Top 10 Best CFD Brokers in the UK 2024

|

|

8 |

|

|

5 |

|

|

4 |

|

|

eToro |

Would you like to start trading CFDs in the UK, but you do not know what are the best CFD brokers in the UK or what features you should look for when choosing a CFD broker?

To help you start your CFD trading journey, the Traders Union experts researched the market for the 10 best CFD brokers that are FCA regulated, offer a large selection of CFDs, and have low fees to create a rating of them.

Start trading CFD right now! Open an Account on AvaTradeGlossary

-

CFD (Contract For Difference) is an agreement between two parties – the buyer and the seller – on the transfer of difference between the current asset value at the moment of conclusion of the contract (opening position) and its value at the time of the contract expiry (closing position).

-

The UK Financial Conduct Authority (FCA) is one of the earliest world-class regulators. It was created in 2001 and is characterized by having the most stringent requirements for brokerage organizations.

-

Spread is the difference between the best buy price and the best sell price in currency exchange and CFD trading.

-

Leverage means borrowed funds provided by the broker, which allow traders to manage substantial amounts in the market, while having only a small amount of own capital used to cover the margin requirements.

Top 10 Best CFD Brokers in the UK

Tickmill - (Best for low fees)

Tickmill

Tickmill is an FCA-regulated Forex and CFD broker that allows its users to trade CFDs on stocks, currency pairs, indices, and commodities on the MetaTrader 4, MetaTrader 5, and WebTrader trading platform. There is also a mobile app available for IOS and Android devices. It also has a free demo account for beginners.

The minimum deposit is $100, and it has more deposit methods available, such as bank transfers, credit/debit cards, and e-wallets. There are no deposit and withdrawal fees. Tickmill does not have additional commissions for CFDs trading, except for the spread, which can be as low as 0.0 pips in some cases. The average EURUSD spread is 0.1 pips.

Another benefit of this broker is the copy trading feature that allows its users to copy other traders. However, the trader they copy receives 10% of the profits.

Types of Tickmill Trading AccountsAdmiral Markets UK - Best for mobile trading

Admiral Markets

Headquartered in London, Admiral Markets is an FCA-regulated CFD broker that uses the MT4, MT5, and MetaTrader Supreme trading platforms. Admiral Markets also has a user-friendly mobile trading platform and a demo account for beginners.

Admiral Markets allows its users to trade CFDs on currency pairs, stocks, indices, and commodities. The commissions for CFDs on stocks start from $0.01 per share, but CFDs on Australian and Japanese have 0.15% commissions on the transaction’s notional value. For the rest of CFDs, the broker only earns on spreads, which can be as low as 0.0 pips for certain assets. The minimum deposit is $100.

RoboForex

RoboForex

RoboForex is an award-winning international forex broker operating since 2009. The company operates under the regulations of the International Financial Services Commission (IFSC) of Belize.

The broker provides access to a range of market-leading trading platforms. These include MetaTrader 4, MetaTrader 5, and cTrader. RoboForex prides itself on offering its users the best trading conditions in the market, including tight spreads, generous leverage, and no re-quotes.

They offer a range of account types to cater to different traders' needs, such as Cent, Standard, ECN, and Prime. Traders can start with a minimum deposit of just $10.

The brokerage fees charged by RoboForex are competitive and transparent, with spreads starting from 0 pips and a commission of $20 per million traded ($2 per lot).

Traders on RoboForex can access a range of educational resources, market analysis, and 24/7 customer support. The Negative Balance Protection feature ensures that traders cannot lose more funds than they have in their accounts.

FxPro - Best User Experience

FxPro

In July 2006, the FxPro broker was established in Cyprus. Financial regulators such as the FCA in the United Kingdom, CySEC in Cyprus, the SCB in the Bahamas, and the FSCA in South Africa supervise the company's operations. It uses the popular MT4, MT5, cTrader trading platforms, as well as a proprietary trading platform.

FxPro has a reputation for delivering the best trading tools, and it has received a lot of positive feedback from its users. Almost all of its users consider FxPro to be a great broker for beginners, and they like trading with it because of its attractive trading conditions and fees. By storing client funds in large international banks, FxPro maintains high-security standards. They are secured and do not constitute part of the broker's equity.

The minimum deposit for this broker is $100. FxPro charges its users a $45/million dollar fee for opening and closing a position, as well as an average spread. It also charges a small overnight fee to keep a CFD position open over the weekend. FxPro has a Negative Account Protection feature that automatically closes all of your positions to keep you from falling into a negative balance.

Pepperstone - Best for low spreads

Pepperstone

Pepperstone is an online broker based in Australia that was founded in 2010. It is regulated by the reputable FCA in the UK and ASIC in Australia. Client assets are held in aggregated accounts with major banks. These aspects demonstrate the company's reliability and ensure the security of the clients’ funds.

Pepperstone allows its users to trade CFDs on stocks, indices, currency pairs, and commodities using the popular MetaTrader 4, MetaTrader 5, and cTrader platforms.

This broker has a 0.10% commissions of the trade’s total value for CFDs on UK and German stocks, with a minimum commission of €/£10. There is a 0.07% commission for CFDs on Australian stocks. There is a $0.02 per share fee for CFDs on US stocks.

Other advantages of this broker include quick order execution and very low spreads starting at 0.0 pips. The EURUSD spread is 0.09 pips on average.

Multibank

Multibank

MultiBank is a global broker founded in 2005. The broker is regulated by multiple financial authorities, including the ASIC, FSC and CySEC.

MultiBank offers a wide range of trading platforms, including MetaTrader 4 and 5, and a proprietary platform called MEX. The broker also provides traders with access to over 1,000 financial instruments. These include forex, commodities, indices, and stocks, enabling them to diversify their portfolios and take advantage of market opportunities.

One of the significant advantages of trading with MultiBank is its competitive pricing. The broker offers tight spreads, low commissions, and no hidden fees. The minimum deposit requirement for opening an account with MultiBank is $50, which makes it an accessible option for traders of all levels.

MultiBank also provides a range of educational resources, including webinars, seminars, and trading guides. Additionally, the broker offers a demo account, which allows traders to practice trading without risking their funds.

The broker maintains segregated accounts for clients' funds and also provides negative balance protection to prevent clients from losing more than their account balance.

eToro - Best platform For CFD copy trading

eToro

Another excellent FCA-regulated broker for CFD trading in the UK is eToro. It was founded in New Jersey, USA, in 2007. eToro's proprietary platform allows users to trade CFDs on currency pairs, indices, commodities, and stocks. It is an excellent CFD broker for beginners because it has an advanced educational section and is one of the best copy trading softwares in the market. It has a $50 minimum deposit.

The CFD trading fees are low at eToro. For most assets, the broker only makes money from the spread. Currency pairs, for example, have spreads as low as one pip, whereas commodities have a minimum spread of two pips. Fees for CFDs on stocks start at 0.09 percent of the lot size, while CFDs on indices start at 0.75 points. In addition, there is a very small overnight fee for keeping a CFD trade open overnight.

FxOpen

FxOpen

FxOpen is a regulated forex broker founded in 2005. The broker is regulated by multiple financial authorities, FCA and ASIC.

FxOpen offers a variety of trading platforms, including MetaTrader 4 and 5, as well as a proprietary platform called TickTrader. The broker also provides traders access to over 50 forex pairs, commodities, indices, and cryptocurrencies. One of the unique features of FxOpen is its cryptocurrency trading, allowing clients to trade Bitcoin, Ethereum, and other cryptocurrencies against major fiat currencies.

FxOpen offers various account types, including ECN, STP, and Crypto accounts, to cater to traders with different trading styles and preferences. The broker also provides clients with access to a range of educational resources, including webinars, tutorials, and market analysis, to help them improve their trading skills.

The broker maintains segregated accounts for clients' funds and uses SSL encryption to protect clients' personal information. Additionally, theey provides negative balance protection. FxOpen's fees are competitive, with tight spreads and low commissions.

AvaTrade - Best For Beginners

AvaTrade

AvaTrade is one of the best FCA-regulated brokers in the UK for beginners. AvaTrade uses the MetaTrader 4, MetaTrader 5, WebTrader, ZuluTrade, as well as a mobile trading app to offer its users CFDs on all major assets, such as stocks, currency pairs, and indices.

The minimum deposit amount is $100, and you can use almost every deposit and withdrawal method, including different e-wallets, without any commissions. Other benefits for beginners are the presence of a demo account, cent account, and copy trading feature.

This broker does not have additional fees for CFD trading, and it only earns from the spread. The spread is average and even lower than the market average in some cases. For example, the average EURUSD spread is 0.9 pips.

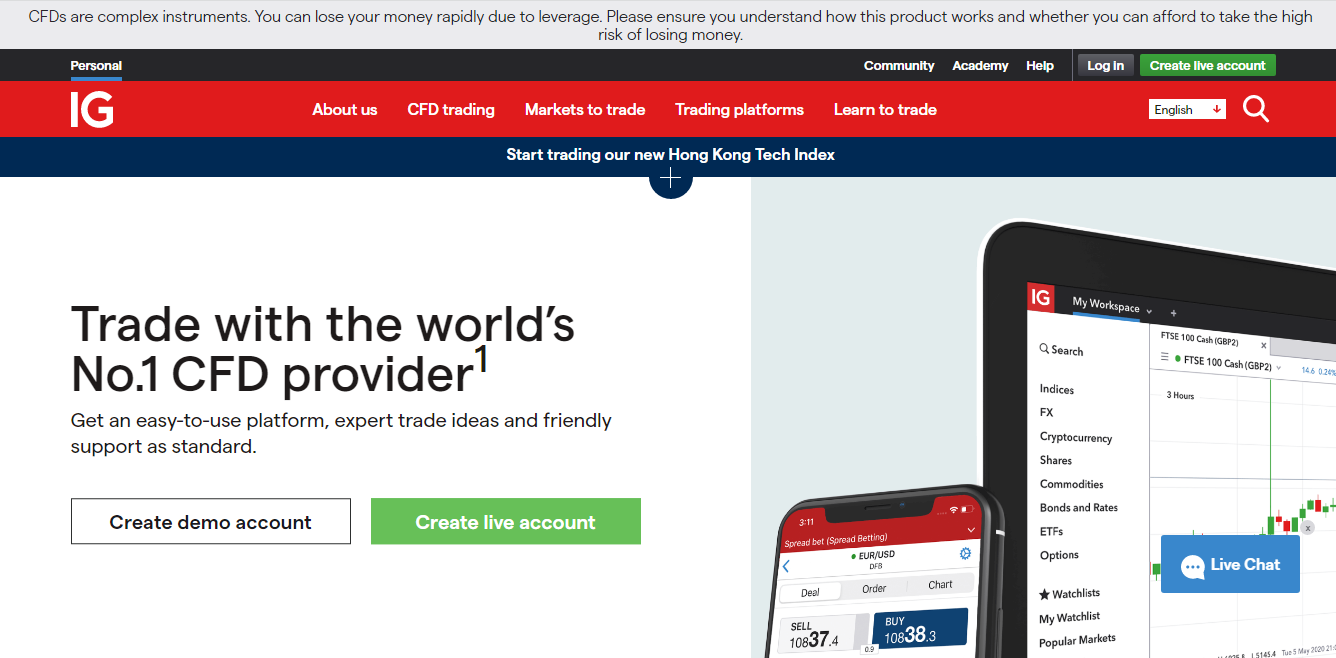

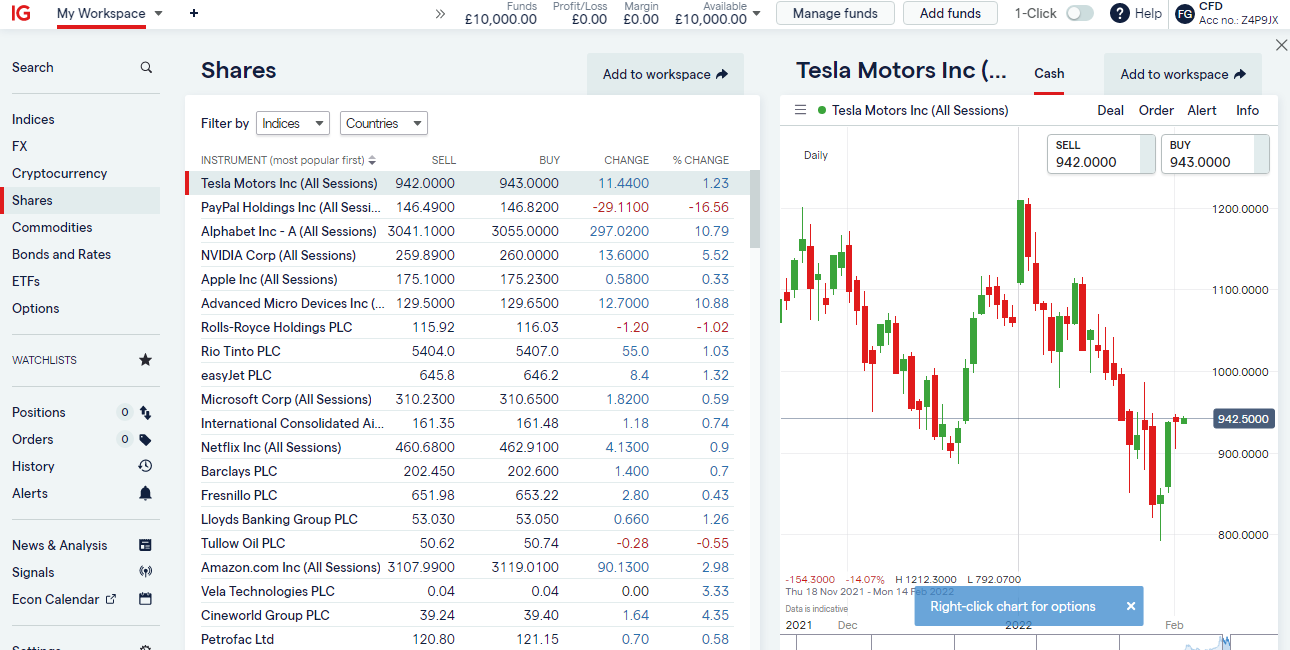

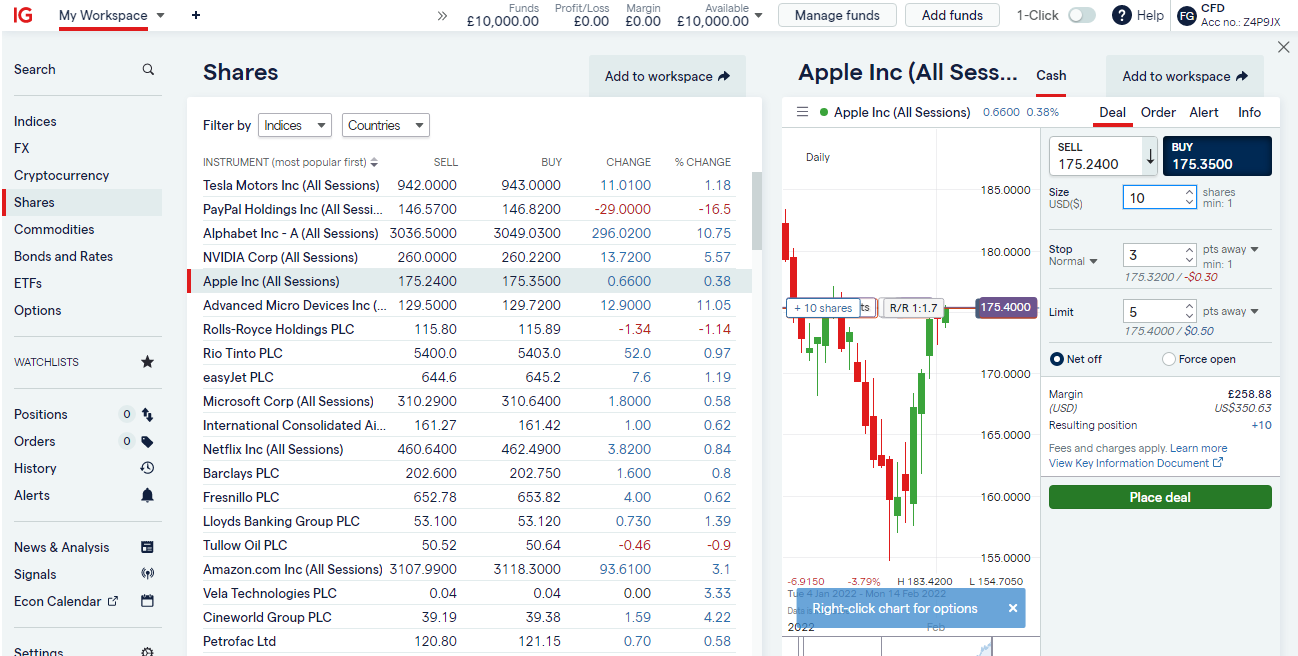

IG - Best CFD broker in the UK

IG

IG Markets is a UK-registered company founded in 1974 and regulated by the FCA in the United Kingdom. This broker offers CFDs on currency pairs, stocks, indices, and bonds through a proprietary trading platform.

A bank transfer has no minimum deposit, but credit cards, debit cards, and PayPal have a $300 minimum. For CFDs on stocks, the commission is 0.10 percent of the lot size for UK/Euro stocks, but the minimum commission is £/€10. There is a 2 cent per share commission and a $15 minimum commission for CFDs on US stocks. In the case of the other types of CFDs, the broker only earns from the spread, which is not higher than the market average. It also charges a small overnight fee for keeping a CFD position open overnight.

A demo version is also available for beginners to test different strategies and gain trading experience.

Best CFD Trading Platforms in the UK - Comparison

| CFD Broker | FCA Regulation | Minimum Deposit | Features | Options for beginners | |

|---|---|---|---|---|---|

Yes |

$100 |

CFDs, Forex, indices, commodities |

Demo account, low spreads, negative balance protection |

||

Yes |

$100 |

Forex, CFDs on stocks, indexes, commodities, bonds |

Demo account, great educational materials |

||

No |

$10 |

Forex (currency pairs), ETFs, index CFDs, oil CFDs, CFD on European and U.S. stocks, cryptocurrency CFDs, real securities |

Copy trading, demo account |

||

Yes |

$100 |

Forex, CFDs on stocks, indices, commodities |

Pamm account, Copy trading, Demo account |

||

Yes |

$200 |

CFDs, Forex, stocks, indices, commodities, crypto |

Fast execution speed, low spreads, demo account |

||

No |

$50 |

Forex, Metals, Shares, Indices, Commodities, Cryptocurrencies |

Copy trading, PAMM accounts, free MAM, EA, VPS, API, demo account |

||

Yes |

$50 |

2000+ trading assets Free US Stocks and ETFs trading, Advanced copy trading, Crypto trading |

Free Social trading platform, Demo account |

||

Yes |

$1 |

50 currency pairs, CFD, indices, gold and silver, 43 pairs with BTC, LTC, EOS, PTC, ETH, DASH, EMC |

Demo accounts, cent accounts, PAMM-investing, copy trading |

||

Yes |

$100 |

Forex, stocks, cryptocurrencies, indices, metals, commodities, CFDs |

Copy trading, cent account |

||

Yes |

$0 |

17,000 + trading assets, strong regulation, low fees |

Copy trading, Trading Academy, low minimum deposit, Demo account |

Top 3 CFD Trading Platforms in the UK for Beginners

Some of the best characteristics of a CFD broker for beginners are the presence of a demo or cent account, educational materials, small minimum deposits, an easy-to-use platform, and the availability of passive investment opportunities, such as copy trading and PAMM account.

Although all the CFD brokers included in this rating offer great functionality, we consider that the following three CFD brokers are more suited for beginners. Here they are:

eToro

The reason why eToro is considered one of the best CFD brokers for beginners is because it has a great, free copy trading platform called Copy Trader. Copy Trader is regarded as the best platform for copy trading because it has one of the largest social trading networks for generating passive income. It stands out for its low entry threshold, favorable trading conditions, excellent functionality, and simplicity. It also uses one of the most sophisticated methods for determining which trader to copy.

AvaTrade

The reason why AvaTrade can be considered the best CFD trading platform in the UK for beginners is that it lets its beginner users trade CFDs on a cent account. A cent account is very similar to a standard account, and the main difference is that the price of assets is indicated in cents instead of dollars. For example, $100 on a standard account is the equivalent of 100 cents on a cent account. Trading on a cent account allows you to gain trading experience while minimizing your risks of losing big amounts of money.

AvaTrade also lets its users copy other traders at no cost by connecting their accounts to copy trading software such as ZuluTrade and DupliTrade. AvaTrade has recently launched its proprietary copy trading software, called AvaSocial, which is available as a mobile app for iOS and Android devices.

FxPro - Best User Experience

FxPro is a great CFD broker for beginners because it has lots of positive reviews from its users, and almost all of them recommend it to beginner traders. It also has favorable trading conditions and an easy-to-use interface.

FxPro offers a cent account and a MAM account. MAM is an abbreviation for Multi-Account Manager. In a MAM account, the managing trader, called the manager, can receive funds from other traders, known as investors. The manager can use the funds to make trades and receive a portion of the profits. The remainder of the profits is distributed to the investor.

5 Tips to Choose The Best CFD Brokers in the UK

Check-up Regulation

If you live in the United Kingdom, you should choose an FCA-regulated broker because a broker regulated by a reputable regulator provides better trading conditions and better protection for its users' funds.

Try it in Demo mode

A demo account would assist novice traders in gaining a thorough understanding of the trading platform's features. It also aids in comprehending the trading conditions.

Pay attention to the reviews

Before you create a trading account with a broker and make your first deposit, you should first read reviews from its users. A big number of negative reviews should be a big turn-off for you, and it is safer to avoid that broker.

Test research options

Technical indicators, educational content, analytical reports, and charting tools all play an important role in a Forex trader's success. Check to see if the broker you intend to use has good analytical tools.

Explore automation tools

Copy Trading and PAMM are examples of automation tools that can help you execute trades without your physical presence. Choosing a broker who provides automation tools is always a good idea.

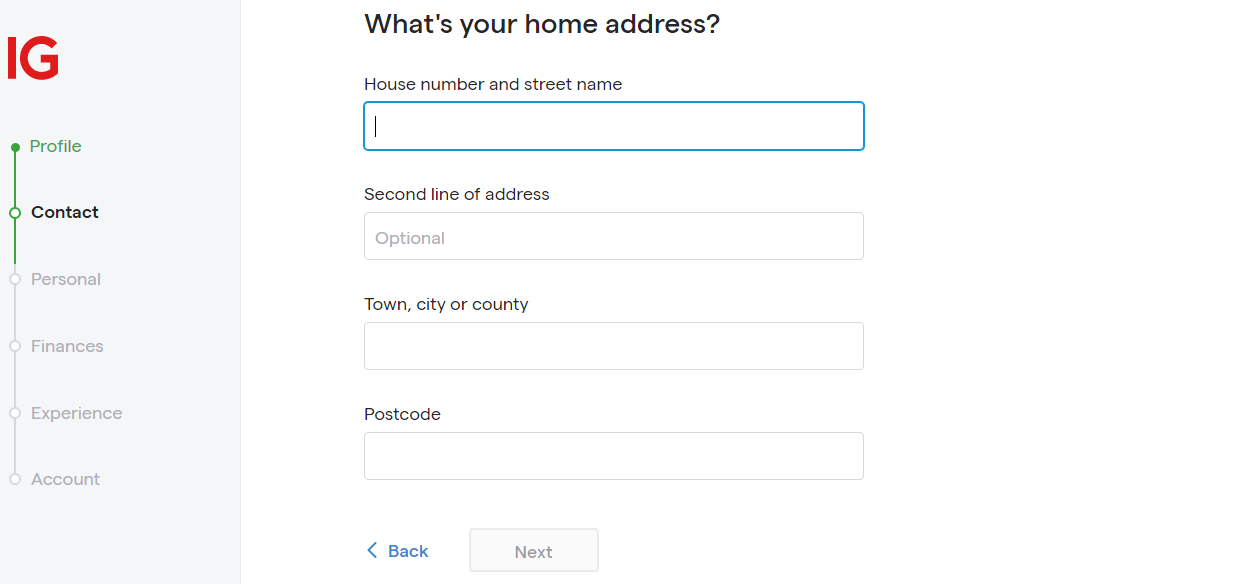

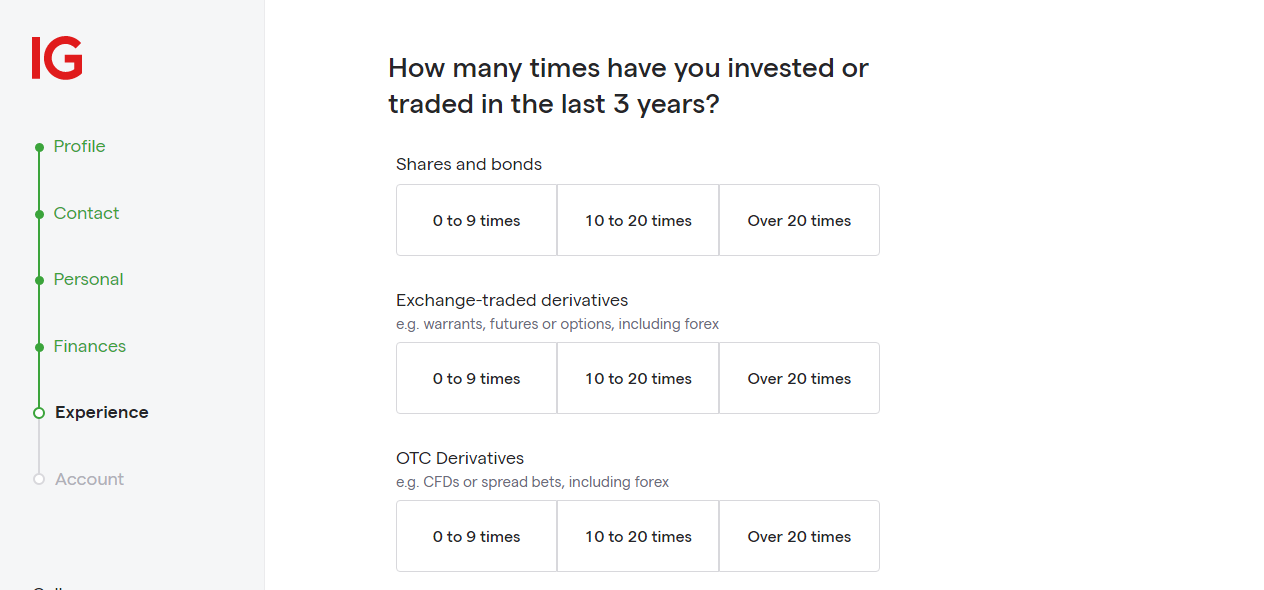

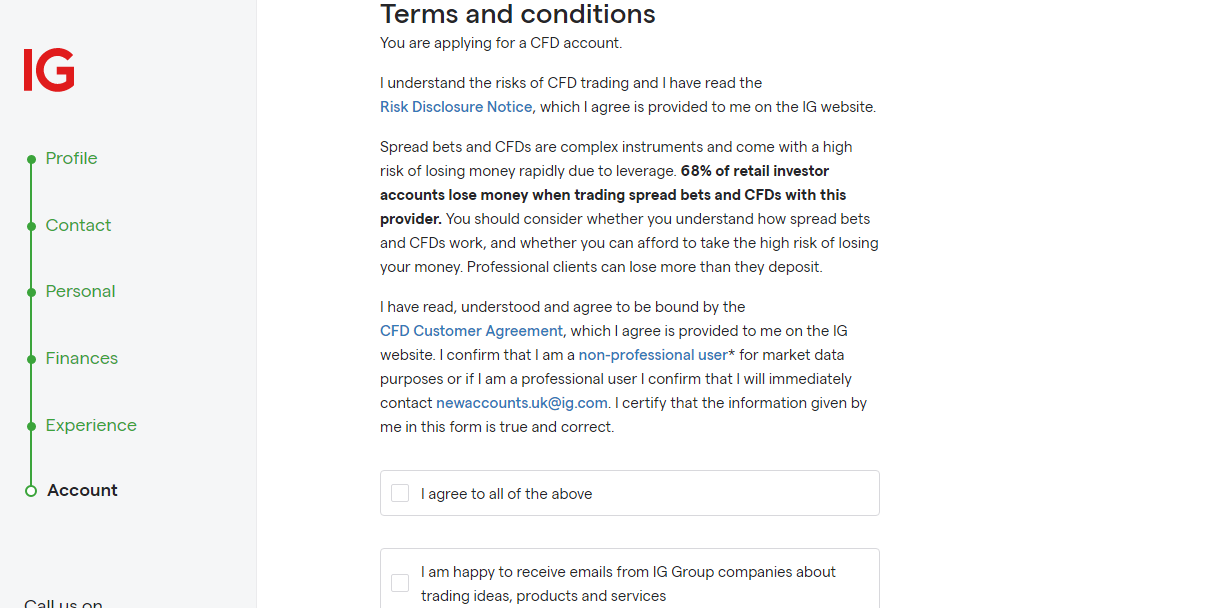

How to trade CFDs with IG Markets: a real-life example

IG is one of the best CFD brokers because it uses a proprietary platform designed to offer the best trading experience for CFD trading. Here is how to open an IG CFD trading account:

Go to the IG.com website

In the beginning, all you have to do is go to the IG.com website and click on the “Create live account” button to begin your application.

IG

IG Registration

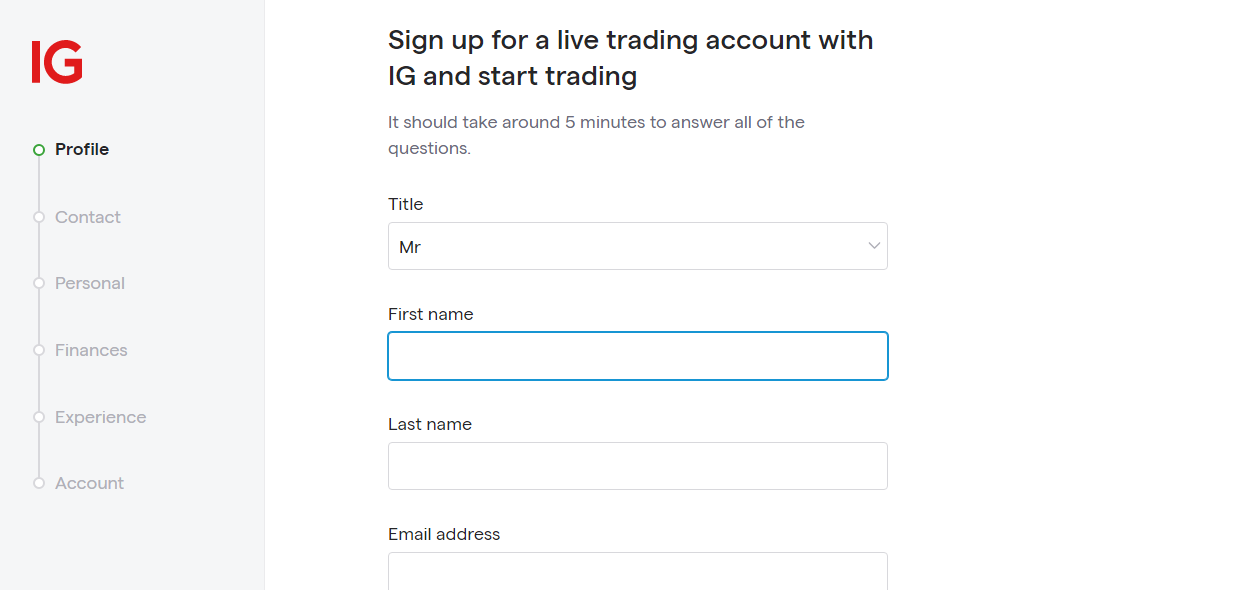

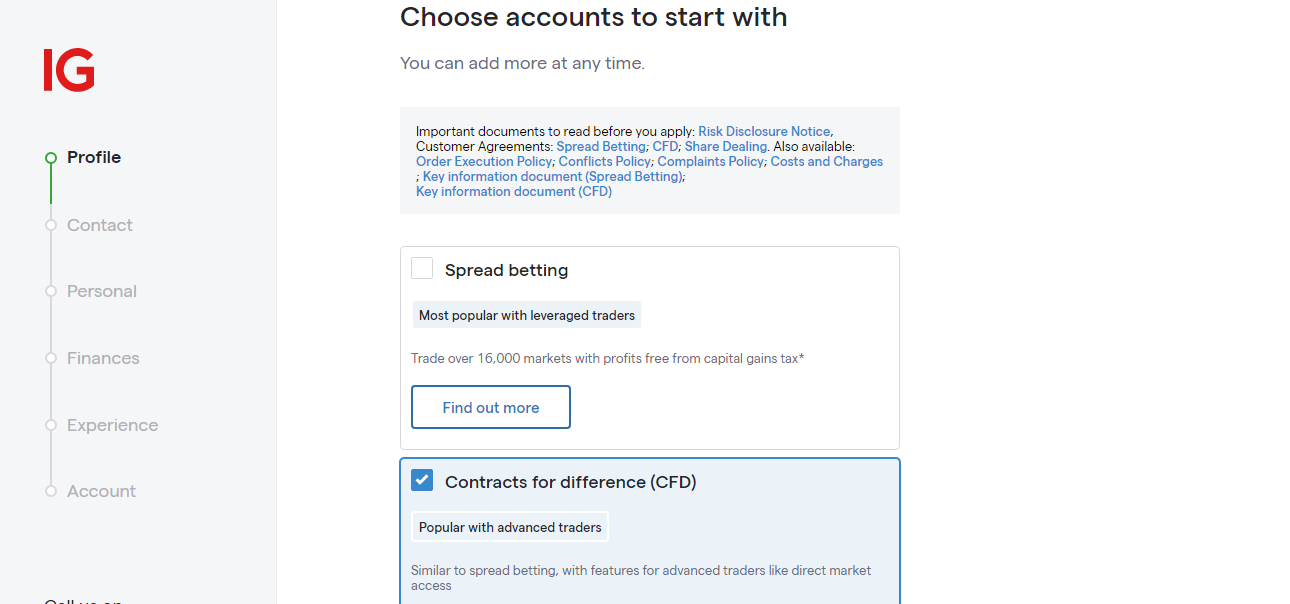

Select “Contracts for difference (CFD)” account

At the beginning of your application, you have to select what type of trading account you want to create. In this case, you will select “Contracts for difference.”

IG Registration

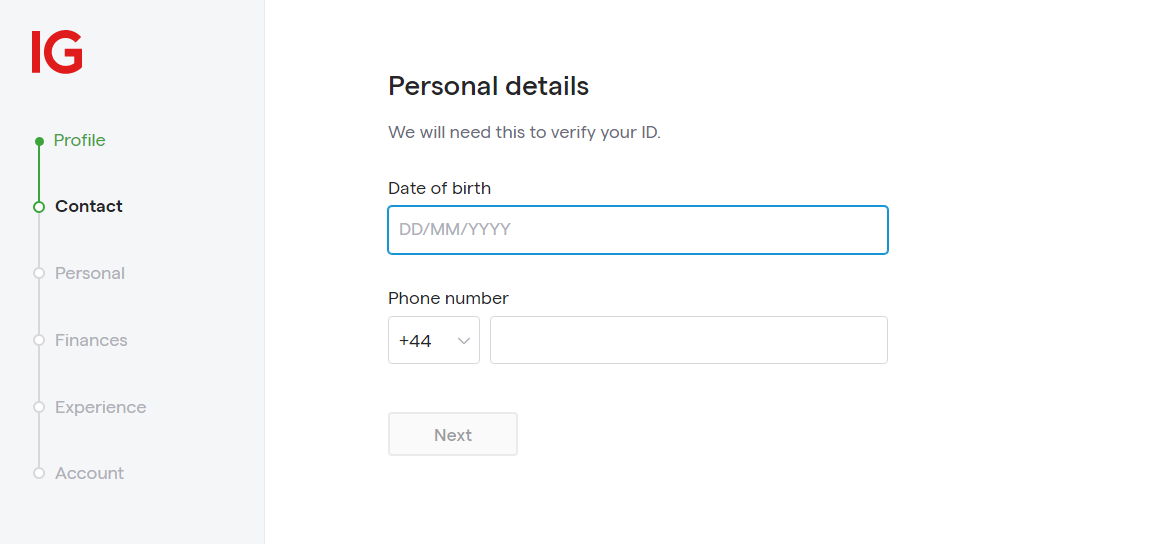

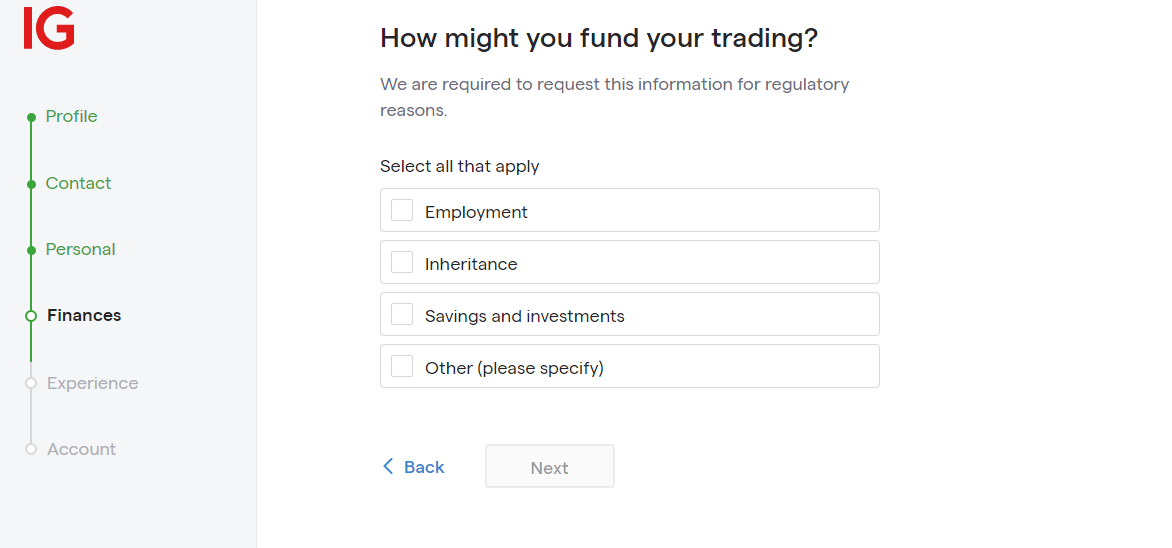

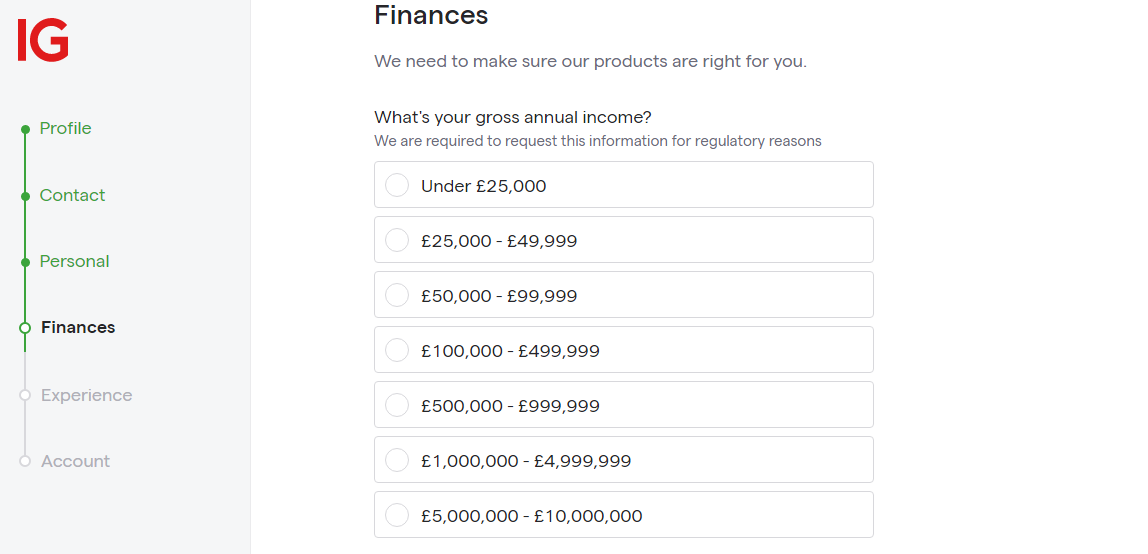

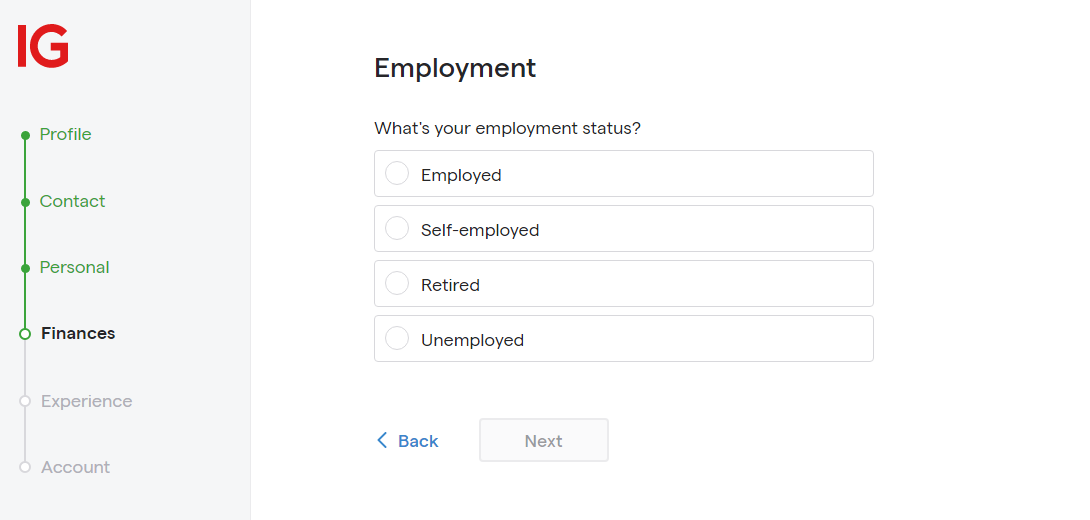

Complete your application

Now, you have to complete your application by answering a few questions about your address details, financial details, employment details, and how much trading experience you have. To finish your application, you have to upload pictures of your documents to verify your identity.

IG Registration

IG Registration

IG Registration

IG Registration

IG Registration

IG Registration

IG Registration

IG Registration

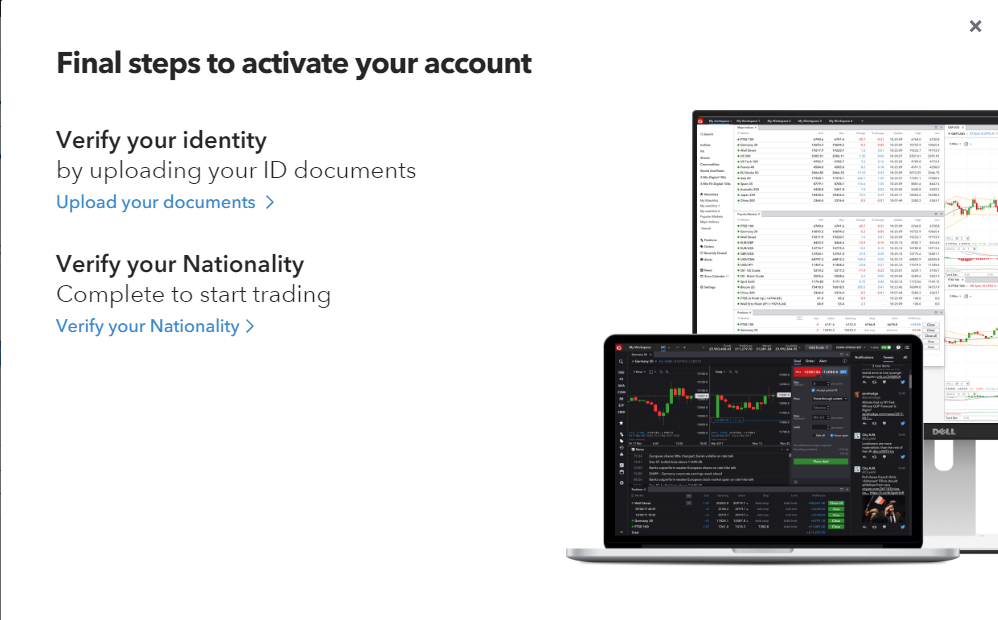

Verify your account

IG Verification

Deposit money on your new IG account and start trading

Now that you created your IG account, you can deposit money into your account balance and place CFD trades.

Depositing money

Depositing money

How to trade CFDs with IG Markets: a real-life example

Are you interested in trading CFDs but unsure where to start? This guide will provide you with a step-by-step approach to help you begin trading CFDs in the UK.

Understand What CFD Trading Is

CFD trading allows traders to speculate on price movements of a wide range of financial assets such as forex, commodities, indices, and individual stocks. CFDs are based on margin and leverage, meaning traders only need to invest a small percentage of the total trade value to gain market exposure. However, please note that CFDs come with risks, and it's important to have a sound trading strategy in place before you start trading.

Choose a Broker

The first step to trading CFDs is finding a reputable broker. Look for a broker regulated by the Financial Conduct Authority (FCA) in the UK to ensure they adhere to the strictest customer protection standards.

Check whether the broker offers a demo account that allows you to practice trading with virtual funds before going live. Moreover, research thoroughly about the fees, spreads, and the quality of customer service, as these factors can affect your trading experience.

Fund Your Account

After selecting a broker, you need to fund your account. Most brokers offer a range of payment methods, such as credit cards, bank transfers, and e-wallets. Ensure you understand the minimum deposit, withdrawal processes, fees, and other terms to avoid any surprises.

Start Trading

As a beginner, start small and focus on one or two markets to gain expertise. Remember that CFDs are traded on margin, and leverage enables you to magnify gains and losses. Keep your risk management in check by setting stop-loss and take-profit orders to minimize losses.

Learn and Develop Your Strategy

CFD trading is a constantly evolving and learning process. You should constantly seek to learn new trading strategies and tools to refine your trading approach. Some websites offer educational resources, such as trading videos and tutorials to help you improve your trading skills.

Is CFD Trading Legit in the UK?

Yes, CFD trading is legit in the UK. The UK's financial regulator, the Financial Conduct Authority (FCA), regulates and oversees CFD brokers in the UK.

The FCA requires CFD providers to follow strict guidelines to protect investors from negative balance, the risks associated with leverage, and unmanageable losses.

The regulator has implemented a series of measures to prevent retail clients from taking on too much risk when trading, such as introducing margin restrictions, leverage limits on CFD trades, and negative balance protection.

The FCA also requires CFD brokers to disclose the risks associated with CFD trading to their clients in a comprehensive and easy-to-understand manner. CFD providers must also adhere to strict rules on the marketing and promotion of CFD trading to the general public.

CFD Trading in the UK – Is it Taxable? Is it Safe?CFD Trading Restrictions

One of the primary restrictions on CFD trading is leverage limits. In Europe, the maximum allowed leverage for retail traders is 30:1 for major currency pairs, while other assets have lower leverage limits. These leverage limits are designed to reduce the risk of large losses.

Another restriction is the ban on bonuses and promotions. The European Securities and Markets Authority (ESMA) prohibits CFD providers from offering signup bonuses, rebates, or any other incentives to encourage traders to open or continue trading with them. This is to prevent traders from taking on excessive risks to obtain bonuses.

Some regulators have taken a more strict approach to CFD trading and have imposed bans on certain types of CFDs. For instance, in the UK, the FCA has prohibited the sale of cryptocurrency-based CFDs to retail consumers.

Can I Trade With Non-FCA Regulated Brokers?

Technically, you can trade with non-FCA-regulated brokers in the UK. In the UK, you can also trade with brokers that are regulated in one of the EU countries.

However, brokers that are not regulated by the FCA may not adhere to the same strict regulatory standards as FCA-regulated brokers. FCA-regulated brokers are required to follow strict rules, such as keeping client funds in segregated accounts, offering negative balance protection, and participating in the Financial Services Compensation Scheme (FSCS).

Is CFD Trading Taxable?

Yes, CFD trading is taxable in the UK. If you are a UK resident and earn profits through CFD trading, you are required to pay capital gains tax (CGT) on any gains made above the annual CGT allowance, which is currently £12,300 for the tax year 2021/22. If your total capital gains amount to £50,270 or below, you will be charged a 10% tax.

Keep a record of all your trades, profits, and losses for tax purposes. You can offset any losses against your gains and deduct the cost of trading, such as broker fees and spreads, from your taxable profits. You may also be eligible for certain tax deductions, such as contributions to a personal pension or Individual Savings Account (ISA).

Is CFD Trading Good for Beginners?

CFD trading can offer certain advantages for beginners, although it's important to keep in mind that it also comes with risks. Here are some pros and cons to consider when trading CFDs as a beginner:

👍 Pros

•Low entry barrier: Many brokers offer demo accounts with virtual funds, making it easy for beginners to try their hand at CFD trading without risking their own money.

•Easy to access: CFD trading can be done from anywhere with an internet connection.

•Potential for passive income: CFD trading allows for overnight positions, which can result in passive income for traders.

•Flexible trading options: Traders can choose from a wide range of underlying assets, including stocks, indices, and commodities.

•Ability to profit from market volatility: CFD trading allows traders to profit from both rising and falling markets.

👎 Cons

•Risks of high leverage: CFD trading involves high leverage, which can amplify profits but also losses. This can be particularly risky for beginners.

•Most beginners lose: The majority of beginner CFD traders lose money, so it is important to tread carefully and do your research.

Our Methodology

The TU experts have researched the market to select the best FCA-regulated CFD brokers to create this rating.

Some aspects we paid special attention to while including those CFD brokers in this rating were the CFD trading fees they charge, favourable trading conditions, positive reviews from previous users, certain features of the platforms, the types of CFDs supported, how easy to use they are, educational materials and demo account for beginners. Then, we ranked them based on their overall features.

Summary

CFD trading can be a very exciting activity for many traders who can accurately predict price fluctuations of different assets. Trading with a great CFD broker ensures you will have higher chances of making profits, and your funds are not in danger when trading with that broker. So, you should carefully study each CFD broker before choosing one.

FAQs

Can UK citizens trade CFDs on cryptocurrencies?

CFDs on cryptocurrencies are considered too risky by the FCA, and they were banned in the UK.

Are CFDs considered risky?

Yes, CFDs are considered to be one of the riskiest types of investment because 60-80% of traders lose money when trading CFDs.

Should novice traders copy more experienced CFD traders?

Because beginner traders are most likely to lose money when trading CFDs themselves, copying a more experienced trader decreases this risk. However, you should be very careful when choosing which trader to copy.

Are CFDs tax-free in the UK?

No, CFDs are not tax-free in the UK. CFD traders have to pay capital gains tax (CGT) in the UK.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.