According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- TRY 50,000

- MetaTrader4

- CMB

- YTM

- 1991

Our Evaluation of Tacirler Yatırım (FXTCR)

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Tacirler Yatırım (FXTCR) is a moderate-risk broker with the TU Overall Score of 5.7 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Tacirler Yatırım (FXTCR) clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Tacirler Yatırım (FXTCR) offers trading with variable spreads without additional transaction fees. However, it may not suit every trader due to stringent initial deposit requirements, lack of cent accounts, and limited asset choices. Nevertheless, its operations are overseen by Turkey's main financial regulatory fee, ensuring commitment fulfillment and stable operations.

Brief Look at Tacirler Yatırım (FXTCR)

Tacirler Yatırım is an investment holding firm established in 1991 in Turkey. It offers access to the stock markets through the Istanbul Stock Exchange (Borsa İstanbul - BİST). In 2015, its subsidiary, FXTCR, emerged, enabling traders to engage in Forex trading. This avenue facilitates trading in currency pairs, precious metals, CFDs on global stock indices, and energy commodities. Regulated by the Capital Markets Board of Turkey (CMB), Tacirler Yatırım participates in an investment compensation scheme. Its clients can trade popular OTC assets 24/5, benefitting from dynamic spreads and using the MetaTrader 4 platform.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Participation in the Turkish compensation scheme Yatırımcı Tazmin Merkezi (YTM);

- Quotations from BİST (Borsa İstanbul) — the Istanbul Stock Exchange;

- Activity regulation at the state level — operating under the CMB license;

- Provision of the MetaTrader 4 platform supporting copy trading and algorithmic trading;

- Demo account availability;

- Access to combining investment activities in the stock market with active Forex trading;

- Quality analytical support for trading.

- High minimum deposit — TRY 50,000 (≈ $1,855);

- Limited range of trading assets, absence of cryptocurrencies, CFDs on stocks, and agricultural commodities;

- Broker services are exclusively available to Turkish citizens.

TU Expert Advice

Financial expert and analyst at Traders Union

Tacirler Yatırım's separate division for Forex trading, known as FXTCR, emerged in 2015. Like its parent holding company, FXTCR operates under strict supervision by Turkey's state regulator, ensuring its clients a high level of reliability and the security of their investments. The company adheres to Forex regulation rules in its country of registration, allowing Forex traders to use leverage no higher than 1:10.

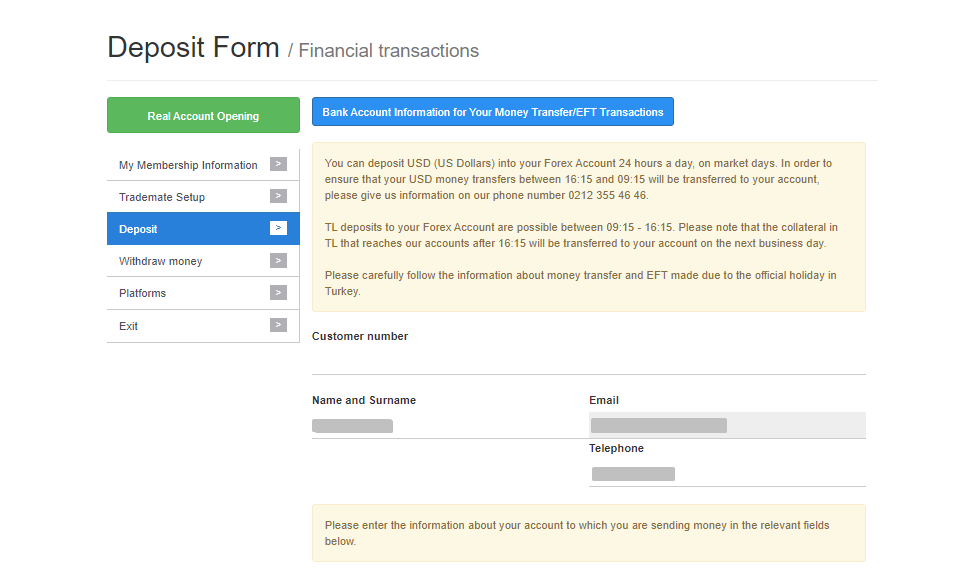

Bonuses are unavailable as they are considered impermissible incentives according to Tacirler Yatırım's perspective, and partnership programs are also not accessible. Tacirler Yatırım's (FXTCR) choice of CFDs is limited compared to its competitors, but the broker does offer the most traded currency pairs, global indices, and metals. However, the company restricts client payment options, allowing only bank transfers.

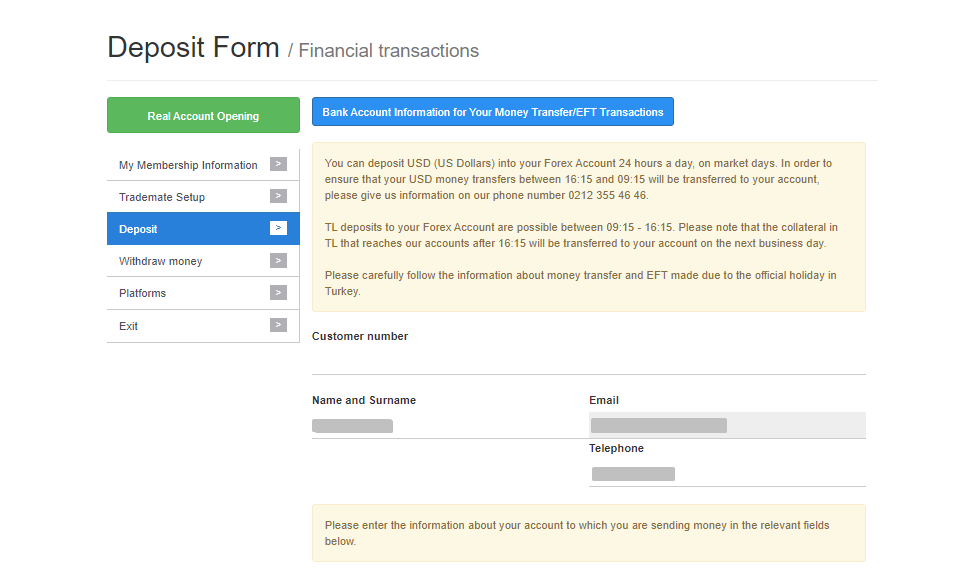

Deposit details (account numbers and IBAN), supported banks, and currencies are specified on Tacirler Yatırım and FXTCR websites, facilitating the search for an intermediary to deposit funds into the trading account. The company doesn't provide online support, but its employees are available to assist via phone, email, or in-person communication at the office. There is a demo account available for testing trading conditions and execution speed, but cent accounts are absent, which is a downside for novice traders.

Tacirler Yatırım (FXTCR) Trading Conditions

| 💻 Trading platform: | MetaTrader 4 (desktop, mobile app) |

|---|---|

| 📊 Accounts: | Demo, User |

| 💰 Account currency: | TRY |

| 💵 Deposit / Withdrawal: | Bank transfer |

| 🚀 Minimum deposit: | 50,000 TRY |

| ⚖️ Leverage: | Up to 1:10 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,5-0,9 pips |

| 🔧 Instruments: | Currency pairs, indices, gold, silver, oil, stocks, metal futures |

| 💹 Margin Call / Stop Out: | 50%/20% |

| 🏛 Liquidity provider: | Borsa Istanbul (over 50 providers) |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | Unified account type for all Forex traders |

| 🎁 Contests and bonuses: | No |

Tacirler Yatırım offers classic trading conditions for currency pairs and CFDs such as the MT4 platform, accounts with floating spreads and no additional trading fee, and market order execution. The broker operates in strict accordance with the rules of the currency market in Turkey. In 2017, the authorities in this country prohibited trading leverage exceeding 1:10 for retail trading and also set the minimum investment size for accessing Forex at TRY 50,000.

Tacirler Yatırım (FXTCR) Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

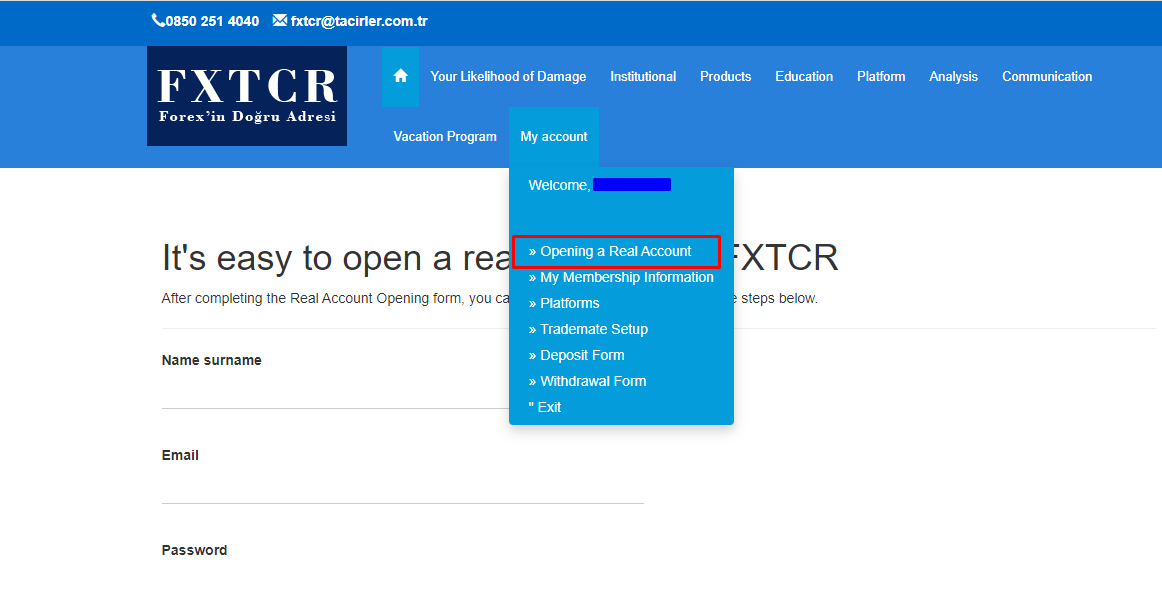

Trading Account Opening

To begin trading Forex through the Tacirler Yatırım conglomerate, follow the instructions provided below:

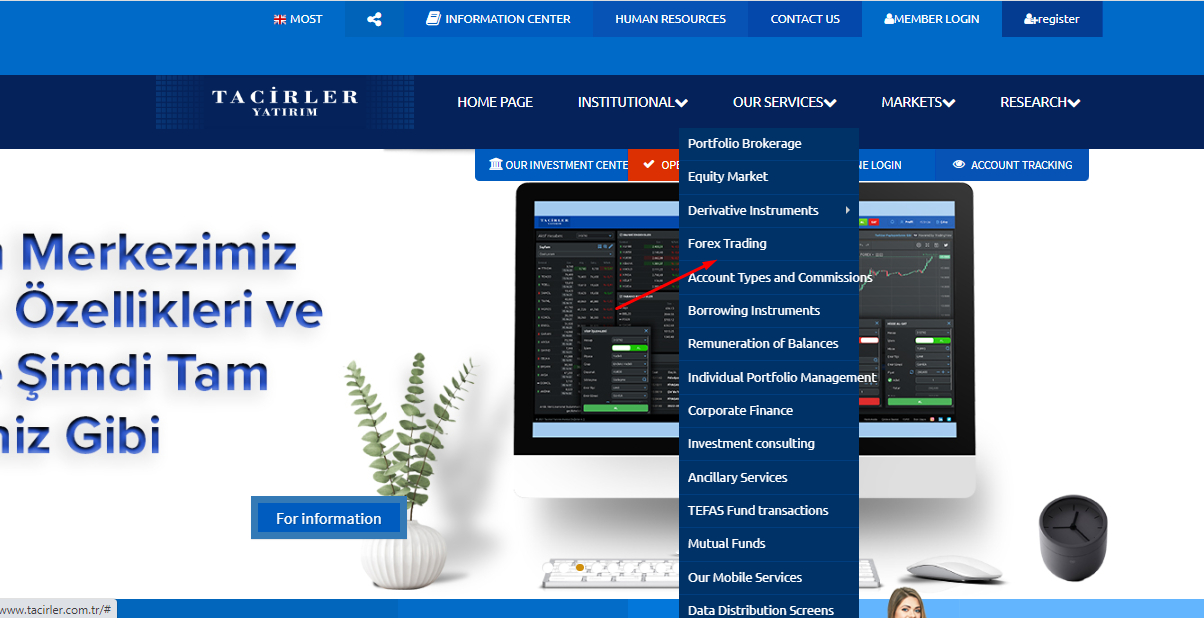

Visit the Tacirler Yatırım website and under the available services, click on Forex. On the page that opens, you'll find a link to the FXTCR website. Click on it to proceed.

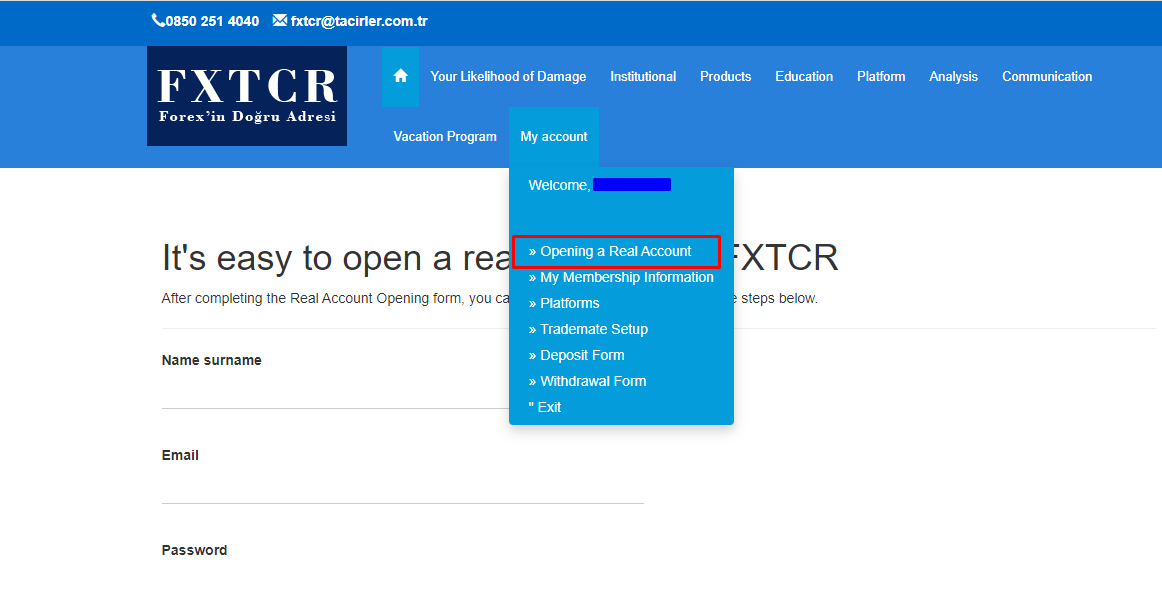

Click on 'Open user account' to initiate the account creation process. Enter personal details: name, surname, phone number, and email. Create a password to secure your user account from unauthorized access. Confirm your email by following the instructions on the screen, enter your login and password in the authorization window.

Functions of the Tacirler Yatırım (FXTCR) user account:

The user account allows you to:

-

Verify and confirm your residence;

-

Set up the MT4 trading platform;

-

Manage account and internal wallet;

-

Withdraw profits;

-

Select preferred notification types and their delivery method (via phone, SMS, or email).

Regulation and safety

Tacirler Yatırım (FXTCR) has a safety score of 6.8/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Track record over 34 years

- Not tier-1 regulated

- No negative balance protection

Tacirler Yatırım (FXTCR) Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

| SPK (Turkey) | Sermaye Piyasası Kurulu (SPK) – Capital Markets Board of Turkey | Turkey | TL 160,000 | Tier-2 |

Tacirler Yatırım (FXTCR) Security Factors

| Foundation date | 1991 |

| Negative balance protection | No |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Tacirler Yatırım (FXTCR) have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Tacirler Yatırım (FXTCR) with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Tacirler Yatırım (FXTCR)’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Tacirler Yatırım (FXTCR) Standard spreads

| Tacirler Yatırım (FXTCR) | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,5 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,9 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,1 | 1,4 | 0,5 |

Does Tacirler Yatırım (FXTCR) support RAW/ECN accounts?

As we discovered, Tacirler Yatırım (FXTCR) does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Tacirler Yatırım (FXTCR). This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Tacirler Yatırım (FXTCR) Non-Trading Fees

| Tacirler Yatırım (FXTCR) | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

A trading account for over-the-counter markets is opened at FXTCR — a division that serves Forex traders. For trading on the stock market, it's necessary to open an investment or futures account directly with Tacirler Investment Securities Inc. All Forex traders trade on equal terms regardless of the deposited amount.

Account Types:

The company offers the MT4 platform, supporting the creation of demo accounts. They are opened for free without requiring any deposits, but registration on the FXTCR website is necessary.

Tacirler Yatırım offers transparent trading conditions without differentiating accounts based on fee types. The fee size per transaction depends solely on the market situation and the asset, not the account type.

Deposit and withdrawal

Tacirler Yatırım (FXTCR) received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

Tacirler Yatırım (FXTCR) offers limited payment options and accessibility, which may impact its competitiveness.

- No withdrawal fee

- Bank wire transfers available

- Low minimum withdrawal requirement

- No deposit fee

- No bank card option

- Limited deposit and withdrawal flexibility, leading to higher costs

- Minimum deposit above industry average

What are Tacirler Yatırım (FXTCR) deposit and withdrawal options?

Tacirler Yatırım (FXTCR) offers a limited selection of deposit and withdrawal methods, including Bank Wire. This limitation may restrict flexibility for users, making Tacirler Yatırım (FXTCR) less competitive for those seeking diverse payment options.

Tacirler Yatırım (FXTCR) Deposit and Withdrawal Methods vs Competitors

| Tacirler Yatırım (FXTCR) | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Tacirler Yatırım (FXTCR) base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Tacirler Yatırım (FXTCR) supports the following base account currencies:

What are Tacirler Yatırım (FXTCR)'s minimum deposit and withdrawal amounts?

The minimum deposit on Tacirler Yatırım (FXTCR) is $1500, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Tacirler Yatırım (FXTCR)’s support team.

Markets and tradable assets

Tacirler Yatırım (FXTCR) offers a limited selection of trading assets compared to the market average. The platform supports 0 assets in total, including 40 Forex pairs.

- 40 supported currency pairs

- Copy trading platform

- Indices not available

- Crypto trading not available

Tacirler Yatırım (FXTCR) Supported markets vs top competitors

We have compared the range of assets and markets supported by Tacirler Yatırım (FXTCR) with its competitors, making it easier for you to find the perfect fit.

| Tacirler Yatırım (FXTCR) | Plus500 | Pepperstone | |

| Currency pairs | 40 | 60 | 90 |

| Total tradable assets | 2800 | 1200 | |

| Stocks | No | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | No | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Tacirler Yatırım (FXTCR) offers for beginner traders and investors who prefer not to engage in active trading.

| Tacirler Yatırım (FXTCR) | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Company operating hours: Monday to Friday from 9:00 to 18:30 (GMT+3). During this time, its staff handles phone calls and provides support to clients and traders without trading accounts. Emails can be sent at any time.

Advantages

- Phone support available through company representatives

- The feedback form allows the inclusion of both email and phone numbers for contact

Disadvantages

- No Live Chat on the website

- Traders are not serviced on Saturdays and Sundays

Contacting the company's support can be done via the following methods:

by phone;

via fax;

through email;

using the feedback form;

visiting a physical office.

Service is exclusively provided in Turkish, as the broker caters solely to Turkish citizens.

Contacts

| Foundation date | 1991 |

|---|---|

| Registration address | Tacirler Yatırım Menkul Değerler A.Ş., Nispetiye Cad. B3 Blok Kat 9 Akmerkez Etiler / İstanbul, Türkiye |

| Regulation | CMB, YTM |

| Official site | https://www.fxtcr.com/ |

| Contacts |

0850 251 4040

|

Education

There is no educational material available on Tacirler Yatırım's website, only reports, research, and analytical reviews are provided to assist professional traders. However, the Forex division's website, FXTCR, features an education section specifically tailored for beginners, offering a wealth of useful information.

Tacirler Yatırım is a licensed investment company, thus offering professional trading education to its clients on a paid basis. For free training, one needs to use a demo account.

Comparison of Tacirler Yatırım (FXTCR) with other Brokers

| Tacirler Yatırım (FXTCR) | Bybit | Eightcap | XM Group | Exness | Pocket Option | |

| Trading platform |

MetaTrader4 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | Pocket Option, MT5, MT4 |

| Min deposit | $2000 | No | $100 | $5 | $10 | $5 |

| Leverage |

From 1:1 to 1:10 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.3 point | From 0 points | From 0 points | From 0.8 points | From 0 points | From 1.2 point |

| Level of margin call / stop out |

50% / 20% | No / 50% | 80% / 50% | 100% / 50% | 60% / No | 30% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | No |

Detailed review of Tacirler Yatırım

Tacirler Yatırım stands as one of the leading investment companies in Turkey, offering a wide range of services in financial markets. Regardless of the trading type (exchange or OTC), it ensures swift order processing, precise pricing, and quotes from major liquidity providers. The broker is supported by a team of experienced analysts, managers, technical support, and IT specialists. All of this facilitates comfortable round-the-clock trading with instant asset buying and selling at the best Borsa İstanbul prices.

Tacirler Yatırım by the numbers:

Over 30 years of overall experience in financial markets, with more than 8 years in the online format;

Company's capital exceeds TRY 815 million.

Assets at the end of 2022 was 4.403 billion Turkish liras;

Tacirler Yatırım is the largest minority shareholder of Takasbank, Turkey's central clearing and settlement organization, owning a 5% share in the bank's capital.

FXTCR, a subdivision of Tacirler Yatırım, provides Turks access to the Forex market

After registering on the FXTCR website and opening a user account, access becomes available to 40 currency pairs, WTI and Brent oil, copper, and energy resource futures. Trading is also possible with 9 U.S., Australian, EU, UK, and Japan indices, including the most traded American indices Nasdaq 100, S&P 500, and Dow Jones 30. Silver, palladium, and platinum are traded against the USD, while gold is paired with the USD and EUR. The broker aims to shield clients from very high spreads during market openings and closings, hence trades commence on Monday and conclude on Friday. All accounts have position rollover swaps for the next trading day, but for some assets, these swaps are positive, bringing profit rather than losses to traders.

Tacirler Yatırım (FXTCR) offers classic MetaTrader platforms in the most user-friendly MT4 version. Within the client's account, they can download the desktop platform with advanced analysis capabilities or mobile applications, enabling trading without being tied to a specific location. WebTrader is not available.

Useful Functions of Tacirler Yatırım:

Tacirler Mobile – a mobile application to track market data for the currency and stock markets;

Forex newsletter containing forecasts for the most traded assets, intraday analysis, fundamental data, and weekly market reports;

Market analysis by experienced analysts in video format on the broker's YouTube channel;

Trading charts for currency markets, stock indices, and commodities indicate early market closure.

Advantages:

The broker offers a diverse range of services, from Forex trading to investing in asset portfolios;

Clients receive quotes from the Istanbul Stock Exchange through more than 50 suppliers;

Tacirler Yatırım partners with major banks in Turkey and Europe, ensuring no delays in payments when the requisites are correctly specified;

The company publishes reports with financial indicators and quarterly performance every three months;

Traders' investments are protected by regulators, and in case of the broker's bankruptcy, client losses will be compensated through a compensation program.

Separate accounts in banks are used to store traders' funds, preventing their use in Tacirler Yatırım's operations. Additionally, the company collaborates with major depositories, ensuring the safety of purchased securities for clients trading on the stock market.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i