Best Time to Trade Forex in South Africa

Best time to trade Forex in South Africa - from 8.00 to 14.00 and from 20.00 to 02.00 South African time. During this period, the market has high liquidity, tight spreads and less chance of slippage.

For South African Forex traders navigating changing market conditions, selecting optimal trading times requires careful strategy. While the 24-hour currency market is always active, liquidity, volatility and opportunities vary significantly across sessions. By understanding these global rhythms and how they intersect with local time zones, savvy Johannesburg-based traders can gain an edge.

Through rigorous research analyzing thousands of real trader accounts, our analysts have identified surprising patterns about the highest probability days and hours for success. To cut through speculation, we surveyed experts across experience levels about their most profitable trading windows. The results offer practical insights that differentiate weekday folklore from empirical evidence.

In the following report, we integrate these findings with disciplinary context on inter-session dynamics.

Do you want to start trading Forex? Open an account on Exness!Key points from the article

-

Research showed that Wednesdays are generally the most profitable day to trade, followed by Thursdays.

-

The best times on Wednesdays were found to be between 6am-12pm GMT and 6pm-12am GMT.

-

For long-term strategies, Wednesdays and Mondays work best. For short-term, Wednesdays and Thursdays are most successful.

-

Recommended Forex pairs to trade include EUR/USD, GBP/USD, and USD-based pairs since trading times fall in London and New York sessions.

-

Exness, XM, and IC Markets are highlighted as some of the top brokers for South African Forex traders.

Classical Forex Trading Sessions

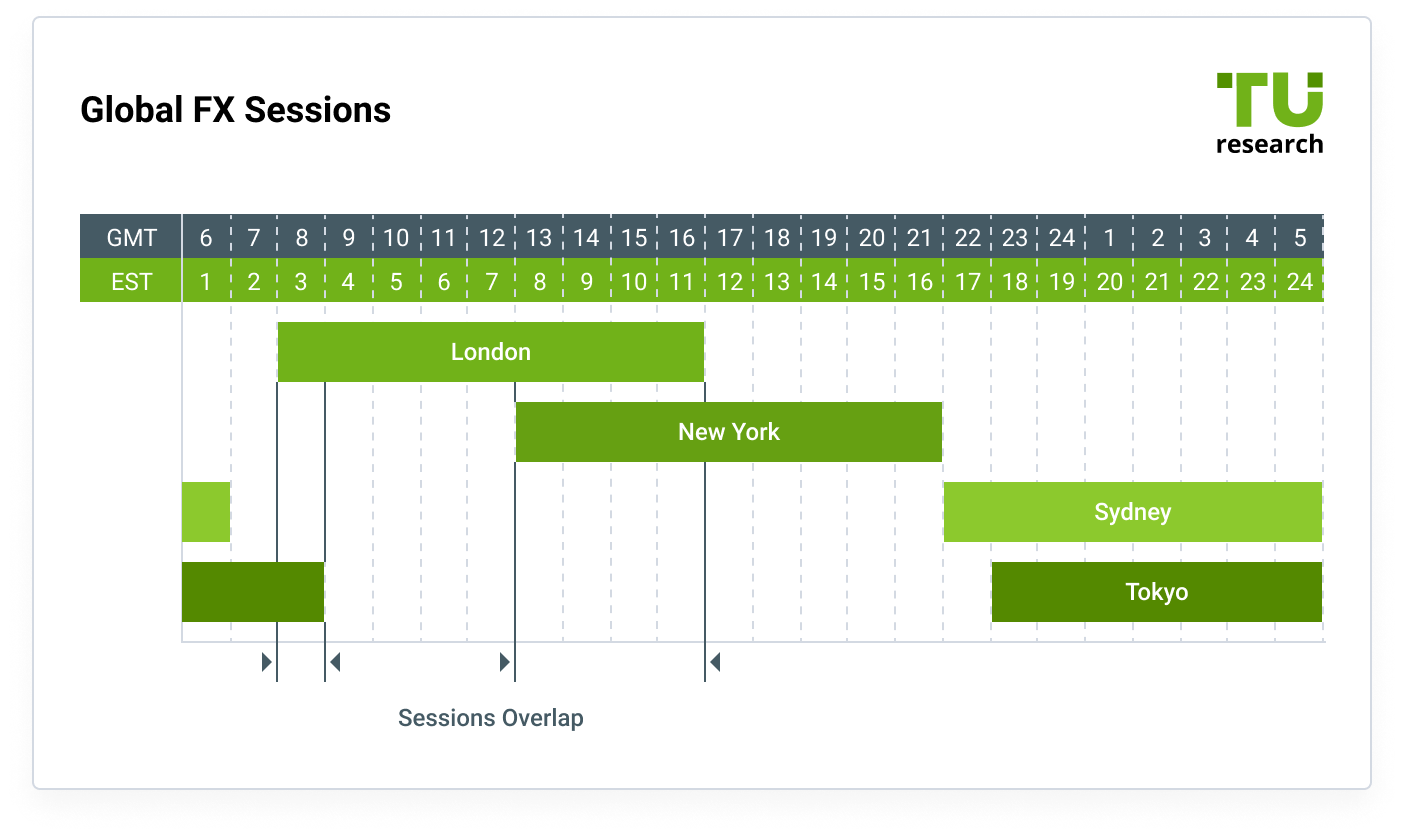

Before looking at when the best times are to trade forex in South Africa, it’s important to first understand when the global forex sessions are around the world. There are basically four main trading sessions around the world that account for over 65% of the volume of the global forex market and most of the overall liquidity.

Global FX Sessions

These four trading sessions are:

-

Sydney (Pacific region). Trading in Sydney starts at 10 pm GMT (5 pm EST) and stops at 7 am GMT (2 am EST). During this session, the most actively traded currency pairs are NZD/USD, AUD/USD, and other NZD and AUD-based currency pairs.

-

Tokyo (Asian region). Trading in Tokyo starts at 11 pm GMT (6 pm EST) to 9 am GMT (4 am EST). During this session, the most actively traded currency pairs include Japanese Yen-based currency pairs including USD/JPY, EUR/JPY, GBP/JPY, and others.

-

London (European region). Trading in London starts at 8 am GMT (3 am EST) and stops at 7 pm GMT (12 pm EST). During this session, the most actively traded currency pairs are euro and pound sterling-based currency pairs including EUR/USD, GBP/USD, EUR/GBP, USD/CHF, and other currency pairs within the European region.

-

New York (American region). Trading in New York starts at 1 pm GMT (8 am EST) and closes at 10 pm GMT (5 pm EST). The most actively traded currency pairs during this session are US dollar-based pairs including EUR/USD, USD/JPY, GBP/USD, and others.

During these four sessions, there are also several overlaps during which the volume and liquidity increase and, as such, have an impact on trading. The first is between 11 pm GMT (6 pm EST) and 7 am GMT (1 am EST) when there’s an overlap between Sydney and Tokyo. During this overlap, the maximum volume is traded with the currency pairs of these regions.

Best Currency Pairs To Trade Forex - TU ResearchBetween 8 am GMT (3 am EST) and 9 am GMT (4 am EST) there’s another overlap when the sessions in Tokyo and London overlap. During this overlap, the most actively traded currency pairs are the pairs of Europe and Japan.

Finally, there’s an overlap between the sessions in London and New York between 1 pm GMT (8 am EST) and 5 pm GMT (12 pm EST) during which the most actively traded currency pairs are EUR/USD and GBP/USD.

During these overlaps, trading volumes increase significantly, in other words, there’s substantial liquidity in the market.

Time Zones in South Africa

The first step in determining what the best times are for trading forex in South Africa is determining the relevant time zones in the region. The entire country falls within a single time zone that is 7 hours ahead of Eastern Standard Time and 2 hours ahead of Greenwich Mean Time (GMT).

Here, it’s also important to note that South Africa doesn’t utilize daylight savings time. This means that during South Africa’s summer months, its time is 6 hours ahead of EST and 1 hour ahead of GMT.

What is the Best Time to Trade Forex in South Africa?

Now that we’ve looked at the main global forex sessions around the world and the relevant time zones in South Africa, it’s time to consider when the best time for trading forex in South Africa is.

Best time to Trade Forex - TU Research

The first step to determine the best time to trade forex in South Africa is to determine when the best times are to trade overall. Traders always believed that the times with the most liquidity and volatility in the market were the best times to trade forex. Generally, these times fall on Thursdays and Fridays and, as a result, many traders believed that these days were the best days to trade forex.

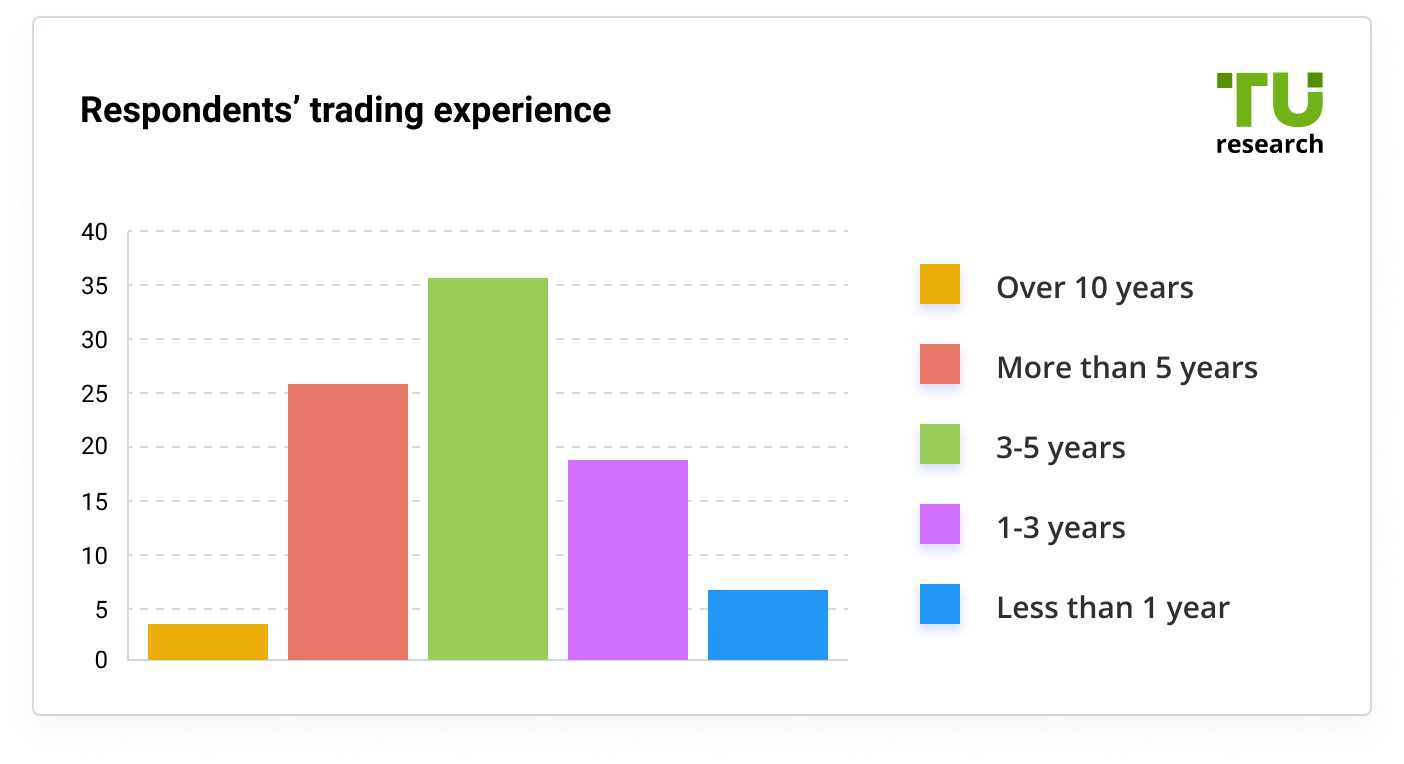

However, at Traders Union, our experts have conducted research and can now disprove this myth. During this research, our experts interviewed 2,080 traders of whom 81% were men and 19% were women.

In the cohort, 4% of the traders have been trading forex for over 10 years, 28% have been trading for more than 5 years, 38% have been trading between 3 and 5 years, 21% have been trading between 1 and 3 years, and 9% have been trading for less than a year.

Respondents trading experience

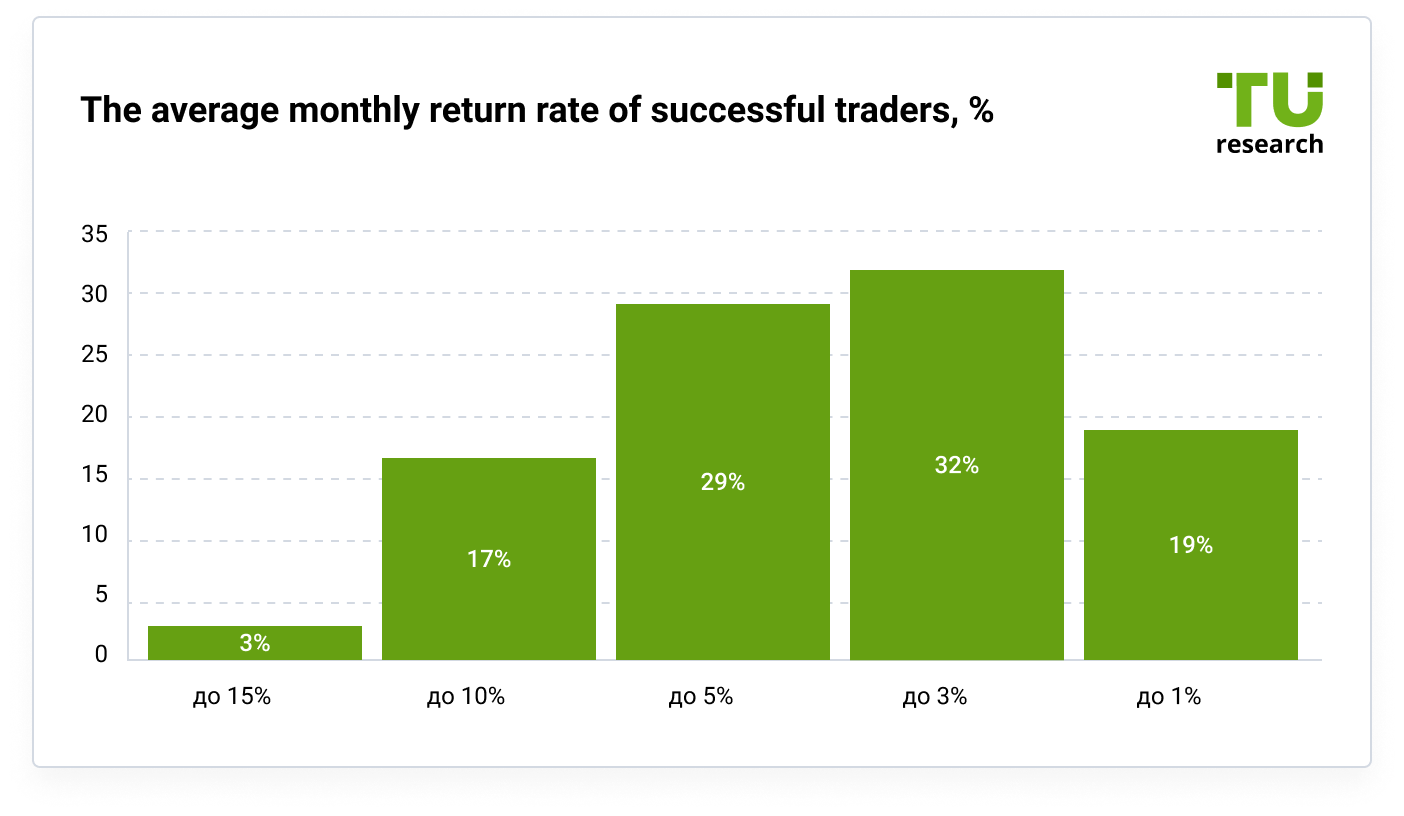

In respect of returns, 3% of the cohort showed an average monthly return of up to 15%, 17% showed monthly returns of up to 10%, 29% showed monthly returns of up to 5%, 32% showed monthly returns of up to 3%, and 19% showed monthly returns of up to 1%. To achieve these returns, 44% of the traders used intraday strategies while 44% used long-term strategies.

The average mountly return rate of successful traders, %

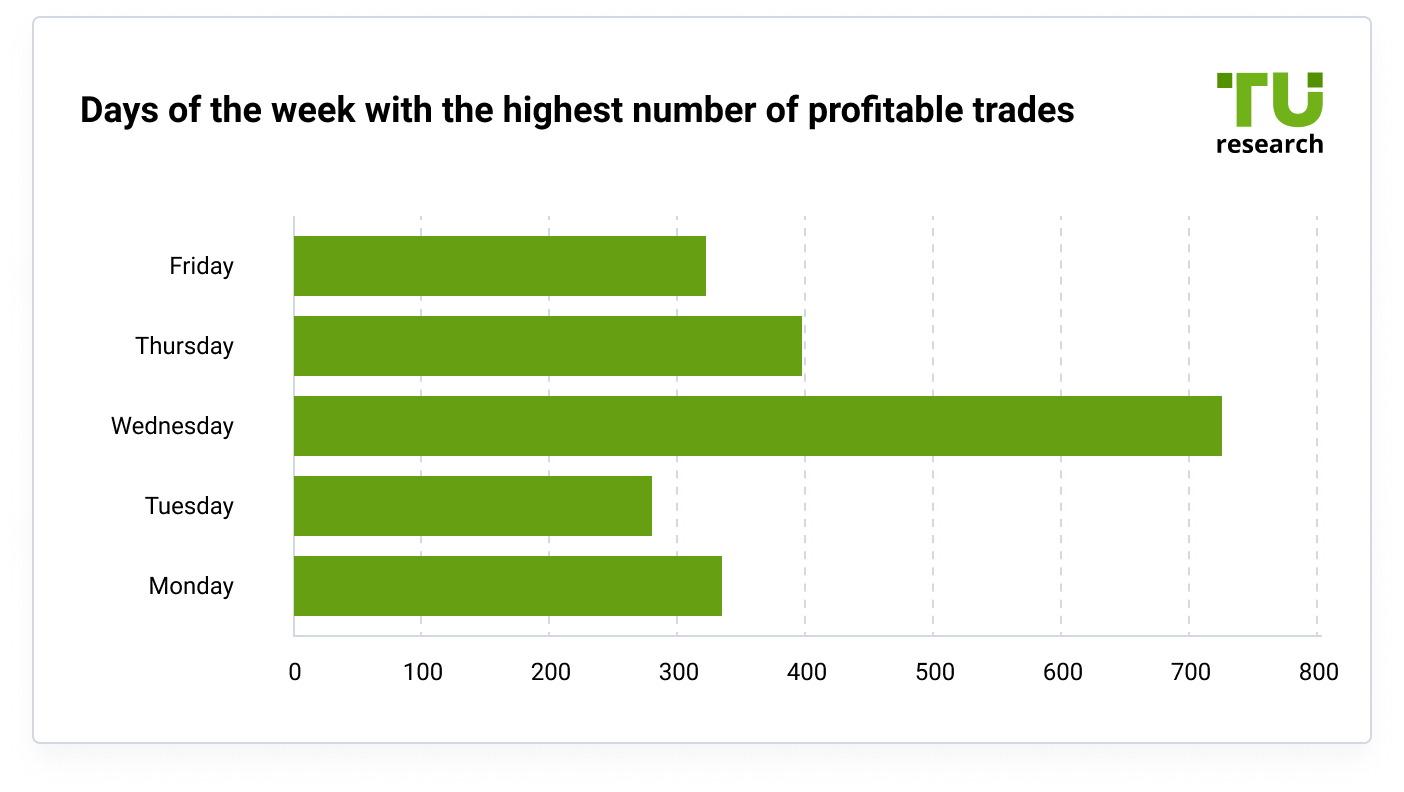

Now, based on the above research and the responses from the traders, what is the best time to trade forex? Interestingly, an overwhelming majority of traders stated that their most profitable day of the week to trade forex was Wednesday.

days of the week with the highest number of profitable trades

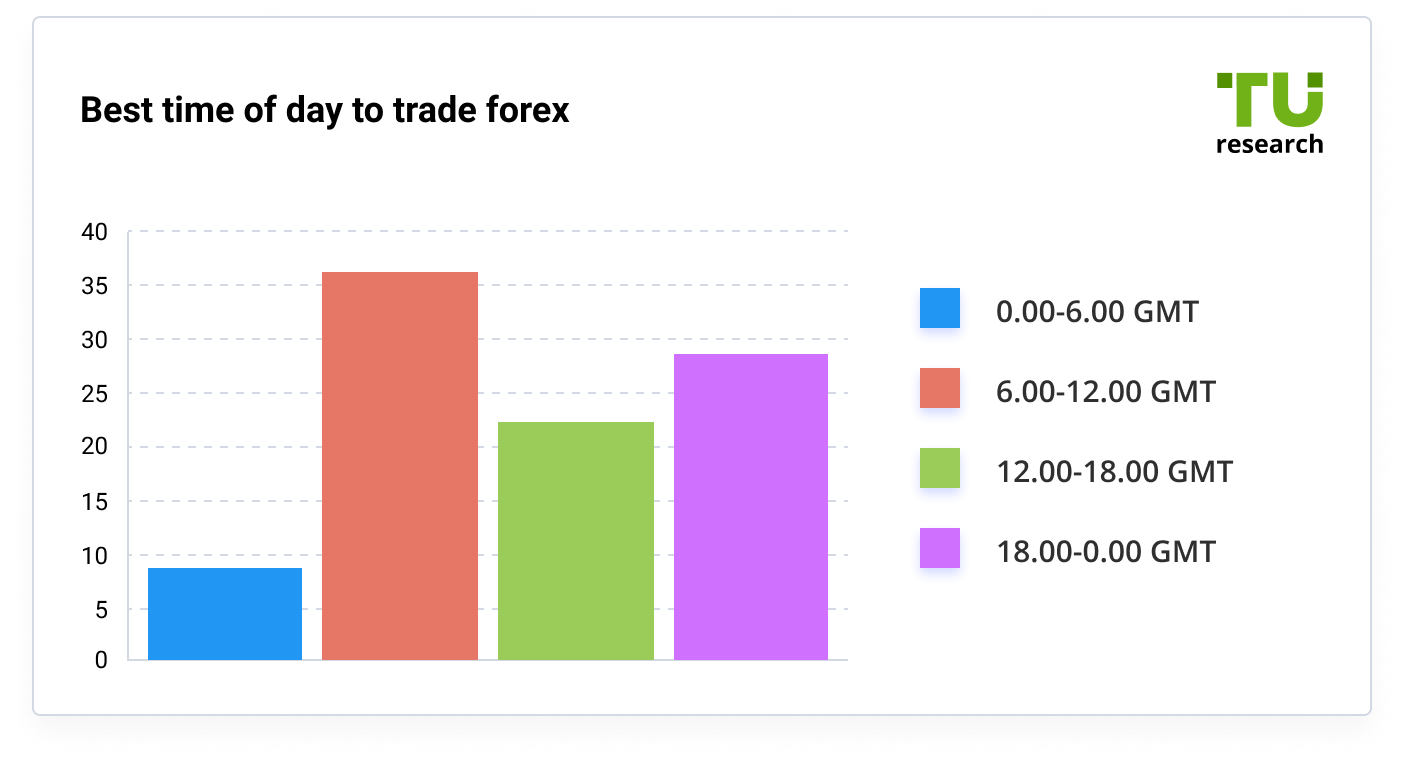

In respect of the best time to trade forex, the majority (38%) of the traders stated that the best time to trade was between 6 am GMT (1 am EST) and 12 pm GMT (7 am EST). In turn, 31% of the traders stated that the best time for them to trade was between 6 pm GMT (1 pm EST) and 12 am GST (7 pm EST).

best time of day to trade Forex

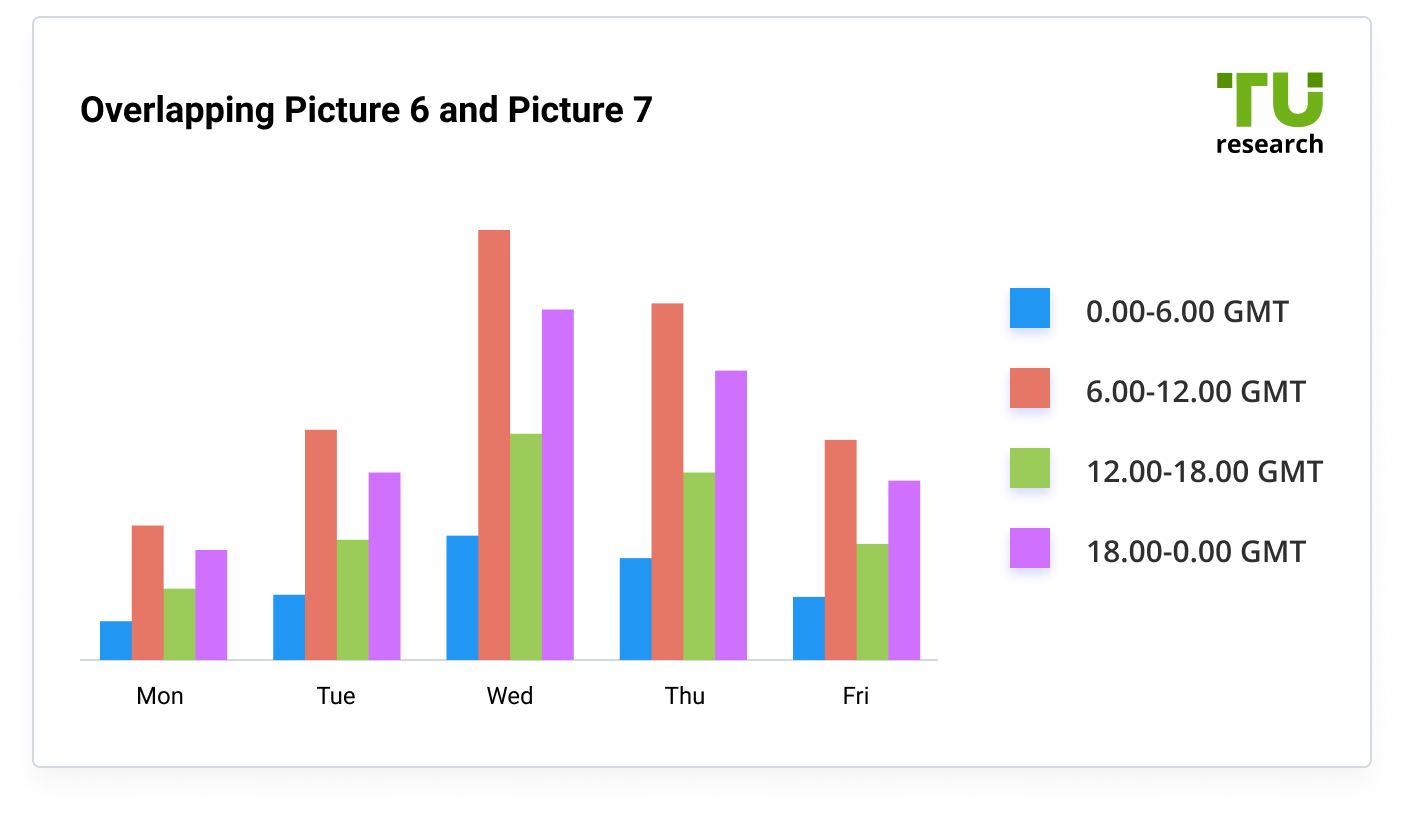

Now, if we combine the above results, it appears that Wednesdays are the best days to trade between 6 am GMT (1 am EST) and 12 pm GMT (7 am EST). It also appears that Thursdays are the second-best day to trade at the same times mentioned.

overlapping picture 6 and picture 7

In addition, other results from the research show that, for long-term strategies, Wednesdays and Mondays are the most successful days for trading. Moreover, for short-term strategies, Wednesdays and Thursdays are best.

Best Time for Forex Day Trading in South Africa

Now, based on the results of the research, we can establish what the best times are to trade forex in South Africa. Here, the best times to trade forex are on Wednesdays and Thursdays. When it comes to specific times, the best times to trade are 8 am South African time to 2 pm South African time and between 8 pm South African time and 2 am South African time.

Keep in mind, however, that, apart from taking note of these times when it could be more profitable to trade forex in South Africa, it’s also important to understand the impact that liquidity, volatility, other market conditions and indicators, and news like statistical data releases have on trading.

For example, higher liquidity generally means lower spreads and a reduced possibility for slippage which could lead to higher profits. Once you understand these aspects and the interplay between them, you’ll be able to trade profitably no matter what time of the day or day of the week it is.

Best Forex Pairs to Trade in South African Trading Sessions

Considering the best times to trade forex in South Africa as mentioned above, it appears that these times fall mostly within the New York session, the London Session, and the overlap between them. At the fringes of these time periods, there are also an hour or two of the Tokyo and Sydney sessions.

It, therefore, seems that the best forex pairs to trade will be those that are based on the US dollar or European currencies. However, as mentioned earlier, when you understand the aspects mentioned above, you’ll be able to execute profitable trades with any currency pair.

Time to Pause Forex Trading in South Africa

Generally, it’s best not to trade during times of low liquidity. A perfect illustration of this is at about 7 am South African time when the only open session in Tokyo is nearing its close. At these times, you’ll be more likely to encounter slippage and delayed execution which could lead to losses.

Moreover, it’s important to preferably close positions at the end of a session. This is to avoid rollover from one session to the next. During this time, you’ll incur an interest charge for holding the position overnight.

How Can Daylight Savings Time (DST) Impact Your Trading?

As mentioned earlier, South Africa doesn’t use daylight savings time. This means that, during its summer months, the best times to trade and rollover times will shift forward by one hour. As a result, you should know when this will happen so that you can prevent any unnecessary losses.

Best Forex Brokers in South Africa

Now that we’ve shown you what days and times are best for forex trading in South Africa, let’s look at some of the Top brokers you can choose from when you want to start trading.

Exness

Founded in 2008, Exness is one of the most popular brokers in South Africa and gives South African traders access to 107 currency pairs, 81 stocks and indices, 13 cryptocurrencies, and 12 metals and commodities. Exness offers various trading accounts and a variety of trading platforms including the well-known MetaTrader 4 and 5.

On its standard accounts, it offers a spread from 0.3 pips and the platform charges no commissions. As far as regulation goes, Exness is properly authorized by the Financial Sector Conduct Authority (FSCA).

XM

One of the major benefits of using XM is the sheer variety it offers. For example, it gives you access to over 1,000 trading instruments and offers 16 trading platforms. In addition, XM also offers several trading accounts including a Micro Account with spreads as low as 1 pip and its Ultra Low Account with spreads as low as 0.6 pips. All its forex trading accounts have a minimum deposit requirement of only $5.

Although XM is not regulated in South Africa, the broker is regulated by the International Financial Services Commission and the Cyprus Securities and Exchange Commission.

How to use XM copy trading to earn moneyIC Markets

IC Markets is an Australian forex broker that offers its trading services to customers around the world, including South Africa. It gives you access to 61 currency pairs, 730 stocks, 22 commodities, 25 indices, 10 cryptocurrencies, and more.

The broker offers a Standard Account with spreads as low as 0.6 pips and raw spread accounts with no spreads but a commission from $3.00 per lot traded, depending on the trading platform. And here, IC Markets offers a variety of trading platforms including MetaTrader and cTrader.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.