Renta 4 Banco Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €1

- Renta 4 mobile app

- Terminal Trader

-

Up to 1:30 for CFDs

1:1 for stock market instruments

- There are no minimum fees per order. Brokerage fees vary depending on the instrument and market

Our Evaluation of Renta 4 Banco

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Renta 4 Banco is a high-risk broker with the TU Overall Score of 2.84 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Renta 4 Banco clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker.

Renta 4 Banco is a regulated Spanish broker providing a wide range of trading and investing services.

Brief Look at Renta 4 Banco

Renta 4 Banco (also Renta 4), managed by Renta 4 Banco S.A., is a brokerage company offering access to trading securities and derivatives, including CFDs and Forex futures, on the Spanish stock exchanges Bolsa de Madrid, Bolsa de Barcelona, Bolsa de Valencia, and Bolsa de Bilbao, the MEFF derivatives exchange, as well as numerous international exchanges such as Nasdaq, NYSE, AMEX, Euronext, LSE, CME, NYMEX, CBOE, Comex, CBOT, and others. The broker is regulated by the Bank of Spain and the National Securities Market Commission (CNMV). It also participates in the FOGAIN investor compensation scheme.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Supervision by Spanish state financial regulators.

- Access to trading domestic and international securities and derivatives.

- No minimum deposit for active trading; only €10 minimum for investing in ready-made portfolios.

- An all-in-one platform for trading on local and international exchanges.

- Trading fees as low as €2 for stocks of Spanish companies.

- A wide selection of investment solutions for clients with varying levels of capital.

- Client support by phone and through a broad network of offices.

- Forex futures contracts on MEFF have a face value of €10,000.

- Online support is not available, and the call center is closed on weekends.

- The minimum investment for ready-made portfolios (funds and stocks) is €20,000, and €500,000 for customized portfolios.

TU Expert Advice

Author, Financial Expert at Traders Union

Renta 4 Banco offers a variety of trading and investing services through its proprietary web and mobile platforms. Its clients can trade securities and derivative instruments on Spanish and international exchanges, taking advantage of no minimum deposit requirements for active trading. Leverage is up to 1:30 for CFDs. The broker stands out with low fees, starting at €2 on Spanish stocks, and offers multi-currency accounts for cost-effective trading. Additionally, Renta 4 Banco provides diverse investment options, from ready-made to customized portfolios, ensuring a wide range of solutions for different capital levels.

However, there are notable drawbacks such as the high minimum investment requirement of €20,000 for ready-made portfolios and €500,000 for customized portfolios. The absence of online support, alongside limited withdrawal options and platforms, may not be suitable for traders who prioritize accessibility and flexibility. Renta 4 Banco's offerings are best suited for experienced and long-term investors who prefer a regulated environment with comprehensive investment options. The broker's services may not meet the needs of traders who require a more flexible, lower-entry platform or require continuous online support.

Renta 4 Banco Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | Trader web platform and Renta 4 mobile app |

|---|---|

| 📊 Accounts: | Online Trading Account |

| 💰 Account currency: | EUR as the primary currency + USD, GBP, SEK, JPY, and CHF on multi-currency accounts |

| 💵 Deposit / Withdrawal: | SEPA bank transfers, worldwide currency transfers, urgent transfers for deposits only, and bank transfers via Bizum |

| 🚀 Minimum deposit: | No requirements |

| ⚖️ Leverage: |

Up to 1:30 for CFDs 1:1 for stock market instruments |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 1 security, 0.01 lots for CFDs |

| 💱 EUR/USD spread: | Exchange spreads |

| 🔧 Instruments: | Stocks, ETFs, stock indices, fixed-income instruments (bonds, promissory notes, funds), derivatives (futures and options), investment funds, currency futures, and CFDs |

| 💹 Margin Call / Stop Out: | 100%/50% for CFDs |

| 🏛 Liquidity provider: | Renta 4 Banco S.A. |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Exchange execution |

| ⭐ Trading features: | There are no minimum fees per order. Brokerage fees vary depending on the instrument and market |

| 🎁 Contests and bonuses: | Yes |

Renta 4 Banco provides access to stock trading on Spanish and international exchanges through a convenient mobile app and a proprietary web platform. Fees on trading Spanish stocks start from €2 per order. Clients can trade securities and derivative instruments, including perpetual currency futures.

Renta 4 Banco Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

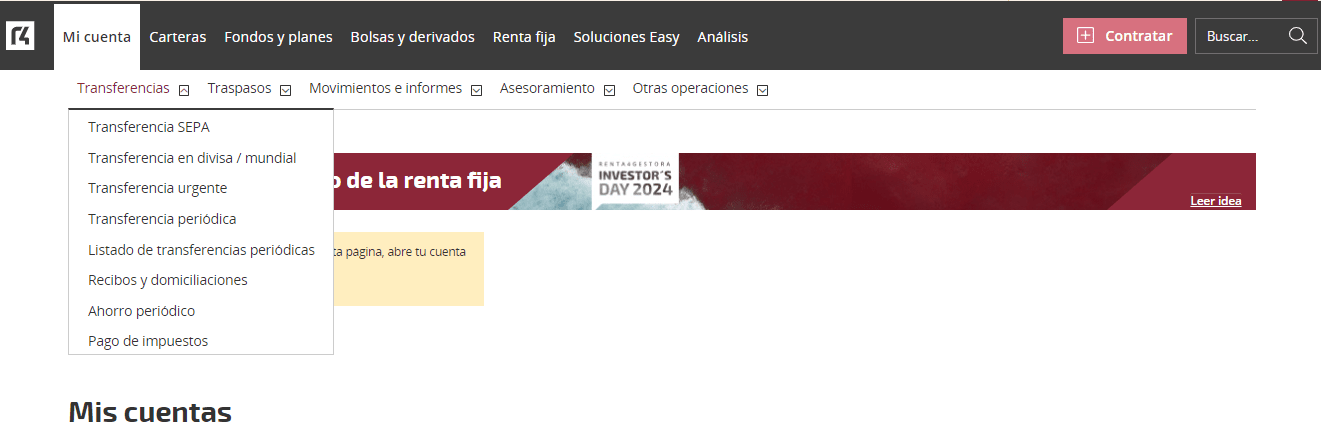

Renta 4 Banco’s user account allows investors to make financial transactions, manage their trading accounts, monitor portfolios, and trade on the web platform.

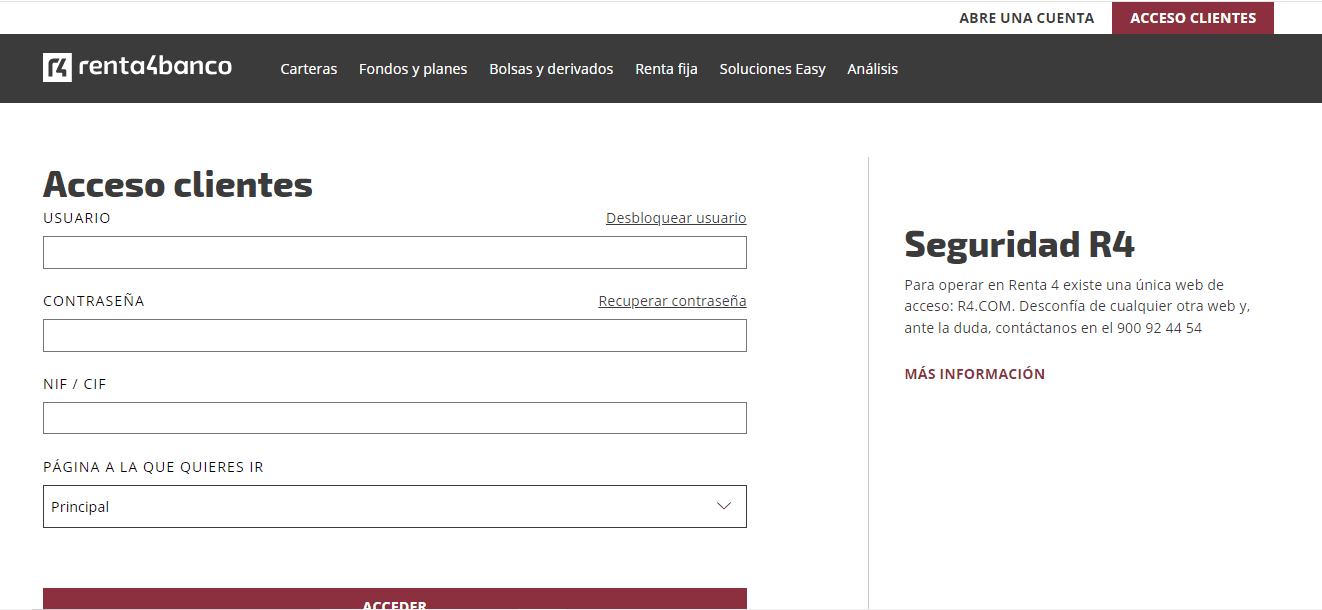

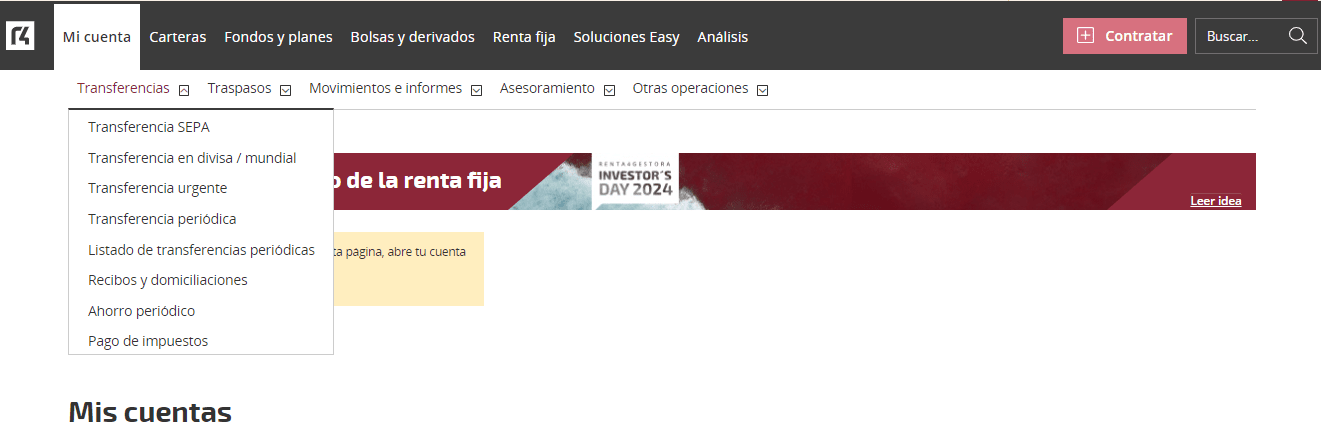

Renta 4 Banco’s user account is accessed by clicking “Acceso Clientes” and entering a username, password, and NIF or CIF (Spanish tax identification numbers).

If the user is not registered with the broker, he needs to click “Abre Una Cuenta” in the top right corner, choose the Personas account, and enter the required personal details. The broker offers a single account for trading and investing. Opening a joint account requires specifying the beneficiary and all co-holders.

Renta 4 Banco’s user account features:

Other features include:

-

identity verification;

-

portfolio details and reports;

-

investment ideas and advice;

-

management of trading limits and margins;

-

dividend statistics;

-

transfers of securities.

Regulation and safety

Renta 4 Banco is a subsidiary of Renta 4 Banco S.A., a banking holding established in 1986. Its ticker on Bolsa de Madrid is R4. The broker is also registered with the CNMV under the number 234 and with the Bank of Spain under the number 0083.

The CNMV and the Bank of Spain, the primary financial regulators in Spain, supervise the market, ensuring its steady operation and compliance with the law. Investments are protected through the FOGAIN compensation scheme that covers investors’ losses in case a broker goes bankrupt or fails to fulfill its financial obligations. If Renta 4 Banco fails financially, its every client will recover their securities or money in the amount of up to €100,000.

Advantages

- Oversight of Renta 4 Banco’s operations by state regulators of Spain ensures the protection of clients’ investments

- The parent bank has been in business for more than 35 years, properly fulfilling its financial obligations

- CNMV considers complaints from not only legal entities, but also retail investors

Disadvantages

- A non-citizen of Spain can open an account only if he has a Foreigner’s Identification Number

- The broker is not allowed to incentivize retail clients to increase trading volumes

- Some instruments can only be bought with 70-100% margin

Commissions and fees

The fees on trading on European and U.S. exchanges are 15 units of the base currency for volumes over $/€/£ 30,000 and 0.15% for lower volumes. The brokerage fee in the MILA securities market is 0.45% for any volume.

The fee on derivatives varies depending on the market and is charged for each traded contract. When withdrawing funds, the client pays the bank’s fee. The use of Trader costs 15 EUR per month.

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Online Trading Account | €2 | Charged by the bank |

Renta 4 Banco periodically offers trading with reduced or zero fees. During such promotions, the trader pays less for the broker’s services, but his trades are subject to standard charges of exchanges, depositories, and other market participants.

When the volume is under €50,000, the average fees are €3.3 on intraday trading and €6,5 on longer trades. The table below presents a comparison of the average fees of Renta 4 Banco and two other brokers.

| Broker | Average commission | Level |

|---|---|---|

|

$5.2 | |

|

$2 |

Account types

Trading with Renta 4 Banco is available through its web platform or mobile app. To gain access to them, you need to become a broker’s client by creating an account and verifying your identity. The easiest way is video identification through a special app, Renta 4 ID, but you can also get verified in your user account.

Account types:

Renta 4 Banco does not offer demo accounts, but a trial version of the trading platform is available. It allows users to explore the broker’s features, tradable assets, and analytical tools. Renta 4 Banco makes trading conditions as convenient as possible, adapting them for investors with various levels of experience and trading volume.

Deposit and withdrawal

-

Withdrawal requests are submitted from the user account.

-

SEPA (Single Euro Payments Area) bank transfers are the only available withdrawal method. The broker does not allow withdrawals to electronic payment system accounts, bank cards, or cryptocurrency wallets.

-

Refunds are made to the same bank account from which funds were deposited. Choosing another account belonging to the client or a third party is not possible.

-

All transactions are made in the euro. If the trader requests a withdrawal in another currency, Renta 4 Banco S.A. converts it at an internal rate with a fee.

Investment Options

Renta 4 Banco offers a wide selection of solutions for passive earning, but they all involve holding funds for at least 6 months. There are options with low entry thresholds of €10-100.

Renta 4 Banco products and tools

Investment services are one of the company’s priorities. Renta 4 Banco offers the following passive earning options:

-

Ready-made portfolios of three types – portfolios of funds, stocks, and profile portfolios. Fund portfolios are divided into subtypes – conservative, moderate, tolerant, and dynamic – depending on the risk level. Stock portfolios allow investing in stocks of the five largest companies from the IBEX 35 index, 10 most promising Spanish stocks, and dividend stocks. Profile portfolios consist of funds, ETFs, and derivatives, and allow starting with €10. The minimum investment in fund and stock portfolios is €20,000.

-

Customized management. This is a service for large investors that involves dynamic analysis and adapting portfolios for market situations. Unlike investing in portfolios, management includes creating customized asset baskets. The minimum investment is €500,000.

-

Investment funds. They are a form of joint investment in which an investor buys a part of the fund and receives returns on the growth of its price. Renta 4 Banco allows investing in funds with variable, absolute, and fixed yields, as well as in mixed and thematic funds. The initial investment is €100.

Every new client of Renta 4 Banco receives a personal investment consultant who provides free advice on working with portfolios, funds, and assets. Investors can also get expert recommendations at the broker’s offices.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Renta 4 Banco partnership programs

The broker does not offer partnership programs for retail traders or investors.

Customer support

Renta 4 Banco provide support both at offices and by phone. The company’s call center operates Monday through Friday from 08:00 till 20:00 (GMT+2). Offices accept clients till 18:30-19:00.

Advantages

- Free help from a personal investment specialist

- The broker has profiles on popular social media

Disadvantages

- Support is not rendered via chat

- The service does not respond on weekends or Spanish national holidays

To get support from Renta 4 Banco, investors can:

-

call the call center;

-

visit an office;

-

fill out the contact form by email or phone;

-

send messages on Facebook, X (Twitter), LinkedIn, or Instagram.

Personal managers can be contacted by phone or using a video conference.

Contacts

| Registration address | Paseo de la Habana, 74–28036 Madrid, Spain |

|---|---|

| Regulation | CNMV, Bank of Spain |

| Official site | https://www.r4.com/ |

| Contacts |

+34 900 92 44 54

|

Education

Formación, a section of the Renta 4 Banco website for stock trading beginners, lists the available online webinars and office classes. In total, the company offers over 300 courses for various types of investors. Formación can be quickly found in the website’s footer.

Everyone can use the trial version of the Renta 4 Banco platform for 15 days.

Detailed review of Renta 4 Banco

Renta 4 Banco operates on the principle of "slow finance," catering to clients who prioritize long-term investment strategies. The company discourages short-term trading, viewing it as excessively risky and unsuitable for most investors. Instead, Renta 4 Banco emphasizes high-quality informational and analytical support, believing that a thorough understanding of the market empowers clients to make informed investment decisions and mitigate risks.

Renta 4 Banco by the numbers:

-

over 35 years of experience as a bank, broker, and financial consultant;

-

63 offices in a number of cities in Spain;

-

access to over 20 stock exchanges across the globe;

-

access to trading over 1,000 ETFs of various countries.

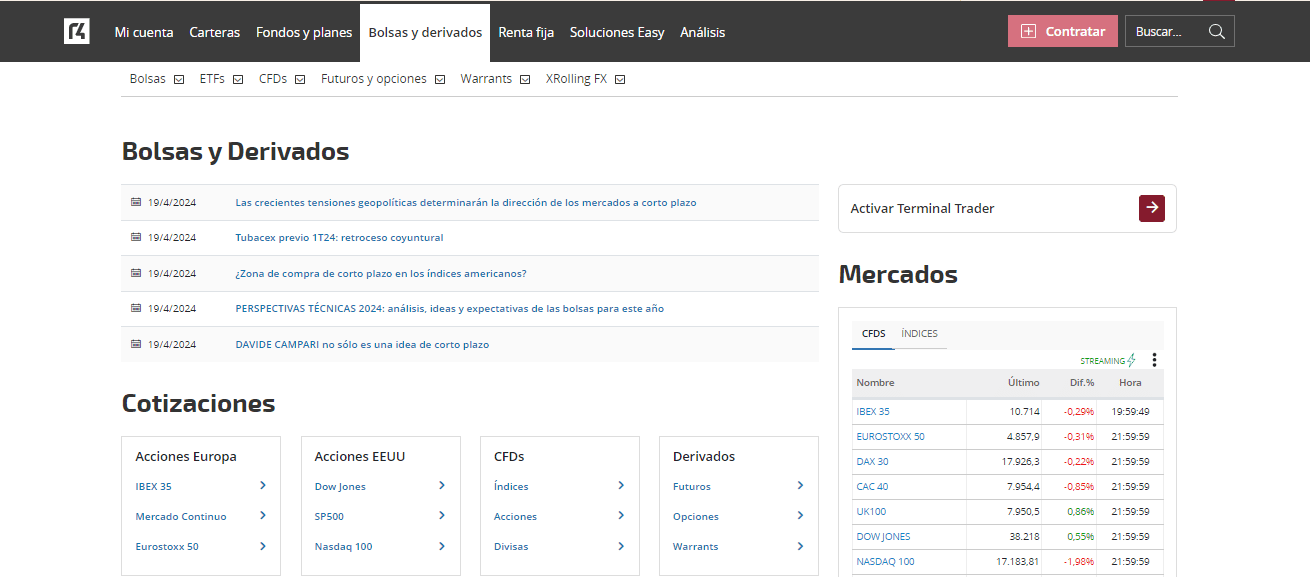

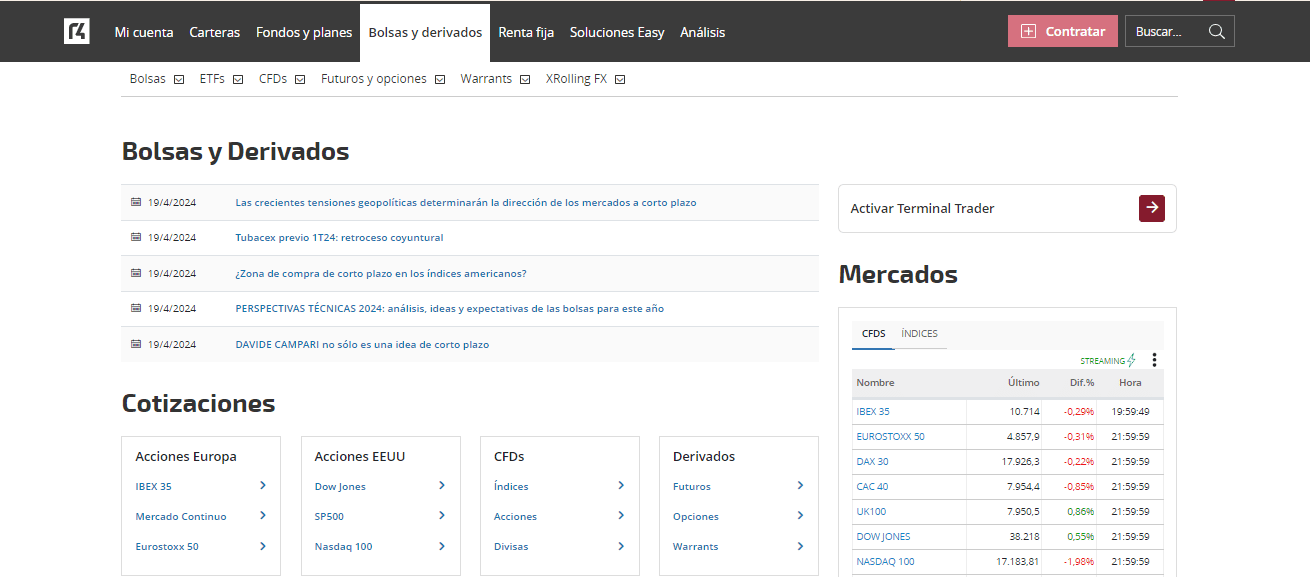

Renta 4 Banco is a broker that provides access to all stock exchanges in Spain, as well as securities and derivatives exchanges in other countries.

Clients can trade stocks, ETFs, bonds, and various other securities on Spanish stock exchanges. They also have access to underlying assets on major international exchanges, including the NYSE, Nasdaq, AMEX, LSE, Nasdaq Stockholm, Frankfurt Stock Exchange, and Euronext, as well as derivatives on CME, Comex, CBOT, NYMEX, and CBOE.

Furthermore, Renta 4 Banco offers access to the MILA market, which integrates the stock exchanges of Chile, Colombia, Peru, and Mexico. Created to enhance liquidity, reduce costs, and attract investment to the region, MILA expands trading opportunities for Renta 4 Banco clients. By enabling access to a diverse range of assets on a single platform, Renta 4 Banco facilitates portfolio diversification and simplifies the investment process.

Renta 4 Banco useful services:

-

Free daily newsletter. Daily analytics on financial markets, expert opinions, original articles, and recommendations.

-

Market analysis. Research of macroeconomic indicators, daily quotes, and various companies’ performance in previous trading sessions.

-

Cazastock. A tool for finding the most promising stocks based on a number of criteria such as dividend yield, price-to-earnings ratio, overvaluation potential, etc.

-

Soluciones Easy. Automated investing solutions that allow clients to activate suitable account types in 5 minutes and invest in funds or treasury bills.

Advantages:

The broker has a reliable parent company with steady financial performance.

Multi-currency accounts allow reducing the costs of trading on foreign exchanges.

Renta 4 Banco provides a variety of educational courses for investors with various levels of knowledge and experience.

Users can open accounts online without visiting an office.

Fixed-income instruments are available for trading.

Renta 4 Banco clients can trade on stock exchanges, get current market data, and use analytical reports and tools to manage their investment portfolios.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i