What Is Ethereum Used For: All Solutions

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Key Ethereum use cases:

Decentralized finance (DeFi). Ethereum powers platforms offering financial services.

Non-fungible tokens (NFTs). Ethereum enables the creation and trading of unique digital assets.

Asset tokenization. Ethereum transforms real-world assets into blockchain-based tokens.

Supply chain management. Ethereum enhances transparency and traceability in supply chains.

Digital identity and data management. Ethereum secures data storage and transfer using smart contracts.

Decentralized autonomous organizations (DAOs). Ethereum DAOs facilitate decentralized decision-making and resource management.

Ethereum trading. Profit from cryptocurrency price fluctuations through buying and selling Ethereum.

Ethereum is a decentralized blockchain platform that allows users to develop and run decentralized applications (dApps) and smart contracts without the need for intermediaries. The main feature of Ethereum is its ability to support automated contracts and applications that operate without the intervention of third parties. Currently, Ethereum is actively used in the financial sector, where decentralized finance (DeFi) is revolutionizing traditional banking. In the non-fungible tokens (NFTs) sector, the Ethereum network allows the creation of unique digital assets. In addition, Ethereum supports the tokenization of real-world assets and supply chain management, expanding its capabilities in other industries. Let’s discuss Ethereum use cases in more detail now.

Key Ethereum use cases

DeFi on Ethereum

Decentralized finance (DeFi) on Ethereum offers an alternative to traditional financial services by eliminating intermediaries and giving users full control over their assets. Unlike banks and financial institutions, DeFi protocols run on smart contracts that automatically execute the terms of transactions without the involvement of third parties. This technology has already covered the field of issuing loans, passive income in staking, direct trading of assets, and much more. And all this can be done directly, without the need to trust your funds to centralized structures. Let’s take a look at a few examples of Ethereum DeFi platforms:

Sky.money (formerly MakerDAO)

MakerDAO, now rebranded as Sky as part of its "Endgame" plan, hosts two tokens, USDS and SKY, which replace the previous stablecoin DAI and governance token MKR, respectively. USDS is a dollar-pegged stablecoin that aims to improve liquidity and accessibility for users, while SKY is the governance token that allows users to participate in the decentralized decision-making process. Importantly, the Sky ecosystem also introduces new features like the Sky.money platform, a decentralized gateway designed to simplify user interaction, making it easier for users to manage assets without needing extensive technical expertise.Aave

Another platform on the Ethereum blockchain, Aave is one of the leading platforms for decentralized lending and borrowing. It also runs on all the functionality of Ethereum, including smart contracts, loan issuance, and collateral management. One of Aave’s innovations is flash loans — instant loans that are provided without collateral and must be repaid in a single transaction. The entire process is based on the security and transparency of Ethereum, making Aave a powerful tool in the decentralized finance (DeFi) ecosystem.

The possibilities of DeFi on Ethereum have been expanded with the development of Layer 2-based solutions like Arbitrum and Optimism. Ethereum solves the scalability problem and reduces transaction fees, making DeFi more accessible and efficient. Going forward, such solutions are set to grow rapidly, opening up new opportunities for the development of DeFi protocols and their wider adoption.

NFTs on Ethereum

NFTs (non-fungible tokens) are unique, one-of-a-kind digital assets. Unlike traditional tokens that can be fungible (like Bitcoin), each NFT is unique and cannot be replaced by another token. The main property of NFTs is to confirm ownership of various items, such as digital art, music, in-game items, and virtual real estate. This makes them especially popular for creating and trading digital objects in areas such as collecting and creativity. NFTs can exist not only on the Ethereum blockchain, but it is a pioneer in creating the ERC-721 standard, which made the creation of NFTs possible.

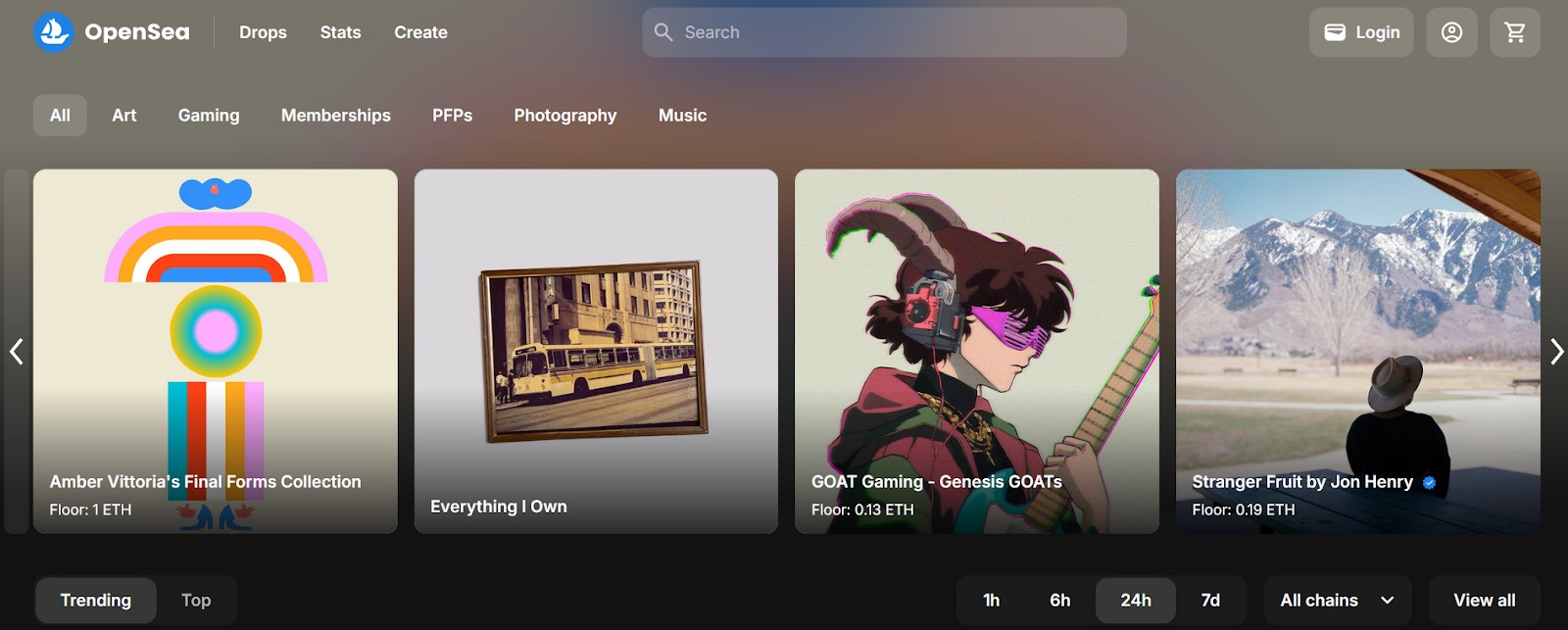

Among the most popular NFT platforms is OpenSea, the largest marketplace for trading digital assets, supporting millions of unique NFTs. In games (the same Axie Infinity), players can own in-game assets, allowing them to trade and use them outside of the game itself, creating a new level of interaction between users and the game. Decentraland uses NFTs to represent virtual real estate, where users can purchase and develop plots of land in a digital universe.

Also, Ethereum's Layer 2 solutions are helping to bring down costs and speed up transactions, making NFTs more accessible for everyday users. With platforms like Optimism or Arbitrum, creators and collectors can avoid the high fees that have held back some users in the past.

Lastly, NFTs are finding their way into gaming and the metaverse, where they serve as in-game characters or virtual property. Projects like Decentraland and Sandbox are already showing how NFTs can create value in virtual worlds, giving players new ways to interact and even make money.

Asset tokenization

Ethereum enables the transformation of real-world assets such as stocks, bonds, real estate, and others into tokens on the blockchain, enabling trading and management of them. Tokenization makes these assets more accessible to a wider range of investors, allowing for fractionalization and more flexible distribution of ownership. Implementation through smart contracts allows for secure and transparent transactions of real estate or securities. Ethereum became the basis for the ERC-3643 standard, designed to tokenize real-world assets (RWAs) in a regulatory-compliant manner.

Supply chain management

Ethereum is good at increasing transparency and traceability in supply chains. Every transaction can be recorded on the blockchain, allowing for tracking of the origin of goods, their movement, and delivery. The use of smart contracts allows for the automation of verification and confirmation processes in supply chains. This reduces the likelihood of counterfeiting and loss, increasing reliability.

Digital identity and data management

Ethereum smart contracts support secure storage and transfer of data. This eliminates the need for centralized institutions to manage identities and personal information. Self-sovereign identity (SSI) technology gives users full control over their data, allowing them to share only the necessary information in encrypted form.

Decentralized autonomous organizations (DAOs)

DAOs are a new way of governance and decision-making using smart contracts. These organizations operate without traditional leaders, where participants (token holders) vote on decisions and manage assets based on transparent and automated rules. DAOs are used in various fields such as finance, philanthropy, and content creation, providing decentralized governance without intermediaries.

Ethereum trading

This is an active form of earnings based on buying and selling cryptocurrency in order to profit from its price fluctuations. Ethereum trading can be carried out on various cryptocurrency exchanges, where traders make transactions based on current market trends and technical analysis.

There are several approaches to trading:

Short-term trading (day trading) — traders make transactions within one day, trying to benefit from small price changes.

Medium-term trading (swing trading) — transactions can last from several days to weeks, focusing on larger market fluctuations.

Long-term trading (hodling) — buying an asset for a long term in anticipation of its growth in the future.

Here are some proven and safe exchanges where you can trade Ethereum and other digital assets.

| Demo | Coins Supported | Min. Deposit, $ | P2P Maker Fee, % | P2P Taker Fee, % | Spot Taker fee, % | Spot Maker Fee, % | Open account | |

|---|---|---|---|---|---|---|---|---|

| Yes | 329 | 10 | 0 | 0 | 0,1 | 0,08 | Open an account Your capital is at risk. |

|

| No | 278 | 10 | Not supported | Not supported | 0,4 | 0,25 | Open an account Your capital is at risk. |

|

| No | 250 | 1 | 0,10 - 0,16 | 0,16 - 0,20 | 0,5 | 0,25 | Open an account Your capital is at risk. |

|

| Yes | 72 | 1 | 0,1 | 0,2 | 0,2 | 0,1 | Open an account Your capital is at risk. |

|

| No | 1817 | No | No | No | 0 | 0 | Open an account Your capital is at risk. |

Advantages and limitations of Ethereum

Advantages

Ethereum provides a decentralized infrastructure that enables the creation and execution of smart contracts and decentralized applications (dApps). These contracts and applications operate autonomously and are tamper-proof, providing censorship resistance and high security. Due to its decentralization, the Ethereum network is independent of central authorities, allowing users to retain control over their assets and transactions. The efficiency of smart contracts also improves processes in various sectors, such as finance, data management, and supply chain management.

Challenges

Ethereum regularly faces scalability issues and the problem of high transaction fees (gas fees), especially during periods of high network activity. The cost of conducting transactions on the main chain can be significant, limiting accessibility for users. Layer 2 solutions such as Arbitrum and Optimism help reduce network congestion by processing transactions off the main chain and periodically recording them on Ethereum. Despite this, the need to write data to the main chain still generates high fees for users.

Improvement plans

Ethereum recently introduced the Dencun upgrade, which aims to improve scalability and reduce the cost of data storage for Layer 2 solutions. Dencun implemented proto-danksharding (EIP-4844). It allows temporary storage of data off the main chain in the form of "blob" files, reducing the cost of writing and increasing the speed of transactions. Thanks to this upgrade, Layer 2 fees have fallen by 90%, making the network more accessible to users and developers. In the long term, Ethereum plans to continue improving scalability, approaching a throughput of 100,000 transactions per second.

Ethereum’s potential is on the rise with major companies turning towards smart contracts

Ethereum’s potential goes far beyond DeFi and NFTs. In recent years, more and more real-world use cases for blockchain have emerged, such as in the area of global settlements and settlements between companies. Many large enterprises, such as Microsoft and Amazon, have begun integrating smart contracts to automate internal operations and contractual obligations. This reduces audit costs and minimizes the risk of human error, which is especially important for multinational companies, where even the slightest delays can lead to significant financial losses.

If you are considering Ethereum for automating business processes, pay attention to new solutions based on sidechains. They allow you to increase throughput without significantly increasing the cost of transactions. For example, Polygon-based solutions have already proven themselves to be an effective way to reduce the load on the Ethereum main network, making them ideal for large corporate clients. Integrating such solutions can significantly improve the efficiency of data and transaction processing.

Also worth keeping in mind are new security standards like EIP-4788, which improves communication between the consensus and execution layers within the Ethereum network. This allows for greater security when handling financial data and tokenized assets. Those planning to use Ethereum for business purposes should keep an eye on these improvements to ensure a high level of security and regulatory compliance.

Conclusion

Ethereum continues to be one of the most powerful platforms for decentralized applications and innovative solutions in the blockchain space. Its applications in DeFi and NFTs demonstrate how blockchain can transform traditional financial and creative sectors. However, Ethereum’s potential goes far beyond these areas: tokenization of real assets, data management, and decentralized organizations open up new horizons for business and technology. Updates such as Dencun aim to solve scalability issues and high transaction costs, making Ethereum even more accessible to developers and users. In the future, Ethereum will likely remain the central platform for decentralized solutions, continuing to influence the development of the global economy and technology.

FAQs

What is the difference between Layer 2 and sidechain?

Layer 2 is a solution that is built on top of the Ethereum mainnet and helps to relieve it by reducing the number of transactions on the main chain. Sidechains are separate blockchains that run in parallel to the main network and can have their own consensus rules. Layer 2 is closely tied to Ethereum security, while sidechains are usually independent and can have higher throughput but less security.

How can Ethereum scaling impact the future of enterprise applications?

Scaling Ethereum, especially using Layer 2 solutions like rollups, can significantly reduce transaction costs and increase their speed. This will open up opportunities for wider blockchain adoption in enterprise systems to automate contracts, manage supply chains, and improve financial transactions.

What is the relationship between smart contracts and legal obligations?

Smart contracts can automatically execute the terms of an agreement when pre-agreed conditions occur, making them useful for legal obligations. However, they cannot always replace traditional legal procedures, as their implementation may depend on national laws and regulations.

What are the potential risks associated with using DAOs?

The main risks include difficulties with legal regulation, vulnerabilities in smart contract code, and potential conflicts among participants. The lack of centralized governance can complicate decision-making in critical situations and lead to disagreements that are difficult to resolve within smart contracts.

Related Articles

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.