How Did Carl Icahn Make His Money?

Carl Icahn made his money by taking on underperforming corporations and attempting to change their management or methods of operation. He seizes control of the business and introduces cost-cutting strategies that enable the failing enterprise to become profitable.

An investor's investment strategy and pattern distinguish them from others in the investing world. Every investor renowned for their accomplishments or wealth did something unique that others did not. Among these extraordinary investors, Carl Icahn stands out as a top figure.

What he did and how he did it will be of great value to potential traders. Let's say Carl Icahn's trading strategy is practicable and can help a beginner become a professional in a short time.

So in this article, you will learn about:

Carl Icahn

Carl Icahn's trading strategy

How Carl Icahn makes his money

Carl Icahn's net worth

Carl Icahn quotes

Who Is Carl Icahn?

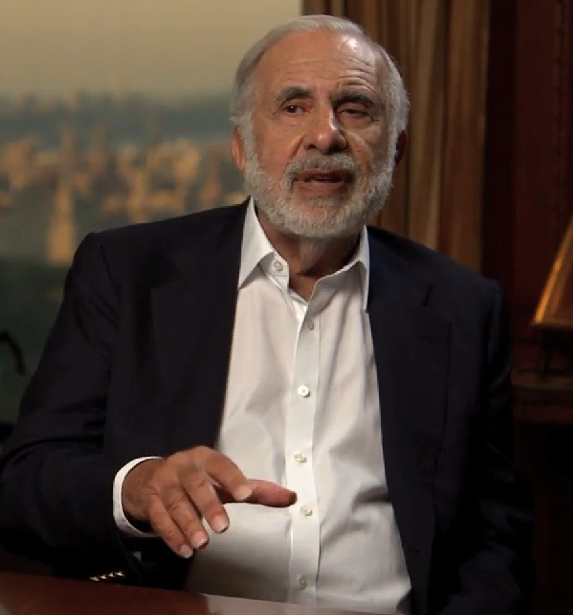

Carl Icahn

| Name | Carl Icahn |

Date of Birth |

February 16, 1936 |

Age |

87 years |

Gender |

Male |

Height |

1.76m (5' 8") |

Alma Mater |

Princeton University New York University (dropped out) |

Occupation |

Activist shareholder |

Marriage Status |

First Married Liba Trejbal and divorced her, remarried Gail Golden (2 children) |

First Activist deal |

Bought a controlling stake in the appliance company Tappan, in 1978 |

First establishment |

Icahn Enterprise |

First investment amount |

Got a $400,000 loan from his uncle and added $150,000 from his pulse |

Companies he invested in |

TWA, S.Steel, Texaco, Marvel Comics, RJR Nabisco, Time Warner, Blockbuster, Yahoo, Biogen, Netflix, Hertz Global, Telik, Apple Inc, Clorox, etc |

Born in Far Rockaway, Queens, New York, on February 16, 1936, Carl Icahn was the only child of a female teacher whose husband was doing different jobs to care for the family. The father of Carl Icahn was a teacher, attorney, and cantor, and through this, he was able to see Carl through school. Carl Icahn attended Far Rockaway High School before continuing his education at Princeton University, where he graduated in 1957 with an A.B. in philosophy.

Along the way, he made the decision to pursue a different academic goal and enrolled in the New York University School of Medicine. But this dream was cut short when Carl Icahn got an opportunity to join the military reserve force. He grabbed the opportunity, and it led to him dropping out of medical school, putting an end to the medical profession.

Carl Icahn is a driven individual who is receptive to chances that will boost his financial situation. This trait made him give investing a try. Although Carl started investing in stocks as a college student, his expertise as a poker player earned him $2,000 every summer.

But he developed into a better investor through the mechanics of his "corporate raider" and activist investor strategies, which contributed to his success as a billionaire.

Carl Icahn's investing experience

Carl Icahn held positions with several companies before starting his own. To finance his brokerage firm, Icahn and Company, he borrowed $400,000 from his uncle and supported it with $150,000 from his account. Risk arbitrage and options trading were his company's areas of expertise.

He profited from each trade after perfecting the art of arbitrage trading by taking advantage of the price discrepancy in stocks across markets. His highest point is ranking 11th among hedge fund managers with the highest salaries in 2019.

Below is a summary of some business disputes and investments that Carl was involved in:

First was the Talisman Energy investments in October 2014

Icahn invested $100 million in Lyft in May 2015

Icahn launched an acquisition bid for Pep Boys in December 2015. The same month, he increased his ownership of Cheniere Energy to 13.8%, making him the company's largest shareholder

Icahn acquired the unfinished Fontainebleau Resort Las Vegas for more than $400 million before selling it for $600 million in August 2017

In January 2016, Icahn made public his 4.66% ownership of Gannett Company

Icahn increased his ownership of Herbalife Nutrition to 21% in August 2016

In November 2016, after the company's stock price had fallen precipitously, Carl increased his holdings in Hertz Corporation

Icahn sold all 55.3 million shares, or his 39% ownership in Hertz Global, in May 2020 for a price of 72 cents per share

How did Carl Icahn make his money?

Carl Icahn's wealth comes from multiple sources because he amassed his fortune by purchasing sizeable shares in diverse businesses. He preferred investing in companies that were run inefficiently and needed some adjustments to their organizational and managerial structures.

Icahn initially started earning by buying and selling stocks before he was able to set up his investment firm. His business, Icahn and Co., served as evidence of Icahn's stock trading success. He invested in undervalued companies, broadening the scope of his investment expertise.

Carl Icahn gained significant profits after impacting the company's routine operations. He was an activist shareholder who employed a plan to make sure that the value of the company's stock was increased for shareholders.

The best opportunity for Carl Icahn came in the 1980s when he acquired Trans World Airlines (TWA). He bought TWA, which was about to go out of business, and eight years later, he began by promoting its most profitable routes to other airlines. Icahn made $469 million in profit while serving as chairman and saved the company from bankruptcy.

Icahn manages an investment company that he funds with funds from Icahn Enterprises. Additionally, he funds the operation of Mount Sinai's Icahn School of Medicine. He has donated over $200 million for this purpose.

Top American business influencer Carl Icahn served as President Donald Trump's advisor, earning him the moniker "corporate raider".

Carl Icahn’s Net Worth

According to Forbes, Icahn's net worth, as of June 21st, 2023, is $9.2 billion. Icahn currently owns more than 18 different businesses, including 70.82 percent of CVR Energy and 94.97 percent of the shares of Icahn Enterprises.

| Year | Net worth |

|---|---|

2017 |

$18.4 billion |

2018 |

$16.8 billion |

2019 |

$17.7 billion |

2020 |

$14..5 billion |

2021 |

$6.0 billion... |

2022 |

$22 billion |

2023 |

$9.2 billion |

What is Carl Icahn's Investing Strategy?

Icahn invests in stocks, futures, options, and debt; he can predict the future of faltering businesses and underperforming stocks. He searches for stocks with low price-to-earnings (P/E) ratios that are valued higher than their current market value as a contrarian investor.

Icahn claims that his general investing philosophy is to purchase items when nobody else wants them, with some exceptions. Because he believes that the market will value the stocks he owns, which will lead to price growth, he invests money in these underperforming assets. His style of investing follows a long-term approach. His approach to investing focuses on improving the fortunes of failing businesses.

He employs a value investing strategy, but before investing in any company, he researches its resources and business practices.

Carl Icahn in the HBO documentary Icahn: The Restless Billionaire

A man who started with nothing and amassed a fortune worth $20 billion is the subject of the documentary The Restless Billionaire. The movie presents the lead as a fearsome investor who unlocked value and generated prosperity. His name is Carl Ichan, the son of a cantor and a teacher. The documentary examines Icahn's background, personality, business dealings, and philosophical views.

According to the documentary, Icahn, an activist investor, was called a "raider" and a "pirate" by people unfamiliar with his trading strategy. Icahn has always been a shrewd and cunning thinker. He then became a stockbroker after dropping out of medical school and joining the Army, where he won and lost a lot of money before realizing that risk arbitrage and investing in options were better choices. He obtained a loan from his uncle so that he could buy a seat on the New York Stock Exchange.

Icahn's relentless pursuit of success allowed him to make significant profits in a short period. He was preoccupied with making trillions of dollars for shareholders. The Restless Billionaire explains that he’s good at making money from assets and companies that have lost value. The documentary, which Bruce David Klein produced, wrote, and directed, also tells the tale of a noteworthy failure.

Carl Icahn's advice for beginners

The most valuable quality Carl Ichan possesses is his willingness to take chances and invest in any project he believes has the potential to be profitable. He has established a benchmark with his clever investing techniques. He has some investment guides for those seeking trading success, especially novice investors seeking business principles and ideologies from well-known investors. Carl Icahn posts insightful information about investments and other business endeavors on his Twitter page.

Here are some of his most insightful suggestions for assisting investors in increasing wealth and achieving long-term success:

1. Work on your patience level

Carl Icahn counsels novice investors to develop patience when they invest in any asset, regardless of the state of the asset at the time of the investment. However, when it comes to acting, they should be very aggressive.

However, that does not mean that investors should put money into any struggling business they come across. Traders need to have the tenacity and capacity to develop incisive strategies that will enable them to deal with the ups and downs of the financial markets.

2. Get used to long-term investment

A value investing strategy pays off if an investor can wait, according to Carl Ichan, who favors a long-term strategy. Simply choose a company whose stock is underperforming at its current price, has a low price-to-earnings (P/E) ratio, or has book values that are higher than market value as your target. The risk a trader takes when investing short-term is the same as the risk they take when investing long-term; the potential return should be the main consideration.

Carl stated in a video interview that “Wall Street analysts look for quarterly earnings performance, while I look for companies to liberate. I commit money to this business, change its organizational structure, and watch it develop. It is a long-term investment, so other investors frequently get bored with specific situations”.

3. Understand business pricing power

According to Icahn, a company's pricing power is among the most important metrics for assessing its productivity. As pricing power evolves and impacts a company's productivity, it is crucial to comprehend how it operates. An investor should understand what drives product price increases while sustaining demand for a company's goods.

4. Invest in unpopular stocks

Carl advises investors to purchase stock in under-appreciated companies and even suggests shares of companies whose stocks have lost market appeal. Carl advises investors to be cautious when others are greedy and aggressive when others are cautious. Find undervalued assets and invest in them; when the market recognizes their value and stock prices rise, the trader can profit.

5. Be bold and stand by the stocks you buy

"There are two cardinal sins in life and business. The first is to act hastily and without consideration, and the second is to take no action at all", he claims. Investors need a strong sense of conviction for each stock they purchase. As soon as you are confident in the stock, go all in and let your conviction guide your investments. Beginner investors must have the flexibility to react appropriately to emerging situations and quickly adapt.

Carl Ichan quotes

“Some people get rich studying artificial intelligence. I make money studying natural stupidity”. ~ Carl Icahn

“I am a value guy, and the activism model is still the best model if you can find a company with hidden value and the board is not taking advantage of it”, Icahn insists from his new office digs in Florida. “It is still the best on a risk-reward basis, but you need a lot of patience”. ~ Carl Icahn

“Compared to the "good life" after a win, I much prefer the hunt”. ~ Carl Icahn

“You learn in this business: If you want a friend, get a dog”. ~ Carl Icahn

Best Forex brokers 2024

Summary

Carl Icahn's trading strategy can serve as an example for investors with the ability to spot markets that might yield gains if they are well-positioned. He would buy significant stakes in a company whose management he thought was subpar. Then he would use his influence to make significant internal changes to the company and, in turn, increase the company's revenues, profits, and significance.

FAQs

How did Carl Icahn make his money?

Carl accumulated his wealth by buying shares in undervalued companies. He takes over the company's management and introduces cost-cutting measures to turn the struggling company around and turn a profit.

What businesses does Carl Icahn own?

Icahn owns an 81% stake in two businesses, Icahn Enterprises (IEP -3.77%) and CVR Energy (CVI 1.82%). Icahn Enterprises is the proprietor of many companies, including Pep Boys, CVR, American Railcar Industries, and others.

What is Icahn investing in?

Icahn started as a stockbroker, but most of his investments were in the shares of failing businesses.

What are the current holdings of Icahn?

CVR Energy Inc. (CVI), FirstEnergy Corp. (FE), Occidental Petroleum Corp. (OXY.WS), Icahn Enterprises LP (IEP), and Southwestand Gas Holdings Inc. (SWX) are among the current holdings of Carl Icahn.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.