Steps to place binary options trade

To place a binary options trade, follow these steps:

-

1

Log in to your binary options trading account

-

2

Select the asset you want to trade

-

3

Choose the amount you want to invest and the expiry time

-

4

Decide if the price will go up or down

-

5

Click on the "Up" or "Down" button to execute the trade

-

6

Monitor the trade in real-time and exit when you want to

In the innovative and exciting world of binary options trading, traders are required to predict asset prices in a time-bound manner, place the trade, and wait for the outcome. In this article, the experts at TU will dive into why traders choose binary options, how to place a binary options trade, the available platforms, setting up and overseeing your trading accounts, and the various types of trades you can make. They will also discuss some popular strategies to help you make the most of this form of trading.

Start trading binary options right now with Pocket Option!What is a binary options trade?

Binary options are a type of financial derivative that enables you to forecast the future price fluctuations of an asset. In contrast to traditional financial tools, binary options offer a set payout and a defined time frame. Essentially, you make a call on whether the price will rise or fall within a designated period. If your prediction is correct, you earn profit and if not you lose your invested amount.

Why trade binary options?

| Reasons to trade | Explanation |

|---|---|

Lower entry costs |

Starting with binary options typically requires less capital, making it accessible to beginners as well as those with restricted capital |

|

Clarity of outcome |

Binary options allow you to calculate profits or losses before entering a trade, enabling you to make calculated decisions |

|

Potential for higher profits |

Short trading periods in binary options can lead to the opportunity for higher profits, if you employ the right skills and strategies |

|

Lower trading costs |

Trading binary options is cost-effective due to lower commissions and fees compared to some other markets |

|

Easy to start |

Binary options trading is relatively simple to get started with, especially for beginners, compared to other complex markets. The structure of this style of trading can easily be understood with some efforts |

|

User-friendly platforms |

Binary options trading platforms are designed for user-friendliness, making them suitable for new traders |

How to choose a binary options trading platform

According to experts, some key considerations for choosing a binary options trading platform include

Regulation and reputation

Before choosing a trading platform, it's crucial to ensure that it is regulated by a renowned financial authority. This provides a level of protection and transparency for traders. Additionally, it's equally important to assess the platform's reputation. Reading reviews and testimonials from other users can offer valuable insights into its reliability and track record.

Trading assets

When it comes to trading, diversification is a wise approach. Seek out a platform that offers a broad range of assets, including stocks, commodities, currencies (Forex), indices, and cryptocurrencies. This allows for a more diverse portfolio, offering better risk management for your investments. Before committing to a platform, make sure your desired assets are available for trading.

Trading platform features

The features and tools provided by various platforms can greatly impact your trading experience. Key elements to consider are:

-

Charting Tools – Adequate charting tools are a must-have for effective price analysis. Pick a platform that offers a variety of timeframes, technical indicators, and drawing tools to aid your analysis.

-

Technical Analysis – Ensure the platform supports technical analysis by offering a range of technical indicators and overlays. Specifically, consider the maximum indicator limit that can be employed at any given time.

-

Order Execution Speed – Swift and accurate order execution is vital in binary options trading. Delayed executions can affect your profitability, so choose a platform known for its reliability.

-

User-friendly interface – An easy-to-navigate platform is a boon, especially if you're new to trading. It simplifies placing trades, managing your account, and using trading tools. Use trading platform demos to judge this criterion.

How to open a binary options trading account

Opening a binary options trading account requires careful consideration of these factors

Choosing a binary options trading broker

Take your time to carefully select a broker with a trustworthy reputation. Consider the assets and features that are important to you and make sure the broker offers them. Don't forget to thoroughly assess the fees, spreads, and commissions to avoid any unexpected costs that could potentially eat into your profits. Keep in mind that the broker's policies regarding clients in your country may affect your trading opportunities. Additionally, it's crucial to thoroughly research the broker's standing in the trading community and assess their level of customer service by reading reviews and gathering feedback from other traders. To help you get started, we've compiled a table of some of the most established and highly recommended brokers in the industry.

| Broker | Payout | Minimum Deposit | Free Demo | Bonus Offered | Regulatory Bodies |

|---|---|---|---|---|---|

|

98% |

$10 |

Yes |

50% bonus |

FMRRC |

|

|

92% |

$50 |

Yes |

50% bonus |

FMRRC |

|

|

95% |

$10 |

Yes |

200% bonus |

Alberta Securities Commission |

|

|

91% |

$10 |

Yes |

N/A |

CySEC, FSA |

|

|

95% |

$250 |

Yes |

200% bonus |

FMRRC |

|

|

90% |

$10 |

Yes |

200% bonus |

VFSC |

|

|

90% |

$10 |

Yes |

N/A |

FMRRC |

|

|

90% |

$5 |

Yes |

N/A |

MFSA, Isle of Man |

|

|

90% |

$10 |

Yes |

N/A |

IFC |

|

|

90% |

$10 |

Yes |

N/A |

FMRRC, VFSC |

|

|

100% |

$10 |

Yes |

N/A |

Alberta Securities Commission |

Opening a demo account

Before entering into binary trading with real money, it is advisable to trade in a demo account to gain confidence. Steps to open a demo account are

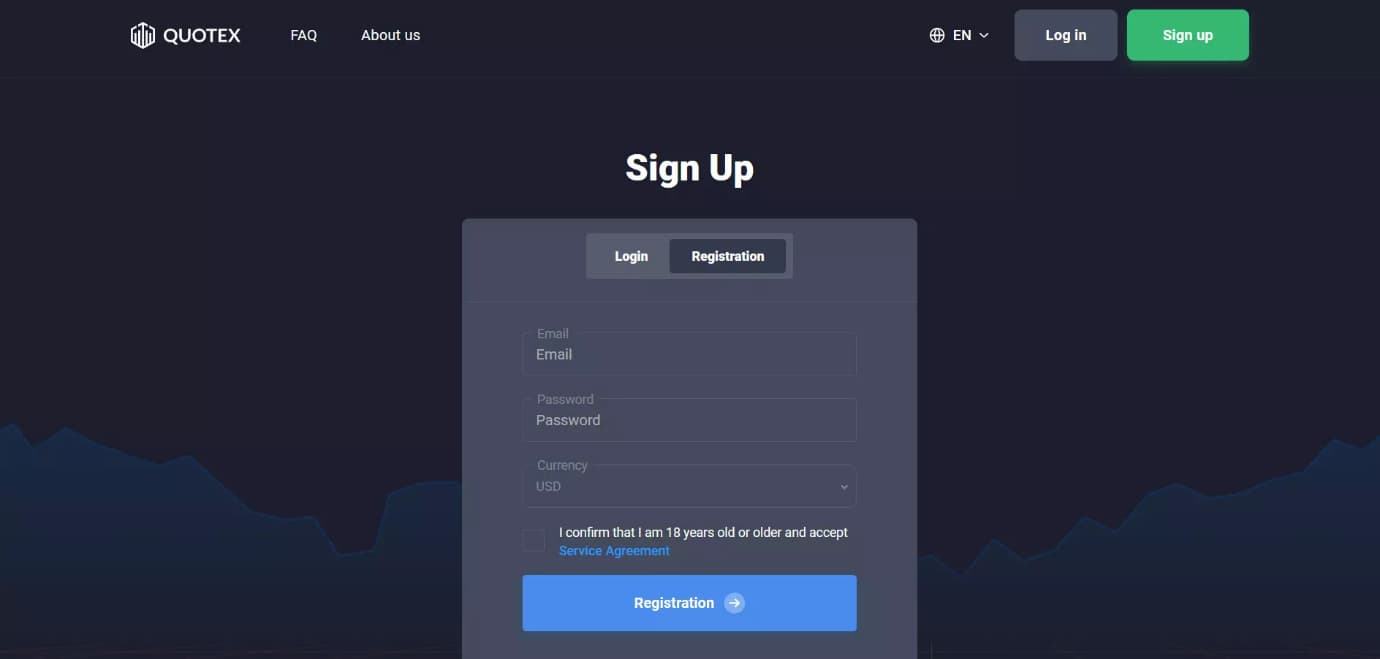

Registration

As the first step, head to the broker's website and locate the "register" button. Here, you'll be prompted to create a demo account. This process involves providing some essential details such as your name, email address, and preferred trading currency.

Verification

As part of ensuring a secure and compliant trading environment, you may be required to verify your identity after completing the registration. The verification process may differ, but it typically involves either submitting identification documents or having a video call with the broker's team. This step is crucial for your safety and adhering to regulatory standards.

Practice trading

Now that you've confirmed and set up your demo account, begin your trial of the broker’s platform and work towards finetuning your skills. Take your time to get cozy with its layout, features, and trade execution methods. Also, capitalize on the fact that you won't be using actual money in this simulation.

Learning

Treat the demo account as your personal learning laboratory. Experiment with a variety of binary options, ranging from Call/Put to one-touch, and even boundary options. It can be the perfect opportunity to gain a full understanding of how these options operate without putting your funds at risk. Master the art of reading charts, following trends, and identifying potential entry and exit points. The knowledge acquired here will reap rewards once you transition to a live account.

Opening a live account

After gaining confidence in trading with a demo account, you may enter the live market and trade with real money. Steps to open a live account are

Account setup

To set up your account, head to your preferred broker's website and select the option to open a live account. At this stage, you will be prompted to provide personal details such as your name, address, email, and desired currency. Just like with your demo account, you will need to verify your identity.

Verification

Similar to what you did with your demo account, you'll need to verify your identity. This is a necessary step to meet regulatory requirements and ensure the security of your account.

Fund your account

Now it's time to put some money into your live account. The minimum deposit amount can vary depending on the broker you choose. You can use your preferred payment method to deposit funds. Most brokers offer various options, such as credit cards, bank transfers, or e-wallets.

Trading options

Once your account is funded, explore the different binary options trading choices available on the platform. Select the asset you want to trade and the specific trading option you prefer. Also, decide on the amount you want to invest.

Risk management

It's crucial to fully understand the risks associated with Binary Options trading. Have a solid risk management strategy in place before you start. Be prepared for potential losses, and avoid overextending your trading capital. It's always a good idea to trade responsibly and not invest more than you can afford to lose.

How to place a binary options trade

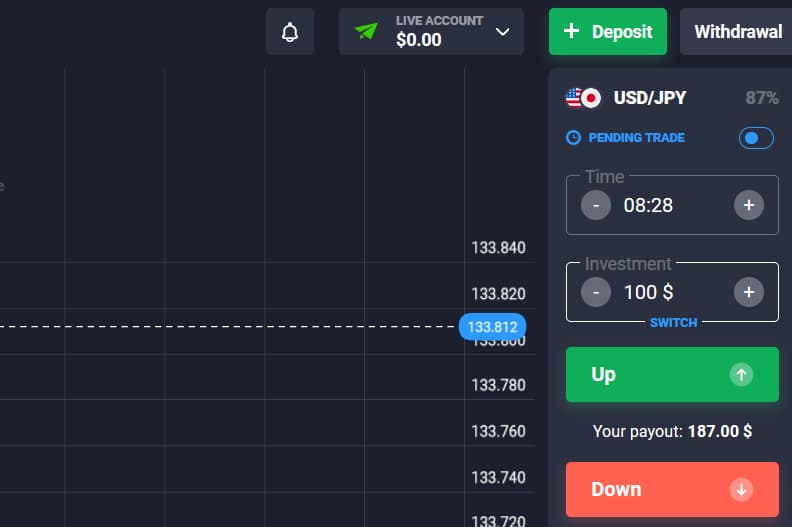

Experts have taken the example of QUOTEX to help you understand how to place a binary options trade. Here’s the step-by-step guide

Log in to your QUOTEX account

You must first log in to your trading account. If you do not have an account yet, you will need to register and complete the sign-up process.

Select the asset you want to trade

Once you are logged in, you may have access to a wide range of assets available for trading, including stocks, currencies, cryptocurrencies, indices, and commodities. Simply select the specific asset you are interested in, such as EUR/USD (Euro/US Dollar). Next, choose the amount you wish to invest and the expiry time for your trade.

Choose the amount you want to trade with and the expiry time

After you select your asset, you will need to specify the amount of capital you want to invest in the trade. This is the amount of money you're willing to risk for this particular trade. Also, you'll have to choose the expiration time for your trade. The expiration time is when the trade will close and its outcome will be determined. You can often customize the expiration time, allowing you to have more control over your trades.

Decide if the price will go up or down

This step is crucial. You'll need to make a prediction about the direction of the asset's price movement. This decision involves application of technical, fundamental, or economic analysis skills.

Click on the "Up" or "Down" button to execute the trade

Once you've made your prediction and are ready to proceed, click on the appropriate button to execute the trade. You have two options

-

"Up" – You believe the price of the selected asset will increase by the chosen expiration time.

-

"Down" – You anticipate the price of the asset will decrease by the expiration time.

Monitor the trade in real-time and exit when you want to

After executing the trade, you can monitor its progress in real-time on the QUOTEX platform. The asset's price will fluctuate, and you can choose to exit the trade whenever you deem it appropriate. You can exit the trade if you've achieved your desired profit or to limit your losses. In QUOTEX, this can be done by clicking on the “Sell” button. The button also indicates the amount you are likely to recover in case you wish to close the trade early. Keep a close eye on the trade and make decisions based on your trading strategy.

Types of binary options trades

| Type | Explanation |

|---|---|

High/Low |

Predict if the asset's price will go up or down by a specified time. |

|

One Touch/No Touch |

One touch trades are predictions on the price touching a specific level; No touch trades are predictions on it not touching that level. |

|

Boundary/Range |

Prediction on the price staying within a defined range with upper and lower limits until expiration. |

|

Short Term/60 Seconds |

Quick trades lasting 60 seconds; predict if the price will go up or down in that brief period. |

|

Long-term |

Longer trades spanning days, weeks, or months; predict if the price will be higher or lower later. |

|

Ladder |

Complex trades with multiple price levels and expiration times; predict if the price will touch these levels at specific times. |

|

Pairs |

Predict which of two assets will perform better relative to the other over a specified time. |

Popular binary options trading strategies

Experts have covered the essential binary options trading strategies in this simplified table, each tailored to help traders make informed choices. These strategies cover a range of methods, from tracking price trends to reacting to news events, empowering traders to navigate the world of binary options trading.

| Strategy | Description |

|---|---|

Support and Resistance Strategy |

Focuses on price levels, such as "support" and "resistance," to determine trade entry points. |

|

Price Action with Candlesticks Strategy |

Uses candlestick charts to analyze price movements. Higher highs with higher lows indicate upward trends, while lower highs with lower lows indicate downward trends. |

|

RSI and Bollinger Bands Strategy |

Combines Relative Strength Index (RSI) and Bollinger Bands to identify overbought or oversold conditions and assess market volatility. |

|

News Trading Strategy |

Relies on news events, both scheduled and unplanned, to predict price changes and adapt to market conditions. Flash news plug-ins are often used by traders employing this strategy. |

|

Candlestick Patterns Strategy |

Studies specific candlestick shapes (e.g., Doji) to predict market trends and determine optimal trade entry and exit points. |

|

Trend Following Strategy |

Analyzes price trends to identify uptrends or downtrends, making predictions and managing trades accordingly. |

|

Early Closure Strategy |

Allows traders to exit a trade before its predefined expiry time, offering flexibility to manage trades in response to changing market conditions. |

Summary

Binary options trading is a financial derivative that allows traders to predict whether the price of an asset will rise or fall within a specified timeframe. It offers several advantages, such as lower entry costs, known profit and loss calculations, and potential for higher profits. For traders, it is crucial to choose a reputable trading platform, taking into consideration factors like regulation, available assets, and platform features that can impact the success of your trades. To get started, traders can open a demo account to practice without risking any real money. Once comfortable, they can then move on to a live account where they fund the account, select an asset, determine the investment amount, predict the direction of the asset's price (whether it will go up or down), and execute the trade. In most binary options trading platforms, a trade can be placed by simple clicking the button denoting the trader’s expectation of price movement, i.e. “Up” or “Down”.

FAQs

How do I start trading binary options?

To start trading binary options, educate yourself about this branch of financial markets, formulate your trading strategy, choose a good broker, create an account, and begin trading. As a good practice, always test the waters using demo trading accounts.

Can anyone trade binary options?

Yes, keeping age and regulatory/legal restrictions aside, anyone can trade binary options.

Is binary trading real or fake?

Binary trading is real. However, traders must ensure that the platform they choose is well-regulated and trustable. They must also stay aware of frauds happening in this space.

Is Binary trading easy?

Yes, compared to other trading methods, binary trading is relatively easier to understand and execute. This is why many beginners prefer entering this branch of financial markets.

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

3

Binary options trading

Binary options trading is a financial trading method where traders speculate on the price movement of various assets, such as stocks, currencies, or commodities, by predicting whether the price will rise or fall within a specified time frame, often as short as a few minutes. Unlike traditional trading, binary options have only two possible outcomes: a fixed payout if the trader's prediction is correct or a loss of the invested amount if the prediction is wrong.

-

4

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

5

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).