U.S. Crypto Reserves: A New Era For Digital Assets

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The concept of U.S. strategic crypto reserves has taken center stage following the government's announcement of plans to build a national digital asset reserve. This initiative represents a fundamental shift in U.S. financial policy, reflecting an increasing recognition of cryptocurrency’s role in global economics. The reserve may include Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Solana (SOL), and Cardano (ADA) as core assets.

Meanwhile, the announcement comes at a time of heightened market volatility, with Bitcoin surging over 43% in the past year and Ethereum - 34%. Solana, XRP, and Cardano have also seen major price swings, driven by speculation and regulatory shifts. Following the news, Bitcoin surpassed $94,000, and Solana crossed $150, triggering a market-wide rally.

In this article, we’ll explore the details of this policy shift, the cryptocurrencies included, the immediate market reactions, regulatory developments, and the long-term implications of this historic move.

Key points on U.S. strategic crypto:

Government-backed initiative. The U.S. aims to establish a national reserve with Bitcoin, Solana, and XRP.

Economic strategy. Strengthens digital finance and national security.

Market impact. Bitcoin surged 12%, Solana 15%, and XRP 9% post-announcement.

Regulatory outlook. Federal framework under development to manage digital assets.

U.S. strategic crypto reserves background

On March 2, 2025, President Donald Trump announced the establishment of a U.S. Strategic Crypto Reserve, marking a significant shift in the nation's approach to digital assets. This initiative aims to integrate major cryptocurrencies into the country's financial infrastructure, positioning the United States as a leader in the evolving digital finance landscape.

Background and development

In January 2025, President Trump signed an executive order titled "Strengthening American Leadership in Digital Financial Technology," which established the Presidential Working Group on Digital Asset Markets. This group's mandate was to explore the creation of a national digital asset stockpile, initially considering the use of seized cryptocurrencies. The recent announcement specifies that the reserve will include prominent cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA).

This strategic move aims to diversify the nation's digital asset holdings, reflecting a comprehensive approach to embracing various blockchain technologies. The inclusion of these specific cryptocurrencies underscores the administration's intent to support a broad spectrum of digital assets, each offering unique functionalities and use cases within the crypto ecosystem.

This development aligns with President Trump's broader vision to establish the United States as the "crypto capital of the world," signaling a robust commitment to integrating digital assets into the national financial framework.

Specific cryptocurrencies included

Bitcoin. Recognized as digital gold, U.S. Bitcoin reserves will serve as a hedge against inflation and economic uncertainties.

Solana. The inclusion of U.S. Solana reserves highlights the importance of high-speed blockchain infrastructure.

XRP. Chosen for its use in cross-border payments, U.S. XRP crypto reserves demonstrate the government's interest in fintech solutions.

Cardano. Recognized for its research-driven blockchain and long-term development vision.

In addition to the cryptocurrencies already included in the U.S. Strategic Crypto Reserve, various industry experts and companies have proposed the inclusion of other digital assets:

USD Coin (USDC). A stablecoin pegged to the U.S. dollar, USDC offers stability and could serve as a reliable medium of exchange within the reserve.

Chainlink (LINK). Recognized for its decentralized oracle network, Chainlink enables smart contracts to securely interact with real-world data, enhancing blockchain utility.

Polkadot (DOT). Known for facilitating interoperability among various blockchains, Polkadot aims to create a unified network of decentralized platforms.

Avalanche (AVAX). Celebrated for its high throughput and low latency, Avalanche supports decentralized applications and custom blockchain networks.

These suggestions reflect a growing consensus that a diversified crypto reserve could bolster the U.S. position in the rapidly evolving digital asset landscape.

Evolution of U.S. cryptocurrency policy

Historically, the U.S. government has had a fluctuating stance on cryptocurrency regulation. While agencies like the SEC and CFTC have taken measures to regulate digital assets, the lack of a unified framework has left many uncertainties. With this new initiative, the U.S. is setting the stage for a more structured approach toward integrating crypto into its financial ecosystem.

Previous stance on digital assets

In the past, U.S. authorities have focused on controlling illicit activities and consumer protection. However, recent developments indicate a shift toward fostering innovation and economic competitiveness through strategic U.S. crypto reserves.

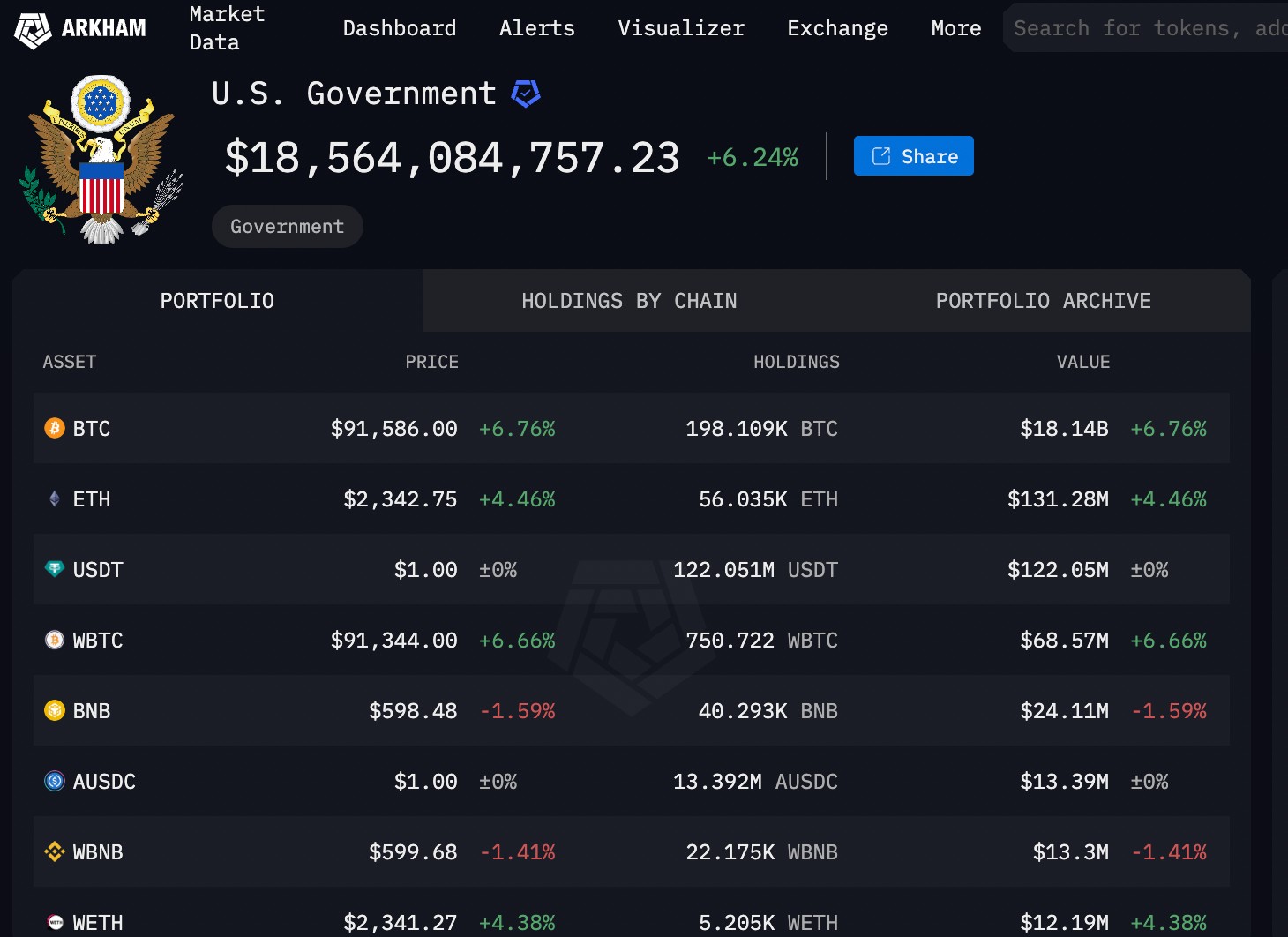

As of the latest reports, the U.S. government holds approximately $18.56 billion in digital assets, spread across multiple blockchains. The breakdown includes:

Bitcoin (BTC): 198.1K BTC (~$18.14 billion)

Ethereum (ETH): 56.0K ETH (~$131.28 million)

Tether (USDT): 122.0 million USDT (~$122.05 million)

Wrapped Bitcoin (WBTC): 750.7 WBTC (~$68.57 million)

Binance Coin (BNB): 40.2K BNB (~$24.11 million)

USD Coin (USDC): 11.5 million USDC (~$11.57 million)

Dai (DAI): 8.6 million DAI (~$8.66 million)

Tron (TRX): 15.1 million TRX (~$3.65 million)

Uniswap (UNI): 300.6K UNI (~$2.36 million)

Chainlink (LINK): 100.1K LINK (~$1.62 million)

The inclusion of stablecoins and DeFi-based tokens such as USDC and LINK highlights the government's evolving stance toward cryptocurrency regulation and adoption. With this growing portfolio, it is expected that more blockchain-based assets could be added in the near future to strengthen the reserve's diversity and security.

Immediate market reactions

Following the announcement, digital asset markets experienced a sharp increase in trading volumes and prices. Bitcoin surged by over 10%, with Solana and XRP following closely behind. The creation of U.S. strategic crypto reserves has fueled investor confidence and renewed interest in government-backed crypto initiatives.

Performance of key cryptocurrencies

Bitcoin. Increased by 12% within 24 hours of the announcement.

Solana. Rose by 15% amid speculation of government adoption.

XRP. Witnessed a 9% price spike, signaling strong institutional interest.

Cardano. Surged by 50% following reports of government support.

Positioning the U.S. as the "Crypto Capital of the World"

One of the primary goals of establishing U.S. crypto reserves is to reinforce the nation's leadership in the blockchain sector. With major economic powers exploring similar reserves, the U.S. seeks to remain at the forefront of innovation and digital finance.

Counteracting previous regulatory challenges

The initiative also aims to create regulatory clarity and mitigate past concerns regarding crypto volatility and illicit use. By officially incorporating U.S. Bitcoin reserves into the financial system, the government signals a more favorable regulatory environment for digital assets.

Regulatory and legal considerations

To oversee the management of U.S. crypto reserves, the government has established a task force dedicated to monitoring and regulating national digital assets.

Development of a Federal Regulatory Framework

A key aspect of this initiative is the introduction of comprehensive legislation to govern U.S. Bitcoin reserves and other holdings. The framework is expected to address security, taxation, and investment guidelines.

Perspectives from financial analysts and crypto experts

Brad Garlinghouse, CEO of Ripple Labs. Advocates for a diversified U.S. digital asset reserve that includes multiple cryptocurrencies beyond just Bitcoin, emphasizing the importance of a multi-token approach to strengthen the nation's strategic crypto holdings.

Matthew Sigel, Head of Digital Assets Research at VanEck. Proposes that establishing a strategic Bitcoin reserve could significantly reduce the U.S. national debt, potentially offsetting up to 35% of liabilities by 2049.

Peter Schiff, Economist and Crypto Skeptic. Criticizes the inclusion of certain cryptocurrencies like XRP in the U.S. strategic reserve, questioning their necessity and value compared to Bitcoin.

Cynthia Lummis, U.S. Senator and Chair of the Senate Banking Subcommittee on Digital Assets. Supports the idea of a strategic Bitcoin reserve, suggesting it could serve as a hedge against inflation and strengthen the country's financial position.

Broader implications

The proposal for a U.S. Strategic Crypto Reserve signifies a pivotal shift in the nation's approach to digital assets:

Economic Strategy. The reserve aims to position Bitcoin as a core element of the United States' economic strategy, enhancing the nation's leadership in the global crypto space.

State-Level Initiatives. At least 13 U.S. states are crafting legislation for Bitcoin reserves, signaling its rising importance in public finance. States like Ohio and Pennsylvania propose BTC-backed diversification to safeguard against USD devaluation and economic shifts.

Global Influence. The U.S. initiative could inspire similar policies worldwide, potentially setting off a cascade of strategic crypto reserves as nations seek to bolster their financial systems.

In conclusion, the U.S. Strategic Crypto Reserve represents a landmark development in the integration of digital assets into national economic frameworks. While the immediate market reactions have been positive, the long-term effects will depend on regulatory clarity, technological advancements, and the evolving global financial landscape.

If the U.S. starts using Bitcoin reserves as a form of financial backing, you’re looking at an entirely new financial paradigm

If you're a beginner navigating the U.S. Strategic Crypto Reserves, don't just focus on Bitcoin or the biggest tokens in the reserve — understand the why behind their selection. The government isn’t just hoarding digital gold; they are strategically positioning themselves to own key infrastructure pieces of the crypto economy.

Solana isn't just about high-speed transactions; its ecosystem is a potential on-ramp for government-backed DeFi applications. XRP isn't just for cross-border payments; it’s a direct bet on regulatory clarity and institutional adoption. As a trader, your edge isn't just in investing in these tokens but in following how government actions will shape their use cases. Think bigger — watch which government agencies interact with these assets, how policies evolve, and where institutional money is flowing. You’re not just investing in coins; you’re investing in a macro strategy that aligns with U.S. interests.

Another critical factor most traders ignore is the role of off-chain reserves and derivatives markets in shaping these asset values. The U.S. might not just hold these cryptos in cold wallets — they could be leveraging them in financial markets, using them for debt issuance, or collateralizing future bonds. If the U.S. starts using Bitcoin reserves as a form of financial backing (similar to gold), you’re looking at an entirely new financial paradigm. The best way to prepare? Track government partnerships, pilot projects, and banking sector integrations. Also, don’t fall for short-term price spikes — government participation creates artificial demand, but sustainable adoption takes time. The real money is in anticipating which part of the financial system these assets will disrupt next.

Conclusion

The U.S. Strategic Crypto Reserve marks a major shift in financial policy, solidifying cryptocurrency’s role in national economic strategy. By holding assets like Bitcoin, Solana, and XRP, the government aims to strengthen digital finance, hedge against inflation, and maintain leadership in blockchain innovation. This move has already fueled market confidence, driving institutional interest and regulatory developments. However, long-term success depends on execution, legal clarity, and global response. For traders and investors, staying informed about policy changes and market trends is crucial. As crypto adoption accelerates, the U.S. reserve could reshape digital finance, influencing global economic strategies.

FAQs

What is the U.S. Strategic Crypto Reserve?

It is a government-backed initiative to hold Bitcoin, Solana, and XRP as strategic assets.

Why is the U.S. government creating crypto reserves?

To enhance national security, stabilize digital finance, and maintain leadership in blockchain innovation.

Which cryptocurrencies are included in the reserve?

The reserve primarily includes Bitcoin (BTC), Solana (SOL), and XRP, among other digital assets.

How does the U.S. Crypto Reserve impact traders?

It boosts market confidence, increases demand for listed assets, and could lead to more regulatory clarity in the crypto space.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).