deposit:

- $1

Trading platform:

- Console

- Kite

- Kite Connect API

- Sentinel

- Coin

- Securities and Exchange Board of India (SEBI)

Zerodha Review 2024

deposit:

- $1

Trading platform:

- Console

- Kite

- Kite Connect API

- Sentinel

- Coin

- No

- The ability to form your own investment portfolio

Summary of Zerodha Trading Company

Zerodha is a moderate-risk broker with the TU Overall Score of 6.73 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Zerodha clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Zerodha ranks 19 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Zerodha is a stockbroker that targets traders and investors from India.

The Zerodha brokerage company was registered in India on August 15, 2010, by professional trader Nitin Kamata. Its registration number is INZ000031633. This stockbroker allows you to trade securities and make short-term and long-term investments on the stock exchange. It is the number one stockbroker in India in terms of trading volume and the number of its clients. About 4 million traders place orders daily through zerodha.com investment platforms, which accounts for over 15% of India's total retail trade in this sector.

| 💰 Account currency: | Rupee |

|---|---|

| 🚀 Minimum deposit: | From Rs 0 |

| ⚖️ Leverage: | No |

| 💱 Spread: | Nonexistent |

| 🔧 Instruments: | Stocks, futures, options, assets of stock and commodity markets |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Zerodha:

- The existence of several proprietary trading platforms, including for mobile devices (iOS and Android), that are designed for both beginners and experienced traders.

- There is no minimum deposit requirement.

- According to customer reviews, the company offers the most transparent and understandable conditions: low commissions on real accounts, the possibility of intraday trading, access to the formation of your own mutual fund.

- The interface of all terminals and the broker's website are available in Hindi and English.

👎 Disadvantages of Zerodha:

- You cannot trade on Forex through this broker.

- It does not provide an opportunity to work on MT4 and MT5.

- A fee is charged for opening and maintaining an account.

- Trading platforms periodically freeze and do not display trade statistics.

Evaluation of the most influential parameters of Zerodha

Geographic Distribution of Zerodha Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Zerodha

For over 10 years, Zerodha has been to Indians a model of honesty and transparency in the Indian financial market. The professional team of the company has created a whole ecosystem of high-tech products that allow you to trade on many devices. The Varsity training section provides an opportunity to study the stock market in detail and improve your knowledge.

Zerodha is a zero debt company with account holders and investors. Customers' securities are kept in segregated accounts, that is, they are completely separated from the company's capital. Investors who have opened an account with Zerodha are protected from negative a balance. However, the broker does not offer trading with margin leverage.

Investing in mutual funds with Zerodha is completely free. No brokerage fees, no software usage fees, and no upfront, hidden or interim fees from fund managers. Besides, there is no limit on the size or number of trades. By offering these terms, Zerodha attracts many large traders and investors who end up paying commissions when trading derivatives.

Dynamics of Zerodha’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Zerodha offers its clients opportunities to invest in stocks, futures, and options; and build their own portfolio of securities, as well as create option combinations using delta neutrals and other strategies. The company does not provide clients with access to services for copying trades and portfolios of other traders. Also, you cannot invest in PAMM or LAMM accounts through Zerodha.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Zerodha’s affiliate program:

-

Referral program. This is for clicking on the referral link and opening a brokerage account, the connected client and Zerodha partner receive 300 points each. For registration in the program, a partner is awarded 100 points once.

Points can be used to gain access to trading and investment applications such as Smallcase, Sensibull, Streak, etc. The trader's personal account displays the required number of points to subscribe to the service.

Trading Conditions for Zerodha Users

Zerodha’s trading conditions are designed for traders with different skill levels. The broker allows anyone to invest: the minimum deposit starts from 1 rupee. Zerodha customers can invest in stocks, currency futures, commodities, and mutual funds. The company accepts payments and withdraws funds only via bank transfer. Forex trading with Zerodha is not available. Zerodha is a regulated broker.

$1

Minimum

deposit

1:1

Leverage

24/5

Support

| 💻 Trading platform: | Console, Kite, Kite Connect API, Sentinel, Coin |

|---|---|

| 📊 Accounts: | Demat |

| 💰 Account currency: | Rupee |

| 💵 Replenishment / Withdrawal: | Bank transfer |

| 🚀 Minimum deposit: | From Rs 0 |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | Nonexistent |

| 🔧 Instruments: | Stocks, futures, options, assets of stock and commodity markets |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | The ability to form your own investment portfolio |

| 🎁 Contests and bonuses: | No |

Zerodha Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Demat | From $ 0.5 | Yes |

Swaps (overnight transfer fees) are not charged. Our analysts have also compared the terms and conditions of the trading accounts of Zerodha and other brokers. As a result of the calculations, we assigned each company a level: low, medium, or high. The results of the analysis can be found in the table below.

| Broker | Average commission | Level |

| Zerodha | $0.5 | Low |

| ETrade | $1 | Medium |

| Charles Schwab | $11 | High |

Detailed Review of Zerodha

The main investment activities offered by Zerodha are stocks, F&Os, commodities, currencies on the NSE, BSE, MCX, and MCX-SX, as well as investments in direct mutual funds, ETFs, government securities, and bonds. The broker charges a fixed commission of Rs 20 per trade regardless of the trading volume, which naturally attracts many investors.

The main figures that characterizes the broker are:

-

It has been operating since 2010.

-

It ranks first in India among the brokerage companies in terms of trade turnover

-

More than 4 million investors use Zerodha’s services.

-

More than 1 million traders open trades through the broker every day.

Zerodha is a fixed commission, passive investment stock broker

The uniqueness of Zerodha lies in the transparency of its conditions and the ability to create various combinations of shares and derivatives. Clients must have a sufficient balance in their accounts to hold/transfer positions. This means that there is no margin trading (leveraged trading) for stocks and ETFs. Intraday trading is allowed for all non-agricultural products except Brent Crude (crude oil) and silver. Leverage depends on market conditions and its proportion changes.

The company has many years of experience in creating conditions for traders who want to make money on changes in the value of stocks, futures, and options. Zerodha became the first broker in India to offer its clients direct investment in mutual funds without charging trading fees. Trading is available in the COIN terminal.

Useful services of Zerodha Investments:

-

Console. The central dashboard displays the customer’s account at Zerodha, which provides access to detailed reports and price charts.

-

Kite. This is a trading and investment platform with convenient functionality that provides clients with access to the stock market.

-

Kite Connect API. This is an algorithmic trading application for private traders.

-

Sentinel. This is a platform that allows you to create market portfolios. They can be adjusted depending on the price, the number of trades, and the accepted level of risk.

-

Z Connect. This is a blog dedicated to trading and investment. Analysts of the company publish articles and useful information here. Any user can ask questions and leave comments.

-

Varsity. An extensive collection of stock market lessons is in Hindi and is available to every client of the company.

-

Coin. An application for buying mutual funds without commission.

Advantages:

Zerodha strictly adheres to Indian laws and conducts business under the requirements of the regulator.

Transparent and understandable working conditions.

Availability of browser and mobile versions of trading platforms.

Has a knowledge base with informative lessons.

The ability to form investment portfolios and trade stock market instruments.

Low brokerage fees for trading stocks and derivatives.

Also, Zerodha collaborates with many leading stock market platforms and portals such as Streak, Sensibull, and others.

How to Start Making Profits — Guide for Traders

Zerodha provides the client with a single trading account, where there are no requirements for the size of the minimum deposit. The account opening fee is Rs 200, operating service fees are Rs 300 per year. No commission is charged for inaction.

Account types:

The broker does not have a demo account, but the Demat account allows you to invest funds with at least 1 rupee on the balance.

In general, Zerodha is the optimal combination of technology, transparency, and favorable investment conditions.

Bonuses Paid by the Broker

At present, Zerodha has no bonus programs or promotional offers for customers.

Investment Education Online

To enable clients to trade profitably and quickly navigate complex exchange instruments, Zerodha has created Varsity, an extensive and detailed collection of lessons on the stock market and finance. It is publicly available and is one of the largest financial education resources in the Indian investment segment.

Each of these tools can be applied immediately to a real trading account.

Security (Protection for Investors)

Zerodha is listed on the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE). The broker is regulated by the Securities and Exchange Board of India (SEBI). The company has registration number INZ000031633 for the cash/derivatives/currency derivatives segments NSE and BSE.

Commodities are traded on the trader's account through Zerodha Commodities Pvt. Ltd., which is a member of the Multicommodity Exchange of India (MCX). Custody services are available through Zerodha Broking Limited when using CDSL, the Central Securities Depository of India, as its custodian.

👍 Advantages

- Activities are carried out under the requirements of the regulator and the legislation of India

- Negative balance protection is active

- The company guarantees the safety of the client's funds

👎 Disadvantages

- Complex verification process

- Only residents of India can become clients of the broker

Withdrawal Options and Fees

-

All payment requests are processed electronically. Payment is received in the customer's main bank account within 24 hours after the withdrawal request is processed.

-

The only available withdrawal method is via bank transfer. Money cannot be transferred to cards and e-wallets.

-

Withdrawal requests are processed until 20:30 on business days Delhi time. If a withdrawal request is placed before 20:30, the money will be credited to the account on the next banking day. If the application is made after 20:30, it is processed the next business day, and the funds are credited within 48 hours.

-

The company's finance department does not process withdrawal requests on Saturday or Sunday.

-

The deposit and withdrawal currency is the Indian rupee only.

Customer Support Service

The company has established a highly efficient support team that quickly resolves customer problems. It is available through the trading terminal 24/5. For identification, it is necessary to provide the account number and your 4-digit PIN.

👍 Advantages

- Support via telephone is available

👎 Disadvantages

- Works on weekdays only

- Operators answer in Hindi and English

You can contact customer support in the following ways:

-

through an interactive window in the browser and mobile versions of the console;

-

by phone;

-

via social networks Twitter, Facebook, LinkedIn, Instagram, Telegram;

-

by email.

Online support is available only in the client's personal account.

Contacts

| Foundation date | 2010 |

| Registration address | #153, 154, 4th Cross Rd, opp. Clarence Public School, JP Nagar 4th Phase, Dollars Colony, Phase 4, BTM Layout, Bengaluru, Karnataka 560078, India |

| Regulation |

Securities and Exchange Board of India (SEBI) |

| Official site | zerodha.com |

| Contacts |

Phone:

+91 80 4718 1888

|

Review of the Personal Cabinet of Zerodha

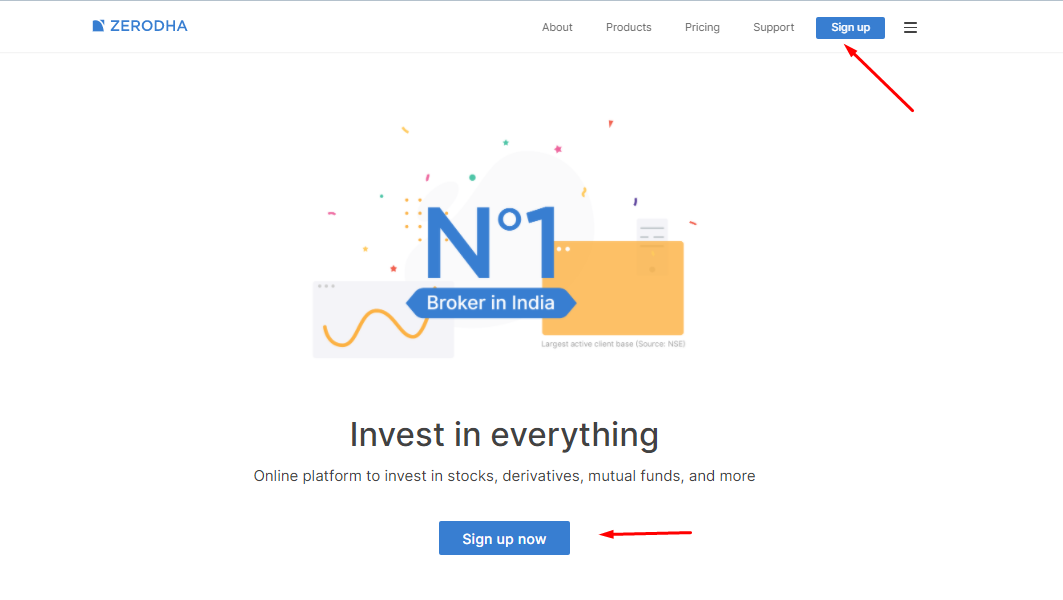

To create a personal account at Zerodha, you need to register. To do this, follow these steps:

On any page of the Zerodha website, click the "Sign Up" button. Enter your mobile phone number and click the "Continue" button. A 6-digit one-time password will be sent to the specified mobile phone number. Enter your password and click the “Confirm” button.

In the form that opens, enter your full name and email address. A one-time password will be sent to the specified email address. Enter it in the confirmation window and click the "Continue" button. Next, go through verification by providing complete personal and financial data, scanned copies of documents, as well as a unique personal Aadhaar number (personal identification number).

The following sections are available in the Zerodha personal account:

1. Profitability statistics for trades and portfolios, presented in the form of simple graphical diagrams:

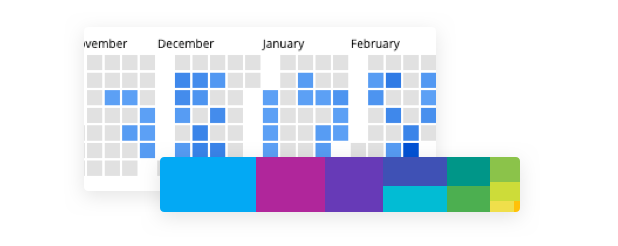

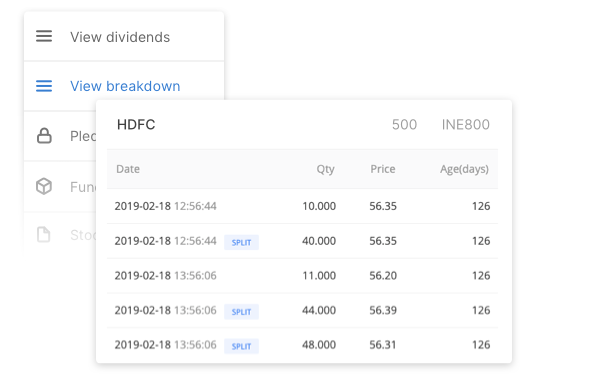

2. Full report on trades from the date of purchase of securities:

1. Profitability statistics for trades and portfolios, presented in the form of simple graphical diagrams:

2. Full report on trades from the date of purchase of securities:

Through a personal account, a trader has the ability to:

-

Replenish a trading account.

-

Apply for a withdrawal of funds.

-

View the number of referrals and review affiliate points for connecting new customers.

-

Assess the profitability of the investment portfolio.

-

Write to support specialists to resolve disputes and troubleshoot technical problems.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Zerodha rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Zerodha you need to go to the broker's profile.

How to leave a review about Zerodha on the Traders Union website?

To leave a review about Zerodha, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Zerodha on a non-Traders Union client?

Anyone can leave feedback about Zerodha on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.