What Is Momentum Trading – A Full Guide For Beginners

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Momentum trading is all about riding the wave of price trends. Here’s a breakdown:

Buy assets on the rise. Look for assets with increasing prices.

Sell when prices drop. Cut losses when the trend reverses.

Focus on quick trends. Act fast to catch price moves.

Use indicators. RSI and moving averages help track momentum.

Follow the market flow. It’s all about momentum, not value.

Momentum trading is all about taking advantage of price trends. The idea is to spot when an asset is moving and jump on that momentum for quick profits. Instead of looking at the fundamentals of a coin or stock, momentum traders follow the price action, trusting that trends will keep going for a while. By using tools like moving averages and the RSI, traders know exactly when to buy and sell to make the most out of the current trend. It’s a fast-paced strategy, where timing is everything and market movements are the key to success.

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

What is momentum trading?

Momentum trading is a strategy where traders capitalize on the strength of a price trend by buying assets that are rising and selling those that are falling. This approach is based on the principle that strong price movements tend to continue in the same direction for a certain period.

The two main types of momentum trading are:

Cross-sectional momentum refers to how an asset is performing compared to other assets in a particular portfolio.

Time-series momentum refers to how an asset is performing now compared to its previous performance. A specified percentage profit threshold is used to assess time-series momentum, and you can buy assets that exceed the threshold.

- Pros

- Cons

Fast action with quick profits. Momentum trading lets you jump into the market and make profits fast, taking advantage of quick price changes. If you don’t want to wait around for long-term trends to play out, this approach can get you in and out of trades quickly.

Bigger returns, faster. If you’re good at spotting strong momentum early, you could make big returns in a short amount of time. Rather than waiting for steady gains, momentum traders focus on price spikes that happen fast, which can lead to larger profits in less time.

Natural risk control with technical tools. Momentum traders often use tools like moving averages or RSI to help with decisions on when to buy or sell. These tools offer a kind of natural risk control by helping you avoid getting in at the wrong moment.

Needs constant market watching. Momentum trading is an active style that requires you to keep a close eye on the market. If you’re not paying attention, you might miss the best moment to get in, and the trend could reverse before you act.

The danger of jumping in too late. The big risk here is trying to ride the wave of momentum after it’s already started, which could leave you exposed to a price drop. By the time you catch the trend, the profits might already be shrinking.

Can lead to stress and mistakes. The fast-paced nature of momentum trading can be stressful, especially in volatile markets. Beginners can end up making impulsive decisions or overtrading, leading to unnecessary losses.

How to build a trading system

Building a successful trading system requires a mix of strategy, adaptability, and discipline — here are some unique insights to help beginners create their own.

Know what makes your approach unique. The best traders have a clear advantage — something they do better than anyone else. It could be how they read the market, the strategies they use, or their risk management tactics. Don’t try to fit into someone else’s system; build one that aligns with your strengths.

Risk management comes first. Most beginners focus too much on making money, but protecting your capital should be your top priority. Set rules for how much you’re willing to risk on any given trade, and stick to them. Use stop-losses and adjust position sizes to keep your losses in check.

Keep your system flexible. Markets change all the time, and your system needs to change with them. Don’t build something too rigid that can't adapt to new conditions. Be ready to tweak your entry points or stop-losses depending on what’s happening in the market.

Use data, but keep it simple. Data is important, but don’t let it overwhelm you. Focus on a few key indicators that really align with your strategy. Don’t complicate things by chasing every metric; sometimes, simplicity works best.

Track every trade and learn. Keep a record of all your trades. This doesn’t just mean noting down what worked, but also what didn’t. By looking back at your wins and losses, you’ll start to see patterns that can help you improve your system over time.

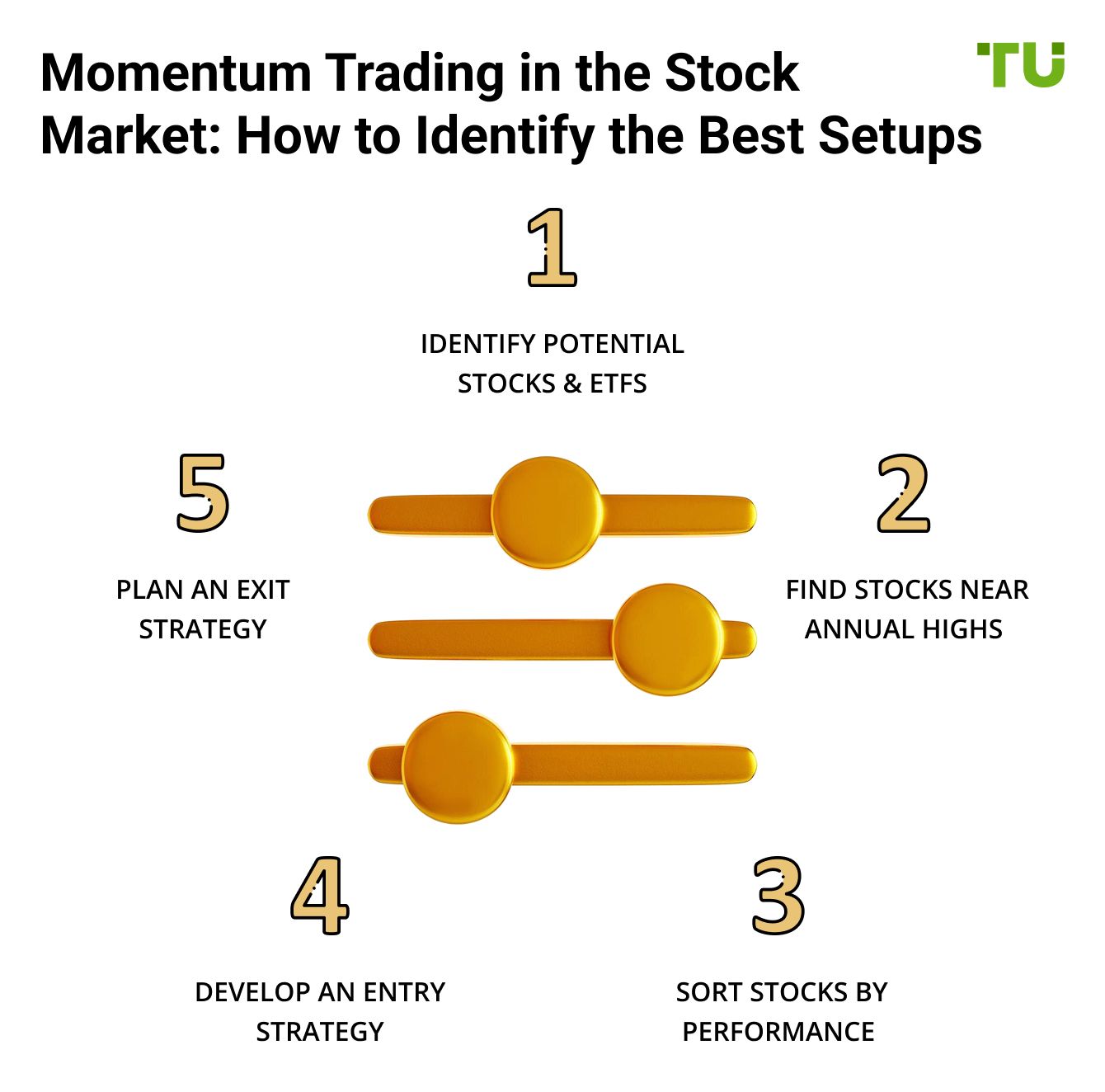

It’s important to be keen when looking for ideal trading candidates in the stock market. Some stocks do not offer momentum trading setups, and you could waste a ton of money and time concentrating on the wrong stocks. Follow these steps to identify the best sectors:

Find out which ETFs and stocks are trading close to their annual highs.

Sort the designated ETFs and stocks from the highest to the lowest to determine which ones perform best.

Come up with an entry strategy. You could, for instance, choose to enter during a pullback and purchase on weakness or get in when an asset is showing short-term strength.

Come up with an exit strategy. Determine the point at which (or under what conditions) you will be inclined to get out with a loss or accept the profits.

Momentum trading in Forex is about identifying trends while they are strong, and here’s how you can stand out as a beginner:

Look for signs that confirm the trend. Momentum alone isn’t enough. Use indicators like the ATR to gauge whether the trend has the strength to continue.

Be patient and wait for the breakout. Sometimes the best opportunities come after waiting for the price to break key levels, signaling that the trend has real momentum behind it.

Trade pairs that show steady movement. Choose pairs that move predictably and steadily, with enough liquidity to ensure smooth trades.

Let the momentum run with a trailing stop. Don’t rush to close a trade — set a trailing stop to lock in profits while letting the price keep moving in your favor.

Don’t get swept up in the news. News can create market swings, but it’s the underlying trend that will carry your trade. Learn to read the news for its long-term impact rather than reacting to every headline.

Momentum trading indicators and tools

As mentioned earlier, momentum traders are not necessarily concerned about the fundamentals of an asset – like the economic circumstances surrounding it or its long-term growth projections. The only thing that matters the most is price action, which is why many traders often use technical analysis and indicators to figure out when to enter and exit a trade.

The most common momentum indicators are:

The momentum indicator;

Moving averages;

The relative strength index (RSI);

The stochastic oscillator.

1. The momentum indicator

The momentum indicator takes the cake for the most popular momentum indicator. It compares the most recent closing price with the previous one to help determine the stability of a trend.

The indicator comes in the form of an oscillator displayed as one line moving to and from a centerline of zero (sometimes 100). You can determine the pace of a stock's price by checking the reading on the indicator line. Most momentum traders use this indicator to determine a price action, but some rely on it to enter and exit trades.

2. Relative strength index (RSI)

The relative strength index (RSI) is also an oscillator that moves from 0-100, providing buy and sell signals. Like other range-bound indicators, it offers oversold and overbought signals depending on its reading. Anything below 30 is oversold, while anything over 70 is overbought.

Remember that the RSI indicator indicates oversold and overbought signals don't automatically translate to a change in the trend. The signal line can remain in the same territory for a long time, and it is important to use other indicators along with the RSI.

3. Moving averages

Traders use moving averages (MAs) to spot emerging market trends. They utilize a formula that disregards random fluctuations to reveal a prevalent trend.

It is important to note that moving averages are a kind of lagging indicator – the signals appear after the price changes. Of course, while you wouldn’t typically jump on a trend at the beginning anyway, you will need to employ other momentum indicators to identify an ideal exit point.

4. Stochastic oscillator

This indicator compares the previous trading range to the most recent closing price over a certain period.

The stochastic oscillator follows the momentum and pace of the underlying market rather than volume or price. It is considered one of the best indicators, as you can use it to project price movements.

Two lines represent it:

The indicator line: a range-bound line that fluctuates from zero to 100. A value of 20 or below is considered oversold, while that of 80 and above is considered overbought.

The signal line: a single line on the same chart that signifies a reversal in the trend if it crosses with the indicator line.

If the stochastic does not return below the under-20 territory during a pullback, it could mean that the trend will progress upward.

Risks of momentum trading

Pure momentum trading ignores fundamentals like stock valuations, the broader economy, and corporate earnings, choosing stocks just because they have already experienced huge gains in price. This strategy of following the crowd eventually becomes a recipe for buying high, which then increases the risks in your portfolio.

Risks of momentum investing include:

Chasing after fast gains can hurt you. It's tempting to jump into a rising trend, but momentum trading can often lead to fast losses when the trend suddenly reverses. Always be prepared for the possibility that things won’t go as planned.

Too much focus on one asset can be risky. Betting everything on one asset is risky — if the market turns on you, you could end up with big losses. Spread out your positions to protect yourself.

Ignoring changes in market mood can be dangerous. Markets are constantly shifting, and trends don’t last forever. Pay attention to subtle changes in sentiment so you can react quickly and avoid getting stuck in a downward trend.

Following the crowd could lead to unnecessary trades. It’s easy to get swept up in the hype, but following the herd can lead to impulsive trades that don’t fit your strategy. Stick to what works for you, not just what everyone else is doing.

Volatile markets make timing crucial. In momentum trading, every second counts. But when prices move quickly, you could miss the ideal moment to enter or exit, leaving you with less than what you hoped for.

Trading momentum markets needs complex risk management strategies to address hidden traps, overcrowding, and volatility that reduce profits. Traders frequently ignore these rules, overcome by the fear of missing the rally or selling off, while others enjoy windfall profits.

The five elements of these rules are:

Momentum security selection. Go for liquid securities and avoid inverse or leveraged ETFs, which have a sophisticated fund construction that makes it challenging to accurately track futures markets or underlying indices.

Tight risk control. Risks come into play when entering and exiting the trades.

Perfect entry timing. Entry timing means jumping into the trade early.

Profitable exits. Exit points call for regular charting.

Position management. Position management involves assessing your holding period and wide spreads.

The two ways of risk evaluation are:

Alpha. This measures the performance of an investment to a particular benchmark. A portfolio’s alpha refers to its excess return over the designated benchmark. A positive alpha means that the investment has performed better than its benchmark. Similarly, a negative alpha means that the investment has performed poorer than its benchmark.

Beta. This determines the volatility of a portfolio or security compared to the whole market. If beta is less than one, the investment is fairly less volatile than the market, and if it is more than one, the security or portfolio is more volatile.

Which brokers are the best for momentum trading

Choosing the right broker is crucial for successful momentum trading. The ideal broker should offer fast order execution, low fees, reliable trading platforms, and access to advanced technical tools. These features ensure traders can respond quickly to market changes and capitalize on short-term price movements effectively. Below, we highlight top brokers that cater to the needs of momentum traders.

| Currency pairs | Demo | Min. deposit, $ | Max. leverage | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Investor protection | Max. Regulation Level | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|

| 60 | Yes | 100 | 1:300 | 0,5 | 0,9 | €20,000 £85,000 SGD 75,000 | Tier-1 | 6.83 | Open an account Your capital is at risk. |

|

| 90 | Yes | No | 1:500 | 0,5 | 1,5 | £85,000 €20,000 €100,000 (DE) | Tier-1 | 7.17 | Open an account Your capital is at risk.

|

|

| 68 | Yes | No | 1:200 | 0,1 | 0,5 | £85,000 SGD 75,000 $500,000 | Tier-1 | 6.8 | Open an account Your capital is at risk. |

|

| 80 | Yes | 100 | 1:50 | 0,7 | 1,2 | £85,000 | Tier-1 | 6.95 | Study review | |

| 100 | Yes | No | 1:30 | 0,2 | 0,8 | $500,000 £85,000 | Tier-1 | 6.9 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Tracking momentum trends and timing exits using advanced strategies

Momentum trading isn’t just about riding a wave — it's about understanding the forces driving it. For beginners, it's important to look beyond the obvious and see why an asset is gaining momentum. Is there a big announcement, a new partnership, or a breakthrough product? These kinds of events create momentum that can push prices higher. But timing is everything — don’t wait too long to cash out because, as with all trends, they eventually lose steam. To really get good at momentum trading, you need to look at the bigger picture. Don’t just rely on charts, but keep an eye on the news and events that are fueling the trend.

One thing that many beginners miss is how to time the market, especially when prices are volatile. It's easy to get caught up in the excitement and enter too early or exit too late. A good way to avoid that is by using tools like the Relative Strength Index (RSI) to help you spot when an asset is overbought or oversold. But don’t just depend on one indicator — combine it with volume analysis to get a clearer view of the trend. A strong trend is one where both momentum and volume are aligned. In the end, momentum trading is about knowing when to jump in, when to step back, and having a plan in place to exit before things turn south.

Conclusion

Momentum trading is about catching short-term market movements and using them to your advantage. It’s a powerful strategy, but it requires a good grasp of the tools you’re using, solid risk management, and the ability to act fast when things change. Whether you're trading stocks, Forex, or other assets, momentum trading is most effective when you're dedicated to doing your homework and keeping a close eye on the market. Pick the right strategy, tools, and brokers to boost your chances, but always be prepared for ups and downs. Practice on a demo account and stay updated to keep improving your trading skills.

FAQs

Can you make money with momentum trading strategies?

Momentum trading strategies are profitable in the financial markets. Momentum trading is more popular than the conventional "buying low, selling high" strategy. Furthermore, the strategy can make high profits over a short period.

Is momentum trading legal?

Momentum investing is legal. However, your broker may have restrictions to trading, so check with their domiciled location and your jurisdiction.

What are the best strategies for momentum trading?

There is no one-size-fits-all answer to this question, as different traders may have different opinions on the best way to trade momentum. However, some common strategies that momentum traders use include trend following, breakout trading, and scalping.

What are the risks of momentum trading?

Like any other type of trading, there are risks associated with momentum trading. One of the most significant risks is that a security's price may reverse direction suddenly, causing losses for the trader. Additionally, it can be not easy to time trades correctly when using a momentum-based strategy, leading to suboptimal results.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Overtrading is a phenomenon where a trader executes too many transactions in the market, surpassing their strategy and trading more frequently than planned. It's a common mistake that can lead to financial losses.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

A trading system is a set of rules and algorithms that a trader uses to make trading decisions. It can be based on fundamental analysis, technical analysis, or a combination of both.