Forex Fury Trading Bot Review

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Forex Fury is an automated trading software compatible with Metatrader 4 and 5. It uses algorithmic trading strategies to execute trades, claiming a 93% success rate. To use it, purchase the software from its official website, install it on your terminal, and customize its settings to align with your trading goals.

Forex Fury is positioned as the #1 product for algorithmic trading. The creators of Forex Fury claim that 93% of transactions made by the Expert Advisor are profitable. However, as you realize, with improper risk management, even 7% of losing trades can destroy an account.

This review will provide an in-depth understanding of Forex Fury, helping potential users make an informed decision before investing in the software.

What is the Forex Fury robot?

Forex Fury is an automated trading robot, or Expert Advisor (EA), designed for the MetaTrader 4 and 5 platforms. It executes trades in forex, indices, and cryptocurrencies, aiming for high success rates with low risk. The robot operates during specific low-volatility periods, typically engaging in trades for about one hour daily. It employs a range-based scalping strategy, focusing on quick, small profits. Forex Fury offers features such as easy installation, free lifetime updates, and customizable settings to accommodate various trading strategies.

Forex Fury specifications

Platform сompatibility. Works with MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Supports brokers offering these platforms globally.

Trading strategy. Focuses on scalping and range-based trading. Trades during low-volatility periods to avoid high-risk events. Optimized for specific currency pairs, including major and minor pairs.

Customizable risk settings. Allows traders to adjust lot size, stop loss, and take profit levels. Options for conservative, moderate, and aggressive trading styles.

Supported asset classes: currencies (Forex major and minor pairs), cryptocurrencies (if they are supported by the broker), indices and commodities (depending on broker compatibility).

Compliance & regulations. Adheres to relevant National Futures Association (NFA) regulations. Supports FIFO trading rules and compatible with hedge-free accounts.

Trading frequency & performance. Conducts trades 1-2 times per session, aiming for consistent gains. Offers real-time trade monitoring and updates through MyFXBook or similar services (if supported).

User support & setup. Comes with easy-to-follow video tutorials and setup guides. Regular software updates and technical support for troubleshooting.

Account management & monitoring. Compatible with both demo and live trading accounts. Users can track trading performance in real-time using integrated tools.

Installation & integration. Simple installation process suitable for beginners. Requires minimal technical knowledge due to step-by-step guidance.

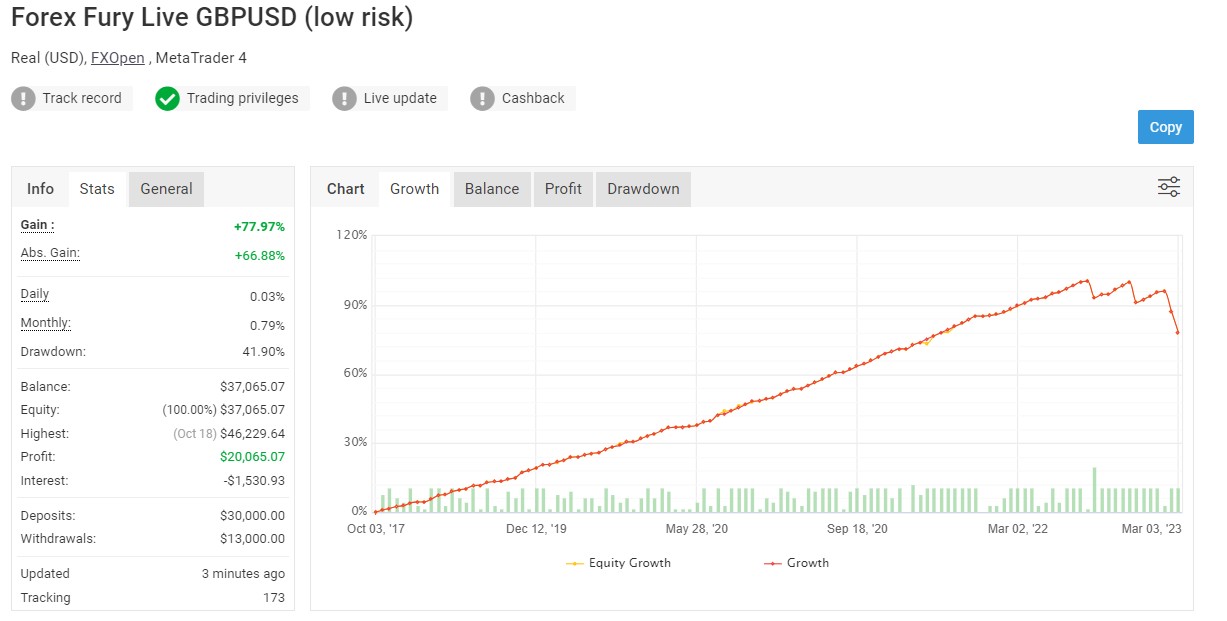

To provide facts confirming profitability, the Forex Fury website provides monitoring of accounts on which the Expert Advisor trades. The monitoring is provided by MyFXbook, an independent and reputable service.

The report above shows that Forex Fury was able to grow the account by 207% in 20 months.

How to use Forex Fury?

To effectively use Forex Fury, you’ll need the following:

Forex broker account. Select a reputable broker compatible with MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms, ensuring support for automated trading systems. Consider opening an account with RoboForex for this purpose.

Initial capital. A minimum deposit of $100 is recommended, especially when starting with a micro account, to facilitate effective trading.

Virtual private server (VPS). Employing a VPS ensures continuous operation of the trading platform, minimizing downtime and enhancing trade execution efficiency.

Forex Fury software. Purchase the Forex Fury Expert Advisor from the official website, then download and install it on your MT4 or MT5 platform.

Steps to use Forex Fury

Install and configure: Set up Forex Fury on your trading platform and adjust the settings to match your trading preferences.

Connect to a broker: Link the software to your forex broker account.

Start trading: Activate the advisor to begin automated trading.

Monitor trades: Regularly check performance and ensure the advisor is operating as expected.

Optimize settings: Use the backtesting feature to test and refine settings for different market conditions to maximize profitability.

Withdraw profits: Transfer earnings from your broker account as desired.

How much is the Forex Fury robot?

Forex Fury offers two membership plans:

Gold membership. Priced at $249.99, this plan includes one live account license, unlimited demo accounts, free lifetime updates, easy installation guides, and performance-optimized settings.

Diamond membership. Available for $459.99, this plan includes two live account licenses and all features of the gold membership.

Both plans offer lifetime access with no recurring charges. Forex Fury does not provide free trials. Access is only available through paid memberships. Compared to other trading advisors, which can range from $349 to $1,745, Forex Fury's pricing is relatively affordable, making it a cost-effective choice for traders seeking an automated trading solution.

Pros and cons of Forex Fury

- Pros

- Cons

Versatile strategies. Offers low, medium, and high-risk automated strategies to suit various trading preferences.

Proven performance. Boasts a 93% winning track record with verified results on Myfxbook accounts.

Customizable. Allows users to tailor settings to align with individual risk tolerance and trading styles.

Passive income. Trades automatically, even while you sleep, creating an opportunity for hands-free income generation.

No free trial. Access is only available through paid memberships, with no free trial option.

No profit guarantee. Like all automated trading advisors, past performance does not guarantee future profits.

Potential high drawdowns. Improper risk management can lead to significant losses.

Limited support. No live chat for customer support, and email responses can be slow.

No Mobile app. Forex Fury does not offer a mobile application for on-the-go management.

The screenshot above shows that suddenly Forex Fury started making losses on one of the accounts. Just 4 large losses destroyed the impressive growth curve built with dozens of profitable trades.

This may have been due to changes in the nature of the market. And you never know if this will happen to your account, which you will risk giving to Forex Fury's automated advisor for trading.

As an option for using the Forex Fury advisor, consider giving it a small portion of your capital (if you can afford it). By including Forex Fury in your portfolio of high-risk strategies, you can diversify your risk and try to achieve a more sustainable growth curve.

Is robot trading real or fake?

Robot trading is real, but its effectiveness depends on the legitimacy of the bot and how it is used. While some trading robots are genuine and can help automate strategies, many free or guaranteed-profit bots are scams designed to deceive users.

Legitimate trading robots operate by executing pre-programmed algorithms, often designed to capitalize on specific market conditions. However, even authentic robots do not guarantee profits, as market movements are unpredictable, and past performance does not ensure future success. Traders must verify the robot's credibility, test it thoroughly, and manage risks effectively.

The widespread use of free or "guaranteed returns" bots raises concerns, as scammers often exploit these claims to lure unsuspecting users. To protect yourself, always research thoroughly, avoid bots with unrealistic promises, and stick to reputable platforms. Robot trading can be a useful tool, but only when used with caution and informed decision-making.

Adjusting parameters like lot size, trading hours, and risk levels can improve trading results.

To maximize Forex Fury's potential, customize its settings to fit your trading style and risk tolerance. Adjusting parameters like lot size, trading hours, and risk levels can improve trading results. Conduct thorough backtesting with historical data to fine-tune these settings and see how they perform in various market conditions. This personalized approach helps build confidence and prepares you for live trading.

Another key strategy is diversifying the currency pairs you trade. Forex Fury supports multiple pairs, so experiment with different combinations to uncover profitable opportunities. Use demo accounts to test various pairs and strategies without risking real money. This allows you to identify what works best before applying your approach in live market conditions.

Conclusion

Forex Fury stands out as a reliable automated trading robot for MetaTrader 4 and 5 platforms, offering advanced algorithmic strategies designed to optimize trading performance. With customizable settings, proven performance records, and user-friendly installation, it appeals to both beginners and experienced traders.

However, like any trading tool, success depends on proper configuration, continuous monitoring, and effective risk management. Before investing, consider backtesting strategies, using demo accounts, and consulting financial experts to align the robot’s performance with your trading goals. With the right approach, Forex Fury can become a valuable asset in your trading journey.

FAQs

Is Forex Fury legit?

Yes, trading with automated EAs is allowed by many brokers. Moreover, Forex Fury meets the requirements of such a reputable regulator as the US National Futures Association (NFA).

Who owns the Forex Fury robot?

Patrick Ryan is the CEO and owner of Forex Fury.

Is Forex Fury profitable?

More likely yes than no. However, past results do not guarantee future profits.

What is the monthly return of forex fury?

The Fury EA is expected to compound monthly returns of 10-20%, depending on the user's settings. But it does not guarantee this much return on every investment.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex Fury is a trading advisor for Metatrader 4/5 terminal. You can purchase it to try and create a passive income stream.

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

Backtesting is the process of testing a trading strategy on historical data. It allows you to evaluate the strategy's performance in the past and identify its potential risks and benefits.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.