Stash Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Proprietary platform

- No

- Investing in fractional stocks is available

Our Evaluation of Stash

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Stash is a broker with higher-than-average risk and the TU Overall Score of 4.42 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Stash clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Stash is a company for investors who prefer a long-term strategy. Clients have access to independent and automated investing, and trading terms are appropriate for both professionals and novice traders.

Brief Look at Stash

Stash is an investment application that was launched in 2015. The company is focused on American investors and allows them to achieve financial goals by investing in ETFs and stocks. Stash is suitable for novice traders and experienced users. During the last 6 years, over 6 million investors have become Stash clients. Stash is authorized by the SEC and works with the regulated Apex Clearing Corporation.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Low level of minimum deposit

- Proprietary training platform with useful information on the investing basics.

- There are no trading commissions.

- The broker offers retirement accounts and deposit accounts for minors.

- Stash investors can buy fractional shares.

- Stocks and ETFs can be bought via the mobile app.

- The company guarantees the protection of clients' investments, personal data, and funds.

- The broker works exclusively with clients from America and those who have a US visa or Green Card.

- There are only two ways for users to withdraw funds and pay a monthly fee.

- Stash income is tax-deductible.

TU Expert Advice

Financial expert and analyst at Traders Union

Stash (Stash.com) is an application for American investors. Here you can achieve your financial goals, learn to manage family and personal budgets, and even teach children how to invest.

The company is ready to cooperate with users, regardless of whether they have experience in investing or not. To get started, just choose a plan and make a monthly payment (from $1 to $9). Fractional shares are available and make investing with Stash more comprehensive. Its price starts at $0.05. Exchange-traded funds are also represented at this brokerage. Investors can select their portfolios on their own or they can use ready-made portfolios managed by Stash. In the latter case, there is no need to have investment knowledge and skills. It is enough to periodically deposit money into the account. Moreover, Stash has a unique system called Stock-Back. It works on the cashback principle, only it doesn't return money to investors for purchases, but fractional shares of the companies the purchases were made in.

Stash is convenient and easy to use. It offers a learning portal with articles, market overviews, and investment guides. However, the company works exclusively with American clients and holders of a visa or Green Card, and income is taxed.

Stash Summary

| 💻 Trading platform: | Stash proprietary platform |

|---|---|

| 📊 Accounts: | Stash Beginner, Stash Growth, Stash+ |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bankcard, ACH |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | $0.05 |

| 💱 EUR/USD spread: | No |

| 🔧 Instruments: | Stocks, ETFs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | No |

| ⭐ Trading features: | Investing in fractional stocks is available |

| 🎁 Contests and bonuses: | Stock-Back program and Traders Union bonuses as rebates |

Stash provides a comfortable trading environment for both novice and experienced traders. Trading transactions are carried out in the mobile application or the web version of the Stash platform. Stocks and ETFs are its trading instruments. The company has three types of packages with different monthly fees, including pension accounts and deposit accounts for minors. There is an opportunity to invest independently and use ready-made portfolios that are managed by professionals.

Stash Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

Investing in Stash becomes available after creating a personal account on the site. To do this, you will need internet access and these step-by-step instructions:

First, open the broker's official website. Then click on the "Log in" button on the main page if you already have a Stash account, or "Get started" if you want to register.

Enter your email address and create a password. In the future, you will use this data to log in to your personal account.

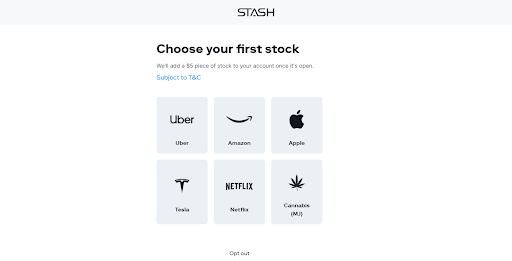

Stash gives $5 on your first investment. Select the stock of the company you’d like to invest in.

Now click on the "Start" button to proceed with the registration.

Enter your full name. This data must be real. It is impossible to open an account using pseudonyms and other fictitious names in Stash.

Enter your phone number.

Enter your residence address.

Confirm that the address you provided is correct.

Indicate your pre-tax income.

Choose the area (or several areas) you are interested in for growth such as investing, retirement, financial education, or investment advice. Click on the options that apply to you.

Now, choose a plan.

There are three plans available on Stash with different monthly fees. Compare the terms of the plans and choose the one you prefer.

Then confirm your investment rights. Indicate your date of birth, and citizenship, or that you are a US citizen, you have a Green Card, a USA visa, or other option.

Indicate your residence country. If you are a US citizen and live in that state, indicate if the US is your place of birth.

The next step is to link the account to your credit card by indicating the name of the card owner, as well as its number, the expiry date, the CVV number, and zip code.

Regulation and safety

Stash cares for client safety. In particular, the broker is registered with the SEC (US Securities and Exchange Commission) as an investment advisor. Moreover, Stash uses the services of Apex Clearing Corporation, a broker-dealer that is also registered with the SEC and is also a member of FINRA CRD#: 287728/SEC#: 8-69908 (the regulator of the US financial industry) and SIPC (Securities Investor Protection Corporation). This partnership protects Stash clients' investments for up to $500,000, of which $250,000 is in cash. Funds that have not yet been used for investment are also protected up to $250,000, provided that the investor participates in the Sweep program.

Linking a bank card to a merchant account allows you to track the activity of the card, and if necessary, you can block the card in the Stash mobile application. The use of a VISA card requires an EMV chip with a three-digit security code to be indicated when making purchases. To protect personal data, Stash uses 256-bit encryption, the TLS protocol is in the mobile application and biometric protection — which includes logging in using a fingerprint or face scan.

Advantages

- Stash is registered in the USA

- Customer investments are protected

- Funds not used for investment are insured for up to $250,000

- The broker cooperates with a reliable clearing company

- Some security measures are used to protect the personal data of investors.

Disadvantages

- To invest, you must link your bank card to your trading account

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Stash Beginner | From 1$ | No |

| Stash Growth | From 1$ | No |

| Stash+ | From 1$ | No |

Please note that money earned with Stash is taxed.

Stash commissions have been compared by TU analysts to provide an unbiased assessment of the company's trading terms. They used the indicators of brokers Fidelity and Charles Schwab for comparison. The results are below:

| Broker | Average commission | Level |

|---|---|---|

|

$1 | |

|

$4 |

Account types

Only American investors, as well as those who have a US visa, Green Card, or an American bank account, can become a client of the company. There are three types of packages available at Stash, each of which provides you with different features.

Types of accounts:

The specificity of the company assumes the absence of demo accounts.

Stash also maintains retirement savings and underage accounts for the parents of minors.

Deposit and withdrawal

-

Link your account to your bank card during registration. That will allow you to replenish a trading account, make a withdrawal and make a monthly payment directly from and to the bank card. ACH translations are also available.

-

Financial transactions from a trading account or to a trading account are made within 5 working days. No transfers are made on weekends and holidays.

-

There are no commissions for deposits or withdrawals at Stash. The exception is the issuance of paper checks and other papers.

Investment Options

Stash offers convenient investment options not only for active investors. The broker is ready to cooperate with both novice investors and traders who are not ready to spend time studying the market. An automated portfolio will allow the client to invest without much effort.

Smart Portfolio program

To get income using Stash, there is no need to independently understand stocks and exchange-traded instruments, or collect a portfolio and monitor its profitability. Stash offers a Smart Portfolio service that makes investing even easier and requires almost no effort on the part of the investor.

The benefits of Smart Portfolio are:

-

Professionals can create ready-made portfolios with different levels of risk, potential profitability, and time constraints.

-

The client's task is to deposit funds for investment in the Smart Portfolio.

-

The ready-made portfolio is also managed by a team of professionals, so the client doesn’t need to monitor the market situation and rebalance the portfolio.

-

Smart Portfolio is a managed portfolio. You don’t need knowledge about investing; it is enough to define your investment goals and level of risks.

-

Using a ready-made portfolio doesn’t guarantee that you will make a profit.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Stash's affiliate program:

At the moment, Stash doesn’t have a referral program or an opportunity to get extra income for attracting new customers to the company.

Customer support

Investors may have questions regarding the work of a broker at different stages such as before opening an account, in the process of registration, or investing funds. In any case, you can contact Stash support and get answers to your questions. The company's employees assist around the clock, seven days a week. Before contacting the support service, you should study the "Help" section, which contains answers to frequently asked questions (FAQs).

Advantages

- Two convenient ways to contact support.

- The site has a Help section, which contains detailed answers to questions about the company

- Support service works 24/7:

Disadvantages

- There is no way to visit the offline broker's office

- No online chat on the broker’s website

- No callback function

There are two ways to contact the client support specialists:

-

by writing an email;

-

call the phone number indicated in the footer.

There is no online-chat on the broker’s website.

Contacts

| Foundation date | 2015 |

|---|---|

| Registration address | Stash Financial, Inc. 500 7th Ave, 18th Floor New York, NY 10018 |

| Regulation | SEC, FINRA, SIPC |

| Official site | https://www.stash.com/ |

| Contacts |

(800) 205-5164.

|

Education

Stash is a broker for both professional and novice traders. The company's website has a section with useful materials that will help you understand the long-term investment options, as well as information on investing for clients of different ages: starting from children and students to retirees.

Stash offers terms for long-term investment, so there is no demo account for testing trading terms and investor skills.

Detailed Review of Stash

Stash is an application that aims to make investing comprehensive. The company has two types of assets: ETFs and shares, including fractional shares. Clients can assemble a portfolio themselves or use ready-made solutions. The company is suitable for long-term investment.

Stash’s success by the numbers:

-

The minimum investment amount is $1.

-

The company has over 6 million users.

-

Support service works 24/7.

-

Clients' investments are insured up to $500,000.

Stash is a broker for users who prefer long-term investment

The broker works with American investors with long-term financial goals. The Stash functionality allows you to develop the habit of investing, starting with small amounts. Then you can make an automatic investment and use the Smart Portfolio managed by Stash. Thus, Stash allows you to generate income through passive investing and allows you to manage your portfolio yourself.

Trading is carried out in the personal account, as well as through the Stash mobile application.

Useful Stash services:

-

Help. This is an extensional section with answers to frequently asked questions (FAQs) from investors, as well as all the information you need to know before starting work with Stash.

-

Auto-Stash. Allows you to develop a habit of investing. You can set up automatic debiting of funds from a bank card to a Stash account with a certain frequency (once a month, a week, etc.).

Advantages:

Fractional shares are available in the company, which makes the investment process comprehensive.

You can form a portfolio on your own or use ready-made solutions.

The platform is free to use and has lots of training materials.

The broker reliably protects the investments, funds, and personal information of its clients.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i