How To Invest In S&P 500

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to Invest in S&P 500:

- Open an account;

- Choose your investments;

- Place your order;

- Monitor and rebalance your portfolio.

For beginner investors, the S&P 500 offers a straightforward way to diversify their portfolios across multiple sectors, including technology, healthcare, finance, and consumer goods. By investing in the S&P 500, you can benefit from the growth of these leading companies while mitigating the risks associated with investing in individual stocks.

In this guide, we'll explore the various options for investing in the S&P 500, the benefits of including this index in your portfolio, and tips for getting started. Whether you're a seasoned investor or just beginning your investment journey, understanding how to invest in the S&P 500 can help you build a solid financial foundation.

How to invest in S&P 500: step-by-step guide

Open an investment account

To start investing in the S&P 500, you must open an investment account. This can be a standard brokerage account, an IRA, or a 401(k). Each type of account has its own advantages:

Brokerage account: Offers flexibility and access to a wide range of investment options.

IRA (Individual Retirement Account): Provides tax advantages for retirement savings.

401(k): Often includes employer matching contributions and tax benefits.

Most brokers allow you to open an account online within minutes. You'll need to provide some personal information and choose your account type. You can check out the best brokers to trade S&P 500 before making a decision.

We advise you to familiarize yourself with this comparison table to choose the best broker for you:

| Yes | Min. deposit, $ | Leverage, 1: | ETFs | Indices | Investor protection | Open account | |

|---|---|---|---|---|---|---|---|

| Yes | 100 | Up to 1:30 or up to 1:300 | Yes | Yes | €20,000 £85,000 SGD 75,000 | Open an account Your capital is at risk. |

|

| Yes | No | Up to $400:1 retail, 500:1 Pro | Yes | Yes | £85,000 €20,000 €100,000 (DE) | Open an account Your capital is at risk.

|

|

| Yes | No | Up to 1:200 | No | Yes | £85,000 SGD 75,000 $500,000 | Open an account Your capital is at risk. |

|

| Yes | 100 | Up to 1:400 | Yes | Yes | £85,000 | Study review | |

| Yes | No | Depending on the asset | Yes | Yes | $500,000 £85,000 | Open an account Your capital is at risk. |

Choose your investments

Once you have your investment account, you need to decide whether to invest in ETFs, mutual funds, or individual stocks:

ETFs (Exchange-Traded Funds): ETFs offer a low-cost way to invest in the entire S&P 500. They trade like stocks on an exchange, meaning you can buy and sell them throughout the trading day at market prices. ETFs are known for their low expense ratios, making them a cost-effective choice for many investors. Popular options include the SPDR S&P 500 ETF (SPY) and the Vanguard S&P 500 ETF (VOO).

Mutual Funds: These also track the S&P 500 but are bought and sold at the end of the trading day at the net asset value (NAV). While they might have slightly higher fees compared to ETFs, they offer the same broad market exposure. The Vanguard 500 Index Fund (VFIAX) is a well-known mutual fund that mirrors the performance of the S&P 500.

Index Funds: These are similar to mutual funds but often have lower fees. They are also designed to replicate the performance of the S&P 500.

Individual Stocks: If you prefer a more hands-on approach, you can buy stocks of individual companies within the S&P 500. This option requires more research and is riskier because your investment is not spread out across the entire index. However, it allows you to potentially benefit more from the success of specific companies.

Place your order

After choosing your investment, the next step is to place an order through your brokerage account. For ETFs and mutual funds, you can search for S&P 500-specific options like SPDR S&P 500 ETF (SPY) or Vanguard 500 Index Fund (VFIAX). Follow the instructions on your broker’s platform to complete the purchase.

Monitor and rebalance your portfolio

Regularly monitoring and rebalancing your portfolio is crucial to ensure it stays aligned with your investment goals. Rebalancing involves adjusting your holdings to maintain your desired asset allocation, which helps manage risk and optimize returns. Use tools and features your broker provides to track performance and make necessary adjustments.

Considerations for beginners

When starting your investment journey, it's crucial to begin small and diversify your investments to manage risk effectively.

Start small and diversify

Begin with modest investments and gradually increase them. Diversifying your investments, such as through the S&P 500, reduces risk by spreading your money across 500 different companies.

Use Robo-advisors

Robo-advisors simplify investing by using algorithms to create and manage diversified portfolios based on your risk tolerance and goals, often at lower fees than traditional advisors.

Betterment: Offers personalized investment plans, automatic rebalancing, and tax-loss harvesting with low fees.

Wealthfront: Provides automated investment management with additional financial planning tools and tax-loss harvesting.

Considerations for advanced traders

Advanced traders should focus on optimizing their portfolios through tax-efficient strategies, hedging, and diversification across different asset classes.

Tax optimization

Use tax-loss harvesting to offset gains with losses, reducing your tax liability. For example, sell underperforming investments to balance out gains from profitable ones.

Using options for hedging

Hedge your investments using options. For instance, buying put options can protect your portfolio from significant losses during market downturns.

Diversify across asset classes

Maintain a diversified portfolio that includes bonds, commodities, and real estate, along with stocks. This helps manage risk and improves potential returns.

Choose tax-efficient funds and accounts

Invest in tax-efficient funds like ETFs and use tax-advantaged accounts such as Roth IRAs or 401(k)s to maximize after-tax returns.

Pros and cons of investing in the S&P 500

- Pros

- Cons

- Diversification: Exposure to 500 large U.S. companies.

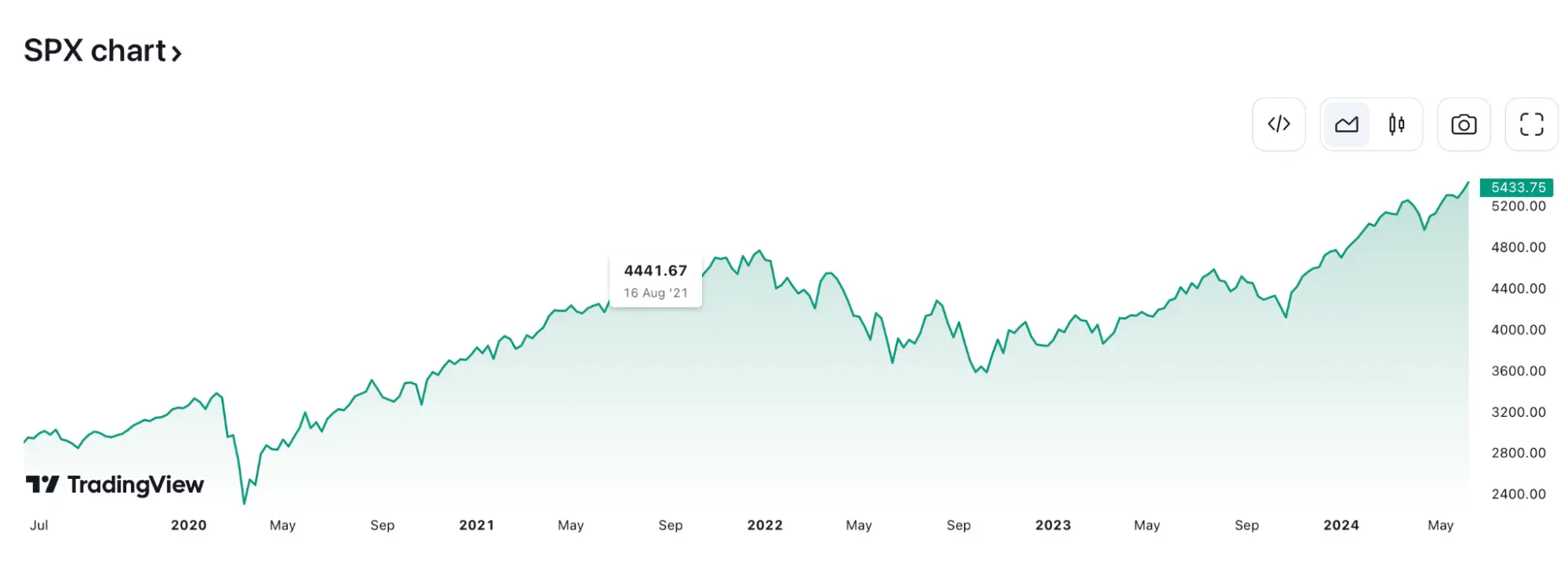

- Historical performance: The S&P 500 has historically provided strong returns.

- Low cost: ETFs and index funds tracking the S&P 500 often have low expense ratios.

- Lack of international exposure: Limited to U.S.-based companies.

- Market volatility: Can be affected by economic downturns and market fluctuations.

Top-performing companies in the S&P 500

Top-performing companies in the S&P 500 include Apple, Microsoft, Amazon, and Alphabet (Google). These firms have shown consistent growth and innovation, significantly contributing to the index's overall performance.

Apple (AAPL): Known for its innovation in technology and consumer electronics.

Microsoft (MSFT): A leader in software and cloud computing.

Amazon (AMZN): Dominates e-commerce and cloud services.

Alphabet (GOOGL): Parent company of Google, leading in online advertising and technology.

How much can I earn in the S&P 500?

The S&P 500 has historically returned about 10% per year on average. This means that a $10,000 investment could grow significantly over time. For example:

10 years: Approximately $25,937

20 years: Approximately $67,275

30 years: Approximately $174,494

These projections assume a consistent annual return and do not account for fees or taxes. Read our S&P 500 Price Prediction - SPX Forecast for 1 Day, Week, Month. This will allow you to make reasoned decisions.

Regularly review and adjust your investment strategy

Make the S&P 500 a key part of your investment strategy. The S&P 500 includes 500 of the largest U.S. companies, providing broad market exposure and diversification across various industries.

Investing in the S&P 500 can be straightforward. One of the easiest ways is through an S&P 500 index fund or ETF, which replicates the index's performance. Opt for funds with low expense ratios to keep your costs down and your returns higher.

Consider dollar-cost averaging, which means investing a fixed amount regularly. This method can help you manage market volatility and avoid the pitfalls of market timing.

Be mindful of the tax implications of your investments. Some funds are more tax-efficient than others, so it's wise to understand your tax situation and seek advice from a financial advisor if necessary.

Regularly review and adjust your investment strategy. Both the market and your financial goals can change over time, so staying informed and adaptable is important. Investing in the S&P 500 requires a long-term perspective, but with patience and careful planning, it can significantly contribute to your financial success.

Summary

To invest in the S&P 500, start by determining your investment goals and risk tolerance. Choose the right investment vehicle, such as ETFs (e.g., SPDR S&P 500 ETF) or index funds (e.g., Vanguard 500 Index Fund).

Consider setting up automatic dividend reinvestment and using a dollar-cost averaging strategy to mitigate market volatility. Regularly review and rebalance your portfolio, maintaining a long-term perspective to capitalize on the S&P 500's historical growth. Stay informed and avoid impulsive decisions based on short-term market fluctuations.

FAQs

What are the best ways to invest in the S&P 500?

The best ways to invest in the S&P 500 are through index funds and exchange-traded funds (ETFs) that track the index's performance. These options offer low-cost, diversified exposure to the 500 largest publicly traded companies in the U.S.

What is dollar-cost averaging, and how can it benefit me?

Dollar-cost averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. This approach can help manage market volatility, reduce the impact of market timing, and lower the average cost of your investments over time.

How do I choose the right S&P 500 fund?

Сhoosing an S&P 500 fund, consider factors such as expense ratios, tax efficiency, and the fund's performance history. Look for low-interest funds to maximize your returns, and consult with a financial advisor to ensure the fund aligns with your investment goals and risk tolerance.

What are the risks of investing in the S&P 500?

While the S&P 500 is generally considered a stable investment, it is not without risks. The value of your investment can fluctuate due to market volatility, economic downturns, and changes in the performance of the underlying companies. Diversifying your portfolio and maintaining a long-term investment perspective can help mitigate some of these risks.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

A Robo-Advisor is a digital platform using automated algorithms to provide investment advice and manage portfolios on behalf of clients, often with lower fees than traditional advisors.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.