How To Calculate Zakat On Crypto

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Step-by-step guide how to calculate Zakat on Crypto:

Since cryptocurrencies are considered a form of wealth under Islamic finance, they fall under the category of assets subject to zakat on crypto assets. While there has been ongoing discussion among Shariah scholars regarding the permissibility of crypto trading, the consensus today leans toward their inclusion in zakat obligations. It’s important to understand the method used to calculate this form of zakat and gain clarity on how it applies in practical scenarios, and that is what this article would cover in detail.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

Note: Calculations use the London Gold Fixing price, which is considered the global benchmark for gold valuation in international financial and commercial contracts. This price is determined during two daily trading sessions held in London at 10:30 (GMT+1) and 15:00 (GMT+1). Actual data and price history (in US dollars per troy ounce fine gold 995) can be found on the official website of the London Bullion Market Association (LBMA).

Step-by-step guide to calculate Zakat on crypto

Zakat, one of the five pillars of Islam, is a charitable obligation aimed at purifying one’s wealth by distributing a portion to those in need. Traditionally, it is calculated on savings, gold, silver, and agricultural produce. Its role in supporting social welfare and maintaining economic balance within the Muslim community is deeply rooted. But do you pay zakat on crypto? As digital assets gain wider acceptance, zakat on cryptocurrency has become a topic of growing importance among both scholars and Muslim investors, prompting many to seek clarity on how to calculate zakat on crypto.

If you’re interested in learning about the key principles of Islamic finance, you may refer to our articles on riba, maysir, and gharar.

Determining the Nisab threshold

The Nisab is the minimum amount of wealth a Muslim must possess before being liable to pay zakat on cryptocurrency. It is equivalent to the value of 85 grams of gold.

Nisab = Price of Gold per Gram × 85

Example: If the current price of gold is $60 per gram:

Nisab = $60 × 85 = $5,100

Note: Calculations use the London Gold Fixing price, which is considered the global benchmark for gold valuation in international financial and commercial contracts. This price is determined during two daily trading sessions held in London at 10:30 (GMT+1) and 15:00 (GMT+1). Actual data and price history (in US dollars per troy ounce fine gold 995) can be found on the official website of the London Bullion Market Association (LBMA).

Calculating the total value of crypto assets

Assess the market value of all your crypto holdings, which is essential for determining zakat on crypto assets.

Total Value = ∑(Holdings × Market Price)

Example:

Bitcoin (BTC): 0.5 BTC at $61,565

Ethereum (ETH): 10 ETH at $1,900

Total Value = (0.5 × 61,565) + (10 × 1,900)

Total Value = 30,782.50 + 19,000

Total Value = 49,782.50

Deducting liabilities

Subtract any outstanding debts from your total assets to find the amount subject to cryptocurrency zakat.

Net Assets = Total Value of Crypto Assets − Liabilities

Example: If you have liabilities of $5,000:

Net Assets = 49,782.50 − 5,000 = 44,782.50

Applying the Zakat rate (2.5%)

Multiply the remaining amount by 2.5% to determine your Zakat liability. This is the standard method for calculating zakat on cryptocurrencies.

Zakat = Net Assets × 0.025

Example: Zakat = 44,782.50 × 0.025 = 1,119.56

To make this easier, many Muslims now turn to tools like a crypto zakat calculator or other digital aids to make the process more manageable, especially when handling a range of assets. In some cases, individuals opt to pay their Zakat in crypto, based on local rules and their school of thought. Within the different schools of Islamic thought, the method of how to calculate zakat on cryptocurrency often differs based on factors like how liquid the asset is and whether it’s meant for trading to determine whether zakat should be given.

Zakat calculation methods

There are several ways to calculate Zakat, depending on the method used to value one’s digital holdings. However, the purpose remains consistent: to ensure that zakat on cryptocurrency is fulfilled accurately, both in terms of asset valuation and religious duty.

Market value method

This approach requires valuing your digital assets at their current market price. It is a practical method to assess your zakat on crypto, especially when prices fluctuate daily. Keeping track of your holdings' real-time value helps ensure a fair and timely contribution. This method is particularly useful for individuals seeking clarity on whether they need to pay Zakat in a volatile market.

| Cryptocurrency | Holdings (Units) | Market price (USD) | Total value (USD) | Zakat (2.5%) (USD) |

|---|---|---|---|---|

| Bitcoin (BTC) | 0.5 | 61,565 | 30,782.50 | 769.56 |

| Ethereum (ETH) | 10 | 1,900 | 19,000 | 475.00 |

| Ripple (XRP) | 1,000 | 0.50 | 500 | 12.50 |

| Litecoin (LTC) | 20 | 100 | 2,000 | 50.00 |

Always verify the latest rates before calculating zakat on cryptocurrency to maintain accuracy, especially if you’re following the market valuation approach. This approach offers a clear, data-informed answer that aligns with current pricing.

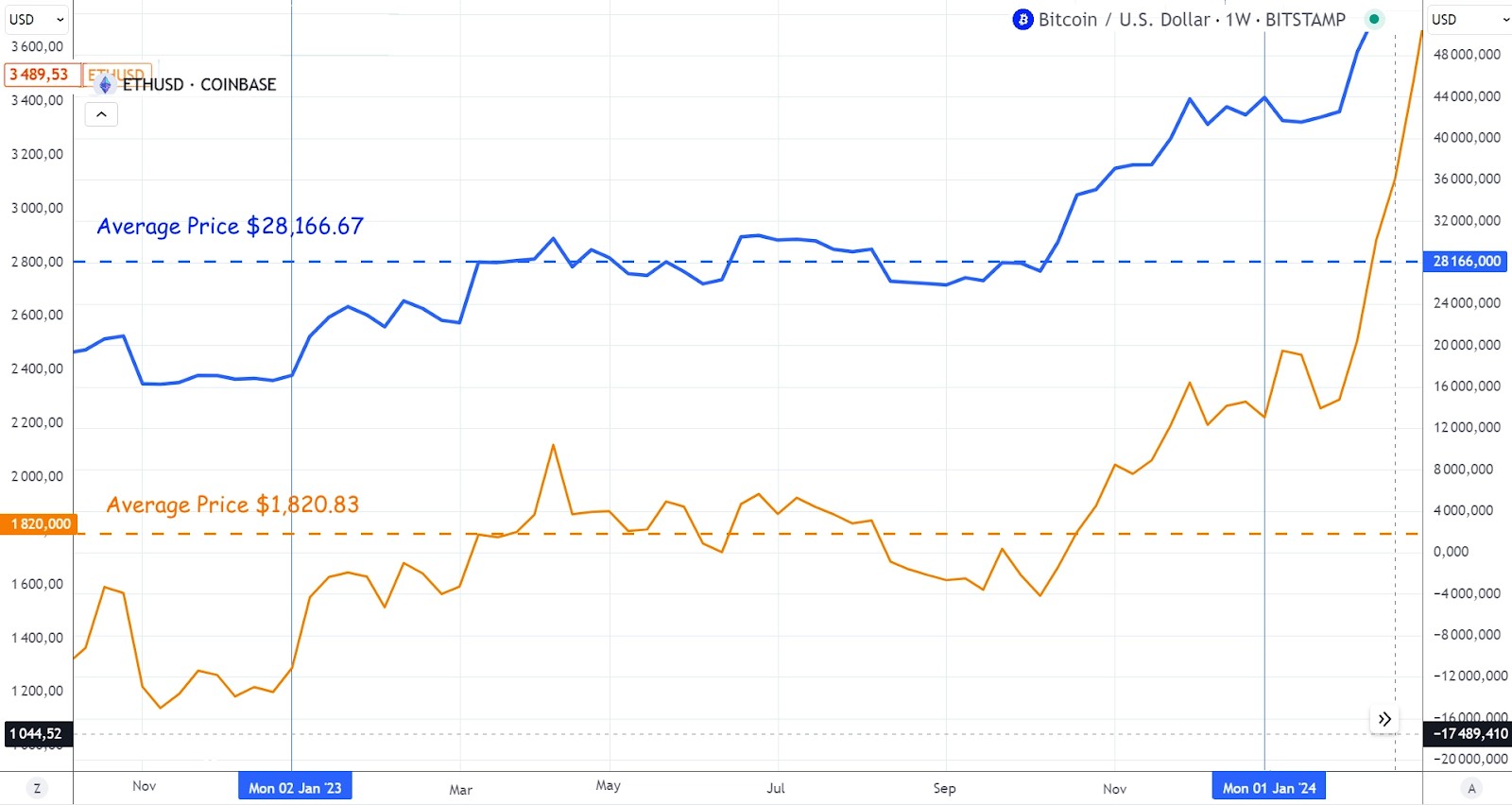

Average value method

The average value method works by computing the mean value of your crypto assets over a defined period. This technique helps balance out the ups and downs of digital markets and is especially useful if you’re uncertain about how to assess zakat on cryptocurrency during months with unpredictable price swings.

How to calculate average prices:

Bitcoin (BTC):

Average Price = (23000 + 24500 + 25000 + 26000 + 27500 + 28000 + 29000 + 30000 + 31000 + 32000 + 33000 + 34000) / 12

Average Price = 338000 / 12 = $28,166.67

This becomes your reference point to determine crypto zakat for BTC.

Ethereum (ETH):

Average Price = (1550 + 1600 + 1650 + 1700 + 1750 + 1800 + 1850 + 1900 + 1950 + 2000 + 2050 + 2100) / 12

Average Price = 21850 / 12 = $1,820.83

Use this for calculating zakat on crypto assets held in ETH.

This method helps clarify concerns like “do I have to pay zakat on crypto?”, especially when cryptocurrency values fluctuate widely during the year. It also aligns with scholarly views under the zakat on cryptocurrency’s hanafi interpretation, which emphasizes fairness in asset valuation.

Using crypto calculators

There are several online tools that help calculate zakat on digital assets efficiently. These platforms make the process easier, especially for individuals with mixed portfolios, and are helpful for those wondering how to fulfill their zakat obligations on crypto or whether it's allowed. You can simply search for terms like “crypto zakat calculator”, and you’ll come across tools that assess zakat based on either the current market price or an average value. Most calculators also accept entries in different currencies, including crypto. They help resolve a common concern in Islamic financial practice today: can zakat be paid in crypto or should it be converted to fiat first?

Distributing zakat on digital assets

The rise of digital currencies has opened up fresh ways for fulfilling Zakat obligations, particularly regarding zakat on crypto assets. As the market matures, more Muslims are asking questions like how to calculate zakat on cryptocurrency or do you have to pay zakat on cryptocurrency, with a follow-up question being around distribution of zakat on digital assets.

Methods of distribution

Zakat on cryptocurrencies can be fulfilled through two main routes: converting crypto into fiat currency before distribution or directly donating the crypto itself. The second method is increasingly popular among younger donors and those familiar with digital technology who wish to pay zakat in crypto without unnecessary conversions or third-party fees.

This shift toward halal blockchain-based giving has also sparked interest in tools that make the math easier. Platforms that offer a crypto zakat calculator or zakat calculator crypto make it easier to complete the process by integrating live market prices and Islamic legal rulings, allowing Muslims to grasp how to calculate zakat on crypto and fulfill their obligations correctly.

Recognized zakat organizations

Many trusted organizations have now adapted to support zakat cryptocurrency donations. These groups accept digital assets and make sure funds are distributed according to Islamic principles, addressing questions like “is there zakat on cryptocurrency?” and offering guidance for zakat on cryptocurrency hanafi followers.

Zakat-accepting organizations and their donation processes caption

| Organization | Donation process |

|---|---|

| Islamic relief | Accepts crypto donations directly through their website; enables zakat on crypto assets to be processed transparently. |

| Muslim aid | Donations can be made in crypto or converted to fiat, which aligns with zakat on crypto preferences across diverse communities. |

| NZF (National zakat foundation) | Provides an option to donate crypto, which is then converted into fiat and allocated according to cryptocurrency zakat guidelines. |

| Zakat foundation of america | Accepts a variety of cryptocurrencies; donors can specify zakat on cryptocurrency at the time of donation. |

| Penny appeal USA | Offers crypto donation options with a focus on transparency and simplicity — ideal for those using a zakat calculator for cryptocurrency. |

Sharia scholar guidance

Here's a table summarizing the scholarly opinions on the permissibility, valuation, and distribution of zakat on crypto:

| Aspect | Opinion type | Details | Qur’anic / Scholarly References |

|---|---|---|---|

| Permissibility | Consensus | Most scholars agree cryptocurrencies should be included in zakat calculation being valuable, tradable assets. | Qur’an 2:267 – “O you who have believed, spend from the good things which you have earned…”; AAOIFI Standard No. 35; Fiqh Council North America. |

| Differing opinions | Some scholars raise concerns due to volatility and speculative misuse, but the majority still affirm that zakat on cryptocurrencies is required. | Mufti Taqi Usmani (critical of crypto’s speculative nature); International Islamic Fiqh Academy – ongoing deliberations. | |

| Valuation | Market value method | Uses real-time asset pricing for accuracy in how to calculate zakat on cryptocurrency. | Supported by Dar al-Ifta Egypt and Islamic Reliefzakat guidelines: Islamic Relief Zakat Guide |

| Average value method | Smooths price fluctuations over time, helping Muslims determine how to calculate zakat on crypto in volatile markets. | Suggested in AAOIFI Shariah Standard as acceptable for assets with price instability. | |

| Distribution | Direct crypto donations | Allows donors to pay zakat in crypto, streamlining the process while preserving blockchain transparency. | Backed by scholars like Dr. Monzer Kahf and organizations like Muslim Giving and Zakat.io. |

| Conversion to fiat | Recommended by some scholars who favor converting crypto before distribution. | Fiqh Academy Resolution No. 140 (2004); Sheikh Yusuf al-Qaradawi – emphasizes ease and clarity in zakat distribution. |

Even for Muslims who follow the zakat calculation on cryptocurrency as per hanafi school, these valuation and distribution models are especially relevant, as they emphasize precision, market-based assessment, and direct charitable intent.

Key fatwas and legal rulings

Multiple fatwas confirm the validity of zakat on crypto assets. These rulings offer guidance for those who ask “do I have to pay zakat on crypto?” or wonder “is there zakat on cryptocurrency” in contemporary practice.

| Year | Fatwa/Legal ruling | Details |

|---|---|---|

| 2018 | First fatwa by darul ifta | Declares cryptocurrencies eligible for zakat purposes; encourages tracking fair market value for compliance. |

| 2019 | Islamic finance guru's support | Recommends inclusion of crypto in zakat and encourages using a crypto zakat calculator for accuracy. |

| 2020 | Shariah advisory council’s guidelines | Explains how to pay zakat on cryptocurrency by valuing and distributing according to Sharia principles. |

| 2021 | Inclusion in islamic finance conferences | Discussions centered around crypto zakat led to unified methodologies for calculating and giving zakat on cryptocurrency. |

| 2022 | Endorsement by the global fatwa council | Reinforces global consensus on cryptocurrency zakat and urges scholars to educate Muslims on using a zakat calculator cryptocurrency for accuracy. |

| 2023 | New rulings by prominent scholars | Clarifies guidelines on how to pay zakat on crypto and addresses frequently asked questions like “do you have to pay zakat on cryptocurrency?”. |

Before you pay: Make sure your crypto activities are halal

Once you’ve calculated your zakat on crypto, the next question is whether your holdings and activities themselves comply with Islamic finance principles. This step is often overlooked but is essential before fulfilling your zakat obligation. Not all digital assets or crypto practices qualify as halal, and understanding the Shariah perspective behind each can ensure your wealth is purified in both form and spirit.

For instance, some coins are considered halal because they offer utility and avoid interest-based or exploitative mechanisms. On the other hand, high-risk tokens like meme coins have drawn mixed opinions, and it's worth reviewing the Islamic stance on meme coins before including them in your zakat base. To trade halal cryptos, you can use any of the crypto exchanges listed in the table below. They are known for listing a wide range of Sharia-compliant cryptos:

| Foundation year | Crypto | Coins Supported | Spot Fee Tier | Min. Deposit, $ | Tier-1 regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| 2017 | Yes | 329 | No | 10 | No | 8.9 | Open an account Your capital is at risk. |

|

| 2011 | Yes | 278 | No | 10 | Yes | 8.48 | Open an account Your capital is at risk. |

|

| 2016 | Yes | 250 | No | 1 | Yes | 8.36 | Open an account Your capital is at risk. |

|

| 2018 | Yes | 72 | Level 0 (Regular Fee) | 1 | Yes | 7.41 | Open an account Your capital is at risk. |

|

| 2004 | No | 1817 | No | No | No | 7.3 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Next, your trading methods matter too. If you engage in spot crypto trading, it’s generally more acceptable under Islamic finance. However, leveraged and margin-based activities like crypto futures or leverage trading involve elements of riba or excessive risk (gharar), which are not permissible. Even short-term crypto day trading can raise questions depending on the intent and frequency.

If you’re earning passive income, make sure to assess whether staking, yield farming, or liquidity mining aligns with Islamic principles. Many of these activities involve lending pools or complex derivatives, which could make them non-compliant.

Lastly, if you’re using decentralized platforms, it’s important to consider whether your activity on DeFi protocols falls within permissible boundaries. Is DeFi halal or haram? This is a nuanced topic, but clarity here is just as important as your zakat math.

For those mining crypto, remember that mining itself must also be evaluated through a Shariah lens. The energy use, intent, and end-application all contribute to whether it is considered halal or haram.

In summary, calculating zakat is only part of the process. Ensuring your crypto practices are ethically aligned with Islamic values helps fulfill the deeper intent of zakat — purification of wealth, inside and out.

Crypto holding types and staking rewards change your zakat calculation

If you’re just looking at the total value of your crypto and calculating zakat from that, slow down — you could be making a major mistake. Every coin in your wallet isn’t treated the same. If you’re flipping coins often, it’s like trading goods and zakat applies to the whole market value. But if you're holding them long-term with no plan to sell, it’s a different story. The reason you’re holding a coin, whether to flip it, earn rewards, or just park it, decides how zakat should be applied. Categorizing your holdings this way makes your zakat fair and accurate.

Also, don’t just include every reward or airdrop blindly in your zakat total. Say you got staking income or free airdrops. Those aren’t counted the moment they hit your wallet. They’re only zakatable if they’ve stayed with you for a full lunar year and reached the nisab limit by themselves. If a random airdrop gave you $8 worth of tokens that just sat there, there’s no zakat due. Keep each type of income separate in your records. Zakat is about being just, not about guessing with round numbers.

Conclusion

You can use different methods to calculate zakat on crypto holdings, such as the market value method or the average value method. If you're wondering how to calculate zakat on cryptocurrency, these approaches offer clarity, especially when used with reliable tools like a crypto zakat calculator.

Regularly track the value of your holdings to determine zakat on crypto assets, especially at the end of the lunar year. Zakat is applicable if your assets exceed the nisab threshold and meet the criteria defined. When it’s time to fulfill your obligation, you can pay zakat in crypto directly if the charity supports it, or convert it to fiat.

FAQs

What happens if I lose access to my crypto wallet before paying Zakat?

If you’ve lost access and can’t recover your funds, zakat on crypto doesn't apply to those lost assets. Shariah scholars agree that zakat is only due on wealth that is fully accessible and owned. It's wise to secure your crypto and back up wallets, especially if you're planning to pay zakat on crypto.

Does staking or earning interest on crypto change my Zakat calculation?

Yes. If you’re earning returns through staking or lending, those earnings are added to your total crypto value. You should include them when calculating zakat cryptocurrency, especially if they’re reinvested or remain in your wallet at the end of the lunar year.

Do I pay Zakat on crypto I received as a gift or airdrop?

If gifted or airdropped crypto holds value and you keep it for over a lunar year and it meets the Nisab, zakat on cryptocurrency applies. It doesn’t matter how you acquired it — what matters is ownership, value, and time held.

How do I calculate Zakat if I use my crypto frequently for trading?

Frequent trading requires you to assess your crypto portfolio on your zakat due date. You’ll calculate your crypto zakat based on the market value of all holdings at that point — even if some assets were short-term trades. Real-time valuation matters more than transaction history.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.