CFD Trading in South Africa - A Full Beginner's Guide

CFD trading provides a money-making opportunity for traders in South Africa. However, many traders, especially beginners, wonder ‘ is CFD trading legal in South Africa?’ If you are one of them, this article is for you. Also, we have prepared a guide to help novice traders from South Africa understand all the critical concepts and the best platforms for CFD trading South Africa in 2023.

Start CFD trading right now with AvaTrade!Glossary

-

CFD (Contract For Difference) is an agreement between two parties – the buyer and the seller – on the transfer of difference between the current asset value at the moment of conclusion of the contract (opening position) and its value at the time of the contract expiry (closing position).

-

Spread is the difference between the best buy price and the best sell price in currency exchange and CFD trading.

-

Leverage means borrowed funds provided by the broker, which allow traders to manage substantial amounts in the market, while having only a small amount of own capital used to cover the margin requirements.

What is CFD Trading?

CFD means 'contract for difference', a trading instrument that allows traders or investors to profit from price movements of financial assets without actually owning them. CFDs are traded like stocks, but while trading stocks depend on changes in the value of an asset, trading CFDs rely on the price difference (spreads) between the trade's entry and exit points. The contract, usually short-term, engages the trader or investor (buyer) with a broker (seller) and stipulates that the trader or investor will pay the difference between the asset's current value and its initial value at the time of the contract. Learn more about CFD trading and how it works.

CFDs: Pros and Cons

CFD trading has many benefits making it an exciting investment opportunity, especially for day traders. With access to a wide range of markets, high leverage, and the ability to hold short positions for faster profits, CFD trading is becoming more popular among South African traders. However, you need to understand that it involves a high measure of risk. Beginner traders should be aware of the pros and cons of trading CFDs before venturing into them.

👍 Pros

• High leverage means you only require a small margin to open a position.

• Profits are not dependent on market trends as you can earn even in a crashing market.

• Trade a wide range of markets, including commodities, shares, Forex, and crypto.

• CFD trading can be a helpful way to hedge your investment.

• Reduced investment conditions as compared to standard exchanges.

👎 Cons

• Market volatility can lead to gapping, increasing the possibility of substantial losses.

• Leveraged products, though highly profitable, can lead to a complete loss of your investment.

• Brokers determine margin requirements and trading conditions.

Is CFD Trading Legal in South Africa?

The confusion surrounding the legality of CFD and Forex trading in South Africa may be linked to conflicting reports from different sources. While some point to strict regulatory policies, others claim that there are no well-defined laws on CFDs in the country.

Nevertheless, most companies that offer Forex trading services to South Africans are regulated by top-tier bodies like the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and Australian Securities & Investments Commission (ASIC)- a proof of reliability.

The Financial Sector Conduct Authority (FSCA), which replaced the Financial Services Board (FSB) in April 2018, is mandated to oversee all financial activities in South Africa. These activities include Forex and CFD trading and licensing of firms operating in the country that provide such services to South Africans. Hence, traders can rest assured that not only is it lawful to engage in CFDs trading but that they are doing so under a regulated system in South Africa.

How Much Money Do I Need For CFD Trading?

In general, the minimum start-up amount for most brokers is $10 (approx.153 ZAR). However, that would mean connecting too high a margin to earn anything reasonable when trading with such an amount. As a beginner, you would be starting on the wrong foot. So, avoid using too low amounts and large margins.

On the other hand, it is not advisable to invest too much capital, given the risks involved and your lack of experience with this type of instrument. We recommend starting with between $500 - $1000. In doing so, you place yourself in a healthy position where you can recover from occasional losses, keeping your investment afloat.

South African CFD Brokers Minimum Deposit - Comparison

| Exness | AvaTrade | Tickmill | |

|---|---|---|---|

Minimum Deposit |

$10 |

$100 |

$100 |

How to Trade CFDs in South Africa? A Step by Step Guide

Every trader has the ultimate goal of succeeding out of the financial markets. Trading CFDs can be lucrative only if you know the right way to go about it. Before you begin trading CFDs, what steps do you need to take to increase your success rates? Consider these 7 steps below:

Step 1. Choose an FSCA-regulated CFD broker

Many brokers offer CFD trading services to South Africans, but you should pay attention to the broker’s details, including commissions and the potential to earn passive income. Any broker you choose should be FSCA regulated to ensure your investment is safe. As an added layer of reliability, such a broker should also be licensed by some top-tier financial regulators worldwide.

Step 2. Learn, learn, learn

As a newbie, trading CFDs can be a daunting task. Many beginner traders lack the patience to understand the concepts of CFDs and begin live trading with their capital. Sadly, many have incurred catastrophic losses in the process. No beginner wants to lose money at the beginning. So, the only way to achieve success is never to stop learning. Explore new strategies and test earning options. Gather every information you will need to make the right decisions.

Step 3. Think about your trading strategy

Build a trading plan. Your success as a trader depends on your trading strategy, which will depend on the amount of time invested in formulating one and your wealth of knowledge. Researching your strategy is the best thing you could do to increase your chances of success.

For beginners, it is better to use low-activity trend strategies that do not involve enormous leverage and many trades. The best trading strategy is one that employs adequate risk management! It’s vital to learn margin trading rules to avoid significant losses.

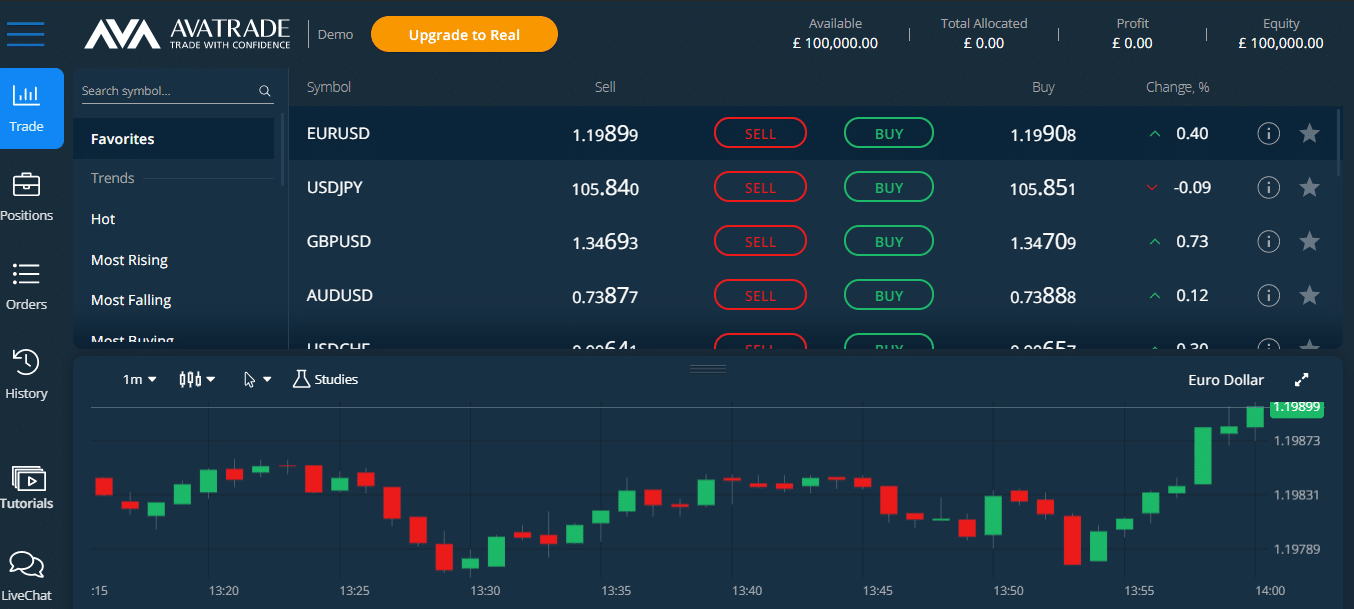

Step 4. Try demo

The best way to begin trading CFDs is to use demo accounts. CFDs are complex investment products that carry a high risk. Demo accounts allow you to test different strategies without any cash involvement. As you become more proficient with trading, transitioning to live trading becomes more manageable. Demo trading also gives you an idea of how the platform works to know if it matches your preferences.

Step 5. Explore passive income options

Becoming a master at trading CFDs takes much time. For many newbies, working on a strategy that will be profitable can be a challenge because the market is dynamic. As you hone your trading skills, look for other ways to earn money from the markets in the meantime.

An excellent way to earn passive income is through social trading or copy trading. Copy-trading allows you to mimic trades of the pros in real-time, make money with them and learn from their experience. Another good option would be managed accounts- MAM and PAMM Accounts. Professional fund managers can earn you profits on your investments, allowing you to focus on building your trading skills.

Step 6. Open and fund a live trading account

Once you are ready to begin real-time CFDs trading, open a live trading account with a suitable broker. You can do so using a bank card or direct wire transfer. With so many instruments to choose from, you will need a broker that offers enough tools and education to assist you in identifying the right deal. Since there are so many brokers out there, we have selected 3 of the best platforms for beginners. You can check them out below.

Step 7. Start a live trading session

Once you have selected your preferred market, it's time to place a deal. Here are the basics of how to go about it:

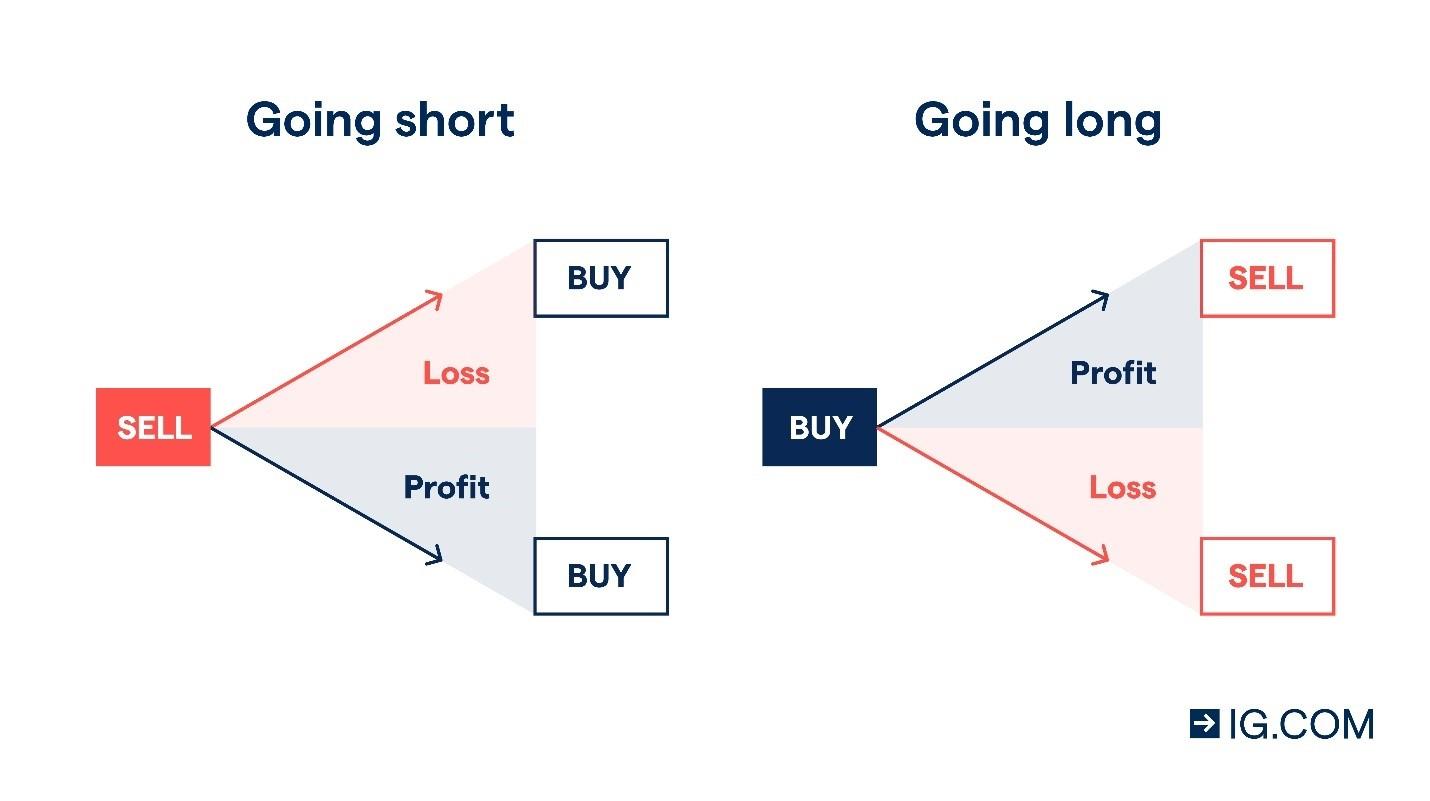

Decide if you want to "go long" or "go short." When you go long (open a buy position), it means you expect the price of your chosen asset to rise. You go short if you think it will fall (open a sell position).

Long and short position

Determine your entry and exit points and open a position.

Monitor your trade. You can open new positions depending on your strategy.

Close the trades. Profits or losses are thus credited or debited to your margin account.

Best CFD Trading Platforms in South Africa 2024

Many beginners find it hard to know what platforms can provide the best trading experience as there are so many of them available today. With that in mind, we reviewed brokers' platforms available to South Africans, focusing on critical criteria that would be helpful to beginner traders. These criteria included FSCA regulation, minimum deposit, usability, educational materials, and CFD trading fees. We also considered platforms that provided opportunities to earn passive income, like copy trading and managed accounts. As a result, we came up with 3 of the best brokers for CFD trading South Africa that we recommend:

Exness

Exness was established in 2008 and has become one of the best platforms, especially for beginners. It holds licences to operate in various countries, including the UK, Cyprus, and South Africa. Exness accepts South African traders and offers ZAR base accounts. Beginners will find the platform's interface easy to navigate as the broker has prioritised making its platform user-friendly for all its clients.

Exness Forex – Is it a Scam or a Safe Broker?Trading on the Exness platform is safe because, apart from being regulated by top-tier regulators, the broker protects clients' funds using the segregated account system. They also ensure investors' capital using a compensation scheme that repays clients in the case of insolvency.

Features of Exness include:

-

Minimum deposit of 10$

-

Narrow spreads

-

Multiple trading platforms

-

Demo account

-

Cent account suitable for beginner traders

-

Efficient customer service

-

Dedicated education platform for beginners

Avatrade

Avatrade, established in 2006, has its headquarters in Dublin, Ireland. Avatrade is a safe broker to use, licensed by 3 tier-1 and three tier-2 regulators across five continents. This broker offers access to more than 250 instruments, including stocks, securities, crypto, and currency pairs. The platform also offers over 1200 CFDs with competitive spreads.

Avatrade is attractive to beginner traders as it provides options for automated trading, technical analysis tools, and adequate educational materials. The Duplitrade platform offers beginners an opportunity to earn passive income. Using this tool, they can copy trades of experienced traders to make money and learn from them.

AvaTrade

Other features of Avatrade include:

-

A minimum deposit of $100.

-

Segregated account for customers' fund storage.

-

Tight spreads.

-

Zero commission on CFD trading.

-

Negative balance protection.

Tickmill

Tickmill is an internationally known CFD and Forex broker founded in 2014. This low-cost broker is accredited by several financial regulators, including the FCA, CySEC, and FSCA. It offers seamless account opening and charges no fees on deposits and withdrawals.

Tickmill works best for investors and traders interested in trading CFDs and is familiar with the MT4 platform. The broker provides hassle-free deposit options, including bank transfers, electronic wallets, and bank cards. Traders can choose from 85 CFD options comprising currency pairs, bonds, metals, and cryptocurrencies on this platform.

If you are looking for a platform that offers alternatives to earn passive income, you should try Tickmill. The broker provides PAMM accounts to investors. The PAMM account arrangement allows professional fund managers to trade on your behalf, making profits.

Other features include:

-

Low minimum deposits starting from $100.

-

Electronic deposit options include Neteller, Skrill, and Webmoney.

-

Demo account for beginners.

-

Customizable workspace

Do I Pay CFD Trading Taxes in South Africa?

In South Africa, gross income is taxable under the Income Tax Act. And since gross income includes profits from CFD trading, the South African Revenue Service (SARS) requires traders to pay personal income tax on earnings. The amount payable as a tax depends on the income tax threshold. However, traders can deduct expenses from their gross income before declaring them.

Also, the SARS does not require investors or traders to pay stamp duty on derivatives, including CFDs. It means that when you trade CFDs, you are exempted from paying certain taxes that you would have incurred while trading other securities. It's best to contact a qualified tax advisor to guide you.

Rules and Regulation

Forex regulation in South Africa

The Financial Sector Conduct Authority (FSCA) oversees financial institutions, including Forex brokers, in South Africa. However, the FSCA does not issue licenses to Forex brokers. Forex trading at the federal level is not directly supervised in South Africa.

Investor protection in South Africa

At the governmental level, South Africa regulates the Forex market to some extent, but investors may not receive direct protection from the government. However, investor safeguarding can be sought through international organizations to which Forex brokers may belong.

Taxation in South Africa

In South Africa, traders are subject to income tax on Forex gains, typically at a rate ranging from 18% to 45%. Value Added Tax (VAT) may also be applicable to professional traders.

How Much Can I Earn?

There are no limits to how much you can earn trading CFDs. It all depends on the decisions you make while trading. The opportunity to make huge profits with only a fraction of the cost attracts many traders to CFDs. But such high margin trading exposes you to higher risk. On average, about 60-80% of traders incur losses due to higher leverage associated with CFD trading. Before starting CFD trading, get adequate training to understand key concepts and pitfalls. Try using demo accounts to test and improve your skills without fear of losing money.

FAQs

Can CFD trading make me rich?

CFD trading can make you a lot of money, but it can harm your finances too. Employing adequate risk management and educating yourself on how it all works can help you maximise your earnings.

Is CFD trading in South Africa safe?

Trading CFDs in South Africa does not shield you from risks. Although it is possible to trade using small margins and high leverage, you can lose all your capital.

What is the best CFD trading platform South Africa?

The best platform is reliable, easy to use, and has adequate educational tools to assist beginner traders. The platforms we recommend on our site meet these requirements.

What is the minimum amount for me to start trading CFDs?

With just $10, you can begin trading on most platforms. But to increase your chances of success while trading CFDs, it is advisable to start with at least $500.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).