Revolut Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Mobile Revolut App

- 1:1

- The ability to auto copy deals from traders with a public profile

Our Evaluation of Revolut

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Revolut is a reliable broker with the TU Overall Score of 7.69 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Revolut clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

Revolut provides its clients access to shares of international and American companies, cryptocurrencies, and metals. For investors, Revolut offers a social trading program. Revolut's copy trading platform is trendy among investors because it has a forum for traders to communicate with each other in real-time. Also, various charts and indicators are available in the Revolut trading platform for technical analysis. Revolut is a company actively developing and plans to make all of its services available to foreign citizens. Fractional share trading offered by the broker allows beginners to learn trading without high financial risks.

Brief Look at Revolut

Revolut is a British fintech company that has been providing investors with accounts for trading precious metals, cryptocurrencies, and stocks listed on U.S. exchanges since 2015. The broker offers its clients access to investing in stocks and ETFs on European stock exchanges. For organizations and private clients, the company offers a multi-currency account with the possibility of exchanging currencies at the current inter-bank exchange rate. Revolut is supervised by the Financial Services Authority (FSA).

- In addition to stock trades, customers can trade cryptocurrencies and precious metals.

- The broker offers commission-free trading plans.

- The minimum number of shares to buy is 0.00000001.

- There are no minimum deposit requirements.

- Social trading is available, which allows newcomers to the stock market to copy trades of successful traders.

- Communication with the support service via chat is available in the mobile application 24 hours a day.

- There is no fee for opening and maintaining a trading account.

- Stock trading is currently only available to UK residents.

- Operations in precious metals and cryptocurrencies are not regulated by supervisory authorities.

- The company does not offer fiduciary management of its investment portfolio.

TU Expert Advice

Author, Financial Expert at Traders Union

Revolut provides trading stocks, cryptocurrencies, and precious metals via a mobile app. The company supports social trading, allowing novice traders to copy successful traders, enhancing its accessibility for beginners. Revolut’s trading environment is particularly appealing due to fee-free trading and the absence of minimum deposit requirements. Fractional share trading is another advantage, enabling investments with minimal financial risk.

However, Revolut presents some disadvantages, such as limited stock trading availability, restricted to UK residents, and unregulated operations in cryptocurrencies and precious metals. Its lack of personalized investment advice and fiduciary management also limits its appeal to those seeking comprehensive financial consulting. Revolut may suit independent traders and beginners but may not be ideal for those requiring broader advisory services.

Revolut Summary

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

| 💻 Trading platform: | Mobile Revolut App |

|---|---|

| 📊 Accounts: | Standard, Plus, Premium, Metal |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Wire transfer, debit/credit cards, including Apple Pay or Google Pay |

| 🚀 Minimum deposit: | From $1 |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 EUR/USD spread: | £2.99 —£12.99 |

| 🔧 Instruments: | Shares, fractional shares, crypto, XAU, XAG, XPT |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | The ability to auto copy deals from traders with a public profile |

| 🎁 Contests and bonuses: | No |

Revolut offers commission-free trading with no minimum deposit requirements. Stocks, cryptocurrencies, and precious metals are available for trading. Client funds are kept on segregated accounts, which is a guarantee of their safety. Since fractional share trading is available at Revolut and there is no brokerage commission per transaction per month, you can start with a minimal investment. Deposits can be made in 28 currencies, but the broker translates them into USD since trading is only on the US stock market.

Revolut Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

PK Karachi

PK Karachi Helpful

Nothing

PK Rawalpindi

PK Rawalpindi trading platform feels quite smooth.

none

PK Islamabad

PK Islamabad They offer a good environment to work in

The site functionality is too intrusive, couldn't find how to quickly contact the support team

Trading Account Opening

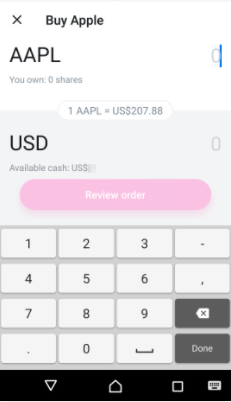

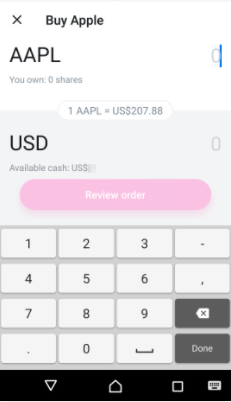

Registration with the Revolut broker is done only through its mobile application. Here is a short instruction:

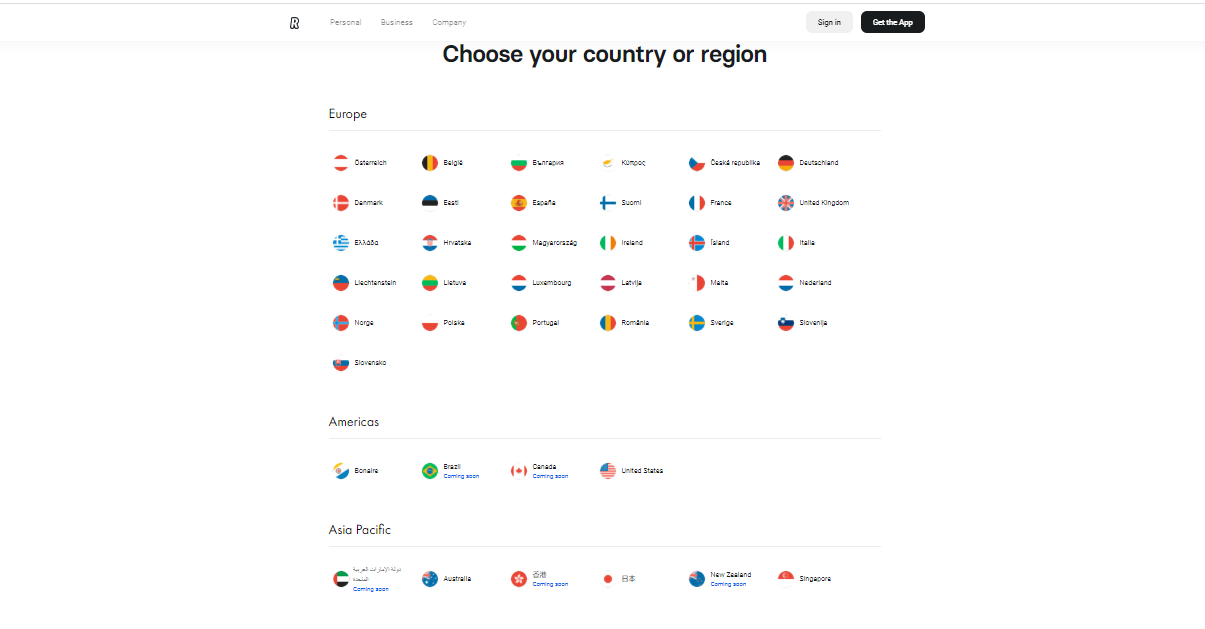

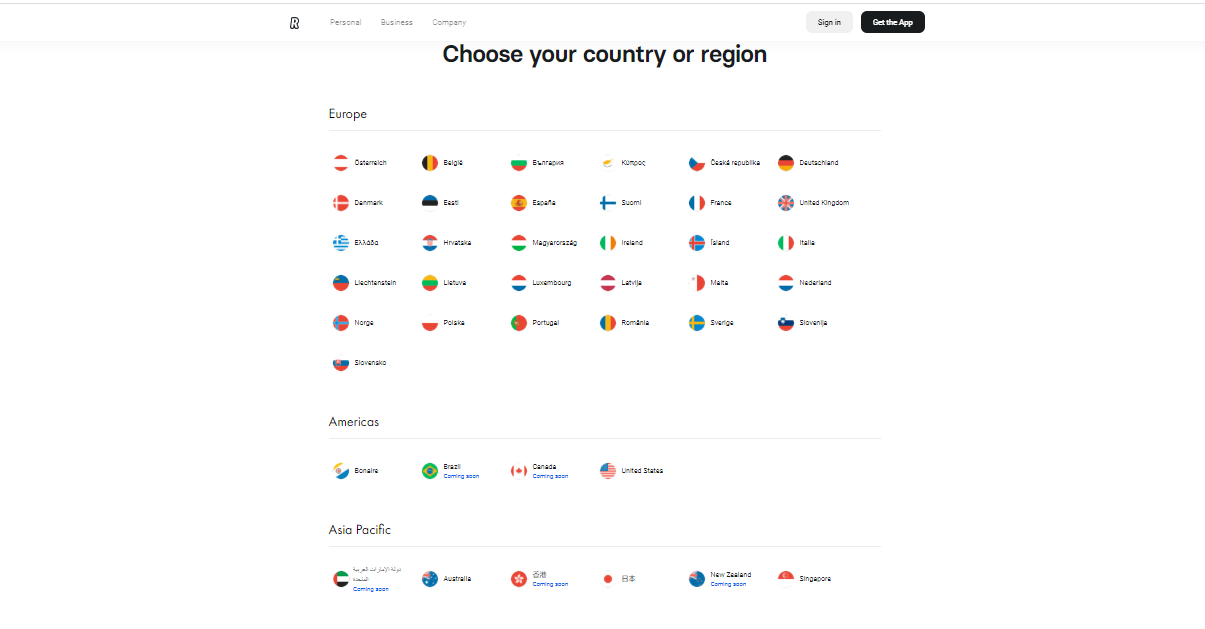

Download the Revolut App from the App Store or get the link at www.revolut.com. If you prefer the second option, the first thing to do is to select your country of residence:

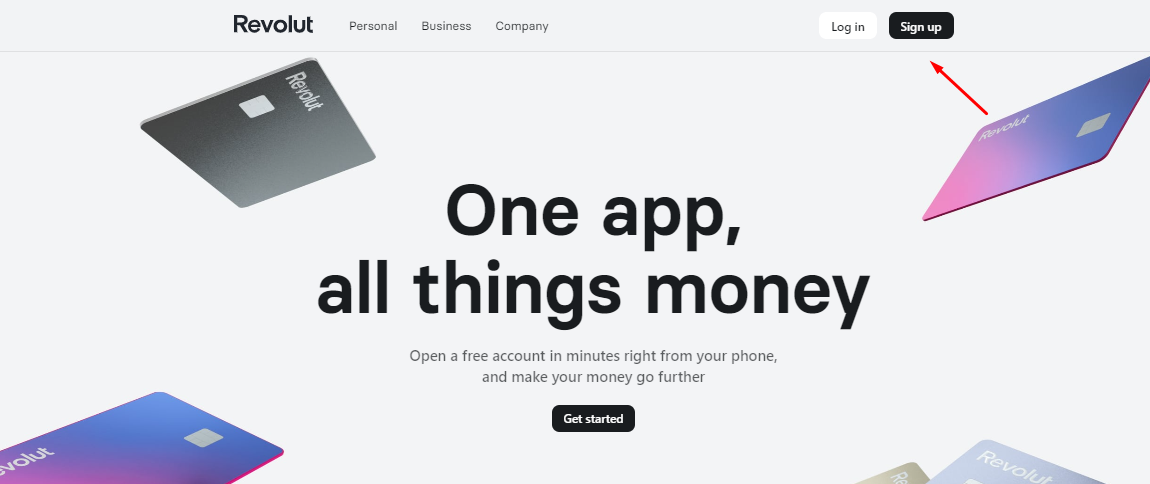

Next, click Sign Up:

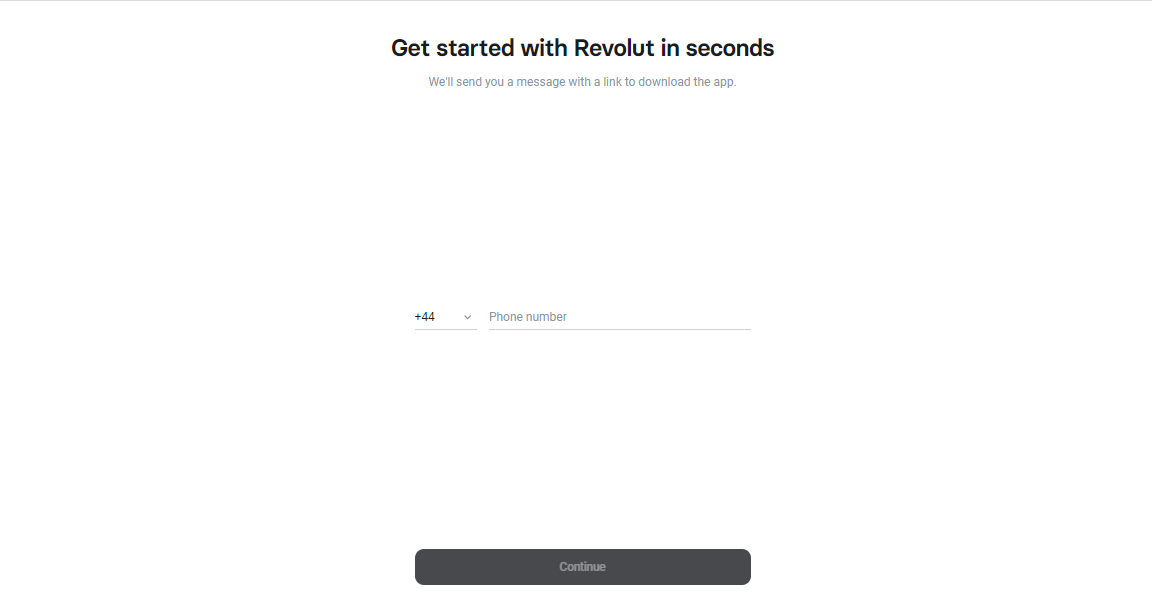

Enter your cell phone number:

Fill out the registration form with personal information, citizenship, and tax number. You will also have to answer a few questions (about employment status, annual income, and investment goals) and get verified. After that, you can open a trading account and make a deposit.

In the personal account, the Revolut client can perform the following actions:

Also in the personal cabinet, a trader can:

-

Search assets by asset name or ticker.

-

Review statistics on expenses and transactions made during the current month.

-

Set up price alerts.

-

Get real-time market data.

-

Receive third-party news from CNBC, Zolmax, Investing, and Yahoo.

-

Generate observation lists.

Regulation and safety

Revolut is regulated by the Financial Conduct Authority (FCA, 780586), a respected UK supervisory body. One of its requirements is to keep client funds in segregated accounts. The company also holds a banking license.

Revolut's executive partner, DriveWealth Llc, is regulated by the SEC and FINRA (CRD#: 304600/SEC#: 8-70365). Its clients' assets are also protected by Securities Investment Protection Corporation (SIPC) insurance for up to $500,000, including $250,000 in cash. Keep in mind that the regulator's oversight does not apply to trading in cryptocurrencies and precious metals, as they are not stock market financial instruments.

Advantages

- Possibility to file a complaint with the regulatory body

- Segregated client funds are held in accounts of third-party banks

- Safe transactions are available on the deposit using one-time virtual cards

- Support client fingerprint identification function in proprietary app

- The broker uses the Sherlock anti-fraud system to warn of suspicious account activity

Disadvantages

- Operations in cryptocurrencies and precious metals are not regulated

- No personal contact in case of controversial issues

- It is impossible to replenish the deposit without providing scanned copies of identity and other documents

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | From £2.99 | No |

| Plus | From £2.99 | No |

| Premium | From £2.99 | No |

| Metals | From £2.99 | No |

The monthly fee for holding financial instruments is 0.12% of the market value of the assets on deposit.

Revolut declares that there are no fees for transactions in U.S. stocks, so a comparison of trading conditions with other brokers that also offer these trading instruments was made.

| Broker | Average commission | Level |

|---|---|---|

|

$2.99 | |

|

$4 |

Account types

Revolut offers four types of accounts for investing, which differ in subscription fees, trading conditions, and the range of additional services. On all accounts, you can reduce the subscription fee by up to 20% if you make a payment in advance for a year.

Account types:

The broker does not offer a demo account.

Revolut is a broker for British investors who trade securities on international markets.

Deposit and withdrawal

-

Profits from transactions with financial instruments are deposited to the electronic account of the Revolut client and then transferred by the broker to his personal bank account. Transfer to cards is not possible.

-

Withdrawal is possible after all open positions are closed.

-

Funds are credited within 1-2 business days after the withdrawal request is approved.

-

There is no withdrawal fee from the broker, but there may be additional charges from the beneficiary bank.

-

Money can be withdrawn in one of the available 28 currencies. The company deducts a commission for converting USD to the withdrawal currency chosen by the client.

Investment Options

Revolut offers its clients more than 800 stocks, precious metals, and cryptocurrencies for investment. But due to the UK's exit from the European Union, stock trading is not available to foreign nationals.

Buying fractional shares is a popular way to invest with Revolut

Revolut does not provide leverage or margin accounts, but it does allow you to buy fractional shares. Such an offer means that you can start trading with minimal investment. In addition, the absence of leverage eliminates the risk of a negative balance on the deposit. Taking into consideration that a standard account is allowed one trade per month without a brokerage fee, cooperation with Revolut is possible for investors without any experience in the stock market. At any time, if a subscription fee is paid, it is possible to switch to another account with an increased number of trades without commission. Advantages of buying fractional shares:

-

You can start investing with a minimum amount.

-

Trading is done without providing leverage, which allows you to conduct transactions without the use of borrowed funds and prevent the threat of debt to the company.

-

For newcomers to the stock market, trading fractional stocks is an opportunity to gain experience without the risk of serious losses.

Money that is not involved in trading can be moved into an established vault and earn up to 0.65% per annum with a daily payment on deposit. If necessary, you may apply for transferring the funds to your trading account or cash them out at any time.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Revolut’s affiliate program:

-

The impact is a referral program in which you need to be a Revolut customer to participate. Depending on which plan the connected referral chooses, the partner is paid from £2 to £20. Payments are calculated and made every month.

After approving the request, the company gives the partner a unique link and materials to be placed and promoted on websites. The partner can track the number of link clicks and referrals in his personal cabinet.

Customer support

The company's support team is available to customers in the Revolut App 24/7.

Advantages

- Support is provided around the clock

- Unregistered users can contact the support service through the form on the website

- The site has a section with answers to frequently asked questions (FAQs)

- Service status check function available

Disadvantages

- Pre-recorded telephone responses only

- Priority in servicing clients with accounts with a monthly fee

- There is no possibility of personal contact through a physical office

- There is no way to contact support by email

To get in touch with the support specialists you need to:

-

call the phone number listed in the Contact Us section (you can get answers from an answering machine);

-

write a message in the online chat application;

-

fill out a reply form on the company's website;

-

ask questions on the broker’s Facebook, Instagram, Twitter, or LinkedIn accounts.

The site has a forum for client communication, where you can ask a question of experienced traders.

Contacts

| Foundation date | 2015 |

|---|---|

| Registration address | 7 Westferry Circus, Canary Wharf, London, England, E14 4HD |

| Regulation | FCA, SEC, FINRA |

| Official site | https://www.revolut.com/ |

| Contacts |

+1 (844) 744-3512

|

Education

Revolut doesn't offer training programs on the basics of stock trading. But the company's site has a blog section, which contains articles and videos with investment tips from Revolut experts and a description of the nuances of stock trading.

The information presented in the Blog section can be useful not only for beginners but also for professional investors.

Detailed Review of Revolut

Revolut broker has been offering its clients investment services on the U.S. stock exchanges since 2015. The list of financial instruments is actively expanding. Due to the UK's exit from the EU, stock trading is not available to foreign nationals from December 31, 2020. However, Revolut has already applied for a license in Ireland to the supervisory authorities, and after its review, the company plans to resume operations in the EU.

Revolut by the numbers:

-

The company conducts more than 100,000 transactions per month.

-

Account opening is available in 28 currencies.

-

About 500,000 business partners.

-

More than 15 million clients cooperate with Revolut.

Revolut focuses on working with all clients, regardless of their investment experience in the stock market

With this broker, clients can trade stocks of American and some international companies, cryptocurrencies, and precious metals. Social trading is also available. Thanks to that, inexperienced investors can use the services of professional traders from the public list, which is available to registered users. The Revolut social trading platform became popular not only because of the possibility of copying trades but also because it is a kind of forum where investors can communicate and gain experience.

For trading, the company offers a mobile application it calls Revolut App, which can be downloaded from Google Play Market or the App Store. There is no trading platform with charts, indicators, and other instruments for technical analysis. To make a transaction, you need to select a financial instrument and the type of order you want to place, and then send a request for execution.

Useful services of Revolut:

-

Setting up notifications on the status of the deposit. The client is informed immediately in case of a critical decrease of funds or suspicious actions related to the account.

-

Pockets is a service for the automatic distribution of funds on accounts.

-

Social trading is a service for communication and copying transactions.

-

Price warnings in the terminal are triggered when the value of an asset exceeds or falls below a pre-set level.

Advantages:

FCA controls the activity.

Lightning-fast, easy, and fully digital account opening.

Ability to open an account in one of 28 foreign currencies.

Access to automatic copying trades of successful traders.

Currency conversion is done at the current exchange rate.

Cryptocurrency trading is offered.

Round-the-clock customer support in the online chat.

After making a monthly subscription fee of £12.99, the limit on the number of free share transactions is removed.

Latest Revolut News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i