Common Trading Mistakes: How to avoid them and improve results

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Common trading mistakes for traders include overleveraging, failing to set stop-loss orders, and letting emotions drive decision-making.

Trading offers the potential for significant financial rewards, but it also comes with inherent challenges and risks. Understanding and avoiding them are crucial for improving your trading success and longevity. This article explores the most frequent pitfalls traders encounter and provides actionable advice to help you avoid these errors.

List of common trading mistakes

Mistakes in trading can be costly and detrimental to a trader's portfolio. Being aware of these common errors can help you avoid them and enhance your trading strategies.

Lack of a Trading Plan

A trading plan is essential for consistent success. It outlines your entry and exit strategies, risk management rules, and trading goals. Without a plan, traders are more likely to make impulsive decisions based on emotions rather than logic. An example of a Trading Plan Template is below.

| Section | Details |

|---|---|

| Trading Goals | Monthly return of 3%, limit losses to 2%, annual growth of 30% |

| Market Analysis | Trade on NYSE, NASDAQ, S&P 500 Futures, Crude Oil Futures; use trend-following in trending markets |

| Trading Strategies | Trend Following: Enter long above 50-day MA, exit below 50-day MA. Mean Reversion: Short above 20-day BB, exit at 20-day MA |

| Risk Management | Risk 1% of capital per trade, set stop loss at 2% below/above the entry price |

| Trade Management | Review positions daily, adjust stop losses as needed, conduct weekly trade reviews |

| Record Keeping | Maintain a detailed trading journal with screenshots, and track performance metrics monthly |

| Continuous Improvement | Complete trading courses quarterly, read trading literature, and backtest new strategies before live trading |

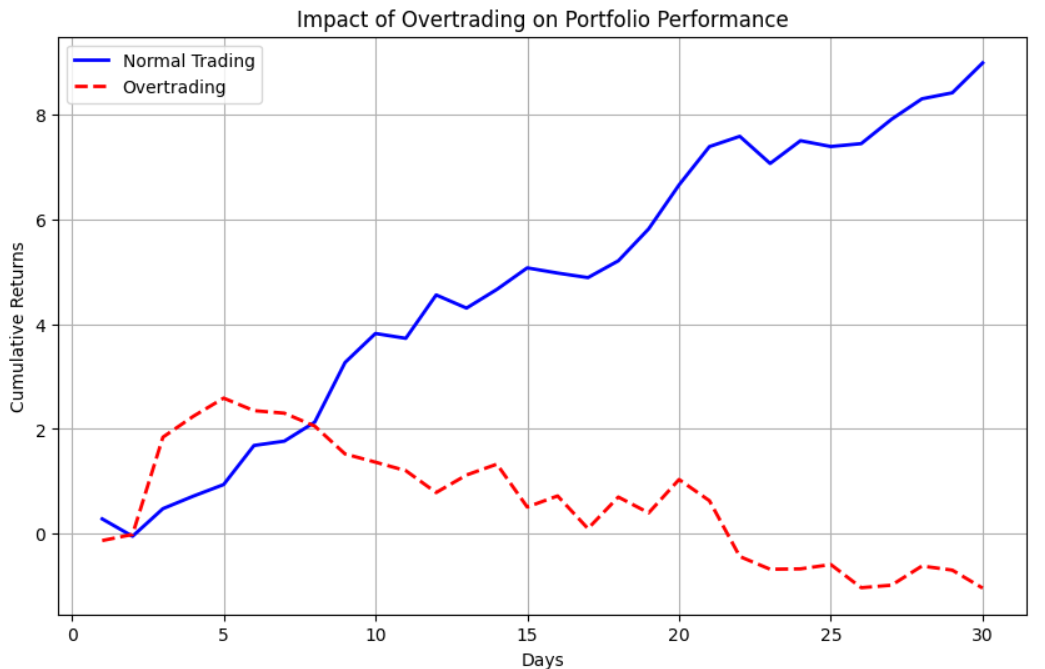

Overtrading

Overtrading occurs when traders execute too many trades in a short period. This behavior often stems from a desire to recoup losses quickly or capitalize on every market movement. However, overtrading can lead to increased transaction costs and emotional burnout.

Impact of Overtrading on Portfolio Performance

Impact of Overtrading on Portfolio PerformanceIgnoring Risk Management

Risk management is vital to protect your capital. Common techniques include setting stop-loss orders and determining appropriate position sizes. Ignoring risk management can result in significant losses and potentially wipe out your trading account.

| Technique | Description | Advantages | Disadvantages |

|---|---|---|---|

| Stop-Loss Orders | Automatically close a position when it reaches a certain price to limit losses | Protects against significant losses, easy to implement | Can trigger premature selling due to short-term volatility |

| Position Sizing | Determines the amount of capital to allocate to a single trade based on risk tolerance | Helps manage risk on a per-trade basis, and prevents overexposure | Requires accurate assessment of risk and volatility |

| Diversification | Spreads investments across different assets to reduce exposure to any asset or risk | Reduces the impact of a poor-performing asset, and can improve risk-adjusted returns | May limit potential gains, and require more effort to manage a diverse portfolio |

| Hedging | Uses financial instruments like options and futures to offset potential losses in other positions | Can protect against significant downside risk, helpful in managing portfolio volatility | Can be complex and costly, and requires an understanding of derivatives |

| Risk-Reward Ratio | Evaluates the potential return of a trade relative to its potential risk | Helps in making informed trading decisions, and encourages disciplined trading | Requires accurate estimation of potential returns and risks |

| Trailing Stops | Moves the stop-loss price based on the asset’s price movement to lock in profits | Protects profits while allowing for further gains and adjusts to market conditions | Can be triggered by short-term price fluctuations, and may require regular adjustments |

| Value-at-Risk (VaR) | Estimates the maximum potential loss over a specific time frame with a given confidence level | Provides a quantitative measure of risk, useful for portfolio-level risk assessment | Based on historical data, may not predict extreme events accurately, complex to calculate |

| Risk Limits | Sets predefined limits on the amount of capital risked in a single trade or period | Ensures controlled risk exposure, and enforces discipline in trading practices | Can be restrictive, and requires regular review and adjustment based on market conditions |

Emotional Trading

Emotions like fear and greed can cloud your judgment and lead to poor trading decisions. Emotional trading often results in chasing losses or holding onto losing positions for too long.

Lack of Knowledge and Education

Continuous learning is crucial in trading. Many traders fail because they do not invest enough time in understanding market dynamics, trading strategies, and the available tools. You can find also important information on the Traders Union to learn something new and helpful.

Not Using Stop Losses

Stop losses are essential for limiting potential losses. Without them, traders risk losing significant portions of their capital if the market moves against them. A quick guide on setting stop losses in popular trading platforms:

Step 1: Open a site and log in to your account

Step 2: Navigate to the chart of the asset you are trading

Step 3: Click on the “Buy/Sell” panel at the bottom of the chart

Step 4: Select “Stop Order” from the order type dropdown menu

Step 5 : Set the stop price and quantity for the order

Failing to Keep Records

Maintaining a trading journal helps you analyze past trades, identify patterns, and improve strategies. Without proper records, learning from past mistakes and successes is challenging. Without proper documentation, traders cannot effectively analyze their performance, identify patterns of success and failure, or make necessary adjustments to improve their strategies. Keeping records helps traders learn from their mistakes and build on their successes, ultimately leading to more disciplined and informed trading decisions.

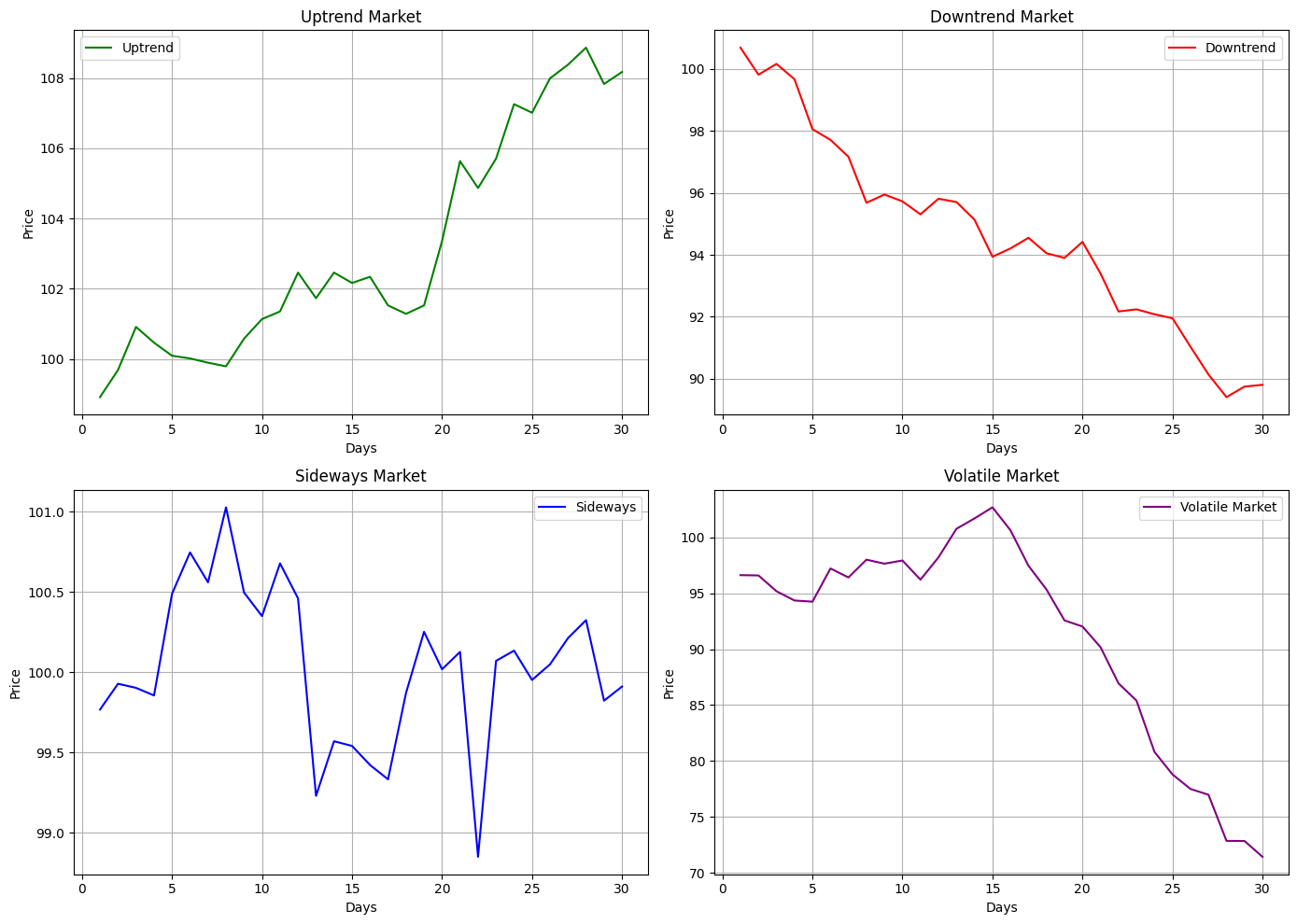

Ignoring Market Conditions

Market conditions can greatly affect trading strategies. Understanding whether the market is trending, ranging, or experiencing high volatility is essential for making informed trading decisions.

Сharts illustrating different market conditions and their impacts

Сharts illustrating different market conditions and their impactsUnrealistic Expectations

Many traders enter the market with unrealistic expectations, such as achieving consistently high returns or never experiencing losses. Setting realistic goals and understanding the nature of trading can prevent disappointment and frustration.

| Expectation | Realistic | Unrealistic |

|---|---|---|

| Return on Investment (ROI) | Expect moderate returns, such as 10-20% annually, recognizing that some years may be better or worse | Expect to double or triple the investment in a short period, like a few months, without considering risks |

| Market Knowledge | Understand that continuous learning is essential, and it takes time to master trading skills and strategies | Believe that trading is easy and quick to learn, expecting instant expertise without much effort |

| Trading Losses | Accept that losses are part of trading; even successful traders have losing trades | Expect never to experience losses or believe that every trade will be profitable |

| Trading Hours | Recognize that trading requires dedication, analysis, and time, but also understand the importance of breaks | Believe that successful trading only requires a few minutes a day and can be done without any preparation |

| Risk Management | Emphasize the importance of risk management strategies to protect capital and manage potential losses | Ignore risk management practices, thinking all trades will go in the desired direction |

| Market Volatility | Accept market volatility as a regular part of trading and adapt strategies accordingly | Expect the market to move predictably and smoothly without significant fluctuations |

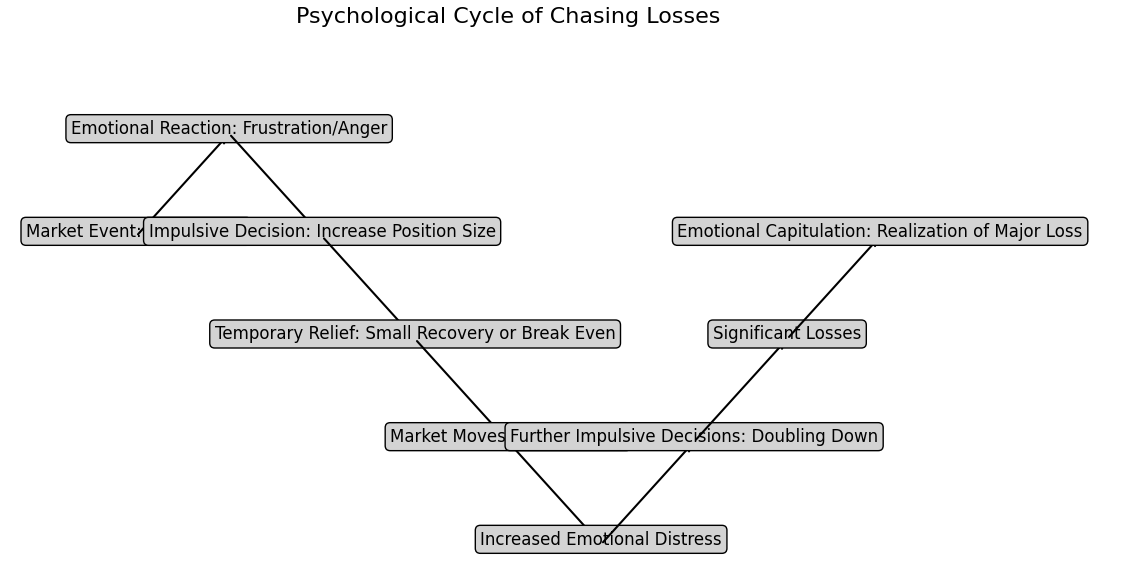

Chasing Losses

Chasing losses involves trying to recoup losses by taking on additional risks. This behavior often leads to further losses and is driven by emotional reactions rather than sound trading principles.

Psychological Cycle of Chasing Losses

Psychological Cycle of Chasing LossesHow to avoid common trading mistakes

Avoiding common trading mistakes is essential for achieving long-term success in the market. You should focus on education, solid trading plans, and risk management. Patience and realistic expectations are also key to long-term success.

Education. Beginners should invest time in learning about market dynamics, trading strategies, and risk management. Online courses, reading trading books, and attending webinars can provide a solid foundation.

Trading Plan. Developing a detailed trading plan can help beginners stay disciplined. This plan should include straightforward entry and exit strategies, risk management rules, and realistic goals.

Risk Management. New traders should start with small positions and use stop-loss orders to limit potential losses. Diversifying investments can also help manage risk.

Patience. Understand that trading success doesn't happen overnight. Set realistic expectations and be prepared for a learning curve.

Advanced traders also should refine and test their strategies, use advanced tools, and manage more extensive portfolios. Continuous learning and adaptation are essential for staying competitive.

Refining Strategies. Advanced traders should continuously test and refine their trading strategies using backtesting and forward testing to ensure they remain effective in different market conditions.

Advanced Tools. Utilizing sophisticated trading platforms with advanced charting tools, algorithmic trading capabilities, and real-time data feeds can enhance trading efficiency.

Managing Larger Portfolios. As portfolios grow, advanced traders should implement more complex risk management strategies, such as hedging and diversification across various asset classes.

Continuous Learning. Keeping up with market trends, new trading technologies, and advanced strategies is crucial for maintaining a competitive edge.

Best practices to help you succeed

Avoiding common trading mistakes requires discipline, managing emotions, overcoming laziness and continuously improving your trading skills. Here are some practical recommendations and best practices to help you succeed in the market:

Stick to Your Trading Plan. Develop a well-defined trading plan that outlines your strategies, risk management rules, and goals

Manage Stress and Emotions. Trading can be emotionally taxing

Regularly Review and Analyze Your Trades. Consistently review your trading journal to analyze past trades, identify patterns, and learn from successes and mistakes

By adhering to these key points, you can enhance your trading discipline, manage emotions effectively, and continuously refine your trading strategies for long-term success.

Conclusion

Avoiding common trading mistakes is crucial for anyone looking to succeed in the financial markets. You can significantly improve your trading outcomes by developing a solid trading plan, managing risk effectively, controlling emotions, and continuously educating yourself. Both beginner and advanced traders must understand that discipline, patience, and realistic expectations are the foundations of long-term trading success.

Regularly reviewing your trades and adapting your strategies based on market conditions will help you stay ahead. Utilizing advanced trading tools and seeking feedback from experienced traders can further enhance your skills and knowledge. Remember, trading is a journey that requires constant learning and adaptation.

FAQs

What is the most common mistake traders make?

The most common mistake is not having a trading plan. This can lead to inconsistent decision-making and poor risk management.

How can I avoid overtrading?

Set strict rules for entering and exiting trades to avoid overtrading, and stick to your trading plan. Monitor your trading frequency and take breaks when necessary.

Why is risk management critical in trading?

Risk management is crucial because it helps protect your capital from significant losses. Techniques such as stop losses and position sizing are essential for long-term success.

How can I manage emotions while trading?

Develop a trading plan, journal, and practice mindfulness techniques to manage emotions. Taking breaks and staying disciplined also help maintain emotional control.

Related Articles

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Overtrading is a phenomenon where a trader executes too many transactions in the market, surpassing their strategy and trading more frequently than planned. It's a common mistake that can lead to financial losses.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.