Best Time To Trade Forex In France 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The optimal time for Forex trading in France is during the overlap of the U.S. and London markets. This period provides the highest liquidity and trading volume, which usually occurs between 13.00 and 17.00 CET.

The Forex market operates on a 24/7 operational schedule, primarily because of the diverse operational requirements across different nations. With the world divided into various time zones, Forex trading is always ongoing. But precisely because of these different time zones, traders in some countries are most active during specific hours, aligning with their local times.

France mainly follows the Central European Time (CET) zone, which corresponds to UTC+1. However, it adjusts its clocks during the daylight saving period. From the last Sunday of March to the last Sunday in October, France moves to the Central European Summer Time (CEST), or UTC+2.

This article explores the best time to trade Forex in France, focusing on key trading sessions, liquidity trends, and EUR/USD dominance. It also covers rules, regulations, taxation, and broker selection to help traders maximize their success.

What is the best time to trade Forex in France?

The ideal time to trade Forex in France is between 2:00 PM and 6:00 PM CET, when the London and New York markets overlap. This window brings higher liquidity, more price movement, and better trade execution, making it easier to enter and exit positions with minimal slippage. During this time, banks, hedge funds, and institutional traders from Europe and the U.S. are active, driving volatility and increasing potential trade setups.

Why this period matters

The Forex market follows global trading sessions: Sydney, Tokyo, London, and New York. Among these, London sees the highest daily trading volume, handling nearly 35% of global transactions. When New York opens and overlaps with London, trading activity surges, especially for major currency pairs like EUR/USD and GBP/USD. This is when price action is most predictable, spreads are lower, and traders get more efficient trade execution.

Best time to trade Forex – TU research

When evaluating the best time to trade Forex in France, traders should focus on the overlap between the U.S. and London sessions, from 13:00 to 17:00 CET. This period offers higher liquidity, tighter spreads, and increased market activity, creating more opportunities for profitable trades.

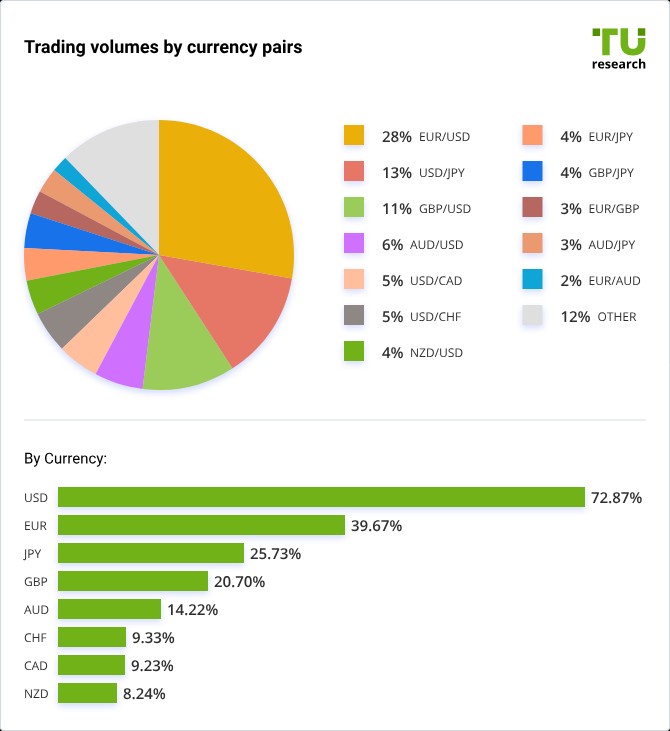

This optimal window isn't only due to market overlaps. In France, the EUR/USD pair plays a significant role, dominating 27.95% of all trades, according to data from traders, Forex brokers, and the Bank for International Settlements. The prominence of this pair adds to the trading volume and volatility during these hours.

The overlap between the London and U.S. sessions is particularly beneficial for EUR/USD traders, as it includes the active participation of the U.S., a key player in this major currency pair. Trading during this time ensures French traders can capitalize on global activity while aligning with the peak performance of their preferred market.

Best time for Forex day trading in France

For day traders, the interval from 8 AM to 5 PM CET in France is ideal, marked by superior liquidity. This heightened liquidity is vital as it ensures smoother trade executions, avoiding risks related to lower levels of liquidity.

Among day traders, EUR/USD remains a prime choice, but also pairs that involve currencies such as GBP and CHF, and other major European currencies are worth noting.

Best Forex pairs to trade during the French session

The EUR/USD pair remains a top choice for traders due to its high volatility, driven by European economic news and data releases. Major announcements from the Eurozone often cause significant movements in this pair, making it ideal for short-term trading strategies.

Beyond EUR/USD, pairs like GBP/USD and USD/CHF also see substantial activity during European trading hours. The interconnected nature of European economies means that political events or economic updates from one nation can influence multiple currencies, offering traders diverse opportunities to capitalize on market movements.

Selecting the right Forex broker is equally critical. A reputable broker provides essential tools, guidance, and access to major currency pairs. Traders should evaluate brokers based on fees, platform usability, customer support, and whether they offer currencies aligned with their trading goals. Beginners should prioritize brokers offering educational resources and user-friendly platforms to build confidence in their trading journey.

Best Forex brokers in France

Eightcap

XM Group

TeleTrade

Vantage Markets

VT Markets

Available in France

Yes

Yes

Yes

Yes

Yes

Demo

Yes

Yes

Yes

Yes

Yes

Min. deposit, $

100

5

10

50

100

Min Spread EUR/USD, pips

0,4

0,7

0,8

0,3

0,4

Fixed Spread EUR/USD, pips

No

No

No

No

No

Investor protection

£85,000

€20,000

£85,000

€20,000

No

€20,000

£85,000

No

Max. Regulation Level

Tier-1

Tier-1

Tier-1

Tier-1

Tier-1

TU overall score

9.1

9

8.6

8.25

8.69

Open an account

Open an accountYour capital is at risk.

Open an accountYour capital is at risk.

Open an accountYour capital is at risk.

Open an accountYour capital is at risk.

Open an accountYour capital is at risk.

| Eightcap | XM Group | TeleTrade | Vantage Markets | VT Markets | |

|---|---|---|---|---|---|

|

Available in France |

Yes | Yes | Yes | Yes | Yes |

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

100 | 5 | 10 | 50 | 100 |

|

Min Spread EUR/USD, pips |

0,4 | 0,7 | 0,8 | 0,3 | 0,4 |

|

Fixed Spread EUR/USD, pips |

No | No | No | No | No |

|

Investor protection |

£85,000 €20,000 | £85,000 €20,000 | No | €20,000 £85,000 | No |

|

Max. Regulation Level |

Tier-1 | Tier-1 | Tier-1 | Tier-1 | Tier-1 |

|

TU overall score |

9.1 | 9 | 8.6 | 8.25 | 8.69 |

|

Open an account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Forex trading runs 24 hours a day, five days a week, but not all hours offer the same trading conditions. Certain periods are less favorable due to lower liquidity, wider spreads, and unpredictable price movements.

Worst times to trade in France

The least favorable time to trade is between 10:00 PM and 12:00 AM CET, when the New York session closes and before the Tokyo session opens. During this period, most major financial centers are inactive, leading to lower liquidity and wider spreads. This can increase trading costs and make price movements more erratic.

Impact of market holidays

While Forex remains open during most holidays, trading conditions can be poor due to reduced volume. In France, key market holidays include:

Good Friday

Easter Monday

Labor Day

Christmas Day

On these days, financial markets like Euronext Paris are closed, limiting liquidity and making trade execution less reliable.

How to avoid bad trading periods

Traders should avoid trading during low-liquidity hours and focus on high-activity periods like the overlap between the London and New York sessions (2:00 PM to 6:00 PM CET). Additionally, keeping track of global market holidays can help prevent trading during periods of sluggish movement and high spreads.

Forex trading sessions in France

Different time zones dictate distinct peak activity periods in the Forex market:

Asian session. Spanning from 23.00 UTC to 9.00 UTC, the Tokyo session primarily sees a high trade volume in currency pairs linked to the Japanese yen (JPY), such as USD/JPY, EUR/JPY, and GBP/JPY

European session. Running from 8.00 UTC to 17.00 UTC, this session, heavily influenced by London, witnesses heightened trading in pairs like EUR/USD, GBP/USD, and USD/CHF.

American session. Focused around New York, this session is active from 13.00 UTC to 22.00 UTC. Traders here mainly deal in pairs such as EUR/USD, USD/JPY, and GBP/USD.

Time zones in France

Forex trading sessions are particularly influenced by time zones. This is something that those looking to grasp the basics of how to start Forex trading should consider. There are several reasons why this happens:

An active trading session guarantees higher liquidity. During the day, traders can have access to economic releases. Traders can avoid overnight risks – according to the strategies they use

To assess the best time to trade Forex in France, traders should consider the specific time zones of the country – namely CET (UTC+1) and CEST (the Summer Time, corresponding to UTC+2).

Rules and regulation in France

Here are some rules and regulations of Forex in France:

Licensing in France

Forex brokers operating in France must be authorized and regulated by the Autorité des Marchés Financiers (AMF). This regulatory body enforces strict licensing requirements to ensure brokers comply with transparency, investor protection, and risk management protocols. Brokers must meet capital adequacy standards, implement secure fund segregation practices, and follow fair trading conditions. Additionally, under MiFID II (Markets in Financial Instruments Directive II), brokers licensed in another EU country can offer services in France under the European passporting system, provided they comply with AMF guidelines.

Investor protection in France

France has established a legal framework for Forex trading under the Digital Assets Law (Loi Pacte) of 2019, aimed at improving financial market oversight. However, there is no compensation scheme for traders if a Forex broker goes bankrupt — unlike bank deposits, which are protected under French banking laws. To mitigate risks, traders should choose AMF-registered brokers that hold client funds in segregated accounts and offer negative balance protection. Additionally, the AMF regularly updates a blacklist of unlicensed brokers and scam trading platforms to help traders avoid fraudulent firms.

Taxation on Forex in France

Forex trading profits in France are subject to capital gains tax, but the rate depends on the trader’s classification:

Retail traders typically fall under the Prélèvement Forfaitaire Unique (PFU), or "flat tax," which is set at 30%. This includes 12.8% income tax and 17.2% social contributions.

Professional traders who generate the majority of their income from trading may be taxed under progressive income tax rates (up to 45%), plus social security charges. Traders in this category must declare their profits differently and may face additional business tax obligations.

Losses from Forex trading can be offset against gains for tax optimization, and traders can leverage deductions where applicable. Since tax rules can vary based on income and legal classification, consulting a tax professional is strongly recommended to ensure compliance and optimize tax liabilities.

Instead of diving into this peak time, consider focusing on the early hours of the London session

As a beginner in Forex trading in France, it's crucial to recognize that while the overlap between the London and New York sessions (2:00 PM to 6:00 PM CET) is often highlighted for its high liquidity, this period can also exhibit heightened volatility. Instead of diving into this peak time, consider focusing on the early hours of the London session, from 9:00 AM to 11:00 AM CET. During this window, the market is active, but the volatility is more moderate, providing a more controlled environment to develop your trading skills. This approach allows you to observe market movements without the intense fluctuations that can occur during the major session overlaps.

Additionally, it's beneficial to align your trading activities with the release of economic news pertinent to the Eurozone. Economic indicators, such as the European Central Bank's announcements or key economic data releases, often occur during the European session. By staying informed about these scheduled events, you can anticipate potential market movements and plan your trades accordingly. This strategy not only enhances your understanding of how economic factors influence the market but also helps you make more informed trading decisions.

Conclusion

The best time to trade Forex in France depends on market volatility, liquidity, and your trading strategy. The most active periods are during the London and New York sessions, offering high liquidity and opportunities for profit. The overlap between these sessions is particularly ideal for day traders and scalpers due to increased volatility. Meanwhile, the Asian session can be beneficial for those focusing on pairs involving JPY or AUD. By aligning your trading schedule with these optimal market hours, you can enhance your chances of success in the Forex market.

FAQs

What time does the Forex market open in France?

The Forex market operates 24 hours a day, ensuring global accessibility. However, in terms of the primary trading hours that align with France's activity, it begins with the European session starting at 9.00.

What is the best time period to trade Forex in France?

The optimal time for Forex trading in France is during the overlap of the U.S. and London markets. This period provides the highest liquidity and trading volume, which usually occurs between 13.00 and 17.00 CET.

Who is the best Forex trader in France?

Identifying the "best" Forex trader in France can be subjective as success metrics in trading can vary. While France prides itself on several seasoned traders and financial institutions active in the Forex market, it's challenging to pinpoint a single individual as the best. Success in Forex trading can be gauged by profitability, consistency, risk management, and other factors.

Is Forex legal in France?

Yes, Forex trading is legal in France. The Autorité des Marchés Financiers – AMF (the Financial Markets Authority) – is the institution charged to regulate Forex trading in the country.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).