Fusion+ Copy Trading | Full Review

Fusion+ by Fusion Markets is a copy trading platform that allows traders to copy the trades of experienced investors in real time. The platform is available to all clients outside of Australia and offers free use as long as you trade at least 2.5 lots per month. If you don’t meet this volume, there is a $10 per month fee to cover hosting. Experienced traders can sign up as Fusion+ Masters and charge up to 30% of the profits of subscribers..

Fusion Markets is an Australian broker that offers a wide range of financial services, including copy trading. Copy trading allows traders to copy the trades of experienced professionals, making it attractive to newbies and busy investors. In this review, we will take a closer look at the features and benefits of copy trading on the Fusion Markets platform, as well as provide practical tips on how to get started.

Fusion+ overview

Fusion+ is an innovative platform from Fusion Markets, specially designed for copy trading. The platform supports cooperation with DupliTrade and MyFxBook AutoTrade, which allows traders to choose from a variety of strategies and signals to copy.

-

DupliTrade — is known for its careful selection of traders. A minimum deposit of $5,000 is required to start copying. Users can monitor the statistics of traders and choose those that match their investment goals. The platform provides access to a wide range of financial instruments, including Forex, stocks, indices and commodities.

-

MyFxBook AutoTrade — has a lower entry threshold - the minimum deposit is $1,000. MyFxBook offers convenient analytics and the ability to copy trades on a demo account before switching to a real account. Disadvantages include the lack of filters for finding traders and an outdated interface.

The process of registering and setting up an account on Fusion+ is simple and takes minimal time. It only takes a few steps: register on the site, confirm your identity and top up your account. After that, users can start copying the trades of the selected traders.

How to start copy trading on Fusion+

To start copy trading on Fusion Markets, follow these steps:

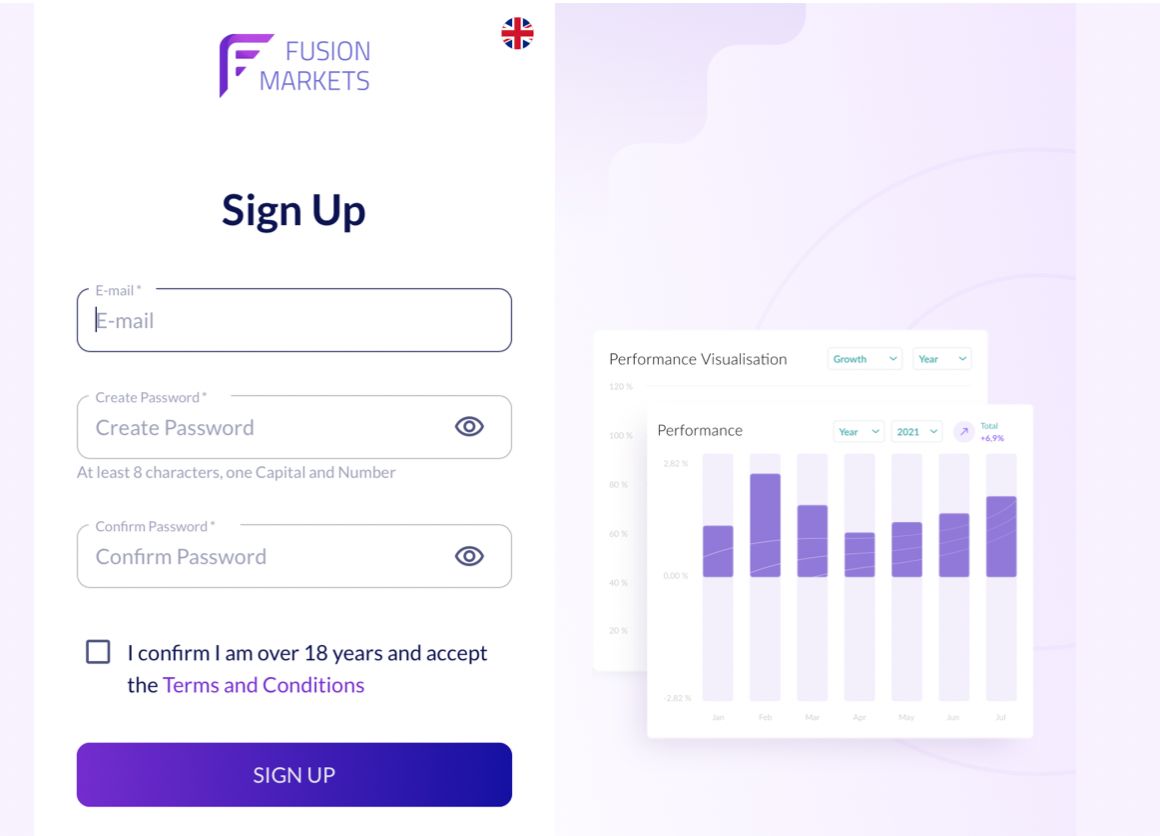

1. Register. Register on the Fusion+ platform by filling out a simple online form and verifying your identity. Registration takes no more than 10-15 minutes.

Fusion+ screen

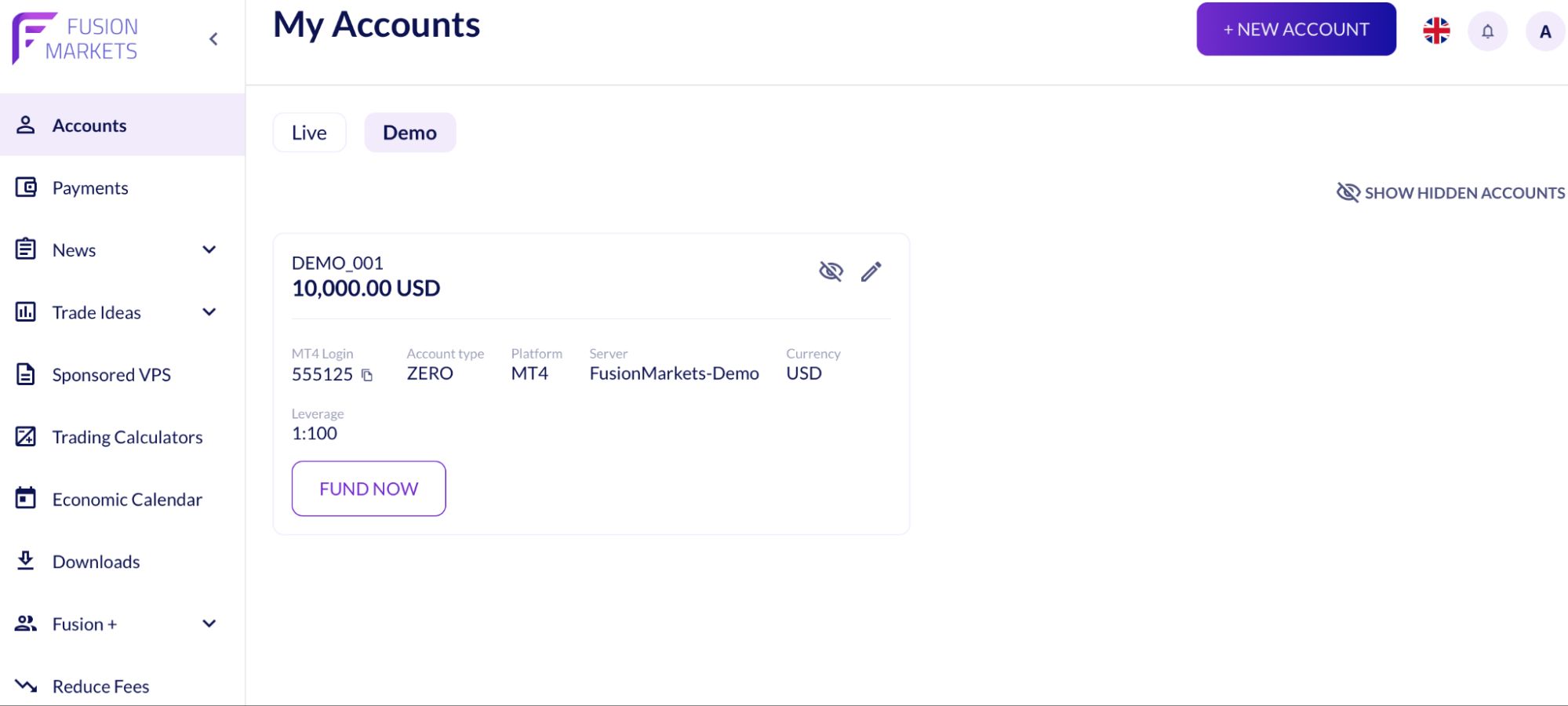

2. Choose an account type. The following account types are available on the Fusion+ platform from Fusion Markets:

Classic account:

-

Spreads: wider, starting from 0.9 pips.

-

Commissions: none.

-

Perfect for: traders who prefer no commissions on trades.

ZERO account:

-

Spreads: tighter, starting from 0.0 pips.

-

Commissions: $4.50 per lot (both ways).

-

Perfect for: traders who want the tightest spreads.

Swap-free account:

-

Spreads and commissions: same as Classic or ZERO accounts.

-

Feature: no swaps for Islamic traders.

Demo account:

-

Spreads and commissions: same as real accounts.

-

Use: for testing strategies without the risk of losing real funds.

Fusion+ screen

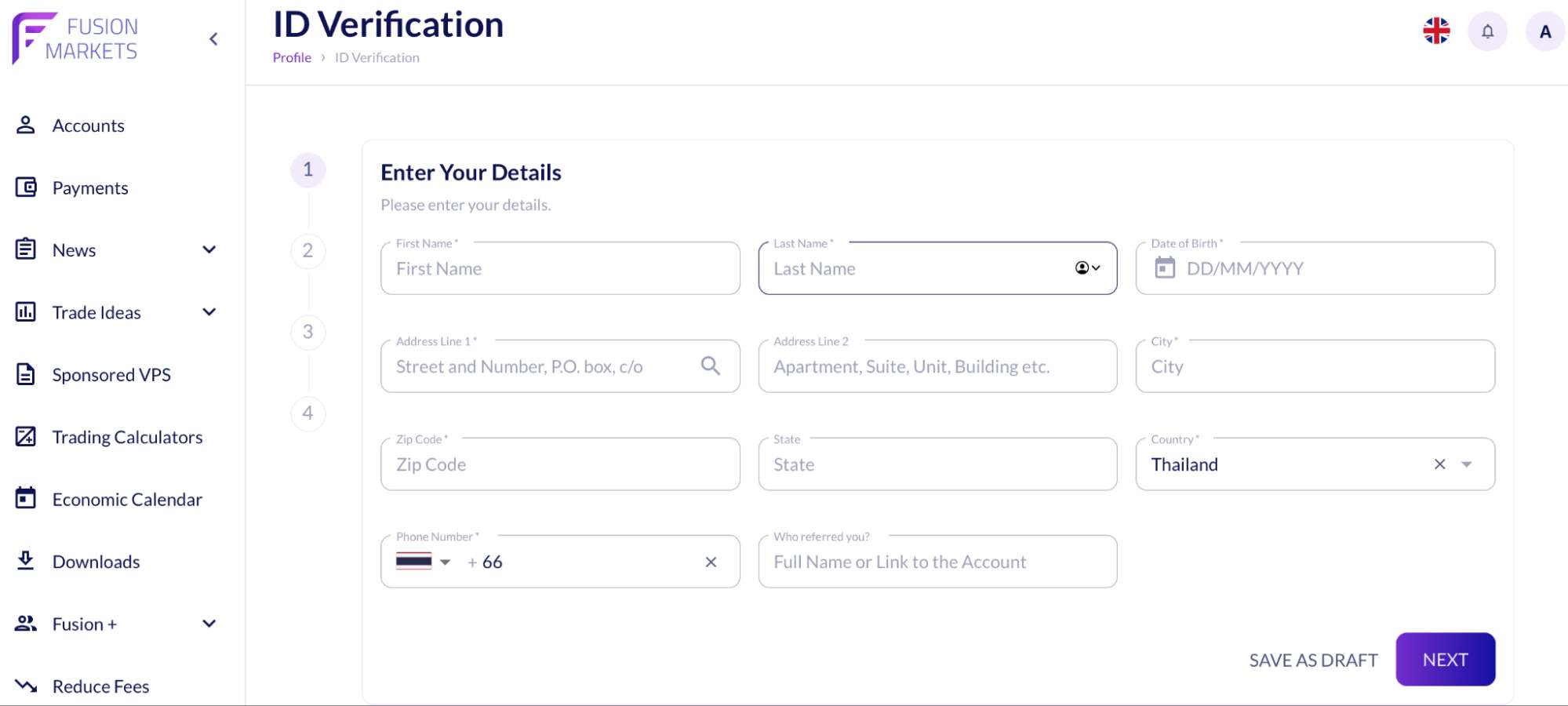

Before choosing an account, you must go through verification:

Fusion+ screen

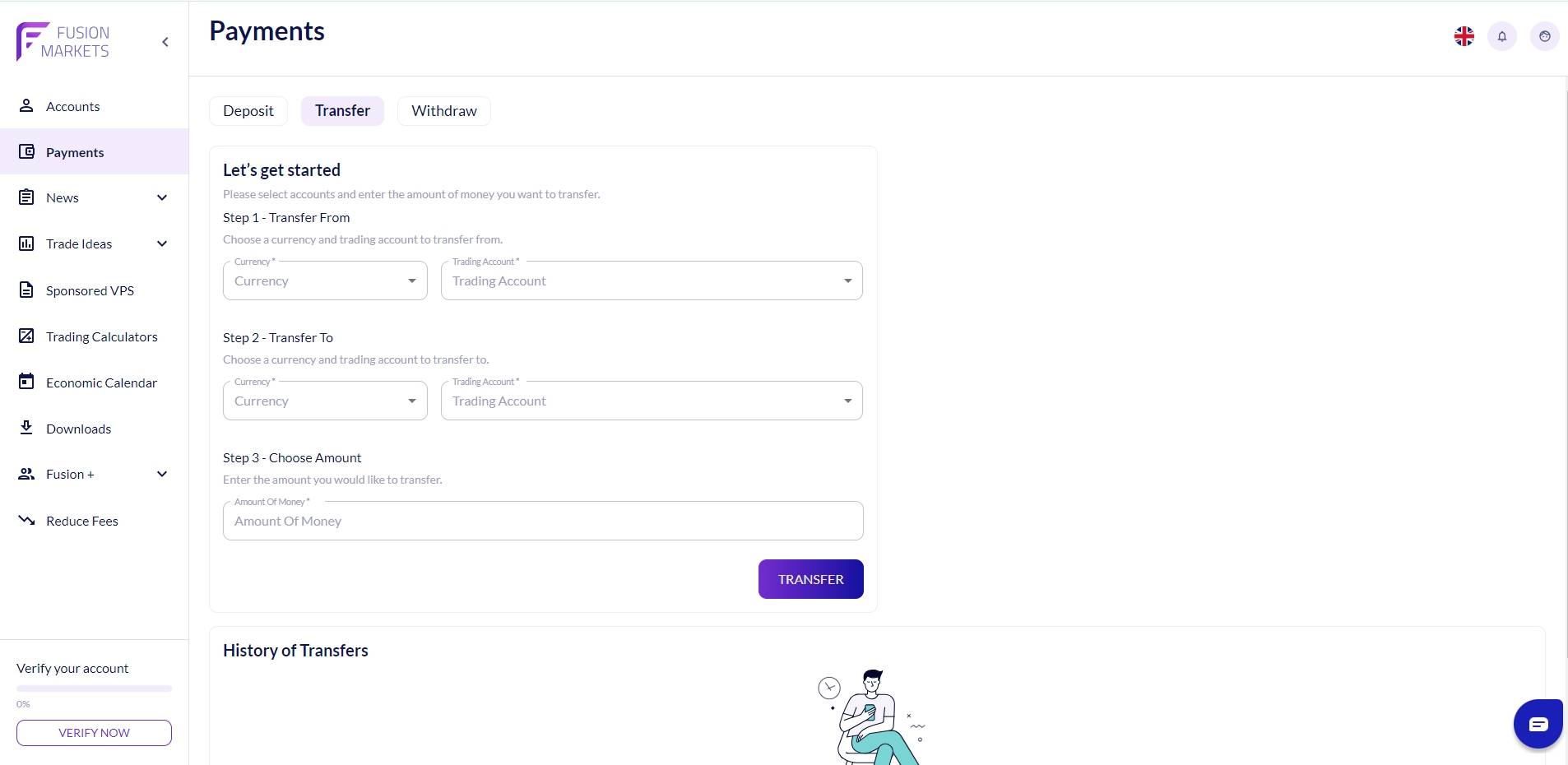

3. Fund your account. Fund your account using bank wire, credit/debit card, or e-wallets such as PayPal or Neteller. Fusion Markets does not charge any fees for deposits, but international bank wires can cost between $20 and $30.

Fusion+ screen

4. Choose a signal provider. On the Fusion+ platform, select a signal provider from the list of available traders on DupliTrade or MyFxBook AutoTrade. Review the statistics to choose a trader that suits your investment goals and risk level.

5. Start copying trades. Once you have selected a signal provider, configure the copy settings and start copying trades. You can monitor the results via the MT4 terminal and your personal account on the Fusion Markets website.

Fusion+ fees

The Fusion+ copy service is free as long as you and your subscriber trade at least 2.5 FX/Metals lots per month. If you or your subscriber trade less than this, you will be charged a flat fee of $10 per month to cover Fusion hosting costs). As an approved Fusion+ Master, if you wish to charge a performance fee to your clients, you can do so at a rate of up to 30%.

Copy trading features of Fusion+

Fusion Markets offers low commissions and competitive spreads, making it one of the most affordable brokers on the market. The platform offers over 90 currency pairs, as well as CFDs on stocks, cryptocurrencies, and commodities. For example, users can trade popular stocks like Tesla, Apple, and Microsoft, or cryptocurrencies like Bitcoin and Ethereum.

Fusion Markets’ deep liquidity and fast order execution is ensured by its partnership with leading liquidity providers. This helps minimize slippage and ensure execution at the best available prices. For example, the average spread on the EUR/USD pair is only 0.05 pips.

Regulation and Security — Fusion Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). This ensures a high level of safety and security for clients’ funds. ASIC is one of the strictest regulators in the world, which adds an additional layer of trust to the broker.

Pros and cons of copy trading on Fusion+

👍 Pros:

• Ease of use. The Fusion+ platform is intuitive and user-friendly. The registration and account setup process takes minimal time.

• Possibility of passive income. Copy trading allows you to profit from trading without having to actively participate in the process. Users can copy the trades of experienced traders and get similar results.

• Reliable regulation. Fusion Markets is regulated by ASIC and VFSC, which guarantees a high level of safety and protection of client funds.

👎 Cons:

• High fees for international bank transfers. Users complain about high fees for international bank transfers, which can reach $20-$30. This makes withdrawals less convenient for traders located outside of Australia.

•Limited number of withdrawal methods. Fusion Markets does not support withdrawals through popular e-wallets such as Skrill and Neteller, which may be inconvenient for some users.

eToro makes buying Bitcoin a lot simpler

Having tested many copy trading platforms over my career, I have observed the obvious need of thoroughly researching the traders whose trades you are going to copy. Do not rely solely on their successful trades - study their history to understand how they cope with losses and what strategies they use to minimize risks. This will help you choose those who are not only successful, but also stable in the long term.

Another important point is diversification. Do not limit yourself to copying the trades of one trader. Spread your investments among several traders with different styles and strategies. This will help reduce risks and increase the likelihood of stable profits. For example, you can choose one trader who specializes in Forex and another who successfully trades stocks or cryptocurrencies. This approach will allow you to take advantage of different markets.

Finally, do not forget about constant learning and self-improvement. Copy trading is a great way to learn from professionals, but don’t rely on them alone. Study analytical materials, follow market news, and try to apply the knowledge you gain in practice. This will help you better understand why your copied traders make certain decisions, and over time, you will be able to develop your own successful strategy.

Conclusion

Fusion Markets offers excellent conditions for copy trading, especially for beginners and busy investors. Low fees, high liquidity and ease of use make it an attractive choice. However, before starting trading, it is important to consider all possible risks and carefully select strategies and signal providers.

FAQs

What is the minimum deposit recommended to start copy trading?

It is recommended to start with a deposit of $1,000-$2,000. This allows you to diversify your investments between several traders, reducing risks and providing more stable results.

How to choose the right traders to copy?

Pay attention to the trader's history, their approach to risk management, and the stability of their results. Study the trader's reviews and rating, and also monitor their strategy over a long period to understand how they cope with different market conditions.

What safety measures should be taken when copy trading?

Set limits on losses and profits, use only those funds that you are willing to risk, and constantly monitor the results of the traders whose trades you copy. Do not rely entirely on automation - always be aware of what is happening in your account.

Is it possible to make money on copy trading without trading experience?

Yes, copy trading allows beginners to make money by copying the trades of experienced traders. However, for maximum efficiency, it is recommended to gradually learn the basics of trading and market analysis to better understand the strategies of the chosen traders and make informed decisions.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).