Richest Crypto Traders In Nigeria 2025: Who Leads The Market

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Top crypto traders in Nigeria:

Ifeanyi Ezenwaogene – a professional trader and market analyst known for providing educational content and crypto trading signals via Telegram.

Gaius Chibueze – a bestselling author and entrepreneur who champions Bitcoin education and mass adoption across Africa.

Hanu Fejiro Agbodje – founder of Patricia, a major Nigerian crypto platform focused on simplifying digital finance for everyday users.

Linus Williams (Blord) – a well-known crypto investor and influencer building a digital asset ecosystem and community in Nigeria.

Tola Joseph Fadugbagbe – a seasoned crypto trader and YouTube educator offering in-depth tutorials on technical analysis and trading psychology.

Behind Nigeria’s crypto boom is a core group of traders who do more than speculate — they shape narratives, build platforms, and define what success looks like in volatile digital markets. From high-profile educators to fintech founders, these individuals don’t just trade coins — they build ecosystems. Gaius Chibueze, a.k.a. Bitcoin Chief in Nigeria, turned a personal brand into the Abitnetwork empire. Ifeanyi Ezenwaogene mixes technical strategy with mentorship through Fortune Beach Academy. Hanu Fejiro Agbodje developed Patricia into a go-to crypto access point across West Africa. By studying how these traders operate — what tools they use, how they manage risk, and where they educate others — we uncover the models that actually work in the Nigerian crypto space today.

Successful and rich crypto traders in Nigeria

Nigeria is home to a small number of traders who influence the balance of power in the digital asset segment. These individuals accumulate capital, launch platforms, build educational projects, and develop trading infrastructure. Their methods of dealing with volatility, use of P2P tools, and integration of formats ranging from OTC to DeFi are shaping the way newer players enter the market. This operational foundation defines the presence of the best crypto traders in Nigeria.

Ifeanyi Ezenwaogene

In 2020, he launched his first trading group via Telegram, which produced dozens of users who became active participants in crypto trading in Nigeria. In 2021, he formalized Fortune Beach Academy, a project combining educational and investment modules. His total net worth is estimated at $12 million, including liquid holdings in Ethereum, Avalanche, BNB Chain, and multiple DeFi contracts executed through DEX platforms like Uniswap and Trader Joe.

He uses staggered entry models with distributed exposure: trades are divided into 3–4 phases, each with independent stop-loss and take-profit levels. Ezenwaogene relies on interval-based strategies on the daily timeframe, typically holding positions for up to six weeks. Approximately 25–30% of his capital is parked in stablecoins, while the rest is rotated based on altcoin seasonality and real-time TVL metrics.

According to data from public wallet addresses and internal analytics from Fortune Beach, his monthly trading volume averages $600,000–800,000, with reinvested returns of around 12–18% per quarter. He regularly streams live trading sessions, combining on-chain flow analysis with classic liquidity level techniques.

Gaius Chibueze (Bitcoin Chief)

Chibueze started with early Bitcoin and altcoin positions — his first BTC purchase was in 2011, buying 5 BTC at $32 each. By 2016, his wallets held over $400,000 in digital assets. In 2020, he launched Tatcoin and built Abitnetwork — a layered platform combining financial services, token utility, and trading education. His current net worth is estimated at $10–12 million, with around 30% held in BTC, 20% in ecosystem tokens like Tatcoin, and the rest allocated to liquid positions across Binance, Gate.io, and OTC deal pools.

Publicly known as Bitcoin Chief Nigeria, he drives sentiment across retail segments. He trades based on a dominance wave model, entering altcoins when BTC.D drops below 46% and rotating out above 50%. His profit-locking setup splits exits into two parts: one closed on Take Profit, the second rebalanced into USDT or BNB and held until liquidity rebounds. Average monthly trading volume is between $150,000–300,000, peaking at $1 million during high-volatility periods, based on data from wallet analytics and Abitnetwork APIs. Transfers are primarily handled over TRC-20 and BSC. He routinely works with OTC desks in Lagos and Accra.

Ripple, Stellar, and other transactional chains are integrated into his portfolio for their role in cross-border flows within ECOWAS. His on-chain activity is tracked in blockchain analytics platforms and often signals significant market entries. Based on volume, infrastructure, and flow coordination, he consistently ranks among top crypto traders Nigeria.

Hanu Fejiro Agbodje

Agbodje founded Patricia in 2017, initially focusing on gift card arbitrage, before expanding into a multi-functional platform for crypto trading in Nigeria. His early trading strategy centered on pricing inefficiencies between local Naira exchanges and global BTC/USDT markets. Between 2018 and 2020, he scaled operations by integrating local payment channels and deploying an automated order-routing engine.

By 2021, Patricia’s monthly transaction volume exceeded ₦10 billion (approx. $13 million), with user growth driven by P2P fiat-crypto conversion tools. Agbodje's personal net worth is estimated at $8.9 million, with trading-related assets accounting for roughly 60% of that. His positions span Bitcoin, USDT, and high-turnover altcoins like Solana and BNB, with 10–15% of capital actively rotated across local exchanges and international desks.

He applies counterparty risk-scoring algorithms in all Patricia-linked P2P trades, incorporating transaction history, frequency, and wallet reputation metrics. Liquidity is maintained using multi-account load balancing and adaptive thresholds, allowing Patricia to settle high-frequency trades even during volatile periods. These infrastructure controls ensure uptime and settlement flow, making Patricia one of the best crypto trading platforms in Nigeria by operational resilience.

Agbodje personally oversees Patricia’s risk desk, where positions are recalibrated weekly based on NGN inflation data, international remittance rates, and TVL fluctuations across Binance Smart Chain protocols. Roughly 45–55% of monthly revenues derive from commission on domestic swaps; another 20% comes from cross-border activity routed via Ghana and Kenya.

He regularly features in investor briefings and DeFi roadmap discussions and is recognized across analyst dashboards as one of the richest crypto traders in Nigeria operating at scale within the regulated fintech corridor.

Linus Williams (Blord)

Blord began trading crypto in 2017 using peer-to-peer arbitrage between Binance and local Nigerian exchanges, focusing on price gaps in BTC/NGN pairs. His early profits came from fast turnover — executing up to 100 micro-deals per week, often using manual escrow verification before P2P platforms scaled. By 2019, he had generated over $350,000 in net trading gains, which he reinvested into payment infrastructure and branded resale tools under the Blord Group.

His current net worth is estimated at $5 million, with crypto assets representing close to 60% of that total, primarily split across BTC, TRON-based stablecoins (TRC-20 USDT), and high-liquidity tokens like BNB. His average monthly trade volume exceeds $400,000, with peaks during market volatility reaching $900,000, as verified via Jetpay settlement logs and OTC desk records.

Blord operates a closed-loop trading system using internal accounts across his platforms (Jetpay and Billpoint), which allows instant swap routing between NGN, USDT, and BTC with sub-minute confirmation times. He avoids holding volatile altcoins for more than 72 hours and uses fixed profit triggers of 2–4% per cycle, with a loss cap of 1.5% enforced through automated risk filters.

He teaches this exact trading model through closed mentorships and is known for running Telegram groups with over 50,000 participants. In public interviews, he confirms reinvesting roughly 20–25% of monthly gains into non-crypto businesses (logistics, real estate), insulating his portfolio from sector-specific drawdowns.

Tola Joseph Fadugbagbe

Tola started trading crypto in 2016 after exiting a ₦25,000 ($16.21) per month teaching job and reinvesting savings into Bitcoin at ~$600 per coin. By 2018, through a mix of swing trading and community-based signal sharing, he had cleared $100,000 in cumulative profits, mostly from leveraged trades on Ethereum and early altcoins like NEO and ADA.

In 2020, he formalized his operations under the Cryptomasterclass brand, teaching trading through structured webinars, bot-supported scalping setups, and on-chain analytics training. His personal portfolio now totals an estimated $4–5 million, with 50% in liquid holdings (BTC, ETH, USDT) and the remaining capital distributed across staking contracts and VC entries in early-stage DeFi projects.

Tola’s primary strategy is liquidity zone reversal trading — he monitors high-volume rejection areas on 4H and daily charts and sets layered limit entries just outside the consolidation. He avoids market orders, uses up to 4:1 leverage, and exits 70% of position size within 3% movement. His typical cycle lasts 24–72 hours, and he tracks volatility compression before expanding volume phases to time entries.

He executes trades via Binance, LBank, and AscendEX, often routing fiat through non-custodial peer gateways. His average monthly volume is between $250,000 and $500,000, and in bull months exceeds $800,000. According to his recent webinars, he adjusts exposure dynamically based on stablecoin dominance and volume-weighted funding rates.

Tola reinvests a fixed 15% of quarterly gains into educational programs, certifying new traders and running proprietary signal channels. His name consistently surfaces in Nigerian OTC circles and local DeFi dashboards, marking him as one of the richest crypto traders in Nigeria with a scalable, risk-managed system.

| # | Trader | Estimated Net Worth | Monthly Trading Volume | Core Strategy | Trading Focus | Platform/Brand |

|---|---|---|---|---|---|---|

| 1 | Ifeanyi Ezenwaogene | $12 million | $600,000–800,000 | Staggered entries, long holds, interval-based trading | ETH, AVAX, BNB, DeFi assets | Fortune Beach Academy |

| 2 | Gaius Chibueze (Bitcoin Chief) | $10–12 million | $150,000–1 million | Dominance wave model, altcoin rotations, BTC.D-based entries | BTC, Tatcoin, stablecoins | Abitnetwork |

| 3 | Hanu Fejiro Agbodje | $8.9 million | $13 million (via Patricia platform) | P2P arbitrage, liquidity optimization, automation infrastructure | BTC, USDT, SOL, BNB | Patricia |

| 4 | Linus Williams (Blord) | $5 million | $400,000–900,000 | High-frequency P2P arbitrage, OTC, sub-minute swaps | BTC, TRON USDT, BNB | Blord Group (Jetpay, Billpoint) |

| 5 | Tola Joseph Fadugbagbe | $4–5 million | $250,000–800,000 | Liquidity zone reversal, layered limits, leveraged scalping | BTC, ETH, early-stage altcoins | Cryptomasterclass |

How to start your path in crypto trading in Nigeria

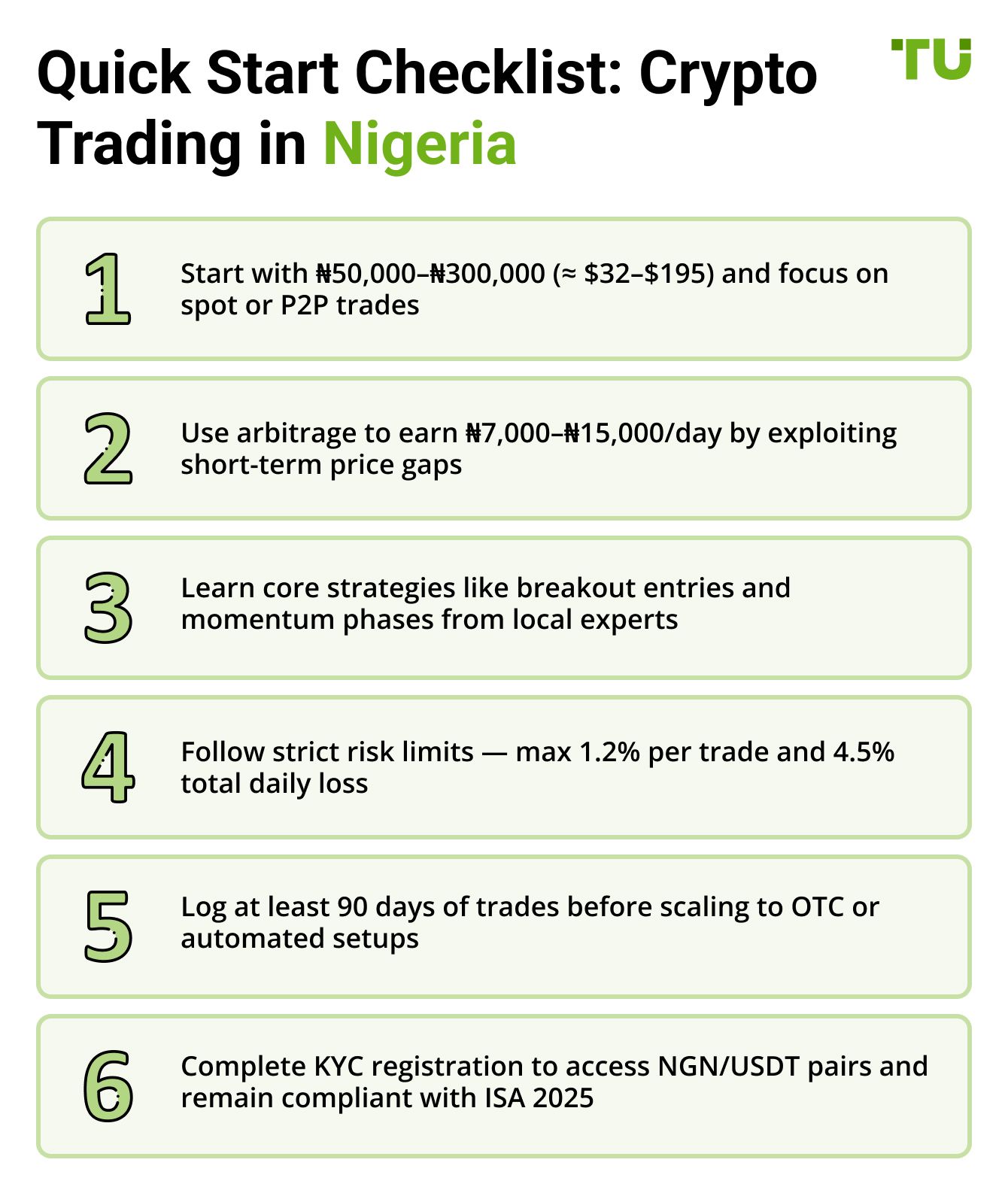

New traders in Nigeria typically enter the market with a starting capital between ₦50,000 (≈ $32.43) and ₦300,000 (≈ $194.60), working with spot pairs and P2P spreads. The first functional method involves exploiting price differences across best crypto trading platforms in Nigeria like Binance, Quidax, and Bybit. Average arbitrage margin on short cycles is 1.8–2.7%. With daily turnover under $100, this yields a profit of ₦7,000–₦15,000 ($4.55 to $9.75) per day, assuming 60-minute trade windows.

Education is non-optional. Traders like Ifeanyi Ezenwaogene and Tola Fadugbagbe teach practical frameworks focused on breakout entries, momentum phases, and exhaustion zones. Their strategy uses BTC, ETH, SOL, and DOGE, targeting 5% daily volatility. Beginners are advised to hold positions no longer than 12–18 hours and aim for 1–1.5% profit per trade. This is the foundation for scalable crypto trading in Nigeria.

Risk parameters are fixed and enforced. Position-level loss is capped at 1.2%, with zero leverage used. Once 4.5% total daily loss is reached, all trading activity is paused until the next session. These rules are confirmed inside private groups run by Bitcoin Chief Nigeria (Gaius Chibueze), based on actual logs from portfolios sized $300 to $2,000.

The next stage is semi-automation. Platforms like Patricia and Binance offer API access to order books. Traders begin scripting rule-based strategies: take-profits triggered by spread compression, entries driven by volatility formulas, and exits aligned with order book pressure changes. This setup uses multi-account infrastructure — a system Agbodje (Patricia) operationalized in 2021 to scale execution reliability.

Top crypto traders Nigeria often built their equity from four-figure portfolios, using structured OTC entries into assets like Tatcoin and Ardor, achieving up to 12% profit in 7-day cycles. To reach this level, traders typically need 90+ days of verified trades, logged performance records, and a demonstrated ability to maintain capital under pressure — all under regulatory compliance.

Since the enactment of ISA 2025, registration is mandatory. Any monthly flow above ₦500,000 requires full KYC: NIN, BVN, photo-ID. Crypto trading in Nigeria is monitored by the SEC, and platforms such as Binance Africa, Luno, and Patricia are under formal oversight. Without verified status, traders lose access to NGN/USDT gateways and fiat bridges.

To apply these strategies effectively, traders must operate through platforms that support fast execution, P2P trading, and regulatory compliance. Below is a comparison of the best crypto trading platforms in Nigeria, highlighting features relevant to beginner and intermediate traders.

| Min. Deposit, $ | Coins Supported | Futures leverage | Spot Maker Fee, % | Spot Taker fee, % | TU overall score | Open an account | ||

|---|---|---|---|---|---|---|---|---|

|

1 |

1 | 638 | 100 | 0,1 | 0,1 | 9.2 | Open an account Your capital is at risk. |

|

|

2 |

1 | 2276 | 125 | 0 | 0,05 | 9.1 | Open an account Your capital is at risk. |

|

|

3 |

10 | 329 | 125 | 0,08 | 0,1 | 8.9 | Open an account Your capital is at risk. |

|

|

4 |

No | 415 | 100 | 0,1 | 0,1 | 8.7 | Open an account Your capital is at risk. |

|

|

5 |

10 EUR | 831 | 100 | 0,1 | 0,1 | 8.65 | Open an account Your capital is at risk. |

|

|

6 |

1 | 701 | 200 | 0,2 | 0,2 | 8.5 | Open an account Your capital is at risk. |

Top company reviews

How to reach profitability fast in Nigerian crypto trading

At the entry stage in Nigeria, it’s more effective to start directly with spot pairs tied to local liquidity — particularly NGN-pegged stablecoins and major crypto pairs. While many beginners spend weeks on theory, measurable progress begins with a structured daily trade plan: three defined sessions, $20 per trade, and a stop-loss cap of 1.2%. This setup typically yields weekly returns of 4.5–6%, based on common peer-to-peer (P2P) spread behavior and market cycles.

In P2P environments, most newcomers ignore order book depth. Success depends not only on pricing but also on volume thresholds and recent transaction history. Filtering for counterparties with consistent trading performance and high execution rates helps avoid stuck orders — especially useful during weekend liquidity gaps or high-demand hours.

Another key recommendation: skip profit-percentage goals in your first month. Focus instead on minimizing drawdown. If you can complete 60–80 trades in 30 days without exceeding a 5% capital loss, you've built a workable base. From there, gradual testing of semi-automated tools becomes viable. In the Nigerian context, disruptions often stem from NGN processing lags or manual platform delays. Setting up multi-account routing and buffered confirmation workflows offers a reliable advantage during peak load periods.

Conclusion

Crypto trading in Nigeria is based on operational models that reflect measurable outcomes across the active market. Entry-level strategies rely on high-frequency execution, moderate volatility, and strict position control. Progression to advanced systems depends on trade history, technical infrastructure, and regulatory alignment. At present, access to liquidity, structured learning, and consistent risk control remain central to functional trading. Profiles of established traders show which parameters support capital retention and scale. These methods are replicable within the standard conditions of the local ecosystem.

FAQs

What is the minimum timeframe needed to gather reliable trading performance data?

The baseline is 30 calendar days with at least 60 completed trades. This is enough to assess profitability, model consistency, and the frequency of drawdowns.

How should performance be tracked under unstable liquidity conditions?

Keep a separate log for entry and exit points, and use a floating equivalent in stablecoins. This allows you to evaluate performance based on the expected 100% cash-out value, not just nominal gains.

Can intraday trading be combined with position holding?

Yes, if capital is strictly segmented. For example, 30% can be allocated to short-term trades, while 70% remains in structured positions with 3–7 day holding periods.

What to do when P2P channels begin to stall?

Use limit orders with delayed execution and trade outside of peak hours. Another workaround is to manually shift your offer by 0.5–1% above or below the average spread to queue up against available counterparties.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).