According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $200

- MT4

- FCA

- 2010

Our Evaluation of ICM Capital

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

ICM Capital is a broker with higher-than-average risk and the TU Overall Score of 4.74 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ICM Capital clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

ICM Capital focuses on currency pairs and CFD trading and offers attractive conditions in these areas. Traders benefit from narrow spreads and average commissions. There are more than enough assets to diversify risks and implement various strategies, especially since the platform does not set limits. The user interface of the user account is intuitive, and the MT4 is a plus for both beginners and experienced market participants. Unfortunately, there are no passive earning options, and client support is not available 24/7, but these drawbacks are unlikely to be considered critical.

Brief Look at ICM Capital

Clients of ICM Capital can trade currency pairs and CFDs on stocks, indices, commodities, and metals. The minimum deposit is $200, and the allowed currencies for deposits and withdrawals are USD, EUR, GBP, and SGD. This broker offers a demo account and two real accounts, and any of the standard accounts can be upgraded to a professional account for expanded trading opportunities, but only if you qualify. The spreads are floating and start from 0 pips. There are no commissions on the Direct account, while the Zero account charges $7 per lot. Traders have the option to use the MT4 trading platform, including the mobile version. This broker does not provide alternative earning options such as joint accounts, copy trading, or referral programs. Educational materials are not available on the website, but there are many tools for technical and fundamental analyses.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- This broker offers straightforward and clear conditions, with only account types that differ in trading costs.

- Traders can deposit and withdraw funds using various methods, and no commission is charged for the first withdrawal each month.

- Broker’s clients use the MetaTrader 4 trading platform, which is easy to learn and highly customizable through plugins.

- The company is officially registered in the United Kingdom and regulated by the Financial Conduct Authority (FCA).

- Clients' funds are protected against unforeseen circumstances, with insurance coverage of up to £5 million.

- This broker issues its own Mastercard plastic card, which can be used for payments worldwide and online.

- The company's website and the trader's user account provide numerous resources for market analysis and forecasting.

- The technical support operates only on weekdays and during limited hours (from 6:00 to 18:00 GMT).

- Clients cannot earn through any means other than active trading.

- If a user withdraws funds more than once per month, they will be charged a commission for each subsequent withdrawal.

TU Expert Advice

Author, Financial Expert at Traders Union

ICM Capital provides Forex and CFD trading services via the MetaTrader 4 platform, offering Direct and Zero accounts to suit diverse trading needs. With currency pairs and CFDs on stocks, indices, commodities, and metals, traders can access leverage up to 1:200. The company offers floating spreads starting from 0 pips and maintaining regulatory compliance with the FCA. Insurance protection up to £5 million enhances client confidence, while a free monthly withdrawal and various deposit methods add convenience.

The primary drawbacks of ICM Capital include limited client support hours and the lack of passive income options like copy trading. A fee applies to additional monthly withdrawals beyond the first. Consequently, ICM Capital may suit active traders seeking protective measures but could be less ideal for those preferring varied income streams or requiring round-the-clock support.

- You're an experienced trader requiring some specialized features. ICM Capital's MetaTrader 4 platform caters to seasoned traders with advanced features.

- You value the assurance of your funds being protected against unforeseen circumstances. This broker offers services with insurance coverage of up to £5 million.

- You want a broker that offers diverse income avenues. With this broker, clients cannot earn through any means other than active trading.

- Withdrawal costs are a concern for you. With this broker, if a user withdraws funds more than once per month, they will be charged a commission for each subsequent withdrawal.

ICM Capital Trading Conditions

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | Demo, Direct, Zero (a standard account can be converted to a professional account) |

| 💰 Account currency: | USD, EUR, GBP, and SGD |

| 💵 Deposit / Withdrawal: | Bank transfer, Visa/MC card, Skrill, Neteller, PayPal, China UnionPay |

| 🚀 Minimum deposit: | $200 |

| ⚖️ Leverage: | Up to 1:200 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, metals, energies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

Two standard accounts, each can be converted to professional; Narrow spreads; Mid-market commissions; The first withdrawal in a month is not charged; Many tools for technical and fundamental analyses |

| 🎁 Contests and bonuses: | Yes (rebates from TU ) |

If a broker offers multiple trading accounts that differ significantly in conditions, the minimum deposit will also vary. In the case of ICM Capital, the real accounts are identical in all aspects except for trading fees. To open any of these accounts, a minimum deposit of at least $200 is required. Leverage is not dependent on the account type (except for professional accounts, which may receive increased leverage). The trading leverage is primarily determined by the traded asset. The highest leverage is available for currency pairs, up to 1:200. Client support operates only on weekdays and is not available during the night. Managers can be contacted through any of the standard communication channels.

ICM Capital Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

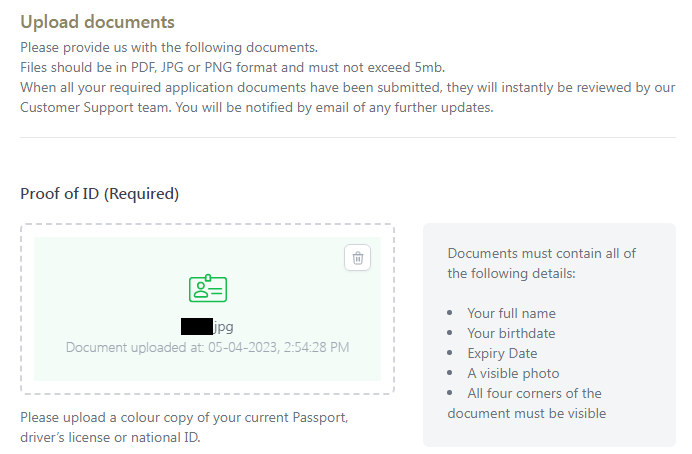

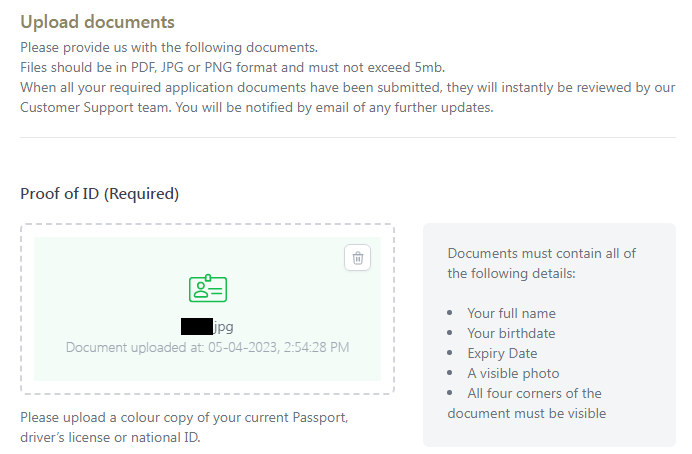

Trading Account Opening

To start collaborating with this broker, it is necessary to register on its official website and obtain a user account. Through the user account, traders can open and close accounts, make deposits and withdraw profits, and download trading platforms. The experts at TU have prepared the below step-by-step guide on registration and the features of ICM Capital’s user account.

Go to this broker's website. In the top right corner, select the language for the interface. Click on the “ICM Access” button.

Click on the line “Don't have an account?” to proceed with the registration. You can also access the registration form by clicking on “Open an Account” or any other button with a similar name. Such buttons are located on different pages of the website.

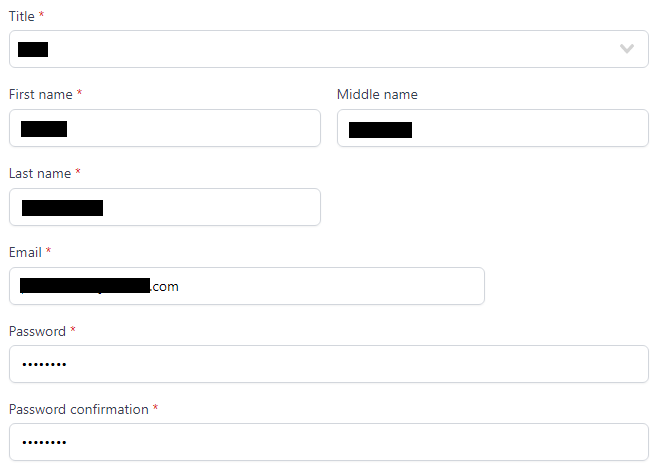

Choose the appropriate salutation, enter your first and last names. Provide your email address. Create a password and enter it twice.

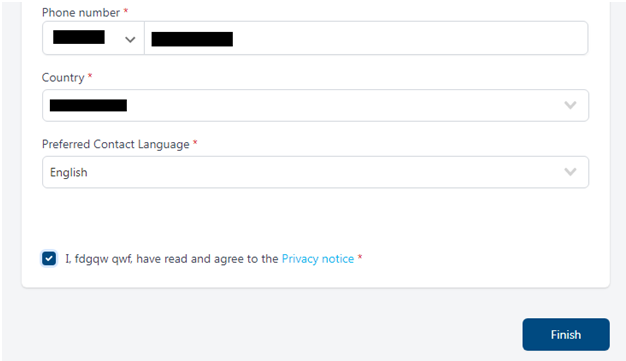

Now enter your phone number. Select the country of residence and preferred language. Agree to the terms and conditions by checking the box. Click on “Finish”.

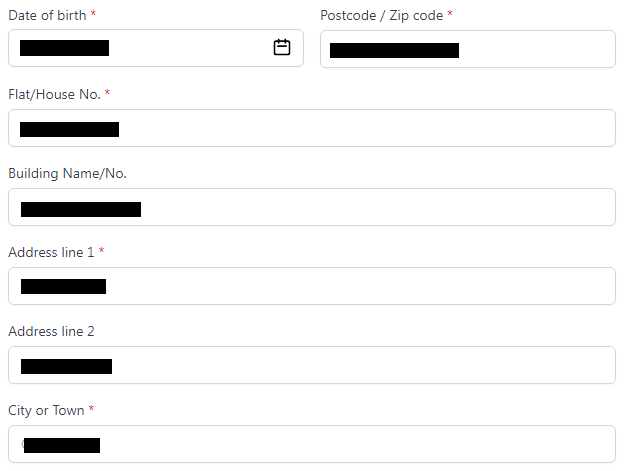

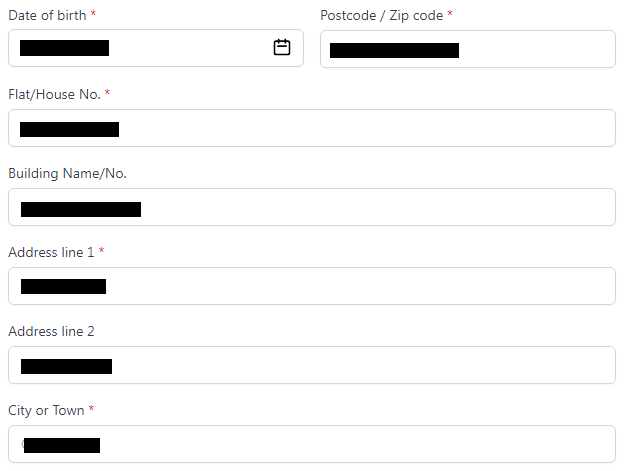

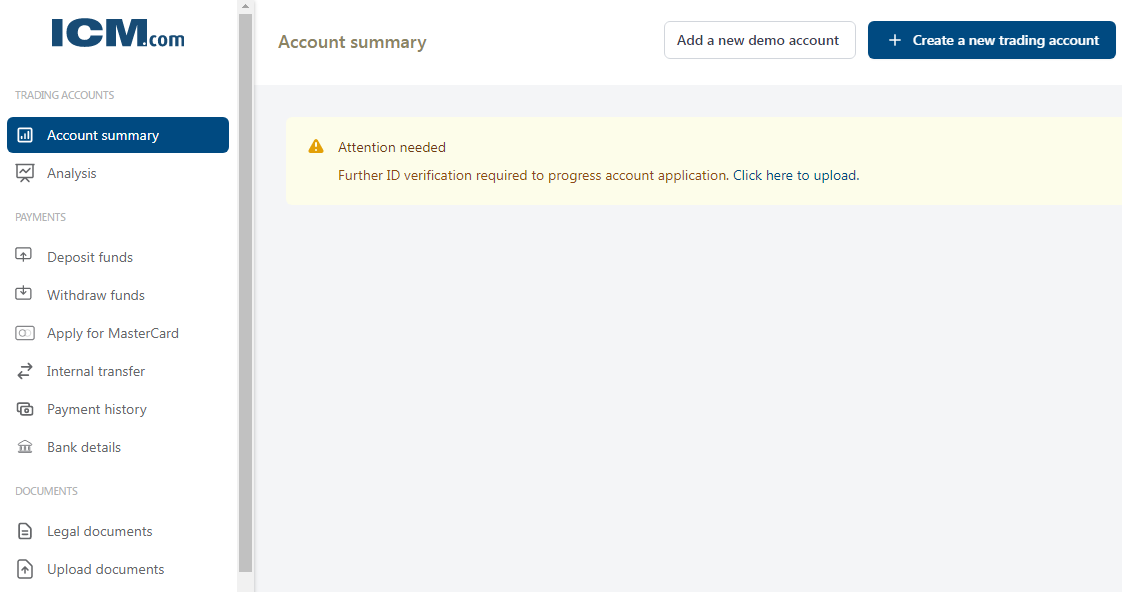

Once you are in the user account, go to the verification section (you can click on the link in the warning message). Read the comments and instructions on the screen carefully. Upload scans/photos of the required documents and wait for them to be verified.

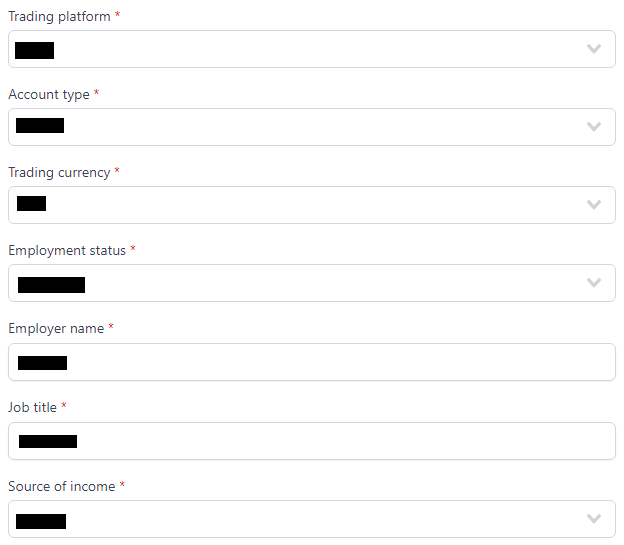

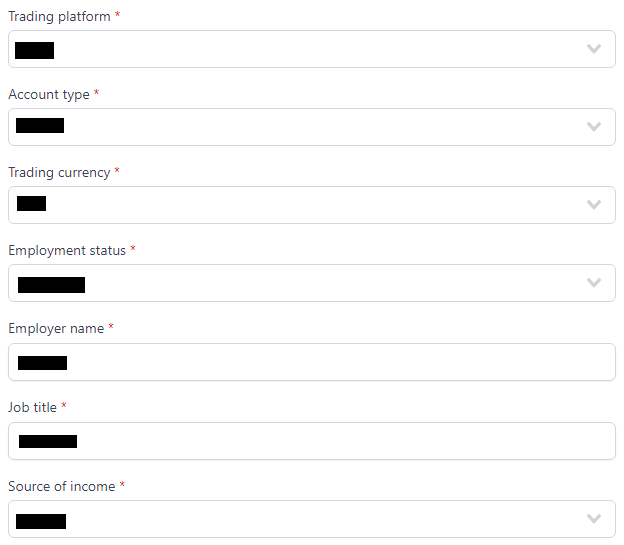

Now click on “Open a Real Account”. Enter your date of birth, complete your address with postal code, specify your nationality, and answer a few questions. After filling in all the mandatory fields, check the box at the bottom to agree to the processing of your data and click on “Next”.

Choose the trading platform, account type, and base currency. Answer a few questions about your experience and financial capabilities. Read the comments and warnings. Check the box at the bottom and click on “Finish”. Please note that a confirmation email with registration details will be sent to the provided email address.

Go to the "Deposit Funds" section, choose the appropriate deposit method, and follow the on-screen instructions. After that, you need to download the trading platform. You can do this on this broker's website or the MetaTrader portal. Install the platform and start trading.

Your ICM Capital user account also provides access to:

Account summary. Provides an overview of all accounts with detailed trading parameters.

Analysis. Shows current market trends and filtered news based on assets.

Deposit funds. Allows you to top up the balance of the selected account using any available method.

Withdraw funds. Generates a request to withdraw money from the balance in the specified amount and through the specified channel.

Apply for Mastercard. Allows you to pay for and receive a plastic card from ICM Capital.

Internal transfer. Required to transfer funds between accounts.

Payment history. An archive that displays all completed transactions.

Bank details. Required for depositing and withdrawing funds through the corresponding channel.

Legal documents. This section contains all the legal acts on which this broker operates.

Upload documents. Allows traders to provide scans/photos of their documents for verification.

Additionally, in the user account, you can select the interface language, change security settings, and update personal information.

Regulation and safety

ICM Capital has a safety score of 9.7/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 15 years

- Strict requirements and extensive documentation to open an account

ICM Capital Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

SVG FSA SVG FSA |

Financial Services Authority of St. Vincent and the Grenadines | St. Vincent and the Grenadines | No specific fund | Tier-3 |

ICM Capital Security Factors

| Foundation date | 2010 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker ICM Capital have been analyzed and rated as Medium with a fees score of 5/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of ICM Capital with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, ICM Capital’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

ICM Capital Standard spreads

| ICM Capital | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,3 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,3 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

ICM Capital RAW/ECN spreads

| ICM Capital | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,1 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with ICM Capital. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

ICM Capital Non-Trading Fees

| ICM Capital | Pepperstone | OANDA | |

| Deposit fee, % | 1-3,75 | 0 | 0 |

| Withdrawal fee, % | 0-2 | 0 | 0 |

| Withdrawal fee, USD | 0-15 | 0 | 0-15 |

| Inactivity fee ($, per month) | 5 | 0 | 0 |

Account types

A client’s primary task is to choose a trading account, but this is only relevant if this broker offers multiple account types. ICM Capital has only two accounts, and the difference between them lies in the spreads and commissions. On the Direct account, spreads are slightly higher, starting from 0.7 pips, but often have a minimum value of 1 or 1.3 pips, depending on the asset. However, this broker does not charge any commissions on trades conducted by the trader on this account. On the Zero account, the minimum spread is 0 pips, and the average value is lower than on the Direct account, but the trader has to pay a commission of $7 per full lot. It is difficult to say which option is more beneficial. The client needs to use specialized calculators to calculate the costs for their typical trades. Otherwise, the accounts are identical, they require a minimum deposit of $200 to start, the minimum trade size is 0.01 lots, and the maximum leverage is 1:200. These are comfortable and, in many ways, are average market indicators that will suit most clients.

Account types:

The standard practice for most traders who are starting to work with a specific platform is to first open a demo account. This allows them to explore this broker's conditions, pros, cons, and peculiarities without any risk to their capital. Additionally, a Demo account provides an opportunity to experiment with different strategies without risking real money. Then, the trader can open a real account according to their personal preferences. If they adhere to the Islamic religion, the account can be converted to a swap-free one upon request.

Deposit and withdrawal

ICM Capital received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

ICM Capital offers limited payment options and accessibility, which may impact its competitiveness.

- Bank card deposits and withdrawals

- PayPal supported

- Minimum deposit below industry average

- Bank wire transfers available

- Deposit fee applies

- Wise not supported

- USDT payments not accepted

What are ICM Capital deposit and withdrawal options?

ICM Capital offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire, PayPal, Skrill, Neteller. This limitation may restrict flexibility for users, making ICM Capital less competitive for those seeking diverse payment options.

ICM Capital Deposit and Withdrawal Methods vs Competitors

| ICM Capital | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | Yes | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are ICM Capital base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. ICM Capital supports the following base account currencies:

What are ICM Capital's minimum deposit and withdrawal amounts?

The minimum deposit on ICM Capital is $200, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact ICM Capital’s support team.

Markets and tradable assets

ICM Capital offers a limited selection of trading assets compared to the market average. The platform supports 130 assets in total, including 42 Forex pairs.

- Indices trading

- Crypto trading

- 42 supported currency pairs

- No ETFs

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by ICM Capital with its competitors, making it easier for you to find the perfect fit.

| ICM Capital | Plus500 | Pepperstone | |

| Currency pairs | 42 | 60 | 90 |

| Total tradable assets | 130 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products ICM Capital offers for beginner traders and investors who prefer not to engage in active trading.

| ICM Capital | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Technical support is essential for any company dealing with a wide range of clients. For brokers, it is conceptually important because traders often encounter situations they cannot resolve independently. Whether it's a system failure, issues with depositing or withdrawing funds, or anything else, clients must receive competent assistance and have their problems resolved promptly. If, for any reason, this is not possible, or if the client service does not meet the user's expectations in terms of quality and responsiveness, there is a high probability of disappointment, and the client may switch to a competitor. All brokers understand this well and strive to optimize their client support. ICM Capital's technical support is available through all main communication channels, including phone, email, and live chat. They operate on weekdays from 6:00 to 18:00 GMT. This means it is not possible to reach the managers during night hours and on weekends. Traders have no complaints regarding the competence of the support team.

Advantages

- It is possible to receive assistance from specialists without being this broker's client

- Technical support is available through all main communication channels and it responds quickly.

- Users and experts highly appreciate the quality of client services.

Disadvantages

- Managers are not available on weekends

- Technical support does not operate at night

To contact client support, you can use the following channels:

-

Phone (UK, UAE, emergency department).

-

Email.

-

Live chat on the website and in the user account.

-

Complete a ticket on this broker's website.

The emergency department operates 24 hours a day on weekdays, but you can only contact them for inquiries related to current trading. All other communication channels are available according to the aforementioned schedule. For example, if you send an email on a Saturday or Sunday, it will be addressed on Monday morning.

Contacts

| Foundation date | 2010 |

|---|---|

| Registration address | ICM Capital Ltd, Level 17, Dashwood House, 69 Old Broad St, London EC2M 1QS United Kingdom |

| Regulation |

FCA

Licence number: 520965 |

| Official site | https://www.icmcapital.co.uk/ |

| Contacts |

Phone (UK): +44 207 634 9770,

Phone (UAE): +971 4 429 4500 |

Education

For a trader, continuous development is crucial, and regular trading alone is not enough. It is necessary to read specialized literature, engage with colleagues on relevant forums, and attend expert webinars. Only then can a trader stay up to date with market trends and enhance their trading potential. In this regard, some brokers offer educational resources to their clients, which can be in the form of standard FAQs or comprehensive educational courses. However, ICM Capital is not one of those brokers. Their website only provides answers to most FAQs about the platform and trading platform. No educational materials are offered, which can be seen as a drawback in some sense. On the other hand, this broker is not obligated to educate its clients, and it is reasonable to assume that traders registering with them have at least a basic understanding of trading currency pairs and other assets.

It is important not to confuse education with support. ICM Capital does not offer educational courses, but its website provides a wealth of analytical information, including newsfeeds. These are extremely useful materials that can assist both experienced and novice traders in their trading activities. That is why we do not consider the lack of education as a conceptual drawback of this broker; rather, it is a feature that needs to be taken into account. Moreover, the platform does not leave its clients without comprehensive and high-quality support.

Comparison of ICM Capital with other Brokers

| ICM Capital | Bybit | Eightcap | XM Group | TeleTrade | InstaForex | |

| Trading platform |

MT4 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5 | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $200 | No | $100 | $5 | $10 | $1 |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:1000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | 1.00% | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0.8 points | From 0.2 points | From 0 points |

| Level of margin call / stop out |

No | No / 50% | 80% / 50% | 100% / 50% | 70% / 20% | 30% / 10% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | Yes |

Detailed review of ICM Capital

Since this broker works with the MT4 trading platform, the company's clients can trade on any device with any operating system. The company has developed its solution for managing accounts, which is ICM Access. Thanks to it, users’ funds and data are securely protected. Even after 12 years of this broker's operation, there have been no leaks of confidential information or theft of traders' funds recorded. In addition, the platform uses an advanced technological stack, as evidenced by the order execution speed, which does not exceed 30 ms. ICM Capital pays attention to the server side and also to the service aspects. For example, this broker's technical support assists in sixteen languages, and each trader can have access to a virtual private server (VPS). If they have more than $4,000 on their balance, the service is provided for free. The multitude of tools for technical and fundamental analyses indicates that the company strives to make its clients' work as comfortable as possible. And it succeeds in doing so.

ICM Capital by the numbers:

-

The minimum deposit is $200.

-

The spreads are floating and start from 0 pips.

-

The highest commission is $7 per lot.

-

The maximum leverage is 1:200.

-

The insurance protection is up to £5 million.

ICM Capital is a Forex and CFD broker for active trading

If a user aims to earn passively, this platform is not suitable because there are no joint accounts or copy trading options. However, if a trader is focused on active trading, ICM Capital is a good choice. This broker offers currency pairs as well as CFDs. There are CFDs on stocks, indices, energies, and metals. This variety is certainly sufficient to form a diversified portfolio where the drawdown of one asset is compensated by the stability and progress of others. In addition, the more trading instruments in this broker's pool, the wider the range of strategies available to its clients. It is also worth noting that ICM Capital does not impose trading restrictions, and the maximum leverage is 1:200, which increases profit potential. Yes, there are brokers offering leverage of 1:500 or even 1:1000, but it is important to understand that in such cases, the risk increases proportionally. Therefore, for many, a leverage ratio of 1:200 is a balanced solution.

ICM Capital’s analytical services:

-

Virtual private server (VPS). VPS ensures a trader's presence in the market 24/7. It is an ideal option for automated trading and expert advisors. A virtual server reduces latency and slippage and improves trade execution speed.

-

Trading signals on MT4. This broker's clients can make trades using signals from experienced market participants. Signals are constantly provided, and the client can filter providers based on trading parameters. This allows for trading with reduced risk.

-

Micro lots. Available on demo and real accounts, it eliminates the risk of significant financial losses in real trading. It is an optimal option for traders who are just starting their journey to test and refine their initial strategies.

-

Trailing stop. A simple and incredibly useful function that makes the stop-loss follow the price level of the position. This means that the trader can keep the position open and continue to make a profit as long as the price moves in the desired direction.

-

Trading Central. A comprehensive analytical service that provides traders with a daily market overview. The system also includes a news portal and a unique MetaTrader 4 Indicator. All of this is equally beneficial for traders at any level.

Advantages:

This broker offers comfortable conditions, including a free demo account and two real accounts that differ only in trading costs, with a small minimum deposit.

Experienced market participants can qualify and upgrade their account status to professional, gaining extended opportunities. Additionally, there are Islamic (swap-free) accounts.

This broker works with MT4, the simplest and most reliable trading platform, providing users with personalized working conditions through numerous plugins.

The company's commission policy is transparent and clear. There is a commission only on the Zero account, while it is not applicable on the Direct account. Furthermore, this broker does not charge any fees for the first withdrawal in each month.

Although client support is not available on weekends and at night, it is highly regarded by clients for its responsiveness and competence. The support team communicates in 16 languages.

Latest ICM Capital News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i