Michael Saylor’s Crypto Investments: An Overview

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Michael Saylor, who started MicroStrategy (now Strategy) and serves as its executive chairman, has heavily invested in Bitcoin personally and through his company. Strategy owned around 499.096 bitcoins, totaling roughly $33.1 billion. Back in October 2020, Saylor shared that he personally held 17,732 bitcoins. He believes strongly in Bitcoin as protection against inflation and chooses not to invest in other cryptocurrencies.

Michael Saylor, co-founder and executive chairman of MicroStrategy, has played a major role in shaping Bitcoin’s mainstream adoption. Since 2020, he has consistently pushed the idea that Bitcoin outperforms traditional assets as a long-term investment. His aggressive accumulation strategy, both personally and through MicroStrategy, has had a ripple effect on the crypto market. Saylor’s unwavering confidence in Bitcoin has kept him in the spotlight, with many likening MicroStrategy’s holdings to a corporate treasury securing its financial future.

Breakdown of Michael Saylor’s cryptocurrency holdings

Michael Saylor, who co-founded Strategy (the company formerly known as MicroStrategy), has heavily invested in Bitcoin both through his company and personally.

Saylor's personal holdings. Saylor has shared that he personally holds 17.732 bitcoins, which he bought for around $175 million, averaging $9,882 per coin.

Strategy's Bitcoin holdings. The company owns about 499.096 bitcoins, totaling roughly $33.1 billion. This already includes 20,056 BTC that the company acquired from February 17 to 23, 2025.

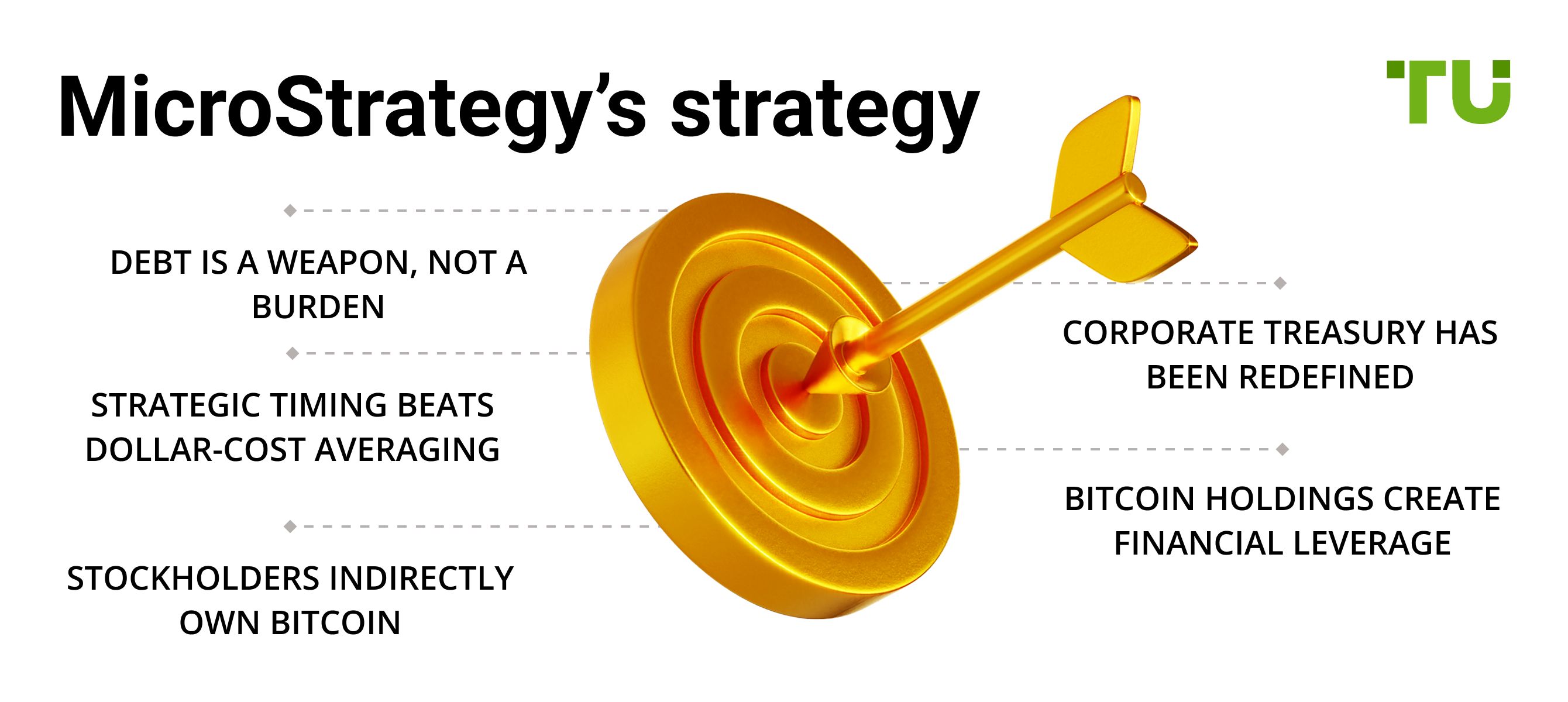

MicroStrategy’s Bitcoin strategy

MicroStrategy’s Bitcoin approach isn’t just about buying and holding — it’s a calculated strategy that challenges traditional corporate finance. Here’s what makes it stand out.

Debt is a weapon, not a burden. Instead of using company cash, MicroStrategy raises debt through convertible notes to buy Bitcoin. This lets them acquire BTC without sacrificing cash flow, betting that Bitcoin’s value will outgrow the debt’s interest.

Corporate treasury has been redefined. Unlike most companies that keep reserves in cash or bonds, MicroStrategy treats Bitcoin as a primary asset, arguing that fiat depreciates while BTC appreciates long-term.

Strategic timing beats dollar-cost averaging. While many investors use dollar-cost averaging, MicroStrategy buys Bitcoin aggressively after price drops or major market corrections, securing a lower cost basis over time.

Bitcoin holdings create financial leverage. Holding a massive Bitcoin reserve lets MicroStrategy tap into its balance sheet strength for further funding, as investors view BTC as a valuable backing asset.

Stockholders indirectly own Bitcoin. MicroStrategy’s stock acts as a Bitcoin proxy, meaning shareholders gain exposure to BTC’s price movements without directly buying crypto. This attracts institutional investors who can’t hold Bitcoin directly.

Ethical considerations and regulatory scrutiny

MicroStrategy’s deep dive into Bitcoin has put it in a unique spot, bringing up questions about ethics, risks, and future regulations.

Bitcoin strategy shifts company focus. MicroStrategy started as a software firm, but its massive Bitcoin buys make it look more like a crypto fund, leaving investors wondering about its true identity.

Regulators might step in fast. The company uses creative financial moves, like issuing debt to buy Bitcoin, but if rules change, these strategies could be shut down overnight.

Stockholders might not be ready. Many bought shares expecting software growth, not a bet on Bitcoin. A crackdown on crypto could leave these investors in a risky position.

Saylor’s influence is hard to ignore. As a major Bitcoin advocate, his vision shapes MicroStrategy’s choices, making it unclear whether decisions serve the company or his own Bitcoin beliefs.

Crypto tax rules could change everything. Holding Bitcoin under a company brings tax challenges, and if governments tighten policies, MicroStrategy could face big financial shifts.

Reputation affects future regulations. If Bitcoin takes a huge hit, authorities might view MicroStrategy’s strategy as reckless, pushing for new restrictions on corporate crypto holdings.

Future outlook: What’s next for Michael Saylor in crypto?

Michael Saylor’s Bitcoin strategy has already reshaped corporate investment, but his next moves could push crypto adoption even further.

Expanding Bitcoin-backed loans. Strategy might leverage its massive Bitcoin holdings to secure loans for new acquisitions, creating a new model for corporate finance.

Spearheading Bitcoin accounting reforms. Saylor is vocal about outdated financial reporting rules for crypto and may push for new standards that better reflect Bitcoin’s market value.

Developing a Bitcoin-powered economy. Expect Saylor to back businesses or ecosystems built entirely on Bitcoin, from payment networks to corporate treasury tools.

Strengthening Bitcoin’s institutional adoption. He could work with major financial institutions to drive Bitcoin-backed products like ETFs, bonds, or interest-bearing accounts.

Shifting into Bitcoin governance. While he isn’t a Bitcoin developer, Saylor’s influence could shape how corporations interact with Bitcoin’s evolving technology, including Layer 2 solutions.

Advocating for pro-Bitcoin policies. With growing regulatory scrutiny, he might take on a more active role in shaping legislation that protects Bitcoin ownership and innovation.

Risks and warnings

While Saylor’s Bitcoin strategy has been highly profitable, it comes with risks:

High volatility. Bitcoin remains a highly volatile asset, which can lead to significant financial fluctuations.

Regulatory changes. Governments worldwide are exploring cryptocurrency regulations, which could impact MicroStrategy’s holdings.

Liquidity concerns. Converting large Bitcoin holdings into fiat currency without impacting the market could be challenging.

The key is to focus on acquiring Bitcoin during market corrections

Michael Saylor’s approach to Bitcoin isn’t just about buying and holding — it’s about structured accumulation with strategic leverage. Instead of dollar-cost averaging like most retail investors, Saylor uses corporate debt and convertible notes to acquire Bitcoin in massive tranches. Beginners can take a cue from this by leveraging safe, long-term loans with low interest rates to scale their crypto holdings, but only in an environment where debt servicing remains manageable.

The key is to focus on acquiring Bitcoin during market corrections when fear dominates the market, rather than blindly buying at all-time highs. This method requires patience, but it’s how institutional players like Saylor optimize their cost basis without taking excessive short-term risks.

Another overlooked aspect of Saylor’s strategy is his use of tax-efficient corporate structures. He leverages MicroStrategy’s status as a publicly traded company to avoid direct capital gains taxation on Bitcoin holdings. While the average investor doesn’t have a corporation at their disposal, they can still utilize tax-advantaged retirement accounts or crypto-friendly jurisdictions to minimize tax liabilities.

Conclusion

Michael Saylor’s crypto portfolio, primarily centered around Bitcoin, has played a pivotal role in shaping institutional investment in digital assets. His unwavering confidence in Bitcoin has positioned MicroStrategy as both a tech company and a Bitcoin powerhouse. While his strategy has yielded substantial gains, it also carries risks that investors must consider. As Bitcoin adoption grows, Saylor’s influence in the space will likely continue to expand, making him one of the most significant figures in cryptocurrency history. MicroStrategy’s crypto investments are a case study in bold financial strategy, blending corporate finance with Bitcoin maximalism.

FAQs

What role does Michael Saylor play at MicroStrategy?

Michael Saylor is the co-founder and Executive Chairman of MicroStrategy, known for its significant Bitcoin investments.

How does MicroStrategy finance its Bitcoin acquisitions?

The company raises funds through convertible bonds and stock sales to finance its Bitcoin purchases.

How has MicroStrategy’s workforce changed due to its Bitcoin investments?

In 2024, the company reduced its workforce by 20.7%, despite increasing its Bitcoin holdings.

Does MicroStrategy plan to sell its Bitcoin holdings?

As of 2025, MicroStrategy remains committed to holding Bitcoin long-term, with no plans to sell.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.