Note!

This article was created for informational purposes only. Please consult a professional for more detailed information regarding your individual case.

Note!

This article was created for informational purposes only. Please consult a professional for more detailed information regarding your individual case.

Paying the proper taxes is an obligation every American must comply with. However, not all industries have clear-cut regulations that are common knowledge. Take cryptocurrency, for example. Being relatively new, the majority of traders may have several clarifications on how to go about this process, the requirements needed, and what percentage of their earnings should be paid to the Internal Revenue Service.

Since we don’t want you getting in hot water - which would most likely lead to a hefty penalty fee - we’d like to offer a solution.

In today’s article, we’ll be discussing everything you need to know about crypto taxes. This also includes the proper way of reporting it on your tax statement, the difference between income and capital gain tax, and many more.

So that when the tax collector comes along, you’ll have all your bases covered.

Start trading cryptocurrencies right now with Binance!Knowing how to report crypto on taxes isn’t as simple as one-plus-one. Since the landscape of digital currency is constantly changing, with more and more features being introduced, so are its regulations and the laws attributed to it.

What we can say for certain now is that crypto tax is typically based on two factors: how much you earn, and how long you’ve held it for. Therefore, holding an asset for more or less than one year (as a long-term or short-term investment) will affect the percentage of income you’ll have to pay.

At this point, this may still seem like a foreign concept. But we’ll do our best to break it down further in the succeeding sections.

The short answer here is yes.

Cryptocurrency falls under the category of income-generating assets, making it eligible to be taxed. According to an IRS ruling in 2014, they are treated more like stocks or bonds, rather than monetary currency. Thus, you are only required to pay taxes when buying, selling, or trading it at a profit.

At present, many traders are also practicing a strategy called tax-loss harvesting. This is a perfectly-legal game plan where you sell assets at a loss to neutralize any capital gains. As a result, you end up paying less taxes.

How to invest in cryptocurrency?Based on what we know, the IRS won’t have access to your day-to-day access and transactions on trading platforms. Because this technology is still relatively new, they are still finding new ways to qualify the amounts that taxpayers are declaring. In short, they’re still banking heavily on the honesty of people.

Nevertheless, this branch of government is finding ways to adapt.

One such example is the 1040 or US Individual Income Tax Return declaration form. On it, you’ll be asked whether you’ve entered into any transaction involving virtual currency. If you did, you’d be legally-bound to answer truthfully.

The IRS is also experimenting on using artificial intelligence and data analytics to track consumer trading patterns. This is on top of the more traditional strategies it’s been using for several years now when monitoring money laundering, under-reporting, or other illegal activities.

First, let me begin by saying that under-declaring your dividends is equivalent to tax fraud, and obviously illegal. This is not what we’ll be talking about here.

As mentioned earlier, one often-used method to minimize taxes on crypto is through tax-loss harvesting, defined as the deliberate sale of assets while their value is low to maximize overall profit. When these are reported, they can bump you down to a lower bracket, resulting in deductibles up to $3,000 per year.

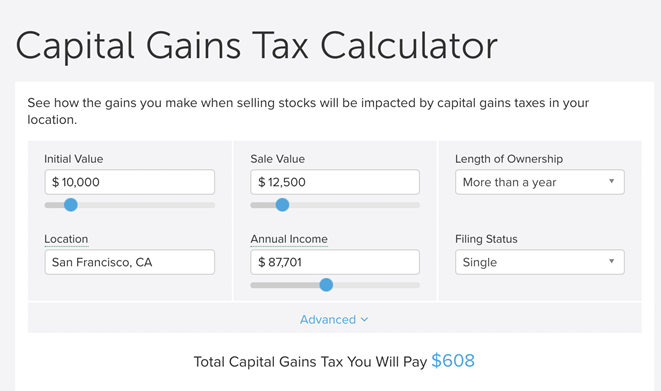

capital gains tax calculator

Mastering tax-loss harvesting is by no means a simple task. It takes very precise calculations, not to mention a deep understanding of the industry. Thankfully, there are several web applications available that do the math for you. Beginners may want to check out SmartAsset as it has one of the most user-friendly versions around.

Typically, this is done towards the end of the calendar year. With a smaller time frame, you can predict trends more easily, resulting in more accurate results. However, this can be done anytime. For instance, seasoned traders have learned to control this over longer periods, which helps them protect their earnings.

Trading isn’t the only way to obtain digital currency. Some users mine for them, where computers are used to answer complex mathematical equations. Whoever answers them correctly first is awarded the next block of cryptocurrency.

Once it becomes your possession, it can be sold, given away, or used as a trade chip. In many ways, this is how it enters into the virtual economy.

Whichever the case, the crypto’s fair market value at the day you received it becomes part of your regular taxable income. Over time, as its value increases, you will also be liable to pay a capital gains tax. Both are based on your respective tax grouping.

Moreover, you can write off any equipment used in mining as an expense, assuming, of course, your business is registered as much. This should reduce the amount you pay to the IRS.

To most people, these two concepts can be interchanged by accident. But a closer look will show they are actually quite different.

Income tax is very clearly defined as payment for goods or completion of a particular service. This also includes instances when cryptocurrency was received through mining. As we said earlier, its value will be based on fair market price at that time.

On the other hand, capital gain tax happens each time you earn a profit when an asset is either sold or exchanged. The difference between its original and current valuation is what is taxable. Remember that this does not apply to unfortunate incidents when you incur a loss.

In the succeeding sections, we’ll talk more about how to compute each one.

Day Trading Cryptocurrency Guide - Basic Rules and StrategiesIt’s perfectly normal for individuals to hold onto virtual assets for longer than one year. Especially if they haven’t reached their peak yet. This is just one way to ensure that you get the maximum value in return.

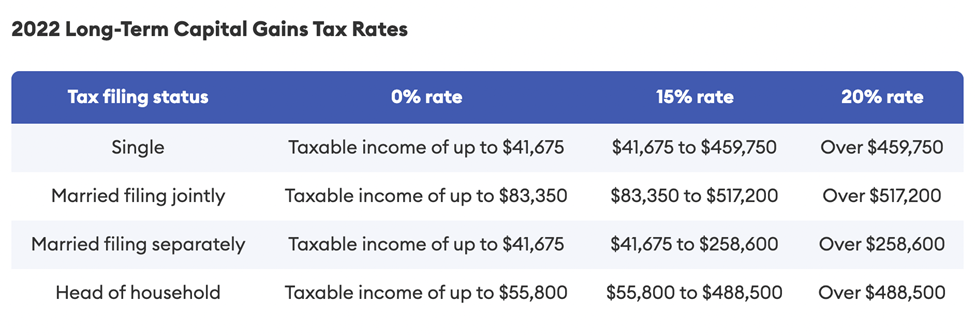

Well, besides the added earnings, lower tax rates is another benefit that long-term traders and investors enjoy. According to Bankrate, which is based on data shared by the IRS, even the highest earners are taxed up to 20% only, which is a big difference from highest among for short-term assets at 37%.

You can see the other income brackets in the chart shown above.

If you’ll see, there are also special considerations based on civil status. Individuals who are single or married (but file separately) have a lower threshold for each category. Conversely, there seems to be more consideration given to heads of households and married couples, which can be attributed to their supposed higher expenses.

As a trader, this setup makes it increasingly important to know how much you earn per transaction. This will determine what column you fall under, and ultimately, how much long-term capital gain tax needed to be paid.

For experienced traders, it’s the crypto capital gain tax that they closely monitor. We know it’s been mentioned over and over, throughout our article. But just for us to be on the same page, let’s define it one more time, shall we?

Basically, capital gain tax is the percentage of earnings you pay to the IRS. You can compute this by knowing the difference in value now, compared to when you initially acquired it. Remember, you are only accountable for capital gain tax, as its name suggests, when gaining a profit, and not when incurring losses.

Another factor to consider is the amount of time you hold it for. Assets can be categorized according to short-term and long-term. The former can be described as currency kept, and then traded, for less than one year, while the later is anything more than that.

Estimating Your Projected Capital Gain Tax

Computing for this is actually fairly simple, contrary to what most people may think.

The first step is by remembering how much you bought a particular cryptocurrency for, while comparing it to its current market value. To explain this more clearly, here’s an example.

Let’s say in 2018, you invested money to buy digital currency valued at $10,000. Assuming it grows to $150,000 after four years, you’ll have a capital gain of $140,000, which is the taxable amount. Now, the exact deductible percentage is based on your total declared income for the entire calendar year.

Aside from that, how long you’ve held onto the asset, as well as your current civil status, are other factors that affect capital gain tax. To put things into perspective, here are two charts that help illustrate our point.

How to Get Free Bitcoins - 8 Best OptionsStrategies Implemented and How It Affects Taxation

Capital gain tax has a direct impact on your end profit. Therefore, understanding and taking a more strategic approach to this will help you maximize earnings. Experienced traders, who have already mastered this practice, are known to use certain methods. We’ll be describing a couple of those right now.

long-term capital gains tax rates

federal income tax brackets

Since crypto is an extremely volatile asset, its price fluctuates on a daily basis. One day, it could peak, then suddenly hit rock bottom tomorrow. One way of adapting is through active trading, which is the buying and selling of crypto within shorter periods. Each time its value drops, you purchase a substantial amount, then quickly dispose of it when the price increases.

The key here is to be quick on your feet. It may also require you to regularly monitor trends and movements. However, seeing as this is classified as a short-term asset, you’ll need to pay a higher tax rate.

Another often-used strategy is the buy-and-hold technique. Here, traders purchase securities at a loss, but hang on to them for longer periods, usually reaching several years. This triggers a waiting game in hopes that it will mature. And in order to minimize costs, tax-loss harvesting is practiced as an activity to forecast how much taxes you must pay. You can also be interested in information about What Is The Best Time To Trade Crypto In The United States read the Traders Union article.

For this section, let’s turn our attention to the chart posted earlier on long-term capital gain tax rates. If you’ll notice the second column, there are amounts that aren’t taxable. This is what we consider as a non-taxable maximum. Individuals who fall under those respective categories won’t be obligated to pay long-term capital gain tax.

Of course, the ceiling price of each one varies, depending on your social status.

For instance, individuals who are single, or married but filed separately, only have a threshold up to $40,400 per year. In comparison, couples filing jointly can earn up to $80,800 without paying any capital gain tax (which is double the amount of what we discussed earlier), while heads of households have a non-taxable maximum of $54,100, on their own.

Presumably, this regulation their projected household expenses, responsibilities, and possible dependents. Which is probably why married couples and heads of families enjoy more leeway before paying anything to the IRS.

It’s also important to note that this only applies to crypto held more than one year, or what’s considered as long-term assets. Profits earned less than that fall under a totally different bracket. Don’t worry, though, we’ll be discussing that in greater detail in one of the succeeding sections.

By its very definition, tax breaks are any acts or entries in a financial statement that results in reduction of taxes. Typically, this covers business expenses or fees shouldered by a company. For crypto, since they are technically considered as a capital asset, losses may also fall under this category.

One situation where this applies is when an individual mines for cryptocurrency. Since this is technically an income-generating practice, the expenses incurred when undergoing this venture can be considered as a tax break. Just remember your company must have the appropriate paperwork, and be registered correctly, to enjoy this benefit.

The same can be done for investments. Being a risk, in more ways than one, there’s always that possibility of losing money. These deficits experienced could also be logged as an expense. In some instances even, traders will intentionally take a loss to lessen the amount of capital gain tax they are liable for. By this time, you’re already very much familiar with this, which is called tax-loss harvesting.

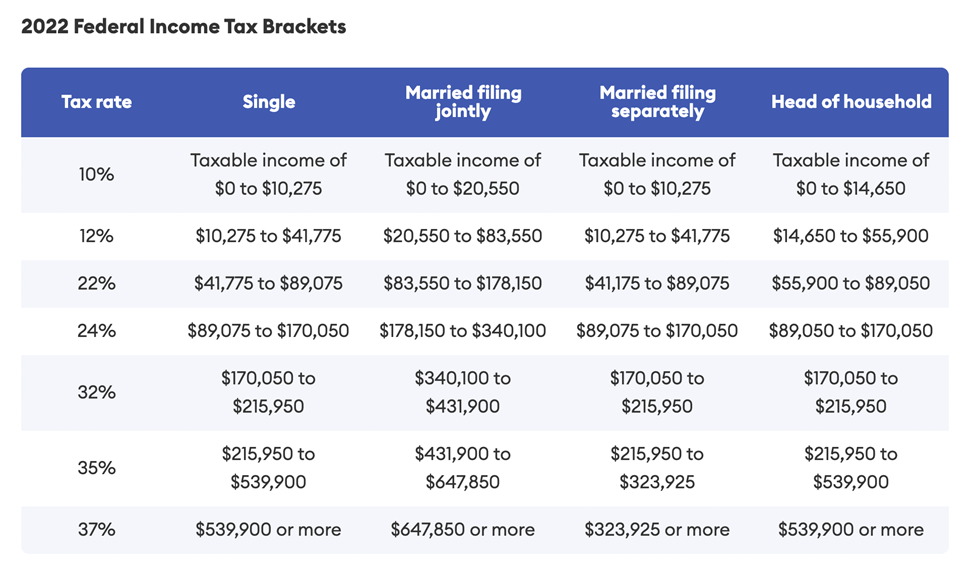

If capital gain tax is geared towards long-term digital assets, then income tax pertains to receiving crypto payments in return for goods, services, or barters. Furthermore, these are only short-term transactions that aren’t held for more than one year.

Like any type of tariff paid to the government, people are classified according to income brackets based on how much they earn in a year. A specific percentage of that is what is handed over as taxes.

Since this changes every so often, it’s important to keep yourself updated on new guidelines announced by the IRS. But for 2023, at least, here’s a quick look at how income tax is computed.

When you plan on buying or selling virtual assets, crypto exchanges are the best platforms to do so. They are registered and held liable by a specific department in the government, making them completely legalized. At least on that front, your interests will be protected.

Among the numerous trading sites available online, Coinbase and Binance US are two of the most popular options. Let’s take a deeper look at each one, and see if they are worth your time.

Founded in 2012, Coinbase is a crypto exchange that caters to beginners. Its platform and user interface is very basic, which in this case is a good thing. Traders have constantly shared how easy it is to navigate through, order, and trade currencies, even for beginners.

Being around for almost a decade, they have amassed up to $255-Billion in assets, and have opened the door to over one hundred types of cryptocurrency.

However, some downsides we saw with Coinbase are their surprisingly high transaction fees and unreliable customer service channels. Interested users may want to consider these issues when going onboard their platform, so the necessary contingencies can be made.

Coinbase vs Binance: which exchange is cheaper?Compared to Coinbase, the Binance US platform faces a lot more problems. Their verification process is infamous to be painfully excruciating. Users won’t be allowed to enter into any transaction with completing every step, which several people have described as unnecessary.

Besides that, this crypto exchange only has a limited amount of assets. So investors looking to trade less popular forms of cryptocurrency might not find much success here.

The only saving grace of Binance US, in our opinion, is their low trading fees. This way, you can enjoy a bit more of your hard-earned profits. Still, this is a big price to pay for convenience, and the comfort that should be felt when doing this activity.

How to Use Binance: A Step-By-Step GuideAfter reading through this article, we hope you were enlightened on how to pay crypto taxes in the USA.

Although this is a relatively young industry, it is still our obligation as citizens to fulfill our duties. We just need to balance this with maximizing our earnings. Thankfully, there have been some strategies introduced in recent years that provide individuals with a win-win situation.

Yes, but only if your income goes beyond the maximum threshold for long-term capital gains. Otherwise, you just need to declare the profit, without paying anything.

The short answer here is that income tax is payment for goods or services, while capital gains tax is profit enjoyed after selling a non-inventory capital asset.

Yes, of course. This should be included when you file for your yearly income.

When you incur expenses or losses in investing, these can be declared to the IRS. As such, these can be deduced from your total obligation.

Aneeca Younas is a math wizard with extensive knowledge in research, data mining, forum commenting, and all types of writing and editing. As a contributor to the Traders Union website, Aneeca’s goal is to help newcomers and experienced users have the best possible information.

Bruce Powers is an expert trader and technical analyst with over 20 years of experience in Forex, commodities, ETFs, cryptocurrencies and other assets. He is an active trader, technical and fundamental analyst, media commentator, educator and a writer. As an author for Traders Union, he contributes his deep analytical skills, expertise and understanding of the global economy and financial markets to provide market analysis and insights. Powers is also a frequent guest on business TV news shows.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.