What Is The Best Month To Buy Crypto?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Based on historical data, Bitcoin has a monthly return of +14.15%. However, the monthly returns are not evenly distributed throughout the year. The most favorable time to invest in Bitcoin can be considered:

- early October, as in September the Bitcoin price decreases by 4.41% on average

- early April, as in April the Bitcoin price rises by 33.79% on average

For a cryptocurrency investor, understanding the cyclicality of Bitcoin's value can be key to optimizing one's portfolio. This article isn't just a dive into Bitcoin's historical performance. It's a map that tells you which months might be the best months to invest in Bitcoin.

Here, we unravel the patterns hidden in the numbers, offering you a lens to spot the ideal month to purchase Bitcoin. The information provided could be the compass that leads you to make informed decisions in the erratic tides of crypto trading.

Which month is the Bitcoin rate low?

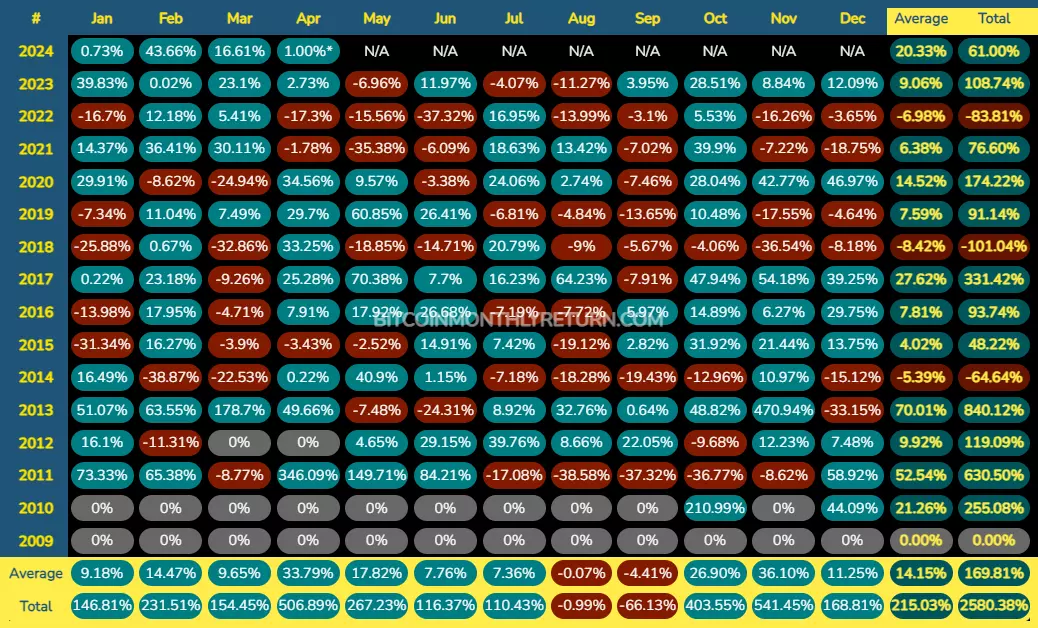

Scouring the historical data available from BitcoinMonthlyReturn.com, we look for patterns that reveal the opportune moments to buy Bitcoin.

Bitcoin Historical Return

Bitcoin Historical ReturnHistorical trends are not prophecies, yet they are the whispers of the market's past, offering insights into its potential future. Analysis of this colorful tapestry of numbers indicates a recurring theme: September shows a consistent trend of being a valley amidst the peaks of Bitcoin's price graph.

With an average return dipping into the negatives more often than not, it seems September may hold the key to the lowest rates, suggesting a potential time frame to invest. This trend beckons the question, should one consider September as the time to bolster their Bitcoin portfolio?

The data suggests, quite compellingly, that investing at the very end of September could be a wise move for the savvy investor, especially considering that 10 out of the last 14 Octobers, and 5 out of the last 5 have historically proven bullish.

Is September a bad month for Bitcoin?

Labeling September as a "bad" month for Bitcoin might not capture the nuanced reality of the market. However, the numbers do lean towards a trend of subpar performance during this period. Historically, September has been the month where Bitcoin investors brace for a downturn.

This phenomenon could be attributed to a variety of factors:

Traditional financial markets often experience a slump in September, a pattern that could be spilling over into the crypto arena

September marks the end of the third quarter, a time when businesses finalize their accounts, which may lead to less speculative investment and a more risk-averse climate

It's also a period of renewed regulatory discussions, with financial authorities frequently revisiting policies as the fiscal year edges towards its close

These elements, among others, can contribute to the lackluster performance of Bitcoin during this month, creating what some may argue is an opportune buying window for long-term investors.

What are the best months for Bitcoin?

Turning our gaze from the lows to the highs, we identify the zeniths in Bitcoin's seasonal journey. According to the same historical data, the final quarter of the year - October, November, and December - often bask in green with consistently high returns.

These months stand out with a hefty average uptick, suggesting a robust bullish sentiment. The surge could be influenced by various factors:

Increased retail activity due to holiday sales, which leads to greater liquidity and potentially higher investment in cryptocurrencies

As investors look to solidify their portfolios before the year's end, there's a noticeable shift towards assets with high growth potential like Bitcoin

The beginning of the year, January, also shows promise, possibly fueled by the injection of fresh investment as individuals set financial goals and diversify their holdings with new vigor

These patterns indicate that while September might present a buying opportunity, the end-of-year months are historically where Bitcoin has shone the brightest.

What was the worst year for Bitcoin?

2014 is being called one of the worst years for the bitcoin price. During 2014, the price fell by 64%.

2014 is often referred to as the worst year in Bitcoin's history

2014 is often referred to as the worst year in Bitcoin's historyAfter reaching a peak around $1,000 in 2013, Bitcoin faced a catastrophic drop, attributed to several high-impact events. It was challenging months for the Bitcoin market for several reasons:

Losses at Mt. Gox, one of the largest Bitcoin exchanges at the time, declared bankruptcy in February 2014 after losing about 850,000 Bitcoins, which was about 7% of all Bitcoins in circulation at the time. This caused panic among investors and significantly undermined confidence in the cryptocurrency.

Regulatory risks. In 2014, many nations began to consider regulating cryptocurrencies, which created uncertainty about the future of bitcoin. In particular, China imposed restrictions on the use of bitcoin, which led to a decline in its price.

Overall market downturn. Bitcoin wasn't the only asset that struggled in 2014. The cryptocurrency market as a whole suffered a general downturn caused by various factors, including security issues and negative news.

This combination of security breaches and regulatory crackdowns created a perfect storm that saw Bitcoin's value slashed dramatically, leaving many to question its viability. 2014 stands as a testament to the currency's resilience, surviving what was indeed a tumultuous period in its journey.

Best crypto exchanges to buy BTC

What will Bitcoin be worth in 10 years?

Forecasting the value of anything 10 years from now is an exercise devoid of guarantees, especially when it’s something as volatile as Bitcoin. It's an exercise in probabilities rather than certainties.

Bitcoin has carved out a reputation for being notoriously difficult to predict, with factors both internal and external influencing its price trajectory. However, one can venture to make an educated guess based on historical trends, technological advancements, and the evolving regulatory landscape.

In the past, Bitcoin has demonstrated a strong upward trend over the long term, punctuated by periodic corrections. Should this trend continue, propelled by increasing adoption and recognition as a “digital gold,” it is not unreasonable to posit that Bitcoin could significantly appreciate over the next ten years.

This optimistic outlook is bolstered by the cryptocurrency's capped supply of 21 million coins, which may induce scarcity as the remaining Bitcoins are mined, potentially driving up value.

Bitcoin's price

Bitcoin's priceOn the technological front, advancements in blockchain technology, improved security measures, and greater integration with financial systems could further cement Bitcoin's position as a mainstream financial asset. Conversely, the digital currency could face hurdles from stringent regulations, competition from other cryptocurrencies, or a shift in investor sentiment.

Given these considerations, while it is impossible to put a definitive number on Bitcoin's future value, it is clear that Bitcoin is poised to remain a key player in the financial landscape. If current patterns hold, the next decade could see Bitcoin grow in value, albeit with the volatility that has become its hallmark.

To see detailed reviews, analyses and predictions for Bitcoins future price movements along with specific timeframes and price points, read our article Bitcoin Price Prediction 2024, 2025, 2030 - Will BTC Go Up?.

Conclusion

Bitcoin's journey through the years has been emblematic of the larger cryptocurrency narrative - volatile, unpredictable, yet undeniably fascinating. Our exploration of its historical price patterns offers a semblance of understanding, suggesting strategic entry points for potential investors.

While September historically marks a dip, inviting purchases, the year's end promises lucrative highs.

Looking ahead, we tread with cautious optimism, aware that the next decade could either elevate Bitcoin to unprecedented heights or test its resilience in the face of emerging challenges. In the realm of Bitcoin, the only certainty is change, and the only constant, a spirited debate on its future worth.

FAQs

When to buy Bitcoin?

The optimal time to buy Bitcoin appears to be during periods of low prices which historically, often occurs in September, aligning with the traditional financial market's patterns and end-of-quarter financial activities.

Should I buy Bitcoin when it's low or high?

It is of course better to buy Bitcoin when it's low to capitalize on potential price increases. However, timing the market is challenging, and a long-term investment strategy may be preferable for many investors. As the saying goes, time in the market beats timing the market.

What was the highest price of Bitcoin ever?

The highest price of Bitcoin (all-time-high) to date was just above $73000, which was reached on March 14, 2024.

Is Bitcoin still a good buy?

Bitcoin continues to be considered a good buy by many investors who believe in its long-term growth potential despite its volatility. However, consider your risk tolerance and investment horizon when making any investment decisions.

Related Articles

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Uptrend is a market condition in which prices are generally rising. Uptrends can be identified by using moving averages, trendlines, and support and resistance levels.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.