Trading Trend Reversal Patterns in Binary Options

Reversal patterns provide signals of a potential change in trend direction. These patterns observed on price charts offer traders valuable information about potential entry or exit points. Among the reversal patterns are differentiated:

-

Chart patterns: head and shoulders, double bottoms.

-

Indicator patterns: Divergences.

In binary options trading, where prices can change quickly and unpredictably, spotting potential turning points is essential for success. Here's where reversal patterns emerge as invaluable tools, aiding traders in anticipating and potentially profiting from market shifts.

These reversal patterns are crucial because they provide valuable insights and improve trading opportunities. They act as essential guides for binary options traders, helping them understand and navigate the unpredictable market, aiming for consistent success.

Start trading binary options right now with Pocket Option!-

What is the best trend reversal pattern?

While singling out the "best" trend reversal pattern is subjective and contingent on market conditions and trading styles, some notable patterns include:

Head and Shoulders: A robust reversal pattern, especially potent with high-volume breakdowns.

Double Top/Bottom: Involves two consecutive peaks or troughs, demanding confirmation through volume and breakouts.

Inverse Head and Shoulders: Signals a potential shift from bearish to bullish, featuring a head lower than the shoulders and an upward-sloping neckline.

Engulfing Patterns: Larger candles engulfing the previous one signify a momentum shift.

Doji Candles: Small or non-existent bodies indicate indecision and potential reversal points.

What are the reversal patterns for binary options?

In binary options trading, reversal patterns are crucial in identifying potential shifts in market trends. These patterns indicate a change in the prevailing direction of an asset's price movement, providing traders with valuable insights for making informed decisions.

Before getting into specific reversal patterns, it's crucial to understand the concept of a trend in binary options trading.

A trend signifies the market's general direction — upward (bullish) or downward (bearish).

Reversal patterns are specific formations on price charts that indicate a potential shift in the current trend. These patterns can be grouped into chart patterns and candlestick patterns.

Chart patterns

-

Head and Shoulders (SHS)

-

Double Top/Bottom and Triple Top/Bottom

-

Wedges

Candlestick patterns

-

Engulfing

-

Doji

-

Shooting star

Indicator patterns

-

Divergences

Head and Shoulders

This classic pattern depicts a head (highest peak) flanked by two lower peaks (shoulders) with a neckline connecting the troughs. A confirmed SHS suggests a potential downtrend reversal.

Example

Consider a chart showing a high, higher, and lower high — a classic head and shoulders pattern.

Inverted head and shoulders – bullish

The chart above shows an inverted SHS – it helps to identify the end of a downtrend and the beginning of a period of rising prices.

How to trade

Traders often initiate a short position when the price breaks below the neckline, anticipating a downtrend.

Double Top/Bottom

Two consecutive peaks (tops) or troughs (bottoms) forming a distinct resistance or support zone, indicating a potential trend reversal. Double top signifies a trend reversal after an uptrend, while Double Bottom suggests a reversal after a downtrend.

Example

Observing a currency pair reaching a peak twice before a decline — a precise double-top scenario.

Double Top

The weekly chart above shows a double top in the bitcoin market (although the pattern can form even on minute charts). Moreover, the second top is above the first one, as if trapping buyers who think that the bullish trend will continue and the price will reach $100,000 per coin.

How to trade

Get confirmation (for example, by seeing expanding bearish candles and increasing volumes). Find an entry point for a short position on the lower timeframes - for example, when a support level is broken.

Similar to Double Top/Bottom, Triple Top/Bottom indicates trend reversal with three peaks or troughs. But with three peaks or troughs, this pattern offers a stronger confirmation of a potential trend reversal.

Rising/Falling Wedges

These formations are characterized by converging trendlines, narrowing down towards a point, suggesting a potential trend reversal upon breaking out of the wedge. Wedges signal a reversal, with Rising Wedges indicating a potential bearish reversal and Falling Wedges suggesting a bullish reversal.

Example

Spot security forming converging trendlines, indicating a potential trend reversal.

Rising Wedge

The chart above shows a wedge pattern in the EURUSD market. Even though the price consistently showed the formation of higher highs and lows (a sign of an uptrend), the situation quickly changed to bearish.

How to trade

Trade in the direction opposite to the wedge, anticipating a reversal. Look for confirmation (e.g. rising volumes and expanding bearish candles). Consider opening a short position - alternatively, on a breakdown of the pattern's lower boundary or other support levels. Opening a short position on short-term recoveries can also be justified and may suit more conservative traders.

Engulfing

A longer candle engulfs the previous candle's body, signifying a solid shift in momentum, potentially indicating a trend reversal. Engulfing patterns involve one candle fully covering the previous one.

Example

A bullish engulfing pattern occurs when an upward candle follows a downward one.

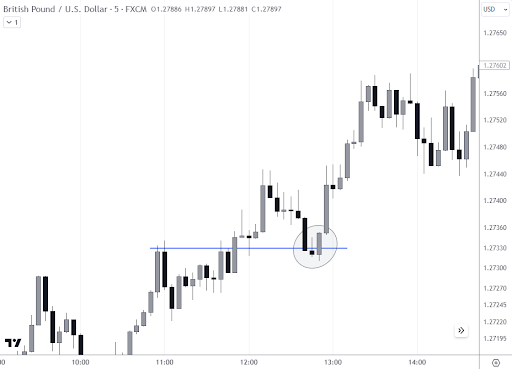

Bullish Engulfing

Binary options traders should favour the bullish engulfment pattern if there is a prevailing uptrend in the background. The chart above shows how the breakout level test occurred. A bullish engulfment in this case means the end of the test and reversal of the short-term decline to the upside.

How to trade

Traders may enter a long position after identifying a bullish engulfing pattern.

Doji & Shooting star

The chart below shows two candlestick patterns, a doji (1) and a shooting star (2):

-

A Doji is a candlestick with an open and close at the same or nearly the same price, suggesting indecision in the market. The Doji is often part of other candlestick reversal patterns consisting of 2-3 candles.

-

A Shooting Star is a single candlestick pattern with a small body and a long shadow, signaling a potential reversal.

Doji & Shooting star

Although each of these 2 patterns can be considered separately, together they tell the story of how, after a period of indecision, the bulls tried to continue the uptrend but failed.

This should warn the binary options trader of a likely trend reversal in a downward direction.

Divergences

In binary options trading, divergence occurs when the price of an asset moves in the opposite direction of a technical indicator, such as an oscillator. This can signal a potential trend reversal or continuation.

Example

In the illustrated example of positive divergence, a noteworthy observation emerges. Despite the price continuing its descent and forming a lower low, the Relative Strength Index (RSI) demonstrates a contrasting behavior, showing higher lows. This divergence signifies a potential weakening of the downward trend in EUR/USD, as the price's negative momentum loses strength while the RSI suggests a positive divergence in market dynamics.

A bullish divergence

How to trade

When engaging in divergence trading, it's crucial not to depend solely on divergence signals for trading decisions. Look for additional confirmation signals, such as:

-

Candlestick Patterns: Watch for bullish Hammer or Engulfing patterns occurring after the identified divergence. These patterns can strengthen the case for a potential reversal.

-

Support/Resistance Levels: Check if the price aligns with known support or resistance levels at the time of the identified divergence. Confluence with these levels can enhance the likelihood of a market bounce.

-

Entry Point: Consider initiating a long position once the confirmation signals have manifested. Determine an appropriate expiry time based on your risk tolerance and the prevailing market volatility.

-

Stop-Loss: If the trend persists in the opposite direction, strategically place a stop-loss order below the recent swing low to mitigate potential losses. This risk management measure helps safeguard your capital during adverse market movements.

Best binary options brokers

Is reversal trading profitable?

Whether reversal trading is profitable is a complex question with no simple answer. It depends on various factors like your trading skills, risk management, and the specific trading strategy you use.

The choice to trade breakouts or reversals also depends on personal preference. If by nature you are close to selling at the highs and buying at the lows, consider the pros and cons of trading reversals. This trading style may be more suitable for you.

| Pros | Cons |

|---|---|

Capitalize on both upward and downward price movements. |

Not all patterns are reliable, and some may lead to false signals. |

|

Identify support and resistance levels for better stop-loss placement. |

Binary options have limited expiry times, increasing pressure for accurate predictions. |

|

Effective risk management with clear reversal signals |

Facing losses and managing emotions during reversals can be challenging. |

If you are wondering if you can benefit from trading reversal patterns, try doing it on a demo account first. More details for beginners - in the article: How to Start Binary Options Trading in 7 Simple Steps.

Tips for trading reversal patterns

Trading reversal patterns require a strategic approach to maximize potential returns while managing risks effectively. Here are essential tips to enhance your understanding and improve your success rate in identifying and trading these patterns:

-

Look for Patterns at Support or Resistance Levels

Understanding the context in which reversal patterns form is crucial. Focus on identifying patterns that occur at significant support or resistance levels. These levels provide additional confirmation and increase the probability of a successful reversal. -

Use Multiple Indicators to Confirm the Pattern

Enhance your analysis by incorporating multiple indicators that complement your identified reversal pattern. Combining technical indicators such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence) can provide additional confirmation, strengthening your trading decision. -

Back-Test Your Reversal Strategy

Conduct thorough back-testing using historical data before implementing your reversal strategy in live markets. This process involves applying your strategy to past market conditions to assess its effectiveness. Back-testing helps identify strengths, weaknesses, and potential areas for improvement in your approach. -

Control Risks and Never Overcommit

Risk management is a cornerstone of successful trading. Set clear risk limits for each trade, and ensure you only invest what you can afford to lose. By defining and adhering to your risk tolerance, you protect your capital and maintain a disciplined approach to trading.

Summary

By incorporating reversal patterns into their strategies, traders gain a slight understanding that improves decision-making and risk management, contributing to potential success in binary options trading.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.