Justin Sun’s Crypto Investments: An Overview

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

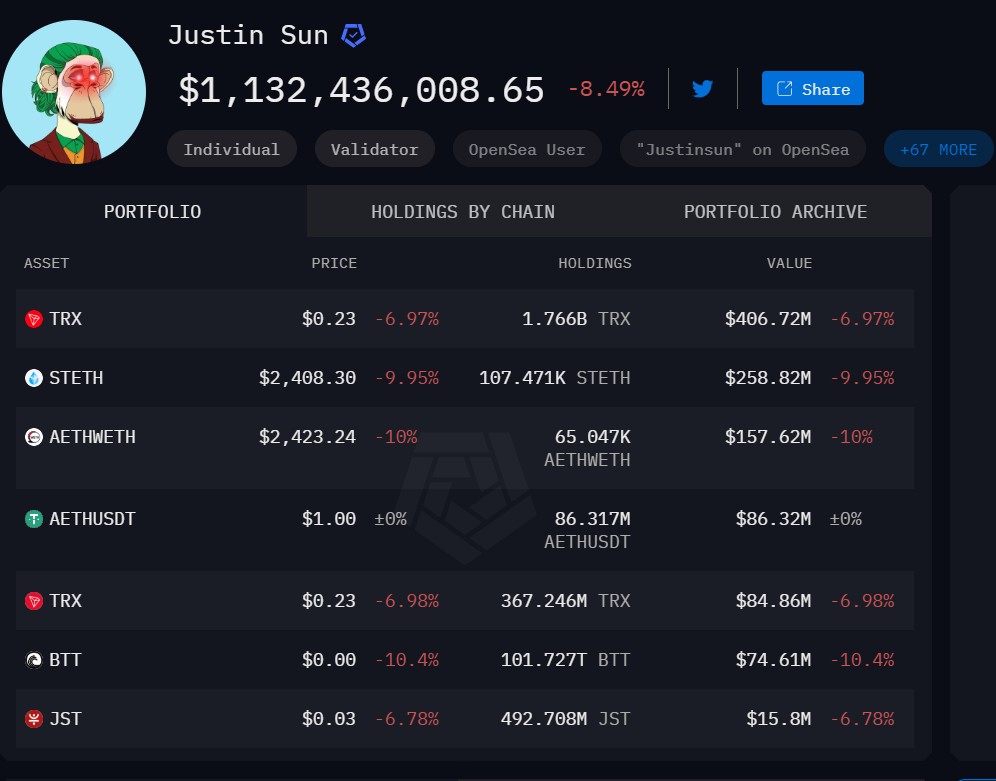

Justin Sun's known crypto assets are worth about $1.99 billion. The bulk of this wealth is in TRON (TRX), amounting to roughly $603 million. He also has substantial holdings in staked Ethereum (STETH) at $396 million, USDD stablecoin at $326 million, AETHWETH at $257 million, and BitTorrent (BTT) tokens totaling $129 million.

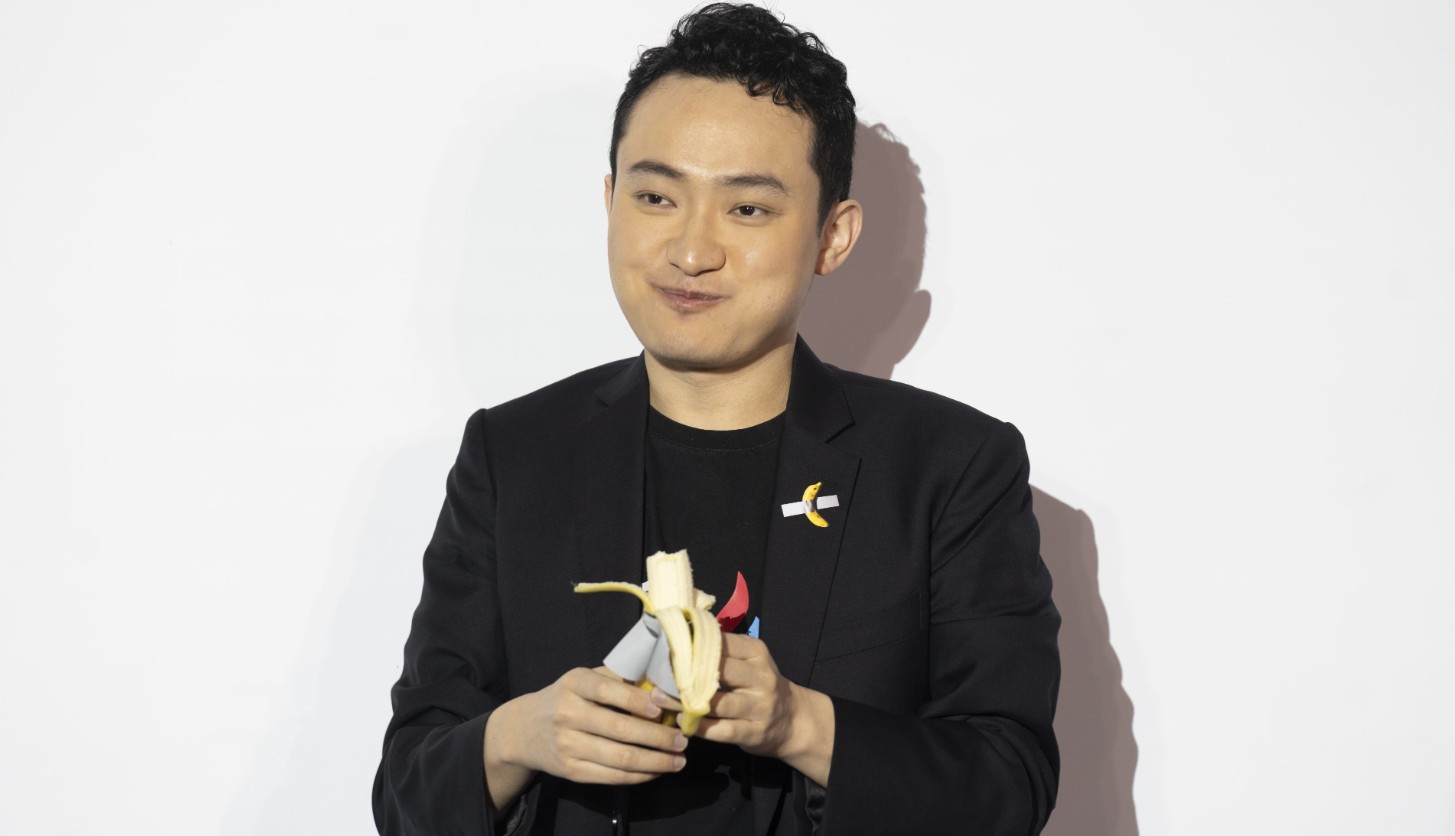

Justin Sun’s impact on the crypto world goes beyond just running TRON. He’s made bold investments in various cryptocurrencies, stablecoins, and DeFi projects, often making headlines with his high-stakes moves. Whether it’s acquiring blockchain companies or shifting large amounts of capital, his strategies tend to influence market trends and stir up debates about decentralization.

Sun’s portfolio isn’t just about holding assets — it’s a way for him to stay ahead of industry shifts. From investing in emerging blockchain projects to securing stablecoins for liquidity, he constantly positions himself in key areas of crypto finance. His presence in the market keeps traders and investors watching closely, knowing that his moves often signal bigger trends in the space.

Breakdown of Justin Sun’s cryptocurrency holdings

Justin Sun's known cryptocurrency holdings total approximately $1.99 billion. His portfolio includes:

Tron (TRX). Sun holds around $603 million in TRX, showing his deep commitment to the network he founded.

Staked Ethereum (STETH). He has about $396 million in STETH, highlighting his active participation in Ethereum's staking activities.

USDD. Sun's assets feature approximately $326 million in USDD, a stablecoin tied to the Tron ecosystem.

AETHWETH. He holds roughly $257 million in AETHWETH, indicating his interest in Ethereum-based derivatives.

BitTorrent (BTT). Sun's investments include $129 million in BTT, the token for the BitTorrent platform he owns.

Bitcoin (BTC). He holds about $98 million in BTC, reflecting his confidence in Bitcoin's role in the market.

Stablecoins (USDT, USDJ). His portfolio includes $91 million in USDJ and $9 million in USDT, offering flexibility for his trading strategies.

Ethereum (ETH). Sun maintains around $9.22 million in ETH, supporting his activities across various blockchain networks.

Altcoins. He has also invested in tokens like Shiba Inu (SHIB - $11.56 million) and Floki (FLOKI - $5.63 million), showcasing his engagement with a wide range of digital assets.

TRON and Justin Sun’s blockchain influence

TRON offers a refreshing take on how transaction fees are handled. Instead of charging for every transaction, it uses Bandwidth and Energy points, letting users make transactions without fees. This setup is particularly welcoming for beginners. And even if you run out of these points, the fees are still much lower compared to platforms like Ethereum.

Justin Sun, who started TRON, has played a key role in making blockchain more user-friendly. Back in 2018, he bought BitTorrent and combined its file-sharing features with TRON. This merger made it easier to share digital content worldwide. Sun aims to build a decentralized internet, allowing creators to connect directly with their fans, cutting out the middlemen, and changing how we experience online entertainment.

Financial impact and market reactions

Justin Sun, the founder of TRON, often makes bold moves that shake up the cryptocurrency world. In January 2025, he moved more than $320 million worth of Ethereum and related tokens to HTX in just 13 hours, part of a bigger $1.124 billion shift since November 2024. Such large transactions can cause market volatility, as traders watch his actions closely for signs of market changes. For example, his deposit of 96,591 ETH, worth about $316 million, added noticeable volatility to the Ethereum market, leading to price swings that can be both opportunities and challenges for traders.

Besides his trading moves, Sun's investments have significant financial effects. In early 2025, he put $75 million into World Liberty Financial (WLFI), a crypto project linked to President Donald Trump. This investment not only increased his presence in the crypto scene but also made him an advisor to the project, potentially influencing its direction and how the market views it. High-profile investments like this can affect investor feelings and draw attention to specific projects, highlighting Sun's impact on market trends.

Justin Sun’s cryptocurrency strategy

Learning from Justin Sun's approach to cryptocurrency can provide practical tips for newcomers aiming to succeed in this ever-changing field.

Stick with your projects. Sun believes in staying committed to your crypto ventures, even when the market gets tough. This dedication can keep you on track and lead to long-term achievements.

Look for high-return opportunities. Sun points out that aiming for a 20% return on your crypto investments can boost your earnings. It's worth exploring these possibilities, but always be mindful of the risks involved.

Spread your investments. Sun doesn't just focus on his own TRON network; he also invests in Bitcoin and Ethereum. Diversifying your investments across different blockchain platforms can help reduce risks and open up various growth prospects.

Build meaningful partnerships. Sun works with notable individuals, like his role with World Liberty Financial, showing that forming alliances can broaden your reach and opportunities in the crypto world.

Build meaningful partnerships. Sun stays engaged in conversations about crypto rules, emphasizing the need for investors to be aware of policy changes, as they can greatly affect investment plans and market conditions.

Pay attention to market moods. Sun's public comments and actions often sway market trends. Watching these behaviors and understanding their possible effects can give you an edge in predicting market shifts.

Future outlook: What’s next for Justin Sun in crypto?

Justin Sun’s future in crypto isn’t just about TRON — it’s about creating a cross-chain financial empire and expanding blockchain’s influence beyond what most people expect. Here are some key moves he’s likely planning.

Cross-border stablecoin dominance. Sun has been vocal about his goal to make USDD a leading stablecoin, but his bigger play might be in expanding cross-border transactions. Instead of competing directly with USDT and USDC, he could be positioning USDD as a bridge asset between traditional finance and digital currencies in underbanked regions, particularly in Africa and Latin America.

The next big Web3 financial institution. Sun’s track record shows he’s not just building blockchain projects; he’s acquiring and integrating them. His investments in Poloniex, Huobi, and various DeFi protocols indicate he might be building the first fully blockchain-powered financial institution, where lending, payments, and trading happen on-chain without the need for intermediaries.

The return of algorithmic stablecoins — but smarter. The collapse of Terra’s UST spooked the market, but Sun has been refining USDD’s algorithmic model with collateralized backing. Expect him to push for a new generation of algorithmic stablecoins that are less reliant on volatile assets and more intertwined with real-world financial instruments, such as tokenized bonds or commodities.

Geopolitical crypto influence. Sun has been strategic in aligning himself with governments that are friendly to crypto, like those of St. Kitts & Nevis and Dominica, where TRON has gained regulatory approval. His next move could be leveraging these relationships to position TRON as the backbone for state-backed digital currencies or tax-free blockchain hubs.

The expansion of tokenized real-world assets. While many are focused on tokenizing real estate and stocks, Sun is likely to push for more niche, high-value markets. His interest in art, luxury collectibles, and even financial derivatives could lead to a new wave of tokenization, where previously illiquid assets become tradeable on the blockchain.

Risks and warnings

While Sun’s portfolio showcases a strong diversification strategy, there are key risks to consider:

Regulatory threats. Ongoing legal challenges could impact TRON’s adoption and Sun’s ability to operate freely.

Market volatility. Crypto prices fluctuate widely, and Sun’s heavy exposure to certain assets could lead to significant losses.

Concentration risks. A large portion of his portfolio is in TRX and TRON-related projects, making him vulnerable to ecosystem-specific downturns.

Public perception. Any negative news regarding Sun or his companies could trigger market sell-offs. Justin Sun’s crypto portfolio is under constant market scrutiny, making it essential for traders to assess associated risks.

Justin Sun builds influence and liquidity with strategic crypto holdings

Most beginners think diversifying a crypto portfolio means holding a mix of Bitcoin, Ethereum, and some altcoins. But Justin Sun takes it further — his approach is all about staying in control while keeping his options open. Instead of just spreading his investments, he locks in liquidity with stable assets like USDD, making sure he can jump into trades anytime without selling off his main holdings.

His massive stake in TRX isn’t just about belief in the project — it’s a power move. Holding a significant portion of TRON means he has a say in network decisions, which lets him shape its future while profiting from its growth. If you’re serious about crypto, don’t just invest in a coin — think about how much influence you have over it.

Sun also does something many overlook — he doesn’t just stake Ethereum, he stakes in a way that keeps him flexible. His investments in STETH and AETHWETH let him earn staking rewards while still being able to use his funds elsewhere. That’s a smart way to earn passive income without locking yourself out of opportunities.

His BitTorrent (BTT) holdings follow a similar logic. Instead of just holding tokens for price appreciation, he makes sure they have a use case within TRON’s ecosystem, keeping demand alive. If you want to build a solid portfolio, don’t just buy coins based on hype — choose assets that work together and give you more ways to stay liquid and profitable.

Conclusion

Justin Sun remains a highly influential figure in the cryptocurrency industry, with a diverse and strategically structured portfolio worth nearly 2 billion. His involvement spans across Bitcoin, Ethereum, TRON, stablecoins, DeFi projects, and NFT markets, demonstrating his adaptability and market insight.

Despite regulatory challenges, Sun continues to innovate and expand his blockchain empire. His future investments in AI, Web3, metaverse applications, and financial integrations could further solidify his influence. However, traders and investors should remain cautious about the risks associated with regulatory scrutiny and market volatility surrounding his projects. By staying informed and strategically managing their investments, traders can navigate the dynamic landscape of Sun’s crypto ecosystem effectively.

FAQs

What cryptocurrencies are in Justin Sun’s portfolio?

His portfolio includes BTC, ETH, TRX, USDT, USDC, TUSD, BNB, SOL, DOT, AVAX, UNI, AAVE, and other DeFi/NFT tokens. What coins does Justin Sun own? His holdings span across a variety of altcoins, stablecoins, and leading blockchain assets.

How much is Justin Sun’s crypto portfolio worth?

It is estimated to be nearly $2 billion, with holdings spread across various blockchain ecosystems.

Is TRX a good investment?

TRX has been growing in adoption, but regulatory concerns and market volatility should be considered before investing.

What is Justin Sun’s connection to stablecoins?

Sun frequently moves large amounts of stablecoins (TUSD, USDT) and has been involved in stablecoin liquidity management within DeFi platforms. His TRON blockchain portfolio is deeply connected to the movement of stablecoins across DeFi platforms.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.