What Time Of Day Is Best To Trade Crypto?

Crypto trading activity tends to coincide during US stock market hours, i.e. between 9:30am and 4:00pm (Eastern Time). For Ethereum specifically, it generally peaks between 1pm and 6pm GMT.

In a world where cryptocurrency trading never sleeps, pinpointing the ideal moment to dive into the digital currency market can be as elusive as a mirage.

Unlike traditional markets, crypto markets operate 24/7 across various time zones. Identifying the peak trading hours is key to capitalizing on market movements.

Whether you're a seasoned trader or a newcomer, understanding the interplay of time and market volatility is crucial for your trading strategy.

This article aims to unravel the mystery of the best trading times, translating complex market rhythms into actionable insights.

What time is crypto traded the most?

In cryptocurrency markets, volatility is not just a buzzword, but a real tangible phenomenon that shapes the trading landscape. Volatility in crypto markets often translates to opportunities for astute traders.

However, it's a double-edged sword. The same fluctuations that can yield significant gains can also lead to substantial losses. Hence, understanding when crypto markets are most active is vital in formulating a strategy that leverages volatility to your advantage.

Best time of the day to trade crypto

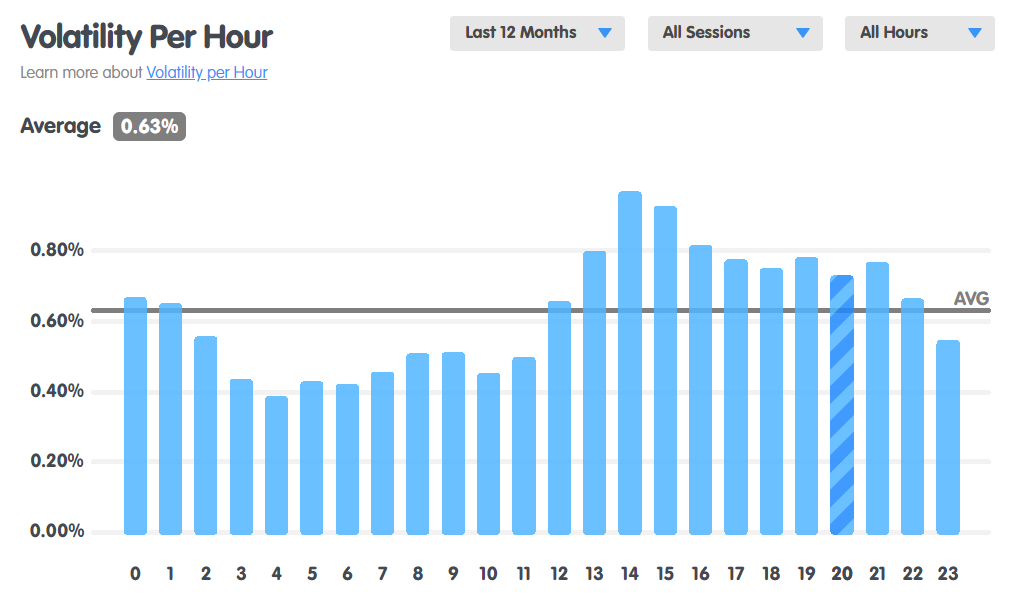

There are times of day with more or less trading activity, so more or less liquidity. After analyzing the data, it's evident that the average volatility per hour shows significant variances throughout the day.

How cryptocurrency volatility changes intraday, UTC

How cryptocurrency volatility changes intraday, UTC

The provided chart indicates that the highest average volatility occurs around 2 pm in UTC. This corresponds to the early trading hours in the United States, particularly the opening hours of the East Coast markets.

Notably, this time frame is not just a hive of activity for crypto traders, but also coincides with significant financial movements in the traditional stock market, which can have correlating effects on the cryptocurrency market due to the interrelated nature of global financial systems.

The lower end of volatility tends to present itself during the late night to early morning hours in UTC, which translates to late night in North America and the early hours of the Asian markets. This could be a strategic window for those looking to place trades with less noise and potential for slippage (and lower gas fees), though one must always be wary of the trade-off between lower volatility and liquidity.

It's also worth noting that the period of heightened volatility is not a standalone beacon for all traders. While it can represent a period of opportunity for those looking to capitalize on large price movements, it can also signal a time of increased risk.

Traders must align their strategies with their risk tolerance, trading style, and the specific cryptocurrency they are trading. As the adage goes, "with great volatility comes great responsibility."

Best time of the week to trade crypto

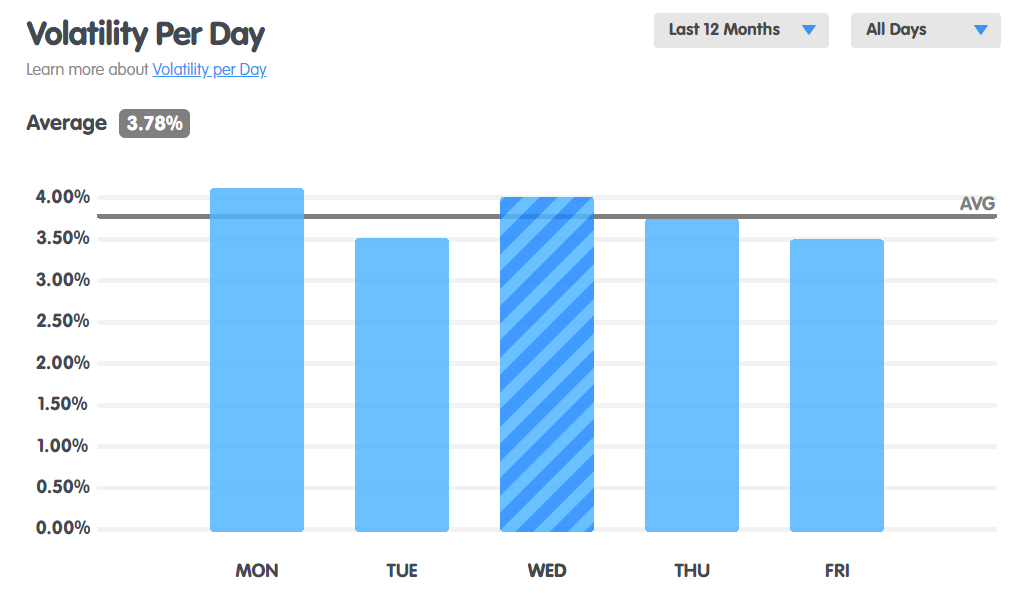

The weekly cycle of crypto markets tells a different story than most traditional assets. Typically, many financial markets experience a case of the “Mondays”, where the opening of the week can be slow or cautious as traders set their bearings. In the crypto market, however, Monday is not a day to ease into action but to embrace it.

How cryptocurrency volatility changes within a week

How cryptocurrency volatility changes within a week

The data tells us that Monday stands out with a higher volatility average than the rest of the week. The chart suggests that the average volatility on Mondays is a notch above the weekly average. This could be attributed to several factors, including the accumulation of news and developments over the weekend, which the non-stop crypto market reacts to once the traditional business week begins.

Wednesday also shows a slight uptick, perhaps reflecting mid-week adjustments as global markets digest the week's developments.

Friday's figures retreat ever so slightly, but do not dip significantly, suggesting that the cryptocurrency market's appetite for trading is somewhat different from the volatility that characterizes stock indices or the forex market.

The takeaway for traders is clear: while Monday may offer the waves, any day could be your day to surf. The crypto market’s unique rhythm means that any day of the week could turn into the best time to trade, depending on how news, global events, and market sentiment converge.

Best cryptocurrency exchanges

Tips for choosing the best time to trade crypto

Navigating the crypto market demands more than a keen eye for charts. It requires a strategy that aligns with the ever-changing digital tides. Here are some essential tips to help you choose the best time to trade crypto:

-

Understand market volatility. Volatility is a trader's heartbeat. Monitor it closely. High volatility periods can yield significant returns but come with increased risk. Conversely, low volatility might offer safer trade entry points but with less potential upside. Chart analysis and volatility indicators can be valuable tools in predicting these prime trading windows.

-

Stay on top of economic news and events. Economic announcements, policy changes, and international events can cause ripples or tidal waves in crypto prices. Timing your trade around these events could be advantageous, but always prepare for surprises. An economic calendar is a trader's best friend.

-

Consider gas fees. Gas fees are an inherent part of crypto trading you need to be aware of. Transaction costs on networks like Ethereum can vary significantly throughout the day. Plan your trades when gas fees are traditionally lower to maximize your cost-efficiency.

-

Align with your trading style and goals. Self-awareness is key. Are you a day trader thriving on the adrenaline of intraday volatility, or a swing trader looking for longer-term trends? Match your trade timing to your personal trading style and objectives.

-

Time the market with technical analysis. Chart the course. Utilize technical analysis to identify patterns and trends that suggest optimal trade times. Look for convergences of trading signals and market sentiment to time your entry and exits with precision.

-

Observe and adapt. The market is your greatest teacher. Observe how the market behaves at different times and adapt your strategy accordingly. The best time for others may not be the best for you.

-

Risk management. No matter how well-timed your trades are, without managing risk, you're sailing in treacherous waters. Set stop-loss orders, only invest what you can afford to lose, and never let emotions dictate your trades.

Considering these factors and tips will let you refine your strategy to choose the best times to trade crypto, turning knowledge into power, and power into profits.

Summary

The peak of crypto trading aligns with the American workday, presenting a prime window for investors to capitalize on volatility. However, this window also brings heightened risks. Wise traders must balance the allure of active hours with prudent risk management to navigate these opportunities successfully.

FAQs

What time frame is best for trading crypto?

The best time frame for trading crypto varies by individual strategy, but periods of high volatility, such as during the American workday, are often preferred for their potential opportunities.

Should I trade crypto on weekends?

Trading crypto on weekends is possible since the market operates 24/7, but be aware of unpredictable volatility due to lower trading volumes.

Which crypto is most volatile?

Generally speaking, the larger the market cap a crypto has, the less volatile it is. Following this logic, Bitcoin is usually less volatile than most altcoins (excluding stable coins).

Is crypto trading profitable?

Crypto trading can be profitable, but it requires knowledge, a well-thought-out strategy, and an acceptance of the high risks involved.

Related Articles

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Forex indicators are tools used by traders to analyze market data, often based on technical and/or fundamental factors, to make informed trading decisions.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.