XM Forex Education: Tools And Free Courses

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

XM offers a comprehensive learning center with free Forex trading courses tailored for beginners, covering essential topics such as fundamental and technical analysis, risk management, and trading strategies. Additionally, XM provides a suite of trading tools, including an economic calendar, trading calculators, and access to real-time market news, to support traders in making informed decisions. These resources are designed to help novice traders build a solid foundation and enhance their trading skills effectively.

XM offers traders a variety of learning materials, including live lessons and free webinars in multiple languages. These sessions are made for traders to improve their understanding of fundamental and technical analysis, risk management, and trading strategies at their own pace.

To help traders sharpen their knowledge, XM provides tools like Trading Central, which combines AI tools with expert advice, along with an economic calendar that keeps traders updated on key financial events. Traders can also get real-time market updates from Reuters and daily insights from XM’s team of market analysts.

XM free trading courses

The XM Education Center offers traders access to free, structured courses designed to enhance their knowledge and skills in trading the financial markets. Courses cover three key areas: fundamental and technical analysis, risk management, and developing trading strategies. All materials are available online, allowing traders to learn at their own time and pace, regardless of their experience level.

Major learning areas

Fundamental analysis. Traders learn economic indicators that affect exchange rates, such as inflation, interest rates, and macroeconomic statistics. Courses help them understand how world events affect financial markets.

Technical analysis. The program includes the study of chart patterns, indicators, and tools for predicting market movements. Participants learn to apply these methods to determine entry and exit points.

Risk management. Traders learn methods to minimize risk, including calculating acceptable losses, diversification, and determining position sizes. Special attention is paid to money management and building sustainable trading strategies.

Trading strategies. The courses introduce participants to popular trading approaches such as scalping, swing trading and long-term investing. Particular attention is paid to developing a personalized action plan based on goals and risk level.

Format and access

The training is conducted in the form of webinars, available daily. Webinars are conducted by professional analysts who share their experience and practical recommendations. For more in-depth study, traders can use live educational rooms, where real-time trading is demonstrated and current market conditions are analyzed.

These courses provide structured training and access to practical knowledge for successful trading.

Advanced trading tools

XM offers powerful tools that help traders understand the market and manage their investments better. Whether you're just starting out or already experienced, these resources can simplify market analysis, improve predictions, and make risk management easier. Here’s what they offer and how you can use them.

Trading Central

Trading Central is a powerful market analysis tool that blends AI-driven insights with expert strategies. It helps traders track price movements, spot trends, and find key support and resistance levels. These tools make it easier to plan trades and stay ahead of market shifts. XM clients can use Trading Central for free when they sign up for an account.

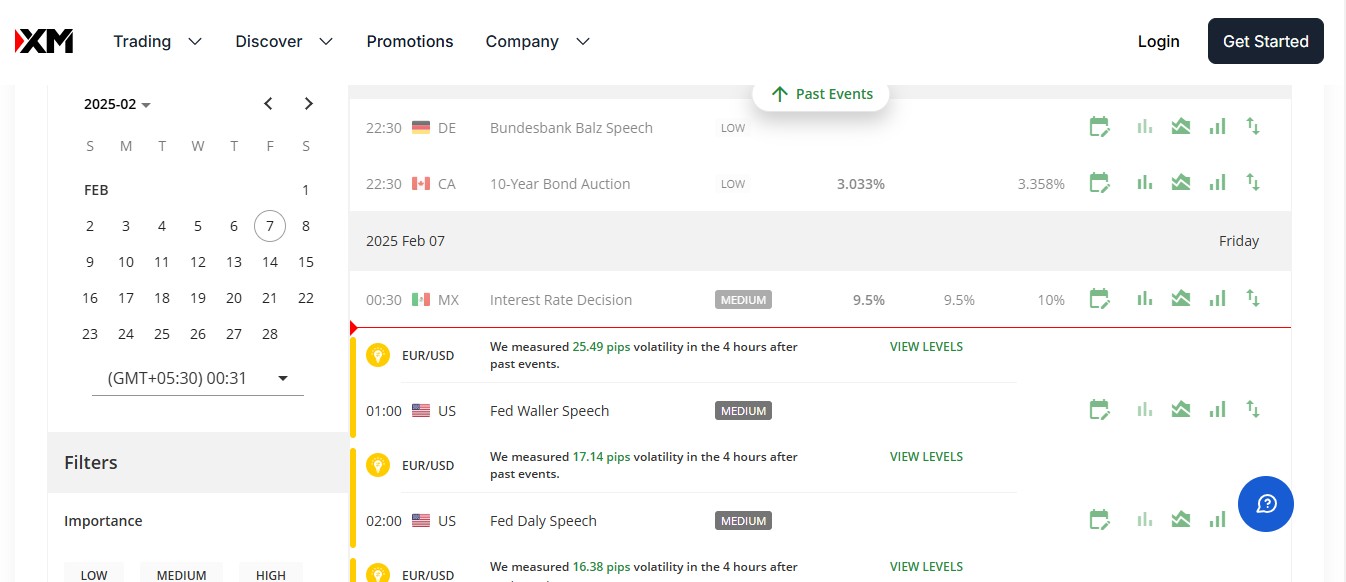

Economic calendar

The XM Economic Calendar helps traders stay ahead by tracking key financial events. It lists macroeconomic reports, central bank meetings, and other major updates that influence market movements. By following the calendar, traders can prepare for potential price swings and adjust their strategies accordingly.

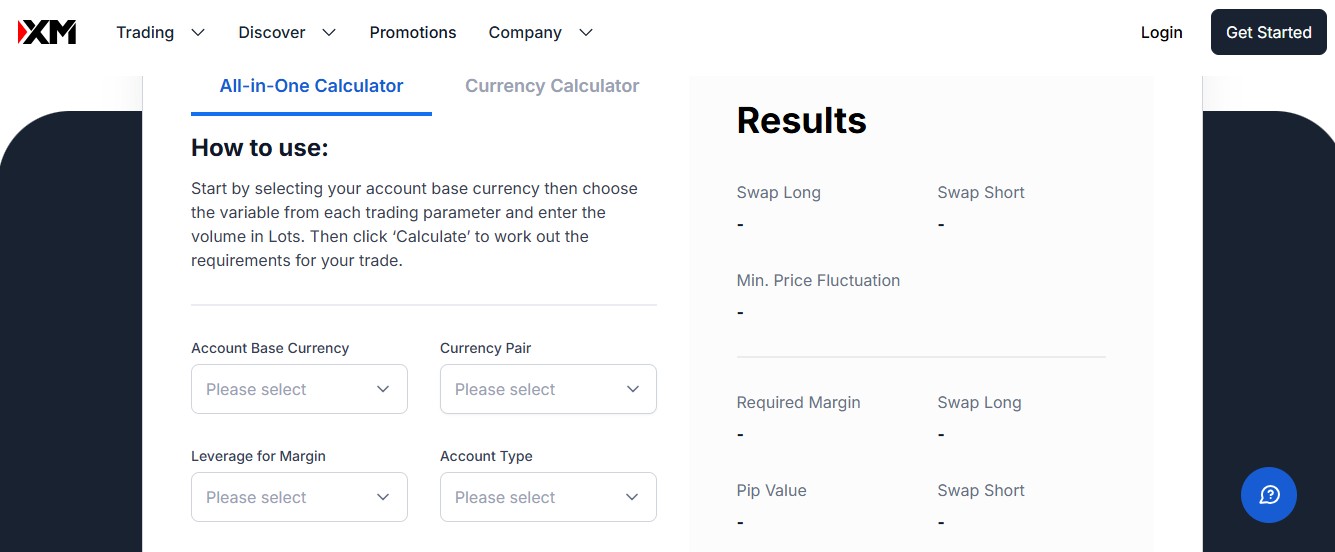

Trading calculators

XM provides handy calculators that simplify key trading decisions. The Margin Calculator shows how much you need to open a trade, the Pip Calculator helps you figure out the value of each pip, and the Swap Calculator estimates overnight fees or earnings. These tools make it easier to plan trades and manage risks without guesswork.

Reuters news

The integration of Reuters news into the XM platform provides traders with timely and reliable information on events in the global financial markets. With access to news 24/7, traders can react to changing market conditions and make informed trading decisions.

XM podcasts

XM’s daily podcasts provide educational content and analysis, allowing traders to expand their knowledge and stay on top of current market trends. The podcast format is convenient for listening at any time, which helps integrate learning into a trader’s daily schedule.

XM Live

XM Live is a video platform that offers continuous streaming of market news, analysis, and product information. Video content allows traders to receive visual and auditory information about current market events, which helps them gain a deeper understanding of market dynamics and supports their decision-making process.

Market analysis and analytics

XM provides its clients with access to comprehensive market analysis that helps traders understand current market conditions, predict future price movements, and make strategic decisions. Let’s take a closer look at the key aspects of XM’s research services.

Daily market watch

XM’s analysts break down daily market trends, covering Forex, stocks, commodities, and indices. Their reports highlight key events like central bank decisions, economic data, and geopolitical shifts that move the markets.

Traders can access these insights in both text and video formats, making it easier to stay updated in a way that fits their routine.

Technical and fundamental analysis

XM provides traders with two main types of analysis:

Technical analysis. This is based on the study of historical price and volume data. With this approach, traders can identify trends, support and resistance levels, and forecast price movements. XM uses advanced analytical tools and visualizations such as candlestick charts, RSI, and MACD indicators to help make accurate forecasts.

Fundamental analysis. Focuses on assessing macroeconomic indicators such as GDP, unemployment, and consumer price indices. XM analysts consider their impact on exchange rates, bond yields, and other financial assets. This helps traders adapt their strategies to market realities.

These two approaches complement each other harmoniously, allowing traders to make balanced decisions.

Expert forecasts and recommendations

XM provides market updates with trading ideas and forecasts. These insights are built on real-time data and trends, considering global events and price shifts. Traders get guidance on finding the best times to buy and sell, along with stop-loss and profit-taking strategies that suit different skill levels.

Forecasts are available in articles and video breakdowns. For those who prefer live discussions with experts, XM hosts webinars and interactive sessions where analysts share live market breakdowns and answer questions.

The benefits of XM research

Using XM research systematically helps traders:

Increase their awareness of current market conditions.

Develop strategies based on proven data.

Minimize risk with timely information on market volatility.

Using XM free Forex course to outsmart the market

Most beginners think a free Forex course only covers the basics, but XM’s training goes way deeper. Most skip the market psychology section, but that’s where you’ll find how big players watch retail traders. It explains how market makers move prices to shake out traders before the real move happens. If you pay attention to this, you’ll stop falling for fake breakouts and start spotting real trading opportunities.

Another hidden gem is XM built-in simulator, which lets you practice without risk. Instead of just placing random demo trades, use it to watch how price moves in key market sessions. This helps you recognize when the market is tricking traders into bad positions before a reversal. If you use the XM course and tools the right way, you won’t just be learning — you’ll be gaining an edge over other beginners.

Conclusion

The resources provided by XM create ample opportunities for learning, analyzing, and making informed trading decisions. Free courses and webinars help beginners gain fundamental knowledge, while experienced traders can deepen their skills with analytical materials and tools. Solutions such as Trading Central, the economic calendar, and Reuters news allow traders to effectively analyze the market and react promptly to changes. With these resources, traders can not only improve their competence, but also optimize their strategies to achieve their financial goals. XM provides a platform that combines education, analytics, and technology tools, giving traders everything they need to succeed in the financial markets.

FAQs

What is the best way to start using trading tools if you are a beginner?

Start by learning the basic concepts using available courses and webinars. In parallel, master practical tools such as margin and position size calculators to understand how they help manage risk in real conditions.

How to combine technical and fundamental analysis for better results?

Use fundamental analysis to identify long-term trends based on macroeconomic data, and connect technical analysis to find entry and exit points. For example, news about rising interest rates can be combined with chart analysis to refine the timing of a trade.

What types of assets should you choose for your initial trading?

Beginners should focus on liquid instruments with relatively low volatility, such as major currency pairs. These assets are easier to analyze, and the provided analytical materials will help you better understand their behavior.

How to keep your market knowledge relevant in dynamic conditions?

Regularly study analytical reviews, forecasts, and market news. Take advantage of daily webinars and video reviews to help you adapt to changing markets and put your knowledge into practice.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).