How To Swap Crypto For Another Crypto: A Simple Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to swap crypto for another crypto:

Crypto swaps are lightning-fast exchanges of one cryptocurrency for another without converting it into fiat. Such exchanges are instant and can be carried out on both centralized and decentralized platforms. The main reasons for performing a swap include diversification of an investment portfolio, protection from volatility through exchange for stablecoins, and the opportunity to participate in new blockchain projects that require certain tokens. Swaps play a key role in simplifying access to various cryptocurrencies, especially those with a low capitalization. This method of exchange is becoming increasingly popular among traders, as it allows for flexible response to market changes.

How to swap crypto for another crypto

Swapping one cryptocurrency for another is straightforward, and you can do it on various platforms or exchanges that support crypto-to-crypto trades. Here’s a simple guide:

Step 1: Choosing a platform

Determine which platform to use for the exchange:

Centralized exchanges (CEX), such as Binance and Coinbase, provide high liquidity and a user-friendly interface for beginners. However, they require verification and trust in a third party, since the assets are stored on the platform itself.

Decentralized exchanges (DEX), such as Uniswap and PancakeSwap, provide a higher level of control over funds, since you use your own wallets for transactions. However, there are risks of slippage due to low liquidity and higher fees for illiquid assets.

Aggregators (for example, Rubic) allow you to find the most favorable conditions by collecting liquidity from various DEX. They help reduce fees and ensure the best price by optimizing exchange routes.

Step 2: Connect a wallet

When using a DEX or aggregator, you need to connect your crypto wallet. These wallets allow you to connect to decentralized applications and make exchanges directly through the wallet interface.

MetaMask, for example, aggregates data from several DEXs, which helps find the best deals with minimal network fees.

Step 3: Select a cryptocurrency pair for swap

Select the cryptocurrency you want to swap and the asset you want to swap it for. For example, if you want to swap ETH for USDT, enter the amount and check the estimated price of the trade, including the fee.

Step 4: Confirm and complete the trade

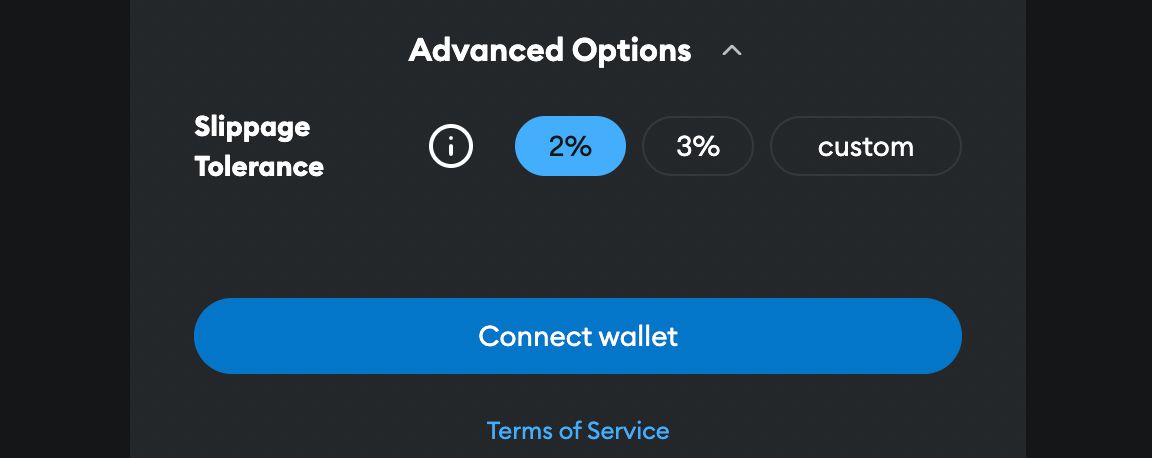

Check the terms of the swap, including the rate and possible slippage. Once the transaction is confirmed, the system automatically completes the trade and the new cryptocurrency arrives in your wallet.

Using platforms like MetaMask or Trust Wallet allows you to minimize the number of steps required and provides protection from sharp price fluctuations thanks to anti-slippage features.

Benefits of crypto swaps

Fees savings. Crypto swaps can significantly reduce costs compared to traditional exchanges, which often require conversion through fiat currencies. Using specialized platforms such as Changelly or SimpleSwap, users pay fees only once, as the exchange is carried out directly between cryptocurrencies, avoiding the additional costs of multiple transactions or using banking services. This is especially useful for frequent exchanges, as the costs of each transaction are minimized.

Transaction speed. Cryptocurrency exchange transactions are instantaneous, making them more convenient than traditional methods. The exchange process can be completed in a matter of minutes, and optimized transaction routes help minimize delays. The speed of trade execution allows for rapid response to market changes, allowing traders to take profits or change their strategy in time.

Protection from volatility. The cryptocurrency market is highly volatile, and using swaps to quickly switch to stablecoins protects assets from sharp price changes. This approach allows investors to preserve the value of their investments during periods of instability without leaving the crypto market, and quickly return to riskier assets if necessary.

Portfolio diversification. Swaps facilitate access to various digital assets, allowing for quick portfolio rebalancing and risk minimization. Investors can switch between DeFi tokens, NFTs, or stablecoins, adapting to changing market conditions. Platforms such as Rubic and Swapzone provide a wide range of cryptocurrencies to swap, making it easier to add new assets to a portfolio and improving risk management.

How to choose a crypto swap platform

Security. When choosing a crypto swap platform, consider security measures. For centralized exchanges (CEX) like Binance, look for security certificates and use of cold storage to protect assets. For decentralized exchanges (DEX) like Uniswap, check the smart contract audit results and the platform’s reputation. It is also important to implement measures like two-factor authentication to reduce the risk of losing assets due to hacking.

Liquidity. Token liquidity is the ability to quickly exchange an asset without significant price fluctuations. On DEX, trades are executed through liquidity pools, which can lead to slippage if the pool is underfunded. To avoid this problem, choose platforms with high liquidity or use aggregators that automatically find the best deals across multiple exchanges. This helps minimize price deviations and improve the terms of the swap.

Fees. Fees are unavoidable when exchanging cryptocurrencies. It’s important to consider not only the platform’s fixed fees, but also the network fees, which depend on the blockchain load. For example, Ethereum’s fees can be high when the network is heavily loaded. Research the platform’s fee structure — some exchanges offer discounts for users with high trading volumes or use tiered fee schemes that depend on account status or trading volume.

Regulation. Cryptocurrency regulations vary by country, so make sure the platform complies with local requirements before trading. For example, centralized exchanges often require KYC (identity verification) to comply with anti-money laundering (AML) laws. Check the legal status of the platform in your jurisdiction to avoid legal troubles and ensure the safety of your assets.

| Coins Supported | Demo | Min. Deposit, $ | Spot Taker fee, % | Spot Maker Fee, % | Open an account | |

|---|---|---|---|---|---|---|

| 329 | Yes | 10 | 0,1 | 0,08 | Open an account Your capital is at risk. |

|

| 278 | No | 10 | 0,4 | 0,25 | Open an account Your capital is at risk. |

|

| 250 | No | 1 | 0,5 | 0,25 | Open an account Your capital is at risk. |

|

| 72 | Yes | 1 | 0,2 | 0,1 | Open an account Your capital is at risk. |

|

| 1817 | No | No | 0 | 0 | Open an account Your capital is at risk. |

Keep an eye out for times when the market is buzzing with activity

When you’re looking to swap one cryptocurrency for another, keep an eye out for times when the market is buzzing with activity. Here's something you won’t hear often: instead of sticking to just one exchange, pull up trading volumes on both big-name platforms and smaller, decentralized ones. Using real-time price comparison tools isn’t just smart — it might give you a chance to spot small but profitable price differences. Plus, if you notice news shaking up global currencies, expect crypto to act up too, and consider that in your timing.

Another overlooked but powerful move is splitting up large trades to stay under the radar. Big exchanges make every transaction public, so spreading your swaps across privacy-focused platforms can keep your finances your business. It's not about breaking any rules, just about being smart with who gets to see your wallet details. You can even use contracts that auto-complete your trades when the right conditions hit — making your swaps safer and a bit more hands-off.

Conclusion

Fast cryptocurrency exchange is a convenient tool for managing digital assets, allowing you to quickly respond to market changes. Understanding the features of different platforms, such as centralized exchanges, decentralized exchanges, and liquidity aggregators, helps the user choose the best solutions for their purposes. It is important to consider factors such as security, liquidity, and fees to minimize risks and costs. By following the simple steps and recommendations outlined in the article, you will be able to manage your crypto assets more effectively. Remember that constant market monitoring and the use of modern tools can significantly improve exchange results and increase your financial flexibility.

FAQs

How to choose the right time to exchange cryptocurrency to minimize fees?

The time of day can greatly affect the fees for the exchange. Try to make trades during off-peak hours when the network is less congested to avoid high fees. For example, early morning or late evening activity is usually lower, which makes for better conditions.

What to do if the cryptocurrency of your choice has low liquidity?

In case of low liquidity, it is better to split the exchange into several smaller trades or use aggregators that can find the most favorable offers. This will help to avoid large losses due to slippage.

Can using a VPN affect access to crypto exchange platforms?

Some platforms restrict access from certain countries, and using a VPN can bypass these restrictions. However, this may violate the platform's terms of use, so you should be aware of the possible risks.

How to determine if a platform is suitable for cross-chain swaps?

Make sure the platform supports the blockchains you need and offers cross-chain swaps through decentralized mechanisms, not bridges. Check if you can adjust slippage settings and transaction limits to ensure the stability of the exchange.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

The deviation is a statistical measure of how much a set of data varies from the mean or average value. In forex trading, this measure is often calculated using standard deviation that helps traders in assessing the degree of variability or volatility in currency price movements.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.