5 Steps To Trade Forex on Your Phone

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

5 steps to trade forex on your phone:

- Choose a broker with a user-friendly platform and competitive fees

- Open an account with the chosen broker, providing necessary documentation

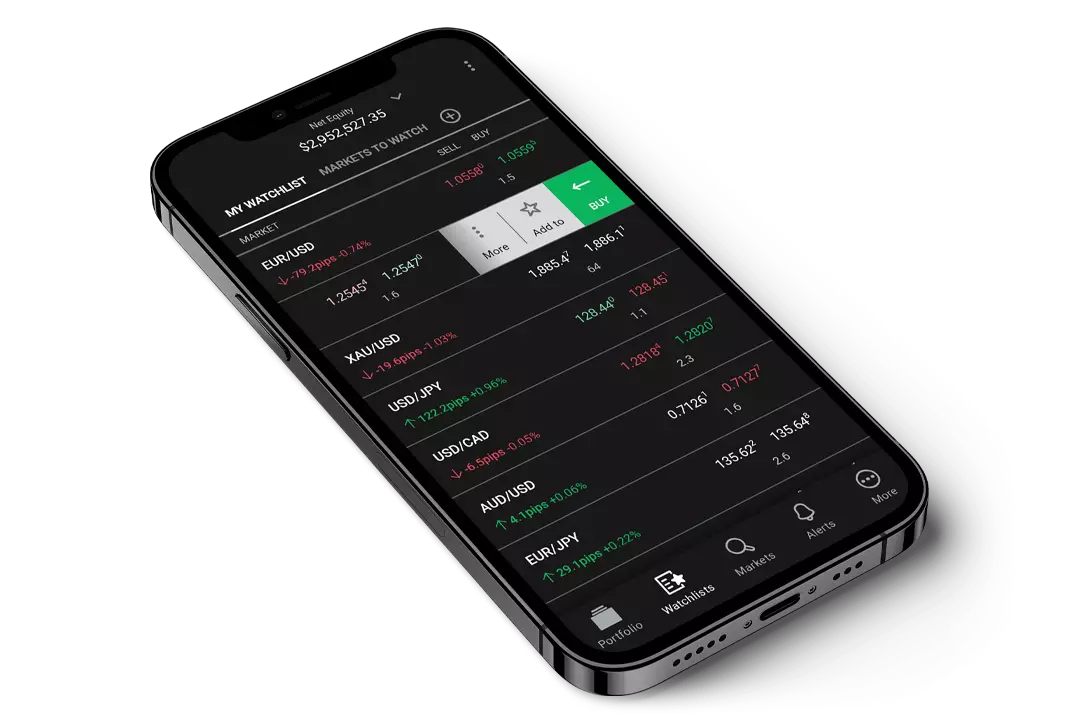

- Download a trading app from your phone's app store

- Learn the basics of Forex trading

- Start trading by executing your first few trades with caution

According to Statista, there were about 250 million active forex traders in the world in 2023. Of those, about 80%, or about 200 million people, trade through their smartphones. It is expected that the number of traders trading forex through their smartphones will continue to grow in the coming years. By 2025, their number could reach 250 million people.

This guide is all your go-to buddy, helping you step by step to smoothly start trading forex on your phone. This process typically involves these five steps: choose a broker, open an account, download a trading app, learn the basics, start trading.

5 steps to trade forex on mobile phone

Step 1: Choose a broker

Selecting the right mobile trading broker is the foundation of successful forex trading. Brokers act as intermediaries, facilitating your trades in the dynamic foreign exchange market. With a multitude of options available, conducting thorough research is key to finding a reputable broker that aligns with your trading needs.

Consider the Following Factors:

Fees : Understand the fee structure of potential brokers. Fees can vary, so compare them to ensure they align with your budget and trading frequency

Platform : Different brokers offer various trading platforms for smartphones. Assess your preferences and skill level to choose a platform that suits your trading style. Some are user-friendly, while others offer advanced features

Customer Support : Ensure the broker provides assistance when needed. Prompt and effective customer service can make a significant difference in your trading experience

When you choose the right broker, you will be able to make your trades profitable with the help of their services, quick response, and efficient liquidity available.

Step 2: Open an account

Opening a forex trading account is a straightforward process, typically quick and user-friendly.

To open an account, follow these simple steps:

Gather Information : Prepare basic personal details such as your name, address, and contact information. Have any necessary identification documents ready for verification

Choose an Account Type : Select the type of forex trading account that aligns with your trading goals. Different accounts may offer varying features, so consider your preferences and experience level

Verification : Be prepared to undergo a verification process to ensure the security and authenticity of your account. It may involve submitting identification documents

Step 3: Download a trading app to your phone

Take your forex trading on the go by downloading a reliable trading app offered by your chosen broker. Here's how to make the right choice:

Ease of Use : Opt for an app that is intuitive and user-friendly. The easier it is to navigate, the smoother your trading experience will be

Features : Evaluate the app's features. Ensure it provides essential tools like charting capabilities and efficient order execution. The right features enhance your ability to make informed trading decisions

Security : Prioritize security. The app should employ robust security measures to safeguard your personal information and financial transactions

Step 4: Learn the basics

Before diving into the dynamic world of forex trading, it's crucial to grasp the fundamentals.

Here's what you need to focus on:

Types of Orders : Understand the various order types, such as market orders, limit orders, and stop orders. Knowing when and how to use each type empowers you to execute trades strategically

Types of Analysis : Explore both fundamental and technical analysis. A balanced approach to both can enhance your trading decisions

Risk Management : Acknowledge and manage risks. Learn how to set stop-loss orders and determine a risk-reward ratio. This knowledge is crucial for preserving your capital and navigating the unpredictable nature of the forex market

Step 5: Start trading

Now, you've equipped yourself with the basics, and it's time to initiate your trades:

Start Small : Begin with modest investments. Starting small allows you to gain practical experience without exposing yourself to significant risks

Gradual Risk Increase : As you become more confident and experienced, consider gradually increasing the size of your trades

Caption Top 3 iOS trading apps in 2025

| iOS apps | Trading platform | Spread EUR/USD | Raw/ECN Commission | User Satisfaction | Open account | |

|---|---|---|---|---|---|---|

| Yes | Mobile, Web, Desktop | No | No | 5.60 | Open an account Your capital is at risk. |

|

| Yes | MT4, MobileTrading, WebTrader, cTrader, MT5, TradingView | 0,1 | 3 | 8.40 | Open an account Your capital is at risk.

|

|

| Yes | WebTrader, MetaTrader4, Mobile platforms, MetaTrader5 | 0,15 | 3,5 | 6.70 | Open an account Your capital is at risk. |

Tips to trade forex on smartphone

Set realistic goals by establishing achievable objectives in your forex trading journey; success takes time and patience

Manage your risk through safeguarding your investments by implementing stop-loss orders, limiting potential losses and preserving your capital

Don't trade when you're emotional because emotions can cloud judgment

Conclusion

Trading forex through an app on your phone has both advantages and disadvantages:

- Pros

- Cons

- Convenience and mobility

- The availability of information and tools for market analysis

- The ability to trade at any time and from anywhere in the world

- The difficulty of managing risks

- The risk of fraud

- The limited capabilities of some mobile trading platforms

Before you start trading forex through your smartphone, make sure you have sufficiently researched the markets and can assess your risks and chances of success.

FAQs

Is it possible to trade on a phone?

Yes, it is entirely possible. Mobile trading apps provide a seamless experience, allowing you to execute trades, analyze markets, and manage your portfolio directly from your phone.

Can you do Forex trading on only a mobile device?

Yes, you can. With the advanced features of mobile trading apps, you have the flexibility to conduct your entire forex trading journey using only a mobile device. But keep in mind that market analysis software for desktop computers usually offer more features and tools for making trading decisions.

How secure is forex trading on a mobile device?

Forex trading apps prioritize security measures such as encryption and authentication, ensuring the safety of your financial information. It's crucial to choose a reputable broker and follow the best security practices for added protection.

What is the most popular forex trading app on your phone?

Metatrader for iPhones and Android phones can be considered as the most common application for forex trading via smartphone

Related Articles

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.