Best Time To Trade Forex In Saudi Arabia: Market Hours & Tax Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Сhoosing the best time to trade Forex in Saudi Arabia pay attention to:

The London session brings strong moves. High volatility and liquidity during London hours.

Overlap with New York is ideal. Best price action when sessions overlap.

Peak time is 3–7 PM KSA. Most active trading window in Saudi time.

Avoid low-volume early mornings. Limited movement before major sessions open.

Forex gains not individually taxed. No personal income tax on profits.

Confirm latest ZATCA tax rules. Check official updates on VAT or regulations.

Forex trading in Saudi Arabia is picking up quickly, and many traders want to know when the market offers the best opportunities. Since the market runs 24/5, knowing the right trading sessions in Saudi time can help you focus on the hours when action is high.

Along with timing, it’s also important to get clear on how taxes work in Saudi when it comes to Forex. Some think Forex profits aren’t taxed — but that depends on your trading activity and income level. Skipping over tax rules can cause trouble, especially if you're trading big volumes.

In this article, we’ll break down the best times to trade, when major sessions overlap, and what you need to know about taxes. No matter your skill level, understanding your trading window and your tax position can give you an edge.

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

Best time to trade Forex in Saudi Arabia

Choosing the best time to trade Forex in Saudi Arabia depends on market liquidity and session overlaps. The most profitable periods occur when multiple trading sessions are open at the same time.

| Trading Period | Time (AST) | Why It’s Ideal |

|---|---|---|

| London Session | 11:00 AM – 8:00 PM | High liquidity in EUR, GBP, and USD pairs. |

| New York Session | 4:00 PM – 1:00 AM | Active USD trading; strong market reactions. |

| London-New York Overlap | 4:00 PM – 8:00 PM | Maximum trading volume; best spreads. |

Trading at the wrong time: What to avoid

Not all hours are ideal for trading. Some periods offer low liquidity, causing wider spreads and unpredictable price swings.

Sydney-Tokyo overlap (3:00 AM – 10:00 AM AST). Lower volume in USD and EUR pairs.

Post-New York closing (1:00 AM – 3:00 AM AST). Market slowdown; fewer opportunities.

Forex market overview

The Forex market runs 24 hours a day and is divided into four major trading sessions. Each session offers different liquidity levels, affecting how traders in Saudi Arabia can plan their strategies.

Global Forex trading sessions

| Trading Session | Opening Time (GMT) | Closing Time (GMT) | Opening Time (AST) (+3 hrs) | Closing Time (AST) (+3 hrs) |

|---|---|---|---|---|

| Sydney Session | 10:00 PM | 7:00 AM | 1:00 AM | 10:00 AM |

| Tokyo Session | 12:00 AM | 9:00 AM | 3:00 AM | 12:00 PM |

| London Session | 8:00 AM | 5:00 PM | 11:00 AM | 8:00 PM |

| New York Session | 1:00 PM | 10:00 PM | 4:00 PM | 1:00 AM |

To trade Forex in Saudi Arabia, you’ll need to match market hours with local time (AST, GMT+3). Since Saudi Arabia is on AST, knowing when major markets open helps you plan better.

The most active hours fall during overlapping sessions when global traders are most engaged. Trading during those busy times means better price movement and faster execution.

The London–New York overlap (4:00 PM – 8:00 PM AST) is where the action is — it’s fast, liquid, and ideal for most strategies.

How daylight saving time (DST) affects Forex trading in Saudi Arabia

During Daylight Saving Time (March to November), hours shift slightly, especially for New York and London. When DST kicks in, New York opens earlier — at 3:00 PM AST — and so does the London–New York overlap.

Once DST ends in November, everything shifts back to the regular Saudi trading hours.

Factors influencing Forex market in Saudi Arabia

If you're trading Forex in Saudi Arabia, there are local dynamics that most global traders don’t factor in.

Oil prices drive SAR sentiment. As one of the world’s top oil exporters, any sharp change in crude prices can impact the Saudi Riyal’s strength.

Central bank interventions matter. The Saudi Arabian Monetary Authority (SAMA) closely manages the SAR-USD peg and may step in if the currency shows volatility.

Religious calendar affects liquidity. Trading slows during Ramadan and Hajj season — expect lower volume and tighter regional participation.

Regional geopolitics create volatility. Events in the Gulf — like Iran tensions or OPEC decisions — can cause sudden spikes in local currency pairs.

Riyal’s peg limits breakout trades. Because SAR is pegged to the USD, traders can’t rely on technical breakouts like in floating currencies.

Weekend gap risks are unique. Saudi Arabia’s weekend is Friday–Saturday, so Sunday openings may reflect two-day global news shifts.

Shariah compliance shapes platform choice. Some brokers offer Islamic (swap-free) accounts to match religious norms, but conditions vary.

Legal and regulatory framework for Forex trading in Saudi Arabia

Forex trading in Saudi Arabia is regulated to protect traders from fraud and ensure financial stability. The Saudi Arabian Monetary Authority (SAMA) and the Capital Market Authority (CMA) oversee financial markets, including Forex trading platforms.

Is Forex trading legal in Saudi Arabia?

Forex trading in Saudi Arabia is legal but operates within a unique regulatory framework that differs from many other countries. The Capital Market Authority (CMA) oversees the securities market, including Forex trading, ensuring transparency and investor protection. However, the CMA does not directly regulate international Forex brokers, leading many Saudi traders to engage with brokers regulated by reputable international authorities.

An intriguing aspect of Forex trading in Saudi Arabia is the influence of Islamic finance principles. Many traders seek brokers offering Islamic (swap-free) accounts to comply with Sharia law, which prohibits earning interest. While some brokers provide such accounts, the conditions can vary, and it's essential for traders to thoroughly understand the terms to ensure they align with their religious beliefs.

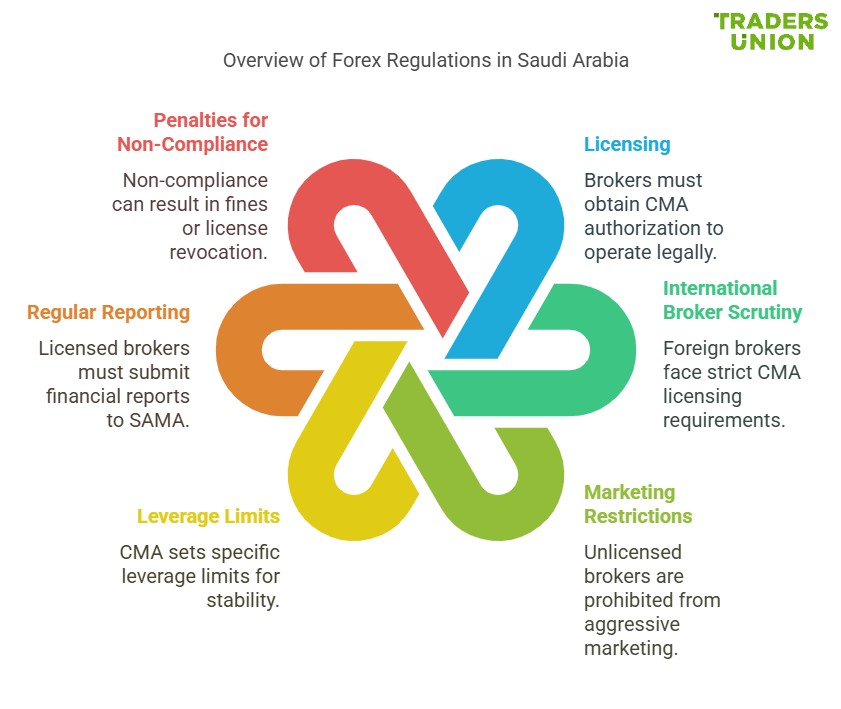

Regulations for Forex brokers in Saudi Arabia

If you're considering Forex trading in Saudi Arabia, understanding the local regulatory landscape is crucial.

Licensing is mandatory. Forex brokers must obtain authorization from the Capital Market Authority (CMA) to operate legally within the Kingdom.

International brokers face strict scrutiny. Foreign brokers are prohibited from conducting securities business in Saudi Arabia without proper licensing from the CMA.

Marketing restrictions are enforced. Aggressive marketing or solicitation by unlicensed brokers can lead to investigations and penalties under Saudi law.

Leverage limits are imposed. The CMA sets specific leverage limits for Forex trading to maintain market stability and protect investors.

Regular reporting is required. Licensed brokers must submit detailed financial reports to the Saudi Arabian Monetary Authority (SAMA) to ensure transparency and compliance.

Key trading restrictions in Saudi Arabia

The Forex market in Saudi Arabia has some restrictions:

You can’t trade non-INR pairs through local brokers. Only SAR pairs approved by CMA and traded on local exchanges are allowed — popular global pairs like EUR/USD are off-limits unless routed through proper channels.

Weekend trading is tricky. Since the Saudi weekend is Friday–Saturday, international trades opened on Friday can’t be monitored until Sunday night.

Unlicensed offshore brokers are illegal. Using a broker not approved by the CMA can land you in legal trouble — even if it’s regulated elsewhere.

Forex leverage is limited with local brokers. CMA-approved platforms often offer far lower leverage than international standards.

No hedging with some local accounts. A few platforms restrict opening opposite positions in the same pair — so check rules before applying your strategy.

Shariah compliance changes account structure. Swap-free (Islamic) accounts remove overnight interest, but brokers might add hidden costs elsewhere.

Why regulation matters for Saudi traders

Regulation plays a big role in keeping Forex trading safe in Saudi Arabia. It helps protect your money by making sure brokers follow clear financial rules. Licensed brokers must keep your deposits separate from their own funds, lowering the chance of misuse.

Regulated platforms also make trading conditions more transparent. This means fair pricing, honest spreads, and less room for shady practices. Without regulation, you might end up with a broker who bends the rules in their favor.

One big plus of using licensed brokers is the legal safety net. If something goes wrong, you have a way to fight back and get your money.

To protect yourself, always go with brokers who follow Saudi laws and keep up with any rule changes. When the system is regulated properly, you get peace of mind, fair trades, and better chances of long-term gains.

| Tradable assets | Standard EUR/USD spread | Cent | Copy trading | Regulation level | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|

| 800 | 1,0 | No | No | Tier-1 | 9.1 | Open an account Your capital is at risk. |

|

| 1400 | 1,0 | No | Yes | Tier-1 | 9 | Open an account Your capital is at risk. |

|

| 12000 | 1,0 | Yes | Yes | Tier-3 | 8.9 | Open an account Your capital is at risk. |

|

| 200 | 1,1 | Yes | Yes | Tier-1 | 8.7 | Open an account Your capital is at risk.

|

|

| 1000 | 0,8 | Yes | Yes | Tier-1 | 8.69 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Tax implications of Forex trading in Saudi Arabia

Many traders wonder whether Forex trading taxes in Saudi Arabia apply to their profits. While Saudi Arabia has no personal income tax, trading profits may still have tax considerations.

Are Forex trading profits taxed in Saudi Arabia?

No personal income tax on Forex trading profits.

No capital gains tax for individual traders.

Corporate traders may face taxation under business regulations.

Individual traders do not pay taxes on their Forex earnings. However, businesses engaging in Forex trading may need to report profits under corporate tax laws.

Foreign traders residing in Saudi Arabia also benefit from the tax-free structure. However, expats must check tax obligations in their home country, as some nations require reporting foreign income.

VAT and Forex trading in Saudi Arabia

In 2020, Saudi Arabia implemented a 15% Value-Added Tax (VAT). Although VAT covers various financial services, most Forex trading activities are exempt. However, traders should confirm whether their brokers apply VAT to trading commissions or spreads.

Institutional and corporate Forex traders in Saudi Arabia might be subject to Zakat and corporate taxes.

A 2.5% Zakat is levied on business-owned assets.

Non-Saudi business owners trading Forex through a company face a 20% corporate tax.

Certain tax exemptions may apply based on the company's structure.

Trade smarter in Saudi Arabia by timing withdrawals and targeting midweek London – New York overlaps

If you're in Saudi Arabia and want to avoid the "noise" of the market, trade during the London – New York overlap (4 PM to 8 PM KSA time) — but only on Wednesdays and Thursdays. Why? That’s when most institutional players make their final weekly moves, and Saudi traders benefit from cleaner technical setups due to reduced regional market influence and stronger liquidity. It’s the sweet spot where volatility meets precision — perfect for beginners learning to spot patterns without chaos.

Also, here's what no one tells beginners: consider the Saudi tax angle when timing your withdrawals. While Saudi Arabia has no income tax, frequent transfers from offshore brokers may trigger compliance reviews under SAMA's anti-money laundering filters. The trick? Consolidate profits and withdraw monthly or quarterly instead of weekly. This keeps you under the radar, makes reporting easier (if needed), and gives your trading capital time to compound inside your broker account.

Conclusion

Understanding the best time to trade Forex in Saudi Arabia is essential for maximizing profits. The London-New York session overlap (4:00 PM – 8:00 PM AST) offers the highest liquidity and tightest spreads, making it the optimal trading window.

Traders must also be aware of Forex trading taxes in Saudi Arabia. While individual traders do not pay income tax, corporate traders may have tax obligations under Saudi business laws. Keeping financial records is a good practice to ensure compliance with any future regulations.

To trade safely, choosing a regulated Forex broker is crucial. Saudi traders should verify CMA or SAMA licensing, use Islamic (swap-free) accounts, and implement strong risk management strategies. Monitoring economic news, oil prices, and global Forex trends also improves trading success.

FAQs

Does the Saudi weekend affect Forex trading strategy?

Yes. Since the Saudi weekend is Friday – Saturday, traders in Saudi Arabia should be cautious with Thursday night trades. Any positions left open over the weekend may react to two full days of global news when the market reopens Sunday night, increasing gap risk.

Can I trade Forex during Ramadan in Saudi Arabia?

You can, but expect lower volume and slower market behavior, especially in the afternoons. Many regional traders reduce activity, so liquidity dips slightly. It's best to adjust your strategy — shorter trades and smaller lot sizes can help during this period.

Should I avoid trading right after major Saudi economic announcements?

Not necessarily. If you understand how those announcements (like GDP or inflation reports) impact SAR or regional sentiment, they can actually create sharp, tradable movements. But stay cautious — spreads may widen, and prices can spike unpredictably for a few minutes.

Do Saudi traders need to declare Forex income when sending funds abroad?

While there’s no personal income tax, large or frequent remittances from trading accounts can trigger compliance checks under anti-money laundering rules. It’s smart to keep clear records of profits and withdrawals, especially if sending funds to international accounts.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).