Best Forex Brokers In Madagascar For 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

If you're too busy to read the entire article and want a quick answer, the best Forex broker in Madagascar is Plus500. Why? Here are its key advantages:

- Is legit in your country (Identified as United States

)

- Has a good user satisfaction score

- Low commissions

- Fast execution speeds

Best Forex brokers in Madagascar are:

- Eightcap - Best broker to trade directly from TradingView charts

- XM Group - Best Order Execution (99.35% of orders are executed nearly instantly)

- RoboForex - Best Forex broker for beginners ($10 min. deposit, copy trading)

- Exness - Best raw spread account (avg. spread for major FX pairs 0.1-0.2 pips)

- VT Markets - Attractive Forex bonuses (50% welcome bonus, 20% deposit bonus)

Forex trading has significantly grown in popularity in Madagascar. The reasons lie in its legality, suitability for the country’s young market, and its developing economy. Madagascar's diverse economy places it 139-th in the world with a nominal GDP of 15 billion USD. As an emerging nation with a growing financial sector, Madagascar’s unique economic prospects have sparked interest in Forex trading.

Success in Forex trading depends on the trader’s skills and sound decisions. However, trading is fundamentally impossible without a reliable broker. For those currently residing in or traveling to Madagascar and looking to choose a broker for Forex trading, this article will talk about the best brokers in Madagascar, the most important factors to consider when choosing one, and valuable tips on how to trade Forex in this country.

Top Forex brokers in Madagascar

Madagascar offers a developing landscape for Forex trading, with several brokers providing services suited to the needs of local traders. These brokers offer decent trading platforms, competitive spreads, and customer support. They also provide educational resources to help traders improve their skills. Security measures are in place to protect client funds. Overall, Madagascar's brokers strive to offer a reliable trading experience.

Below is a comparative table detailing the key features of these brokers:

| Eightcap | XM Group | RoboForex | Exness | VT Markets | |

|---|---|---|---|---|---|

|

Min. deposit, $ |

100 | 5 | 10 | 10 | 100 |

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Leverage, 1: |

Up to 1:500 | 1:30 (only for EU regulated Entity and AU). For all the other countries - 1:1000. | 1:2000 | 1:unlimited for retail clients (Terms and Conditions apply) | Up to 1:500 |

|

Min Spread EUR/USD, pips |

0,4 | 0,7 | 0,5 | 0,6 | 0,4 |

|

Max Spread EUR/USD, pips |

1,5 | 1,2 | 2 | 1,5 | 1,2 |

|

Regulation |

ASIC, SCB, CySEC, FCA | CySEC, FSC (Belize), DFSA, FSCA, FSA (Seychelles), FSC (Mauritius) | FSC | FCA, CySEC, FSA (Seychelles), FSCA, BVI FSC, CBCS, CMA | ASIC, FSCA, FSC Mauritius |

|

Accept citizens of Madagascar |

Yes | Yes | Yes | Yes | Yes |

|

Investor protection |

£85,000 €20,000 | £85,000 €20,000 | €20,000 | €20,000 £85,000 | No |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Considerations for сhoosing Forex brokers

A reliable broker in Madagascar would offer a safe trading environment and useful tools for handling the unpredictable Forex market. When looking at different brokers in Madagascar, keep these important factors in mind:

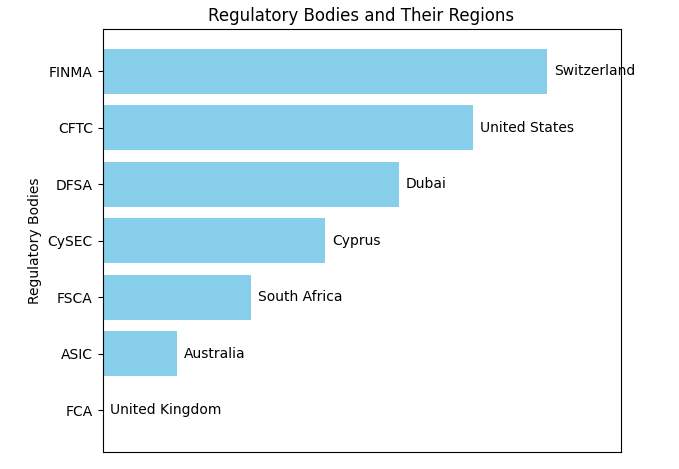

Regulation: Ensures brokers operate under strict guidelines, providing security and trust for traders.

Regulatory bodies and regions: Understand the specific regulatory bodies overseeing brokers in Madagascar.

Fees and spreads: Brokers charge spreads (the difference between buy and sell prices) and sometimes commission fees. Comparing these costs across brokers is crucial.

Platform features: Look for user-friendly interfaces, advanced charting tools, and automated trading capabilities.

Customer service: Responsive customer service is essential for resolving issues quickly and efficiently.

Deposit and withdrawal options: Check the variety of funding methods and ease of deposits and withdrawals.

Reputation and reviews: Broker reputation and user reviews provide insights into reliability and performance.

Educational resources: Educational tools and resources help traders improve their skills and knowledge.

Execution speed: Fast execution speeds are crucial for taking advantage of market opportunities.

What beginners should pay attention to

When starting Forex trading in Madagascar and choosing a broker, novice traders should focus on these essential factors:

Demo accounts and education: Brokers offering demo accounts and comprehensive educational resources enable learning and practice without risking real money.

Local support: Brokers providing customer service tailored to Madagascar, including local language support and convenient communication channels, enhance the trading experience.

User-friendly trading platform: An intuitive and easy-to-use trading platform, suitable for beginners and equipped with necessary tools, is essential. We have compared the best brokers in Madagascar based on their platform support in the table below:

| MT4 | MT5 | cTrader | WebTrader | NinjaTrader | Proprietary platform | |

|---|---|---|---|---|---|---|

| Yes | Yes | No | Yes | No | No | |

| Yes | Yes | No | Yes | No | No | |

| Yes | Yes | No | Yes | No | Yes | |

| Yes | Yes | No | Yes | No | No | |

| Yes | Yes | No | Yes | No | No |

Risks and warnings

Forex trading in Madagascar, as in any other country, carries significant risks. It is important for novice traders to be aware of these potential pitfalls:

Market volatility: The Forex market is highly volatile, and prices can change rapidly, leading to substantial gains or losses.

Leverage risks: High leverage can amplify both profits and losses. It’s crucial to understand how leverage works and to use it cautiously.

Lack of regulation: Not all brokers operating in Madagascar may be fully regulated, increasing the risk of fraud and malpractice. Always verify a broker's regulatory status.

Scams and fraud: Be cautious of scams and fraudulent schemes. Only trade with reputable brokers with positive reviews and transparent operations.

Emotional trading: Emotional decisions can lead to significant losses. Maintaining a disciplined and well-planned trading strategy is essential.

Technical and operational risks: Technical issues, such as platform outages or slow execution speeds, can affect trading outcomes. Ensure your broker has reliable systems and infrastructure in place.

Understand the risks before trading Forex

As a financial expert with extensive experience in the Madagascar Forex market, I want to share some important insights for novice traders.

First and foremost, be aware of market volatility. The Forex market can experience rapid and unpredictable price movements. To navigate this, start by trading small positions and gradually increase your exposure as you gain experience and confidence.

Leverage is another critical factor. While it can amplify profits, it can also significantly increase losses. Use leverage cautiously and never trade more than you can afford to lose. It’s advisable to start with lower leverage ratios and only increase them as you become more comfortable with your trading strategy.

When trading through brokers, especially in emerging markets, regulation is an important consideration. Ensure your broker is regulated by reputable authorities. This provides a level of security and trust that your funds are being handled properly. Always verify the broker's regulatory status before committing your money.

Lastly, educate yourself continuously. The Forex market is complex, and staying informed about market trends, economic news, and trading strategies can help you make more informed decisions. Use the educational resources provided by brokers and consider joining trading communities to learn from experienced traders.

Our Methodology

Traders Union applies a rigorous methodology to evaluate brokers using over 100 both quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

Regulation and safety. Brokers are evaluated based on the level/reputation of licenses and regulations they operate under.

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

Trading instruments. Brokers are evaluated on the breadth and depth of assets/markets available to trade.

Fees and commissions. A comprehensive analysis is done of all trading costs to analyze overall cost to clients.

Trading platforms. Brokers are assessed based on the variety, quality and features of platforms offered to clients.

Other factors like brand popularity, customer support, education resources are also evaluated

Conclusion

Forex trading in Madagascar has its own opportunities and challenges, and the right broker can help you handle the market better. When choosing a broker, look at regulation, fees, platform features, customer support, and educational resources. Also, know the risks and have a good trading strategy. By keeping these in mind, traders in Madagascar can make better decisions and improve their trading experience.

FAQs

Are there any local regulatory bodies for Forex brokers in Madagascar?

While Madagascar does not have a specific regulatory body for Forex brokers, it is important to choose brokers regulated by reputable international authorities. This ensures a higher level of security and compliance with global standards.

What payment methods are commonly supported by Forex brokers in Madagascar?

Forex brokers in Madagascar typically support a variety of payment methods, including bank transfers, credit/debit cards, and popular e-wallets like Skrill and Neteller. It's important to check the broker's website for specific options and any associated fees.

How can I verify the legitimacy of a Forex broker in Madagascar?

To verify the legitimacy of a Forex broker, check if they are regulated by well-known international regulatory bodies such as the FCA, ASIC, or CySEC. Additionally, read reviews from other traders and visit financial forums to get a sense of the broker’s reputation.

Is it possible to trade Forex on mobile devices in Madagascar?

Yes, many Forex brokers in Madagascar offer mobile trading platforms or apps compatible with both Android and iOS devices. These mobile platforms provide a convenient way to monitor and execute trades on the go, ensuring you never miss a market opportunity.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).