Best High-Frequency Trading Platforms

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The best high-frequency trading platforms are:

QuantConnect: open-source platform for multi-asset algorithmic trading with cloud-based backtesting.

MetaTrader 5 (MT5): popular forex and stock trading platform supporting HFT via custom Expert Advisors.

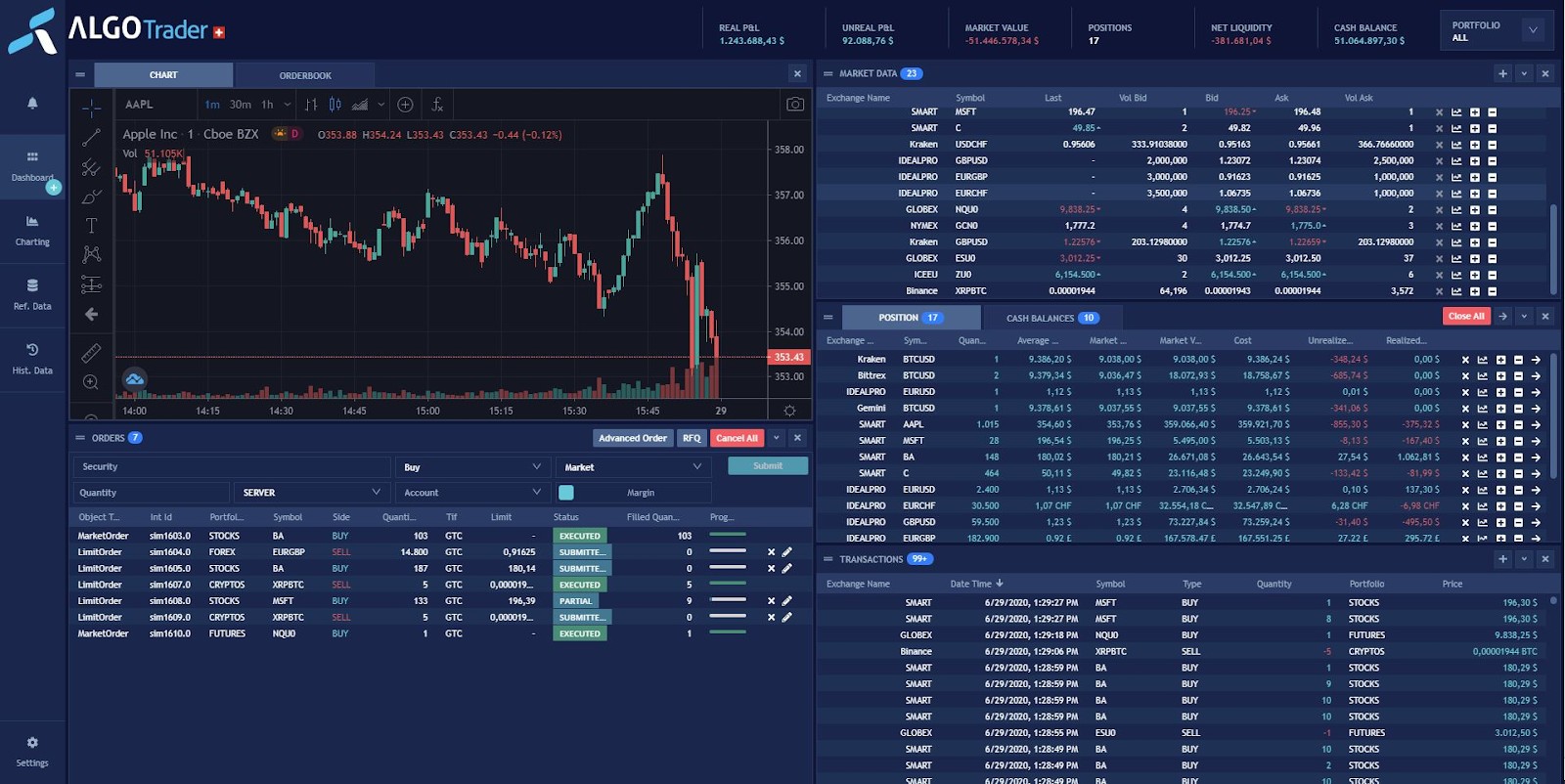

AlgoTrader: institutional-grade platform for multi-asset trading, backtesting, and order execution.

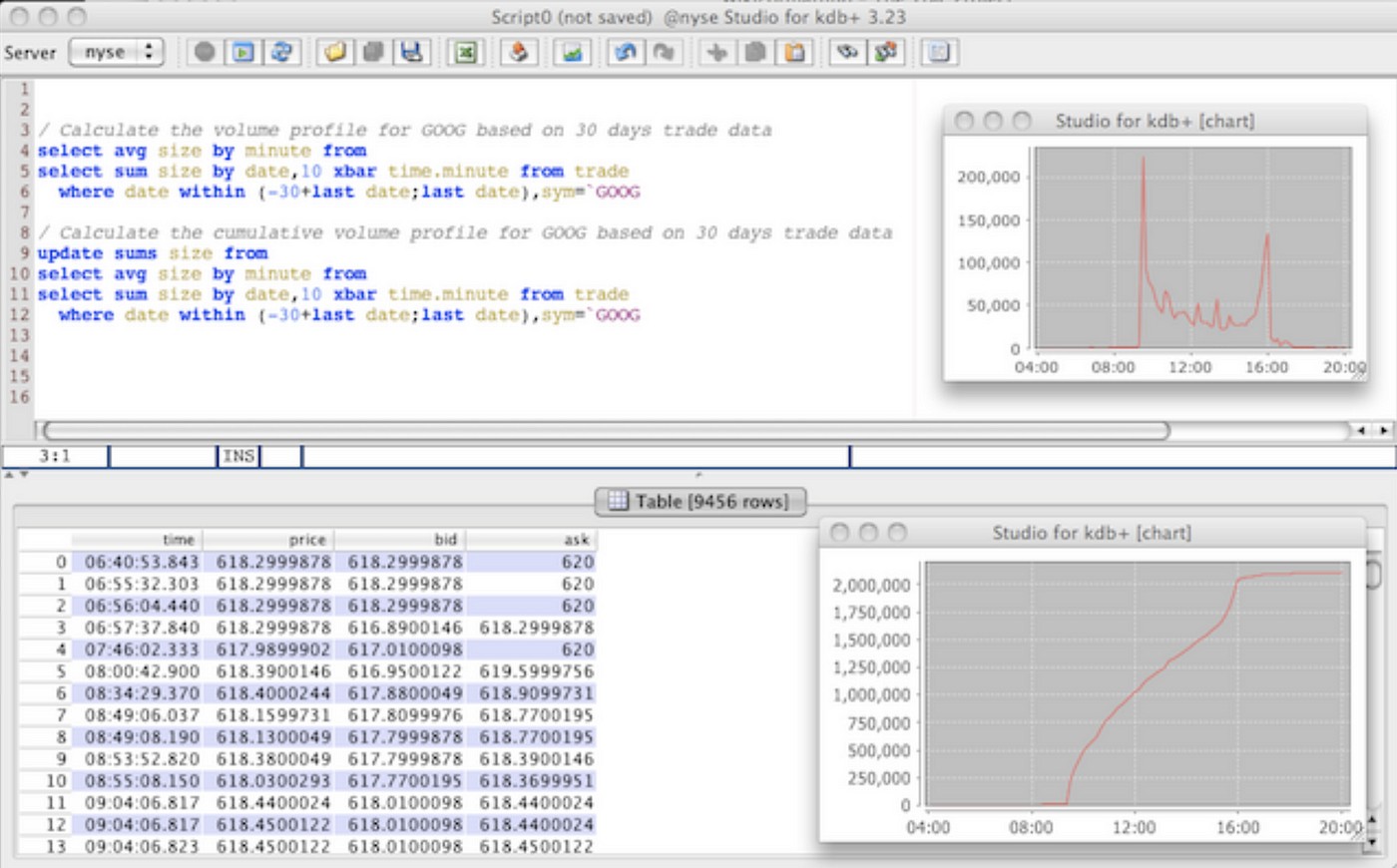

Kdb+/Q: high-performance database and programming language optimized for large datasets in HFT.

FIX Engines: protocol-based trading engines like QuickFIX for efficient communication with exchanges.

QuantInsti's Blueshift: Python-based platform for developing and backtesting HFT strategies.

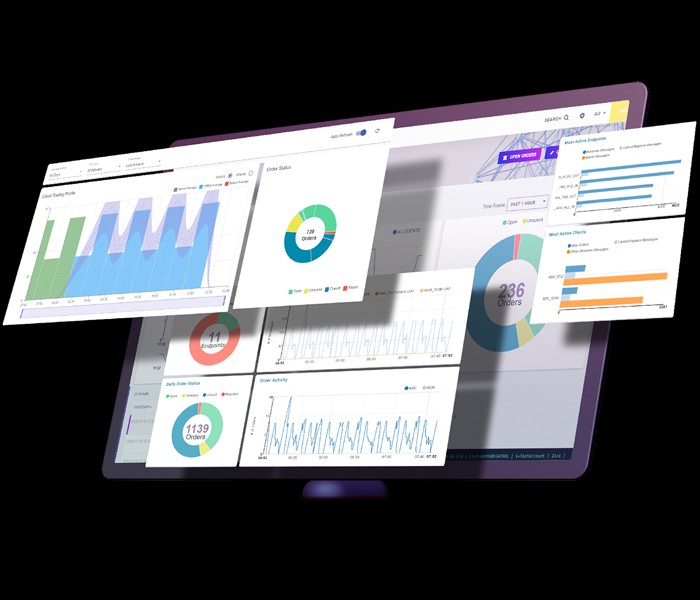

High-frequency trading platforms are designed for speed, precision, and efficiency. They use advanced algorithms to analyze market trends and execute trades in milliseconds, giving traders a competitive edge. This guide will help you find the best platforms to maximize profits and stay ahead in fast-moving markets.

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

Top high-frequency trading platforms

QuantConnect

An open-source platform designed for multi-asset algorithmic trading. QuantConnect enables traders to develop, backtest, and deploy high-frequency trading strategies using a cloud-based environment. It supports a variety of asset classes, including equities, Forex, cryptocurrencies, and futures, and offers robust data integrations to analyze market trends effectively. The platform also supports popular programming languages like Python and C#.

MetaTrader 5 (MT5)

A widely used platform for Forex and stock trading, MT5 supports high-frequency trading through custom Expert Advisors (EAs). It provides a user-friendly interface, a powerful algorithmic trading framework, and access to a wide range of technical indicators. Its compatibility with multiple brokers, combined with its low-latency execution, makes it a popular choice for retail and institutional traders aiming to deploy HFT strategies.

AlgoTrader

An institutional-grade platform for multi-asset algorithmic trading that combines advanced features like backtesting, live trading, and risk management tools. AlgoTrader supports trading across diverse asset classes, including stocks, Forex, derivatives, and cryptocurrencies. It offers integration with major liquidity providers and exchanges while providing sophisticated analytics to optimize HFT strategies. The platform is particularly suitable for hedge funds and proprietary trading firms.

Kdb+/Q

A high-performance database and programming language specifically designed for processing large datasets at lightning speed. Widely used in the financial industry, Kdb+/Q excels in HFT by enabling real-time data analysis and efficient execution of complex trading algorithms. Its scalability and ability to handle terabytes of data make it a favorite for institutions requiring fast and accurate trade processing.

FIX Engines

Protocol-based trading engines, such as QuickFIX, facilitate efficient communication with exchanges and liquidity providers. FIX Engines are essential for HFT firms as they allow for low-latency order routing, execution, and real-time trade confirmations. These engines are highly customizable and can be tailored to meet the specific requirements of different trading environments.

QuantInsti's Blueshift

A Python-based platform tailored for developing, backtesting, and deploying HFT strategies. Blueshift provides access to high-quality market data and powerful tools for simulating strategies in a real-world environment. It is particularly suitable for individual traders and small firms looking to explore high-frequency trading with a focus on flexibility and cost-effectiveness.

We have researched and selected the best broking platforms for high frequency trading. They are presented in the table below along with their key features:

| Tradable assets | Min. deposit, $ | Standard EUR/USD spread, avg pips | MT4 | MT5 | cTrader | Trading bots (EAs) | Regulation level | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|

| 1200 | No | 0,6 | Yes | Yes | Yes | Yes | Tier-1 | 7.17 | Open an account Your capital is at risk.

|

|

| 129 | No | 0,3 | Yes | Yes | No | Yes | Tier-1 | 6.79 | Open an account Your capital is at risk. |

|

| 5500 | 100 | 1,0 | Yes | Yes | No | Yes | Tier-1 | 6.95 | Study review | |

| No | 1000 | 0,3 | Yes | Yes | No | Yes | Tier-1 | 6.09 | Study review | |

| No | 1 | 0,2 | Yes | Yes | Yes | Yes | Tier-1 | 5.8 | Study review |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

What is high-frequency trading?

Rapid trading, or high-frequency trading (HFT), is a type of automated trading that uses fast computers to make a lot of trades at lightning speed. It relies on smart systems and data analysis to spot trading opportunities in milliseconds.

HFT works by using quick networks and instant market data to find price differences between exchanges or to take advantage of small market movements. Traders use custom software and proximity services to make sure their trades are executed faster than the competition. Although HFT is mostly used by large institutions, regular traders can also access platforms that offer HFT tools and strategies, allowing them to be part of this fast-paced world of trading.

Is high-frequency Forex trading legal?

High-frequency Forex trading is legal in most countries, but it must comply with local financial regulations and market rules. Traders need to ensure their activities align with ethical practices and avoid manipulative strategies.

Most regulatory authorities, such as the SEC in the United States and the FCA in the UK, permit HFT as long as it doesn’t exploit market loopholes or harm other traders. However, some practices, like spoofing or front-running, are strictly prohibited.

To ensure compliance, traders must use regulated brokers and adhere to best practices. Authorities actively monitor trading activities to prevent abuse, making legal adherence a critical part of HFT.

Despite legality, the competitive nature of HFT requires traders to stay updated on regulatory changes and technological advancements to remain compliant.

Pros and cons of high-frequency Forex trading

- Pros

- Cons

Quick profit potential. High-frequency Forex trading allows traders to capitalize on small price changes by making many trades in a short time. With the right strategy and fast execution, beginners can see quick returns from compounded profits.

Market influence is minimized. Due to the speed of HFT, traders can enter and exit positions without moving the market too much. This means you can execute large trades without affecting market prices, keeping your actions under the radar.

Less chance for mistakes. HFT uses automated systems, taking emotions and human error out of the equation. This ensures precise, disciplined trading, even in the most volatile market conditions.

High infrastructure costs. The technology required for HFT—such as co-location services and low-latency networks—comes with a hefty price tag. For beginners, these upfront and maintenance costs may be too high to justify diving in.

Requires understanding of technology. To succeed in HFT, traders need to know how algorithms work, along with advanced software and market mechanics. Without a technical background, beginners can find the learning curve steep and overwhelming.

Tough competition. HFT is a domain dominated by big institutions with advanced technology and resources. Competing with these giants as a beginner can feel nearly impossible, as their algorithms can operate much faster and more efficiently than anything most individual traders can access.

Can you do high-frequency trading with Forex?

Yes, individuals can engage in high-frequency Forex trading using specialized software and platforms. However, success depends on access to low-latency technology, robust algorithms, and market expertise.

Forex markets are well-suited for HFT due to their high liquidity and 24-hour availability. Traders use platforms like MetaTrader or cTrader, integrated with APIs for faster execution. Selecting a broker that supports HFT with low spreads and fast execution times is essential.

For individuals, HFT in Forex may involve using pre-built algorithms or creating custom scripts. While challenging, it offers opportunities for traders who invest in the necessary tools and education.

Is high-frequency Forex trading profitable?

HFT can be profitable, but the following factors must be considered:

Requires sharp focus, not gut feeling. High-frequency Forex trading is all about making precise trades. Beginners often think trading is about instinct, but in HFT, every trade requires focus and accuracy. Even a tiny mistake can result in losses, so consistency is the key.

Small profits, lots of trades. In HFT, profits come from small movements in price. While each trade doesn’t bring in much, executing thousands of trades efficiently is where the real money is made. The challenge is making sure each trade is done swiftly and without mistakes.

Faster execution means better profits. Speed is essential in HFT. Even the smallest lag in execution can lead to a missed opportunity. Beginners must focus on fine-tuning their systems to be as fast as possible—slower systems can destroy your profitability, no matter how good your strategy is.

Trade fees can hurt earnings. The more trades you make, the more fees you pay. These costs add up quickly in high-frequency trading, so beginners need to understand that the tiny profits per trade may not always compensate for the fees, especially with high volumes.

Big tech setup is needed. To succeed in HFT, you need top-notch technology—things like co-location services and low-latency networks are crucial. For beginners, setting up this infrastructure can be costly, and without it, your trades may be too slow to stay competitive in this fast-paced environment.

How to start high-frequency trading

To start high-frequency trading, follow this roadmap

Focus on advanced technology. High-frequency trading requires quick networks and high-performance computers. As a beginner, it’s important to start by exploring the infrastructure you'll need to support your trading systems. Investing in top-tier hardware and fast connections will give you an edge.

Create your own trading strategies. To succeed in HFT, you must understand the algorithms that power it. Learning programming languages like Python or C++ will allow you to develop your own strategies or at least understand the ones that are used. Even minor adjustments to your algorithm can drastically improve its performance.

Get instant market information. HFT thrives on real-time market data, so securing fast data connections is a must. Beginners should focus on gaining access to low-latency data feeds and exchanges that enable quick transactions. Even small delays can lead to missed opportunities, so speed is crucial.

Practice trading without risk. Before using real money, start with backtesting and paper trading. These simulated environments let you test your strategies without the risk. It’s important to evaluate how your algorithms perform under different market conditions to ensure they are ready for live trading.

Plan for risk. While HFT can bring rapid profits, it also comes with high risks. As a beginner, it’s essential to set clear risk management parameters, like using stop-loss orders or setting specific limits within your algorithms. Proper risk control helps you minimize the impact of potential losses and ensures long-term success.

How to find the best platform for high-frequency trading

Try focusing on these key factors to find the best high-frequency platform:

Execution speed. Ensure the platform offers low-latency execution.

Regulation. Use regulated brokers to protect your investments.

API access. Look for platforms with advanced APIs for custom strategies.

Cost. Compare spreads, commissions, and other fees.

Customer support. Opt for brokers with reliable support.

User reviews. Research user feedback to gauge platform reliability.

Focus on technology and tools that matter

When picking the right high-frequency trading platforms, beginners need to realize that both technology and setup are just as important as the platform's features. While many platforms claim to offer fast execution speeds, what's more critical is how they handle data connections and offer proximity services like co-location. Co-location places your server near the exchange’s servers, which cuts down on delays. For beginners, it’s important to go for a platform that provides co-location along with fast data feeds to ensure you get your trades executed faster and maximize profit opportunities.

Another factor often overlooked by beginners is the platform’s built-in tools. Look for platforms that provide detailed charting, live market updates, and risk management tools. Some even come with algorithm-building software to help you develop your strategies. But don’t be fooled by simplicity; you need a platform that is user-friendly while still offering powerful tools to scale your strategies over time. It’s important to avoid platforms that are too basic, as they might hold you back from growing and executing more advanced trades in the future.

Conclusion

As high-frequency trading continues to evolve, selecting the right platform is crucial for achieving optimal execution speeds, low latency, and advanced market analytics. Whether you are an institutional trader or an individual investor, choosing an HFT software that aligns with your needs can significantly impact trading success.

When evaluating HFT platforms, traders should focus on reliability, security, and API flexibility, as these factors determine how efficiently strategies can be executed in real-time. Additionally, the platform’s ability to process large volumes of data and integrate with brokerage services plays a key role in enhancing trading performance.

Ultimately, the best high-frequency trading platform will depend on individual requirements, capital investment, and trading goals. By leveraging the right technology and tools, traders can maximize efficiency and capitalize on market opportunities with greater precision and speed.

FAQs

What is the difference between algorithmic trading and high-frequency trading?

Algorithmic trading involves using computer programs to execute trades based on pre-set rules. HFT is a subset of algorithmic trading that focuses on speed and large volumes of trades in extremely short time frames.

Can beginners engage in HFT?

While possible, beginners may find HFT challenging due to its complexity and costs. Starting with demo accounts or simpler algorithmic trading systems is advisable before diving into HFT.

What is the typical investment required for HFT?

The initial investment can range from a few thousand dollars for basic setups to millions for institutional-grade systems. Costs include hardware, software, data feeds, and co-location services.

Are there any risks in HFT?

Yes, risks include high transaction costs, regulatory scrutiny, and losses from poorly designed algorithms. Traders must also account for market volatility and competition.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

HFX trading likely refers to high-frequency forex trading, where automated algorithms execute a large number of trades at extremely high speeds.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

An Expert Advisor (EA) is a piece of software or script used in the MetaTrader trading platform to automate trading strategies. EAs are programmed to execute trading decisions based on predefined criteria, rules, and algorithms, allowing for automated and systematic trading without the need for manual intervention.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.