According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- cTrader

- MetaTrader4

- FCA

- FSC

- LFSA

- 2014

Our Evaluation of VARIANSE

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

VARIANSE is a moderate-risk broker with the TU Overall Score of 5.64 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by VARIANSE clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Varianse is a CFD broker, which means that all assets it offers are CFDs. There are more than 200 trading instruments in the company's assets pool with no restrictions on styles and strategies. Leverage is moderate and spreads are lower than with many of this broker’s competitors. The basic account currencies are USD, EUR, GBP, and PLN. Major deposit and withdrawal channels are subject to withdrawal fees, including crypto (BTC) wallets. Other disadvantages of this broker are high minimum deposits and less than 24/7 phone support.

Brief Look at VARIANSE

The VARIANSE (also “Varianse”, below) company provides its services to traders from more than 100 countries, giving them access to six CFD markets, such as currency pairs, stocks, indices, precious metals, energies, and cryptocurrencies. A demo account and three live account types, namely Classic, ECN Pro, and Prime, are available. The minimum deposit is $500. Minimum spreads are 0-1 pips. Fees, if any, depend on the asset and account type. Or, there may be no pips. For example, the fee for currencies and metals on ECN Pro is $3.5 per lot. This broker’s clients can trade on MetaTrader 4 and cTrader. Education is available only through articles, and there is no current news. There are no special tools for fundamental and technical analyses either. Passive income options are joint MAM accounts and the copy trading service.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- This broker has offices in the UK, Malaysia, and Mauritius, where it is officially registered and regulated;

- Choice of several live account types provides for individualizing offers;

- Traders work on modern trading platforms;

- Large choice of assets in combination with leverage up to 1:500 significantly expands the profit potential;

- Spreads are market average or even more profitable (from 0,0 pips), and trading fees are lower than those of most brokers;

- Traders can receive passive income using MAM accounts and the copy trading service;

- This broker partners with tier 1 liquidity providers, which gives raw spreads from 0 pips on the ECN Pro account;

- Technical support is provided by many major channels, such as email, live chat, and phone, and is highly evaluated by users.

- Minimum deposits are $500, $5,000, and $50,000 for Classic, ECN Pro, and Prime accounts, respectively, which are substantial numbers;

- Call center specialists work Monday through Friday, from 9:00 to 18:00 GMT, that is, managers are not available at night and on weekends.

TU Expert Advice

Financial expert and analyst at Traders Union

Varianse is a project of VDX Derivatives, which has several offices worldwide. The company is regulated by the Mauritius Financial Services Commission (FSC), the UK Financial Conduct Authority (FCA), and Labuan Financial Services Authority (LFSA) in Malaysia. All documents are freely available and can be checked. TU experts did not find any evidence of this broker's non-fulfillment of its obligations to its clients.

Free demo account, leverage up to 1:500, and more than 200 CFDs from 6 groups are standard elements that do not distinguish Varianse from its competitors. Working through MT4 and cTrader is a clear advantage, but not a conceptual one. This broker does not set trading restrictions. Its spreads are lower than market average, especially if you work on the ECN Pro account. The fees are less than those of many of this broker’s competitors, although there are companies with even more favorable conditions.

Traders can use this broker’s proprietary MAM accounts and copy trading services. In general, technicians highly evaluate the site, as it has fast order execution and reliable protection of users’ funds and data. Client money is held in Barclays.

Among the disadvantages, there are regional restrictions and a lack of a referral program for individuals. The entry threshold of $500 for the Classic account is conditionally high, while for other accounts it is even higher. Technical support is not round-the-clock; however, this is not unique. Thus, Varianse confidently occupies a high, but not a top, position in the list of the best CFD brokers.

VARIANSE Trading Conditions

| 💻 Trading platform: | МetaТrader 4 and cTrader |

|---|---|

| 📊 Accounts: | Demo, Classic, ECN Pro, and Prime |

| 💰 Account currency: | USD, EUR, GBP, and PLN |

| 💵 Deposit / Withdrawal: | Swift, Visa, Mastercard, crypto wallets, Neteller, and Skrill |

| 🚀 Minimum deposit: | $500 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | CFDs on currency pairs, stocks, indices, precious metals, energies, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: |

Free demo account; Three live accounts; High entry thresholds; 200+ CFDs from 6 different groups; Low spreads and fees; Withdrawal fees; Proprietary copy trading service and MAM accounts; No analytics or special tools |

| 🎁 Contests and bonuses: | Bonus from Traders Union |

Varianse offers several live account types with minimum deposits of $500 for Classic, $5,000 for ECN Pro, and $50,000 for the Prime account. The maximum trading leverage on all accounts is 1:500, but Prime account holders can request to increase it. In fact, Prime provides quite a few benefits, including customized liquidity optimization and VPS cross-connection. Technical support can be contacted using the call center, email, and live chat, Monday through Friday, from 9:00 to 18:00 GMT.

VARIANSE Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

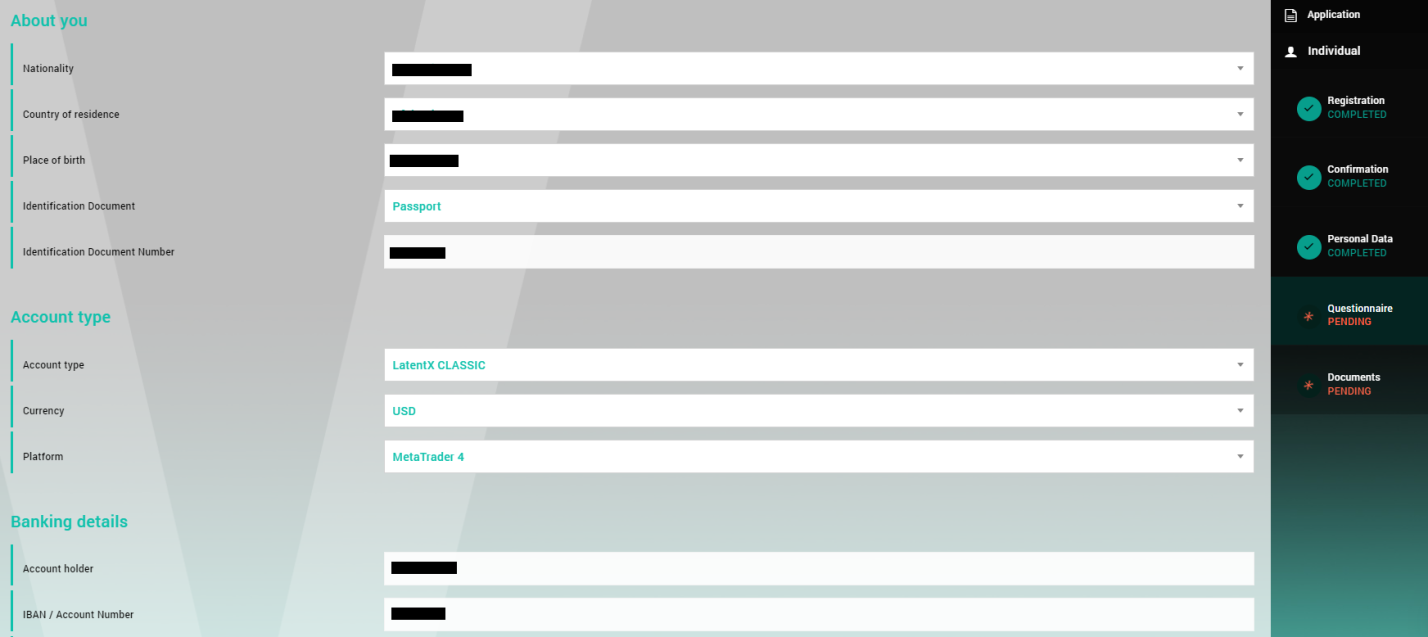

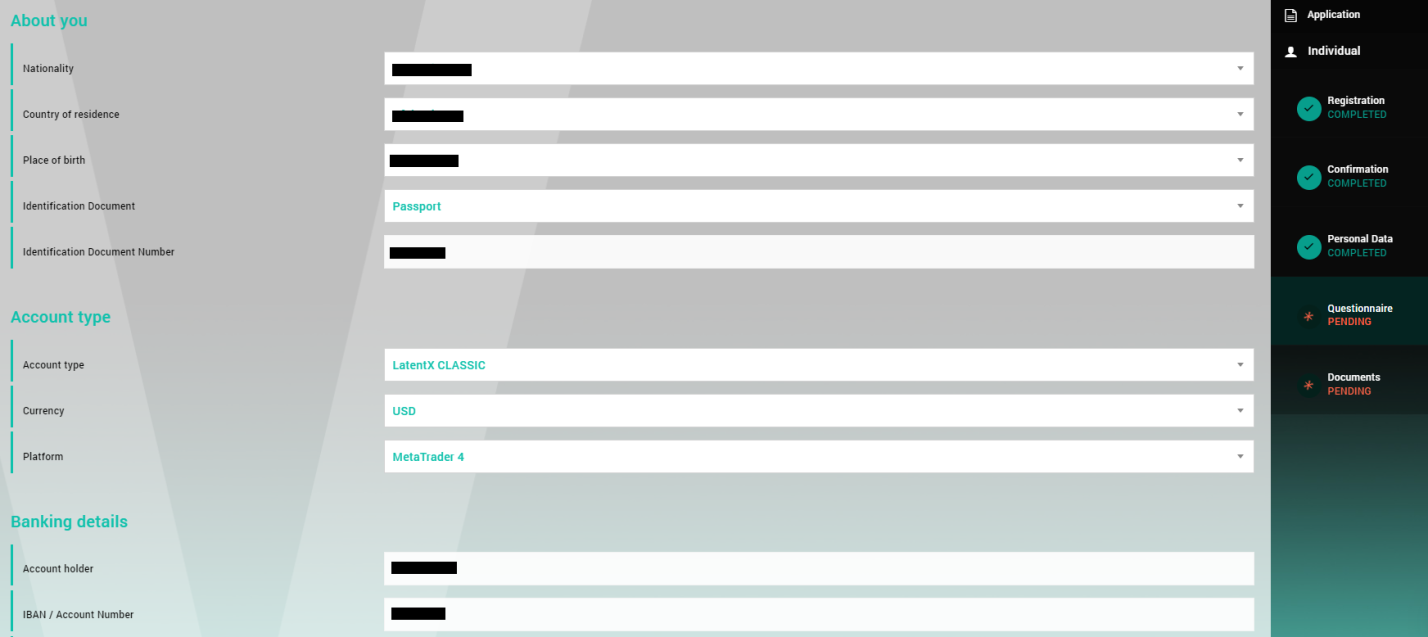

Trading Account Opening

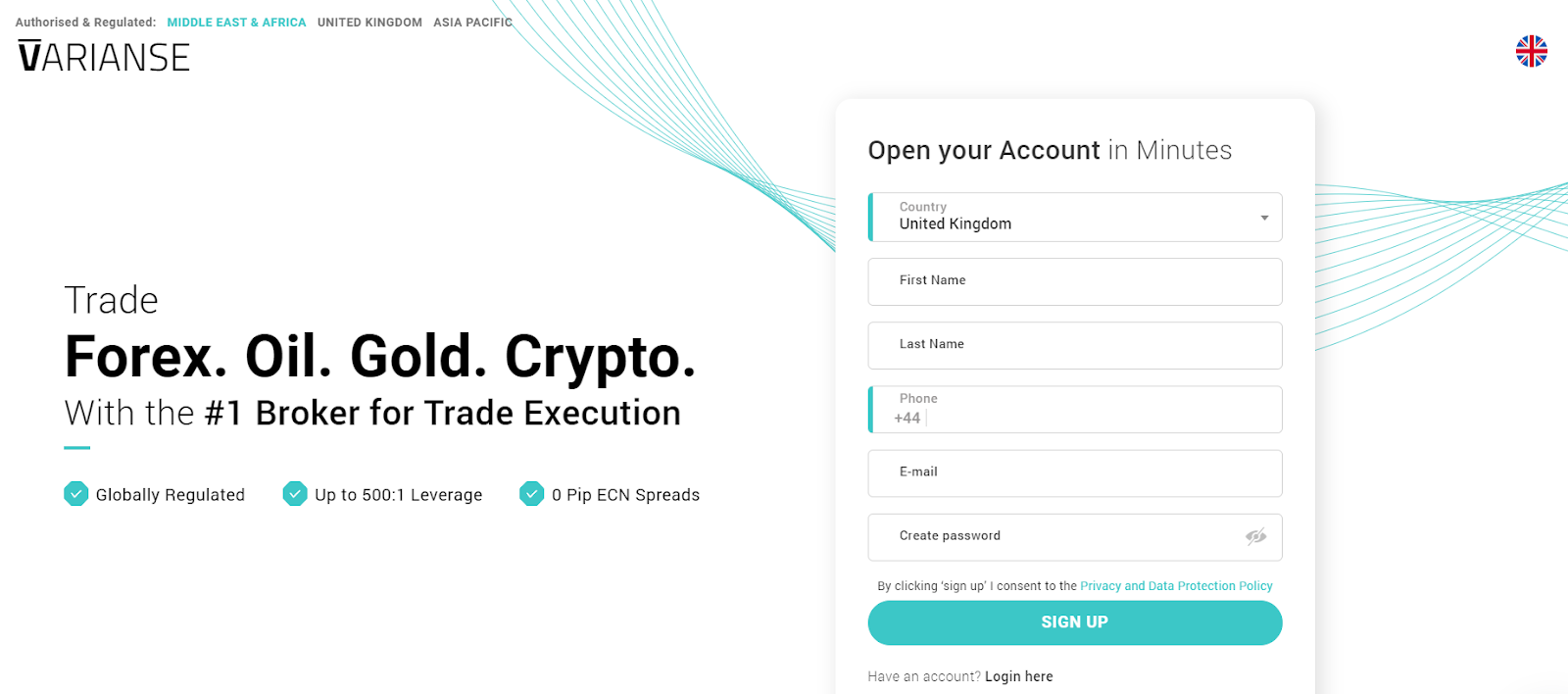

To start working with this broker, register on its website, get verified, open a live account, make a deposit, and download a trading platform. TU experts have compiled the below detailed guide on registration and what features comprise Varianse’s user account.

Go to this broker's website. In the upper right corner, select the interface language and click the “Register” button.

Select your country of residence, enter your first and last names, phone number, and email. Create a password and agree to the terms of data processing by ticking the box. Click the “Sign Up” button.

A letter from this broker will be sent to the specified email. Click the link in this email.

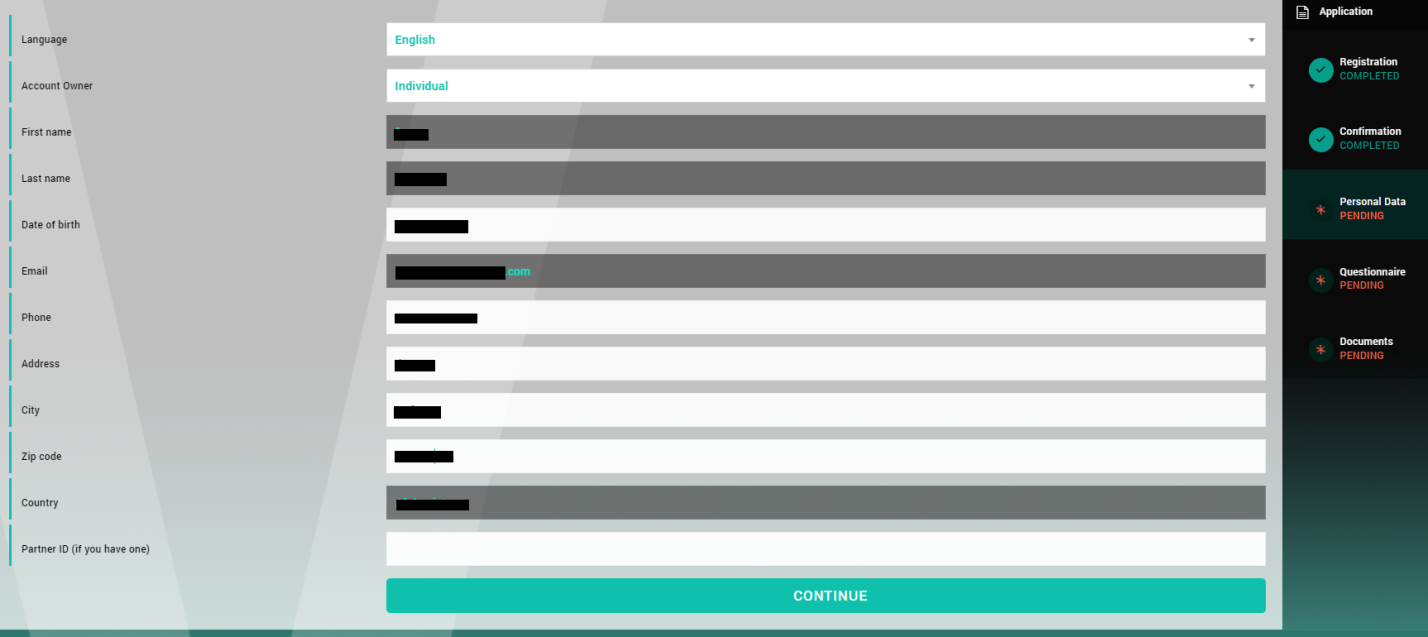

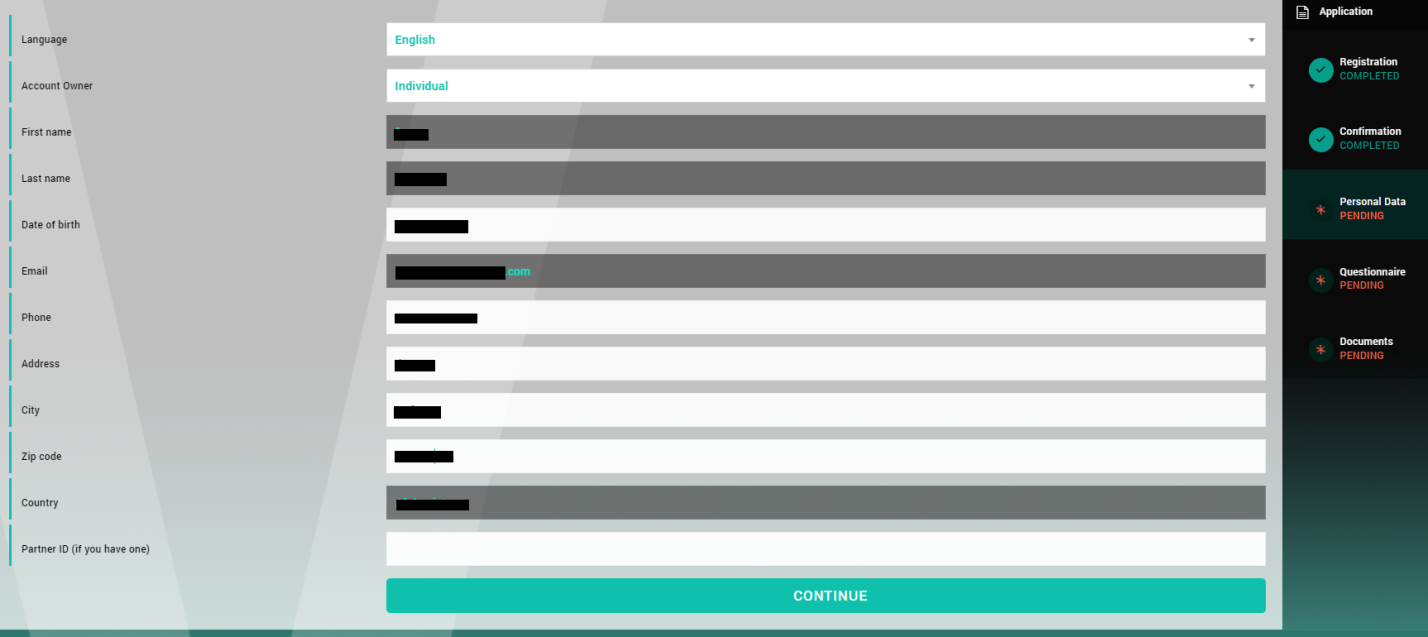

You will find yourself in the user account. Click the “COMPLETE LIVE APPLICATION” button. Choose a language, select an account type, and enter your date of birth and address with postal code. Use a referral code if any and click the “Continue” button.

Select account options. Enter tax, income, and other information. Fill in all the fields and click the “Continue” button.

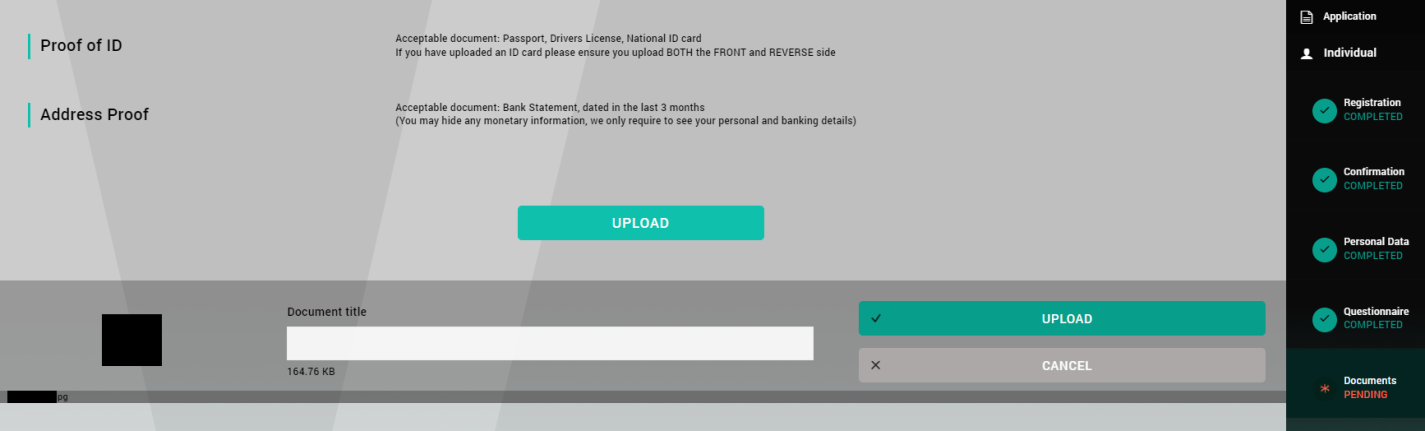

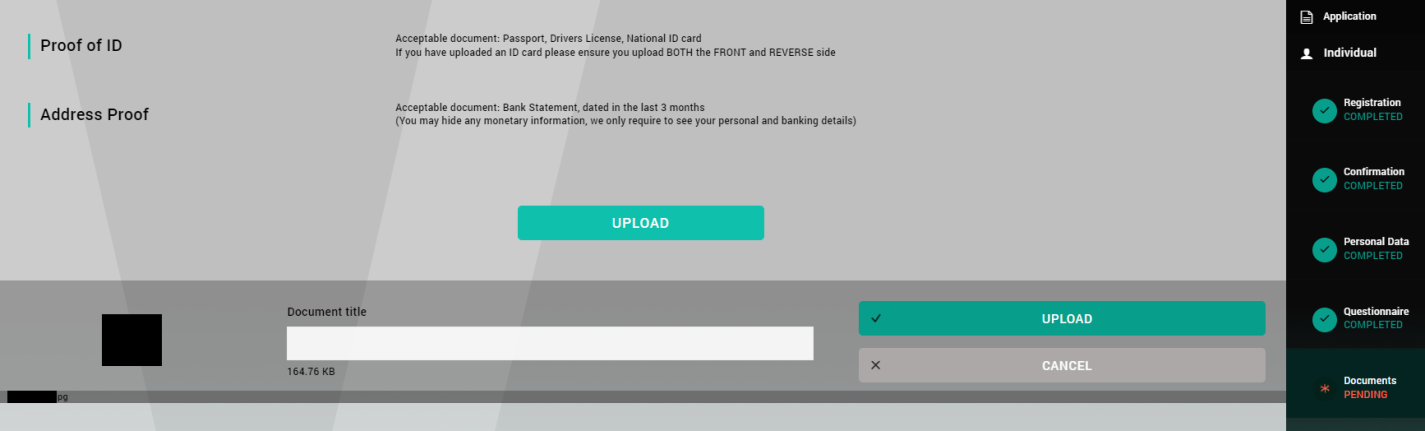

Upload a scan/photo of a document confirming your identity. Wait for the check to complete.

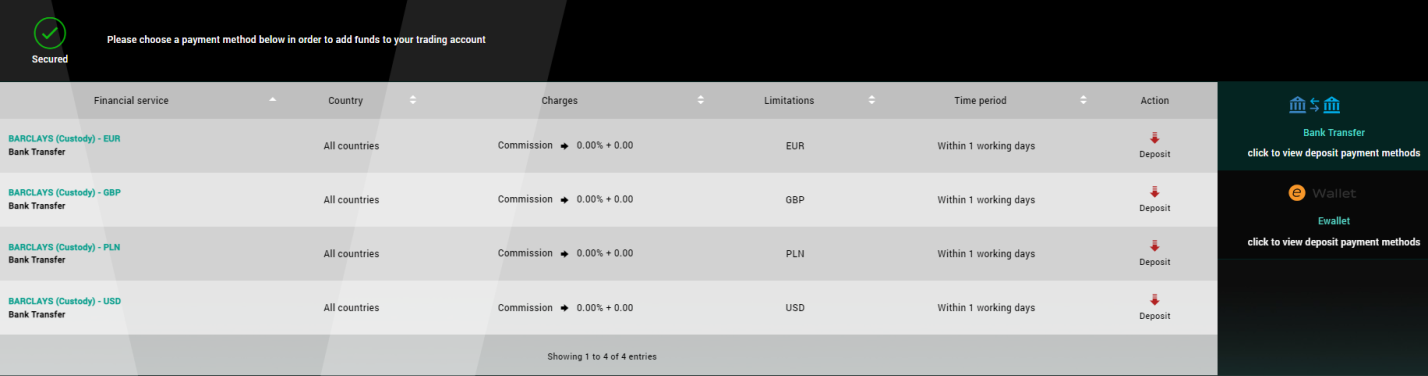

Go to the “Deposit Funds” section. Select a deposit channel and follow the instructions on the screen. Note that there is a minimum deposit amount for every account type

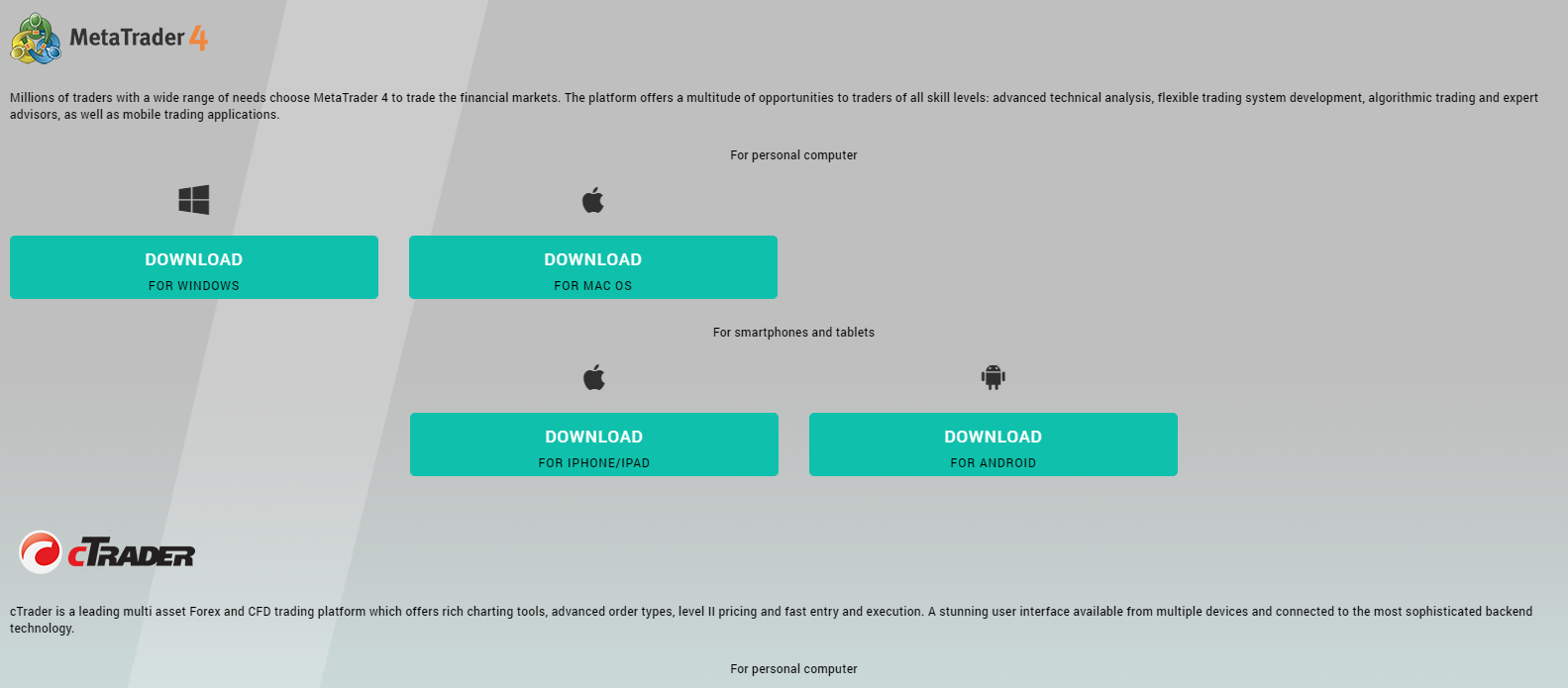

Go to the “Download platform” section. Choose the appropriate MT4 or cTrader option. Download the distribution and install it on your device. Enter your registration data in the platform and start trading.

Features of the user account:

Profile. Here traders enter and edit their personal data, and upload documents for verification;

Accounts. This block is needed to open/close a live or demo account. It also displays statistics on active accounts;

Deposit funds. Here this broker's clients select a deposit channel and fund the account balance;

Requests. This block displays all of a trader's accounts, each with a basic summary for leverage, server, platform, etc.;

MAM room. Here traders have the opportunity to become joint account managers or investors;

Platform download. This block contains distributions of all versions of MetaTrader 4 and cTrader;

VPS. Here you can get access to a free virtual dedicated server subject to conditions.

Regulation and safety

VARIANSE has a safety score of 9.5/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Regulated in the UK

- Track record over 11 years

- No negative balance protection

VARIANSE Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

| LFSA (Malaysia) | Labuan Financial Services Authority | Malaysia | No specific fund | Tier-2 |

VARIANSE Security Factors

| Foundation date | 2014 |

| Negative balance protection | No |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker VARIANSE have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No withdrawal fee

- Above-average Forex trading fees

- Deposit fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of VARIANSE with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, VARIANSE’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

VARIANSE Standard spreads

| VARIANSE | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,1 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,4 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,1 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

VARIANSE RAW/ECN spreads

| VARIANSE | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,1 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with VARIANSE. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

VARIANSE Non-Trading Fees

| VARIANSE | Pepperstone | OANDA | |

| Deposit fee, % | 0-3,9 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

The choice of the account type is of great importance. For some brokers, account types do not differ too much, but at Varianse they differ significantly, and it's not just spreads and trading fees. For example, the extended asset pool and FIX API messaging protocol are not available on the Classic account, while users with ECN Pro get these features. However, they don't have extended liquidity pools and VPS that are available on Prime. Spreads start at 1 pips on Classic and 0 pips on other accounts. There are no standard fees for currencies and metals on Classic, but they are $3.5 per lot on ECN Pro, and the fee is variable on Prime. They also differ significantly in fees for other asset types. After choosing an account, TU experts recommend paying more attention to trading platforms. For example, if users have always worked with cTrader, they should definitely try MT4 and compare these solutions.

Account types:

As a rule, if traders have not worked with the site before, they first open a free demo account. There users trade with real quotes, but virtual currency. This provides for learning this broker’s conditions and working out certain strategies. Then, based on their budget and personal preferences, traders choose one of the three live accounts.

Deposit and withdrawal

VARIANSE received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

VARIANSE provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- BTC available as a base account currency

- Bitcoin (BTC) accepted

- USDT (Tether) supported

- Bank card deposits and withdrawals

- PayPal not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

- Deposit fee applies

What are VARIANSE deposit and withdrawal options?

VARIANSE provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT, Ethereum.

VARIANSE Deposit and Withdrawal Methods vs Competitors

| VARIANSE | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are VARIANSE base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. VARIANSE supports the following base account currencies:

What are VARIANSE's minimum deposit and withdrawal amounts?

The minimum deposit on VARIANSE is $500, while the minimum withdrawal amount is $100. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact VARIANSE’s support team.

Markets and tradable assets

VARIANSE offers a limited selection of trading assets compared to the market average. The platform supports 200 assets in total, including 60 Forex pairs.

- Crypto trading

- Indices trading

- 60 supported currency pairs

- Copy trading not available

- No ETFs

VARIANSE Supported markets vs top competitors

We have compared the range of assets and markets supported by VARIANSE with its competitors, making it easier for you to find the perfect fit.

| VARIANSE | Plus500 | Pepperstone | |

| Currency pairs | 60 | 60 | 90 |

| Total tradable assets | 200 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products VARIANSE offers for beginner traders and investors who prefer not to engage in active trading.

| VARIANSE | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Every broker needs technical support. After all, traders regularly face situations that they cannot figure out on their own. User experience does not matter, the problem may arise when trading, depositing, or withdrawing funds. And the client has the right to count on qualified and prompt assistance. If managers work extremely slowly or are not able to help traders, they will inevitably be disappointed and leave for a competing company. Varianse offers client support available via call center, email, and live chat on the website and in the user account. Standard support hours are Monday through Friday, 09:00 to 18:00 GMT. However, the live chat is available around the clock.

Advantages

- Several communication channels are available

- Non-clients of this broker can contact technical support

- High efficiency of managers during working hours

Disadvantages

- Support can be contacted at night and on weekends via live chat only

Communication channels are as follows:

-

email;

-

telephone;

-

live chat on the website and in the user account.

Note that this broker has its profiles on Facebook, Instagram, Twitter, and LinkedIn. There you can also contact support. Subscribe to this broker to keep up-to-date on its news.

Contacts

| Foundation date | 2014 |

|---|---|

| Registration address |

24 St. Georges Street, Port Louis, Mauritius 20 North Audley Street, Mayfair, London, W1K 6LX, United Kingdom Robin Business Center 3, Lazenda Warehouse, Jalan Ranca-Ranca, Labuan, Malaysia |

| Regulation |

FCA, FSC, LFSA

Licence number: 802012 |

| Official site | https://varianse.com/ |

| Contacts |

+230 5297 0989, +44 (0) 203 475 2285

|

Education

It is important for traders not only to practice, but also to improve their theoretical background. Therefore, many people read eBooks, communicate with colleagues on specialized forums, and take free and paid courses. There are brokers that provide training at various levels from a trading glossary to full-fledged lectures. Varianse does not offer all the above. The website has only standard FAQs in the Help Center and a small collection of articles. This cannot be called a critical drawback, because traders come to brokers to trade, and not to learn how to trade. However, an advanced educational system will always be an advantage for any brokerage company.

Traders who decide to work with Varianse should understand that here they can only learn by doing and watching experienced colleagues in the copy trading service. Also note that this broker does not provide tools for analysis and forecasting, there is not even an economic calendar. That is, the company's clients in any case will have to use third-party resources and/or software.

Comparison of VARIANSE with other Brokers

| VARIANSE | Bybit | Eightcap | XM Group | VT Markets | Pocket Option | |

| Trading platform |

cTrader, MetaTrader4 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MetaTrader4, MetaTrader5, VT Markets App, Web Trader+ | Pocket Option, MT5, MT4 |

| Min deposit | $500 | No | $100 | $5 | $50 | $5 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0.8 points | From 0 points | From 1.2 point |

| Level of margin call / stop out |

No | No / 50% | 80% / 50% | 100% / 50% | No / 50% | 30% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of VARIANSE

Varianse is a project of VDX Derivatives, so from the very beginning it had no problems with constructing an excellent technological base and secure trading environment. Currently, it uses advanced solutions like virtual servers. It also partners with tier-1 liquidity providers. Barclays, one of the UK's largest financial conglomerates, is an official partner of Varianse. Due to all these advantages, the company is able to provide its clients with services meeting the industry's leading standards, including fast order execution, low costs, and convenient and intuitive infrastructure without functional problems.

Varianse by the numbers:

-

Provides services in 100 countries;

-

200+ trading instruments from 6 groups;

-

Average order execution time is 12 ms;

-

Spreads are from 0 pips;

-

Average positive slippage is +0.4 points.

Varianse is a convenient broker for novice and experienced traders

Selecting a convenient trading platform is a priority for many traders. Although MetaTrader 4 is considered the best solution, cTrader also has a lot of fans. If a trader can work with a familiar platform, this is always an advantage for a broker. The next key is the choice of assets. The more diverse they are, the wider users’ strategic opportunities, and the easier it is for them to diversify risks through an investment portfolio consisting of several types of assets. Finally, sufficient leverage to achieve one’s financial goals is important.

Useful services offered by Varianse:

-

Joint accounts. The MAM system allows a manager to control several accounts owned by investors and trade using the funds available to them. Managers additionally earn on fees, and investors receive passive income;

-

Copy trading. The copy trading service provides the same benefits as joint accounts. Signal providers charge fees for their services, and investors receive profit without personally participating in trades. Additionally, investors gain relevant experience;

-

Virtual personal servers. VPS is free for Prime account holders. It provides for 24/7 automated trading without using the technical capabilities of the trader's own equipment. Due to such servers, order execution speed increases, and slippage decreases.

Advantages:

A new client of this broker can open a free demo account to explore the site and to practice;

Traders have hundreds of CFDs from six different groups at their disposal, which greatly expands their strategic options;

Passive income options like MAM accounts and copy trading allow each trader to receive additional income;

This broker works 100% transparently, thus there are no hidden fees;

Although the main communication channels with technical support are not available 24/7, this broker's live chat works even at night.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i