OBI Broker Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- UZS 1,000,000

(~ USD 79.08)

- HTS (Home Trading System)

- MTS (Mobil Trading System)

- Exture+ (web trading)

- 1:1

- Exchange fees are included in trading fees

Our Evaluation of OBI Broker

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

OBI Broker is a broker with higher-than-average risk and the TU Overall Score of 4.09 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by OBI Broker clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

OBI Broker is a multi-active stock broker that offers flexibility and diversification of traders’ portfolios by working with various financial instruments on one trading platform.

Brief Look at OBI Broker

OBI Broker (Online Broker International) was registered in Tashkent in 2018 and is regulated by the Capital Market Development Agency of Uzbekistan. It focuses on providing brokerage and trust management services and is the first Uzbekistan broker that offers the Robot Advisor program to help traders invest in the securities markets. OBI Broker allows its clients to buy/sell stocks and bonds on the Toshkent Republican Stock Exchange and foreign exchanges, and to invest in ETFs [(currency) exchange-traded funds], futures, and options on international markets.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Three licenses that allow the broker to provide brokerage, consulting, and investment services;

- Stocks and bonds are traded on the Stock Exchange of Uzbekistan;

- Access to international markets in the U.S., Asia, and Europe;

- Trading securities is available by phone and internet;

- No fees for providing electronic platforms, account maintenance, and conducting financial transactions;

- The broker provides services for capital management and securities underwriting;

- Development of an investment strategy by a robot program.

- No access to OTC (over-the-counter) Forex, cryptocurrencies, or CFD markets;

- Financial transactions are made only by bank transfers since the broker doesn’t work with electronic payment systems;

- High trading fees for small volumes.

TU Expert Advice

Financial expert and analyst at Traders Union

OBI Broker offers access to trading securities on Uzbekistan and foreign stock exchanges for citizens and residents of the country. The company doesn’t work with fiat currency, cryptocurrency, or CFD markets. It focuses on brokerage services, trust management, and securities underwriting.

Upon opening an account with OBI Broker, traders can transfer their securities from another broker or deposit funds from their personal bank accounts. The company complies with domestic and international anti-money laundering and financial security regulations, therefore it verifies each client, doesn’t accept funds from third parties, and doesn’t work with electronic payment systems.

One of the latest broker’s services is building an investment portfolio with a robot advisor. It helps potential investors establish acceptable risks and choose stocks of well-known companies with a price uptrend or ready-made diversified portfolios. Traders who don’t need assistance can buy or sell stocks, bonds, ETFs, futures, and options themselves, by using electronic platforms and by phone.

OBI Broker Summary

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. OBI Broker and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | HTS (Home Trading System), MTS (Mobil Trading System), and Exture+ (web trading) |

|---|---|

| 📊 Accounts: | Depo Start, Depo Business, and Depo Premium |

| 💰 Account currency: | UZS |

| 💵 Deposit / Withdrawal: | Transfers according to bank details and securities transfers from accounts opened with other brokers |

| 🚀 Minimum deposit: | UZS 1,000,000 |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | UZS 1 |

| 💱 EUR/USD spread: | No |

| 🔧 Instruments: | Stocks of Uzbekistan, Europe, and the U.S.; local and foreign bonds; futures, options, and ETFs on foreign exchanges |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Exchange |

| ⭐ Trading features: | Exchange fees are included in trading fees |

| 🎁 Contests and bonuses: | Discount on a paid education course |

OBI Broker provides access to trading securities on the Toshkent Republican Stock Exchange that focuses on stocks and bonds. Also, its clients can trade on the OTC securities market Elsis-Savdo JSC. The trading session lasts from 10:00 to 14:30 and orders to buy/sell assets are placed from 9:30 to 15:00 (GMT+5). OBI Broker clients can enter international U.S. and European exchanges, where they can invest in over 7,000 shares of major global companies, ETFs, bonds, options, and futures contracts.

OBI Broker Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

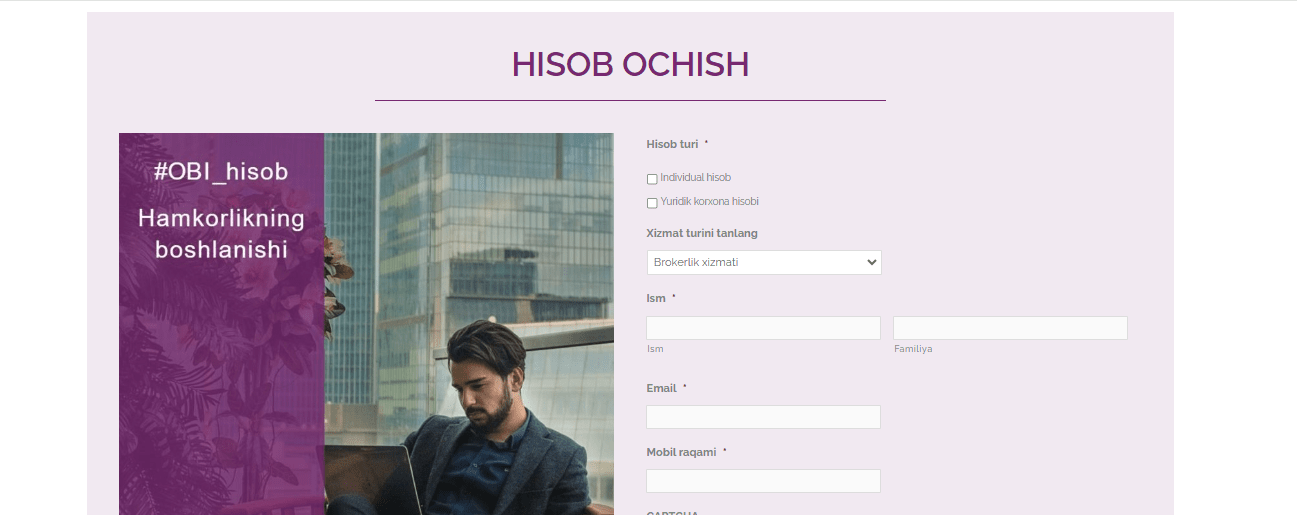

To get access to the user account on the OBI Broker website, become its client. Accounts are opened in the company’s office or remotely. Below is the description of the second option.

The OBI Broker website is available in Uzbek, Russian, and English. The button to open an account is at the top of the screen.

Next, choose the account type, brokerage services, and provide your personal data, such as first and last names, phone numbers, and email.

Within 48 hours of submitting the form, the broker’s representative contacts you and requests the documents. Citizens of Uzbekistan send images of passports, taxpayer numbers, and documents confirming their residence address. Upon verification of the provided data, a password to sign into the user account on the OBI Broker website is sent to your email.

Commissions and fees

The table below provides minimum fees for trading stocks with different tariff plans.

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Depo Start | UZS 0.01 for UZS 1 trade | Not charged by the broker |

| Depo Business | UZS 5,000,000 for UZS 1 billion trade | Not charged by the broker |

| Depo Premium | UZS 17,500,000 for UZS 5 billion trade | Not charged by the broker |

If clients transfer their securities under trust management, they pay a fee of 0.2% of their portfolios. The same rate is used for returning assets to investors.

OBI Broker doesn’t offer Forex trading. TU experts have calculated the average fees for $1,000 trades with stocks, listed on the Uzbekistan Stock Exchange. The table below provides average spreads for currency pairs traded on the OTC market for RoboForex and Pocket Option.

Investment Options

OBI Broker offers trust management services that allow investors to automate the trading process. In this case, the investment portfolio is built by the broker’s experts who also correct it. Also, investors can use a robot advisor to choose a model portfolio. The minimum required investment is $500.

Trust management service offered by OBI Broker

Deep investment knowledge isn’t required to transfer capital under the trust management of OBI Broker’s experts. Clients get comprehensive assistance that ranges from creating the investment goal and building a portfolio to diversification through regular rebalancing.

Main points of OBI Broker’s trust management service:

-

Personal support of trades. Investors receive support and assistance when executing their investment transactions. Experts give advice, analyze markets, and help in making decisions.

-

Timely notifications of investment opportunities. Consultants inform investors of prospective assets based on market analysis and client goals.

-

Personal advice. Investors can discuss their financial goals, acceptable risks, and other investment parameters during personal consultations with managers.

-

Recommendations on portfolio management. Consultants provide advice and strategies for investment portfolio management adjusting them to client goals and needs.

This scheme is designed to create deeper and mutually profitable relations between investors and consultants, providing a more individualized and result-oriented investment experience.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from OBI Broker:

The broker doesn’t offer partnership programs.

Contacts

| Registration address | Online Broker International LLC, Mirabad Plaza, 2 Mirabad St., Level 3, Suite 16, Yakkasaray District, Tashkent, 100031, Uzbekistan |

|---|---|

| Regulation | CMDA |

| Official site | https://broker.uz/ |

| Contacts |

+99871-203-66-77

|

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i