According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- MT5

- cTrader

- ASIC

- VFSC

- 2021

Our Evaluation of AC Capital Market

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

AC Capital Market is a broker with higher-than-average risk and the TU Overall Score of 4.35 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by AC Capital Market clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

AC Capital Market provides generally favorable trading conditions, comparable to other brokers in most indicators. It offers competitive spreads and average commissions for the market. The asset pool is sufficiently diverse, and leverage is moderate. Advantages include a free and unlimited Demo account, support for two trading platforms, and a dedicated app for account monitoring and management. AC Capital Market offers decent education services, a variety of useful tools, and news coverage. Unfortunately, this broker's website lacks transparency, and the initial deposit requirement is quite high.

Brief Look at AC Capital Market

Clients of AC Capital Market have access to CFDs on currency pairs, indices, commodities, and metals. This broker offers a free Demo account and two real accounts, Standard and ECN. Depending on the account, the spread is either standard or raw. There are no trading commissions on the Standard account, while the ECN account has a commission of $6 per lot. The minimum deposit is $500, and the maximum leverage is 1:800. Clients trade through the MetaTrader 5 and cTrader trading platforms, and they are available for both desktop and mobile devices. AC Capital Market also provides its copy trading service for passive income. The website includes an educational section, and numerous tools for technical and fundamental analysis, including comprehensive solutions like Autochartist. This broker also features Market News and forecasts. Client support operates 24/5.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- The ability to open and trade on a Demo account for an unlimited time It will only be closed after 14 days of inactivity.

- Traders have access to hundreds of assets that expand their strategic opportunities, and leverage of 1:800 enhances profit potential.

- MetaTrader 5 and cTrader are powerful comprehensive solutions with intuitive interfaces. Both are customizable to the user's preferences.

- This broker does not limit trading strategies; so scalping, hedging, and use of advisors are allowed.

- The economic calendar, Autochartist, and Market News greatly assist trading, with the newsfeed constantly updated.

- This broker offers a concise but informative educational program that explains trading basics through short video guides.

- Client support is available 24 hours through two call centers, email, and live chat.

- The minimum deposit is $500, regardless of the account type, which is a high entry barrier.

- Some data is not disclosed by this broker without registration (e.g., minimum spreads are unknown).

- Alternative income is only presented through copy trading as there are no PAMM or MAM accounts or referral programs.

TU Expert Advice

Financial expert and analyst at Traders Union

The AC Capital Market broker was launched in 2007. It operates from two offices, one in Australia and the other in Vanuatu. It is regulated by ASIC (Australian Securities and Investments Commission) and VFSC (Vanuatu Financial Services Commission), with valid licenses. Throughout its operation, this broker has not violated its obligations to its clients.

AC Capital Market's trading conditions are market average. The spread is variable, regular on the Standard account, and raw on the ECN account, with minimum values of 1 pips and 0 pips, respectively. As for the commission of $6 per lot on the ECN account, it's a reasonable fee.

The minimum trade size is 0.01 lots, and leverage can reach up to 1:800, which are typical indicators. This broker doesn't impose trading restrictions, following the pattern of many top brokers. These days, strong foundational education is expected, but AC Capital Market's significant collection of specialized tools is a clear advantage. Alongside the economic calendar and Market News, the website features Autochartist, and a special feed with financial analytics.

Regarding the copy trading service, this broker has developed its proprietary solution, unlike many competitors who use third-party services. An advantage of AC Capital Market's copy trading is that investors can adjust numerous parameters, from coefficients to risk levels. On the provider side, they appreciate the simplicity and speed of the service. Unfortunately, this is the only passive income option available to platform users.

One drawback is the lack of transparency. This broker doesn't disclose approximate spread data for unregistered users. Additionally, the entry threshold is indeed high. While most brokers offer a standard account with a deposit starting from $50 or $100, AC Capital Market requires a minimum of $500. Fortunately, there is a free Demo account available to avoid blind investments.

AC Capital Market Trading Conditions

| 💻 Trading platform: | МТ5, cTrader |

|---|---|

| 📊 Accounts: | Demo, Standard, ECN |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Wire, Skrill, Neteller, FastPay, WebPays, PayTM, Paystack, LOT Payments, WebMoney, Adyen |

| 🚀 Minimum deposit: | $500 |

| ⚖️ Leverage: | Up to 1:800 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,10 pips |

| 🔧 Instruments: | CFDs on currency pairs, indices, commodities , metals |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

Demo account is free of charge and unlimited in time; There are two real accounts, high entry threshold, acceptable trading costs, and many different asset types; Two trading platforms are available; The broker's application for account control, and the copy trading service are available. |

| 🎁 Contests and bonuses: | Yes |

For most brokers that offer multiple real account, the minimum deposit requirements vary because the trading parameters differ. However, exceptions are not uncommon. AC Capital Market has two real account types, Standard and ECN. To open either of them, a minimum deposit of $500 is required. The trading leverage is also not tied to the account type. It's flexible, meaning users choose a level within the range of 1:1 to 1:800. Regarding technical support, it's available through all standard channels such as phone center, email, live chat, and website tickets. Managers work 24/5.

AC Capital Market Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

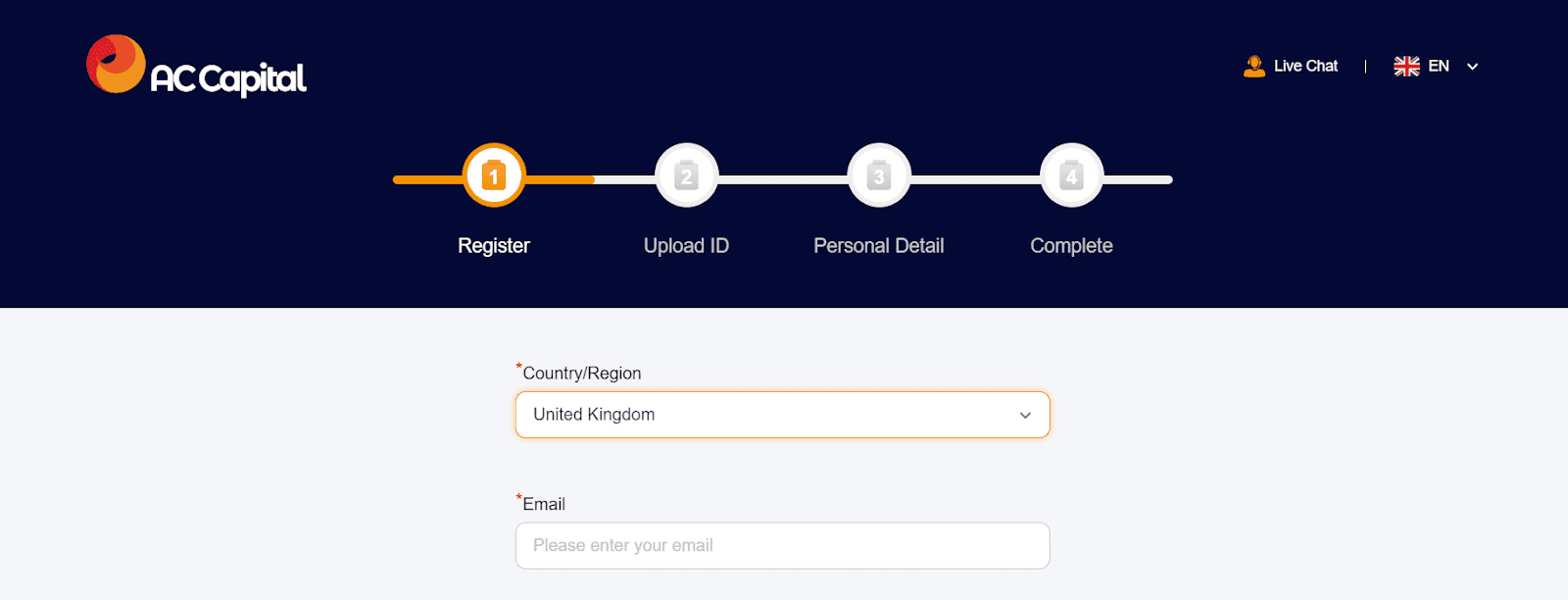

To initiate collaboration with this broker, you need to register on their official website, complete the verification process, open a real account, and make a deposit. Afterward, the trader downloads a trading platform, installs it, enters the registration details, and starts trading. TU experts have prepared a step-by-step guide to address questions about the registration process. They also shed light on the capabilities of the user account.

Go to this broker's website. In the upper right corner, select the interface language. Click on "Live Account" or any other button that signifies the beginning of the registration process.

Choose the country of your residence. Enter your email and phone number. Create a password and enter it twice. Select the trading platform(s) through which you plan to trade. Agree to the collaboration terms by checking the box at the bottom. Click "Register".

Choose the document type that can verify your identity. Upload its scan or photo. Choose the document type that can verify your address. Upload its scan or photo. Enter additional information. Click "Confirm Upload".

Select how you prefer to be addressed, and enter your name, date of birth, and registration address. Answer all questions. Agree to additional collaboration terms by checking the boxes at the bottom. Click "Confirm". Wait for the document verification process to complete.

The Standard account is open by default. You can open Demo and ECN accounts later. Click "Deposits" in the right menu. Choose the funding method available in your region. Follow the on-screen instructions.

Choose your preferred trading platforms in the right side menu. Download the distribution package and install the software on your device. To log in, use the data that this broker will send you via email after the verification process is complete.

Your AC Capital Market user account also enables you to:

-

Open and close accounts (Live or Demo).

-

View your account’s status, and current and archived trades.

-

Deposit and withdraw funds and perform internal transfers.

-

Update personal information and security parameters.

-

Check quotes and spreads for available assets.

-

Use the economic calendar and other tools.

-

Access an updated newsfeed.

-

Download the trading platforms and Autochartist app.

-

Download this broker's dedicated application.

-

Visit the Rewards Store to redeem points.

-

Contact this broker's technical support service.

Regulation and safety

AC Capital Market has a safety score of 3.7/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Not tier-1 regulated

- Track record of less than 8 years

AC Capital Market Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

VFSC VFSC |

Vanuatu Financial Services Commission | Vanuatu | No specific fund | Tier-3 |

AC Capital Market Security Factors

| Foundation date | 2021 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker AC Capital Market have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- Above-average Forex trading fees

- Deposit fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of AC Capital Market with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, AC Capital Market’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

AC Capital Market Standard spreads

| AC Capital Market | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,8 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

AC Capital Market RAW/ECN spreads

| AC Capital Market | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,00 | 3 | 3,5 |

| EUR/USD avg spread | 0,10 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,15 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with AC Capital Market. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

AC Capital Market Non-Trading Fees

| AC Capital Market | Pepperstone | OANDA | |

| Deposit fee, % | 0-0,5 | 0 | 0 |

| Withdrawal fee, % | 0-1 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Usually, when choosing a broker, a trader evaluates its trading accounts. However, with AC Capital Market, this is not conceptually significant. This is because the Standard and ECN accounts differ only in the format of trading costs (regular spread with no commission, or raw spread plus a $6 per lot commission). The minimum deposit, leverage, and maximum trade volume are all the same. There are significant differences between the two trading platforms. MetaTrader 5 shares similarities with MetaTrader 4, being functional and highly customizable. cTrader, on the other hand, features a fundamentally different interface, though its basic framework is similar. It can also be personalized, albeit to a lesser extent. The best course of action is to try both platforms and select the one that suits you best. Note that both platforms have mobile versions. Users point out that this broker's app is ideal for account monitoring, whereas the platforms are mainly used for placing orders. Traders interested in passive earning can register for the copy trading service as either a provider or an investor. This feature is appealing to those looking to earn passively.

Account types:

For traders who have never worked with the chosen broker, it's optimal to start by opening a Demo account. It enables exploration of the platform's capabilities and experimentation with personal strategies. An advantage of AC Capital Market is that the Demo account has a significant reserve of virtual currency, allowing for unlimited trading. If this broker's conditions suit the trader, they can then open a real account and begin full-fledged trading.

Deposit and withdrawal

AC Capital Market received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

AC Capital Market offers limited payment options and accessibility, which may impact its competitiveness.

- Bank wire transfers available

- Low minimum withdrawal requirement

- Wise not supported

- Minimum deposit above industry average

What are AC Capital Market deposit and withdrawal options?

AC Capital Market offers a limited selection of deposit and withdrawal methods, including Bank Wire, Skrill, Neteller. This limitation may restrict flexibility for users, making AC Capital Market less competitive for those seeking diverse payment options.

AC Capital Market Deposit and Withdrawal Methods vs Competitors

| AC Capital Market | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are AC Capital Market base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. AC Capital Market supports the following base account currencies:

What are AC Capital Market's minimum deposit and withdrawal amounts?

The minimum deposit on AC Capital Market is $500, while the minimum withdrawal amount is $50. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact AC Capital Market’s support team.

Markets and tradable assets

AC Capital Market offers a limited selection of trading assets compared to the market average. The platform supports 0 assets in total, including 40 Forex pairs.

- Copy trading platform

- Indices trading

- 40 supported currency pairs

- Futures not available

- Crypto trading not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by AC Capital Market with its competitors, making it easier for you to find the perfect fit.

| AC Capital Market | Plus500 | Pepperstone | |

| Currency pairs | 40 | 60 | 90 |

| Total tradable assets | 2800 | 1200 | |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products AC Capital Market offers for beginner traders and investors who prefer not to engage in active trading.

| AC Capital Market | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Can funds be deposited using a Visa card? Is there an internal transfer option? What's the withdrawal fee for Skrill? Traders often struggle to find crucial information on these and other questions. In such situations, the support team should step in to help. If the managers respond slowly or lack expertise, the trader will inevitably consider switching to a competitor. AC Capital Market aims to prevent this by offering 24-hour, qualified technical support, reachable through various means of communication. However, keep in mind that it operates only on weekdays.

Advantages

- There is a call center, email, live chat, and tickets

- On weekdays managers are available 24/5

- Even non-registered users can contact support

Disadvantages

- On weekends traders have no possibility to contact technical support

Whether you're already working with AC Capital Market or considering becoming a client, don't hesitate to reach out to their support. Here are the current communication channels:

Call center.

Email.

Ticket on the feedback form page.

Live chat on the website and in the user account.

This broker is also on social media platforms such as Facebook, Instagram, X (formally Twitter), and YouTube. Through these platforms, you can also contact their support specialists. Additionally, traders should consider following this broker's accounts to promptly receive updates.

Contacts

| Foundation date | 2021 |

|---|---|

| Registration address |

Unit 803, 213 Miller St, North Sydney, NSW 2060 Room 210, Crystal Palace Building, P.O. Box955, Lini Highway, Port Vila, Vanuatu |

| Regulation | ASIC, VFSC |

| Official site | https://www.accapital.com/ |

| Contacts |

+61 (02) 7209 0626, +678 541 3519

|

Education

Many brokers offer their traders educational programs that can include elements like e-books, expert-produced articles, and online webinars. The purpose of such programs is to enhance traders' effectiveness. At AC Capital Market, education is delivered through video guides. There are several sections, each containing a series of thematic videos for viewing. The training is comprehensive but focuses solely on the basics of trading. As a result, experienced market participants are unlikely to find anything of interest here.

For clients who have limited or almost no knowledge about financial markets, the educational videos provided by AC Capital Market can help them quickly grasp the basics. However, users will likely still need additional external sources for more comprehensive theoretical preparation. This broker also allows clients to open a Demo account for practice.

Comparison of AC Capital Market with other Brokers

| AC Capital Market | Bybit | Eightcap | XM Group | TeleTrade | IC Markets | |

| Trading platform |

cTrader, MT5 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5 | MT4, cTrader, MT5, TradingView |

| Min deposit | $500 | No | $100 | $5 | $10 | $200 |

| Leverage |

From 1:1 to 1:800 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | 1.00% | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0.8 points | From 0.2 points | From 0 points |

| Level of margin call / stop out |

No | No / 50% | 80% / 50% | 100% / 50% | 70% / 20% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | No |

Detailed review of AC Capital Market

As AC Capital Market has been operating for 15 years, the community and experts have formed a solid impression of this broker. It stands as a veteran in the field, having progressed notably over the past years by adding new assets and analytical tools. The copy trading service was also introduced relatively recently in response to client requests. The platform collaborates with first-tier liquidity providers, ensuring low costs. Traders' funds are kept separately from the company's funds for security. Given order execution speeds of up to 30 ms and the existence of a proprietary mobile application, there's no doubt that this broker uses an advanced technological stack and innovative solutions.

AC Capital Market by the numbers:

The minimum deposit is $500.

The maximum leverage is 1:800.

Raw spreads start from 0 pips.

Commission on the ECN account is $6 per lot.

Technical support works 24/5.

AC Capital Market is a CFD broker for traders of all levels

The platform's versatility is defined by its trading conditions. The number of assets in its pool is a pivotal factor. The more assets, the broader a trader's strategic possibilities and the lower the trading risks due to a diversified investment portfolio. AC Capital Market offers more than enough trading instruments, comprising the most popular groups such as currency pairs, indices, commodities, and metals. Another critical aspect is its 1:800 leverage, which is an optimal indicator. AC Capital Market offers additional advantages, such as the support of the MetaTrader 5 and cTrader trading platforms. Both solutions are sought-after, functional, user-friendly, and customizable. Plus, there's the option of earning passively through the copy trading service. As such, AC Capital Market's conditions are suitable for both beginners and experienced players.

AC Capital Market’s services:

Copy trading. This service allows a trader to register either as a signal provider, earning from investor commissions, or as an investor, trading passively with reduced risk.

Autochartist. This is a comprehensive service often referred to as a trading center. It delivers summarized market data, displays trends, and visually offers expert forecasts.

Broker’s app. AC Capital Market has developed its mobile application, enabling fund deposits or withdrawals, trade monitoring, and notifications. The only thing you can't do through it is trade.

Advantages:

This broker provides an unlimited-time free Demo account, offering real quotes but enabling risk-free trading with virtual currency.

On real accounts, there are reasonable spreads and average commissions. No hidden costs. Traders are not restricted in trading styles or methods.

MetaTrader 5 and cTrader trading platforms are highly customizable. Thus, this broker's clients can work in the most convenient conditions.

This broker is regulated, holds confirmed licenses, and has been present in the market for over 15 years. This means traders need not worry about their funds and personal data.

Technical support is available 24/5. Specialists can be reached by phone, email, or by raising a ticket. Live chat is also accessible on the website and in the client area.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i