Top 5 Best Forex Trading Platforms in the UK

Forex is a marketplace for selling and purchasing currencies. Forex trading is the process of trading one currency for another. In a country like the United Kingdom, people have a lot of trading platforms to choose from. Considering this pain point of Forex traders, TradersUnion identified the 5 best Forex trading platforms in the UK.

Do you want to trade forex? Get spread cashback!Top 5 Best Forex Brokers in the UK

TOP 5 Forex brokers in the UK - Dynamics of the popularity of

eToro – Best For Copy Trading in the UK

Established in 2007, eToro is regulated by Financial Conduct Authority (Registration Number 583263) and the Cyprus Securities and Exchange Commission. As of 2023, this Forex broker has over 17 million registered users.

eToro is highly popular for its Forex spreads of as low as 0.8 pips. It offers 49 currency pairs, 93 cryptocurrency pairs, and 31 commodity CFDs. eToro facilitates trading through two accounts which include Retail Account and Professional Account. Traders with higher monthly trading volume can request eToro to upgrade the account from retail to professional.

eToro does not facilitate trading on MT4 and MT5. It has a web-based proprietary trading platform that facilitates social trading and copy trading. eToro Academy provides videos, webinars, and guides on Forex trading. Beginners can advantage of this educational content to gain in-depth knowledge on Forex.

eToro’s customer support is available 24x5 on live chat, phone, and email. For any platform-related assistance, users may need to raise a ticket on its trading platform. The minimum deposit on eToro is $50. It accepts several payment modes, including credit cards, debit cards, wire transfer, Skrill, Rapid Transfer, and PayPal.

Best Forex Brokers in the UK: FxPro

FxPro is a reliable and trustworthy broker with huge experience in handling large Forex orders. Founded in 2006, this Forex Broker has offices in London and Monaco. FxPro is regulated by Financial Conduct Authority (Registration No. 509956), the Cyprus Securities and Exchange Commission, and authorized by the Financial Sector Conduct Authority.

This trading platform offers 70 currency pairs at highly competitive spreads. With the spread of 1.27 pips on EUR/USD trading, FxPro is the most sought-after Forex broker in the United Kingdom. FxPro facilitates Forex trading services on three platforms, which include MT4/MT5, cTrader, and FxPro Edge web platform and FXPro Direct mobile platform.

The minimum deposit on FxPro is $100. It has 30 charting indicators, 31 drawing tools, and a 7-field watchlist. FxPro also offers a broad range of educational content to its customers. Its trading platform offers daily market commentary, educational videos, and snippets of information.

FxTrader has relatively higher fees and commissions when compared to its peers. It does not have a demo account which puts off novice traders. It charges an inactivity fee of $15 if the user does not do any trading on its platform for 12 months, followed by $5 per month.

Admiral Markets UK - Best for Metatrader Fans

Admiral Markets UK is one of the most experienced Forex brokers in the world. It is regulated by the Financial Conduct Authority (Registration Number 595450), Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). Over 120,000 traders from 110 countries do Forex trading on Admiral Markets. It is headquartered in London, the United Kingdom.

This Forex trading platform accepts the minimum deposits from $1. The 1:500 leverage helps experienced Forex traders unleash the true potential of Forex trading. However, it offers 1:30 leverage for retail clients.

Admiral Markets facilitates trading on Metatrader4, Metatrader5, and Metatrader Supreme. It offers account types such as Trade.MT5, Invest.MT5, and Zero.MT5. Admiral Markets is known for its valuable educational content and premium customer service. It publishes in-house analytics that helps traders take appropriate decisions while executing Forex orders. The all-in-cost to trade on Admiral Markets is 0.5 pips. Admiral gives exposure to 49 currency pairs and 27 commodity CFDs and 32 cryptocurrency pairs.

On the flip side, it charges an inactivity fee of 10 Euros per month. It also charges up to 1% for the currency conversion. The deposit and withdrawal facility is limited to wire transfer, credit cards, debit cards, and skrill.

AvaTrade – Best for Mobile Trading

AvaTrade is regulated by the Australian Securities & Investment Commission (ASIC), the Japanese Financial Services Authority (JFSA). Founded in 2016, AvaTrade has its headquarters located in Dublin, Ireland. It is accepted in countries like the United Kingdom, Malaysia, South Africa, India, and Canada.

AvaTrade offers 55 Forex pairs. For beginning traders with low trading volume, the EUR/USD trading would cost around 0.9 pips. For professional traders with huge trading volumes, this cost may go down to 0.6 pips. AvaTrade accepts a minimum deposit of $100 through wire transfer, credit card, debit cards, PayPal, Skrill, and Neteller.

AvaTrade has two types of accounts which include a Standard Account and a Professional Account. It offers leverage ranging from 1:30 to 1:400 for retail traders depending on regulatory terms in that particular jurisdiction.

AvaTrade offers a broad range of trading platforms when compared to its peers. It facilitates trading on MT4 and MT5. It also has proprietary trading platforms like AvaTradeGO and WebTrader. AvaTrade offers huge educational content for Forex traders. It has a library of 40 courses and 200 videos on Forex trading. Customer support is available through chat, telephone, and email 24x5.

Interactive Brokers - Best Desktop Trading Platform

Interactive Brokers is a trusted and reputable Forex broker in the UK. It is suitable for both novice and professional traders. Regulated by UK Financial Regulatory Authority (Registration No. 208159), the US Securities and Exchange Commission (SEC), the US Financial Industry Regulatory Authority (FINRA), Interactive Brokers has been in the market for more than two decades.

The features like $0 minimum deposit and 1:1000 leverage, 105 currency pairs, and 92 CFDs have made Interactive Brokers the most preferred trading platform in the UK.

Interactive Brokers has a proprietary desktop trading platform, Traders Workstation (TWS). Forex Traders may need to use the FXTrader Terminal of the TWS to carry out Forex trading. TWS facilitates real-time quotes, over 100 order types, and paper trading to improve the trading experience of its users.

Interactive Brokers charge a minimum of $2 per side for a Forex order. However, the charges would reduce if the trading volume exceeds 100,000 units of currency per order. This Forex broker gives huge discounts on commissions for active traders. For instance, the charges go down from $2 to $1 per side if the monthly Forex trading volume exceeds $5 billion.

Forex Trading Platform in UK Comparison

We put together a comparison between the 5 best trading platforms in the UK based on their features and characteristics.

FxPro – Features and Characteristics

Safety - FxPro is a safe trading platform regulated by one tier-1regulator two tier-2 regulators and one tier-3 regulator.

Demo Account - FxPro offers a demo account that helps newbies gain relevant trading experience before carrying committing the real money.

Trading Platforms - FxPro offers both web and mobile versions of trading platforms. You get access to MT4/MT5, cTrader, and FxPro Edge web platform, and FXPro Direct mobile platform if you register with FxPro.

Automated TradingFxPro has automated trading tools like FxPro VPS. This service is free for traders who qualify for the premium trading account.

Analytics - FxPro has automated trading tools like FxPro VPS. This service is free for traders who qualify for the premium trading account.

eToro – Features and Characteristics

Copy Trading – It is the best trading platform for copy trading. It enables users to create thematic copy-portfolios from financial third-party firms. You can also copy portfolios of popular traders in the investor program.

Tools – eToro partnered with a third-party analytical service, TipRanks. It offers analysis on equities, ETFs, and several other assets.

eToro Academy – This Forex broker has recently started its academy which offers well-structured videos, webinars, and guides that help both novice and professional traders equally.

Demo - eToro is highly suitable for beginning traders as it offers a $100,000 demo account without the time limit.

Admiral Markets - Features and Characteristics

Protection Tools – Admiral offers a wide range of volatility protection tools like predefined maximum slippage, cancellation of pending orders on price gaps, and activation of stop orders using reverse quotes.

Education – Admiral has a 9-lesson Forex course for beginners. Its in-house analytics team regularly releases analytics reports of various assets.

Technical Indicators – Admiral offers 51 charting indicators and 31 drawing tools.

No Dealing Risk – Admiral eliminates intervention of dealing desk by routing client orders to its parent company, Admiral Markets AS.

AvaTrade – Features and Characteristics

Education – AvaTrade has TradingCentral that offers a broad range of educational content suitable for beginners in Forex trading.

Bonus and Promotions – AvaTrade offers deposit bonuses and refer-a-friend bonuses. Users in a few selected jurisdictions earn a deposit bonus up to $200 and a refer-a-friend bonus up to $250.

Copy Trading – AvaTrade created a proprietary trading platform, AvaSocial, that enables users to copy the trading strategies and portfolios of experts.

Asset List – In addition to 55 currency pairs, it also offers 16 cryptocurrencies, 31 index CFDs, and 27 commodities.

Interactive Brokers - Features and Characteristics

Reliability – A listed entity on NASDAQ and a constituent of the S&P 400.

Research and Education – Traders Workstation gathers the data on Forex trading from Morningstar and Zacks. It also maintains Traders’ Insight and Quant Blog.

Automated Services – It has a mutual fund replication tool that helps investors to identify low-cost exchange-traded funds (ETFs).

Portfolio Management – Interactive Brokers offers automated portfolio management services wherein interactive advisors build and maintain portfolios on behalf of investors at an annual management fee of 0.12%.

Top 3 Forex Trading Platform in the UK for Beginners

TradersUnion has compared the three best Forex trading platforms in the UK for beginners against the characteristics such as demo account, minimal deposit, education, simplicity of the platform, and the availability of passive investment opportunities.

| Broker | Account minimum | Passive investment options | Accounts for beginners | Education | |

|---|---|---|---|---|---|

$50 |

Copy Trading |

Demo |

Professional Social Network, Financial guides, Video Tutorials, financial podcasts |

||

$100 |

Social Trading/Mirror Trading |

Demo, Cent Account |

Analytics through Trading Central. Daily Market Commentary, Educational Videos, and Snippets of Information. |

||

$100 |

Copy Trading |

Demo |

Forex Trading Courses and over 200 Video Tutorials |

5 Tips to Choose Best Forex Brokers in the UK

Choosing the best Forex broker in the UK can be an exhausting journey. We identified five factors that a trader should consider while evaluating forex brokers.

Test Platform in Demo – Beginners may like to test the trading platform through a demo account. Most Forex traders in the UK offer a demo account to help novice traders understand the trading conditions and features of the trading platform.

Pay Attention to Safety – Not all Forex brokers are safe and reliable. A stockbroker is considered safe only when it has relevant approvals and licenses from the regulatory bodies. We recommend beginners open a brokerage account with stockbrokers who are authorized by regulatory bodies.

Pay Attention to the Reviews – Online reviews help beginners gain an understanding of the trading platform, features, and the quality of customer support. TradersUnion has reviewed each Forex broker against several parameters and ranked them accordingly.

Test Research Options – Analytics play a huge role in the success of a Forex trader. We recommend traders choose a trading platform that has a wide range of technical indicators, drawing tools, and analytics tools

Explore Automation Tools – Beginners may not be aware of the trading strategies during the initial days. They may like to emulate professional traders and their strategies. A trading platform that facilitates copy trading, social trading, or mirror trading would be highly appropriate for beginners.

How to trade with FxPro trading platform: a real-life example

A trader needs to go through several steps to execute Forex trades. We choose FxPro as an example to showcase the steps involved in the process of Forex trading.

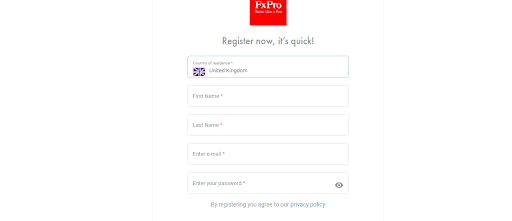

Step-1: Register with a Forex Broker

Account Opening on FxPro

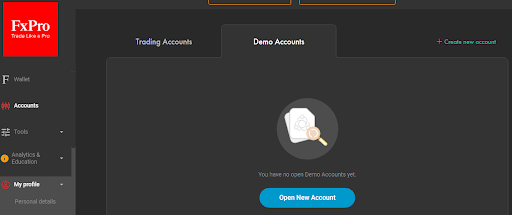

Step-2: Demo Trading

We recommend beginners to do demo trading to get familiar with the trading platform and the Forex trading conditions. Most brokers like FxPro ask you to open a separate demo trading account.

Demo Account Opening on FxPro

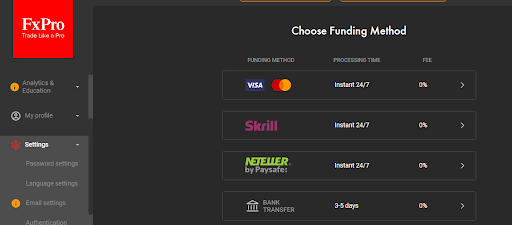

Step-3: Link Bank Account and Add Money

This is the step where you need to link your bank account to the trading platform and deposit money. If you choose to go ahead with FxPro, the minimum deposit amount would be $100. FxPro accepts deposits through debit/credit cards, Skrill and Bank Transfer.

Account Funding on FxPro

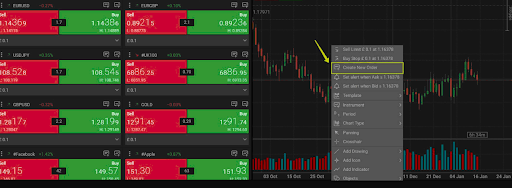

Step-4: Choose a Currency Pair and Open the Chart

You may need to choose the currency pair and open its chart. The currency pairs could include EUR/USD, AUD/JPY, or USD/AUD.

Step-5: Add Technical Indicators to the Chart

Every Forex broker allows users to use technical indicators like MACD, exponential average (200 EMA), Relative Strength Index, Bollinger Bands, and Average True Range. These tools would help in informed decision-making.

Step-6: Place the Order

On FxPro, you can place the order via chart. If you right-click on the chart, you can see ‘Create New Order’ in the list. The order placing window appears when you click on the ‘Create New Order’.

How to Place the Order on FxPro

Our Methodology

Traders Union (TU) makes use of over 100 parameters to evaluate Forex brokers. First, TU checks the safety and reliability of the broker. It evaluates if the broker has the licenses and approvals from the tier-1 and tier-2 regulatory bodies. If a stockbroker does not have relevant approvals from regulatory bodies, TU will not consider it for review.

TU would analyze the financial stability of the stockbroker before recommending it to people. TU analyses the liquidity and solvency position of the broker by checking its ability to meet short-term and long-term obligations. TU also attempts to check the broker’s revenues and the number of new customers added every quarter.

TU also gathers expert opinions from experienced real-time traders to analyze the user satisfaction levels with regards to the aspects such as the platform’s user-friendliness, quality of customer service, commissions, educational content, leverage, and margin rates.

Best Forex Brokers by Countries

Summary

Forex trading can be one of the best side professions to earn additional income. If you can learn the Forex trading strategies and create a personalized framework for trading, you would be able to earn a good income from Forex trading. One of the important steps in the journey of Forex trading is to choose a suitable trading platform. The 5 Best Forex trading platforms outlined in this guide are highly reliable and safe. These brokers have been in the market for more than a decade and offering great customer support. The Forex brokers like FxPro, Admiral Markets, AvaTrade, Interactive Brokers, and eToro are known for good educational content, lowest possible minimum deposits, high leverages, and low commissions.

Best Forex Trading Platform Reviews

-

Comment

Stability in trading is the most important thing that I note in a broker’s operation. There are a lot of scams now, and finding a good broker is now very difficult. The regulator's license is important, but the company's presence on the market is more important. Entrusting the service to someone who has been operating for many years is the best idea. I have decided on eToro.

-

Comment

eToro is the first broker where I am not bothered with requotes. They haven’t occurred in 3 months even at high activity. It is clear that eToro has a thorough approach to work; the equipment is not cheap.

-

Comment

To become a successful forex trader, you must know the four trading sessions and best time to trade in the most busy session. Forex trading sessions are times when the forex market is open and closed in different regions. You have to learn about these sessions to know when each opens and closes before you open a position. Out of the four sessions, new york and London is the ones with the highest trading volume and the best sessions to trade in if you want to trade in a busy market. I use the FXxPro Global Stock Exchanges session times to know what session is open and to monitor when two sessions overlap especially the New York and London overlap which is the best time to trade as it is known to have the heaviest volume of trading and is best for trading opportunities. Personally, this is one of the simple but helpful tools for day traders on FxPro.

-

Comment

You can transfer from your Fxpro wallet to your trading wallet 24/7. I happen to be busy during the weekdays and only trade during the weekends, now i want to transfer funds between my FxPro Wallet and trading accounts during the weekend to trade. The first time i tried i had few open positions and it stalled but after closing the positions it was successful. So transferring funds between fxpro wallet and trading accounts during weekends is possible if the specific trading account you are transferring from does not have any open positions. You will not be able to move money from an open trade you had over the weekend to your wallet until the market reopens on Sunday at 22:00 UK time.

-

Comment

I was looking for a reliable broker with excellent service and support and found it in Admirals. There were some difficulties when passing verification due to problems with my passport, but the support was attentive and helped solve all the problems. Now I trade with Admirals and receive a stable income, feeling calm and confident.

-

Comment

I don’t recommend trading with admirals. If you don't want to lose all your money, don't open an account here. One reason is that stop loss never works during news. I set a stop loss on most of my positions, but the position was closed at least 20 pips away from the set price. That is, admirals deliberately drains money.

-

Comment

Been using AvaTrade for a few weeks now, and I'm happy with the support they offer. They have a couple different ways to get help, which is convenient. There's an AI-powered chatbot that can answer basic questions, and you can also contact them via WhatsApp. That's pretty cool for quick inquiries. If you have a more complex issue, you can email their customer support team. They got back to me pretty quickly with a helpful answer when I had a question about withdrawal options. However, it would be even better if you could connect directly with a customer service rep through the chatbot. Right now, it just directs you to email if your question is complex. A live chat option would be nice too, for those times when you need help right away. Overall, AvaTrade's customer support is good, with multiple ways to get help. Just wish there was a more direct way to connect with a rep through the chatbot.

-

Comment

I mostly use AvaTrade for long-term stock investing, not day trading. Their fees seem reasonable for that, and they have a good selection of stocks to choose from. Can't speak for the other features like CFDs or options, but for basic stock investing, AvaTrade seems like a decent option. AvaTrade's mobile app is handy for checking on trades on the go, but it could be smoother. Sometimes it takes a while to load charts and info, which can be frustrating. Also, placing trades on the app feels a bit clunky compared to the desktop platform. Would be nice if they updated the app to be more user-friendly.

-

Comment

I am very glad that I found Interactive Brokers, because it is convenient to work with — the service is well made and streamlined, the user account is convenient, and you can trade on different platforms and use robots. There are a lot of tools for traders. In general, their approach to work is serious.

-

Comment

I recently started trading with interactive brokers, but I am already trading on a live account. There is no delay in withdrawing money, the execution is excellent, and they make life easier for traders, as they allow you to trade with different strategies. You can try whatever you want and the choice of platforms is amazing, so there is a space for experiments.

FAQs

Is Forex trading legal in the UK?

Yes, Forex trading is legal in the UK. You can do Forex trading on trading platforms offered by authorized Forex brokers like FxPro, Admiral Markets, and Interactive Brokers.

Which currency pairs are the best for Forex trading?

We recommend you choose the most tradable currency pairs for Forex trading. A few recommended pairs are EUR/USD, USD/JPY, GBP/USD, AUD/USD, and USD/CAD.

Is automated trading good?

Yes, automated trading is good because it enables you to earn money without trading on your own. Copy trading is also a form of automated trading. You can also use automated trading services like Percentage Allocation Management Module (PAMM) and Lot Allocation Management Module (LAMM) to earn decent returns from Forex trading.

Which Forex broker is suitable for beginners like me who want to trade with little money?

All five brokers reviewed in this guide are suitable for beginners. However, as a beginner, you may want to choose a broker that offers the lowest commissions. In this case, FxPro, Interactive Brokers, and eToro fit your requirements.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.