According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- WebTrader

- MetaTrader4

- 2020

Our Evaluation of CedarFX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

CedarFX is a broker with higher-than-average risk and the TU Overall Score of 4.6 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by CedarFX clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

CedarFX is an unregulated broker that allows you to start trading with small amounts, but it does not provide micro-accounts and useful instruments for traders. However, the company offers a wide variety of CFDs, margin trading, and free demo accounts.

Brief Look at CedarFX

CedarFX is a Forex broker registered in Saint Vincent and the Grenadines. It offers its clients CFD trading on currency pairs, cryptocurrencies, stock indices, shares, and commodities with margin. CedarFX is a socially responsible company that invests in environmental protection. It was awarded the title of the World's First Eco-Broker. CedarFX also has the Best Commission Free Broker award for high-quality brokerage services and the Best Trade Executions award for low fees.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- The minimum deposit is only $10;

- Tight floating spreads from 0.6 pips;

- Trading in classic MetaTrader 4 (MT4) platform with mobile, desktop, and browser versions;

- No restrictions on the use of strategies and trading styles;

- High leverage;

- Opportunity to test trading conditions on demo accounts;

- A wide range of assets, especially currency pairs, and stock CFDs.

- The broker operates without a license and regulation;

- Lack of training, analytics, and recommendations for beginners and experienced traders;

- Traders do not have the opportunity to evaluate the conditions of the company on cent accounts.

TU Expert Advice

Author, Financial Expert at Traders Union

CedarFX provides access to trading Forex, cryptocurrencies, stock indices, stocks, and commodities via CFDs. Its clients can start trading with a minimum deposit of $10 and utilize the MetaTrader 4 platform, which is available in desktop, mobile, and web versions. The platform permits various trading strategies and styles without restriction, with leverage up to 1:500. CedarFX also offers free demo accounts for testing trading conditions and multiple account currencies including Bitcoin.

However, CedarFX operates without any major regulatory oversight, which may not meet the requirements of traders who prioritize security. The broker lacks educational resources and analytics, limiting its appeal for beginners or those seeking in-depth market insights. The sole reliance on Bitcoin for deposits and withdrawals may also be inconvenient for traders preferring other payment methods. CedarFX may be more appropriate for experienced traders interested in eco-friendly initiatives and flexible trading strategies, but less so for those who prioritize regulation and comprehensive educational support.

- You value eco-friendly initiatives. CedarFX plants 10 trees for every lot traded, offering an optional way for traders to contribute to environmental sustainability.

- Global access is beneficial for you. CedarFX accepts clients from various countries and provides diverse deposit options, even though the current options are limited to Bitcoin.

- Regulation is your top priority. CedarFX is currently not regulated by major financial authorities, which might be a deterrent for traders who prioritize strong regulatory oversight.

- You need a wide range of deposit and withdrawal options. CedarFX currently only accepts Bitcoin for deposits and withdrawals. If you require more conventional payment methods, the limited options may not align with your needs.

CedarFX Trading Conditions

| 💻 Trading platform: | MetaTrader 4 (desktop, mobile versions), WebTrader |

|---|---|

| 📊 Accounts: | Demo, 0% Commission Account, and Eco Account |

| 💰 Account currency: | USD, EUR, GBP, CAD, AUD, and BTC |

| 💵 Deposit / Withdrawal: | Bank cards, bank wire transfers, and Bitcoins |

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,3-0,6 pips |

| 🔧 Instruments: | Forex, cryptocurrencies, commodities, stocks, and indices |

| 💹 Margin Call / Stop Out: | 100%/70% |

| 🏛 Liquidity provider: | Own quote providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | All styles and trading strategies are allowed |

| 🎁 Contests and bonuses: | No |

CedarFX offers trading various CFD types on MT4 and allows you to open accounts in both fiat currencies and Bitcoins (BTC). If clients deposit BTC directly from their wallet, then the minimum deposit is $10. When choosing other payment methods (bank cards and bank transfers), a trader cannot deposit less than $50. All cryptocurrency transactions, regardless of their amount, are subject to blockchain and miner fees. Spreads are floating, and the execution type is market execution.

CedarFX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

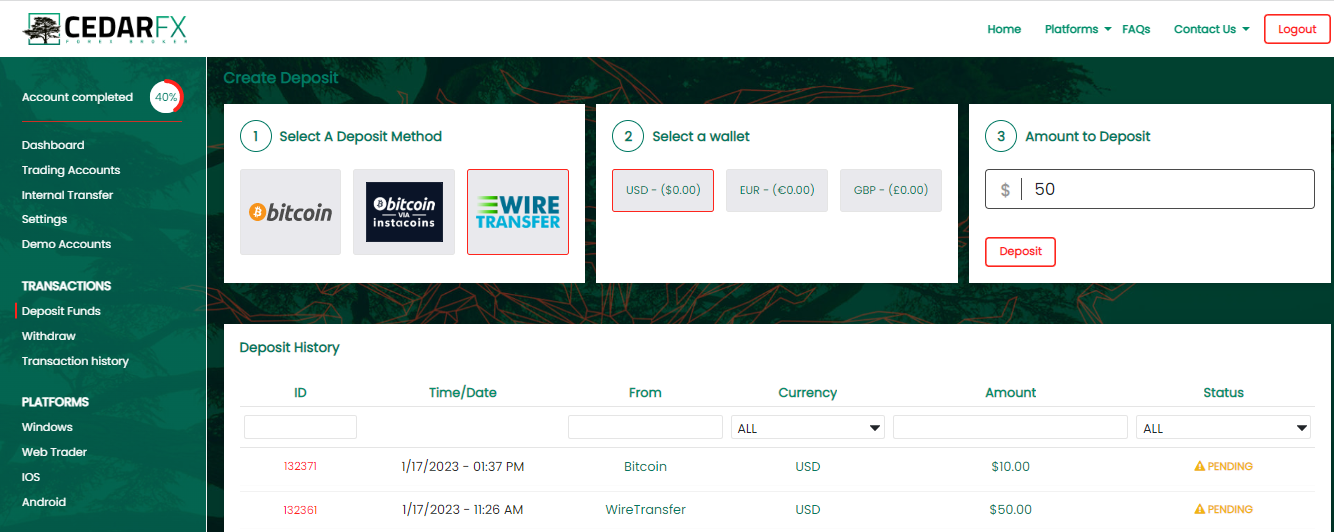

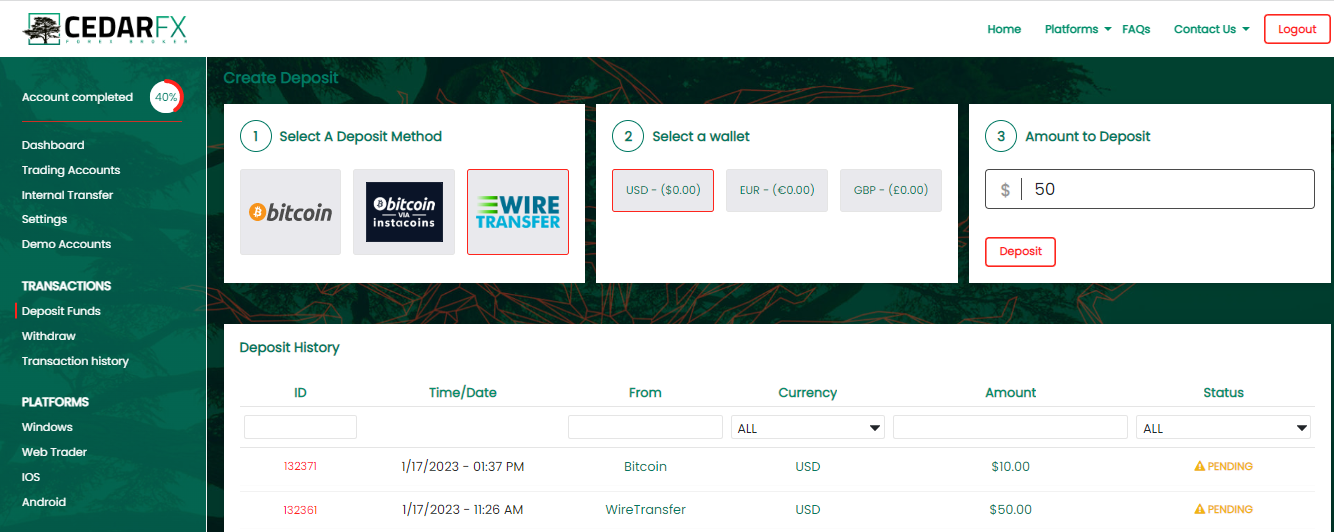

Trading Account Opening

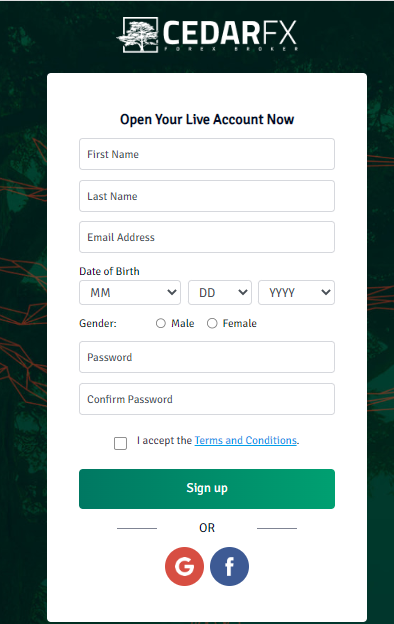

To create a user account on the CedarFX website, follow these steps:

First, fill out the registration form. To open it, click the “Open Live Account” button on the main page of the website or the “Sign Up” button at the top of any page.

Indicate the following personal data in the form for creating an account: first and last names, date of birth, email address, and gender. Also, create and enter a password twice to protect your user account from third parties.

Then confirm your email address. Instructions are sent by email.

To sign in to your user account, enter your email address and previously generated password.

Opportunities of CedarFX’s user account:

Additional services of the user account:

-

Downloading the trading platform;

-

Button to go to WebTrader;

-

Transferring funds between active accounts;

-

Trading history;

-

Submitting requests for withdrawal of profits;

-

Enabling two-factor authentication.

Regulation and safety

CedarFX has a safety score of 4.2/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Not tier-1 regulated

- No negative balance protection

- Track record of less than 8 years

CedarFX Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

SVG FSA SVG FSA |

Financial Services Authority of St. Vincent and the Grenadines | St. Vincent and the Grenadines | No specific fund | Tier-3 |

CedarFX Security Factors

| Foundation date | 2020 |

| Negative balance protection | No |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker CedarFX have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of CedarFX with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, CedarFX’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

CedarFX Standard spreads

| CedarFX | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,3 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,6 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,4 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,6 | 1,4 | 0,5 |

Does CedarFX support RAW/ECN accounts?

As we discovered, CedarFX does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with CedarFX. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

CedarFX Non-Trading Fees

| CedarFX | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

CedarFX offers two types of trading accounts. The spreads, leverage, and minimum deposit are identical, and the list of available trading instruments includes the same assets. Accounts differ in the availability/absence of an additional fee for a traded lot. Each client can have an unlimited number of accounts of both types.

CedarFX account types:

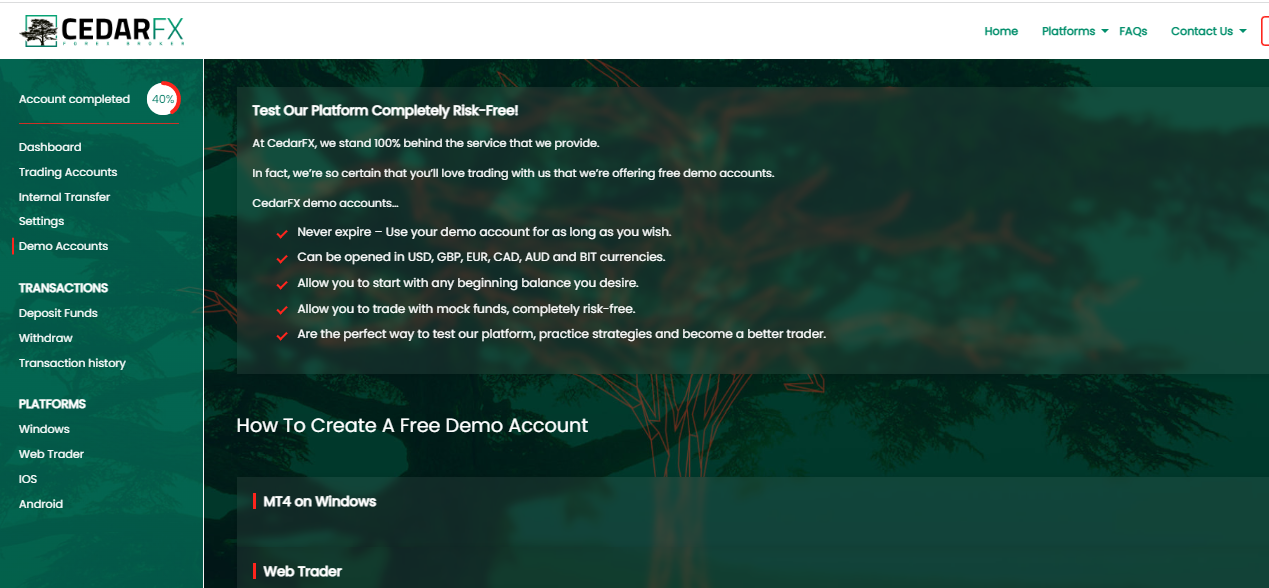

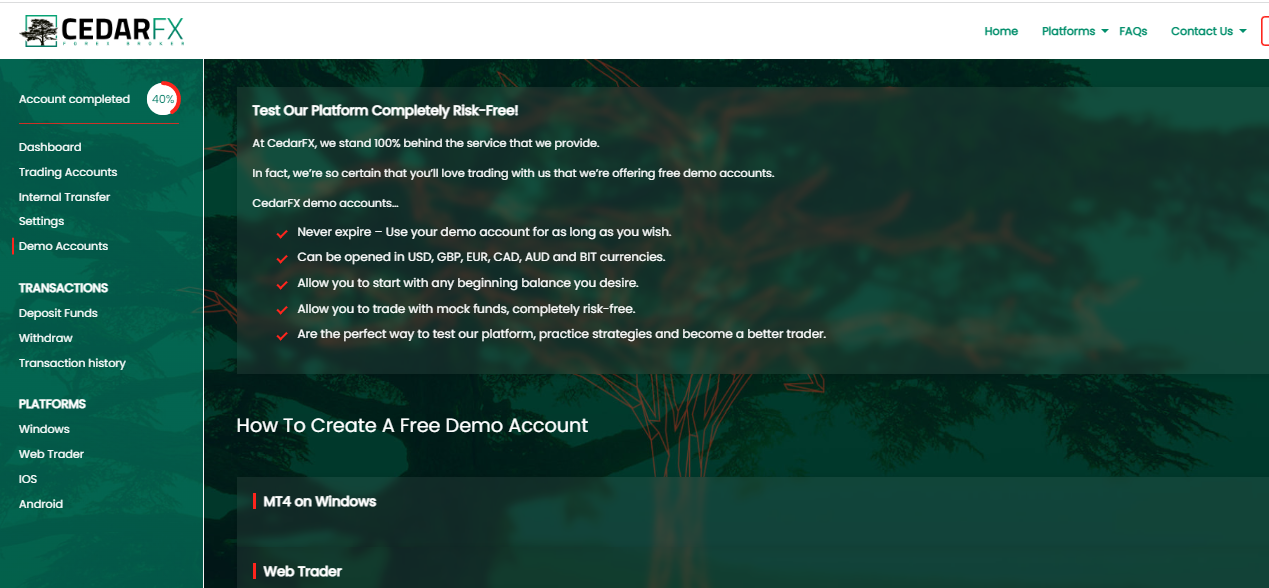

MetaTrader 4 demo accounts are available to test the broker’s conditions. They can be opened in any version of the trading platform. Available account currencies are USD, EUR, GBP, CAD, AUD, and BTC.

CedarFX provides MT4 accounts with floating spreads and high leverage. The choice of assets will satisfy the needs of both beginning traders and professionals in Forex trading.

Deposit and withdrawal

CedarFX received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

CedarFX provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No withdrawal fee

- Bank wire transfers available

- BTC available as a base account currency

- Bitcoin (BTC) accepted

- PayPal not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

- Only major base currencies available

What are CedarFX deposit and withdrawal options?

CedarFX provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, BTC.

CedarFX Deposit and Withdrawal Methods vs Competitors

| CedarFX | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are CedarFX base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. CedarFX supports the following base account currencies:

What are CedarFX's minimum deposit and withdrawal amounts?

The minimum deposit on CedarFX is $10, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact CedarFX’s support team.

Markets and tradable assets

CedarFX offers a limited selection of trading assets compared to the market average. The platform supports 170 assets in total, including 50 Forex pairs.

- Crypto trading

- Indices trading

- Copy trading platform

- Bonds not available

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by CedarFX with its competitors, making it easier for you to find the perfect fit.

| CedarFX | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 170 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products CedarFX offers for beginner traders and investors who prefer not to engage in active trading.

| CedarFX | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Live chat support of CedarFX is available 24/7.

Advantages

- Many means of communication

- Callback is available

- Prompt responses of live chat operators

Disadvantages

- Broker’s phone number is not available on the website

- Clients can get answers to general questions only

To address the broker's technical support, traders can use the following means of communication:

-

live chat;

-

email;

-

callback;

-

Facebook or Instagram.

Describing a problem in live chat is the fastest way to get an answer to a trader's question. This means of communication with the company's support is available to its registered clients and non-registered visitors.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address | Cedar LLC, St. Vincent and the Grenadines |

| Official site | https://www.cedarfx.com/ |

| Contacts |

Education

CedarFX does not educate traders. Its website provides the terms of trading and the available payment methods. There are no basic rules for trading on the Forex market.

The broker provides a demo account that can be used to practice trading. However, theories of trading will have to be researched on the websites of other brokers.

Comparison of CedarFX with other Brokers

| CedarFX | Bybit | Eightcap | XM Group | FBS | 4XC | |

| Trading platform |

MetaTrader4, WebTrader | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MobileTrading, MT5, FBS app | MT5, MT4, WebTrader |

| Min deposit | $10 | No | $100 | $5 | $5 | $50 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:3000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.6 points | From 0 points | From 0 points | From 0.8 points | From 1 point | From 0 points |

| Level of margin call / stop out |

100% / 70% | No / 50% | 80% / 50% | 100% / 50% | 40% / 20% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | No | No | No | No | No |

Detailed review of CedarFX

CedarFX strives to make trading on financial markets accessible to everyone, so it allows you to start with only $10. Also, a trader who has become its client can trade intraday and also use long-term strategies. Live chat operators are available 24/7, and if necessary, you can contact a CedarFX representative by phone. The company does not charge fees for deposits and withdrawals so that clients can reduce their trading costs.

CedarFX by the numbers:

-

More than 180 financial instruments are available for trading;

-

Leverage for some pairs is up to 1:500;

-

Creating a trading account takes no more than 10 minutes;

-

The company has transferred funds for planting 125,859 trees.

CedarFX is a Forex broker for trading financial instruments with leverage

The company offers a wide range of assets. They include 55 currency pairs with major, minor, exotic, and cross rates. Also, 35 cryptocurrency pairs, 64 stocks, 11 indices, commodities, and precious metals are available for trading. All listed instruments can be traded with leverage. The maximum value for stocks is 1:20, for cryptocurrencies, it is 1:100, for indices and commodities it is 1:200, and for currency pairs, it is 1:500. Each CedarFX client can open an unlimited number of demo and live trading accounts. Also, traders can use different leverage settings and create accounts in different currencies to save on conversion.

To make transactions, the broker provides the MetaTrader 4 platform. It is available in three versions - desktop, mobile, and WebTrader. CedarFX allows you to use the functions of the platform to the maximum; i.e., traders can use applications for automated trading and copy trades of other MT4 users.

Useful services offered by CedarFX:

-

Plant a tree. The broker transfers 100% of the withheld trading fees from Eco accounts to the implementation of environmental projects;

-

Demo accounts. These are used to test the trading conditions offered by CedarFX;

-

Request a callback. With the help of this form, a trader can order a call from a support representative at a convenient time.

Advantages:

To make a deposit, it is not necessary to get verified;

Your user account can be secured with two-factor authentication;

Live chat support is available 24/7;

The company processes all withdrawal requests within 24 hours;

Trading accounts with no fee per lot are available.

CedarFX allows all styles and methods of trading, including scalping, hedging, algorithmic trading, and copy trading.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i