Fidelity (Fidelity Investments) Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Active Trader Pro

- Up to 1:1

- You can create an investment portfolio from fractional shares

Our Evaluation of Fidelity

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Fidelity is a reliable broker with the TU Overall Score of 7.27 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Fidelity clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

Fidelity is regulated by the US Securities Commission (SEC). The minimum amount to start working with a broker is $1. Fidelity does not provide leverage, so the company's client must trade exclusively with deposited funds. The company's trading fees are low, and there is no withdrawal fee. The trading platform for transactions - Active Trader Pro, has a straightforward and convenient interface, works stably, and allows you to create up to 50 trade orders simultaneously. Fidelity Investments offers favorable conditions for investors and traders of all skill levels but is more focused on large investors.

Brief Look at Fidelity

Fidelity Investments is a large American financial services company. It was founded in 1946 by American businessman and lawyer Edward Crosby Johnson II. It provides services to traders in trading securities and commodity assets and allows investors to invest in mutual funds and investment funds, form portfolios for a variety of instruments, including bonds and annuities with fixed income. The company has received several awards: according to Barron's, Investors Business Daily, Kiplinger, and Stock Brokers. Fidelity Investments is recognized as the best online broker of 2020.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- availability of its own trading terminal for active trading, Active Trader Pro, with advanced analytics from experts and a wide range of technical analysis tools;

- no brokerage fee for consulting services with an account balance of up to $10,000, and only $3 if a larger deposit is made;

- there is the possibility of individual planning for investors, while the cost of the service is 0.5% of the size of the deposit for each month of use.

- lack of localization;

- there are no active bonus programs; nor is there an opportunity to receive additional profit for attracting new customers;

- margin trading is possible if the account balance exceeds 250 thousand dollars;

- the demo account is limited in functionality and involves working only with investment portfolios.

TU Expert Advice

Author, Financial Expert at Traders Union

Fidelity Investments provides a range of services including trading stocks, commodities, ETFs, options, bonds, and annuities, accessible via the Active Trader Pro platform. It offers Traditional IRA, Rollover IRA, and brokerage accounts with a minimum deposit requirement of $0 and no charges on withdrawals. Its clients can also benefit from low trading fees and the option to invest in fractional shares. Additionally, Fidelity provides educational resources and investor guidance, making its offerings suitable for both novice and experienced traders.

However, Fidelity comes with certain drawbacks such as the absence of active bonus programs and limited demo account features. The requirement for a substantial account balance for margin trading may also be a disadvantage for those with limited capital. Consequently, individual investors with smaller portfolios may find leverage offered limiting compared to high-leverage CFD brokers. Overall, Fidelity Investments is more suited to investors and traders who prefer traditional stock and fund investments, as well as those who prioritize low costs over high leverage options.

Fidelity Summary

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

| 💻 Trading platform: | Active Trader Pro |

|---|---|

| 📊 Accounts: | Demo, Traditional IRA, Rollover IRA, ROTH IRA, Brokerage Account, brokerage and fund management, account "529", Fidelity Go, Fidelity personalized management and consulting |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Visa, Mastercard, Wire Transfer |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | Up to 1:1 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | $1 |

| 💱 EUR/USD spread: | From USD 0 to 0.03 per $1000 turnover |

| 🔧 Instruments: | Shares, commodity assets, exchange-traded (ETF), mutual and investment funds, options, futures, bonds, annuities, fractional shares |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | You can create an investment portfolio from fractional shares |

| 🎁 Contests and bonuses: | For the present, there are no active bonuses |

The Fidelity Investments broker offers traders and investors a large number of account types to choose from. For some instruments, a commission is not charged; for the rest, it is hundredths of a percent. The size of the initial deposit starts from $1, and there is no commission for withdrawing funds. You can start trading after preliminary training on a demo account. To open it, you just need to arrange guest access on the company's website.

Fidelity Key Parameters Evaluation

Video Review of Fidelity

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To get started with the Fidelity Investments broker, you need to follow several steps:

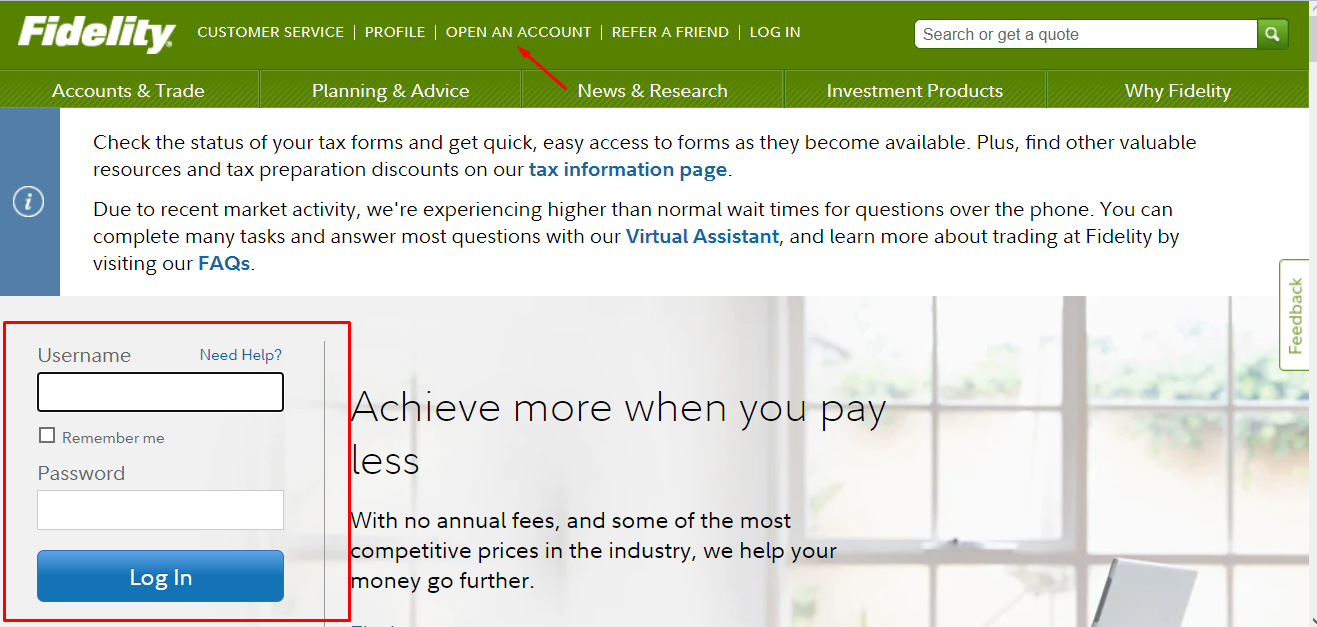

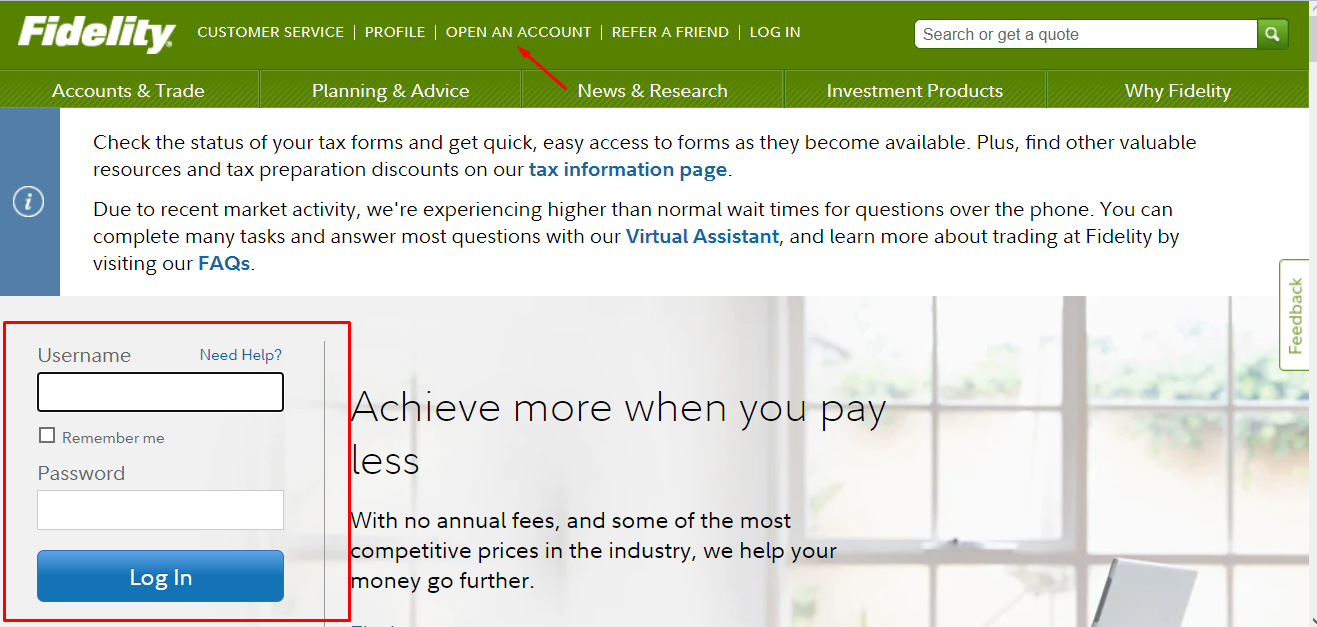

Go through the authorization procedure if you have previously registered on the company's website. If you want to become a new client, you must click "Open an account".

Carefully read the offered account conditions and choose the type of account that suits your strategy. Fill in the registration form, download and install the Active Trader Pro terminal.

Through your personal account, the trader gains access to the following set of functions:

Also, here you can:

-

Deposit or withdraw funds.

-

Contact support.

-

View quotes of traded instruments.

-

Simultaneously place up to 50 orders with requests to buy/sell assets.

Regulation and safety

The regulator of Fidelity Investments is the US Securities Commission (CRD#: 7784/SEC#: 8-23292). Under the requirements of the state regulatory body, the broker publishes documents with a list of conditions for the services offered on its website in the public domain.

Fidelity Investments is also a member of SIPS, a non-profit organization created by the American Congress.The main task of SIPS is to ensure the return of invested funds to investors in the event of bankruptcy of a brokerage company.

Advantages

- SIPS guarantees a refund in case of bankruptcy of the company

- All basic documentation describing trading conditions is in the public access

- Regulated by the laws of the United States

Disadvantages

- The information on the broker's website is intended for US citizens only due to regulatory requirements

- Foreign investors face difficulties due to the need to contact regional offices

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Traditional IRA | From $2 | No |

| Rollover IRA | From $2 | No |

| ROTH IRA | From $2 | No |

| Brokerage Account | From $2 | No |

| Brokerage and fund management | From $2 | No |

| Account «529» | From $2 | No |

| Fidelity Go | From $2 | No |

| Fidelity personalized management and consulting | From $2 | No |

The broker does not have swaps for transferring positions to the next day. Below, there’s a table showing the results of a comparative analysis of brokers by the size of the fees. The companies are assigned levels from "low" to "high" depending on the size of the commission.

Account types

Fidelity Investments offers a choice of 8 account types. The differences lie in the bundle of trading instruments and the nature of the proposed strategies.

Account types:

Before starting work on a real account, there is an opportunity to practice on a demo version. Simulation of trading on a demo account allows you to independently form a virtual portfolio and check the effectiveness of your chosen strategy.

Fidelity Investments is a company that has kept pace with the times throughout all the years of its existence. Tradition is successfully combined with innovation here.

Deposit and withdrawal

-

There is no commission by the broker for withdrawing funds.

-

There are no additional charges for ATM withdrawals in the United States.

-

You can leave an online withdrawal request at any time, including on weekends and holidays.

-

Transfer to a card is made within 24 hours; to a bank account will take up to 5 business days.

-

It is possible to instantly block the transfer at the request of the client.

Investment Options

A significant list of instruments is available to investors such as mutual investment and exchange-traded funds, shares, fixed income securities (short-term and long-term), and the ability to form a portfolio of fractional shares. A share can be purchased for $1. For the convenience of its clients, the company offers a calculator for assessing the profit potential from investments into fixed income, which can also be used for planning retirement.

Annuities are a safe investment with a guaranteed fixed or variable income

The broker's clients can use the investment in annuities to create retirement savings. The level of the minimum deposit for this type of investment varies from USD 5,000 to 50,000. The investment period is 3 to 10 years. An important advantage of working with annuities is tax exemption until the profit is withdrawn from the account, which allows you to accurately plan future profits. Fidelity Investments allows you to invest in instruments with variable and fixed income.

The main features of the latter:

-

The investor can choose the start date of payments and change it, but no more than two times.

-

There are options with the ability to withdraw profits during the entire duration of the program, which the broker positions as a reliable source of constant income.

-

Delayed payments can be adjusted for future reinvestment.

This type of investment makes it possible to diversify risks. Regardless of the market situation, the investor is guaranteed to receive back the amount of his initial investment. He also has the opportunity to select a specific set of tools after preliminary calculations and planning. Investors have access to the services of a personal manager-consultant and direct communication with a professional investment specialist.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Fidelity Investments affiliate program

The affiliate program does not require any payments by the trader and was created for the convenience of attracting new customers. Registered traders are invited to tell Fidelity Investments the names and email addresses of their acquaintances, and write them personal recommendations in favor of the company. After that, the broker sends to the email of the invited users its proposals for cooperation with the attachment of a link to the information services of Fidelity Investments.

Perhaps the reason for the lack of rewards for partners is the popularity of this broker, which has managed to recommend itself very well. Decades of working in the global financial markets make a cooperation with Fidelity Investments attractive for traders.

Customer support

The broker's customer support services are available 24/7.

Advantages

- 24/7 access

- Several options for communication

Disadvantages

- It takes several days to receive the answer via email

Ways to contact the broker’s representatives:

-

by phone;

-

using an automatic assistant via online chat;

-

through the application form on the website to obtain advice from an investment specialist.

Support is available both through the broker's website and through your personal account.

Contacts

| Foundation date | 2046 |

|---|---|

| Registration address | 155 Congress Street, Boston, USA |

| Regulation | US Securities Commission (SEC), SIPS |

| Official site | fidelity.com |

| Contacts |

800-343-3548

|

Education

To teach the basics of stock trading, a special training center has been created on the Fidelity Investments website. It includes online webinars, analytical reviews, and a five-step trading starting guide. All these services are free and available to everyone without registration.

The knowledge gained can be tested on a demo account, on which the formation of an investment portfolio is available.

Detailed Review of Fidelity

Fidelity Investments is a large company with a reputation as a reliable partner for its clients. After analyzing the offered accounts and conditions, we can conclude that it is well suited for traders, but to a greater extent, it is still focused on investors. Clients with significant capital receive comfortable trading conditions due to the existence of low commissions. Also, Fidelity Investments publishes all legal documentation on services and tools on its website for free access.

Here are a few numbers about the Fidelity Investments broker which will help a trader to choose a reliable broker.

-

Employs about 45 thousand workers.

-

484 funds under management.

-

Over 75 years of experience in financial markets.

Fidelity Investments is a broker for large investors

Through Fidelity Investments, investors get the opportunity to invest in funds with low commissions and can form portfolios from share fractions. The broker provides a variety of instruments with fixed income and guaranteed returns, at least for the initially invested funds. The company's clients always have access to support and investment advisors. Simultaneous work on several accounts is possible. Active Trader Pro always works stably and allows you to place up to 50 orders at the same time.

A separate section of the company's website contains a list of investment funds by industry: energy, real estate, pharmaceuticals, information technology, finance, consumer goods, industry, etc. An important factor is the ability to plan a trading strategy in advance using the broker's analytical materials and expert advice. All important information is available around the clock and in real-time.

Useful services of Fidelity Investments:

-

Financial News & Guidance is a section with the latest financial news, investment ideas, and guidance from trusted information sources.

-

Learning Center. It reflects current market trends and hosts analytics on personal finance, investment products, and trading strategies.

-

Notebook. This app helps registered clients capture, track, and store investment ideas in one place on any device, and provides updated information on prices, earnings, and dividends.

Advantages:

Zero initial deposit.

No commission when working with American stocks and exchange-traded funds.

24-hour support services.

Availability of information on trading conditions.

A variety of investment programs.

The presence of a regulator.

There are no restrictions on investment strategies. There is an opportunity for both independent trading and professional help.

Latest Fidelity News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i