What Lower Highs And Higher Lows Mean In Binary Options Trading?

Higher lows and lower highs in binary options trading mean that the market is likely entering a state of supply and demand imbalance . In other words - flat, consolidation, sideways trend. In this case, consider the use of reversal trading strategies.

For example:

-

selling from the overbought zone on the RSI oscillator;

-

buying under the lower Bollinger band.

Lower highs and higher lows serve as indicators of balanced supply and demand, characteristic of a flat market, necessitating the application of strategies tailored for trading in sideways markets.

These patterns suggest a temporary balance in the forces driving prices, creating an opportunity to implement strategies tailored for navigating sideways markets.

Start trading binary options right now with Pocket Option!-

What are the different types of trends?

Bullish (Up), Bearish (Down), Sideways (Flat, Range)

Why lower highs and higher lows formed?

Lower highs occur when demand becomes exhausted, signalling a diminishing interest from buyers in pushing prices higher.

Higher lows emerge as a result of exhausted supply, reflecting a reluctance among sellers to drive prices lower. These patterns indicate a delicate balance between buyers and sellers in the market.

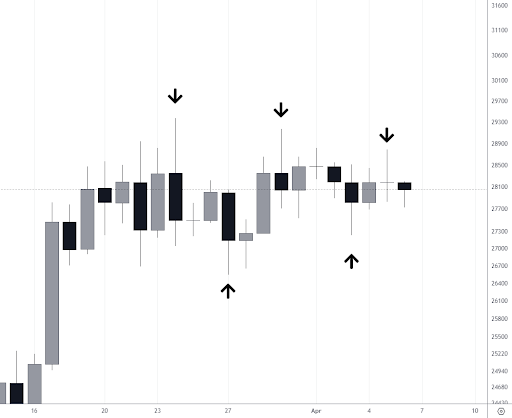

Example. Lower highs and higher lows

The visual representation illustrates the formation of lower highs and higher lows, depicting a graph where peaks (lower highs) and troughs (higher lows) align, highlighting the equilibrium between buying and selling pressures. This consolidation follows a period of rising prices, underlining the transition to a more balanced and sideways market.

For a deeper understanding of ranging markets, explore the guide on what constitutes a ranging market, providing valuable insights into the characteristics and implications of this market phase.

How do you trade when the market is sideways?

In a sideways market, employing strategic approaches is important for successful trading. An example strategy is to sell a binary option when the price exceeds the upper Bollinger Band, indicating a potential reversal.

Other Technical Indicators to Use

-

Averages - Utilize various averages like simple moving averages (SMA) or exponential moving averages (EMA) to identify trends and potential entry/exit points during sideways movements.

-

ADX (Average Directional Index) - ADX helps assess the strength of a trend. In a sideways market, a low ADX reading suggests a lack of a strong trend, signaling potential opportunities for range-bound trading.

-

Keltner Channel - This indicator consists of an upper and lower band based on an average true range. Traders can use it to identify overbought or oversold conditions in a sideways market, offering potential entry or exit points.

Best binary options brokers

The benefits of flat range trading

-

Reduced Risk - Sideways markets exhibit lower volatility compared to trending markets, providing traders with a more stable environment that can help mitigate overall risk exposure.

-

Potential for Profits - Traders can leverage short-term price fluctuations within a sideways market, executing strategic trades to capitalize on price oscillations and generate profits through nimble trading.

-

Diversification - Incorporating flat range trading into a portfolio allows for diversification of trading strategies. In trending and sideways markets, traders enhance their adaptability in different market conditions, contributing to a diversified approach.

The risks of flat range trading

-

Missed Opportunities - Traders face the risk of forgoing significant profits if they fail to identify and capitalize on breakouts from a sideways market, emphasizing the importance of staying vigilant and responsive to market shifts.

-

False Breakouts - Sideways markets are susceptible to false breakouts, where prices momentarily move beyond the established range before swiftly reversing back into it. Traders must exercise caution and employ risk management strategies to avoid losses associated with deceptive market movements.

Some tips for flat range trading

-

Avoid News - Minimize exposure to market noise and unpredictable fluctuations by steering clear of news events, allowing for a more focused and strategic approach to flat range trading.

-

Set Tight Stop-Loss Orders - Mitigate risk effectively by establishing tight stop-loss orders. This disciplined risk management approach helps protect capital and ensures quick reactions to unexpected market movements.

-

Be Patient - Successful flat range trading requires patience. Wait for optimal entry and exit points, and avoid impulsive decisions. Patience is a key virtue in navigating the nuances of sideways markets.

Summary

Lower highs reveal exhausted demand, reflecting diminished buyer interest, while higher lows result from exhausted supply, indicating seller reluctance. This delicate equilibrium prompts the implementation of sideways market strategies. However, caution is needed for missed opportunities and false breakouts.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

-

4

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

-

5

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).