According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader5

- 2020

Our Evaluation of Uniglobe Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Uniglobe Markets is a broker with higher-than-average risk and the TU Overall Score of 4.4 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Uniglobe Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Uniglobe Markets has been operating since 2015. It has a lot of assets in the pool, tight spreads, reasonable trading fees, and high leverage. There is a convenient copy trading service and a proprietary trading service. Traders work with a top trading platform, and trade without any restrictions (except for those that are set on prop accounts only). All this looks attractive, but take into account that the company does not have clear obligations to its clients and is not regulated. Absence of regulation does not make the broker a fraudster, especially since Uniglobe Markets has been successfully operating for 8 years and attracts many traders. However, it’s important to understand that in the event of a dispute, no organization will be able to protect the broker’s clients.

Brief Look at Uniglobe Markets

This broker provides access to the markets of currencies, cryptocurrencies, commodities, energies, metals, and CFDs on stocks and indices. Uniglobe Markets offers 5 account types, including two professional accounts with priority support. Minimum deposit is $100, spreads are from 0 pips, trading fees aren’t charged or there are fees from $2, and leverage is up to 1:500 subject to the asset and account type. Trading is carried out through MetaTrader 5 (MT5). The broker’s clients can use the proprietary trading service and receive up to $100,000 on their accounts with profit split up to 90/10. Among the passive income options are the copy trading service integrated into the website, and PAMM accounts. The company also offers partnerships to legal entities. Basic articles on trading are available for educational purposes, also there are simple technical analysis tools like an economic calendar. Technical support for standard accounts is available 24/5.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Low entry threshold, hundreds of assets from six groups, and loyal fee policy;

- Five account types, including two professional, plus a free demo account;

- Traders can use the broker's capital on favorable conditions with a progressive profit split;

- The copy trading platform provides passive income, like joint accounts;

- Profitable referral program is available, also there are several bonus types, including deposit and trading bonuses;

- The most popular deposit/withdrawal channels, such as bank cards, online transfers, etc., are available;

- Client support can be contacted by call center, email, live chat, and tickets, and is active 24 hours a day.

- The broker is registered in the Marshall Islands, and it does not have competent regulation;

- Technical support works 24/7 only for professional trading accounts, for other account types, it is 24/5;

- The terms of cooperation with the broker do not state its precise obligations.

TU Expert Advice

Author, Financial Expert at Traders Union

Uniglobe Markets offers a range of trading instruments including Forex, cryptocurrencies, commodities, energies, metals, and CFDs on stocks and indices through the MetaTrader 5 platform. The broker provides five account types with leverage up to 1:500 and a minimum deposit of $100. It supports traders with copy trading, PAMM accounts, and a proprietary trading service, allowing access to significant broker capital. Its clients can explore passive income opportunities through referral programs and bonuses, with client support available 24/5.

However, Uniglobe Markets has notable drawbacks. The lack of robust regulatory oversight, as it is registered in the Marshall Islands, may raise concerns for traders prioritizing security. Technical support for the Standard account is not available on weekends, potentially limiting assistance. The broker may suit experienced traders familiar with managing risks in less-regulated environments but may not be suitable for beginners seeking a well-regulated brokerage with full-time support.

Uniglobe Markets Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Uniglobe Markets Ltd and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MetaTrader 5 |

|---|---|

| 📊 Accounts: | Demo, Micro, Uniglobe Premium, ECN Classic, ECN Elite, and Uniglobe VIP |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank cards, online wallets, and online payment systems |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, metals, energies, commodities, and CFDs on indices and stocks |

| 💹 Margin Call / Stop Out: | 110%/70% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: |

Five live account types plus demo; Many assets from six different groups; High leverage; Functional trading platforms; Integrated copy trading service; PAMM accounts; Proprietary trading service; Welcome bonus. |

| 🎁 Contests and bonuses: | Yes |

If a broker offers multiple account types, the minimum deposit almost always depends on the selected account type. Uniglobe Markets is no exception. A $100 deposit is required for the Micro account. If a trader decides to open ECN Classic, a $1,000 deposit will be required. The Uniglobe VIP account implies a deposit of $50,000. This is the minimum value, you can deposit more, but not less. Trading leverage is also determined by the account type. The maximum of 1:500 is available on Micro, 1:300 on Uniglobe Premium, and 1:200 on ECN Classic. The lowest leverage on ECN Elite and Uniglobe VIP is 1:100. Technical support is available around the clock for all traders, however, on the first three accounts, it’s not active on weekends. Only ECN Elite and Uniglobe VIP owners receive 24/7 assistance. You can contact managers by phone, email, live chat, or via tickets.

Uniglobe Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

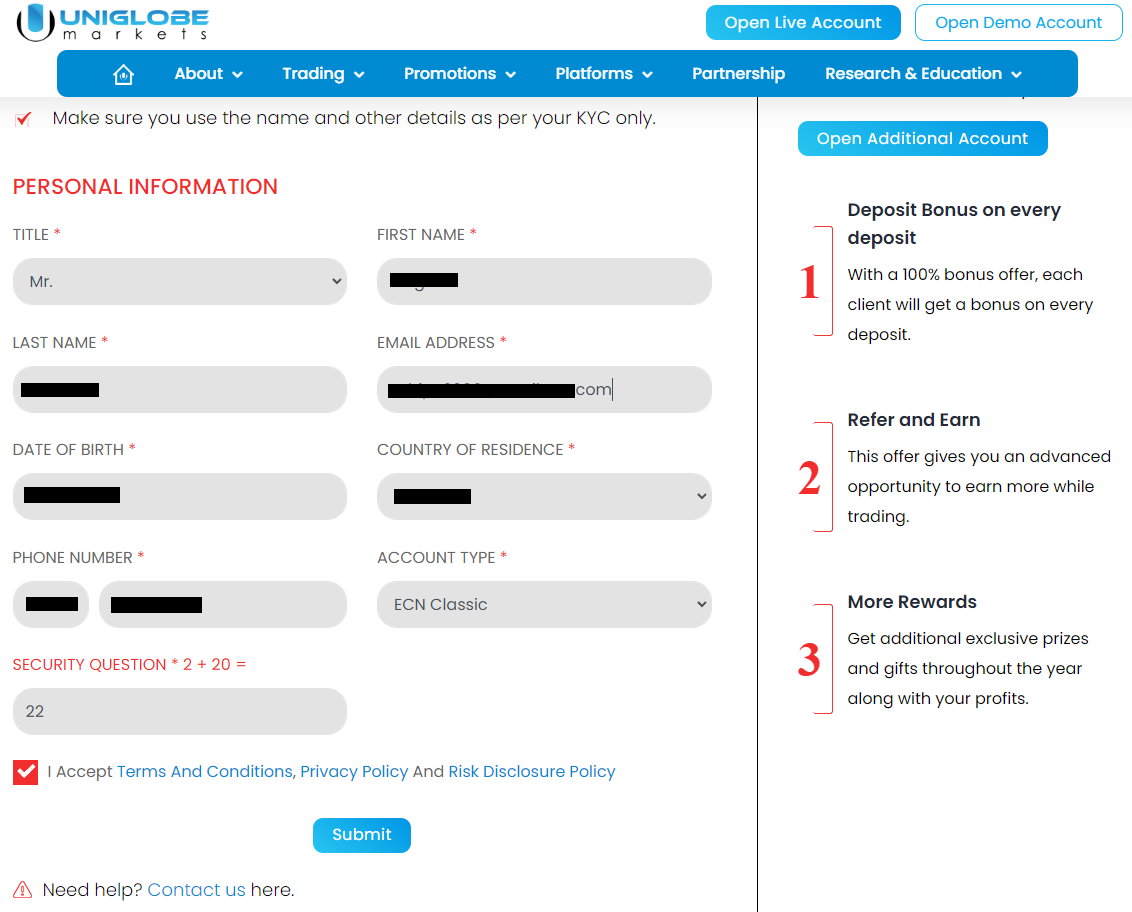

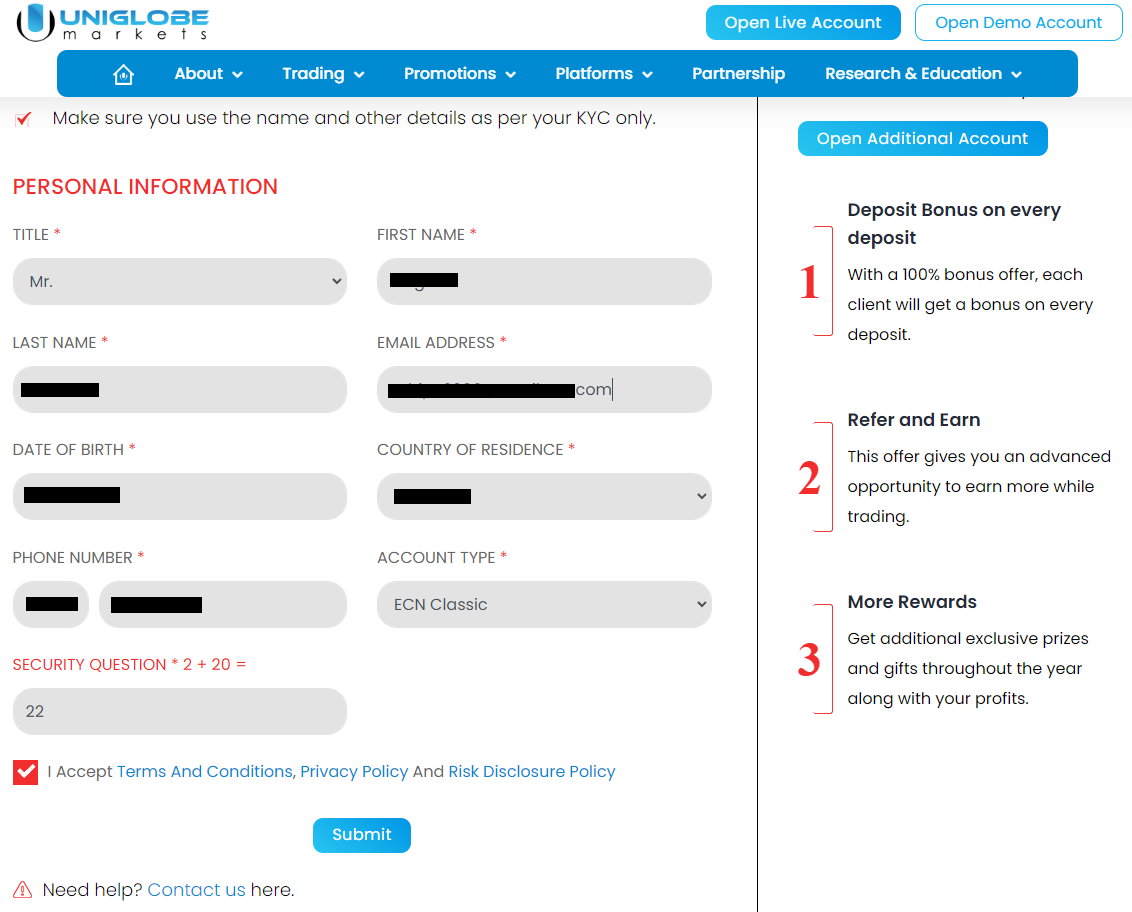

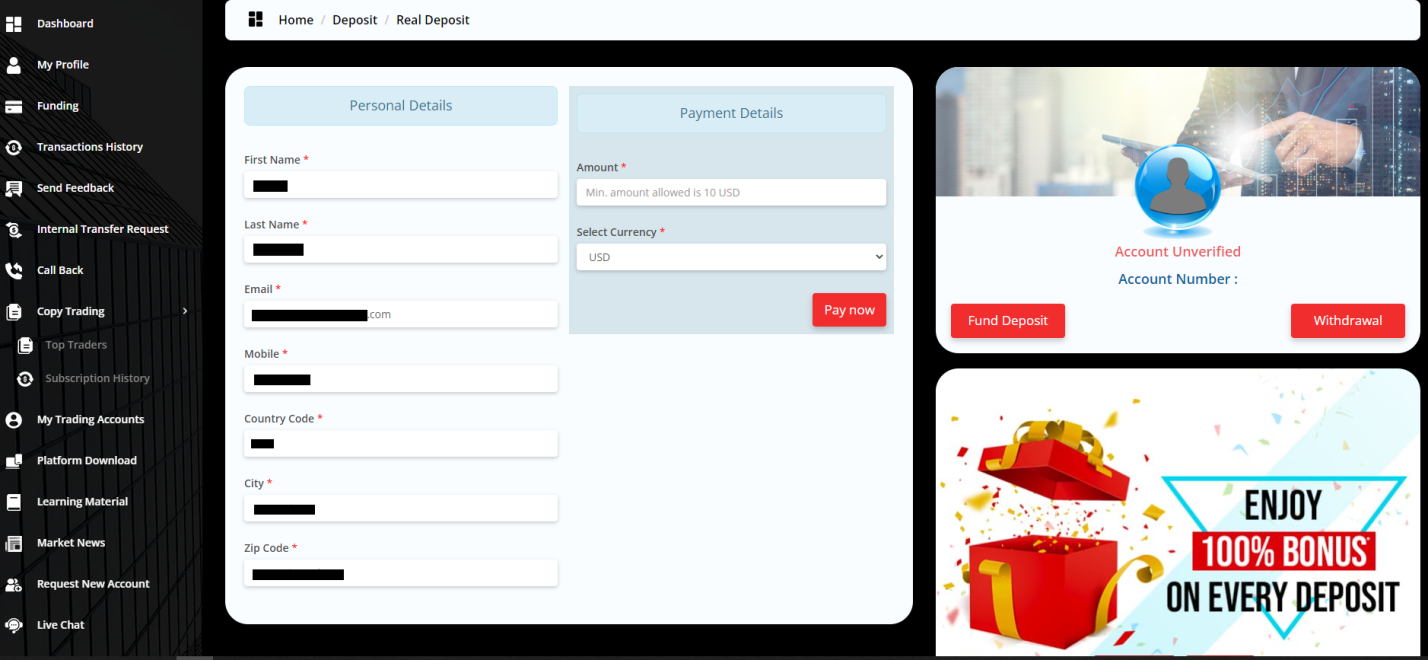

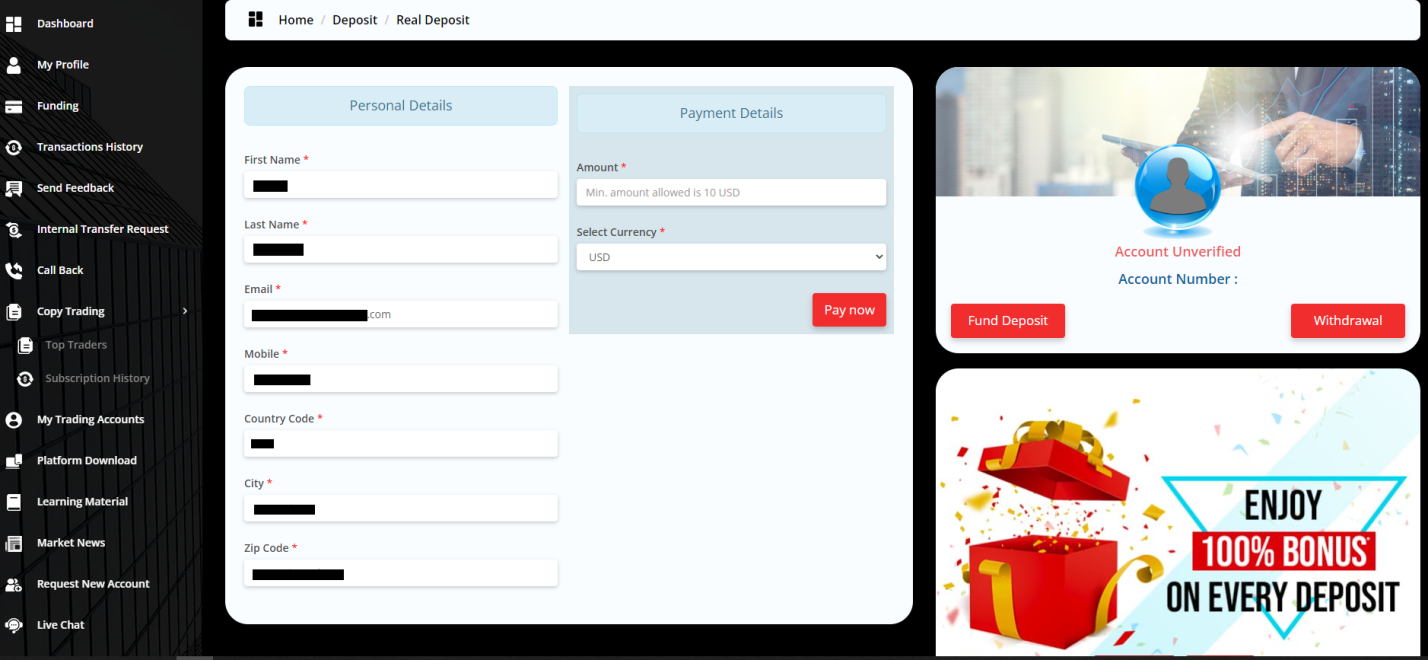

To start working with the broker, register on its official website, go through verification, open a live account, and make a deposit. TU experts have prepared these step-by-step instructions for registration and the functions of the user account.

Go to the broker's website, select the interface language in the upper left corner, and click the "Open Live Account" button on the right.

Indicate your preferred title, enter your first and last names, email, date of birth, country of residence, and phone number. Select the account type you want to open, pass the anti-bot check, and agree to the terms of cooperation by ticking the box. Click the "Confirm" button.

An email with a link will be sent to the provided address. Click this link to activate your account. You will also receive two more emails: one of them will contain information for entering the MT5 terminal, the other is for entering your user account on the website. The login, password, and investor password generated by the system can be changed later.

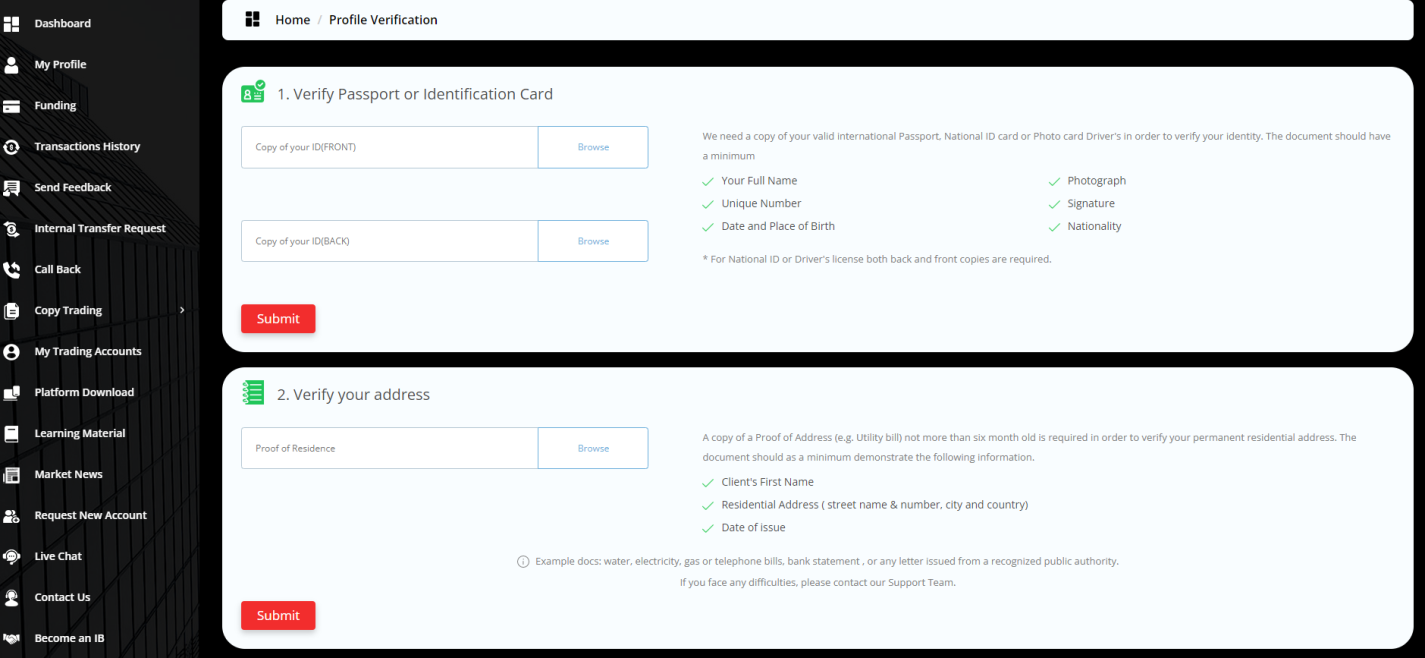

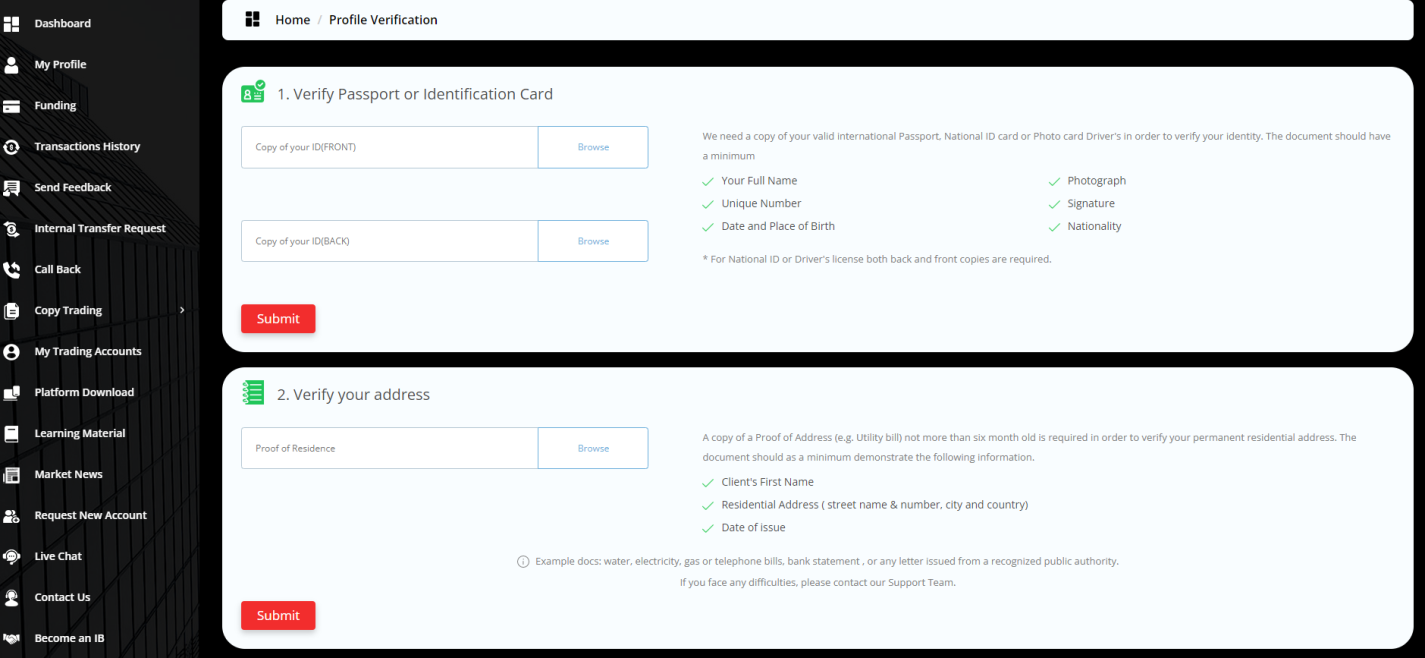

Go to the main page of the broker's website and click the "Login" button in the upper right corner. This page can also be accessed via a link in any of the emails. Enter your login and password, and click the "Login" button. You will enter your user account. Click the red notification about the need to pass verification. Upload scans/photos of the required documents following the instructions on the screen. Wait for the check to complete.

Go to the "Funding" tab in the menu on the left. Select the "Deposit" tab. Select your preferred deposit channel and follow the on-screen instructions to fund your account. After that, you can enter your user account details into MT5 and start trading.

Features of the user account:

Dashboard. This block displays aggregated data on all accounts of a trader;

My Profile. Here traders can enter and correct personal information, and change security settings;

Funding. This block is for making deposits and submitting withdrawal requests;

Transactions history. Here the broker's clients can find an archive of their transactions;

Send feedback. This option provides for creating a ticket directly from your user account;

Internal transfer request. In this block, you can transfer money from one trading account to another;

Call back. Here traders can request a call from the manager;

Copy trading. This block is dedicated to the corresponding service, providing management functions and statistics;

My Trading Accounts. Here the list and details of all trading accounts of a trader are available;

Platform download. In this section you can download MT5;

Learning materials. Currently only one eBook on Forex is available;

Market news. This is a block with a list of analytical materials published by the broker's experts;

Request new account. This option is needed to register a new user account (not a trading account);

Live chat. As the name implies, this button allows you to start a chat with support;

Contact us. By clicking this button, traders will go to the block with the company's contacts.

Become a partner. This option is for institutional accounts and it allows institutions to apply for a partnership.

Regulation and safety

Uniglobe Markets has a safety score of 2/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Negative balance protection

- Not tier-1 regulated

Uniglobe Markets Security Factors

| Foundation date | 2020 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Uniglobe Markets is Not a Regulated Broker

Commissions and fees

The trading and non-trading commissions of broker Uniglobe Markets have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Uniglobe Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Uniglobe Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Uniglobe Markets Standard spreads

| Uniglobe Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,3 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,3 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,8 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Uniglobe Markets RAW/ECN spreads

| Uniglobe Markets | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,15 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Uniglobe Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Uniglobe Markets Non-Trading Fees

| Uniglobe Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Five account types offered by Uniglobe Markets differ in trading conditions, so the choice of the account type is very important. The Micro account offers the lowest minimum deposit and the highest leverage. On Uniglobe Premium, the deposit is higher, leverage is lower, and the remaining parameters for all other accounts are almost the same . ECN Classic, in addition to the fee and leverage, is distinguished by a minimum trade volume (from 0.1 lots against 0.01 lots on the above accounts), stop out (70% against 40%), and a fee charged along with raw spreads. On the most expensive ECN Elite and Uniglobe VIP accounts, stop out is also 70%, but the minimum trade volume is 1 lot, with lower fees and maximum leverage. Thus, traders need to be guided by their preferred trading style, available capital, and their own ambitions when choosing the account type that’s best for them.

Account types:

At first, it is logical to open a demo account, which provides for studying the platform and improving traders’ preferred strategies with virtual funds. And then you can open the most suitable live account for you and start trading with real funds.

Deposit and withdrawal

Uniglobe Markets received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Uniglobe Markets provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Minimum deposit below industry average

- Bank wire transfers available

- No deposit fee

- Bank card deposits and withdrawals

- Wise not supported

- BTC payments not accepted

- Limited deposit and withdrawal flexibility, leading to higher costs

What are Uniglobe Markets deposit and withdrawal options?

Uniglobe Markets provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller.

Uniglobe Markets Deposit and Withdrawal Methods vs Competitors

| Uniglobe Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Uniglobe Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Uniglobe Markets supports the following base account currencies:

What are Uniglobe Markets's minimum deposit and withdrawal amounts?

The minimum deposit on Uniglobe Markets is $100, while the minimum withdrawal amount is $150. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Uniglobe Markets’s support team.

Markets and tradable assets

Uniglobe Markets offers a limited selection of trading assets compared to the market average. The platform supports 100 assets in total, including 50 Forex pairs.

- Copy trading platform

- 50 supported currency pairs

- Crypto trading

- No ETFs

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by Uniglobe Markets with its competitors, making it easier for you to find the perfect fit.

| Uniglobe Markets | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 100 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | No | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Uniglobe Markets offers for beginner traders and investors who prefer not to engage in active trading.

| Uniglobe Markets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Customer support

Technical (client) support is necessary for any broker because traders sometimes face difficult situations. When those occur, they need assistance, and if they don't get it promptly or managers are unable to help, clients may be disappointed and leave for competitors. To avoid this, Uniglobe Markets formed a technical support department, which works 24/5 on most accounts. Weekend support is only available on the ECN Elite and Uniglobe VIP accounts.

Advantages

- Non-clients can contact technical support

- Four communication channels, such as phone, email, live chat, and tickets are available

- Support works 24/5

Disadvantages

- 24/7 support is available only on premium accounts

Whether you are a client of the broker or just intend to become one, you may use the following channels to contact technical support:

-

call center;

-

email;

-

live chat on the website and in the user account;

-

tickets in a special section.

The company has profiles on Facebook, Instagram, Twitter, and LinkedIn. You can contact managers through these media as well. You should subscribe to them so as not to miss important news of the broker.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address | 2 St Saviours Wharf, 23-25 Mill Street, SE1 2BE – London |

| Official site | https://www.uniglobemarkets.com/ |

| Contacts |

+442035040120

|

Education

Many brokers offer training materials to their clients. It can be just FAQs or full-fledged educational courses. At Uniglobe Markets there is no specialized training, the Research and Education section explains the basics of trading, as well as offers tools for technical and fundamental analyses, including market hours and an economic calendar.

If you approach the issue objectively and compare educational activities of Uniglobe Markets with its competitors, the broker does not stand out too much from other websites. Most of them offer the minimum, and only a few have large training programs that are of practical use.

Comparison of Uniglobe Markets with other Brokers

| Uniglobe Markets | Bybit | Eightcap | XM Group | Octa | AMarkets | |

| Trading platform |

MetaTrader5 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MetaTrader4, MetaTrader5, OctaTrader | MT4, MT5, AMarkets App |

| Min deposit | $100 | No | $100 | $5 | $25 | $100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:40 to 1:1000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0.8 points | From 0.6 points | From 0 points |

| Level of margin call / stop out |

110% / 70% | No / 50% | 80% / 50% | 100% / 50% | 25% / 15% | 50% / 20% |

| Order Execution | No | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of Uniglobe Markets

The company was founded by professional traders, so it offers many assets from different groups with high leverage, and tries to minimize trading costs. In other words, Uniglobe Markets understands the problems of its clients. Also, the broker knows that some traders want to earn passively, hence it provides several options for alternative income, such as PAMM accounts, copy trading, and a referral program. Uniglobe Markets provides transparent information about the traded markets, and it does not hide details of its own fees. The technology stack complies with modern standards, including data confidentiality and the security of funds. The user account is highly valued by users for its simplicity and functionality. The only controversial point is the lack of regulation of the broker, as registration in the Marshall Islands is not enough to meet the highest reliability criteria.

Uniglobe Markets by the numbers:

-

Minimum deposit is $100;

-

Floating spread is from 0 pips;

-

Maximum leverage is 1:500;

-

5 live accounts;

-

6 types of financial instruments.

Uniglobe Markets is a broker for trading with reduced risks

The easiest way to diversify trading risks is to work with a portfolio with a variety of trading instruments. This allows you to offset the negative trend of one asset at the expense of the stability and progress of others. Uniglobe Markets offers currencies, cryptocurrencies, metals, commodities, energies, and CFDs on stocks and indices. This variety is more than enough for quality diversification. The company also allows investors to connect to its copy trading service and participate in PAMM accounts. These passive trading methods reduce risks by having trades initiated by professional market participants with extensive experience and a high win rate.

Useful services offered by Uniglobe Markets:

-

Copy trading. Users can register as signal providers and trade as usual while additionally receiving fees from traders who duplicate their trades. Or they can become investors and reduce all risks by trusting an experienced and successful colleague;

-

PAMM accounts. This service of joint accounts allows managers to have increased profits by receiving fees from owners of sub-accounts, whose funds are involved in trading along with their own. Investors, as in the case of copy trading, receive profits with reduced risk;

-

Demo account. Many brokers offer a free demo account with real quotes and virtual currency. Uniglobe Markets does it another way. Every month a demo contest is held among novice traders with a prize fund of $6,000.

Advantages:

The platform has a simple interface, an intuitive user account, and trading is carried out through a modern functional MT5 trading platform;

There are five account types, a demo account, and a proprietary trading service;

Traders can use any styles, methods, and strategies of trading, also hundreds of assets from six different groups are available to them;

Spreads are tight, fees are market average, and trading conditions determine objectively small costs for traders;

Technical support works 24/5 (for elite accounts, it is 24/7) and is available via several communication channels.

Latest Uniglobe Markets News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i