Seedify Launchpad: How It Works & How To Join

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Seedify is a leading Web3 incubator and launchpad specializing in innovative technologies such as DeFi, AI, big data, NFTs, and Web3 gaming. Users can participate in early token sales by staking $SFUND, granting them early access to high-potential projects. To join, participants must connect a compatible wallet, complete KYC verification, acquire and stake $SFUND, and then select projects for investment.

Seedify Launchpad is an incubator and launchpad for blockchain gaming, NFT, and metaverse projects. It provides startups with funding, community development, and marketing support, helping innovative projects scale and succeed. The information will be valuable for both investors seeking high-potential projects and developers looking to secure funding and community backing.

How Seedify Launchpad works

Seedify is a blockchain launchpad and incubator designed to support early-stage Web3 projects, particularly in gaming, AI, and metaverse sectors. It operates as a decentralized platform where new projects can raise funds through Initial Game Offerings (IGOs), Initial NFT Offerings (INOs), and Initial Metaverse Offerings (IMOs) while providing investors with early access to these opportunities.

To participate in the Seedify ecosystem, users need to acquire $SFUND, the platform’s native token. Investors must stake or farm $SFUND tokens to qualify for project allocations. The platform follows a tier-based system, where the amount of $SFUND staked determines the investor’s level and the size of their allocation. Lower tiers rely on a lottery-based selection, while higher tiers receive guaranteed allocations.

Before investing, users must complete a Know Your Customer (KYC) verification to comply with regulatory requirements. Once verified, participants can register for upcoming IGOs, commit funds, and receive tokens before they are publicly traded.

Seedify also runs an incubation program, providing funding, strategic guidance, and marketing support to emerging blockchain projects. Additionally, its NFT and metaverse launchpad allows users to invest in exclusive digital assets tied to gaming and virtual environments.

By combining staking, structured allocations, and incubation support, Seedify creates an ecosystem where both investors and blockchain startups can benefit from early-stage opportunities in the Web3 space.

Rules and conditions for using Seedify Launchpad

To participate in Seedify Launchpad initiatives, users must own SFUND tokens, which serve as the foundation of the platform’s ecosystem. The more SFUND tokens a user holds, the higher their participation tier and access to various projects.

Seedify Tier system and token allocation

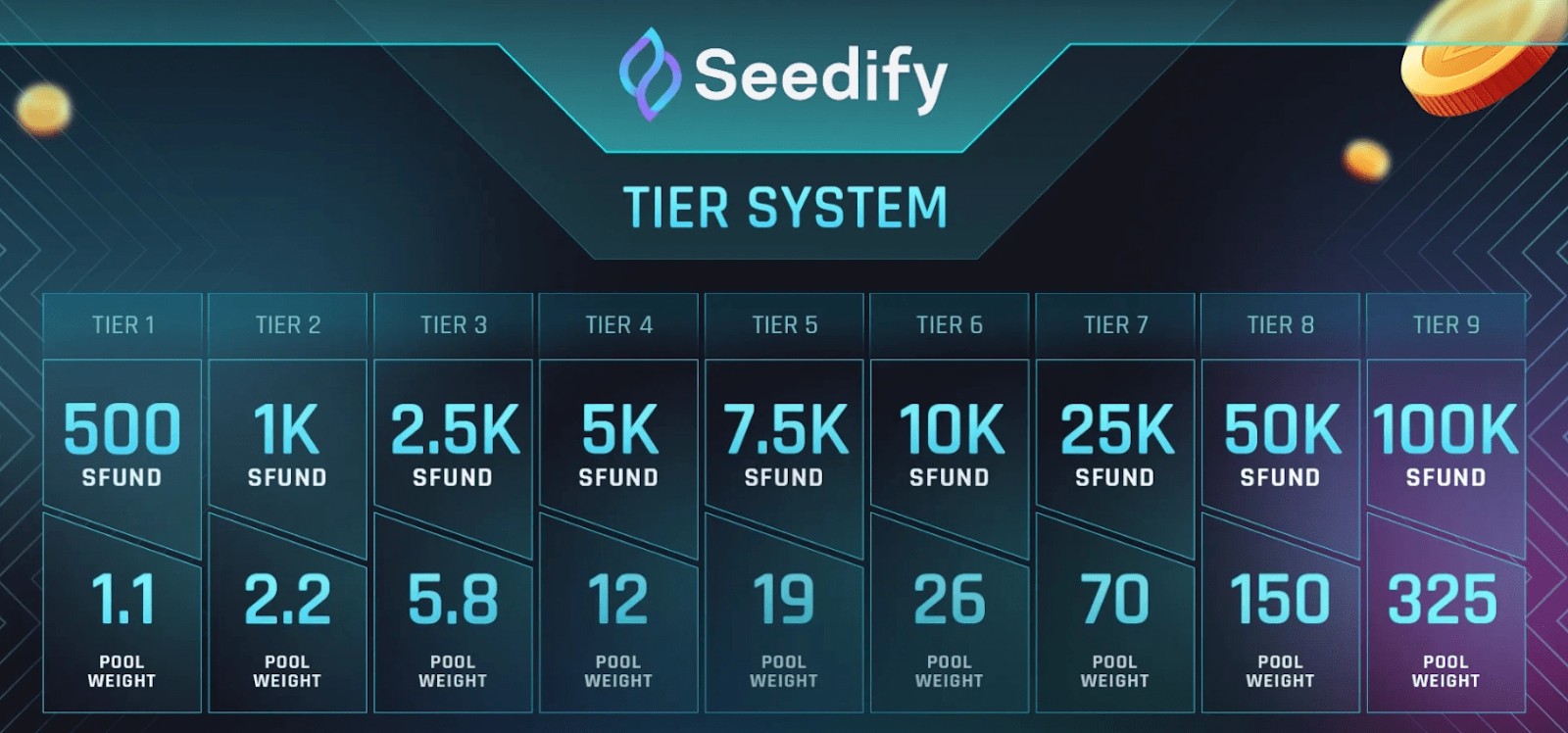

Seedify has implemented a 9-tier system to ensure fair distribution of opportunities among participants:

Tier 1: 250 SFUND — pool weight 1.2.

Tier 2: 1,000 SFUND — pool weight 2.

Tier 3: 2,500 SFUND — pool weight 5.5.

Tier 4: 5,000 SFUND — pool weight 12.

Tier 5: 7,500 SFUND — pool weight 19.

Tier 6: 10,000 SFUND — pool weight 26.

Tier 7: 25,000 SFUND — pool weight 70.

Tier 8: 50,000 SFUND — pool weight 150.

Tier 9: 100,000 SFUND — pool weight 325.

Pool weight in Seedify Launchpad is measured in coefficients that determine the share of tokens distributed among participants.

For Tier 1 participants, token distribution is based on a lottery system, offering even those with a minimal SFUND stake a chance to participate. From Tier 2 and above, participants receive guaranteed allocations, with the pool weight increasing at higher tiers. A higher tier grants a larger share of project tokens.

Participation process

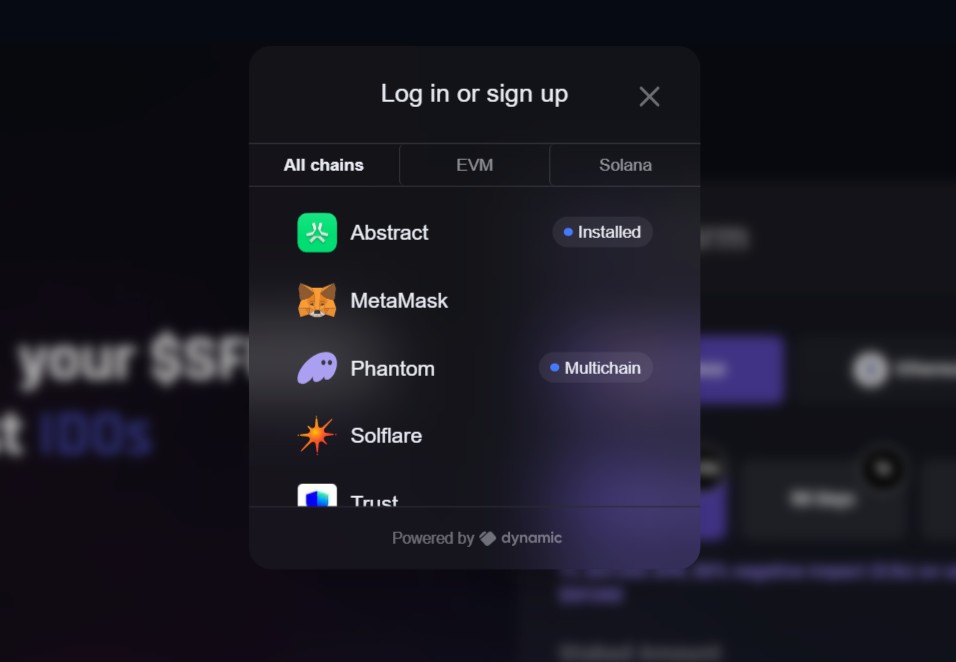

To participate in an IGO (Initial Game Offering) on Seedify, users must follow several steps. First, they need to connect a compatible cryptocurrency wallet, such as MetaMask, to the platform. After that, identity verification (KYC) must be completed by submitting the necessary documents for authentication.

The next step is acquiring and staking SFUND tokens. The number of staked tokens determines the participant’s tier, which directly impacts their allocation size. Once these requirements are met, users gain access to a list of available projects and can invest in those they find promising.

This tier-based system ensures transparent and fair allocation distribution, encouraging active participation and support for innovative blockchain projects. The higher a participant’s tier, the greater their investment opportunities in high-potential projects.

Projects on Seedify Launchpad

Seedify Launchpad has established itself as a leading platform for incubating and launching blockchain gaming, NFT, and metaverse projects. Since its inception, Seedify has supported over 60 projects, many of which have achieved significant success and impacted the industry.

Overview of successful projects

SIDUS HEROES. This project reached an impressive ROI, achieving an ATH (All-Time High) of 109x. The game offers unique gameplay and has attracted a broad audience.

Bloktopia. A blockchain-based virtual world that allows users to interact in a 3D metaverse. The project reached an ATH ROI of 698x, demonstrating its popularity and demand.

ChainGTP. An innovative project focused on integrating blockchain and artificial intelligence technologies. It achieved an ATH ROI, highlighting the potential of such integrations.

How to join Seedify Launchpad

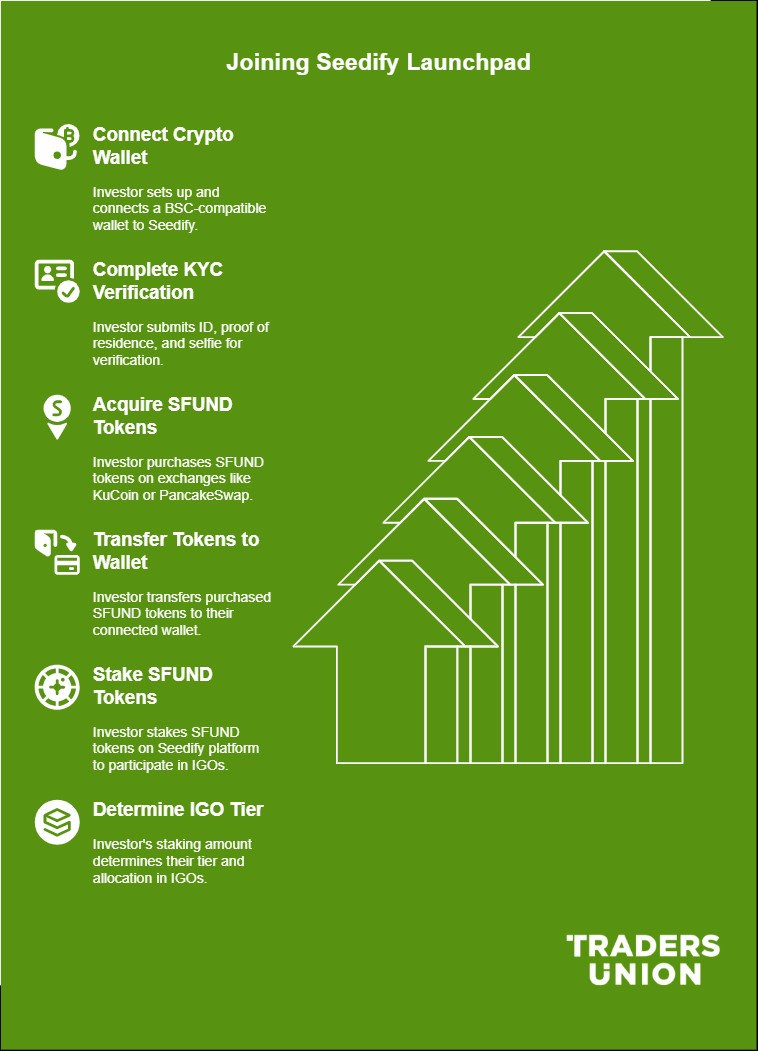

Seedify Launchpad offers investors the opportunity to participate in early-stage blockchain projects through Initial Game Offerings (IGOs). To join, users must complete a few steps, including connecting a crypto wallet, passing KYC verification, and staking SFUND tokens.

Step-by-step guide for investors

1. Connecting a crypto wallet

To get started, investors need to set up a Binance Smart Chain (BSC)-compatible wallet, such as MetaMask or Trust Wallet. After installation, the wallet must be connected to the Seedify platform by selecting "Connect Wallet" and following the on-screen instructions.

2. Completing KYC verification

To participate in an IGO, users must verify their identity through Blockpass by submitting:

A government-issued ID (passport, driver’s license, or national ID).

Proof of residence (utility bill or bank statement).

A selfie for identity confirmation.

Their Ethereum wallet address.

Once approved, the user’s profile will be updated to "Registered", granting them access to investment opportunities.

3. Acquiring and staking SFUND tokens

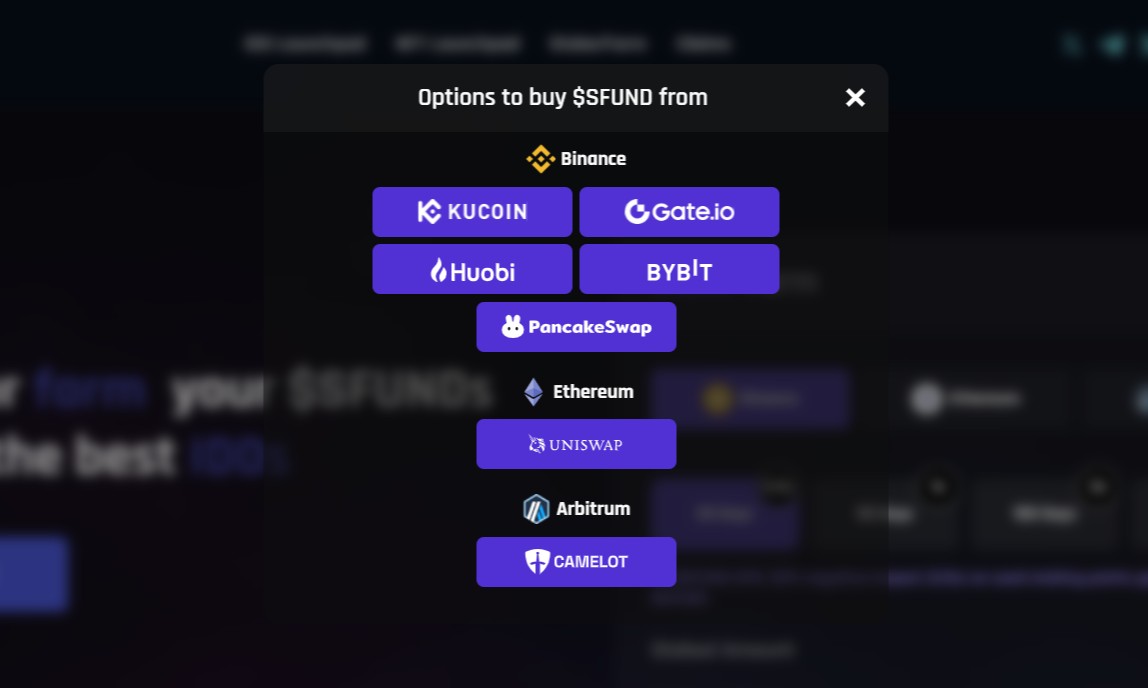

To participate in an IGO, investors need to buy SFUND tokens on supported exchanges such as KuCoin, Gate.io, or PancakeSwap. After purchasing, the tokens should be transferred to the connected wallet and staked on the Seedify platform.

Staking SFUND offers different lock-up periods with varying annual yields:

30 days – 1% APY.

90 days – 3% APY.

180 days – 7% APY.

270 days – 11% APY.

To be eligible for an upcoming IGO, staking must be completed at least 24 hours before the event, as balance snapshots are taken in advance.

How tiers affect IGO participation

Seedify operates a 9-tier system, which determines access to projects and token allocation in IGOs.

Tier 1 (250 SFUND) – Lottery-based participation.

Tier 2+ (from 1,000 SFUND) – Guaranteed allocation.

Higher tiers receive larger allocations, as they depend on pool weight.

Joining Seedify Launchpad requires three key steps: connecting a wallet, completing KYC, and staking SFUND. The tier system determines participation eligibility and allocation size, giving investors flexibility in their strategy and the opportunity to support promising blockchain projects at an early stage.

How to launch a crypto project on Seedify Launchpad

Seedify Launchpad provides developers with a platform to secure funding, gain marketing support, and build a strong community. Blockchain gaming, NFT, and metaverse projects can apply, undergo evaluation, and receive the necessary resources for a successful launch.

Application process for developers

To apply, project teams must submit a form on the official Seedify website, detailing the project concept, technical implementation, business model, and team information. Based on this information, projects go through several selection stages.

The first step is preliminary evaluation. The Seedify team reviews the submitted materials to ensure that the project meets the platform's criteria. If approved, developers proceed to an interview, where they discuss their strategy, market potential, and technical details.

After a successful interview, the project undergoes a detailed audit. Seedify assesses its viability, competitive advantages, and scalability. Following this review, a decision is made on whether the project will be accepted into the incubation program.

Selection and incubation process

Projects that pass the selection process gain access to Seedify’s ecosystem. During the incubation period, the Seedify team helps developers refine their concept, optimize their go-to-market strategy, and prepare for an Initial Game Offering (IGO).

During incubation, Seedify provides support in several key areas:

Connecting projects with investors and strategic partners.

Running marketing campaigns and PR activities.

Helping build an engaged community around the project.

Offering technical guidance and advisory services.

Once the incubation program is complete, the project launches through Seedify and gains access to investments from Launchpad users.

How to increase your success in Seedify: tips for investors and developers

For Investors: staking $SFUND isn’t just about getting a higher allocation — it’s about playing the long game. Look at how previous IGOs handled token unlocks. Some projects release a small percentage of tokens upfront and then unlock the rest over time.

If you're smart about it, you can cash in early profits while keeping a stake in future growth. Also, keep an eye on projects that give token holders voting power. When investors have a say in decisions, the token’s value tends to hold up better after launch because the community stays engaged instead of just flipping for quick gains.

For Developers: a lot of projects struggle after launch because they don’t think past the IGO hype. Instead of offering generic staking rewards, tie rewards to real user activity. If your game or platform rewards people for actual engagement — like completing quests or using features — it keeps your token valuable beyond speculation. And don’t just market inside crypto circles.

Get gaming influencers or industry pros on board to pull in players who don’t know much about crypto but love gaming. This way, you're growing a real audience, not just hype buyers.

Conclusion

Seedify Launchpad plays a significant role in the growth of blockchain gaming, NFTs, and metaverses by providing developers with access to funding, marketing support, and technical guidance. The platform creates an environment where innovative projects can successfully enter the market and build strong communities.

For investors, Seedify offers early-stage participation in high-potential projects, granting access to valuable token allocations. Developers benefit not only from financial backing but also from strategic mentorship, increasing their chances of a successful launch. With its transparent tier system and well-structured token distribution model, Seedify continues to attract participants and strengthen its impact on the industry.

FAQs

What is the minimum capital required to participate in such platforms?

The minimum amount depends on the participation tier. Typically, you need to buy and stake a certain number of tokens, starting from a few hundred dollars. However, for larger allocations, the required amount can be significantly higher.

How can developers improve their chances of getting their project approved?

A project should have a clear economic model, an active community, and a transparent development plan. One effective way to increase approval chances is to release a test version or demo product early to showcase its functionality.

How can investors reduce risks when participating in an IGO?

To minimize risks, diversify investments and analyze projects before joining. It’s important to review tokenomics, project partners, and the development team, as well as monitor community activity to assess long-term potential.

What is the best exit strategy after participating in an IGO?

One approach is to partially take profits at the price peak while holding a portion of the tokens for long-term gains. It’s also crucial to consider token vesting periods to plan the selling strategy accordingly.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.