming to make Bitcoin mining more sustainable.

Has Jack Dorsey shared any personal lessons from investing in Bitcoin?

Dorsey has often said conviction matters more than timing. He credits his success to deeply understanding Bitcoin’s principles before investing — and urges others to educate themselves, not just follow hype.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Ray Dalio is the founder of Bridgewater Associates, one of the world's largest and most successful hedge fund firms. His investment principles, outlined in his book "Principles: Life and Work," have been influential in guiding his investment strategy and the culture of his firm. Dalio is also known for his economic research and predictions, which have garnered significant attention in the financial industry.