TradeZero (Trade Zero) Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- ZeroPro

- ZeroWeb

- ZeroFree

- ZeroMobile

- up to 1:6

- Free limit orders, stock search, and analysis screener

- trading on any device

Our Evaluation of TradeZero

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TradeZero is a broker with higher-than-average risk and the TU Overall Score of 4.33 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TradeZero clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

The TradeZero broker has its strengths and weaknesses, like any platform. However, TradeZero is a simple and reliable solution for entering the global stock market.

Brief Look at TradeZero

TradeZero is a Bahamian broker that provides its clients with access to the interbank market for stock trading. The platform allows you to trade limit orders for NYSE, Amex, and Nasdaq securities for free. Leverage, depending on the parameters of the order, ranges from 1:2 to 1:6. There are no templates for day trading. The broker has developed four trading platforms - ZeroPro, ZeroWeb, ZeroFree, and ZeroMobile, which make it possible to trade with maximum comfort, regardless of the level of the trader and his preferences. The platforms integrate technical analysis tools, news, and analytics.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- The broker allows you to trade all stocks that are listed on the NYSE, Amex, and Nasdaq exchanges.

- In addition to shares, trading in ETFs and options is available on objectively favorable terms.

- Limit orders greater than $1 and containing up to 200 shares are not subject to commission.

- The broker has proprietary software for working from a desktop, in a browser, and on a mobile device.

- Transparent pricing policy, fixed deposit/withdrawal commissions.

- No commissions on the first deposit.

- The broker provides an extensive pool of educational materials for traders of different levels.

- Fast technical support in live chat, and there is a multi-channel call center and email.

- The minimum deposit is $500. It does not charge a commission, but this is a significant amount, which sometimes repels beginners.

- Use of the ZeroPro and ZeroWeb software with professional functions $59 per month.

- Technical support is not around the clock or on weekends.

- Service priority is given to premium accounts.

TU Expert Advice

Author, Financial Expert at Traders Union

TradeZero offers access to stock trading on ZeroPro, ZeroWeb, ZeroFree, and ZeroMobile platforms, supporting stocks, ETFs, and options. Its clients benefit from leverage up to 1:6 and free limit orders for stocks priced over $1, enhancing capital growth opportunities. Two trading platforms are available free of charge, including a mobile app, facilitating versatile trading for users. The broker's structured educational materials and responsive client support further complement the trading experience.

However, TradeZero requires a minimum deposit of $500, which may not attract novice traders. Additionally, ZeroPro and ZeroWeb incur a $59 monthly fee, and client support is limited to weekdays. While TradeZero's strengths suit traders seeking varied investment options and platform flexibility, beginners prioritizing low initial deposits and cost-free professional tools may explore alternatives.

TradeZero Summary

| 💻 Trading platform: | ZeroPro, ZeroWeb, ZeroFree, ZeroMobile |

|---|---|

| 📊 Accounts: | Standard and Premium (requires more than 50,000 USD on the account) |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfers and ACH |

| 🚀 Minimum deposit: | 500 USD |

| ⚖️ Leverage: | up to 1:6 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No information |

| 💱 EUR/USD spread: | No information |

| 🔧 Instruments: | Stocks, ETFs, options |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No information |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | Free limit orders, stock search, and analysis screener; trading on any device |

| 🎁 Contests and bonuses: | Yes |

At the moment, TradeZero has one of the most favorable conditions among stock brokers. The company allows you to trade a variety of assets, including stocks, ETFs, and options. Leverage of up to 1 to 6 makes it possible to rely not only on your own funds but also to quickly increase capital. An important advantage is the presence of two free platforms of proprietary development, including a mobile application that is not inferior in functionality to the desktop version. No commissions are charged for limit orders up to 200 shares.

TradeZero Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

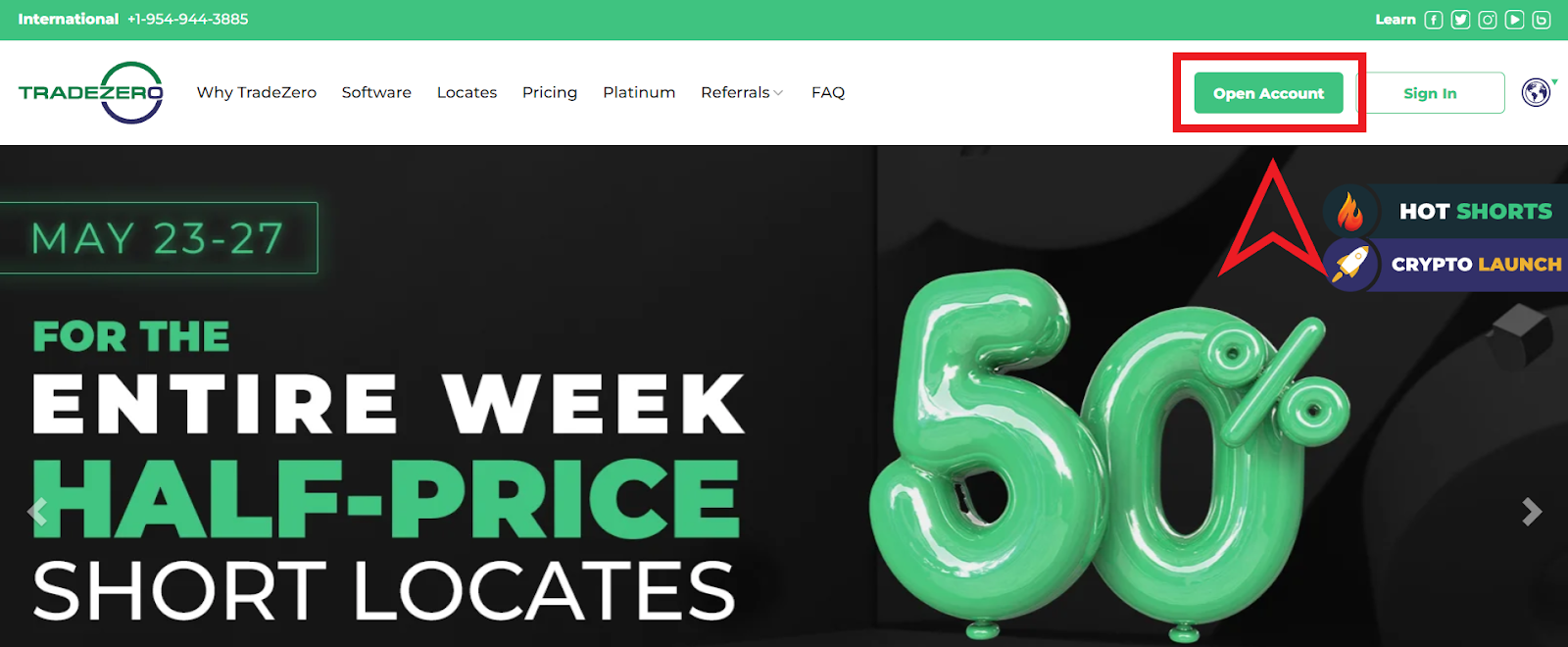

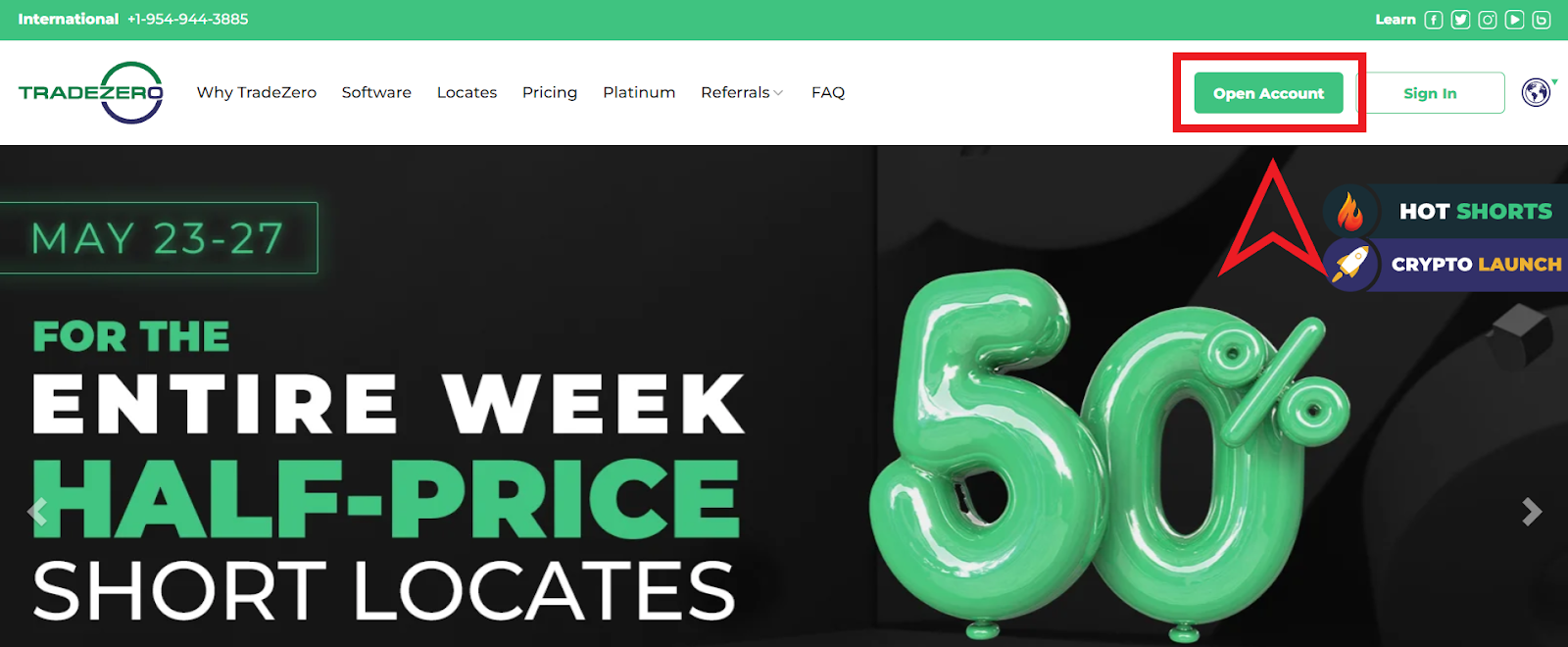

To become a TradeZero client, follow these instructions:

Visit the broker’s official website. In the upper right corner of the screen, there is an “Open an account” button, click on it.

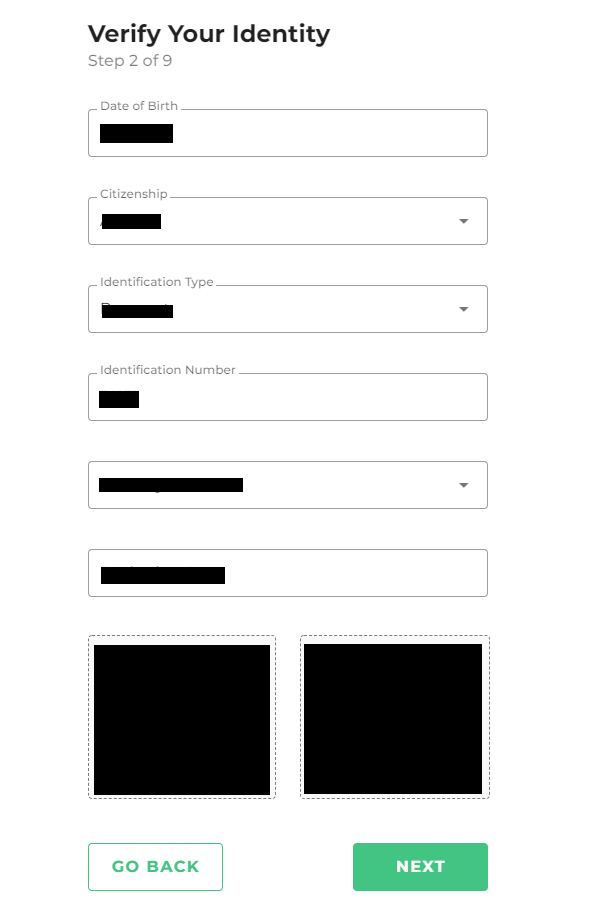

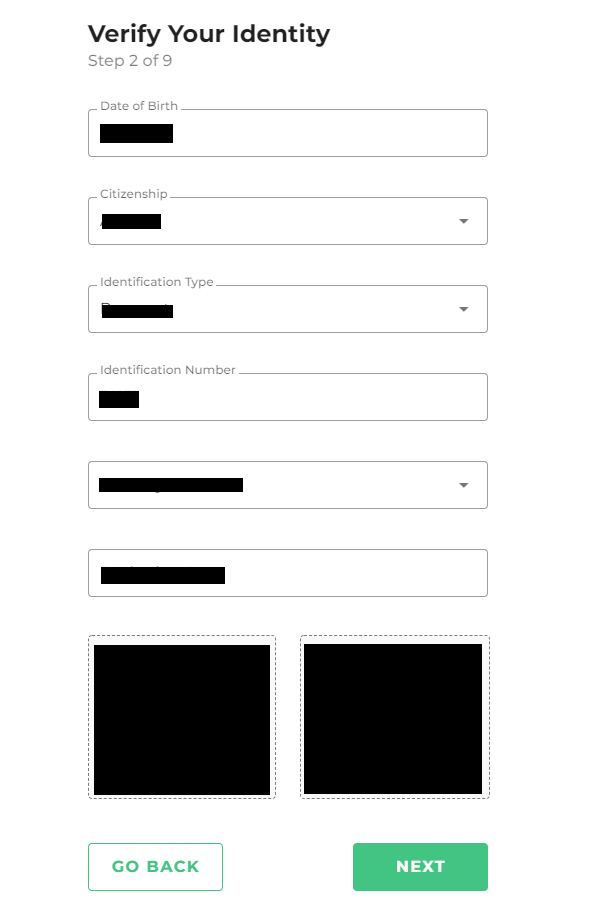

Choose whether you are a resident of the United States, Canada, or another country. Enter your first name, last name, and email. Think of a password and repeat it. You will receive an email with a link to continue registration. By clicking the link, select the type of account (personal or corporate). Enter your address, zip code, and phone number, then provide a scanned copy of your ID (passport or driver’s license). Wait for the security check and get access to your account.

The following functions are available in the user account:

Also, in the user account, a trader can:

-

Search for specific stocks and ETFs using user-provided parameters.

-

Filter promotions and make favorite lists.

-

View charts, order books, etc.

-

Learn news and analytics from experts.

-

At any time, contact support via chat.

Regulation and safety

TradeZero is a member of the Securities Investor Protection Corporation. This is a non-profit financial institution that controls the activities of stock brokers. Traders’ money is insured, and two separate insurance accounts are opened. These measures ensure the security of user funds and data.

The broker is not a member of FINRA and SEC. But it is a part of SIPC. The company has a valid license from this organization, which can be found in the relevant section of the website.

Advantages

- Traders’ funds are insured

- You can file a claim with SIPC

Disadvantages

- Insurance covers only certain types of claims

- Data verification process takes an extended time

- The regulator bears only partial responsibility for the actions of the broker

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | From $1 | Yes |

| Premium | From $1 | Yes |

Note that when funding the account and withdrawing funds, banks, payment systems and other organizations acting as intermediaries may charge an additional commission.

To understand how advantageous TradeZero commissions are, you need to compare them with the offers of its leading competitors. The table below shows data on the average commissions of TradeZero, RoboForex, and Forex4you.

| Broker | Average commission | Level |

|---|---|---|

|

$1 | |

|

$4 |

Account types

Working with the TradeZero broker is convenient because at the start it offers only a standard account; however, there is also a commercial account, but it does not differ functionally from the standard account. All functions of the platform are immediately available on the account. But if a client invests more than $50 thousand US dollars, his account type automatically acquires Platinum status. This is a premium account that provides special benefits.

Account types:

Thus, the TradeZero broker provides equally favorable conditions for traders of all levels. For beginners, there are free solutions and limit orders are without commission. Professionals get more opportunities, unique discounts, and personalized service.

Deposit and withdrawal

-

Traders can withdraw profits in two ways: bank transfer and ACH transfer. The withdrawal option is selected during the formation of the withdrawal request in the user account.

-

Bank and ACH transfers requested before 2:30 pm ET are processed on the same day under normal circumstances. The maximum transfer time is 5 business days.

-

Depositing funds by ACH transfer is not subject to commission. There is a $5 fee for withdrawals. Returned ACH transfers are subject to a $50 fee.

Investment Options

The company does not provide separate investment programs. Its clients are free to invest in thousands of stocks and ETFs and use options to grow their capital.

Investing in ETFs is TradeZero’s popular investment solution

ETF (exchange-traded fund) is a popular investment tool that allows you to diversify risks. TradeZero offers a variety of funds, as well as a stock screener, which gives the investor the possibility to quickly find the most advantageous solutions and get the most profit. Some characteristics of ETF trading at TradeZero are:

-

Exchange-traded funds can be filtered by specific criteria, including industries and regions.

-

ETF trading (as well as other assets) is carried out 24/7, without breaks and on weekends.

-

The user can manage his investment portfolio from a desktop, a browser, or a mobile device.

ETFs are considered one of the most flexible exchange-traded instruments, and traded funds are used with equal efficiency by beginners and experienced investors. The broker’s website has educational materials on working with ETFs.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

TradeZero’s affiliate program:

-

The broker’s referral program allows you to receive bonuses for already registered users and beginners. If a beginner registers using the user’s link and makes a deposit, they both receive from $20 to $100 depending on the amount of the deposit. The bonus is given only for the first deposit, and the account must remain active for at least 60 days

The platform user has the right to place a referral link on any portals, and share it in instant messengers and social networks. There are no restrictions on the number of attracted investors, and for each, you can get a bonus.

Customer support

Traders who cooperate with TradeZero are entitled to receive comprehensive technical support through all available communication channels.

Advantages

- There is a live chat, communication via phone

- There is email

Disadvantages

- The call center is open 5 days a week from 8:00 am to 5:00 pm ET

- English only support

You can contact technical support in the following ways:

-

multichannel call center;

-

email;

-

live chat on the website and in the application.

All communication channels are available, including to unregistered users. It is enough to go to the official website of the broker, where you can immediately write to the live chat, to the bot, or to a manager.

Contacts

| Foundation date | 2008 |

|---|---|

| Registration address | 67 35th Street, Suite B450 Brooklyn, NY 11232 |

| Regulation |

SIPC

Licence number: 1-877-4-TRADE-0 |

| Official site | https://www.tradezero.co/ |

| Contacts |

Education

The broker’s website has a section with training materials, videos, and a detailed manual that can be downloaded in pdf format. There is also a FAQs section with basic information. Thus, the broker provides its clients with all the necessary information so that they can successfully invest in securities.

Some sources write that TradeZero provides a demo account, but it does not.

Detailed Review of TradeZero

The TradeZero stockbroker allows its clients to earn on stocks of leading US companies, and to increase capital with minimal risk. Moreover, investors can work not only with the shares themselves but also with ETFs and options. Commissions for all instruments are lower than the market average, and if an investor places limit orders up to 200 stocks (with the value of one stock being more than 1 US dollar), the transaction is exempt from trading commissions.

TradeZero’s success by the numbers:

-

0 commission for limit orders;

-

$0.005 commission for market orders;

-

1:6 is the maximum leverage;

-

$0 charged for using ZeroMobile and ZeroFree service.

TradeZero is one of the leading stock brokers that allows you to trade on comfortable and favorable terms.

It is important to note the difference between the broker’s trading terminals. ZeroFree is a completely free HTML5-based terminal for use on the desktop. It works in real-time and may be installed on Mac and Windows. It can be expanded with additional add-ons. ZeroMobile is the first such add-on, it is installed on a mobile gadget and synchronized with a desktop terminal. It gives access to quotes and allows you to manage your investment portfolio.

ZeroWeb is a professional browser solution. It is suitable for traders of any level and includes all types of charts and indicators, top lists, news, etc. ZeroPro is an extended version of ZeroFree with all the features that the best trading terminals in the world can offer. For example, there are dynamic streaming quotes, and charting, all windows are customizable and multiple layouts can be saved.

Useful services of TradeZero:

-

Charts with indicators are available for all assets and individually customized by the user.

-

ZeroPro allows you to plot up to 10 charts simultaneously in multiple windows and open up to 6 Level 2 windows.

-

Assets can be filtered using stock tracking and screening.

-

There is a locator for searching and setting alerts.

-

Additional options include the ability to link to Windows, and the presence of custom layouts featuring favorite lists.

-

Level 1 and 2 OTC markets are available for all terminals including Free and Mobile.

-

There is up to 1:6 leverage when trading over $2,500, and all overnight positions automatically receive 2:1.

-

The broker offers educational videos, a detailed manual, and a regularly updated articles section.

Advantages:

The broker gives investors access to the most popular stocks traded on the NYSE, Amex, and Nasdaq stock exchanges.

You can trade stocks of all types in any amount because the broker does not set templates or limits.

Limit orders up to 200 stocks at a stock price of $1 or more are not subject to commission.

Commissions for market orders (any stock price, any order size) are only $0.005 per stock.

The broker has four proprietary terminals for desktop, web browser, and smartphone/tablet.

Two of the four terminals are completely free, and the cost of professional add-ons is $59 per month.

No hidden fees, fixed loyalty fees, or fast transactions.

All terminals are characterized by impeccable stability, high speed, and solid security.

Traders can trade at any time of the day, the work of the broker does not stop even for a minute.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i