Best Binary Options Brokers for Trading with Low Minimum Deposit

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

CloseOption - Best binary options broker for 2025 (United States)

Best binary options broker with low minimum deposits:

- CloseOption - Best broker with government regulation (licensed by the National Bank of Georgia)

- IQcent - Best platform for market analysis (real-time technical analysis, news, and trading calendar)

- Raceoption - Best trading competitions (weekly contests with automatical participation)

- Nadex - Best protection of investors (regulation by CFTC and account segregation)

- Pocket Option - Best for beginners ($5 min deposit, copy trading, many bonus offerings)

Getting started with binary options trading usually requires depositing funds into a brokerage account. While many brokers have account minimums of $100 or more, some high-quality brokers allow you to open an account and start trading with just $5 or $10. These low deposit binary options brokers make it easy to put your toe in the water and learn the markets with lower upfront cost and risk.

Trading with only a small amount of capital may limit your potential profits. However, by selecting trades carefully, managing risk properly, and working within the constraints of a micro account, it is absolutely possible to execute a strategic, disciplined approach. You can gain invaluable experience while still protecting your capital base.

In our guide we identify regulated, reputable platforms that offer top-tier trading tools, resources, features, and make trading accessible for those operating even with modest account balances.

Best Binary Options Brokers With Low Minimum Deposits

| Min. deposit | Min. trade size | Withdrawal minimum | Free Demo | TU overall score | Open an account | |

|---|---|---|---|---|---|---|

| 5 | 1 | 1-500 | Yes | 8.7 | Open an account Your capital is at risk. |

|

| 100 | 0.01 | 20 | Yes | 6.83 | Open an account Your capital is at risk. |

|

| 250 | 0.01 | 50 | Yes | 5.52 | Open an account Your capital is at risk. |

|

| 250 | 1 | No | Yes | 4.12 | Study review | |

| 5 | 1 | 10 | Yes | 9.4 | Open an account Your capital is at risk. |

We compared the following parameters, each chosen for its significance in evaluating brokers suitable for traders seeking affordability and flexibility:

1. Minimum Deposit

Why It’s Important: This parameter determines the initial amount needed to start trading. A low minimum deposit makes trading accessible to beginners or those with limited capital.

2. Minimum Trade Size

Why It’s Important: This reflects the smallest amount that can be traded per transaction. A lower trade size allows for better risk management, especially for new traders testing strategies.

3. Withdrawal Minimum

Why It’s Important: This defines the smallest amount a trader can withdraw from their account. A low withdrawal minimum ensures users can access their funds without unnecessary restrictions.

4. Demo Account Availability

Why It’s Important: Demo accounts allow users to practice trading without risking real money. This feature is vital for learning and strategy testing, especially for those new to binary options.

5. TU Overall Score

Why It’s Important: The Traders Union overall score provides a comprehensive evaluation of the broker's reliability, performance, and user experience, helping traders make informed choices.

Binary Options Brokers With Low Deposits – How Do They Compare?

| CloseOption | IQcent | Raceoption | Nadex | Pocket Option | |

|---|---|---|---|---|---|

|

Min. Payout (%) |

17 | 70 | 70 | No | 50 |

|

Max. Payout (%) |

95 | 95 | 95 | 100 | 128 |

|

Copy trading |

No | Yes | Yes | No | Yes |

|

Crypto trading |

Yes | Yes | Yes | Yes | Yes |

|

Call/Put |

Yes | Yes | Yes | Yes | Yes |

|

Turbo |

Yes | Yes | Yes | No | Yes |

|

Long-Term |

Yes | Yes | Yes | No | Yes |

|

Pair |

Yes | Yes | No | No | Yes |

|

Open an account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

We compared the following parameters, grouped by their relevance to trader preferences and broker features:

Profitability

Min. Payout (%) and Max. Payout (%): Indicates the potential returns on successful trades, helping traders assess the earning potential of the platform.

Trading Options

High/Low (Call/Put), Short-Term (Turbo), Long-Term, Pair: Highlights the variety of trading types available, catering to different strategies and timeframes.

Asset Variety

Crypto Trading: Evaluates whether brokers support trading cryptocurrencies, appealing to traders interested in digital assets.

Additional Features

Copy Trading: Shows if traders can replicate others’ strategies, useful for beginners or passive investors.

These parameters collectively provide a comprehensive view of brokers' usability, profitability, and suitability for diverse trading needs.

How To Make A Binary Options Deposit? Step-By-Step

Binary options allow you to grow and earn more money. However, there are multiple steps included to get started with it, which are as follows:

Step 1: Get to know more about binary options

Many people can find binary options complex, and it is one of the reasons you should get educated regarding it first and then move ahead with the next steps. It will give you a clear picture of how it works and how much you can expect.

Step 2: Connect your device to the internet

Binary trading is done online via trading platforms. You will need mobile phones or a computer device connected to the internet to start the trading.

Step 3: Choose a reputed online binary options

Binary options are often traded through specialized brokers. So, you can choose one renowned broker who will help you choose the best binary platform.

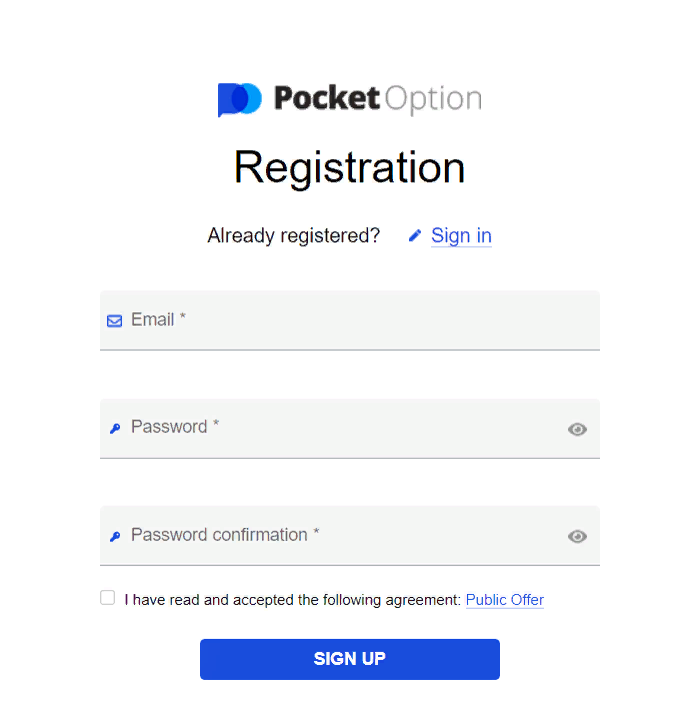

Step 4: Register and binary options trading account

In this process, you have to choose the account type that suits you the best as per the requirements. Make sure that you have enough funds restored to cover the premium.

Account Opening on Pocket Option

Account Opening on Pocket OptionStep 5: Start live trading

This is the last step, and you are ready to start trading finally. To attain your goals, create an authentic strategy to help you a chieve your objectives.

Pocket Option Trading Platform

Pocket Option Trading PlatformWhy Should You Choose a Binary Broker With a Low Minimum Deposit?

There are multiple reasons why a binary broker with a low minimum deposit is the best option for everyone. Some of the prominent reasons are mentioned below:

Easy To Get Started

The significant goal of the brokers is to make it accessible to the investors. If you are just a beginner, who wants to learn more and expand in Binary broker, binary options minimum deposit is the right choice for you. Get started with a minimal deposit, and understand how it turns out.

Free Demo

Investors who are scared of taking risks can start up with a free demo account. You can also watch various video tutorials, read guides, and learn more about it.

Set Your Account With Various Brokers

All the binary options are different from one another. If you want to choose the best one, list out the platforms, compare them and find the one, which completes your requirement. However, do not forget to consider some of the essential things: Minimum Deposit, Promotions, Mobile App, Fees, User Reviews, Customer Service, and Number of Tradable assets.

Best Binary Brokers Deposit And Withdrawal Explained

Binary options trading is one of the foremost schemes for traders. It has helped many low-skilled traders earn extra bucks. The binary platforms, which have higher payouts, have higher deposit bonuses. Choosing the right platform can be a bit challenging for beginners. Therefore, one must consider multiple factors before choosing one, such as country restrictions, customer services, technical support, underlying assets, and platform regulation.

How to start Binary Options trading?

Starting binary options trading involves several steps. Here's a general guide to help you get started:

Educate Yourself: Begin by gaining a solid understanding of what binary options are, how they work, and the associated risks. Learn about different trading strategies and familiarize yourself with market analysis techniques. There are various educational resources available online, including articles, tutorials, and video courses.

Choose a Reliable Broker: Select a reputable binary options broker that aligns with your trading needs. Consider factors such as regulation, asset variety, payout rates, deposit/withdrawal methods, and customer support. It's important to research and compare best binary options brokers with low binary minimum deposit to find one that suits your requirements.

Open an Account: Once you've chosen a broker, open a trading account with them. This typically involves completing a registration process, providing necessary identification documents, and agreeing to the broker's terms and conditions.

Deposit Funds: Fund your trading account with the required minimum deposit (binary trading minimum deposit may be $1). The deposit methods offered by brokers may include bank transfers, credit/debit cards, or e-wallets. Ensure you understand the deposit process and any associated fees or restrictions.

Practice with a Demo Account: Many brokers offer demo accounts where you can practice trading without risking real money. Utilize this opportunity to familiarize yourself with the trading platform, test different strategies, and gain confidence before trading with actual funds.

Learn the Trading Platform: Get acquainted with the trading platform provided by your broker. Understand how to execute trades, set trade parameters (such as expiry times and investment amounts), and use the available charting tools and indicators. Familiarize yourself with the platform's features to effectively analyze the market and execute trades.

Develop a Trading Strategy: Create a trading strategy based on your risk tolerance, financial goals, and market analysis. Determine factors such as asset selection, entry and exit points, money management, and risk management techniques. Remember that consistent profitability often comes from a well-defined strategy and disciplined approach.

Start Trading: Once you have a strategy in place, begin trading by selecting suitable assets and executing trades based on your analysis. Monitor your trades, track their performance, and make adjustments as necessary.

Manage Risk: Implement proper risk management techniques to protect your capital. Set limits on the amount you are willing to risk per trade and avoid overexposing your account to any single trade. Use stop-loss orders and take-profit levels to manage potential losses and secure profits.

Continuous Learning: Forex trading is a dynamic field, and continuous learning is crucial for success. Stay updated with market news, economic indicators, and industry trends. Attend webinars, read educational materials, and engage with the trading community to enhance your knowledge and improve your skills.

Remember, trading binary options involves risks, and it's essential to approach it with caution. Only invest what you can afford to lose, and never rely solely on binary options trading for financial stability.

Pros and Cons Of Low Minimum Deposits Binary Options Brokers

- Pros

- Cons

- Accessibility: Low minimum deposit requirements make binary options trading more accessible to a wider range of individuals. It allows beginners or traders with limited capital to participate in the market and gain experience without needing a substantial initial investment.

- Risk Management: With a low minimum deposit, traders can manage their risk more effectively. They can start with a smaller account size, risking only a fraction of their capital per trade. This can help in learning and practicing risk management techniques before committing larger amounts of money.

- Flexibility: Low minimum deposit brokers provide flexibility for traders to test different strategies or experiment with new trading approaches. They can try out various techniques, trade sizes, and assets without significant financial commitment. This flexibility allows traders to adapt and refine their strategies over time.

- Learning Opportunity: low deposit binary options brokers offer a valuable learning opportunity for novice traders. With a smaller initial investment, traders can gain hands-on experience and understand the dynamics of binary options trading without risking significant capital. This allows them to learn from both successful and unsuccessful trades, refine their strategies, and gradually build confidence before committing larger amounts of money.

- Limited Account Features: Some low minimum deposit brokers may restrict certain features or benefits for accounts with minimal deposits. This can include limited access to educational resources, research tools, or customer support services. Traders should be aware of any limitations that may affect their trading experience.

- Higher Risk of Overtrading: Low minimum deposits may lead to a higher risk of overtrading. Traders with small account balances may be tempted to take excessive risks or make impulsive trades, as the impact of losses is relatively low. This can potentially lead to poor trading decisions and significant losses.

- Potential Limitations on Withdrawals: Certain brokers with low minimum deposits may impose restrictions on withdrawals. They may have higher withdrawal fees, minimum withdrawal thresholds, or longer processing times. Traders should carefully review the withdrawal terms and conditions to ensure they align with their needs and expectations.

It's important to carefully consider the pros and cons of low minimum deposit brokers based on your individual circumstances and trading goals. While low minimum deposits can provide accessibility and flexibility, it's crucial to approach trading with proper risk management, realistic expectations, and a solid understanding of the risks involved in binary options trading.

Expert Opinion

My first piece of advice would be to treat your initial trading balance like a learning and experimentation fund rather than money you expect to withdraw as profits. With a minimal deposit amount, it's easy to feel like you are less at risk and be more cavalier with trades. However, losses still add up quickly. Use the low barrier to entry as an opportunity to try different strategies and assets without pressure to come out ahead financially.

Secondly, research the brokers' withdrawal policies thoroughly before signing up. Some obscure longer waiting periods or higher minimums to take funds out versus depositing. You want a broker where you feel confident you can get your original investment back if you decide binary options aren't for you or the broker isn't a good fit.

Finally, keep position sizes small relative to your balance when first starting out. It's tempting to try and make up for a small account size with larger bets, but this is how new traders often wipe out their deposits rapidly. Stick with 1-2% risk per trade as you're feeling out the markets.

Methodology for compiling our ratings of binary options brokers

Traders Union applies a rigorous methodology to evaluate brokers using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

-

Regulation and safety. Brokers are evaluated based on the level/reputation of licenses and regulations they operate under.

-

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

-

Trading instruments. Brokers are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

-

Fees and commissions. All trading fees and commissions are analyzed comprehensively to determine overall costs for clients.

-

Trading platforms. Brokers are assessed based on the variety, quality, and features of platforms offered to clients.

-

Other factors like brand popularity, client support, and educational resources are also evaluated.

FAQs

What assets can I trade with a low minimum deposit account?

Most brokers allow you to trade major Forex currency pairs, stocks, commodities, and cryptocurrency CFDs even with small account balances.

Are bonuses available on low deposit accounts?

Yes, many brokers offer deposit bonuses up to 100% or risk-free trades even if you deposit only the minimum amount to open an account.

Can my account be disabled if I only make the minimum deposit?

No, as long your account remains active, funded above $0 balance, and you follow all terms, it will stay enabled regardless of your deposit amount.

How long will my minimum deposit last realistically before needing to add more funds?

On average, anywhere from a couple weeks to a couple months, depending on your trade frequency, win/loss rate, and withdrawal activity impacting balance.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Binary options trading is a financial trading method where traders speculate on the price movement of various assets, such as stocks, currencies, or commodities, by predicting whether the price will rise or fall within a specified time frame, often as short as a few minutes. Unlike traditional trading, binary options have only two possible outcomes: a fixed payout if the trader's prediction is correct or a loss of the invested amount if the prediction is wrong.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.