What’s The Best Time To Trade Crypto In US

-

Best Time of Day: 2 PM to 4 PM EST, partially aligning with the U.S. stock market hours

-

Best Days of the Week: Mondays show heightened volatility,; mid-week tends to be less volatile

-

Potential for Profit: Increased volatility during peak hours can lead to significant profit opportunities

-

Associated Risks: High volatility also raises the potential for loss - trade with caution

A crucial question lingers for crypto enthusiasts and investors in the United States: When is the optimal time to trade?

This article will dive into the nuanced realm of crypto trading times, particularly in the U.S. market. Catering to both novice and seasoned traders, it offers insightful analysis and practical tips to navigate the complex but potentially rewarding landscape of cryptocurrency trading.

-

What time is cryptocurrency traded in the US?

Cryptocurrency is traded 24/7 in the US, with peak activity between 12 PM and 10 PM EST.

-

What is the best crypto exchange for day trading in the US?

The best crypto exchange for day trading in the US often includes platforms like Coinbase and Binance US, known for their liquidity and comprehensive trading tools.

-

When to sell crypto for profit?

Sell crypto for profit when it reaches your target price based on your investment strategy, and after considering market trends and personal financial goals.

-

Is crypto trading profitable?

Crypto trading can be profitable, but it carries a high risk due to market volatility and requires in-depth knowledge and a well-thought-out strategy.

Can I trade Bitcoin in the USA?

Absolutely. In the United States, trading Bitcoin and other cryptocurrencies has become increasingly accessible and regulated. The market operates 24/7, offering unique opportunities and challenges for U.S. traders. Understanding the legal landscape, market hours, and the best trading times is crucial for maximizing returns and managing risks in this dynamic investment arena.

Best Time of the Day to Trade Crypto in the USA

The digital currency market is known for its volatility, which, while presenting risks, also opens up opportunities for astute traders. Timing is everything, and in the U.S., certain times of the day can offer heightened volatility that may be leveraged for potential gains.

Best hours for crypto trading in the US

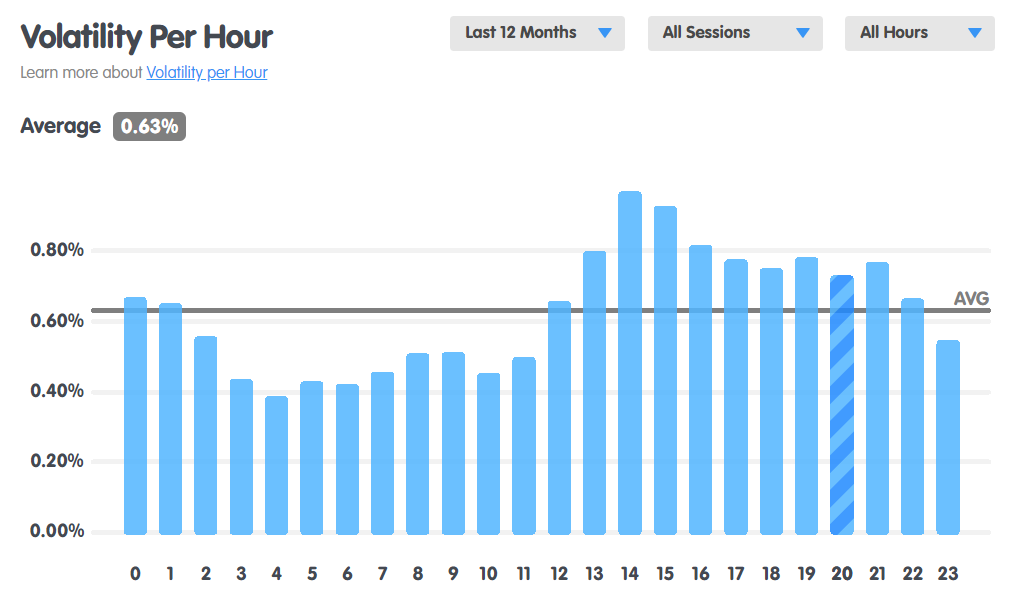

Analysis of market patterns reveals that volatility tends to peak during the U.S. afternoon to evening, roughly from 12 PM to 10 PM EST. The first few hours of this period of heightened volatility coincide with the New York stock market.

Interestingly, the highest average volatility is often observed between 2 PM to 4 PM EST, a window that often aligns with significant financial events and announcements. During these hours, traders should be particularly vigilant, as the market's response to news can be swift and dramatic. As the day progresses, the volatility slightly tapers but still remains above the daily average until 2 AM.

Traders looking to capitalize on these fluctuations should monitor global economic calendars and be prepared for rapid shifts in the market. While this time frame suggests an increased chance for profit, the heightened volatility also means the stakes are higher, necessitating a solid strategy and a clear understanding of one’s risk tolerance.

Best Time of the Week to Trade Crypto in the USA

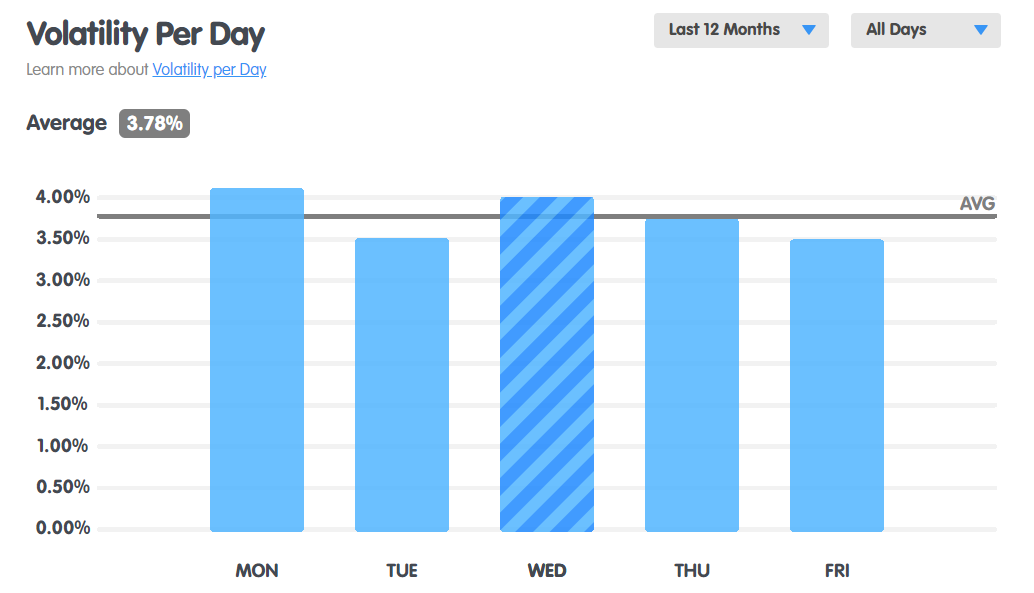

When it comes to weekly trends in the cryptocurrency market, Mondays stand out. Unlike traditional assets, which often see the "Monday effect" of lower returns, crypto markets tend to experience heightened volatility at the start of the week.

Best days for crypto trading in the US

This could be attributed to a variety of factors, including the processing of news and events that occurred over the weekend when most other markets are closed or the renewed activity of traders returning to their desks after the break.

Data suggests that trading on Monday can be particularly turbulent, with average volatility higher than on other weekdays, a trend that stands in contrast to traditional assets. This presents an opportunity for traders to potentially benefit from significant price movements. However, it also calls for a more cautious approach, as the unpredictable swings can just as easily result in losses.

For traders looking to engage the market during peak volatility, Mondays may provide the action they seek. Yet, the savvy trader will balance the allure of these movements with a well-considered strategy, perhaps focusing on times when the market is not at its peak volatility, such as mid-week, to execute longer-term trades.

Ultimately, a trader's best time to trade is as much about their individual trading style and risk appetite as it is about market statistics.

Best cryptocurrency exchanges

Tips for Choosing the Best Time to Day Trade Crypto in the US

Timing the crypto market can seem like a herculean task, yet with strategic planning, it becomes manageable. Here are some tips to guide you:

-

Monitor Global News: Cryptocurrency is sensitive to global events. Regulatory announcements or significant technological advancements can cause prices to soar or plummet. Keep an eye on international news to predict potential market movements.

-

Understand Market Cycles: Like any market, crypto moves in cycles. Recognize patterns associated with bullish or bearish trends and align your trading to the phase the market is currently in.

-

Leverage Technical Analysis: Use charts and indicators to identify the best entry and exit points. Look for high liquidity times, usually when the US market overlaps with another, like during the late morning to the afternoon EST.

-

Stay Updated with Crypto Communities: Engage with online forums and social media groups. They can be a source of sentiment analysis and can help you gauge the mood of the market.

-

Set Up a Trading Schedule: Consistency is key. Set a schedule that aligns with high volatility periods but also fits your lifestyle and risk tolerance.

To start trading in the US, follow these steps:

-

Research: Educate yourself on the different cryptocurrencies and trading platforms.

-

Choose a Reliable Exchange: Select a platform that is user-friendly, has low fees and has robust security measures.

-

Create and Verify Your Account: Complete the necessary KYC (Know Your Customer) procedures.

-

Deposit Funds: Fund your account using the payment methods available on your chosen exchange.

-

Develop a Strategy: Decide on a trading strategy based on your analysis and risk assessment.

Remember, crypto trading in the US or anywhere else comes with significant risk. Education, disciplined risk management, and a clear strategy are your best tools for navigating the crypto markets.

Rules and Regulation

Crypto regulations in the U.S.

Cryptocurrency trading in the United States is regulated by various federal agencies, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Additionally, certain states may have their own regulatory frameworks governing cryptocurrency activities, adding an extra layer of oversight to ensure compliance with applicable laws.

Crypto investor protection in the U.S.

Regulations enforced by the SEC and CFTC aim to protect investors participating in cryptocurrency trading activities. These regulations focus on enhancing market transparency, preventing fraudulent activities, and ensuring fair trading practices. Moreover, investor education initiatives and disclosure requirements contribute to empowering investors and mitigating risks associated with cryptocurrency investments.

Crypto tax in the U.S.

Profits generated from cryptocurrency trading are subject to taxation in the United States. The Internal Revenue Service (IRS) treats cryptocurrencies as property for tax purposes, meaning that capital gains received from cryptocurrency transactions are taxable. Tax rates on capital gains vary depending on several factors, including the individual's income level and the duration of holding the assets. Additionally, tax reporting requirements ensure compliance with tax laws and facilitate accurate tax calculations for cryptocurrency traders.

Summary

The zenith of crypto trading activity in the U.S. aligns with the American workday, typically between 2 PM and 4 PM EST. This synchronization with major U.S. financial markets amplifies volatility, offering astute investors the chance to capitalize on significant price movements.

However, with the potential for profit comes the heightened risk of loss, especially in such a speculative and unpredictable market. Traders must approach these peak hours with a robust strategy and a keen awareness of the risks involved, balancing the prospects of reward against the possibility of abrupt market turns that could impact their investment.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.