How Long Are You Allowed to Hold a Short Position?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

eOption - Best stock broker for 2025 (United States)

As a trader, how long you hold a short position depends on what strategy you’re using, the conditions set by your broker, and the broader market conditions.

- Generally, it’s ok to hold a short position for a long time, as long as the trade is going your way and you expect the asset’s price to continue falling.

- However, broker rules and requirements vary, so margin requirements, swap rates and commissions could prevent you from holding a position for an extended time.

When it comes to investing capital into financial assets for profit, most traders are aiming for a gradual increase in their assets’ prices. However, the opposite is true for short sellers, as they attempt to profit from price drops and market downturns. Short selling helps to diversify a portfolio and hedge against the risks of long positions, while also coming with its own risks.

If you’re a trader turning to short-selling stocks and other assets, you may wonder how long you can hold a short position for, or if there are any limits on short selling. In this article, we’ll explain what short selling is, when you should close a short position, how long you’re allowed to hold a short position, and how to start short selling.

How long can you hold a short position?

Technically, you can hold a short position indefinitely with no set time limit, so long as you can honor the margin requirements and take into account the interest and commission or fees. The short position can be held for as long as your capital allows. However, holding a short position for extended periods comes with its own risks.

Risks of holding a short position

Margin Maintenance: Brokers impose minimum margin maintenance requirements for short positions. The duration of your short position can only be affected by the financial regulations of the margin requirements.

Margin Calls: If the stock price of your short position rises significantly, your account's margin requirements may increase, leading to a margin call. You may be required to deposit additional funds to cover losses or meet higher margin requirements, which, in turn, could force you to prematurely close the short position.

Borrowing Fees: When you’re shorting a stock, you typically pay borrowing fees to the broker. These fees can accumulate over time, reducing the profitability of maintaining the short position. You may have no other option but to close short positions to avoid excessive costs.

Short Squeeze: A short squeeze occurs when a heavily shorted stock's price rises rapidly, forcing short sellers to cover their positions by buying back shares, which further drives up the stock’s price, triggering a cascade of short covering. In the event of a short squeeze, you may be forced to cover your position prematurely to limit losses. This can impact how long you hold a short position and requires closely monitoring short interest and market sentiment to assess the likelihood of a short squeeze.

Best stock brokers

When should you close a short position?

When you’re considering how long you should keep a short position open, compare it to how you’d make the same determination on a long position. When looked at simply, shorting an asset is essentially the same as going long in many ways, just expecting the price to go down instead of up. That means your decision of how long to hold a short position will vary depending on your own trading strategy, the market conditions, and factors related to the specific stock.

Market Conditions: When you open a short position, you may be doing so because the broader market is in a downturn, or because you expect a market decline soon. In a bearish market, short positions may be held for longer times as downward pressure persists. In a downtrend, you might hold a short position until it reverses. In a highly volatile market, you might hold a position for shorter times, to avoid incurring losses as the price fluctuates.

Stock-Specific Events: News or events related to the company, such as product launches, regulatory actions, or management changes, can influence the timing of closing a short position. For example, if you expected Uber (NYSE: UBER) to fall short of revenue expectations for the previous quarter in their earnings call, you could short the stock and only hold the position until after the earnings call or the official publication of the report..

Your Strategy: If you’re a short-term or day trader, you might use technical indicators like moving averages, trend lines, or momentum oscillators to time your exits from short positions based on market signals. If you’re swing trading or long-term investing, you’d more than likely need to hold your short positions for longer periods.

What is short selling?

Short selling is an investment strategy where an investor “borrows” assets (such as stocks, commodities, or currencies) from a broker and sells them on the market with the intention of buying them back later at a lower price. The goal of short selling is to profit from a decline in the borrowed asset’s price. Therefore, short selling is most often linked to an overall bearish sentiment on any particular asset or the market it’s in.

Example. In 2022, META's share price was in a downtrend as investors were dissatisfied with the drop in the number of active users and excessive questionable investments in developments related to virtual reality.

As a result, META's share price declined not only in absolute terms, but also relative to the index. Thus, by mid-August, the price of the S&P-500 had risen (1) relative to early summer, while the META price had fallen (2), as shown in the chart below.

You would hardly want to buy such a stock (at that time), would you? The more rational idea was to open a short position.

How does short selling work?

In stock markets, a short seller borrows shares from a broker and sells them on the open market. The short seller hopes to buy back the shares once their price decreases and return them to the broker, pocketing the difference as profit.

In Forex, short selling involves selling a currency pair with the expectation that the base currency will depreciate relative to the quote currency. The short seller aims to buy back the currency pair at a lower price to profit from the exchange rate difference.

Certain practices in short selling are illegal, such as naked short selling. Naked short selling involves selling shares of an asset without borrowing them or ensuring they could be borrowed first, to profit from the price decline by later buying them at a lower price. This practice has largely been banned in the US and Europe since the 2008 financial crisis.

You may have heard of some notorious cases of short selling, including:

Tesla: Tesla (TSLA) is one of the most shorted stocks out there. Investors who took short positions on Tesla made $11.5 billion in profit in 2022 when Tesla shares lost half their value. However, in 2021, short sellers lost a combined $10.3 billion when Tesla shares rose 50%. That was following a Tesla 743% gain in 2020, which caused short-sell position holders to lose a whopping $40.7 billion total.

British Pound: In 1992, George Soros famously shorted the British pound, betting that the currency would depreciate against other major currencies. Soros' short position led to significant profits during the "Black Wednesday" crisis when the UK withdrew from the European Exchange Rate Mechanism.

What is short selling GameStop?

During the infamous GameStop short squeeze in early 2021, retail investors coordinated on Reddit to drive up GME’s stock price, squeezing hedge funds with large short positions. GameStop's stock surged from around $20 to a peak of over $500 in pre-market value, causing substantial losses for short sellers.

This fiasco exposed problems in short selling, such as how retail investors can coordinate to manipulate the market. It also caused liquidity problems for short sellers, as rising prices forced them to buy back shares at much higher prices, amplifying losses.

Short selling tends to be more complicated and riskier than regular investing.

Is short selling a good strategy?

This really is up to you and how you prefer to trade. Consider the advantages and disadvantages before deciding if it’s right for you.

- Advantages

- Disadvantages

- Profit from Downturns: Short selling can be beneficial during bearish market conditions or for individual stocks with fundamental weaknesses.

- Portfolio Diversification: Short selling provides a way to hedge against market downturns or specific sector risks, diversify your portfolio, and potentially offset losses in long positions.

- Potential for High Returns: On average, stock market drops tend to be more pronounced and rapid than upward movements. If you time your short position correctly and the asset's price declines significantly, you could achieve substantial profits.

- Unlimited Losses: Unlike going long (buying), short selling carries unlimited potential losses if the asset's price rises significantly and continues to grow.

- Margin Requirements and Costs: Short selling involves borrowing assets and maintaining margin requirements, which can incur costs and expose you to margin calls.

- Market Volatility and Short Squeezes: Short positions are susceptible to market volatility and short squeezes, which we looked at above.

Weigh up the pros and cons of short selling to determine if it's right for you. If you’re a beginner, it may be best to stick to long positions as that involves less risk and experience.

How do I start short-selling?

If you’ve decided to go ahead with short selling, then follow these simple step-by-step instructions to get started on your short seller journey:

Open a Margin Account: Choose a reputable brokerage that offers margin accounts for short-selling. Traders Union recommends brokers such as eToro, CapTrader, Charles Schwab, Interactive Brokers, and Ninjatrader, which provide robust trading platforms and margin capabilities.

Identify Opportunities: Conduct thorough research and analysis to identify potential short-selling opportunities. Look for overvalued stocks, deteriorating fundamentals, or bearish market trends that could lead to price declines. Use technical and fundamental analysis to assist you.

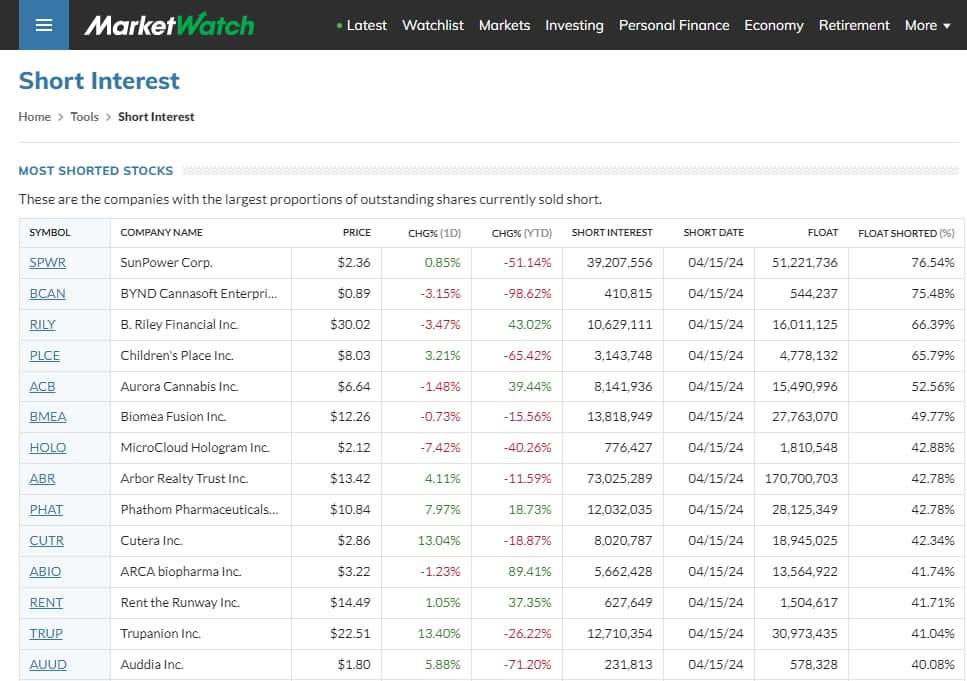

Select Stocks to Short: Choose stocks with high short interest, weak technical indicators, or negative catalysts. Consider liquidity, borrowing costs, and market conditions when making your selection.

Place Short Sell Order: Use your brokerage platform to enter a short sell order for the chosen stock. Specify the quantity of shares to short and execute the order.

Implement Risk Management: Set stop-loss orders to limit potential losses. Determine your risk tolerance and establish predefined exit points based on technical levels or percentage declines.

Monitor Regularly: Continuously monitor market conditions, news, and technical indicators affecting your short positions. Be prepared to adjust your strategies or exit positions based on evolving circumstances.

What is a short-selling ratio

The short interest ratio (often referred to as the days to cover ratio) is a measure used to indicate the bearish sentiment towards a stock. It represents the ratio of the number of shares that have been sold short but not yet covered or closed out, to the average daily volume of shares traded.

Typically, a short interest ratio above 5 is considered high. This means it would take five or more days for all short positions to be covered, given the average daily trading volume. High ratios suggest significant bearish sentiment, as many investors are betting that the stock's price will decline.

Ratios of 10 or higher are particularly noteworthy and suggest very strong bearish sentiment, often leading to close monitoring for potential short squeezes. At the time of writing, SunPower Corporation's (NASDAQ:SPWR) stock had the highest short selling ratio.

SunPower Corp. has been experiencing significant stock price declines due to several factors impacting the solar energy sector as a whole, as well as specific concerns related to the company itself. There are rumors that the company may default on its debts and go bankrupt, which attracts traders to open short positions on the SPWR stock.

Expert opinion

Opening a short position in stocks with high short-selling ratios can be an attractive idea. Having resources like MarketWatch allows you to quickly identify candidates, but I wouldn't recommend opening a short position right away. First, you should consider the risk of a short squeeze. Secondly, a little bit of waiting can be rewarded with a more reasoned entry point from a technical analysis perspective (as in the case of the test of the upper channel boundary on the chart above).

Summary

In conclusion, short selling can be an effective way to profit from declining stock prices and to hedge against market downturns. However, it involves significant risks, including unlimited potential losses, borrowing costs, and short squeeze risks. Successful short selling requires diligent research, risk management, and adaptability to navigate changing market conditions effectively, so make sure you learn as much as possible first. Approach short selling cautiously, utilizing stop-loss orders and regularly monitoring positions to optimize performance and manage risk.

FAQs

Why short a stock?

The overall stock market ebbs and flows and goes through cycles of growth and decline. Shorting stocks in combination with buying them (going long) allows traders to profit from both market environments.

What is a short squeeze?

A short squeeze occurs when a stock that’s been heavily shorted sharply rises in price, forcing short sellers to buy back shares to cover their positions and limit losses. This buying pressure further drives up the stock price, creating a feedback loop. Short squeezes are fueled by panic among short sellers and can lead to rapid and volatile price increases.

Is short-selling illegal?

No, short selling is a legitimate trading strategy that lets you profit from price declines. However, there are certain regulations and restrictions governing short selling to ensure market integrity and stability. For example, The SEC's Alternative Uptick Rule (Rule 201) restricts short selling when a stock's price drops by at least 10% in a day, preventing short sales at prices below the national best bid for that day and the next.

Related Articles

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.